Bank margins and interest rates: Spain in the context of the euro area

Although the expansionary monetary policy of the ECB initially had a positive impact on profitability, maintaining low interest rates over a prolonged period of time may increase negative pressure on financial stability. Reducing banks’ unproductive assets and increasing efficiency may be the path to higher profitability in the future.

Abstract: Low profitability is a common trait today for many European and Spanish banks. This challenge has been magnified by the progressive adaptation of the ECB’s expansionary monetary policies to counteract the crisis. Although these policies initially had a positive impact on increasing loan volumes and demand, it seems that maintaining low interest rates over a prolonged period of time may increase negative pressure on financial stability. The fall in the official interest rate is squeezing bank margins to unprecedented low levels, but also in different ways across European banking sectors. In the case of Spain, banks continue to set higher margins on corporate loans, but lower margins on loans for households for home purchases.The net result has been a decrease in the average income obtained by the outstanding loan portfolio, influenced by the high proportion of floating rate loans. Increasing Spanish banks’ profitability in the future will require increased efficiency and a further reduction in the still high volume of unproductive assets.

[1]

In response to the crisis, the European Central Bank (ECB) has been progressively adopting expansionary monetary policy measures. The potential impact of a prolonged period of such policies on bank margins and thus, on profitability, has been a cause for concern. Although the fall in the official interest rate and the resulting improvement in the access to financing have a positive impact on the reactivation of credit (and, thus, on banks’ profitability) and on the increase in demand (which improves bank asset quality, reducing NPLs), they also squeeze bank margins when rates are low, especially when they are negative. This is due to the existence of a floor for the deposit rate and, therefore, as rates fall, the repricing of assets is more intense than that of liabilities, eroding the net interest margin. Also, as the IMF notes (2016a), the greater the weighting of floating-rate loans (a fall in the reference interest rate automatically leads to a reduction in finance income) and of deposits (impacted by the above-mentioned interest rate floor), the greater the negative impact of a fall in the official interest rates.

In this regard, the aim of this article is to analyse the recent performance of Spain’s bank margins in the context of the euro area, taking advantage of the data provided by the ECB regarding margins on loans to companies, on the one hand, and to households, on the other, and regarding the evolution of interest rates on loans and deposits. The information offered by the ECB relates to margins on new loans, but the comparison of interest rates on said new loans with average interest rates (outstanding balances) enriches the analysis. Therefore, although in terms of the evolution of profitability, the analysis of average margins is more important, the analysis of the margins on new loans is also important, since the changes therein (upwards or downwards) help foresee future changes in average margins. The period analysed is 2012-2016 so as to have at least two years before and after the ECB introduced negative interest rates for the marginal deposit facility in June 2014.

[2]

As well as analysing the evolution of margins and interest rates, this article simulates the effect of fluctuations in Euribor (the main reference rate in Spain) on the net interest margin for various Euribor levels. The evidence is in line with the results obtained in recent studies showing the existence of a non-linear link between margins and interest rates, so that a fall in Euribor squeezes margins more when interest rates are lower. Consequently, despite some of the initial positive impacts of expansionary monetary policy, the warnings made by some analysts, academics and institutions regarding the negative effect on the current financial stability of such low interest rates over a long period also require careful consideration and, therefore, it would be counterproductive of the ECB to cut interest rates any further.

With this objective, this article is structured in the following manner. The first section analyses the recent performance of bank margins on new loans, drawing a distinction between loans to companies and loans to households. Once margins have been analysed, the article then takes the analysis further, studying interest rates on loans and deposits, the two components of the net interest margin. Finally, it simulates the impact of fluctuations of Euribor on banks’ net interest income for various interest levels, which permits an analysis of the beneficial effect in the current climate of an interest rate rise on banks’ profitability and, conversely, the negative effect of the ECB raising the excess liquidity penalty even further.

