Spain’s structural unemployment rate: Estimates, consequences and recommendations

Empirical evidence suggests Spain’s current high rate of structural unemployment leaves little room for the unemployment rate to fall without distorting prices. Lowering this high rate through structural reforms thus becomes an increasingly important priority to reduce potentially negative consequences for the Spanish labour market and overall economy.

Abstract: The consolidation of the recovery has opened up a debate about the economy’s capacity to continue reducing the unemployment rate without leading to inflationary pressures. The Bank of Spain estimates a structural unemployment rate of 16% of the active population, compared to 17.4% calculated by the European Commission. Our estimates point to a range of between 15% and 19% depending on the methodology employed. This high rate of structural unemployment in the Spanish economy could: (i) limit potential growth; (ii) exclude a large swathe of the population; and, (iii) negatively affect competitiveness. Hence, there is a need to implement structural reforms ranging from efficient retraining and refocused support for the unemployed to defending free market competition.

After two consecutive years of growth which have helped to solidify the economic recovery, one of the key issues that will be a focal point for the coming quarters is identifying how far the Spanish economy can continue to reduce the unemployment rate without generating wage and price tensions that would undermine competitiveness and attenuate the cycle.

This level of unemployment is known as structural unemployment and is related to potential GDP. The orthodox approach to measuring structural unemployment, itself vulnerable to a certain degree of methodological subjectivity, uses the Phillips curve as a starting point. The latter relates unemployment to inflation and enables the non-accelerating inflation rate of unemployment (NAIRU) or wage (NAWRU) to be estimated. Alternatively, the structural unemployment rate can also be inferred from the Capacity Utilisation Rate (CUR).

The methodological debate about the estimation of the structural unemployment rate is not just limited to the relationship between unemployment and wages but also between unemployment and potential output. Ultimately, the key point is that there is a floor on the unemployment rate after which any demand stimulus will be accompanied by an acceleration in unwelcome inflation.

In addition to comparing different estimates of structural unemployment, this article provides an overview of the implications of having a high structural unemployment rate and identifies a series of recommendations that could help to lower it.

Total and structural unemployment rate

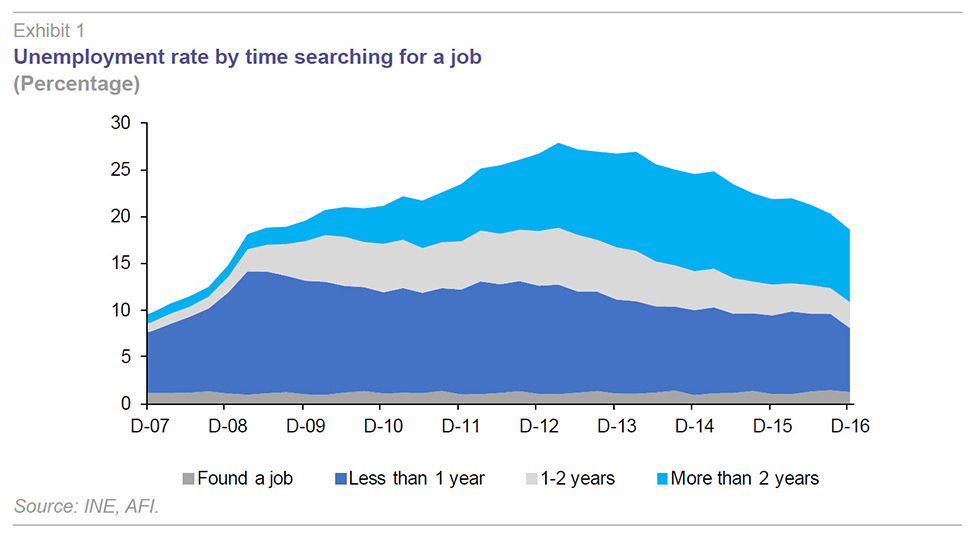

Since reaching a peak in the third quarter of 2016 at 26.9%, the Spanish economy’s unemployment rate has declined by 8.3 percentage points to close 2016 at 18.6%. This is a significant reduction, which has been supported by the no less impressive capacity of the Spanish economy to generate employment over the same period. However, the consolidation of the recovery has raised questions about the Spanish economy’s ability to continue reducing the unemployment rate in the coming quarters – in the context of a forecast for slowing activity and employment growth – without leading to an acceleration in inflationary pressures. This level is known as the structural unemployment rate.

