The Euro: An incomplete architecture

Despite having emerged from the crisis, an incomplete architecture leaves the Eurozone vulnerable to subdued economic performance and cross-country divergence. More progress will be needed on reducing systemic weaknesses if the Euro area is to deliver on its promise of greater prosperity for participating countries and to avoid calling into question the very existence of the common currency.

Abstract: Despite the recent pick-up in economic activity, the Eurozone remains an area of relatively modest growth and high unemployment. Performance is also unequal across countries, leading to a process of divergence which may call into question the very existence of the single currency. This disappointing record reflects the systemic weaknesses which prevail since the construction of the Euro. The paper reviews these weaknesses and their consequences, and examines briefly possible solutions, taking into account efforts already made. Reinforcing the architecture of the Eurozone will be critical for supporting the ongoing recovery phase in Spain, while making growth more socially inclusive.

When it was created almost two decades ago, the Euro was intended to bring greater prosperity to all participating countries. The expectation was that the single currency would strengthen financial stability and facilitate convergence. This worked out well for a while. Between 2000 and 2007, the Eurozone enjoyed robust economic growth and declining unemployment among most of its members.

The growth-cum-convergence process came to an abrupt halt with the advent of the great recession and the subsequent sovereign debt crisis. Since then, major efforts have been made to tackle the consequences of the crisis. The creation of a European Stability Mechanism and the adoption by the European Central Bank of an exceptional arsenal of unconventional measures to prevent deflation and stabilise the Euro are important steps in this direction (European Commission, 2015).

However, these initiatives, important as they are, remain insufficient to make the Euro fulfil its promises. Indeed, the heart of the matter is that the architecture of the Eurozone remains incomplete and, as a result, the area faces the prospect of subdued economic performance as well as cross-country divergences, which may call into question the very existence of the single currency. In its recent report on the future of Europe, the European Commission itself has openly considered such a break up scenario (European Commission, 2017).

The purpose of this paper is to: a) provide an overview of the areas where the weaknesses are most blatant; b) shed light on the potential risks of inaction and to examine reforms options; and, c) briefly discuss the implications for Spain of the present state of affairs.

Economic performance in the Eurozone: Low growth and increasing cross-country divergence

To start with, the growth record of the Eurozone is mediocre. During the central years of the crisis (2008 to 2012), the Eurozone economy performed worse than other European countries –and performance was also worse than the United States, where the global financial crisis originated.