Bank lending margins in new business

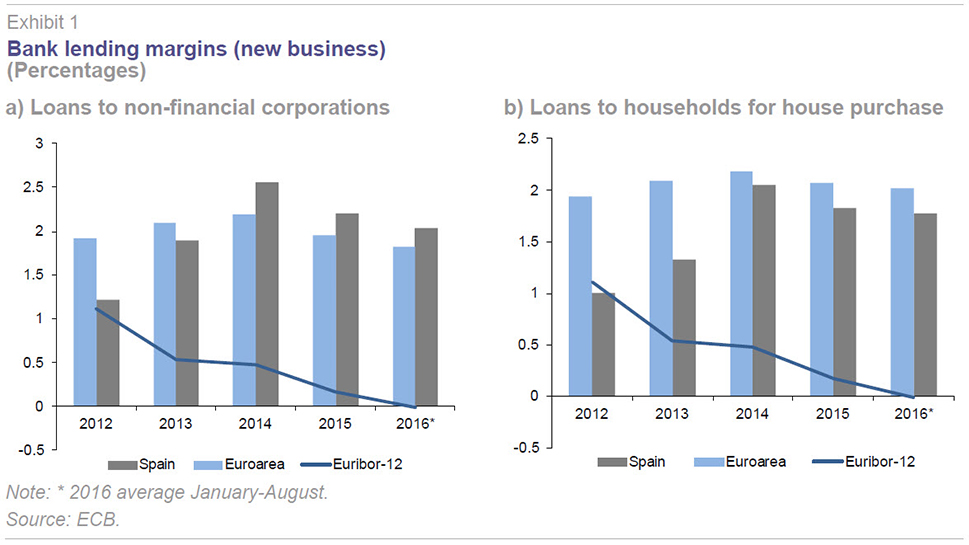

Exhibit 1 shows the performance of interest margins on new loan transactions with companies and households, in the latter case for the purchase of housing. In the case of companies, while the margin applied by Spanish banks is below the average applied by the euro-area banks until 2013, since then it has been higher, with an average spread of 21 bp from January to August 2016 (the latest data available at the time this article was published). As for loans to households for the purchase of housing, Spanish banks always apply narrower margins, with a spread of 24 bp with respect to the euro-area banks in 2016. However, the spread has shrunk considerably since 2012 and it is currently almost four times less than back then.

The combined picture of the evolution of the two banking margins and of Euribor (which has been negative since February 2016 and below 0.5% since July 2014) shows that the fall in rates has been accompanied by a drop in margins on new loans since 2014 but a rise from 2012 to 2014. Therefore, although initially the fall in Euribor allowed margins to recover (since the rates fell more sharply on deposits than on loans), once Euribor hit very low levels (below 0.5%) any further decline hurt margins, exacerbated by the floor on interest rates on deposits. Nevertheless, it should be noted that margins do not only respond to fluctuations in interest rates, but also to variables such as credit risk, risk aversion, market power, management efficiency, etc. In fact, in Spain margins are currently much higher than they were in 2012, when interest rates were higher.

A common trait in Spain and the euro area in the evolution of the net interest margin applied to loans to households and to companies is that it also rose from 2012 to 2014 in the EMU and has fallen since then too. In Spain, the evolution is similar to that of NPLs, which reached highs of 20.3% at the end of 2013 in loans to companies and 6.3% in March 2014 in loans for the purchase of housing, and subsequently fell to 14% and 4.7%, respectively, in June 2016. Consequently, the evidence seems to show that banks raised their net interest margin in order to tackle the provisions required relating to the increase in NPLs (charging the resulting risk premium in the interest rate applied), and that once NPLs started to drop, the margin fell again. However, as mentioned above, the narrowing of the margin since 2014 might also be influenced by the very low interest rates, because 12-month Euribor has been below 0.5% since mid-2014 and it has been negative since February 2016.

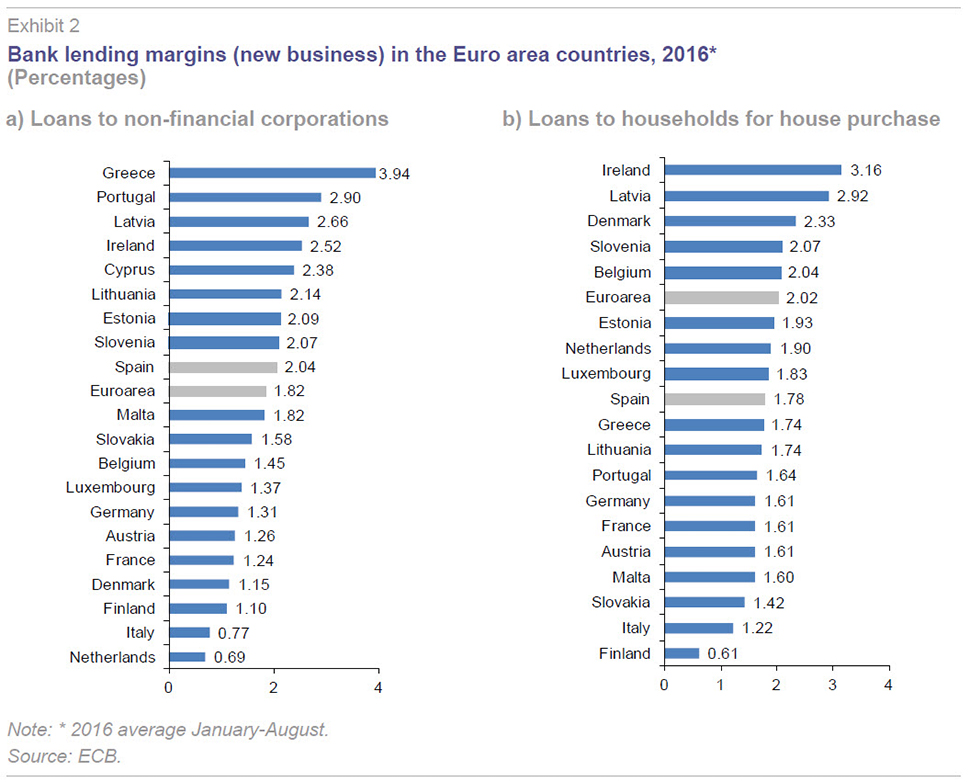

In relation to the main European banking sectors (Exhibit 2), Spanish banks currently stand out because they operate with higher margins on loans to companies, with spreads to date in 2016 (through August) of 72 bp with respect to Germany, 80 bp with respect to France and 127 bp with respect to Italy, with Greece and Portugal having the widest margins of the euro area. As for loans for the purchase of housing, although the margin is below the euro area average, it exceeds that of the major countries, with a spread of 56 bp with respect to Italy, which is the country operating with one of the lowest. Ireland, in contrast, is the country with the highest bank margin on loans for the purchase of housing (316 bp).