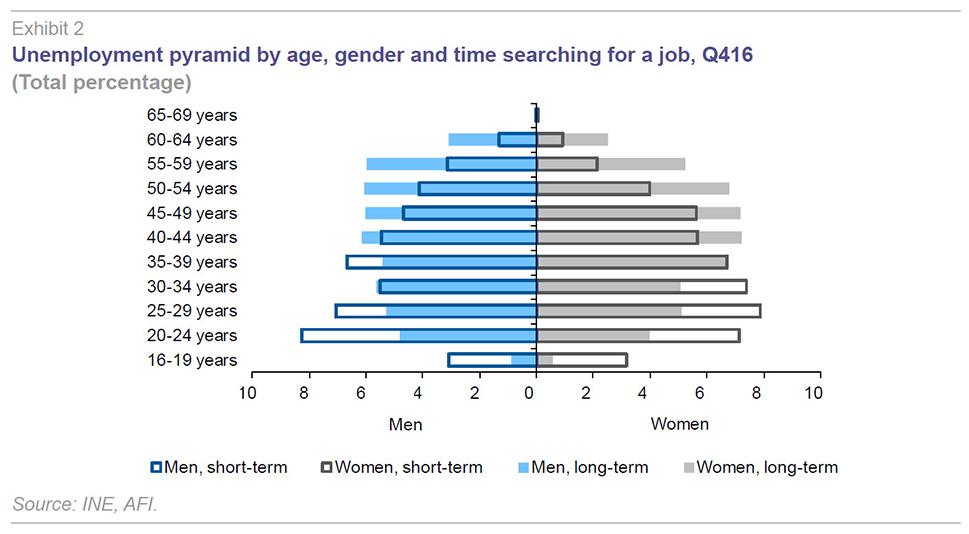

The unemployment malaise continues to impact the most vulnerable groups in society, such as women or those over 45 – they not only tend to be more frequently affected by unemployment, but they are also more likely to be unemployed for longer periods of time. The long-term unemployed, which in Q416 were 56.4% of the total, are primarily formed by these types of groups. Similarly, younger age groups who have the highest rates of unemployment are equally deserving of opportunities to work. The need to reincorporate all of these groups into the labour market requires renewed effort on top of what has been done so far.

In this regard, it is not only important to know the current state of play in the economy and how far the unemployment rate is from its structural level, but also to identify and foresee necessary reforms to lower it.