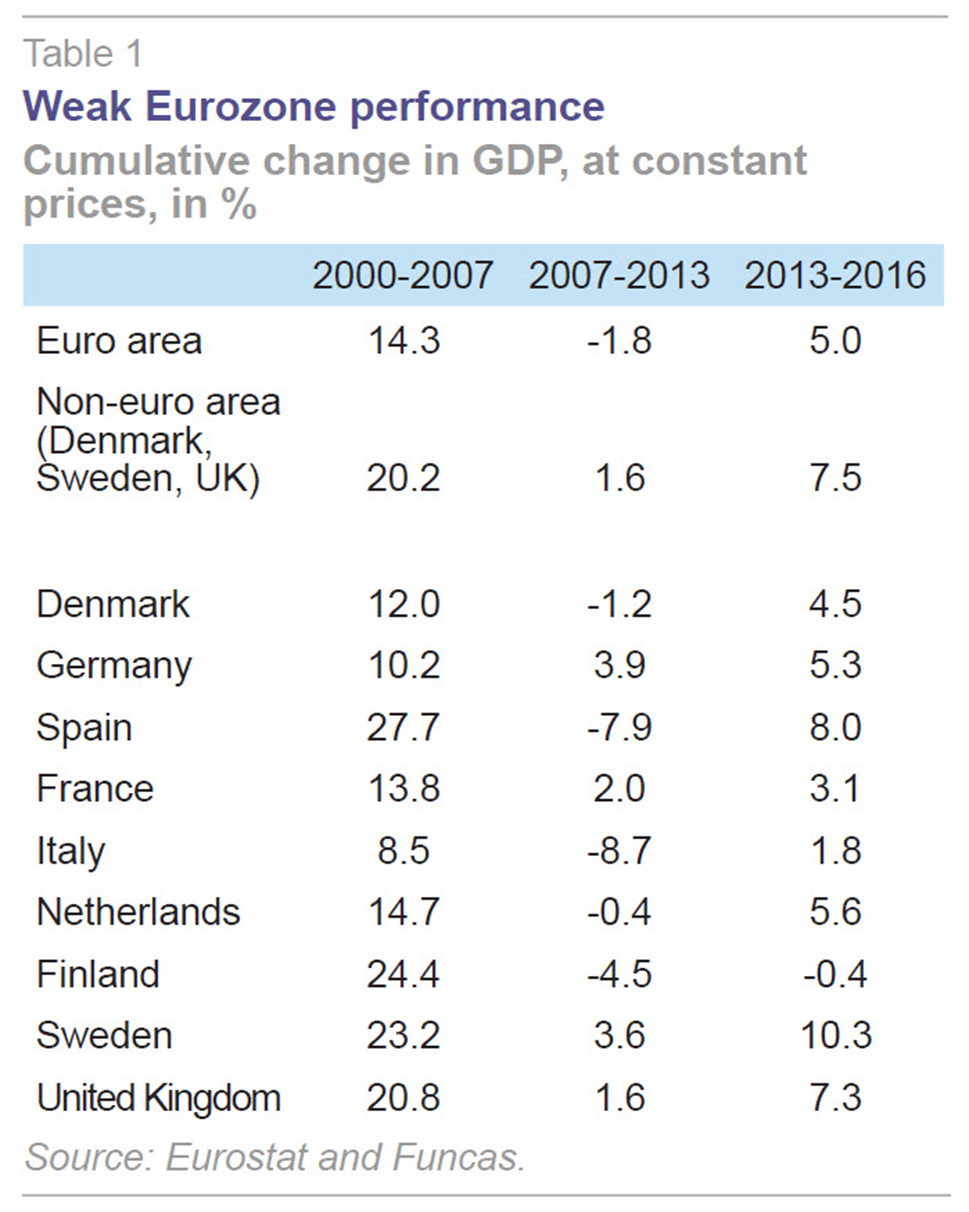

Likewise, during the ongoing recovery phase that followed the exceptional measures of the ECB, economic growth has been relatively modest. Since 2013, GDP increased by a total of 5 per cent in the Eurozone, that is 2.5 percentage points less than in other EU countries and 1 percentage point less than in the United States (Table 1).

Current trends suggest that the Eurozone economy is growing somewhat faster than expected. According to the latest projections, economic growth in the zone should reach 1.7 per cent in 2017, two decimals more than in the previous projections. This is still a relatively modest record, especially in light of the depth of the crisis.

The result is a worsening of labour market outcomes. Unemployment has increased more in the Eurozone than elsewhere in Europe. In view of the gloomy employment prospects, a disproportionate number of working-age people have been discouraged and have exited the labour market. And, for those who obtain employment, job precariousness is on the rise.

