Introducing the right incentives for regulations on commercial debt payment terms

Available results on the impact of recently introduced regulation on late payment of trade debt show they have had a limited impact on reducing late payments. Lessons learned and new incentives could be incorporated into a new regulatory push focused beyond just legally capping payment terms.

Abstract: Since January 2013, Spanish regulations dictate that trade debt must be settled within a legally-binding, maximum term of 60 days. The regulations came about in an attempt to curb the impact of non-performance on SMEs. However, the regulations are deemed to have had a scant impact on shortening average payment periods, reviving an old argument about the substance of the problem pursued by the regulations. Are the payment deferral and non-payment phenomena a result of imbalanced bargaining power? Or, to the contrary, are they a sort of safeguard for resolving an asymmetric information issue? Is the payment term the variable the regulator should attempt to control in order to prevent commercial debt non-performance? Recent experience supports the notion that there exists room to introduce productive changes under a new regulatory push directed not at legally capping payment terms, but rather at supervising and overseeing compliance with the agreed-upon terms, vigorously upholding free competition and the effectiveness of the courts to impose justice and of the mediation mechanisms in the event of conflict. Moreover, efforts should also be dedicated to gathering far-reaching official statistics on this issue, as today’s data appear insufficient for the formulation of effective, economic policy measures to better combat late trade payments.

[1]

Payment deferral has traditionally been underpinned by the commercial and financial benefits that doing so provides suppliers and customers in their everyday operations. On the one hand, it allows debtors to replace access to external financing, while giving them the ability to control the quality of the product or service exchanged before definitively paying for it. For creditors, on the other hand, it constitutes a strategic alternative to traditional price and quantity variables for competing in the marketplace or generating customer loyalty. Nevertheless, insofar as most of the goods and services purchase and sale flows are covered by agreements that postpone the payment or collection of these everyday business transactions, the credit risk

[2] intrinsic to this modus operandi is naturally a source of concern for the affected companies. Most particularly for small-sized enterprises whose solvency depends crucially on liquidity at hand to fund their business activities. Moreover, non-performance requires them to have resources

[3] in order evaluate their exposure to debtor non-payment and to protect themselves against such circumstances. Such resources imply an additional business cost.

The direct impact of payment deferral and non-performance on companies and, by extension, the competitiveness of the productive landscape, prompted European regulators to establish a regulatory framework to limit the distortions that may be caused by opportunistic or abusive conduct on the part of suppliers or debtors. Directive 2011/7/EU of the European Parliament and of the Council,

[4] on combating late payment in commercial transactions (known as the Late Payment Directive), establishes a common set of rules that are applicable in all member states. The aim is to protect the viability of the more exposed or less protected undertakings (in particular, of SMEs, as specified in the Directive’s scope) in the event of unjustified late payment or, in the worst cases, definitive non-payment of commercial debt. Another aim is to eliminate potential grievances in terms of corporate competitiveness as a result of the issue of drawing out payment terms in the context of cross-border transactions.

[5] Spain anticipated the European Late Payment Directive when it passed Law 15/2010, amending the measures for combating non-payment in commercial transactions, stipulating a maximum payment term of 60 days from the date of merchandise receipt or service provision. To enact this requirement, it established a staggered timeline,

[6] stipulating a reduction in the permitted payment term from 85 days in July 2010 to 60 days by early 2013. Moreover, unlike the European Directive, which allows the parties to negotiate the payment term, the Spanish regulations dictate that the term of negotiated agreements may not exceed 60 days.

While commercial debt non-performance has decreased considerably in recent years, it is hard to attribute the reduction to the impact of the regulations insofar as the Spanish economy has undergone a complex cyclical period in the interim, to say the least. However, since the economy has shaken off recession and the financial markets have gradually stabilised, payment terms have stagnated at a ‘stationary’ level that is far from that targeted in the legal framework. This has revived the theoretical and empirical debate about the effectiveness of the regulations and the need to introduce design improvements.

