Europe’s automotive industry in the face of competition from the US and China

The European automotive sector is facing a significant decline, with production contracting sharply between 2019 and 2023, placing it behind American and Chinese counterparts. While Spain has managed to mitigate some of these challenges given its relatively stronger position in the European market, the broader industry faces an uncertain future without strategic investment incentives to address a range of structural weaknesses.

Abstract: The European automotive sector is experiencing a considerable slump in both absolute terms and relative to its American and, even more so, Chinese counterparts. Between 2019 and 2023, the sector contracted by 16.6%, and preliminary data for this year suggest that the downward trend is continuing. The decline is the result mainly of supply factors, including a technology lag, which is impeding the response to the new environmental requirements, creating high prices that are weighing on demand and affecting competition. Barriers to the demand of electric cars also persist. While Spain has not been immune to these challenges, it has managed to mitigate some of them, due to its relatively stronger position within the European market. Nevertheless, the broader industry faces an uncertain future without strategic interventions to address these structural weaknesses. Going forward, neither the imposition of tariffs nor vehicle purchase subsidies are likely, by themselves, to reverse the decline in a sustainable manner. According to the empirical evidence, investment incentives, centred around the technology of key components like batteries, would be the better policy alternative.

Introduction

The automotive sector is one of the most exposed to the technological, energy and geopolitical challenges that are affecting the global economy. In Europe, the sector has historically played an important role, due to its share of the region’s GDP and balance of payments, as well as its contribution to social and economic development in general. During the first two decades of this century, which have been marked by a succession of crises, accelerating technological change due to advances in robotics and the irruption of China, the sector managed to adapt, holding on to its position as one of bastions of European industrial power.

In recent years, however, doubts have emerged about its ability to respond to the challenges posed by a global market in the midst of profound global change. The aim of this paper is to analyse the origin of the difficulties it currently faces using sector production, demand and trade figures, focusing on Europe’s and Spain’s position relative to the US and China. Following a brief macroeconomic assessment, we share some considerations about the effectiveness of the different economic policy options: tariffs, demand subsidies and support for investment.

Europe’s decline

The pandemic was a watershed moment for the European automotive industry. Prior to the health crisis, the sector indicators continued to reveal moderate growth, underpinned by favourable positioning in different international markets. Between 2015 and 2019, production increased by just over 2%, in contrast to a sharp 20% contraction in the US. During the same period, the region reported a trade surplus, while on the other side of the Atlantic the industry accumulated deficits. In parallel, China’s car industry was making inroads, notching up production growth of 14%.

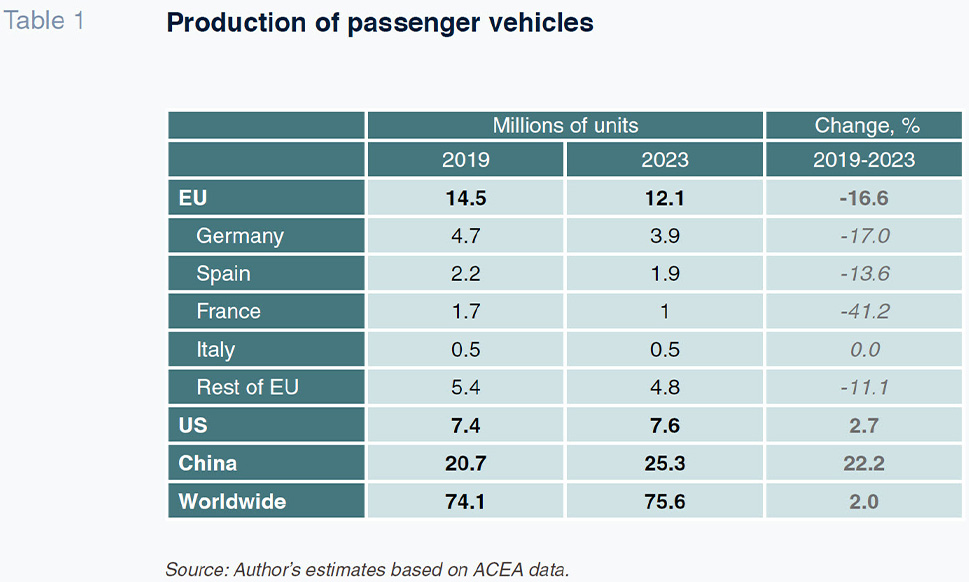

This scenario of relative resistance, however, would appear to have vanished in recent years. Between 2019 and 2023, European production contracted by 16.6% and the data available for this year point to continuation of the negative trend. In the US, by contrast, the sector has managed to stabilise, even making up for a little of the ground lost in the previous years, registering growth of 2.7%, slightly above global total (Table 1). Meanwhile, China has made a leap forward, lifting production by 22.2%. Europe now accounts for just one of every six vehicles made globally, compared to one out of five just a decade ago.