Methodologies and estimates of structural unemployment

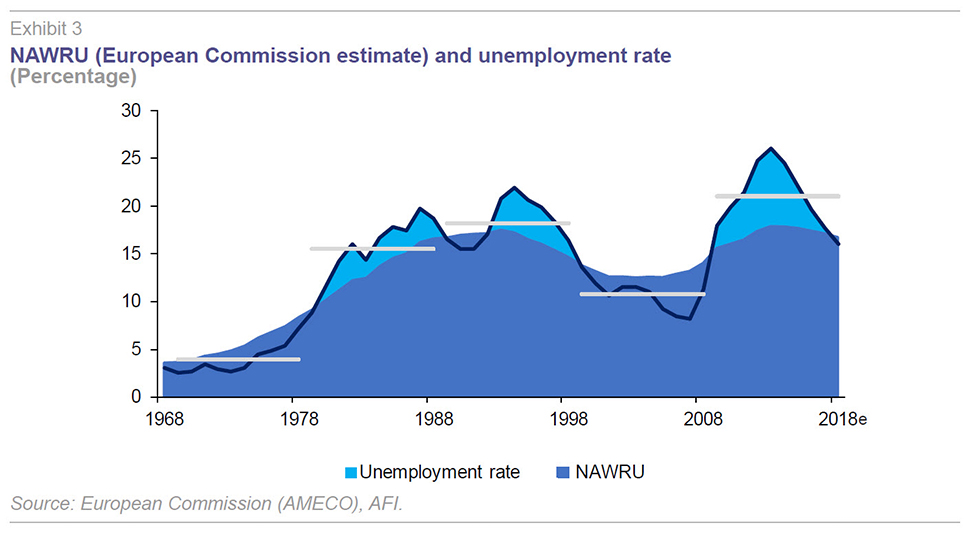

Although there are various estimates of the structural unemployment rate, they are not exactly conclusive. According to the European Commission (EC), the non-accelerating wage rate of unemployment of the Spanish economy stood at 18.4% of the active population at the end of 2015, compared to an observed rate of unemployment of 22.1%. EC forecasts for 2016 and 2017 place the structural unemployment rate at 17.4% and 17.2% respectively, very close to the 18.6% unemployment rate recorded at the end of 2016 (Exhibit 3). Meanwhile, the Bank of Spain in one of its recent occasional papers (Cuadrado and Moral-Benito, 2016) puts the structural unemployment rate of the Spanish economy in the most recent period at between 18% and 19%.

It is difficult to put these estimates into perspective given the lack of a wide range of alternative calculations, unlike other macroeconomic variables estimated by the main research houses and international organisations. In order to calculate the structural rate of unemployment of the Spanish economy, in this article we use the Capacity Utilisation Rate (CUR) and the conventional Phillips curve approach (1958), which we compare with the previously mentioned estimates.

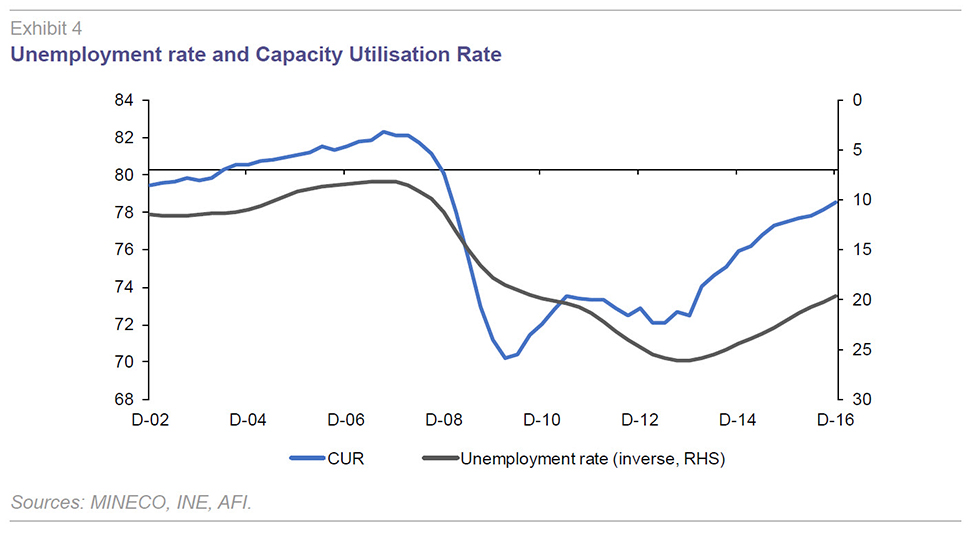

- Capacity Utilisation. The Capacity Utilisation Rate measures the degree of utilisation of the different factors of production, specifically, equipment, space and manpower. It is expressed as a percentage of the optimal operating level. The historical average CUR, aside from structural changes, is related to the unemployment rate.

The CUR methodology assumes that use of capital converges to its long-term equilibrium when the capacity utilisation rate returns to its historical average. Under the assumption of efficient competition, labour utilisation will find its structural level at the same time as capital (factor complementarity) with GDP reaching potential and the output gap closing.

Average utilisation of productive capacity in the pre-crisis period was 80.3%, compared to 79.2% in Q416. On this basis, a polynomial estimate of the capacity utilisation rate observed since the start of the crisis provides an interval for the structural unemployment rate ranging between 16.5% and 17.4%, depending on whether raw or smoothed (four-quarter rolling average) data series are used respectively.

