Financial education and how to improve it

Financial education is evolving rapidly in the context of digitalization and economic transformation, yet Spain still faces inequalities in the implementation and quality of financial education programs. A thorough assessment, including the use of long-term studies and monitoring systems, is essential to ensure initiatives to improve financial education achieve their objectives and reduce social and economic inequalities.

Abstract: Financial education is evolving daily amidst rapid digitalization and economic transformation, bringing with it challenges and opportunities for improvement within Spain and abroad. For instance, financial literacy gaps remain significant, particularly among women, younger individuals, and low-income groups, who are most at risk of financial exclusion. Even though Spain has made progress in this area, there are still inequalities in the implementation and quality of the various educational programmes, warranting a more inclusive approach that is tailored for today’s technological needs. It is thus necessary to carry out a thorough assessment of the financial education programmes in place in Spain. That said, despite the efforts made, the lack of longitudinal studies and random controlled tests limits the ability to identify best practices to continually fine-tune these programmes. Going forward, the establishment of control and monitoring systems to measure the real impact of financial education on financial behaviour in the long run will be necessary to ensure that the initiatives implemented meet their objectives and help reduce economic and social inequalities.

Current importance and main approaches

World Financial Planning Day takes place on 7 October 2024. Financial planning is a priority issue that remains a public policy challenge globally, particularly in the context of rapid digitalisation and accelerating economic and financial change. The PISA 2022 Report, published in 2024, stresses that despite improvements in financial literacy among youths in several countries, significant gaps remain, particularly among socio-economically disadvantaged students and students with reduced access to educational resources. These inequalities highlight the need for more inclusive and targeted interventions to ensure that all segments of the population can acquire the financial skills needed to tackle the challenges of the 21st century. Today, the main topics of debate around how to improve financial literacy pivot around:

- Integration of financial education into education systems: Despite some progress, one of the key topics of debate remains how to effectively integrate financial education into the formal education systems. Although many countries have adopted national financial literacy policies, implementation at the school level is uneven and often insufficient. To effectively attain financial literacy, financial education needs to begin in primary school and continue throughout formal schooling, evolving for students’ changing needs.

- Inequalities in financial literacy: Inequalities in financial literacy constitute another crucial topic. These inequalities are not limited to country differences but also exist within countries, affecting women, youths and low-income individuals in particular. In Spain, the gender gap, in favour of men, in financial knowledge stands at 10 percentage points. According to the Global Financial Literacy Survey of 2023, women and youths remain the most vulnerable in terms of financial education, which exacerbates economic inequalities and limits their opportunities for improving their financial wellbeing (S&P Global FinLit Survey, 2023).

- Impact of digitalisation and artificial intelligence (AI): Financial service digitalisation has created both opportunities and challenges and the mainstreaming of AI is magnifying them. While facilitating access to financial products and education toolkits, new technologies are also increasing complexity and risks. Improving digital financial literacy remains a priority- it is necessary to ensure that consumers not only understand basic financial concepts but also know how to protect themselves in an increasingly complex digital environment.

In response to these challenges, the main initiatives in the public and private spheres are being articulated around three lines:

- Improving the implementation and effectiveness of educational programmes, ensuring that they are accessible to all demographic groups.

- Tackling existing inequalities by focusing efforts on the most vulnerable groups, including women, youths and low earners, as the issues generated by educational inequalities lead to other types of inequality in later life.

- Adapting for new technology by promoting, in addition to traditional financial literacy, digital literacy so as to protect consumers in an increasingly complex technological environment, albeit one that is nevertheless rife with opportunities for learning.

Spain has made significant inroads towards improving financial education although notable challenges remain. According to the

PISA 2022 report, Spain has improved in terms of youth financial literacy but remains below the OECD average, particularly by comparison with northern European countries like Finland and the Netherlands (OECD, 2024). This situation highlights the need to reinforce educational policy to better integrate financial education into the school curriculum. Spain has taken an important first step in this direction. The Royal Decree regulating minimum educational content in primary schooling (Royal Decree 157/2022, of 1 March 2022) requires that students start to learn about basic economic and financial concepts and how to apply them to everyday situations and problems. Spain faces a particular challenge around the financial inclusion of the most vulnerable groups. Despite public and private initiatives,

[1] such as the so-called National Financial Education Strategy, there are still gaps to be closed in access to and use of financial services, particularly in rural populations and among immigrants.

