Spanish banks’ international footprint: Recent developments

Spain’s banks are becoming increasingly more international, as shown by the share of total assets commanded by their international business. This strategy of international expansion and geographical diversification has paid off, yielding the benefits associated with both processes for the consolidated groups relative to the domestic banking business.

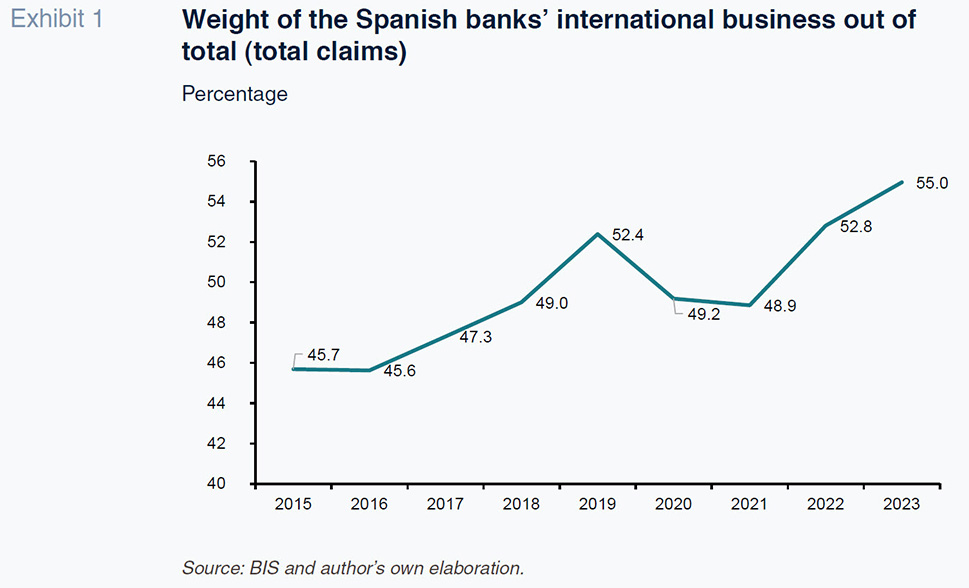

Abstract: Spain’s banks are becoming increasingly more international, as shown by the share of total assets commanded by their international business. In 2023, that share stood at 55%, up nearly 10 points from 2015, one of the highest in the world. The banks’ international presence is also increasingly geographically diversified, with the concentration index down by half since 2015. Business in third countries accounted for 70% of the Spanish banks’ recurring profits in 2023. This strategy of international expansion and geographical diversification has paid off, yielding the benefits associated with both processes. Indeed, whereas profitability (ROE) in the domestic banking business in Spain reached 11% in 2023, that of the consolidated groups was 1.4 points higher, albeit it is worth noting that the international investments made by the latter were not recent.

Foreword

At year-end 2023, the Spanish banks’ domestic business comprised approximately 2.9 trillion euros, whereas the total assets of the consolidated groups (i.e., including their international banking activity) stood at 4.2 trillion euros. The scale of that difference illustrates the Spanish banks’ intense international expansion via foreign subsidiaries with a presence in several countries around the world. In fact, according to the Bank for International Settlements (BIS), specifically its consolidated banking statistics (CBS), in the fourth quarter of 2023, foreign assets (using foreign claims as proxy) accounted for 55% of the total, once again highlighting the degree to which the Spanish banks have expanded abroad. This international presence has increased further over the past decade, with the banks’ foreign business commanding a growing weight of the total.

Against this backdrop, the aim of this paper is to analyse the recent trend in the Spanish banks’ international strategies by comparison with other banking sectors, focusing on the changes observed during the last decade, using 2015 as our base year. We also analyse the geographical composition of the banks’ overseas investments and current levels of concentration and diversification, taking stock of recent developments in this respect. We end the article enumerating some of the advantages afforded by international expansion of the banking business.