[1] It is important to bear in mind that the average historical rate of LFS unemployment between 1979 and 2016 stood at 16.4%, almost identical to the upper end of the range estimated using CUR (raw data).

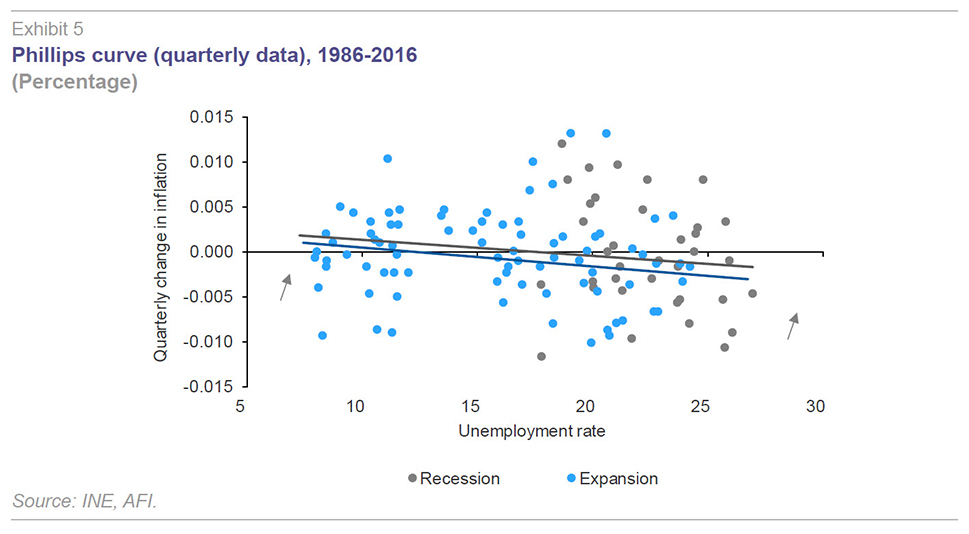

- Phillips curve. When the unemployment rate closes in on its structural level, wage tensions start to emerge due to the scarcity of certain types of workers. The Phillips curve illustrates this through the relationship between the price level of an economy and its unemployment rate.

This relationship makes it possible to differentiate between expansionary and crisis phases. We can therefore reach the conclusion that the latter has lead to a shift in the Phillips curve “towards the right”, consistent with an increase in the estimated structural unemployment rate of nearly six percentage points to reach a 18% threshold (Exhibit 5).

[2] If this result is correct, theoretically the coming quarters could see increases in inflation foreshadowing a lack of employable labour, even when the overall number of unemployed people remains very high.

In summary, estimates of the structural unemployment rate of the Spanish economy vary between 14.7% and 16.5% under the CUR approach and between 18% and 19% on the basis of the Phillips curve.

A vein of literature has emerged which is rather critical in regard to the second set of estimates, which according to some authors (OECD 2014; Ball, 2014) could contain an upward bias due to the imperfect treatment of hysteresis effects. These effects describe the persistence of high unemployment rates even once the initial causes have disappeared. This literature has opened up both an academic and institutional debate about the specification of the NAWRU employed by the European Commission itself (Havik et al., 2014), which is being used not only to determine the structural unemployment rate but also for the cyclical component of the structural deficit.

Meanwhile, the lack of current wage tensions suggests that the structural unemployment rate of the Spanish economy could be closer to the 16% inferred from the Capacity Utilisation Rate than the 18% derived from the Phillips curve. Either way, the key point is that the current high rate of structural unemployment leaves little room for the unemployment rate to fall without distorting prices.

Implications of a high rate of structural unemployment

Among the most significant consequences of a high structural unemployment rate (or an effective unemployment rate that is close to the structural rate) are: (i) the limitation on the relatively modest growth potential of the Spanish economy (which consensus currently puts at around 1.5%); (ii) exclusion from the labour market of a non-negligible group of workers who are currently unemployed; and, (iii) pressure on wages and prices in the economy, which could undermine competitiveness.

