Credit risk and provisions: Prudent management across the Spanish and European banks

Interestingly, the banks’ excellent earnings performance over the past two years, in both Spain and Europe, driven mainly by growth in net interest income on the back of high benchmark rates, has not had an adverse impact on asset quality. Within this context, it is worth singling out the prudent provisioning effort being made by the Spanish banks, and the European banks in general, so far this year, recognising considerably more provisions (overlays) than required under applicable accounting standards and banking regulations.

Abstract: The banks’ excellent earnings performance over the past two years, in both Spain and Europe, has been driven mainly by growth in net interest income. Interestingly, this momentum in margins, on the back of high benchmark rates, has not had an adverse impact on asset quality. Indeed, the downward trend in non-performance, observed in the Spanish banking system for nearly a decade now, has not been altered substantially by this new high-rate scenario, with both the non-performance and Stage 2 ratios holding steady, barely ticking higher after two years of sharply higher interest rates. Within this context of subdued non-performance, it is worth singling out the prudent provisioning effort being made by the Spanish banks, and the European banks in general, so far this year, recognising considerably more provisions (overlays) than they are required to do under applicable accounting standards and banking regulations.

Asset quality: Non-performance and leading indicators stable

Bank asset creditworthiness has been under scrutiny since 2020 when the pandemic and related lockdown measures, which caused the Spanish economy to contract by over 10%, were expected to trigger an increase in non-performance. However, the wide range of measures deployed with direct and indirect effects on the bank sector (public guarantee schemes, implementation of payment moratoria, furlough scheme, etc.) and their swift take-up mitigated the adverse effects of the pandemic on the economic agents’ ability to service their debts.

Subsequently, beyond the potential fallout from the pandemic on the bank sector, with non-performance remaining above the levels observed at the start of the financial crisis of 2008, asset quality would once again come under threat from inflationary forces and the adoption of restrictive monetary policies, particularly the swift and sharp benchmark rate hikes implemented by the central banks from mid-2022.

This increase in benchmark rates has had a clear positive impact on the recovery in the banks’ top source of income, net interest income, and more specifically on the margin in the retail business, as a result, primarily, of credit repricing.

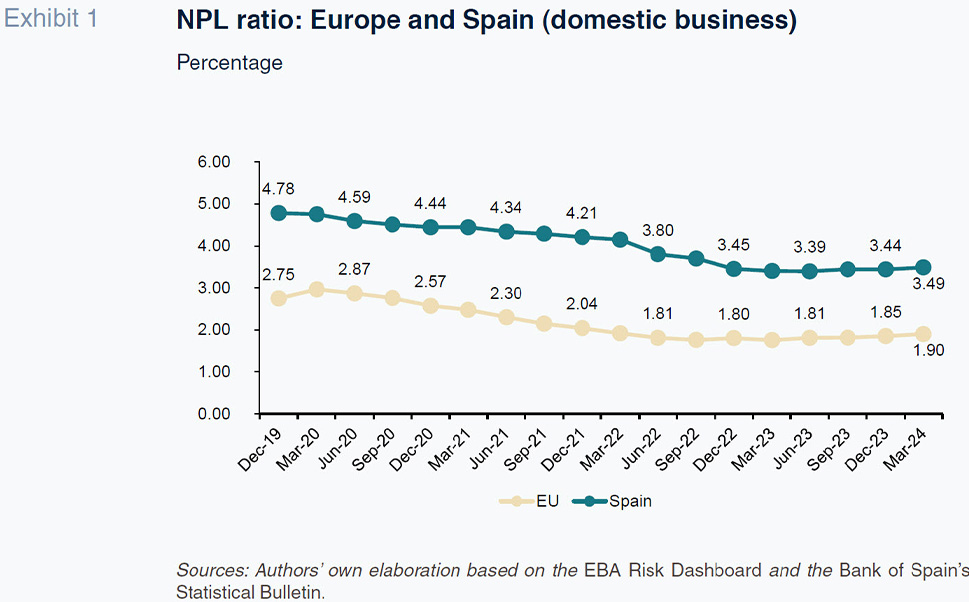

The downside of the rate increases and inflationary episode that led to the monetary policy tightening was expected to be an uptick in sector non-performance, with the new rate environment taking a toll on the financial burden borne by leveraged businesses and households. However, and despite an increase in interest rates of more than 350 basis points, the non-performance ratio continued to etch out a clear-cut downward trend until the end of 2022, in both Europe and Spain, going on to stabilise in 2023 with only a slight increase of 5 to 10 basis points between the end of 2022 and the first quarter of 2024 in both geographies.