Loan interest rates: New business vs. outstanding amounts

The sharp fall in interest rates in the EMU as a result of the expansionary monetary policy implemented to combat the crisis has impacted both the interest rates on new business and average finance income due to asset repricing. Also, the high weighting of floating-rate loans granted in the past automatically brings down average income, and average rates are currently very low in the countries in which the intensity of competition in the past meant that loans were granted with very narrow spreads with respect to the reference rates. This is in fact the case of Spain, where during the expansionary years and the credit bubble the spread with respect to 12-month Euribor was very narrow, which has taken its toll on some banks with big floating-rate mortgage portfolios.

As for deposits, the average financing cost drops with the fall in rates, since new deposits are attracted at ever lower rates, and in this context, the average finance cost being borne by the bank is higher than the marginal cost of the new deposits attracted.

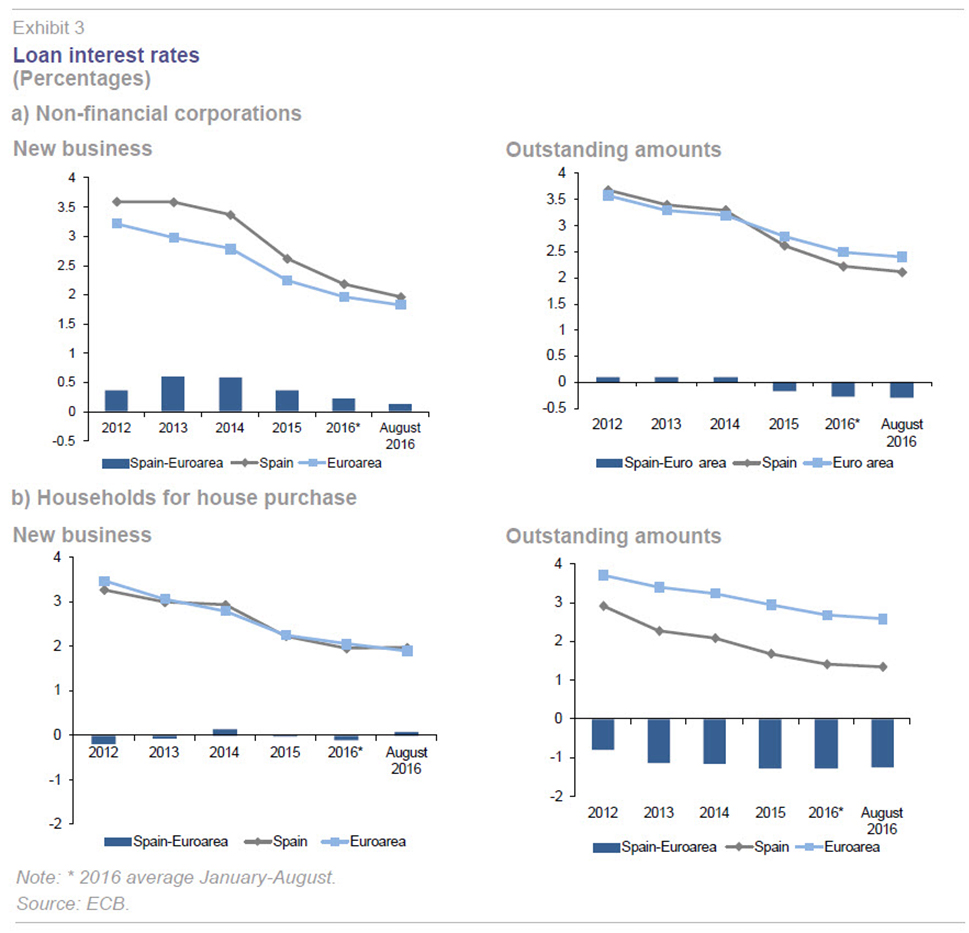

Although as shown in Exhibit 3, Spanish banks set higher interest rates than the EMU on new loans granted to companies (and, as we have seen, they obtain wider margins given the cost of financing), the average income on the loan portfolio is lower due to the greater weighting of floating-rate loans in Spain, the average income of which has fallen more sharply with the fall in Euribor.