Firstly, a high structural unemployment rate implies an underutilisation of productive capacity, insofar as a proportion of the available labour force is kept idle, weighing down on potential growth. In theory, once the structural floor of the labour market has been reached, additional reductions in the unemployment rate can only occur through increasing wages above their equilibrium level. This means that any type of demand stimulus will lead to an acceleration in the general level of prices. The higher the structural unemployment rate, the lower the potential growth and more vulnerable the economy is to inflationary spirals.

High structural unemployment also has a twin negative impact on public finances. Not only does it diminish capacity to raise revenues, but it also increases demand for resources to sustain income levels (in the form of unemployment benefits or other social protection support).

Secondly, a high structural unemployment rate also results in exclusion from the labour market of a significant proportion of potential workers who are unemployed. Rigidities in the Spanish labour market, reflected in the high structural unemployment rate, exclude more that just the long-term unemployed (those who have been unemployed for more than one year) who are by definition harder to employ. Indeed, the proportion of long-term unemployed, despite being very high, is less than the threshold marked by the structural unemployment rate. This means that even though short-term unemployed people have a higher probability of finding a job than those who have been out of work for years, the market could even exclude them – effectively creating chronic long-term unemployment.

The profile of people who have been unemployed for less than a year is different from the long-term unemployed, given that there is no particular gender bias in the former and the short-term unemployed tend to be made up of young people. It is worth bearing in mind that Spain has the highest youth unemployment rate in the European Union. Part of this group is affected by a specific type of “unemployability”, which could come to the fore as the labour market closes in on the structural rate of unemployment.

Finally, the proximity of the effective unemployment rate to its structural level could increase wage and salary tensions which would hamper the competitiveness of the Spanish economy. As previously mentioned, there is no sign of this happening for the time being. Either way, it is worth paying attention to wage developments over the coming quarters, given both high unemployment and modest improvements in productivity, which means that possible wage increases would have negative repercussions on firms’ competitiveness.

Proposals to reduce structural unemployment

A variety of policies could help to reduce the Spanish economy’s high structural unemployment rate, relating both to the supply side (workers) and the demand side (companies), as well as labour regulation. Some of the measures which could serve as a starting point for determining a suitable package of reform are as follows.

- Efficient retraining and refocused support for unemployed people over 45 years old (long-term) and young people (short-term) who could end up being excluded from the labour market. This measure would require the following:

- Enhanced spending on active labour market policies. Spain is one of the coutries with the lowest spending per unemployed person in the EU-15. According to the State Budget, 5.2 billion euros were destined to active labour market policies, the equivalent of 1,100 euros per unemployed person. In comparison to the most advanced European economies, which spend 6,500 euros per unemployed person, Spain is lagging well behind the EU-15 average. There is scope to improve both support for this budgetary heading, as well as how it is oriented, to ensure that it is really spent on improving workers’ employability and their labour market performance. This suggests there should be a greater focus on spending on training, as is the case in the EU-15 average, and to a lesser degree on hiring subsidies. Average spending on training by countries making up the EU-15 accounts for 36% of the total budget for active labour market policies, compared to barely 25% in Spain.

- Focused training on the acquisition of skills that are needed by the production system and which help raise labour productivity. In this regard, digital skills are increasingly important for jobs in an ever more digitalised economy. The decision by the last Council of Ministers of 2016 to launch a support programme to foster training and employment of young people (under 30 years) in the Digital Economy is a step in the right direction. However, the budgetary allocation does not look to be sufficient (the equivalent of a maximum of 200 support measures for companies). It is also important to remember the urgent need for ongoing training of existing workers to mitigate the adverse effects arising from digital transformation.

- Increasing self-employment through improving the business climate. Self-employment accounts for barely 17% of total employment in Spain. The development of economic activities that are emerging in the new economy requires a supportive business environment in which business projects can be unleashed. It would therefore be desirable for Spain to improve its ranking in the World Bank’s Doing Business survey. The 2017 report (using data for 2016), places Spain in 32nd place, a long way behind key EU-15 countries such as Denmark (3rd), United Kingdom (7th) or Sweden (9th). In particular, it would be desirable for Spain to make progress in areas such as business start-up, construction permits or obtaining electricity, where the Spanish economy is lagging behind its European peers.