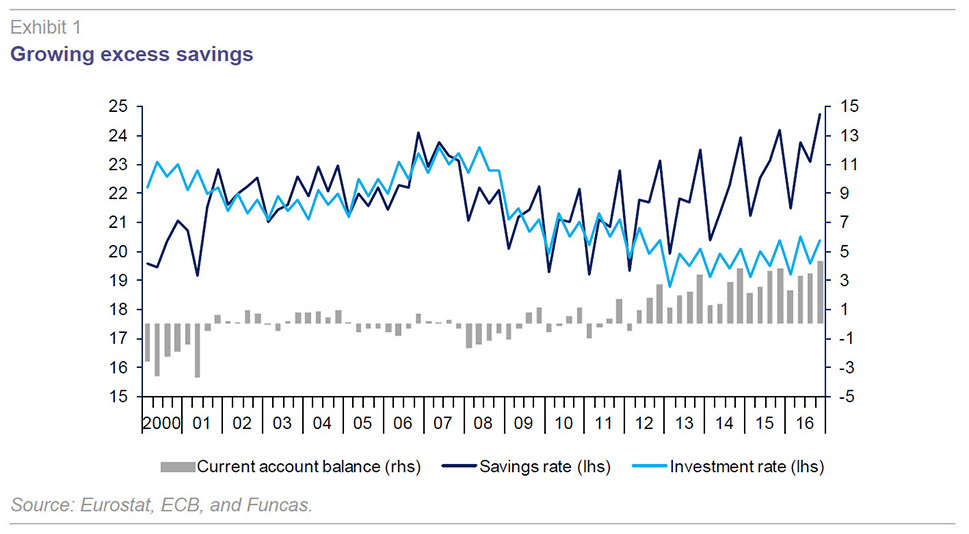

Looking in detail at the components of GDP, it emerges that the Eurozone is characterized by weak domestic demand, notably as regards investment. Today, the area invests less than many other countries in Europe and also less than was the case before the crisis. The result is a situation of excess savings. In other words, Europe saves more than what it is prepared to invest in its economy. In fact, excess savings are growing, as illustrated by the increasing current account surplus, which now represents over 200 billion euros, or 2 per cent of GDP (Exhibit 1). Paradoxically, part of this surplus will serve to invest in countries outside Europe, notably the stimulus programme launched by the new government of the United States.

Secondly, the Eurozone is facing significant divergences. Core countries such as Germany, Austria and the Netherlands do well. These countries enjoy solid growth rates and they are reaching a nearly full employment position. By contrast, growth performance in Greece and, to a lesser extent, Italy remains mediocre. France appears to have de-linked vis-à-vis Germany. And in general Southern European countries face the prospect of prolonged unemployment and/or a high incidence of low-paid jobs.

These divergences, if unchecked, will make the monetary union unsustainable. Indeed, low-growth performers are unable to offer sufficient job opportunities. They run the risk of social dislocation and political fragmentation. These trends are already at work in some countries. In addition, emigration of talented young people to richer areas is a likely prospect. This is tantamount to a subsidy from low- to high-performers.

In theory, low-performers could overcome their handicaps by attracting investment. This is possible when it is cheaper to produce in these countries. However, in a low inflation environment, improving cost-competitiveness requires outright cuts in nominal wages and incomes. This is not easy to achieve and is socially harmful. Moreover, cost-cutting policies affect domestic demand in the short run, while the possible benefits on external competitiveness, gains in export markets and improved investment attractiveness only show up in the medium- to longer-run.