How to ensure the measures taken are effective?

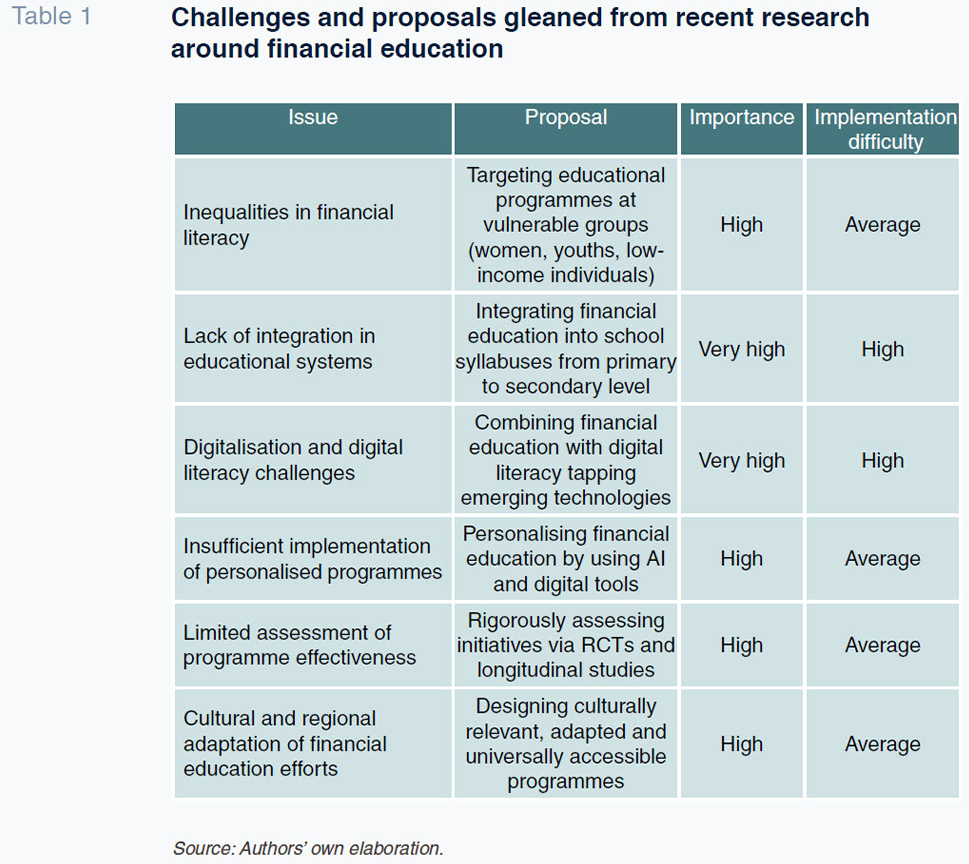

Research into financial education continues to advance, embracing multi-disciplinary approaches that run from the fields of psychology to educational technology. This section briefly explores the main approaches being taken, identifying the most critical pending issues and proposing solutions based on recent developments. Table 1 provides a broad overview of the priority issues, related proposals and their importance.

Assessing the effectiveness of financial education programmes

A central topic of the research thrust relates to assessing the effectiveness of the financial education programmes in place. Recent studies use random controlled tests (RCTs) and longitudinal studies to measure the impact of these programmes not only on financial knowledge but also financial behaviour in the long-term. Kaiser et al. (2022) demonstrate that rigorously designed programmes have a positive impact on individuals’ financial management, particularly when they are integrated into school curricula from an early age.

Personalisation of financial education

Personalisation is another key thrust. Educational programmes are being developed using new technologies such as artificial intelligence so that they can be tailored for users’ personal needs. This approach has proven more effective than generic methods by addressing individuals’ specific circumstances directly (D’Acunto et al., 2019). Moreover, personalisation has been particularly successful in vulnerable groups, such as women and youths, who have traditionally been at a disadvantage in terms of financial literacy.