Trend in the Spanish banks’ assets: Domestic versus foreign business

Since 2015, the Spanish banking sector’s total domestic business assets have increased by just 8.8%, shaped primarily by private sector deleveraging during the period. Following the imbalances piled up during the previous real estate bubble, which led to intense growth in private sector credit, this loan book decreased by 11.6% between 2015 and 2023, implying a loss of 9 points in total assets to 39.1% by 2023. On the other hand, total consolidated assets, including the businesses of the Spanish banks’ foreign subsidiaries, have increased by 13.3% since 2015, evidencing the greater momentum of the international business relative to the domestic business. The business generated by the banks’ subsidiaries in third countries therefore explains much of the Spanish banks’ growth.

An intuitive way to illustrate the importance of the Spanish banks’ international expansion strategies, which have allowed them to offset or mitigate the idiosyncratic shocks affecting the Spanish economy, is to observe the trend in the international business as a percentage of the total. To do that we can use the information provided by the BIS in its consolidated banking statistics, specifically tracking their foreign and domestic claims. Although this metric does not include all financial assets, it is a good proxy as it clearly includes the majority of them.

As shown in Exhibit 1, between 2015 and 2023, the share of international activities in the Spanish banks’ total assets increased by almost 10 points, from 45.7% in 2015 to 55% in 2023. That share increased steadily until 2019, falling in 2020 and 2021 with the onset of the COVID-19 crisis to end 2021 at 48.9%. However, in 2022 and 2023 it once again increased sharply, reaching a high of 55% in 2023. This last figure is similar to the percentage of international assets over total banking assets reported by the Bank of Spain in its Financial Stability Report for the spring of 2024. The Bank of Spain puts foreign banking assets at 2.2 trillion euros, compared to domestic assets of 1.8 billion euros. The equivalent BIS figures (albeit for total claims not total assets), in dollars, estimate the international business at 2.0 trillion euros and the domestic business at 1.7 trillion euros.

By comparison with other banking systems, that percentage (55% of the Spanish banks’ total assets) is relatively high. Of the 26 banking sectors for which the BIS tracks these statistics, the Spanish system ranks fourth, behind only the UK (59%), Singapore (58%) and Finland (58%). The Spanish banks’ international footprint is clearly larger than that of the French (39%), Italian (29%), German (26%) or American (23%) banks.

Breaking down the Spanish banks’ foreign assets by type reveals that household loans are the most important component, representing 32.8% of the total in 2023. The next most important category is public sector financing (25%), followed very closely by financing for non-financial corporates (23.7%). Compared to the composition in 2019 (pre-Covid), the drop in the relative importance of business and household financing (of 2.1 and 3.9pp, respectively) and the increase in the share of public sector financing (+3.5pp) stand out.