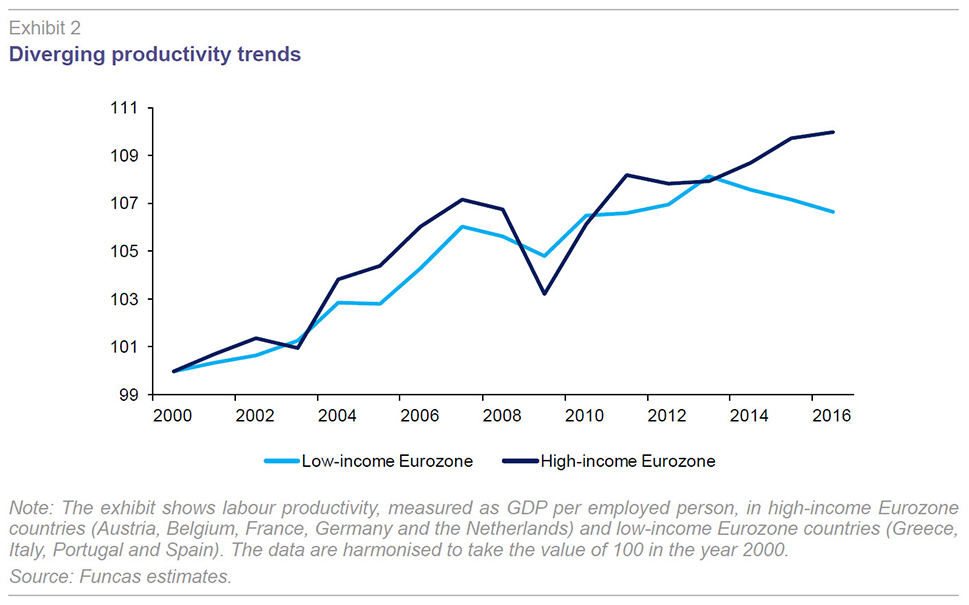

The result is a growing productivity divide (Exhibit 2). Core economies are not only more productive than peripheral ones, but they also enjoy relatively strong productivity gains. These trends, if persistent, will inexorably lead to a different trade-off between the goal of maintaining a single currency area and that of improving economic prosperity.

More generally, weaker performers are more vulnerable to shocks than their stronger peers in the single currency. The probability of such shocks is all the more likely, because the structure of European economies remains different. Those located at the core are specialized in relatively high value-added sectors. They are also more integrated and thus their cycles tend to be synchronized. By contrast, peripheral economies have a different source of comparative advantage and their cyclical behaviour is different from that of the core of the Eurozone.

Missing pieces in the Euro architecture and possible reform options

Undoubtedly, the low growth situation and intensified divergences reflect domestic policy conditions. Some countries have stronger institutions, including effective product and labour markets, well-designed education and social protection, participatory dialogue between employers and workers, and solid financial supervision. They are rewarded with improved economic performance (ECB, 2016).

However, even carefully crafted reforms of domestic policies are not enough to prevent the observed divergences in performance.

Indeed, the fundamental problem is that the Euro is a currency which is weakly connected to the States of participating countries. It therefore lacks the guarantees which the State normally provides in terms of ensuring adequate liquidity, counteracting shocks and reducing the risk of bank runs (Eichengreen and Wyplosz, 2016).

More specifically, the first element of vulnerability of the Euro architecture is that the central bank is not designed as a lender of last resort (Pisani-Ferry, 2012). So governments have to fund their deficits in a currency that they do not control (similar to the situation of a private borrower). Experience shows that such a fragile link between the currency and sovereigns can lead to “sudden stops” of private capital flows, as investors fear about the ability of governments to sustain their debt. This sudden stop, in turn, forces governments to adopt austerity measures with a view to improving budget balances quickly, thereby further aggravating the crisis and requiring more austerity (the so-called austerity trap).

Indeed this is what happened in 2010, when risk premia increased exponentially. Suddenly, investors, including banks, realized that the bonds and obligations of other governments which lied in their balance sheets were not supported by the central bank as lender of last resort. Thus, governments should repay their debt obligations via their own means, i.e. a combination of higher taxes, lower spending and market-based funding. Otherwise they faced bankruptcy.

This problem has been partly addressed through the announcement, as late as in 2012, by the ECB that it would do whatever it takes to save the single currency. Initially, this took the form of a programme of outright monetary transactions (OMTs), whereby the ECB could purchase government bonds in secondary markets. In this initial stage, OMTs were restricted to countries involved in bail-out programmes (through the European Financial Stability Facility and the European Stability Mechanism). In 2015, the programme was scaled up and involved direct purchases of government bonds as well as corporate securities.

A limitation to this instrument is that it only applies to government bonds that have a certain credit rating. At present, the asset purchase programme does not apply to Greek debt, which is regarded as too risky. The same may happen in the case of a future country-specific crisis –unlike in a “normal” central bank, which can act as lender of last resort to its government, under all circumstances.