Integration of emerging technologies

Financial education is increasingly becoming digitalised. Gamification and e-learning platforms are making financial education more accessible and attractive to a broader audience. Online learning platforms have been developed that offer free courses, democratizing access to financial knowledge. Gamification is a relevant example as it has been demonstrated to help increase knowledge retention and foster positive financial behaviours (Fernandes et al., 2014). The fintech’s are also playing a crucial role, integrating educational modules into their platforms to enhance understanding of their financial products.

Cultural and regional adaptation

Studies have demonstrated that financial educational programmes are more effective when they are tailored for their users’ cultural and regional realities. This approach acknowledges that there is no such thing as “one size fits all” in financial education and that programmes need to embrace local idiosyncrasies if they are to be truly effective (Hastings et al., 2013).

Situation in Spain and specific ideas for doing better

According to the European Commission’s most recent figures (2023), just 19% of the Spanish population has a high level of financial literacy, compared to the European Union average of 26%. Spain ranks fourth last in Europe in this respect. Although Spain has made significant progress on fostering financial literacy, it still faces big challenges around programme implementation and effectiveness. This section analyses the current state of financial literacy in Spain, highlighting the efforts made and areas for improvement and comparing its progress with that of other countries.

National Financial Education Strategy

Spain implemented its National Financial Education Strategy in 2008. It is coordinated by the Bank of Spain and the securities markets watchdog (CNMV). The strategy has been to improve financial literacy through educational drives, the inclusion of financial content in school curricula and partnerships between public and private entities. However, effective implementation of that strategy has been uneven. Although financial content has been introduced in some stages of compulsory schooling, the depth and quality of the related teaching varies considerably as financial education has not been integrated uniformly in all schools. This leads to differences in access to and the quality of the financial education received by students, according to the 2022-2025 Financial Education Plan drawn up by the Bank of Spain and CNMV (Bank of Spain and CNMV, 2022)

Challenges specific to Spain

- Risk of regional inequalities: One potential challenge in Spain is the risk of regional inequalities in financial education as a result of differences in educational and technological development among the various regions. Given that the regional governments have significant autonomy over the implementation of education policies, there is room for considerable differences in the quality and accessibility of financial education across the country. Moreover, differences in access to technology and digital educational resources could exacerbate these inequalities, affecting the more vulnerable groups in the more disadvantaged regions in particular.

- Access to and use of digital financial services: Another considerable – and related – challenge is readiness for financial digitalisation. Despite progress on financial inclusion, a significant percentage of the population, especially in rural areas and among the elderly, remain excluded from digital financial services. According to Spain’s statistics bureau, the INE, 66.4% of Spaniards living in towns with fewer than 10,000 inhabitants use online banking services frequently, compared to 75.8% of residents in large cities and provincial capitals. The lack of digital literacy, coupled with low levels of financial education, increases the risk of financial exclusion and

limits access to modern financial management tools (World Bank, 2024).

- Lack of rigorous assessment: While efforts have been made to foster financial education, rigorous assessment of the effectiveness of these programmes remains limited. There are not enough studies to enable stringent measurement of real impact of the literacy initiatives on citizens’ financial conduct. This impedes identification of good practices and continuous programme improvement.

By way of summary, Table 2 synthesis the challenges and current situation in Spain by comparison with the international experience.

Conclusions: Proposals for improving financial education

Financial education continues to evolve today, faced by several challenges that need to be tackled to improve its effectiveness and reach in both Spain and abroad. This section explores the key aspects that need attention, flagging the opportunities for improvement and the challenges that need surmounting.

Improving integration and quality of financial education in school curricula

One of the top challenges in financial education is the need for more complete and consistent integration in school syllabuses. While some progress has been made, with the National Financial Education Strategy in Spain, for example, teaching around personal finances is neither uniform nor compulsory at all levels of schooling. By comparison, counties such as Finland have managed to incorporate financial education end to end, from primary to secondary schooling, a strategy that has proven effective in improving financial knowledge and skills from an early age (OECD, 2024). It would be advisable to make financial education a compulsory subject at all levels of schooling, taking a progressive approach adapted for students’ age and cognitive development. In addition, teachers need to be trained to convey this content in an effective and relevant manner.