With the aim of contributing to the debate about commercial transaction payment term regulations, this paper attempts to assess the impact of the Late Payment Directive in Spain based on an analysis of non-performance in respect of inter-company commercial debt in Spain in recent years and provide a succinct review of the academic effort to decipher the nature of commercial debt deferral and non-payment. Despite the fact that the lack of statistical information prevents more robust cross-checking, the evidence gathered is not promising as far as effectiveness of the late payment regulations are concerned. To the contrary, it warrants the revisiting of the debate about the true causes of the late payment phenomenon, and particularly whether or not the establishment of a maximum payment term, uniformly applicable across all sectors, is the most appropriate way to combat late payment.

Late payment: Bargaining power or efficiency mechanism?

There is broad debate regarding the drivers behind the length of payment terms agreed upon in commercial transactions and the potential breach thereof.

[7] The explanation most widely given ‒ and the one most accepted in the European Directive ‒ relates to the strategies adopted by companies as a function of their bargaining power. According to this line of thinking ‒ which stems from monopoly theory ‒ the causes of late payment terms or unjustified non-performance (relative to the legally-stipulated terms or those agreed between the parties) lie with the size or intensity of competition in the markets in which the suppliers or customers pursue their business activities. This theory holds that the party less burdened by competitive pressure or of greater size has an upfront advantage, namely relatively greater power to impose beneficial terms when negotiating commercial transactions. Among other reasons, on account of the scant incentive on the part of suppliers to penalise customer late payment for “fear of reprisal”. The lower the transaction costs a company with market power (a monopsonist in the extreme) will incur to switch supplier, the lower the suppliers’ incentive to curtail agreement terms and conditions. Therefore, in industries in which there is greater competitive pressure, suppliers will be more inclined to accept higher volumes of trade credit or less favourable collection terms when their commercial counterpart is a customer

[8] of relatively greater size or one active in a less competitive environment.

On the empirical research front, a relatively recent study (Fabbri and Klapper, 2016) finds evidence in support of this line of reasoning. These researchers conclude that suppliers with weak bargaining positions were more likely to extend credit to their customers, carry larger trade receivables balances and offer longer payment terms without demanding late payment interest. Preferred customers then took advantage of this weakness by tending to delay their supplier payments. In the case of Spain, despite the limitations affecting the statistics compiled by the Bank of Spain to track supplier payment and customer collection terms,

[9] the figures available support the thesis that the larger companies are advantageously positioned in terms of commercial transaction payments and collections. The gap between the payment term negotiated with their suppliers and collection from customers stood at 18 days in 2014. However, this gap is shorter in the case of SMEs (10 days). Elsewhere, both indicator levels are manifestly shorter in the case of large companies. Large companies collect 16 days sooner than SMEs, while the payment period is also shorter, at 63 days.

Other interpretations, underpinned by modern contract theory, draw conclusions that are not related to the presumed exercise of bargaining power. In contrast, these theories hold that late payment and non-performance with respect to agreed-upon terms represent a form of “safeguard” in relations between suppliers and customers, efficiently resolving an asymmetric information problem that is intrinsic to commercial transactions. Specifically, the possibility of opportunistic conduct

[10] underpinned by privileged access to information in a commercial transaction. As noted by Arruñada (1999), “the special utility afforded by payment deferral is to impose discipline on relations between manufacturers and distributors”. In other words, late payments allow debtors to evaluate compliance with the terms of contract (product/service quality).

If, on the other hand, there are clear incentives between suppliers and their customers to maintain commercial relations over a dynamic time horizon, the ‘repeat’ nature of the transactions reduces the probability of opportunistic conduct on the part of either party. Said another way, strategies which tend towards abuse of contract terms are disincentivised once there is scope for penalisation thereof in the form of withdrawal of the supplier-customer relations. However, when transactions are more occasional, suppliers may be more tempted to skimp on their efforts to maintain product quality standards or other contract terms. In this manner, payment deferral results in a sort of ‘second best’ in which both parties to the contract maximise the advantages accruing from the transaction deriving from specialisation (efficiency mechanism). Using this line of reasoning, late payment with respect to the legally-stipulated term relates to conflicts arising from non-performance of one or another dimension of the contract rather than to term-setting power on the part of the company better positioned at the negotiation table.