This resilience has probably been shaped by several factors that have mitigated the intense increase in interest rates. First of all, a positive macroeconomic environment, particularly in Spain, which recorded GDP growth of 2.5% in 2023, putting it at the forefront of the European economies. In parallel, the labour market has performed well, while household and business indebtedness has remained at much lower levels than at the onset of the financial crisis of 2008.

Moreover, the smaller increase in non-performance in the Spanish banking sector relative to the European sector as a whole is in line with the divergences among European countries pointed out by the European Central Bank in its latest Financial Stability Review (spring 2024). That report noted how the European countries with the lowest non-performance ratios had sustained moderate deterioration in that metric in 2023 relative to the countries still presenting non-performance ratios above the European average. In the latter group, which includes Spain, the non-performance ratio was more stable in 2023; the banks’ have taken a clearly proactive stance towards shoring up credit quality, in the form of both write-offs and asset portfolio sales, which have offset non-performing loan inflows to leave the non-performance ratio very stable, taking advantage of the room for manoeuvre created by an excellent performance in the top half of their income statements.

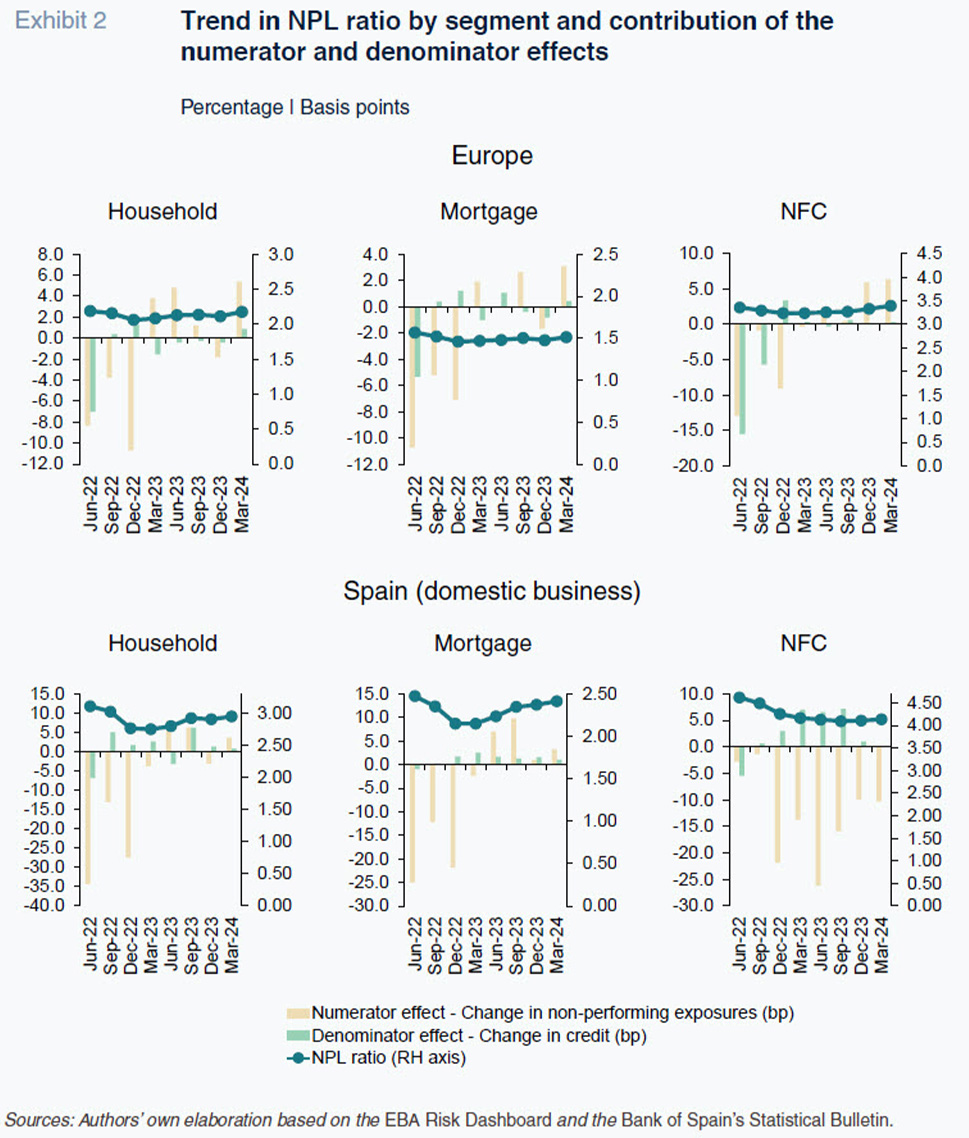

If we look specifically at the trend in non-performance in the main credit segments during the period elapsing since interest rate tightening began, we can see small differences between the various segments and also between Europe and Spain.