Geographical breakdown of the international business

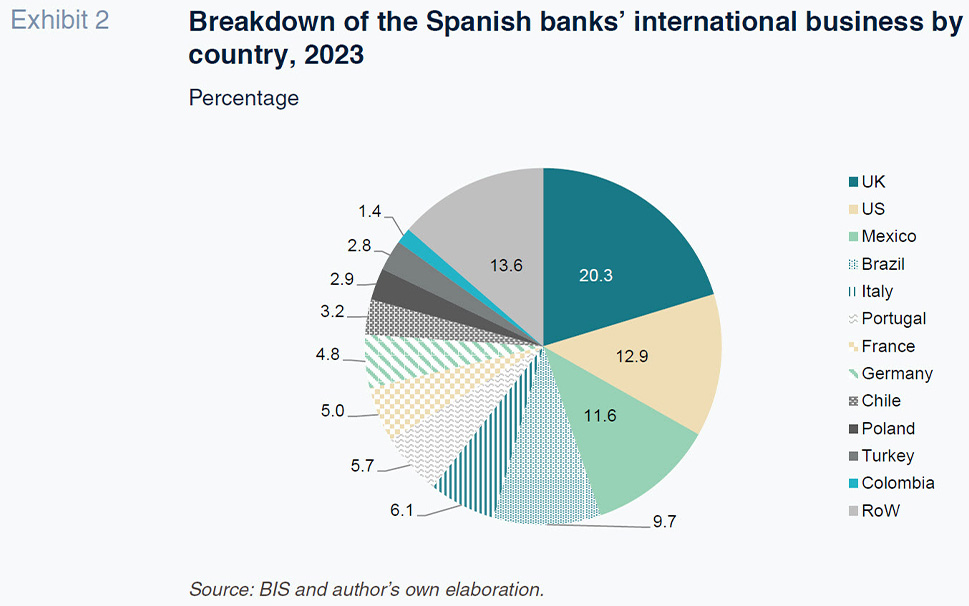

Where are the Spanish banks’ foreign assets concentrated? When the Spanish banks embarked on their international expansion, they initially focused on Latin America, [1] but with time they began to diversify into other regions. The most recent snapshot, which dates to 2023 (Exhibit 2), shows that the UK is the most important market for the Spanish banks: investments in the UK account for 20.3% (456 billion dollars) of total foreign assets. The UK is followed at quite some distance by the US (12.9% of total foreign assets | 291.5 billion dollars), Mexico (11.6% | 261 billion dollars) and Brazil (9.7% | 219 billion dollars). The rest of the list comprising the 12 most important markets is made up of Italy (6.1%), Portugal (5.7%), France (5%), Germany (4.8%), Chile (3.2%), Poland (2.9%), Turkey (2.8%) and Colombia (1.4%). The eurozone accounts for 26% of the total and Latin America, 29%.

Comparing the geographical breakdown of the foreign banking business between 2015 and 2023 (Table 1), the key development is the loss of share of investments in the UK (of 6.9pp in the total pie) and in the US (-4.4pp), with new destination markets such as Chile, Turkey and Colombia taking up the slack. If we compare the situation with 2019, right before the pandemic, we once again observe a loss of share by the UK (-3.5pp) and US (-1.7pp), with the growth in exposure to Mexico (+2.2pp) standing out.

Turning our attention to the most recent figures, for 2023, as already noted, the UK is the Spanish banks’ biggest market, mainly due to the investments by Banco Santander and Banco Sabadell. In Mexico, BBVA commands a notable presence, with Banco Santander the main bank in Brazil.

International presence: Concentration  versus diversification

versus diversification

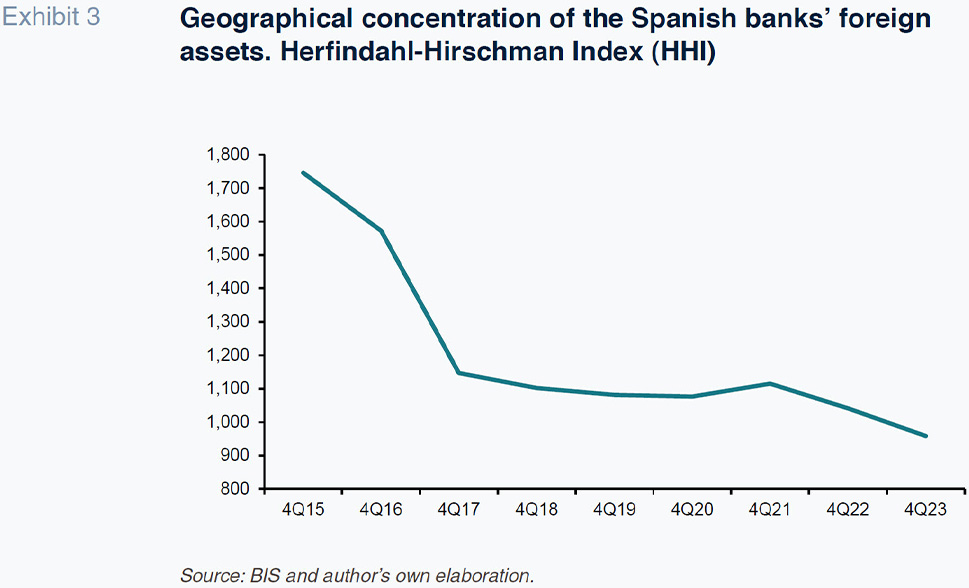

We use two indices to measure the degree of geographical diversification of the Spanish banks’ foreign assets: the market shares of the top 3 (CR3) and 5 (CR5) investment destination markets and the Herfindahl-Hirschman Index (HHI). The advantage of the latter is that it considers all of the countries in which the Spanish banks have assets, not just the three or five most important.