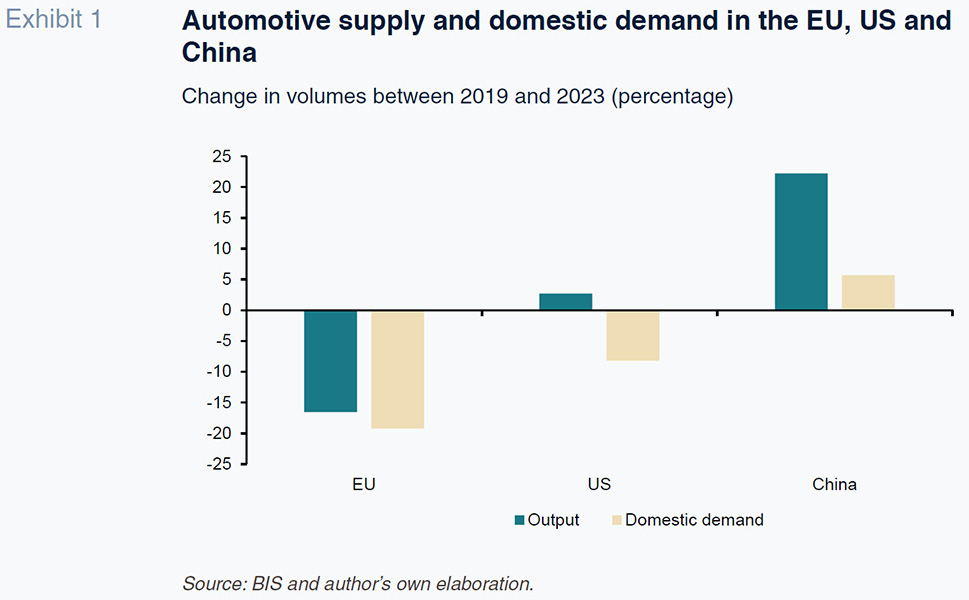

The decline in Europe is attributable, firstly, to weaker demand, reflecting circumstantial factors that are to some degree reversible. The energy shock has taken a relatively higher toll on Europe on account of its dependence on Russian gas and imported fuels. Household purchasing power has been eroded as a result. Proximity to the armed conflicts that have broken out in recent years has also eroded consumer confidence. That explains why private consumption in Europe increased by just 2.3% between 2019 and 2023, compared to growth of 10.7% in the US. Consumption of durable goods, the category cars fall into, has suffered the most. During the period analysed, new registrations plummeted 19.2% in the EU, which is more than twice the drop observed in the US (Exhibit 1).

Regulatory uncertainty may have been a factor, too. The European Union is targeting decarbonisation, announcing a ban on sales of new petrol and diesel cars in the medium term, a measure clearly aimed at incentivising the transition to sustainable cars (which include electric and hybrid vehicles). However, demand for electric vehicles has lagged due to shortcomings in the recharging network, imperfect substitution between electric vehicles and conventional ones, and the fact that prices remain relatively high. Despite recent progress in terms of technology and economies of scale, European electric vehicles remain between 30% and 50% more expensive than conventional models (International Energy Agency, 2024). In some countries, such as Germany, the retail price gap has been reduced by public aid for green vehicle purchases. However, when this aid was recently scaled back due to budgetary constraints, retail prices rebounded, prompting a fresh collapse in new registrations.