More generally, there are doubts as regards the extent to which the ECB can pursue its unconventional monetary policy beyond a certain time horizon (Borio and Zabai (2016), and Borio (2017)). There are indeed side effects associated with these interventions, notably in terms of: an inefficient allocation of savings, distortions in the structure of asset prices, the emergence of new bubbles, and growing difficulties in exiting the measures, as the volume of government debt purchased by the ECB becomes more and more significant. Already, the ECB has announced a gradual tapering of its asset purchase programme in the course of 2017.

In order to move forward, some form of Eurozone-wide insurance of government debt must be put in place. While several ideas have been put forward in this regard, no action has taken place so far.

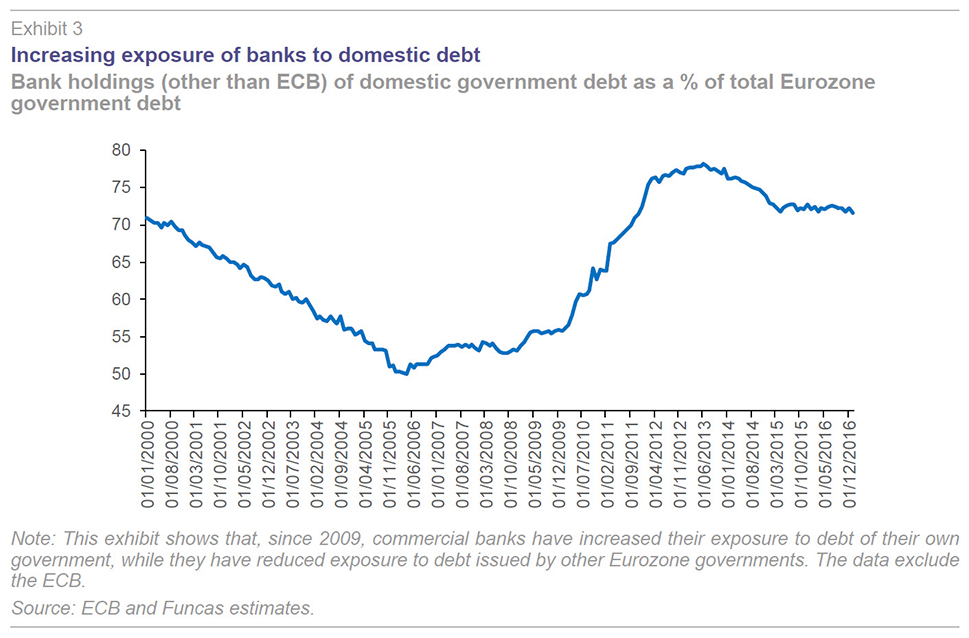

The second systemic weakness of the Eurozone is the strong exposure of banks to domestic shocks (Gros, 2013). For one thing, banks tend to hold a disproportionate volume of government bonds of their own country (Exhibit 3). Therefore, a significant increase in the risk premium tends to aggravate the balance sheet position of national banks, which find themselves in a weaker position to provide credit to the real economy. This, in turn, affects the economy and the fiscal position of governments.

This perverse feedback loop between banks and their governments was in motion during the central years of the crisis in Ireland and a number of South European countries. It only ended because the ECB intervened to calm markets and reduce risk premia.

In addition, bank regulation has been strengthened through the establishment of a single supervisory system and the application of stress tests, designed to act as a prevention device. However, doubts have been expressed regarding the reliability of stress tests. Also, the single supervisory system has emerged slowly and needs to find its proper articulation with national supervision institutions, which will take some time. More fundamentally, as long as banks do not diversity their holdings of government debt, they will continue to be exposed to the risk of a perverse feedback loop. Going forward would therefore require imposing further prudential rules on the composition of bank assets.

Another missing piece in the banking union architecture is the lack of deposit insurance. At present, bank deposits are insured by each government –typically up to a maximum of 100,000 euros per bank account. This means that, in the event of a debt crisis, the insurance scheme is not credible, which may provoke bank runs and the flight of deposits to safer jurisdictions. It is therefore important to establish a single Eurozone-wide deposit insurance, which comes on top of national insurance systems. This should go hand-in-hand with strict bank supervision mechanisms, along the lines noted earlier, as well as proper management of public finances in each country. Uncertainties regarding the ability of different participating countries in achieving this may explain the fact that the European deposit insurance has not been enacted as yet.