In the household segment, for example, the NPL ratio moved higher in both geographies in 2023, with the volume of non-performing exposures increasing by 3.9% and 2.65% in Europe and Spain, respectively. The relatively more intense increase in Europe was shaped mainly by the growth in non-performance in consumer and other loans, which jumped by 5.49% in 2023, compared to more muted growth in non-performing exposures in the mortgage segment (+1.96%). In contrast, last year the Spanish banks experienced a sharper increase in non-performance in the mortgage segment (+6.93%), in all likelihood due to the higher weight of mortgages at floating rates, which have been more heavily penalised by the rate increase, relative to the higher share of fixed-rate mortgages in Europe. In contrast to the European banks and offsetting this sharper increase, non-performance in consumer and other credit continued to trend lower, contracting by 4.75% in 2023.

In another contrast between the two regions, the European banks recorded an increase in non-performance in the non-financial corporation (NFC) segment last year (+2.62%), compared to a sharp contraction (-8.37%) in non-performance in this segment in Spain. Note, however, that the latter trend came to an end in Spain in the last quarter of 2023, when non-performing exposures increased at a quarterly pace of 0.4%, a pattern that continued in the first quarter of 2024, when these exposures increased by 0.7%, albeit still smaller than the increase observed across the European banks in the first quarter (+1.9%).

Compared to the favourable momentum in non-performing exposures in Spain relative to Europe, the non-performing loan (NPL) ratio trended somewhat differently, ticking a little higher in both geographies, albeit by less in Europe than in Spain. Specifically, the NPL ratio in the household segment inched 5 basis points higher in Europe (2 basis points in the mortgage segment), compared to an increase of 14 basis points in Spain (22 basis points in the mortgage segment).

This discrepancy between the trend in non-performing exposures and the NPL ratio is attributable to a denominator effect, specifically the balance of outstanding credit, which has fared differently in Spain and Europe, as we discussed in an

earlier paper.

As shown in the following exhibits, household lending by European banks increased slightly, with growth in new mortgages helping reduce the non-performance ratio in this segment (denominator effect), whereas in Spain, the contraction in credit had a negative impact on the NPL ratio virtually every quarter (except for the seasonal effect in the consumer credit segment in June).

In the NFC segment, although the drop in outstanding credit had a negative denominator effect in Spain, the intense reduction in non-performance more than offset that effect, in contrast to the trend in the overall European NFC segment, where the NPL ratio increased slightly (+9 basis points compared to a drop of 15 basis points in Spain).

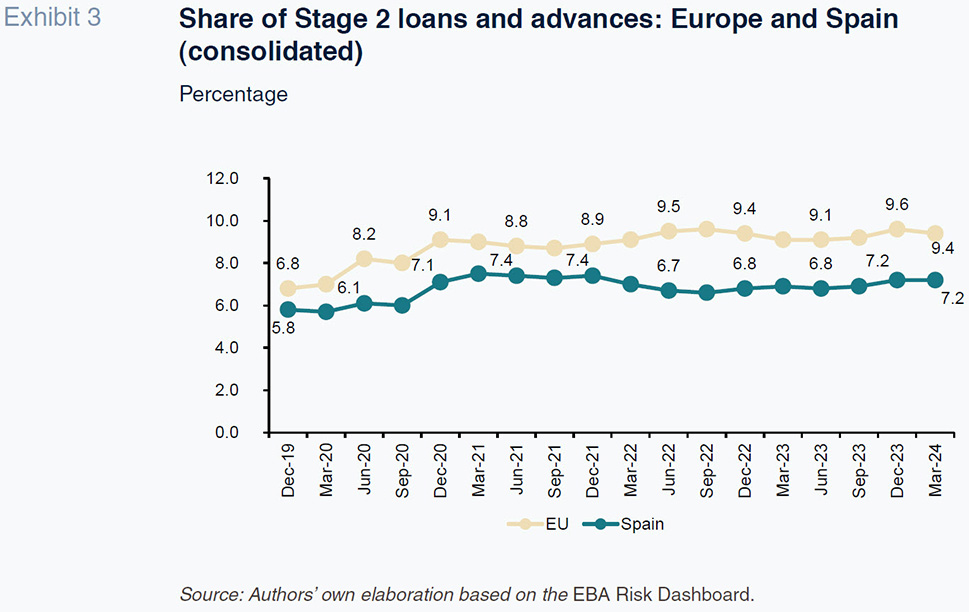

When tracking asset quality, in addition to monitoring non-performance it is important to look at the leading indicators, such as the volume of loans being classified as Stage-2 exposures (to use IFRS nomenclature). The Stage 2 ratio has also been remarkably steady in recent years, edging only slightly higher in 2023. Following a considerable increase in 2020, the European and Spanish banks reported rates of 9.1% and 7.4%, respectively, between 4Q20 and 1Q21. As shown in the following exhibit, the Spanish banks’ share of Stage 2 loans and advances to total gross loans and advances went on to trend down from that high until mid-2022, in contrast with the slight upward trend and higher levels recorded by the European banks on aggregate, where this ratio moved above the levels reported during the pandemic as a result of the relative importance in certain European economies of sectors more exposed to the fallout from the Russian-Ukrainian conflict on energy and commodity prices.