Structural factors

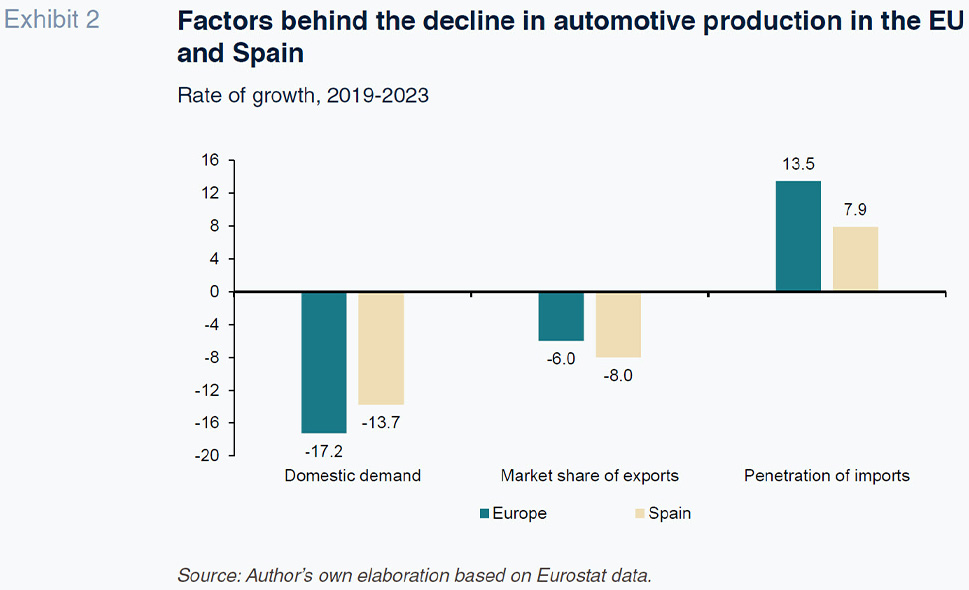

Whereas the above trends are largely circumstantial or could be tackled through better regulations and incentives, there are other more structural, and therefore more worrying, factors at play. First of all, an analysis of recent trade flows reveals that the European industry has lost competitiveness. Exports to third countries have stagnated, in contrast to the growth observed in international markets (Exhibit 2). The loss of the region’s market share is evident virtually across the globe but is particularly noteworthy in China, where flows have fallen by 20.2% in current prices. Imports, meanwhile, have increased at more than twice the pace of decline in exports. The US, China and Japan are among the competitors making the biggest inroads in Europe, as borne out by growth in imports from these markets of 51.4%, 39% and 37.1%, respectively.

Secondly, the trend in production costs attests to the loss of competitiveness. While labour costs have registered only moderate growth, productivity has deteriorated in relation to the region’s main competitors. Energy costs have shot up, especially in the countries that are more dependent on Russian gas.

However, the biggest obstacle is the technology lag that has accumulated around the electric vehicle, a key target of European economic policy. To produce at a large scale and affordable prices, it is crucial to have competitive technology and a secure supply chain right along the value chain, most importantly with respect to the electric battery. European manufacturers, however, have taken too long to make the investments needed to ensure this transition.

The figures are stark: the global sustainable vehicle market (including both electric and hybrid segments) doubled between 2022 and 2023 and while the provisional data point to a slowdown, the market is still expected to expand by 16% this year (Irle, 2024). As a result, one in every six vehicles sold worldwide in 2023 was an electric or hybrid vehicle, compared to one in 12 in 2021 (in 2016 these vehicles accounted for just 1% of the global market).

In this new paradigm, China has emerged as the big winner, ranking first among producer nations and consolidating its new-found positioning. This dominant position is attributable to the fact that the Chinese manufacturers moved so early, buoyed by ample public support, to take advantage of the green transition, carving out important economies of scale in their giant domestic market (Alochet, 2023). Being a first mover in a market can bring a lasting advantage from the point of view of technological leadership, product diversification in response to consumer preferences and control of the supply chain, especially the minerals that are essential for manufacturing electric vehicles.

[1] Also, the subsidies, whether direct or hidden, by the Chinese state, have proven essential to kick-starting and consolidating the transition.

At any rate, the upshot is a lower sales price than the European or North American manufacturers can offer. The Chinese car makers have also been able to adapt for the spectrum of consumer preferences, designing high-end models as well as smaller, more city-friendly ones. More recently, faced by a slump in consumption in China and the risk of not generating a return on their investments, the industry has stepped up its efforts to export the stock of vehicles not sold in the domestic market.

For now, Europe is at a disadvantage. The difficulty in procuring key minerals and the technology lag are undermining the production of batteries, a core component. In tandem, consumer demand for vehicles is stagnating, so that the manufacturers cannot build the scale needed to lower costs, in turn making their products more expensive and further weighing on demand. This vicious circle and its financial consequences are threatening Northvolt, one of the most promising European ventures.