- Defending free competition. Removing entry barriers in protected sectors and proper compliance with conditions for free competition would reduce market prices and stimulate trade in goods and services. In this regard, the corporatism involved in certain professional activities as well as collusive and oligopolistic practices not only directly impact on the distribution of income (to the detriment of the consumer) but also negatively impact on employment creation.

- Reducing labour market rigidities. The last two labour market reforms that took place during the crisis have attempted to move labour market regulation towards a more liberal approach than has traditionally been the case in Spain. The current challenge is to balance the necessary reduction in rigidities with creating quality employment. Identifying effective forms of public-private collaboration, giving a greater role to job placement services and introducing simpler labour contracts are some of the best practices offered up by European countries, which might be worth emulating.

Conclusions

The unemployment rate in Spain is close to its structural level, which we could place (with the range of available estimates) at around 16% of the active population.

The limited space between the observed and structural rate of unemployment has potential implications: (i) on the Spanish economy’s potential GDP; meaning (ii) it could lead to professional exclusion that goes beyond the long-term unemployed, with repercussions on the growing and worrying social exclusion of a considerable part of the population; and, (iii) it could lead to pressures on wages and prices in the coming months which could negatively affect the overall competitiveness of the Spanish economy.

Reducing the high rate of structural unemployment is therefore a pressing concern in order to avoid these repercussions. In order to tackle this problem, it will be necessary to: (i) strengthen spending on active labour market policies, focusing them on improving workers’ skills and knowledge (particularly, the unemployed); (ii) boost self-employment, through improving the business climate; (iii) introduce measures to defend free competition; and, (iv) reduce labour market rigidities without disregard to the quality of jobs being created; among other structural measures.

We estimate the structural unemployment rate using the following polynomial relation U = -0.2341 ∙ CUR2 +34.337 ∙ CUR-1.233, applied to the last economic expansion, where U is the unemployment rate and CUR is the Capacity Utilisation Rate (the average historical CUR of 80.3% has been used). The unemployment rate corresponds to LFS data and CUR comes from the Ministry of Economy.

We estimate the structural unemployment rate from the relationship π=0.0025+0.0012∙Crisis-0.0208 ∙ μ, applied to the period 1986-2016, where π is the quarterly change in inflation (year-on-year change in prices), Crisis is a dummy set to 1 in the quarters when the Spanish economy has found itself in a recessionary phase, and μ is the rate of unemployment. The rate of inflation and LFS unemployment rate come from INE.

References

BALL, L. (2014), “Long-Term Damage from the Great Recession in OECD Countries,” NBER Working Paper, No. 20185.

CUADRADO, P., and E. MORAL-BENITO (2016), “The potential growth of the Spanish economy,” Occasional Papers, No. 1603, Bank of Spain.

EUROPEAN COMMISSION (2017), European Economic Forecast Winter 2017.

HAVIK, K.; MC MORROW, K.; ORLANDI, F.; PLANAS, C.; RACIBORSKI, R.; ROEGER, W.; ROSSI, A.; THUM-THYSEN, A., and V. VANDERMEULEN (2014), “The Production Function Methodology for Calculating Potential Growth Rates & Output Gaps,” European Economy Economic Papers, No. 535.

OECD (2014), Economic Outlook, Vol. 2014, Issue 2, Nº 96.

PHILLIPS, A. W. (1958), “The Relationship between Unemployment and the Rate of Change of Money Wages in the United Kingdom 1861-1957,” Economica, 25 (100): 283–299.

SEBASTIAN G.; RIETZLER, K., and S. TOBER (2015), “The European Commission’s New NAIRU: Does it Deliver? Macroeconomic Policy Institute”, IMK Working Paper, Nº 142.

WORLD BANK (2017), Doing Business 2017: Equal Opportunity for All.

María Romero and Daniel Fuentes. A.F.I. - Analistas Financieros Internacionales, S.A.