These arguments have been used to criticise the monopolistic thesis. Specifically, by arguing the fact that if the debtor has sufficient market power – at the extreme, a monopsonist – it is not so incentivised to defer payment as in reality it can force suppliers to set a lower price, either directly or indirectly (prompt payment discounts, for example).

[11] Nor is it rational for such a buyer to establish a payment term and then systematically breach it if it has the power to set the term in order to maximise its profits without having to risk reputational fallout in the process.

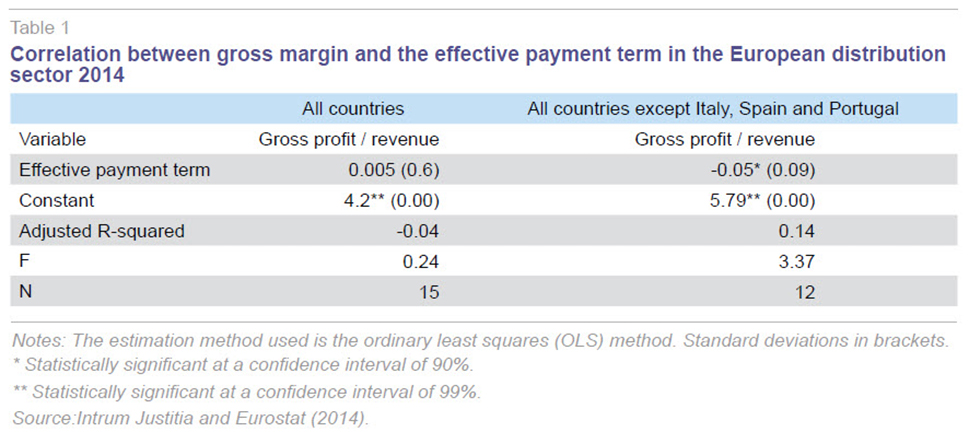

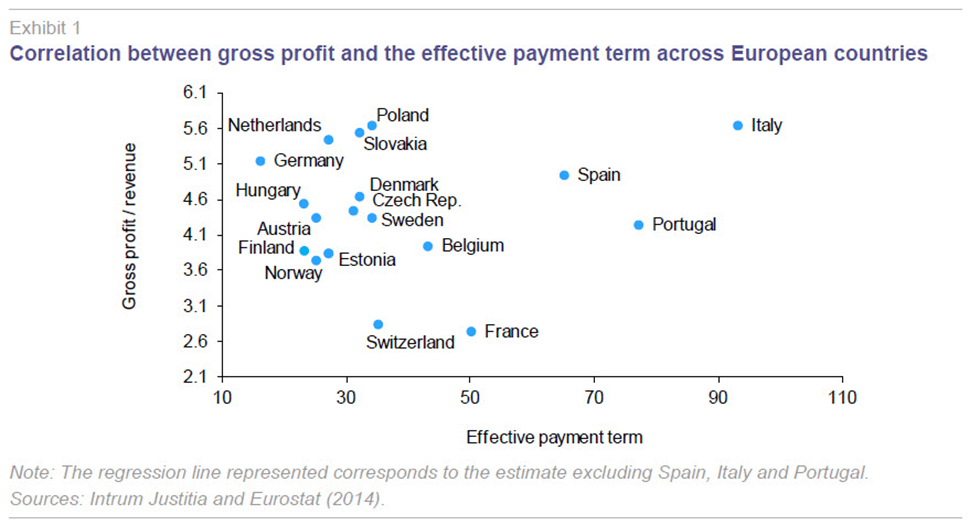

One of the empirical indicators which helps support this criticism, and reinforce the commercial efficiency mechanism thesis, is the fact that supplier payment terms in the distribution sector (retail and wholesale) are inversely correlated with the sector players’ margins. If the monopolistic thesis were to hold, one would expect a correlation, either positive or at least not inverse, given that the terms should be set independently of the price negotiated. In reality, the longer the payment term, the lower distribution margins tend to be, and this might be attributable to the payment of higher prices to suppliers when that price is negotiated with the latter, reducing the margin obtained by the distributor. This thesis cannot be ruled out for most of the European nations; however when the countries comprising the ‘Mediterranean variable’ are factored in to the empirical analysis, the results cease to be statistically significant. However, the fact that these countries have undergone severe liquidity issues may have fostered longer payment terms without having represented an abuse of position. Although the lack of statistics prevents further analysis in this respect, it does suggest a more than anecdotal link.

However, there are also a few arguments against this line of thinking. From the theoretical standpoint, if negotiations regarding the price to be paid by the customer and the payment term functioned as substitutes, the large companies subject to financial market scrutiny, particularly that of the rating agencies which assign grades to their corporate bonds as a function of their balance-sheet financial position, might be tempted to present lower financial borrowings at the cost of a higher trade payables balance. This could imply longer payment terms not attributable to commercial or financial benefits. In this context, the exercise of bargaining power ‒ potentially on a recurring basis ‒ in order to present a healthy credit picture at the cost of suppliers is a legitimate line of argument worth considering.

Business-to-business commercial debt: Recent trends in non-performance in Spain

According to the Non-Performance and Corporate Financing News Bulletin compiled by CEPYME,

