Spanish economic forecasts panel: September 2019*

Funcas Economic Trends and Statistics Department

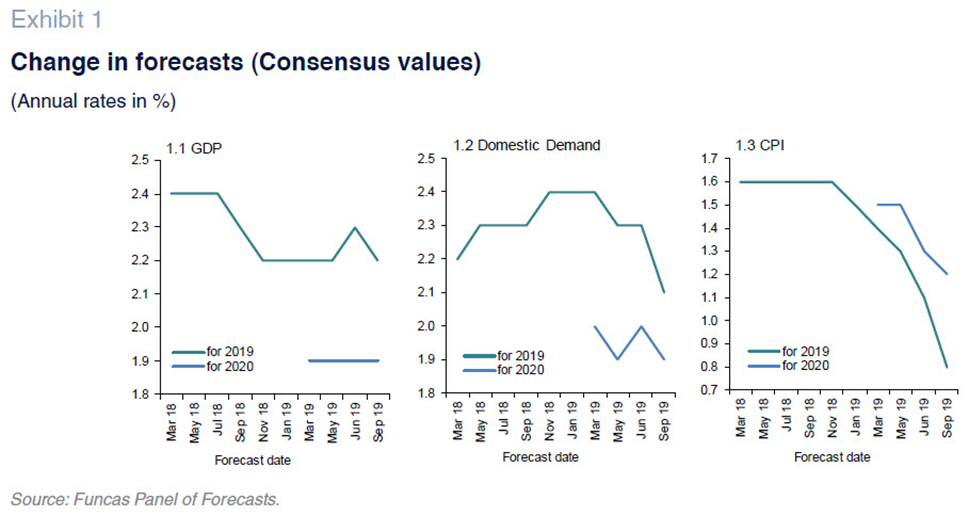

GDP growth estimated at 2.2% in 2019, 0.1pp down from the last survey [1]

Second-quarter GDP growth came in at 0.5%, 0.1pp lower than our Panel members were estimating. The slowdown was evident in most of the services and manufacturing industry related indicators. On the other hand, certain aspects of private consumption, such as retail sales, were stronger than forecast.

The consensus is for third- and fourth-quarter GDP growth of 0.5% (no change from the last survey, published in July). For 2019 as a whole, the consensus forecast points to growth of 2.2%, down 0.1pp from the July report. Ten of the analysts have trimmed their forecasts, whereas none has revised them upwards.

The expected composition of that growth has shifted: net exports are now expected to contribute 0.1pp (compared to a neutral contribution forecasted in last survey) and domestic demand 2.1pp, down 0.2pp from the July consensus estimate. The average forecasts for private and public consumption have been cut by 0.1pp. However, the most significant change is the 0.6pp downward revision to forecast investment in capital goods (driven above all by estimated growth in investment in machinery and equipment, which has been cut by 1.2pp to 3.3%). The forecast for growth in imports has been reduced by 0.5pp to 1.1%, whereas estimated growth in exports is unchanged from July.

Growth forecast for 2020: Unchanged at 1.9%

The consensus forecast for GDP growth in 2020 is unchanged at 1.9%. The only subtle difference is that the analysts are now expecting a slight slowdown in quarterly growth, to 0.4%, to begin in the second quarter (Table 2), as opposed to the third quarter, which is what they forecast in July.

The contraction in growth forecast for next year is attributable to a slowdown in all components of domestic demand and a less favourable contribution by net trade (0% in 2020 versus 0.1% in 2019).

Inflation continues to ease

Inflation has fallen to around 0.4% in recent months, from around 1% at the start of the year, due to the drop in the prices of unprocessed food and, above all, energy products. Inflation is expected to remain at current levels for the rest of the year, reaching slightly higher in November and December. Note, however, that due to the timing of the survey, the analysts’ forecasts do not factor in developments in oil prices relating to the drone attacks on Saudi Arabian oil-producing facilities.

The consensus forecast for average inflation in 2019 has been reduced by 0.3pp to 0.8%; the forecast for core inflation has been revised downward by 0.1pp to 0.9%, which would put it above headline inflation for the first time since 2016. Looking to 2020, headline and core inflation are both forecast at 1.2%. The year-on-year rates of change in December of this year and next are currently forecast at 1% and 1.2%, respectively (Table 3).

Signs of slowdown in the job market

According to the Social Security contributor figures, the rate of job growth continued to weaken in July and August, in tandem with the overall pattern of economic weakening. All sectors are losing momentum.

The consensus forecasts for growth in employment is unchanged at 2.2% for 2019 and down 0.1pp to 1.6% for 2020. The forecasts for growth in GDP, job creation and wage compensation yield implied forecasts for growth in productivity and unit labour costs (ULCs). Productivity is not expected to improve this year but is expected to advance by 0.3% in 2020. ULCs, meanwhile, are expected to increase by 1.9% in 2019 (up 0.2pp from the July report) and 1.5% in 2020 (down 0.2pp vs. July).

The average annual unemployment rate is expected to continue to trend lower to 13.9% in 2019 and 12.9% in 2020, which is nevertheless slightly higher than was being forecast in July.