In 2023, the UK, US and Mexico accounted for 60% of all of the Spanish banks’ foreign assets. Adding in Brazil and Italy lifts the concentration ratio to 81%. If we compare these concentration ratios with the equivalent figures in 2015, the CR3 has increased by 2.6pp, while the CR5 has fallen by 2.25pp, giving us a mixed reading of the trend in concentration during this period.

The HHI avoids this problem by offering a single concentration reading. The HHI for the last quarter of 2023 was 958 points, which is nearly half of the reading as of year-end 2015 of 1,746 points.

[2] As shown by Exhibit 3, between 2015 and 2017, the concentration index fell considerably, as the Spanish banks diversified their foreign investments. Between 2017 and 2021, concentration held steady, going on to fall in 2022 and 2023, so that diversification virtually doubled during the period under analysis.

Advantages of international expansion

It is well known that diversification reduces risk, a tenet that likewise applies to geographical diversification. And risk entails costs, which are therefore lower the more diversified a bank’s business. This is borne out if we compare the profitability obtained by the Spanish banks from their domestic businesses with that of the consolidated groups, i.e., including the business generated by the Spanish banks’ foreign subsidiaries. With the exception of 2020, the year of the pandemic, since at least 2007, the ROE (return on equity) of the consolidated groups has been consistently higher than that of the individual groups (domestic business in Spain). For example, in 2023, the profitability gap amounted to 1.4pp, with the ROE rising to 12.4% when the Spanish banks’ foreign subsidiaries are factored in.

Again, using the most recent data for 2023, the business generated by the Spanish banks’ subsidiaries in third countries contributes a significant percentage of total profits. Specifically, based on the information provided by the Bank of Spain on the geographical breakdown of recurring profit attributable to the parent of the entities with significant international businesses, in 2023, 70% was generated by third countries, implying that the domestic business contributed the remaining 30%. In 2022, the contribution by the international businesses was even higher, at 74%.

The higher profitability of the consolidated groups relative to the purely domestic banks is attributable to the higher margins commanded by the Spanish banks in foreign markets. In 2023, the net interest margin in Spain was 1.31% of total assets, compared to 2.3% for the consolidated groups.

Conclusions

a) By comparison with the world’s main banking systems, the Spanish banking sector stands out for its significant international footprint, with foreign financial assets accounting for 55% of their total assets.

b) The Spanish banks’ international presence has been increasing in recent years, with the share of foreign assets in total assets rising by almost 10 percentage points since 2015.

c) The UK is the Spanish banks’ biggest overseas market, accounting for 20.3% of total foreign assets in 2023. The next biggest markets are the US (12.9%), Mexico (11.6%) and Brazil (9.7%).

d) The Spanish banks’ international exposure is increasingly diverse geographically, with the concentration index falling by half since 2015.

e) Growing international exposure coupled with increased geographical diversification has paid off in terms of profitability, which is higher at the consolidated groups than in the purely domestic banking business. In 2023, 70% of the Spanish banks’ profits were generated by their foreign subsidiaries, clearly illustrating the magnitude of their international footprint.

Notes

Refer to AEI (2024) for an analysis of the Spanish banks’ presence in Latin America.

According to the values of the index, it is usual to consider the market highly concentrated for levels above 1,800 points, being moderately concentrated from 1,000 to 1,800 points.

References

AEI. (2024). La banca española en América Latina: visión histórica, situación y perspectivas de futuro [Spanish banks in Latin America: Looking back and looking forward]. Instituto Español de Banca y Finanzas.

BANK OF SPAIN. (2024). Financial Stability Review, spring 2024.

Joaquín Maudos. Professor of Economic Analysis at the University of Valencia, Deputy Director of Research at Ivie and collaborator with CUNEF