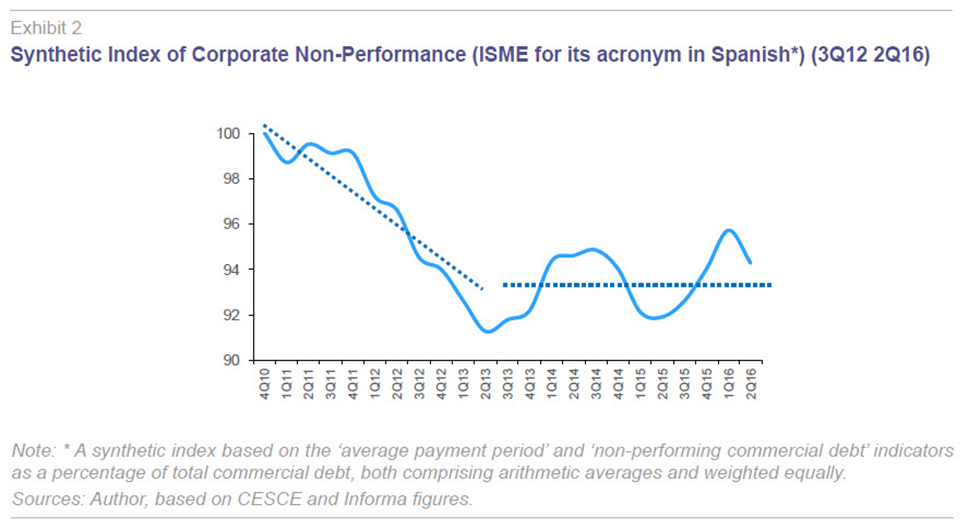

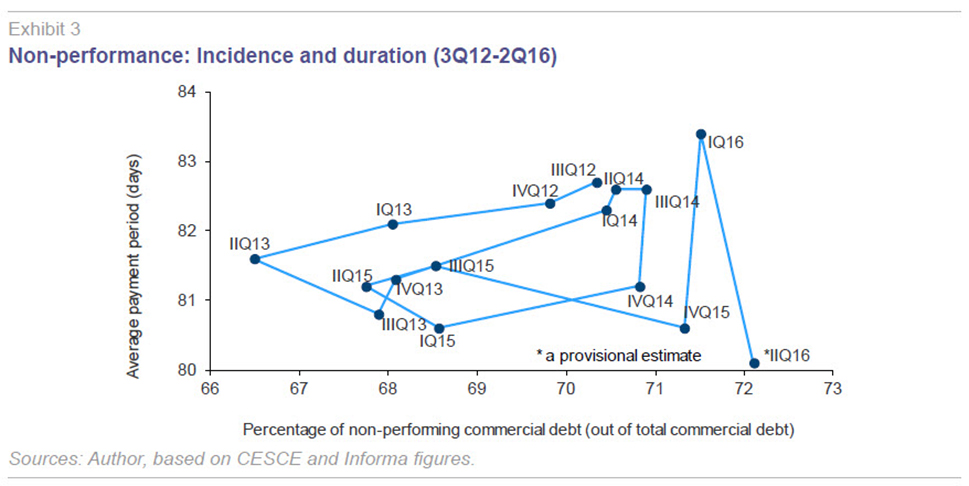

[12] Spain’s SME confederation, the average term of payment on commercial transactions between SMEs currently stands at around 80 days. A level at which this metric appears stuck, despite successive ups and downs since the Spanish economy shook off recession and financing conditions returned to ‘normal.’ The sharp credit crunch and drop in demand put strong pressure on corporate liquidity during the crisis years. This forced companies to lengthen supplier payment periods in order to generate working capital (for funding payroll, etc.). Elsewhere, the percentage of commercial debt in arrears with respect to the legally-mandated term oscillates at around 70% of all trade debt, judging by the trend in both indicators and the so-called Synthetic Index of Corporate Non-Performance (Exhibit 2 and 3).