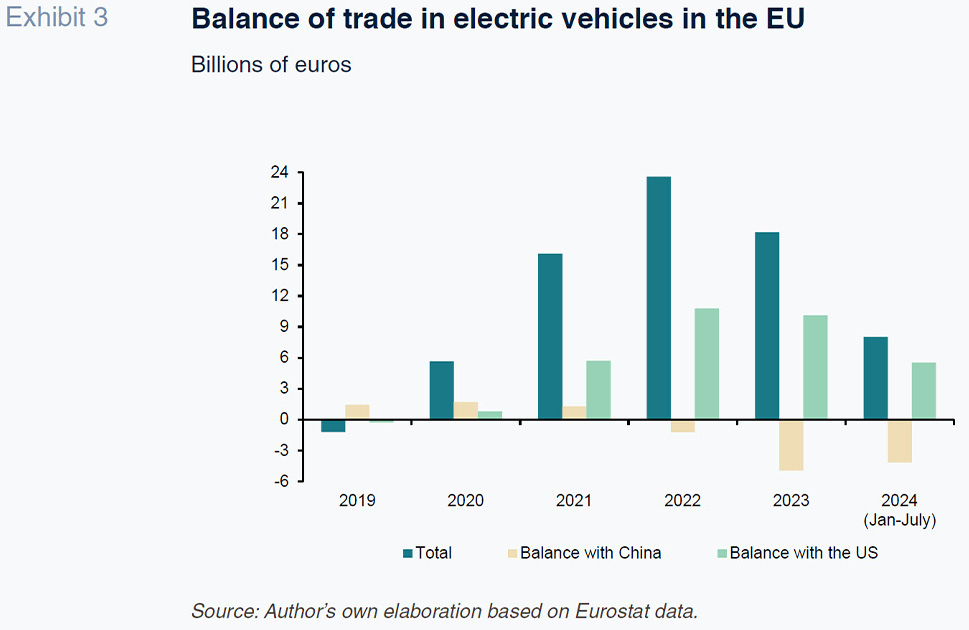

The result is that the EU is losing ground in the international markets for electric vehicles. The initial trade surplus has narrowed drastically (Exhibit 3). The Chinese producers, forced to export to make up for the slump in domestic demand, are gaining market share in Europe, helping to widen the trade deficit with China. In parallel, the surplus with the US is narrowing as the latter attracts investments, drawn the powerful stimulus implied by the Inflation Reduction Act (IRA).

Specifically, the IRA (Inflation Reduction Act) and other recent initiatives like the Infrastructure Investment and Jobs Act are organized around four key objectives, covering the entire value chain of electric vehicles, with a special focus on batteries (Alochet, 2023). First, the Biden Administration has launched an ambitious program to revive the mining industry for minerals essential to battery production. The exploitation of these minerals had declined, and their processing had been outsourced to other countries, as in the case of rare earth elements, which were handed over to a Sino-American consortium in the 1990s. The second objective, which is the most heavily funded, focuses on the manufacturing of batteries and their main components. The program includes the application of tax credits and other subsidies for battery technology and production, contingent upon a high percentage of local content (around 80% of supplies must come from the U.S., Canada, or Mexico to qualify for public support). Third, in parallel with decarbonization goals, the IRA provides incentives for R&D and the production of electric vehicles on American soil. Finally, the battery charging network is being strengthened with a federal investment program and another at the local level.

Spain is partially mitigating the general decline thanks to the European market

The trend in the Spanish automotive sector is similar to that of the rest of Europe (Exhibit 2) but Spain benefits from better positioning in the European market, which is partially mitigating the loss of terrain outside of Europe. Between 2019 and 2023, exports to the EU increased by 18%, which is six points more than the increase in imports from other member states. The trade balance with the EU is a significant surplus. In contrast, the French and Italian car industries present trade deficits with the EU. This helps explain why production in Spain has fallen by somewhat less than the European average, as shown in Table 1.

Policy implications

Our analysis shows that the plight of the European automotive sector stems from tension between targets and the reality. On the one hand, the various governments have set much-needed environmental targets in keeping with their climate action commitments, which has translated into measures such as an increased cost of carbon emissions from 2025, a ban on new sales of conventional vehicles from 2035 (though this goal might be postponed), and incentives for the green transition. On the other hand, however, the production chain is not yet ready to satisfy the potential demand derived from these targets, while demand-side barriers persist. This tension is translating into a sharp contraction in the purchase of vehicles made in Europe and higher import penetration, notably of Chinese electric vehicles.

In this situation, the introduction of tariffs on imports would likely have a relatively insignificant impact on European production, which is essentially being limited by supply factors and the shortcomings of the electric vehicles made in Europe. Tariffs do, however, make sense in the context of subsidies and other practices that distort the playing field and violate international trade regulations. However, applied on their own, i.e., in the absence of a parallel effort to increase the sector’s productive capacity, tariffs do not constitute a long-term solution, as borne out by this analysis.

Subsidies for car purchases have a more direct impact on demand, but in principle do not discriminate between local and foreign production. Furthermore, subsidies come at a cost for the public coffers and are only sustainable if the manufacturers take advantage of the surge in demand to accelerate their technological transition. It has been proven that unwinding them, in order to meet budgetary targets, causes demand to collapse, as the car makers continue to wrestle with technological challenges.

In theory, investment incentives should be more effective as they are more likely to unlock technological development, which is the key issue. The diagnostic suggests that support should focus particular attention to technological development in the battery sector, its manufacturing and the supply chain that sustains it. The problem is that investment incentives take a long time to make their mark and, in the meantime, the region’s competitors are at a considerable advantage. While the task is not easy, the way forward can only be to persevere and fine-tune the measures rolled out in response to their results. It is probably the best option in the face of the “existential” risk facing European industry (Draghi, 2024).

Notes

Suarez and Lanzolla (2005) also give examples of the risks that face first movers.

References

Raymond Torres. Funcas