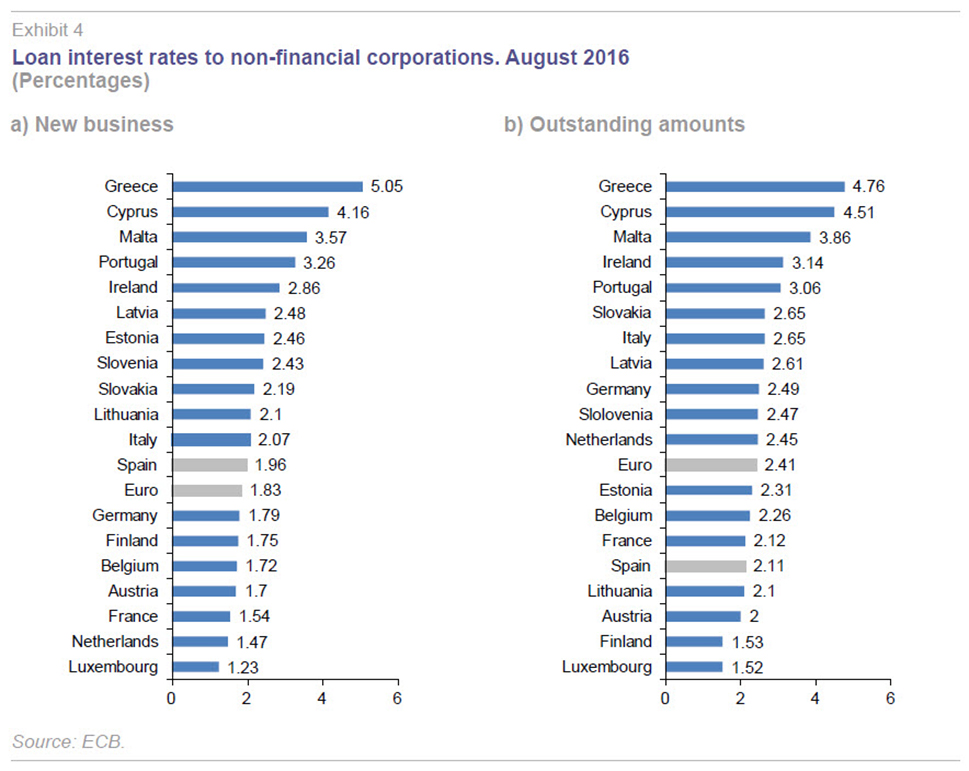

With regard to the euro-area countries (Exhibit 4), the interest rates currently (August data) charged by Spanish banks on new loans granted to companies (1.96%) are higher than those applied by, for example, German banks (1.79%), French (1.54%) and Dutch banks (1.47%), with Greece (5.05%) and Cyprus (4.16%) being the most expensive countries. Conversely, if we consider the average income obtained from the outstanding stock of loans, the average interest received by Spanish banks (2.11%) is below that of Germany (2.49%) and Italy (2.65%). The banks of the bailed-out countries have the highest average interest income.

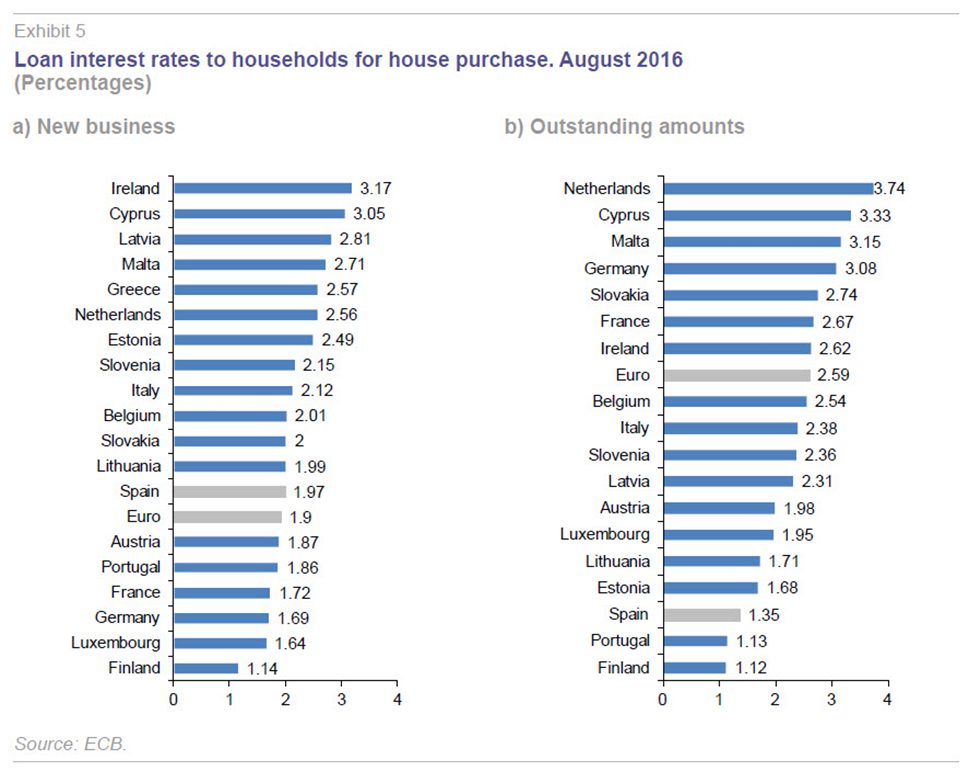

In the case of loans for house purchase, the interest rate on new loans has been similar in recent years in Spain and in the euro area (1.97% vs 1.9% in August 2016). The latest information puts the cost of new mortgages in Spain above that of the major European banking sectors: 1.69% in Germany and 1.72% in France (Exhibit 5).