The circular trajectory traced out by the percentage of non-performing debt and average payment period evidence stagnation in non-performance around a ‘stationary’ level, as is seen in other phenomena. This prompts several readings. Firstly, stripping out the effects of normalisation in economic and financial activity, the effect of the 60-day requirement and elimination of the scope of parties to negotiate different terms have not triggered rapid adaptation by the parties to the objectives pursued by the regulations. Indeed, the average payment term has been stuck at around 81 days since 2013.

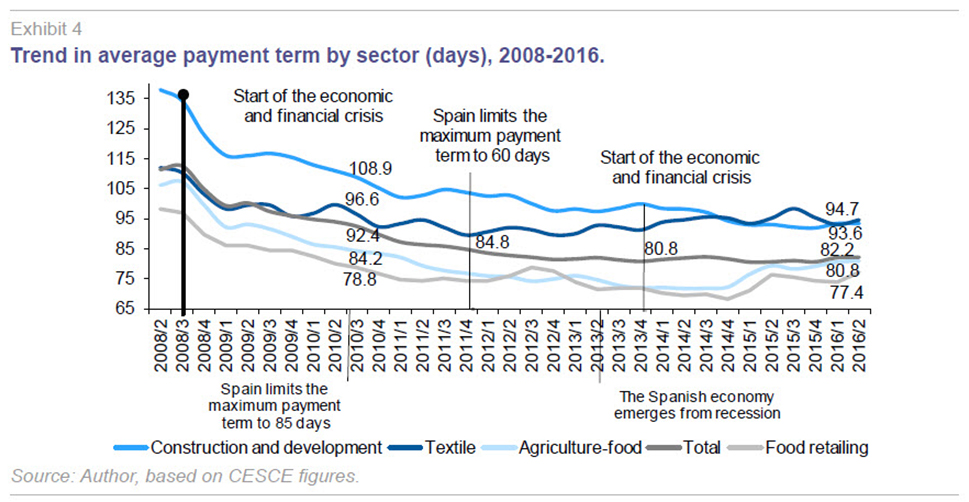

Analysing the trend in the average payment term by line of business reveals considerable differences. The textile and construction sectors are settling their trade debt well in excess of the legal deadline, whereas payments in the food retail sector are far closer to this threshold, albeit still north of the 60-day mark.