The final main missing pillar of the currency union is that the Eurozone lacks an instrument for macroeconomic stability. There are still no effective tools for responding to shocks, both adverse and favourable.

Instead, Europe mainly relies on preventive measures, such as macroeconomic surveillance tools (European Semester, Macroeconomic Imbalance Procedures) designed to avoid the build-up of unsustainable imbalances. This is welcome in general, though the tools operate at the county level and do not take into account the overall European situation (which in present circumstances is one of excess savings, as noted above). It also tends to apply asymmetrically, in that the system is supposed to punish deficit countries, while treating a surplus situation with leniency. Europe also puts considerable emphasis on structural reforms. These are of course important, provided they are well designed and take into account a country’s societal preferences. However, structural reforms take time to feed through the economy and, at any rate, these measures are not meant to respond to major macroeconomic shocks (they can, of course, facilitate adjustment to those shocks over the long run). Moreover, in the short run, certain structural reforms are deflationary and thus aggravate the crisis, e.g. when they impose wage cuts.

The launch in 2014 of the European Investment Plan (or Junker plan) goes some way towards meeting these weaknesses. The aim is to mobilise investment (private and public) in the different countries, in areas with large externalities, such as infrastructure, or where normal funding is not easily available, e.g. small and medium-sized businesses. The amount is relatively small, however – 315 billion euros, or less than 3% of the combined GDP of the Eurozone, spread over a period of three years. Moreover, the plan acts as an aggregation of national investment plans, rather than as a genuine European-wide policy. This means that the Junker Plan, though helpful, is not conceived as a tool to respond to asymmetric shocks.

In order to tackle this problem, several proposals have been made, notably the establishment of a European fiscal capacity (Bénassy-Quéré et al., 2016). A European unemployment insurance system is an attractive option in this respect. This raises issues of political accountability and devolution of national sovereignty, which are complex to address in light of the rising Euro-scepticism and reluctance on the part of core countries to engage in this direction.

Two practical paths that could also be followed include: i) an expansion of the Junker Plan along with a modification of implementation criteria, so that countries most hit receive more support; and, ii) greater use of the Youth Guarantee policy which presently operates in an embryonic manner. This would act as a quasi-automatic stabiliser and possibly face less hostility than a fully-fledged unemployment benefit system. The proposal would have the added advantage that it already exists and thus does not require a major overhaul of social protection. In both cases, however, resources would be called for.

In general, a single currency requires mobility of private savings across countries. At present, there are many investment opportunities in crisis hit countries, such as Portugal. At the same time, other countries are not able to mobilize internally all their available savings. Theoretically, it would be advantageous for them to place their excess savings into other Eurozone countries. However this does not happen, given the uncertainties that savers perceive regarding the future of the monetary union.

Implications for Spain

The case of Spain is important. Indeed, the country has broadly tackled some of the macroeconomic imbalances that had preceded the crisis (Torres and Fernandez, 2017). Yet, the incomplete architecture of the Euro remains a threat to the progress made.

The size of pre-crisis imbalances has been significantly reduced:

- The balance-sheet position of non-financial enterprises has improved considerably. Their debt to income ratio now comes close to the situation of the early 2000s, before the build-up of the credit bubble. Households, too, have managed to alleviate their debt position, though to a lesser extent than enterprises. Both enterprises and households are now in a position to take loans in a sustainable manner, which augurs well for the strength of Spain’s recovery.

- Banks, for their part, have been broadly restructured. The process has been painful to the public purse. Indeed it has entailed significant injections of tax-payers money, while also necessitating significant support of the European Stability Mechanism. However it has delivered important results in terms of improved capital buffers, strengthened governance arrangements, and stricter supervision. The fact is that the flow of new credit to new businesses has resumed its upward trend, thereby nurturing the economic recovery.