In contrast, the difference with the euro area is very significant and it remains at the starting level for average interest income, standing at 124 bp in August 2016, with an interest rate in Spain (1.35%) of almost half that of the euro area (2.59%) and the third lowest of the euro area, only ahead of Finland and Portugal.

The limited lending activity in the crisis years (with negative growth rates for new loans) means that although the interest rate for new mortgages granted approached those charged by euro-area banks, the difference has not been felt in terms of average income, which remains much lower in Spanish banks.

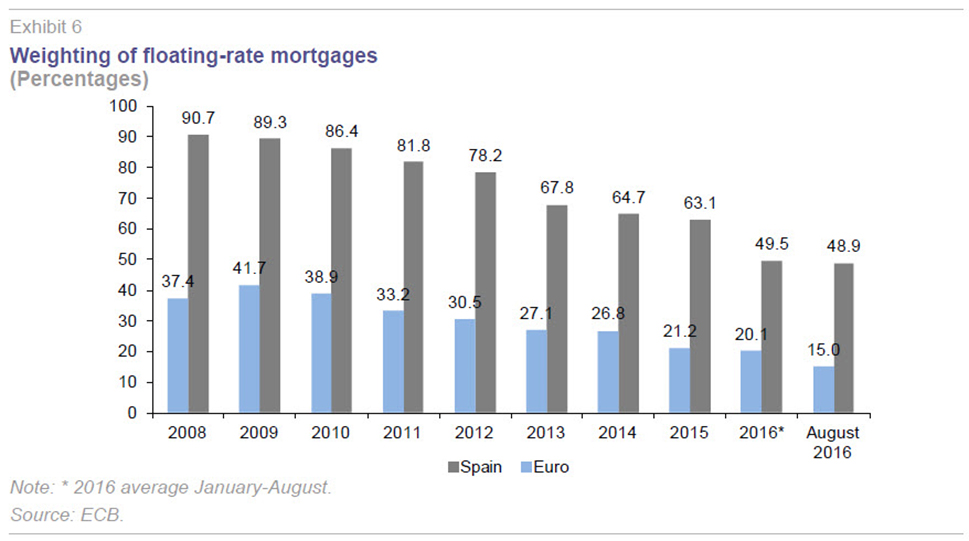

It should be noted that while in Spain the interest rate of new loans for house purchase is higher than the average income of the mortgage portfolio, in the euro area it is just the opposite. This may be partly due to the fact that in Spain there has been a greater and very high percentage of mortgages granted in the past at floating interest rates and with minimal spreads, as a result of the intensity of competition among banks in the context of the real estate bubble. Thus, as shown in Exhibit 6 for the post-crisis period, until the end of 2009 the percentage hovered around 90%, and since then it has fallen progressively, to 49% in August 2016. In contrast, in the euro area, it reached a maximum of 42% in 2009 and currently stands at 15%, 34 pp below Spain. In the major economies the weighting of variable rate mortgage loans is very low: 11% in Germany and 1.8% in France.

Deposit interest rates: The new negative rate scenario

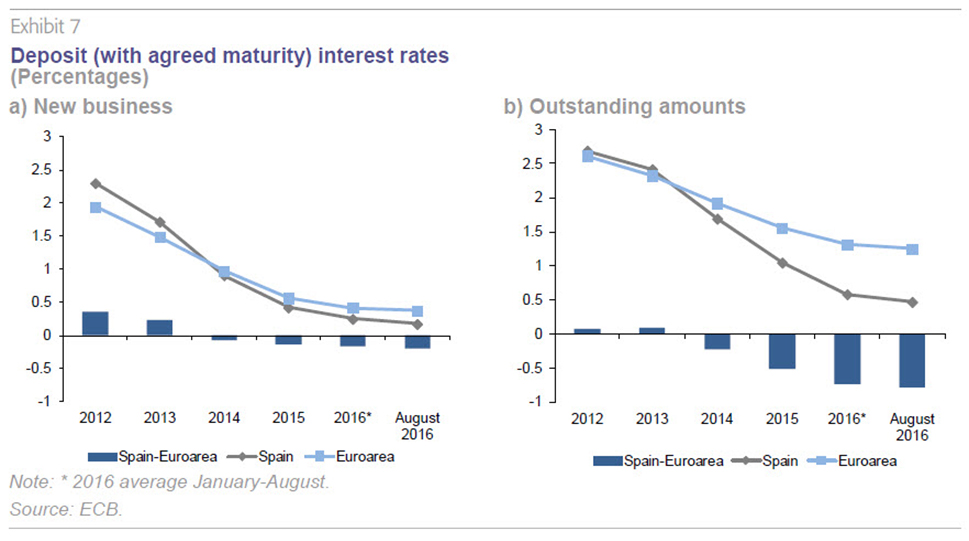

The evolution and level of the bank margin depends on the interest rate on both loans and deposits. In the latter case, as shown in Exhibit 7, Spain stands out in the European context due to the low interest rates on time deposits both for new deposits and for the average interest on outstanding stock. In both cases, the divergence from the European average has increased in the period under analysis, reaching 20 bp in August 2016 on new deposits attracted and 78 bp on stock. The greater intensity of the fall in the interest rate in Spain for new deposits attracted has created a gap with respect to the euro area in terms of average interest on deposits.