[13] In the textile sector, the average payment term has barely changed since the regulations took effect (at close to 90 days), whereas in other sectors, such as the distribution sector, the ability to fall in line with the legally-stipulated term has been far more significant. The fact that the business cycle is possibly longer in the textile sector than in others such as the food industry is one possible explanation for this difference. These descriptive differences lead us to three underlying questions: (i) whether the current payment term, ‘late’ by around 20 days, is effectively its ‘natural’ level; (ii) whether the late payment phenomenon is a consequence of relative bargaining power as the regulations assume or whether current levels represent the minimum term needed by debtors to corroborate whether the supplier has satisfactorily met its contractual undertakings; and (iii) whether the payment term is the right variable to regulate in the effort to eliminate the late/non-performance issue.

Assessment of the impact of the European Directive on late payments in Spain

The goal in this section is to perform an econometric assessment to determine whether the regulations have been effective in Spain and have thereby contributed to correcting the alleged ‘market flaw’ arising from imbalanced bargaining power and, specifically, abuse of market position by companies in setting payment terms.

To this end, an attempt has been made to isolate the impact of the regulations on effective payment terms with respect to other drivers such as economic growth or the companies’ financial position. Unfortunately, the lack of information at the company level precludes more incisive analysis of this phenomenon.

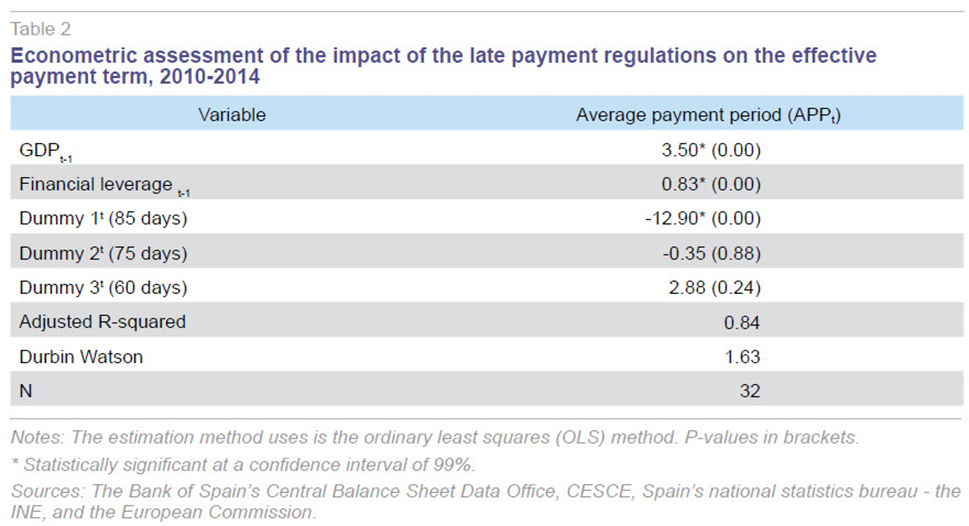

The results of this statistical exercise are presented in Table 2. Both the sign and significance of the parameters are as expected. Economic activity, measured as the quarterly change in GDP with a lag,

[14] is positively correlated with average payment periods, insofar as an improvement in the economic climate leads to more relaxed liquidity requirements and prompts creditors to allow debtors to finance themselves to a greater extent (financial advantage). The companies’ financial position, meanwhile, for which their leverage ratio is the proxy used, is also positively correlated, suggesting that the more leveraged a company, the more it will tend to stretch out payment terms, trade debt constituting a substitute for external borrowings.

In terms of the impact of the late payment regulations, three fictitious control variables, or dummies, have been introduced to enable distinction between the various staggered deadlines for ultimately complying with the 60-day term. The results show that although the regulations had a clear and significant impact on reducing the payment term during the first period (when the term had to be reduced to 85 days between July 2010 and December 2011), the impact of the additional reforms is not statistically significant in the rest of the period analysed.