Prudent asset impairment provisioning (overlays)

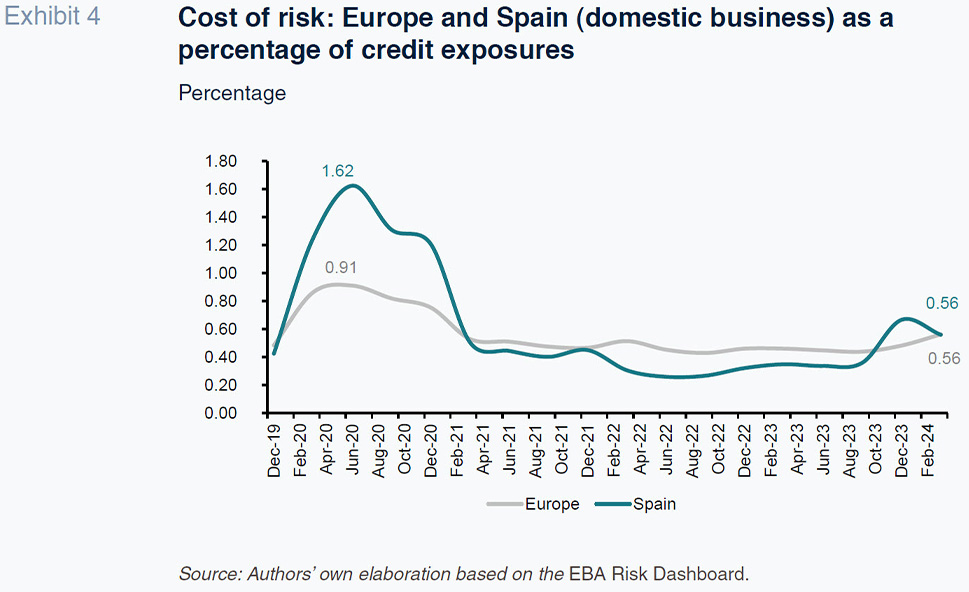

Against this backdrop of muted deterioration in the European and, especially, the Spanish banks’ main credit quality indicators, the entities have been notably prudent with their provisioning efforts, in line with the recommendations made by the supervisors in this regard. This is reflected in the trend in the cost of risk (impairment losses recognised on the banks’ income statements as a percentage of credit exposures): following the efforts made during the pandemic, particularly by the Spanish banks, both geographies have continued to report cost-of-risk metrics very much in line with, or even slightly above, pre-pandemic levels.

The healthy performance in banking margins in 2023, which continued into the first quarter of 2024, has allowed the banks to continue to shore up their provisioning efforts, translating into a logical increase in their cost of risk, which amounted to 0.56% in both Europe and Spain in 1Q24.

Although the data presented by the various banks show a significant degree of heterogeneity, they evidence relative stability around the level of provisions recognised in the first half of 2023, so that the cost of risk remains above ‘cruising speed’ levels. This level of provisioning continued against the backdrop of an aggregate NPL ratio of 3%, down 20 basis points from the first quarter, as non-performing loan inflows eased as outflows accelerated, either due to recoveries or portfolio sales.

This trend in provisions is aligned with the results of the recent (spring) edition of the Risk Assessment Questionnaire published by the European Banking Authority (EBA), in which a wide majority of the banks surveyed (90%) acknowledged using overlays when estimating their provisions. Overlays are also referred to as “management adjustments” to estimated provisions, i.e., adjustments applied to the results of using in-model solutions to estimate provisions or in-model adjustments (to the model inputs and/or model parameters), in keeping with IFRS 9.

Based on the results published, a wide majority of the banks with overlays in place ascribe them to the fact that inflation remains stubbornly above the target set by the ECB, as well as prevailing geopolitical uncertainty and its potential economic and financial impacts, painting a picture once again of a bank sector that is managing expected credit loss prudently, looking beyond the absence of a clear-cut deterioration in performance.

Marta Alberni, Ángel Berges and María Rodriguez. Afi