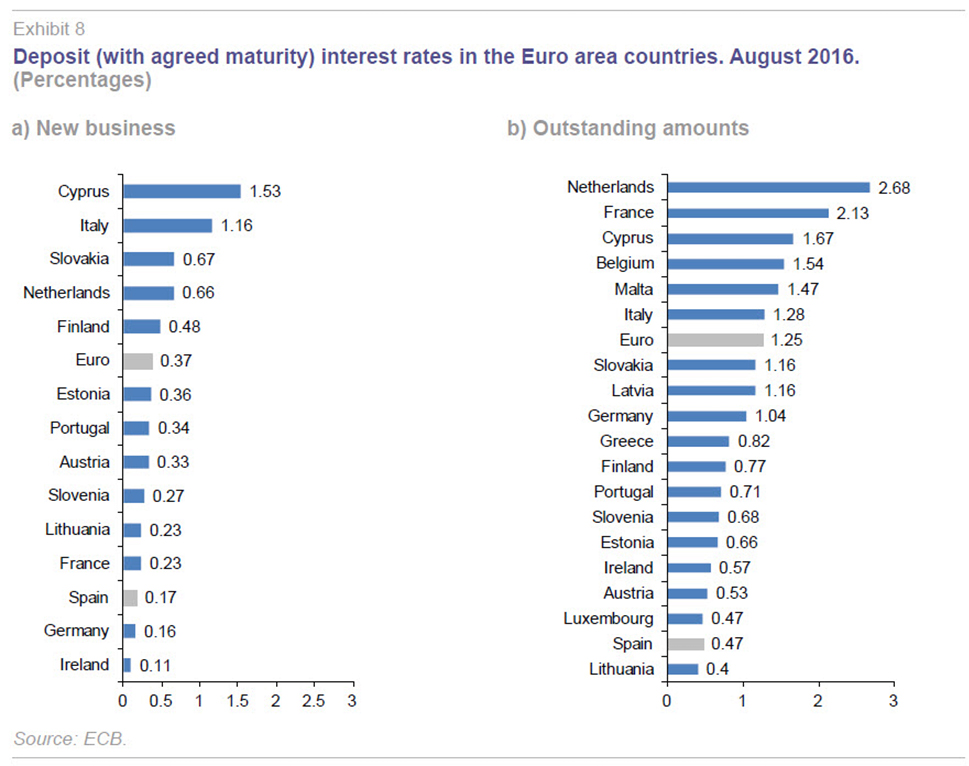

The most recent information for August 2016 (Exhibit 8) puts the interest rate of new deposits attracted in Spain at 0.17% compared with 0.37% in the euro area, making it the country with the third-lowest interest, followed only by Germany (0.16%) and Ireland (0.11%). In the case of the outstanding balance, the interest rate in Spain (0.47%) is the second lowest in the euro area (1.25%).