These findings tally with the conclusions drawn by the European Commission itself. Literally, the Commission’s Report on the implementation of the Directive

[15] concludes that

the improvements in average payment periods remain modest to date. And not only in Spain but right across the EU. Among the factors identified as preventing effective application of the Directive, the lack of a common monitoring system, lack of clarity on some key concepts of the Directive and the market imbalance between bigger and smaller companies are identified as the biggest contributing factors.

Conclusions

The European Commission’s Late Payment Directive has had a very limited impact on compliance with average payment terms, as manifested by the Commission itself in its report on the Directive’s implementation. This is corroborated by the evidence compiled in this article, which fails to establish a positive correlation between the regulations and reduction in payment periods. In fact, the econometric exercise performed in this article reveals a negligible impact between 2012 and 2016.

That being said, these findings do not and are not intended to constitute the last word on the subject. Unfortunately, the lack of available public statistics has considerably limited empirical research in this field, as well as hindering the ability to rigorously check the hypotheses put forward in the academic literature. The information available is scant and, often, biased. What’s more, it is often aggregated which complicates, or rather impedes, the ability to factor in the tremendous heterogeneity characterising B2B commercial transactions and analyse the real drivers underpinning these and their terms. Among other reasons, because the companies are not motivated to disclose information about their daily dealings on the invoicing front. These limitations do not, however, mean that the findings are not valid justification for questioning whether the regulations in place are the best means to the end pursued.

The principles around which the regulations are articulated assume systematic abuse of bargaining power by large companies relative to their smaller counterparts. Without dismissing the possibility of finding evidence to support this theory, as certain academics have done, there are several indicators to suggest that this interpretation is at the very least overstated. Average payment periods in B2B commercial transactions in Spain have been stuck at around 81 days since early 2013, roughly 20 days beyond the legally-stipulated maximum term. The fact that the average term varies considerably by sector corroborates the advisability of reviewing the regulations to factor in the nature of the product or service exchanged.

Against this backdrop, if the safeguard mechanism theory is correct, as several studies suggest, payment terms should be tied to customers’ ability to verify the quality of the product exchanged. In this context, it doesn’t make sense to establish a single, identical and cross-sector payment term. By extension, the parties’ freedom to negotiate payment terms should be the principle guiding any regulations in this arena. This is not to imply, however, that abusive or opportunistic conduct does not take place or should not be corrected. The regulatory thrust should not, therefore, be directed at legally capping payment terms but rather at supervising and overseeing compliance with the agreed-upon terms, vigorously upholding free competition and the effectiveness of the courts to impose justice and of the mediation mechanisms in the event of conflict. Erroneous interpretation of the late payment phenomenon by the regulatory authorities when it comes to establishing the rules that govern trade relations can have high costs in terms of the competitiveness of the productive sectors across the various economies. Specifically, too short a mandatory payment term could distort efficiency, systematically favouring suppliers and fostering opportunistic conduct, just as too long a period could unfairly benefit buyers.

For late payment regulations to introduce the right incentives, policy needs to start to compile far-reaching statistics that enable more in-depth analysis of the late payment phenomenon. The official statistics available, despite providing good signals, are not up to the task of generating sufficiently robust results using conventional analyses of policy effectiveness or of serving as the basis for implementing, on the basis of such results, efficient and effective economic policy measures to better combat late trade payments.

Notes

This paper also includes collaboration by Elena Montesinos, Jaime Lazareno, and Jose Antonio Herce.

Risk of breach of the payment term and attendant non-performance.

These capabilities tend to be scarcer at companies with relatively reduced financial muscle, generally SMEs.

According to the Directive, “Undertakings should be able to trade throughout the internal market under conditions which ensure that transborder operations do not entail greater risks than domestic sales.”