External surplus continues to shrink

To June, Spain presented a current account deficit of 1.2 billion euros, compared to the 1.64 billion euro surplus recorded in the first half of 2018, shaped by the erosion of the trade surplus and increase in the income deficit.

The consensus forecasts for the current account are unchanged from July: a surplus of 0.6% of GDP in 2019 and of 0.5% in 2020.

Public deficit forecasts unchanged

The fiscal deficit, excluding local authorities, amounted to 26.33 billion euros in the first half of 2019, compared to 22.42 billion euros in the same period of 2018. The deterioration is the result of faster growth in spending relative to revenue, at all levels of government.

The consensus forecasts for the public deficit in Spain are unchanged from July: 2.3% of GDP in 2019 and 1.9% in 2020. Those numbers would imply missing the government’s targets by 0.3pp and 0.8pp, respectively.

The external environment has deteriorated by more than expected

When the analysts submitted their forecasts, a barrel of Brent oil was trading at around $60. As a result, this survey does not reflect the spike in oil prices prompted by the recent drone attacks on Saudi Arabian oil extraction facilities. However, even without factoring in those events, the global economy is slowing down faster than was originally expected. The main economic indicators, such as the global PMIs, point to a drop in manufacturing activity levels and slower growth in services, trends that have become more pronounced since the last report was compiled in July.

The global slowdown reflects a host of factors that are reinforcing each other. On the one hand, according to recent estimates, global trade contracted during the first half of the year. The tariff war between the two main economic powers is showing little sign of dissipating. Elsewhere, the Chinese economy continues to slow, while growth in the US is beginning to show signs of sluggishness. Lastly, the industrial sector is facing major structural changes that are weighing on output. All of which is exacerbated by Brexit-induced uncertainty.

The European economy, highly dependent on exports, is one of the most affected. The ECB’s September forecasts point to growth in the eurozone of 1.1% in 2019 (down 0.1pp from its June forecasts) and of 1.2% in 2020 (down 0.2pp).

The analysts have become more pessimistic about the outlook for the external environment since July. Sixteen and fourteen of them now see the environment in the EU and beyond the EU as adverse, respectively (fourteen and eleven, respectively, in July). Moreover, eight believe that the situation will deteriorate further in Europe, whereas none of them believed this in July. Lastly, not a single analyst is expecting an improvement in the coming months.

Monetary policy looks set to remain expansionary throughout the projection horizon

The analysts submitted their forecasts and assessments before September’s ECB Governing Council meeting, at which significant monetary policy decisions were announced in a bid to counteract the deterioration in Europe’s economic prospects and disappointing inflation figures. Specifically, the central bank is rekindling its government debt asset purchase programme (APP), to the monthly amount of 20 billion euros. It is also cutting the rate on its deposit facility by 0.1pp (to -0.5%) and stepping up support for its long-term refinancing operations (TLTRO–III). Lastly, the ECB is introducing a two-tier deposit rate system in order to mitigate the penalisation of the bank reserves placed on deposit.

The markets had already begun to price in the shift towards a more accommodative stance. 12-month EURIBOR has dipped from the readings anticipated in the last report, staying solidly in negative territory (and this situation is largely unchanged in the wake of the ECB’s announcements last Thursday). The yield on 10-year Spanish bonds remains at record lows, below 0.3% (down 0.1pp from July).

The analysts’ assessment of the monetary situation is largely unchanged, with nearly all of the opinion that monetary policy is expansionary. They also agree that these conditions will persist throughout the coming months. The yield on the 10-year bond is barely expected to move in the next few months and is forecast at 0.65% at the end of 2020, down from the last forecast of 0.92%. 12-month EURIBOR is expected to remain in negative territory for the entire forecast horizon, at even lower readings than were being forecast in July. Lastly, the number of analysts who believe that the prevailing accommodative monetary policy is what the Spanish economy needs right now has increased from eleven to thirteen.

Euro largely stable against the dollar

Since the July assessment, the euro has depreciated slightly against the dollar. The analysts believe that the Federal Reserve’s monetary policy easing in the US, potentially more pronounced than in Europe, will translate into a slight appreciation of the euro against the dollar in the quarters to come. They are forecasting an exchange rate of EUR/USD1.14 at the end of the projection period, down a scant USD0.02 from the last report.

Most analysts view fiscal policy as expansionary

There is little change in the analysts’ assessment of fiscal policy. While the number who believe the current policy stance is neutral has increased, the majority continue to view it as expansionary.

The Spanish Economic Forecasts Panel is a survey run by Funcas which consults the 19 research departments listed in Table 1. The survey, which dates back to 1999, is published bi-monthly in the months of January, March, May, July, September and November. The responses to the survey are used to produce a “consensus” forecast, which is calculated as the arithmetic mean of the 19 individual contributions. The forecasts of the Spanish Government, the Bank of Spain, and the main international organisations are also included for comparison, but do not form part of the consensus forecast.

Notes

Note that the survey responses were collected before the National Statistics Office (INE) published its revised national accounting figures.