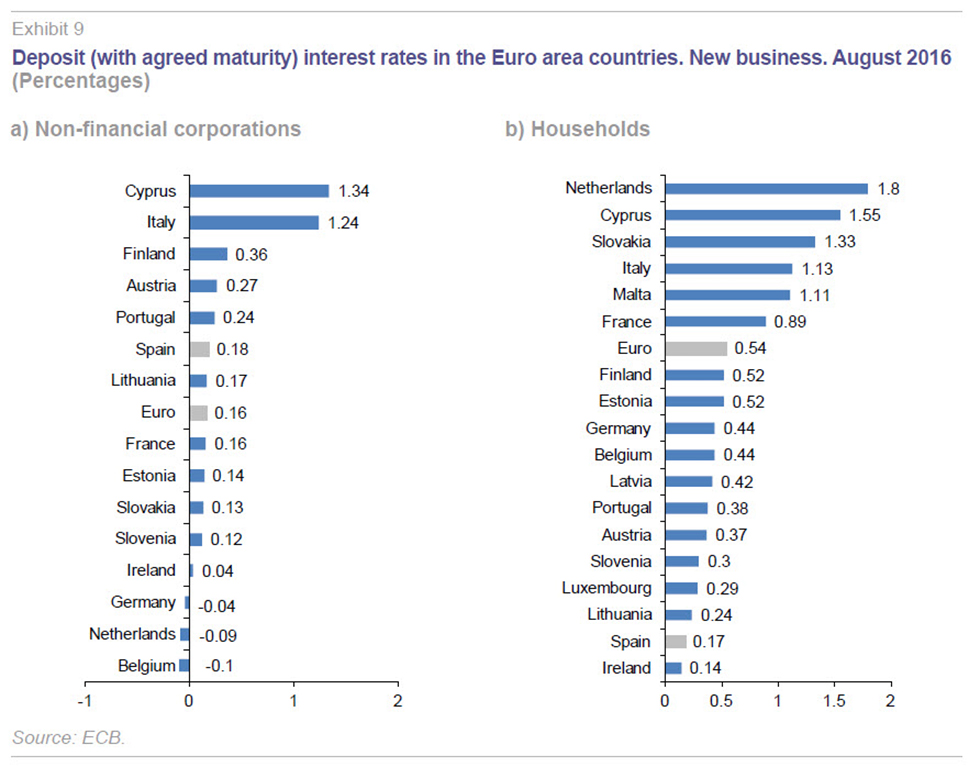

But this aggregate information for households and companies masks important differences in interest rates for time deposits (Exhibit 9). Thus, in the case of companies, there are three countries in the euro area where the interest rate is negative, as the banks have transferred to companies the 0.4% penalty applied to them by the ECB for the marginal deposit facility and for reserves in excess of the reserve requirement. This is the case of Belgium, the Netherlands and Germany. In Spain, the interest on companies’ deposits attracted in August 2016 is 0.18%, almost the same as the European average (0.16%).

In the case of households, interest rates for new time deposits are higher than those of companies and in no country have they fallen below 0% (the lowest interest is 0.14% in Ireland). Thus, for the euro-area average, the rate applied in August was 0.54% on deposits of households, which is three times the average of companies (0.16%). Spain is the country in the EMU with the second lowest interest for households’ deposits, with a rate of 0.17%, as compared with 0.54% in the euro area.

It should be noted that households’ deposits are more important in terms of quantity

[3] and that there is a psychological barrier of 0% that could be hugely damaging to the main source of banks’ funding if households opt to keep that wealth in cash if the banks charge them for having deposits. If negative rates were to be applied to households’ deposits, it could produce a clear disintermediation that would affect financial stability.

Interest rates and bank margins

As mentioned in the introduction, there is currently a debate as to the possible harmful effects that a prolonged period of low or even negative interest rates could have on financial stability. Therefore, while on one hand these low rates stimulate demand (by reducing the cost of financing), on the other hand they might impair banks’ profitability if the net interest margin decreases with the fall in interest rates.

So far, empirical evidence on this matter is limited, as the scenario of such reduced or even negative rates has appeared only very recently. Particularly noteworthy is the work of Borio

et al. (2015), Claessens

et al. (2016) and Cruz-García

et al. (2016) analysing the impact of monetary policy on margins. In all three cases, the result is the same: the effect of a change in interest rates is not linear but rather there is a quadratic relationship with the net interest margin. This result implies that the impact of a change in interest rates is greater in a low rate scenario, as at present, than in a high rate situation.

[4]

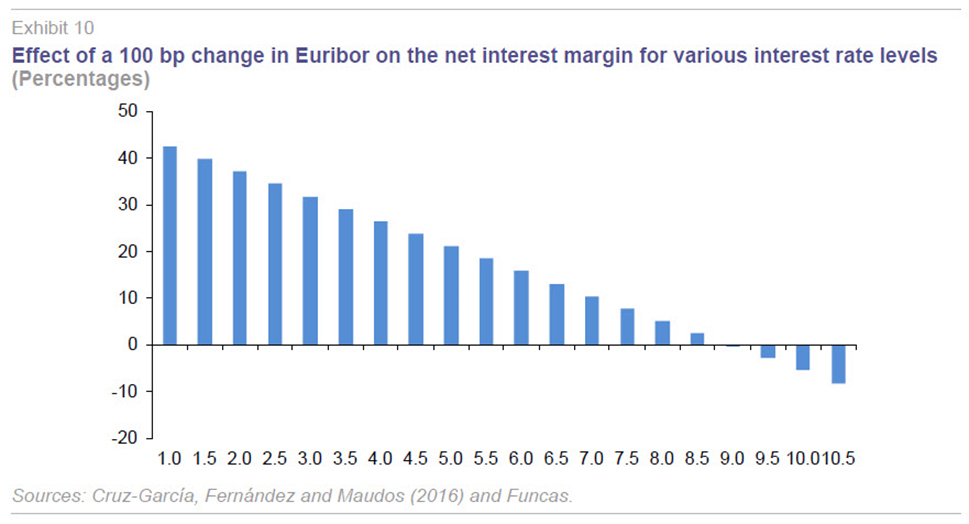

Using the estimates in the work of Cruz-García et al. (2016), Exhibit 10 shows the impact of a 100 bp change in 12-month Euribor on the net interest margin. As can be seen, an increase in Euribor increases the net interest margin to a level of around 8%-9%, and from then on the impact is negative. Moreover, the impact of the increase in the margin is much higher when the interest rate is low. For example, an increase in Euribor from 1% to 2% means a 37 bp increase in the net interest margin, while the increase is 21 bp when Euribor rise from 4% to 5%. The fact that for high levels of Euribor the impact of a rise is negative may be because the quantity effect (the demand for credit falls with the rise in rates) dominates the price effect (higher financial revenues). Furthermore, with very high rates, the investment projects that can access these rates are riskier, which can reduce interest income if there is a rise in NPLs.

The above results show that in the current scenario of negative interest rates in the interbank market, a rise would have very beneficial effects on the margin and thus on bank profitability. Similarly, if the ECB were to further penalize banks’ excess liquidity with negative rates, this would have a detrimental effect on banks’ profitability, as the net interest margin would be reduced further.