The schedule established was as follows: from July 7th, 2010, until December 31st, 2011, the maximum term was 85 days; from January 1st, 2012, until December 31st, 2012: 75 days; from January 1st, 2013, on: 60 days.

Late payment or breach of the payment terms as distinct from definitive non-payment.

Alternatively, when the market power swings in favour of the suppliers, late payments can in practice constitute a price discrimination strategy vis-a-vis customers (Meltzer, 1960). If a supplier offers uniform prices and payment terms, it is implicitly paying lower prices to customers with relatively reduced means for payment. If, on the other hand, it modifies payment terms depending on its customers, it can apply an explicitly uniform sales price while selling at lower real prices to the customers it grants longer payment terms, net of the implicit financial costs.

The series are compiled using year-end balances from the Bank of Spain’s Central Balance Sheet Data Office and Companies Register. These terms do not relate exclusively to business-to-business (B2B) transactions, but rather include all commercial transactions, including business-to-government (B2G) and business-to-consumer (B2C) transactions.

“Adverse selection” arises when one party to a contract can make use of an information advantage available to it before entering into the contract. For example, a distributor may fear that an offer received from a specific unknown supplier may be due to a hidden product defect. And so, in the absence of due guarantees, it will tend to imagine the worst if it is not able to verify the quality ex-ante. Elsewhere, moral hazard arises in respect of compliance with the obligations governing the exchange after entering into the contract. For example, after the contract has been signed, the supplier’s incentive to respect the product quality terms may be lower, particularly if the transaction is more of an ad-hoc one.

One of the most common practices in the distribution sector is, precisely, for the distributor to impose prompt payment in exchange for a price discount.

Recall that the regulations establish a term of 60 days from receipt of the merchandise and not the invoice, which means that the figures may be skewed upwards in this respect.

Using the hypothesis that past information about the economy influences payment terms in the present, as expectations are recalibrated over time.

References

ARRUÑADA, B. (1999), Aplazamiento de pago y morosidad en las transacciones comerciales [Late payment and non-performance in commercial transactions], Instituto de Estudios del Libre Comercio (IDELCO), Madrid.

— (1999), La Directiva sobre morosidad: Una mala solución para un falso problema [The Late Payment Directive: A bad solution to the wrong problem], Instituto de Estudios del Libre Comercio (IDELCO), Madrid.

BARBACEIA, A. (2016), Three Essays on Trade Credit and Market Power.

CEPYME (2016), Boletín de Morosidad y Financiación Empresarial [Non-Performance and Corporate Financing News Bulletin].

FABBRI, D., and L. F. KLAPPER (2008), Trade credit supply, market power and the matching of trade credit terms, CFO.

— (2016), Bargaining power and trade credit, Journal of Corporate Finance, 41: 66–80.

HERNÁNDEZ DE COS, P., and I. HERNANDO (1998), “El crédito comercial en las empresas manufactureras españolas” [Trade credit at Spanish manufacturing companies], Bank of Spain’s Economic Research Department, Working Document No. 9810.

HOWORTH, C., and B. REBER (2003), “Habitual Late Payment of Trade Credit: An Empirical Examination of UK Small Firms,” Managerial and Decision Economics Vol. 24, No. 6/7, The Economics of Credit Management: 471-482.

MELTZER, A. H. (1960), “Mercantile credit, monetary policy, and size of firms,” The Review of Economics and Statistics XLII: 429–438.

PIKE, R.; SANG CHENG, N.; CRAVENS, K., and D. LAMMINMAKI (2005), “Trade Credit Terms: Asymmetric Information and Price Discrimination. Evidence From Three Continents,” Journal of Business Finance and Accounting.

SMITH, J. (1987), “Trade Credit and Informational Asymmetry,” Journal of Finance, Vol. 42: 863-872.

Pablo I. Hernández. A.F.I. - Analistas Financieros Internacionales, S.A.