- The current account balance runs comfortable surpluses. And it does so even though the economy is expanding faster than in neighbouring countries. This is the result of rapidly rising exports, in excess of world markets, and gains in domestic markets vis-à-vis importers. The Spanish economy is much more open than pre-crisis in terms of both trade and foreign direct investment. The cyclical synchronization with respect to core European countries has therefore been enhanced.

- The real economy also seems to follow a sustainable expansion. The construction bubble has burst. Housing investment has declined to levels which are modest by both national and international standards. The recovery phase relies little on the construction sector. Indeed it is broadly based, led by a diversified manufacturing sector and market services, including a dynamic non-tourism sector.

- Cost-competitiveness has improved. Thus, the gap that had widened in terms of unit labour costs vis-à-vis the Eurozone has practically disappeared.

These gains have been achieved at a significant cost in terms of enterprise bankruptcies, employment losses, job precariousness and income inequalities. And public debt has taken the place of private debt.

So Spain needs further action to tackle the legacies of the crisis. Its efforts also should be shouldered by institutional reforms in the Eurozone. Indeed, the country remains vulnerable to shocks. A sudden stop of capital flows would exert upward pressure on the risk premium –all the more likely given the level of public debt. This would automatically worsen the accounts of banks, which are still overly exposed to domestic debt. In addition, and more fundamentally, Spain suffers like other countries from the lack of an effective macroeconomic instrument for addressing shocks.

In this regard, the phasing out of ECB purchases of government bonds will provide an important test. Spain has benefitted significantly from the asset purchase programme of the ECB, and the issue arises as to how risk premia and capital flows will react to the exit from this programme.

Concluding remarks

While there is growing awareness on the need for tackling the failures in the functioning of the Eurozone, significant differences remain regarding the remedies. Some countries stress the need for preventive country-specific measures, that is a combination of structural reforms and fiscal discipline, combined with European sanctions in case of non-compliance with commitments. Others champion stronger European action in counteracting economic cycles, building common institutions and addressing future crises. While a mix of both approaches is called for, it is essential to move quickly. Indeed, the systemic weaknesses have been masked by the ECB’s heterodox policy, which will have to come to an end over the next couple of years. This is exactly the time available for European leaders to make the Euro area one of shared prosperity.

BÉNASSY-QUÉRÉ, A.; RAGOT, X., and G. WOLFF (2016), “Which Fiscal Union for the Euro Area?,” Bruegel Policy Contribution, Brussels.

BORIO, C. (2017), “Secular stagnation or financial cycle drag?,” Keynote speech, National Association for Business Economics, 33rd Economic Policy Conference 5–7 March 2017, Washington DC.

BORIO, C., and A. ZABAI (2016), “Unconventional monetary policies: A re-appraisal,” BIS Working Papers, Nº 570, Basle.

EICHENGREEN, B., and C. WYPLOSZ (2016), “Minimal Conditions for the Survival of the Euro,” Intereconomics (51)1, January-February.

EUROPEAN CENTRAL BANK (2016), “Increasing resilience and long-term growth: the importance of sound institutions and economic structures for euro area countries and EMU,” ECB Economic Bulletin, Issue 5/2016.

EUROPEAN COMMISSION (2015), “Completing Europe´s Economic and Monetary Union,” Five President´s Report, Brussels.

— (2017), White Paper on the Future of Europe – Reflections and scenarios for the EU27 by 2025, Brussels.

GROS, D. (2013), “Banking Union with a sovereign virus,” CEPS Policy Brief Nº 289, CEPS, Brussels.

PISANI-FERRY, J. (2012), “The euro crisis and the new impossible trinity,” Moneda y Crédito, Nº 234, Madrid.

TORRES, R., and M. J. FERNÁNDEZ (2017), “The Spanish economy: Recent developments and forecasts for 2017,” Spanish Economic and Financial Outlook, Funcas, Madrid.

Raymond Torres. Director for Macroeconomic Analysis and Statistics, Funcas