Conclusions and policy implications

Although the fall in interest rates seen in the euro area initially had a positive impact on bank margins applied to new loans, once interest rates reached very low levels, margins have fallen since 2014, although in Spain they are above 2012 levels. At present, the Spanish banks, when compared to European banks, set higher margins on loans to non-financial corporations but lower margins on loans to households for house purchase.

The evolution of margins obviously depends on that of the interest rates of loans and deposits. In the case of companies, Spanish banks charge higher rates on new loans, but the average income obtained by the outstanding balance of their loan portfolio is lower. In the case of households, the average rates are well below the average of the euro area, to the point that only two countries (Portugal and Finland) currently have an average interest income from mortgages lower than that of Spain. This reduced average income is influenced by the fact that a high percentage of loans have always been granted at a floating rate (therefore average income automatically decreases with the fall in Euribor) and that there are still millions of outstanding loans that were granted in the real estate/credit bubble with very narrow spreads with respect to Euribor. Thus, the greater the weighting of these mortgages in a bank, the lower its financial revenues at present and, therefore, its margin.

[5]

Interest rates on time deposits in Spain have always been below the European average, both on average and on new business. Currently, the interest rate on new deposits is half that of the euro area (0.17% vs. 0.37%), making Spain the country with the third-lowest rate. In outstanding balances, there is a greater divergence from the euro area (0.47% vs. 1.25%), with average interest on deposits higher only than Lithuania.

The sharp drop in interest rates in the markets and the growing penalty applied to banks from June 2014 by the ECB for excess liquidity explain why there are currently three countries in the euro area that charge companies for time deposits (Belgium, the Netherlands and Germany). In the case of households, in no country has the psychological barrier of 0% been crossed, which is highly unlikely to happen because of the severe consequences it would have on financial stability if households were to opt to keep their wealth in cash instead of in bank deposits.

Coinciding with the recent evidence showing the existence of a non-linear relationship between interest rates and the net interest margin, the simulation carried out in the study shows that a normalization of interest rates would have a positive effect on banks’ profitability. But in the same way, this non-linear relationship means that to raise the current penalty on the euro-area banks for excess liquidity

[6] could be counterproductive for financial stability, given the negative impact on net interest income and, thus, on profitability, which is already reduced.

The latest 2016 data available show that the net interest margin in new loans is falling, which is a symptom of the consequences of Euribor being negative. The effect is already visible in banks’ net interest margin in their business in Spain (affected by Euribor), which as a percentage of assets fell from 0.97% in 2015 to 0.92% in the first half of 2016. In this context, as indicated by the recent IMF financial stability report (2016b), European (and therefore Spanish) banks are facing the challenge of increasing their profitability, which requires improving efficiency (reducing costs and increasing income) and reducing the high volume of unproductive assets.

Notes

This article was written as part of the Spanish Ministry of Science and Innovation (ECO2013-43959-R) and Generalitat Valenciana PROMETEOII/2014/046 research projects.

The rate was set at -0.1% in June 2014 and it fell to -0.2% in September 2014, to -0.3% in December 2015 and to -0.4% in March 2016, where it has remained to date. Bank reserves in excess of the reserve requirement are also penalized.

For the euro-area average, deposits of the domestic economy sector account for 57.1% of the total private sector, deposits from companies 18.3%, interbank deposits 16.5% and deposits from insurance companies and pension funds 5.1%.

In addition to those papers, the work of the Banco de España (2016) shows that the net interest margin improves when Euribor rises for low levels of Euribor but deteriorates for high levels of Euribor.

Loans for house purchase currently represent almost 20% of Spanish banks’ total assets, as compared to 12.6% in the euro area.

At the end of September 2016, the euro-area banks had excess liquidity of almost one triillion euros consisting of the marginal deposit facility balance and reserves in excess of the reserve requirement.

References

BANK OF SPAIN (2016), Financial Stability Report, May.

BORIO, C. E.; GAMBACORTA, L., and B. HOFMANN (2015), “The influence of monetary policy on bank profitability,” BIS Working Papers, 514.

CLAESSENS, S.; COLEMAN, N., and M. DONNELLY (2016), “Low-for-long interest rates and net interest margins of banks in advanced foreign economies,” IFDP Notes.

CRUZ-GARCÍA, P.; FERNÁNDEZ DE GUEVARA, J., and J. MAUDOS (2016), “Interest rates and net interest margins: the impact of monetary policy”, paper presented at the 2016 Wolpertinger Conference of the European Association of University Teachers of Banking and Finance, Verona, Italy, 31st August - 3rd September.

EUROPEAN CENTRAL BANK (2016), Annual Report.

INTERNATIONAL MONETARY FUND (2016a), “Negative interest rate policy (NIRP): Implications for monetary transmission and bank profitability in the Euro Area,” in Euro Area Policies Selected Issues, IMF Country Report No. 16/220.

— (2016b), Global financial stability report, Fostering Stability in a Low-Growth, Low-Rate Era, October 2016.

Joaquín Maudos. Professor of Economic Analysis at the University of Valencia, Deputy Director of Research at Ivie and collaborator with CUNEF