Fostering continuous learning for adults

Financial education should not stop after formal schooling. As financial markets and digitalisation become increasingly complex, it is essential to provide adults with access to continuous financial learning. In many countries, including some of the most advanced in this area, such as Germany and Canada, specific programmes have been developed for adults that tackle issues such as retirement planning, investing and debt management. These programmes can be offered over accessible digital platforms, combining self-learning modules with personal tutoring.

Tackling regional and social inequalities

In countries like Spain, regional and social inequalities around education and digitalisation, among others, are a potential obstacle for effective financial education. Differences in the implementation of programmes between regions and reduced access in rural communities create gaps that perpetuate economic and social inequalities. Spain could develop incentive schemes for the regional governments to develop and share high-quality educational resources and invest in digital infrastructure in rural areas.

Tapping technology for personalisation and inclusion purposes

Emerging technologies like artificial intelligence offer the potential to tailor financial education programs to individual needs, making learning more accessible and effective.

Technology constitutes a unique opportunity for personalising financial education and making it more accessible. Fintech applications, e-learning programmes and artificial intelligence make it possible to tailor educational content for individual needs, which could be particularly useful for reaching different segments of the population with differing levels of knowledge and experience. It could therefore be useful to foster the development and take-up of technology platforms that offer personalised financial education. These platforms could take the form of mobile apps or online courses with automated teaching designed for different levels of financial and digital literacy.

Strengthening assessment and monitoring of educational programmes

Rigorous assessment of financial education programmes is crucial to understanding their effectiveness and improving their design. Until now, assessment has been limited in many countries, including Spain, which has made it harder to identify best practices or replicate successful programmes. To improve in this area, Spain could establish continuous assessment and monitoring systems for all financial education programmes. This would involve carrying out longitudinal studies and random controlled tests (RCTs) to measure the long-term impact of the programmes on the participants’ financial behaviour.

Notes

References

BANK OF SPAIN and CNMV. (2022). 2022-2025 Financial Education Plan. Bank of Spain and CNMV.

https://www.cnmv.es/DocPortal/Publicaciones/PlanEducacion/plan-educa-financiera-2022-2025-en.pdf D’ACUNTO, F., PRABHSLA, N., and ROSSI, A. (2019). The Promises and Pitfalls of Robo-Advising.

Review of Financial Studies, 32(5), 1983-2020.

EUROPEAN COMMISSION. (2023). Monitoring the level of financial literacy in the EU.

https://europa.eu/eurobarometer/surveys/detail/2953 FERNANDES, D., LYNCH, J. G., and NETEMEYER, R. G. (2014). Financial Literacy, Financial Education, and Downstream Financial Behaviors.

Management Science, 60(8), 1861-1883.

HASTINGS, J. S., MADRIAN, B. C., and SKIMMYHORN, W. L. (2013). Financial Literacy, Financial Education, and Economic Outcomes.

Annual Review of Economics, 5(1), 347-373.

INE. (2023). Survey on Equipment and Use of Information and Communication Technologies in Households.

KAISER, T., LUSARDI, A., MENKHOFF, L., and URBAN, C. (2022). Financial Education Affects Financial Knowledge and Downstream Behaviors.

Journal of Financial Economics, 145(2), 255-272.

OECD. (2024).

PISA 2022 Results: Financial Literacy. Paris: OECD Publishing.

S&P GLOBAL FINLIT SURVEY. (2023).

Global Financial Literacy Survey. Standard & Poor’s.

WORLD BANK. (2024).

Global Financial Inclusion and Consumer Protection Survey 2024. World Bank.

Santiago Carbó Valverde. University of Valencia and Funcas

Pedro J. Cuadros Solas. CUNEF University and Funcas

Francisco Rodríguez Fernández. University of Granada and Funcas