The sustainability of Spain’s trade surplus

Spain has experienced a historically anomalous period of high GDP growth without generating a corresponding trade deficit. An analysis of Spain’s underlying import and export dynamics reveals that, while the latest Spanish export data show some deterioration, the country’s trade surplus may still have the potential to remain positive, if the economy continues to expand.

Abstract: By the end of 2017, the Spanish economy had experienced three years of GDP growth of at least 3%. This is highly unusual and has not occurred in more than three decades. Moreover, periods of high growth have typically corresponded with trade deficits, yet this most recent growth trend has occurred in the context of a positive current and capital account balance. Given that many companies have yet to maximize their exposure to foreign markets, there is still significant room for growth in exports. In terms of imports, their sensitivity to final demand growth has fallen. Therefore, despite some recent negative performance reflected by Spain’s latest export figures, on the basis of an analysis of long-term import and export trends, we believe that if the Spanish economy continues its expansion, there is potential to do so without generating trade imbalances, thereby reducing the country’s unemployment rate and borrowings. It should be noted, however, that there are several downside risks in the current fragile international scenario – oil prices, an increase in the exchange rates and lower global growth- which could negatively impact the trade surplus.

Introduction

By year-end 2017, the Spanish economy had strung together three consecutive years of annual growth of over 3%. Furthermore, Spain’s balance of trade in goods and services as well as its current and capital accounts were in surplus. It wasn’t until the start of 2018 when these key indicators began to show signs of weakness. What’s more, at 2.6% of GDP during the first three quarters of 2018, the long-standing deficit in the goods trade balance is currently at one of its lowest levels in 50 years.

The longevity of this surplus is a new development for the Spanish economy. Not since 1970-1973 has Spain experienced three straight years of GDP growth of over 3% without a corresponding trade deficit. This typically required a currency devaluation coupled with measures to curb aggregate spending.

Precisely because this situation is new, and in light of the potential threats to its consolidation unfolding this year, it is important to determine whether this growth trend can be sustained. It is, without doubt, the Spanish economy’s biggest challenge today. For an economy with a high unemployment rate, the ability to continue posting GDP growth of over 3% is key as this could lead to growth in employment without renouncing increased productivity. Moreover, this new growth pattern must be underpinned by balanced trade accounts if it is to be sustained. This is all the more vital given the magnitude of Spain’s foreign borrowings.

Consequently, this paper attempts to assess the sustainability of Spain’s balanced trade accounts in the context of average GDP growth of 3%. In other words, it will evaluate the Spanish economy’s ability to generate growth without unleashing imbalances in its foreign accounts. To this end, the paper first looks at the recent trend in the balance of trade in goods and services. It then analyses separately the dynamics in exports and imports with the aim of substantiating a solid outlook for the trend in the trade balance for the coming years.

Economic recovery and trade surplus

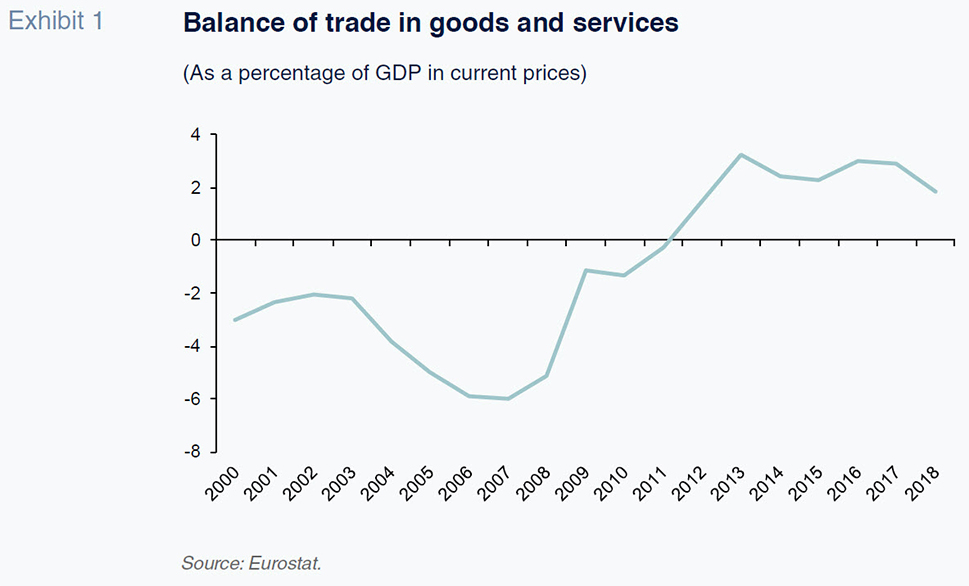

Between 2002 and 2007 Spain experienced considerable growth in the volume of national demand. However, output failed to keep up, triggering sharp growth in imports and a considerable trade deficit (6% of GDP in 2007 measured in constant prices) (Exhibit 1). Adding in income, transfers and the other components of the current and capital accounts of the balance of payments, the deficit climbed to 10% of GDP.

In the wake of the 2008 financial crisis, national demand collapsed, curtailing imports just as growth in exports began to accelerate. By 2011, Spain’s deficit had transformed into a surplus. Over the course of that year, exports virtually matched imports in current terms. In the years to follow, exports would increasingly outsize imports, without hindering the Spanish economy’s efforts to shake off the recession and return to growth. In 2016, the balance of trade in goods and services (current prices) peaked at 3% of GDP. In 2017 it remained close to 2.9%. However, in 2018 this figure fell and is expected to end the year at around 1.9%. The main cause of this one-off deterioration is an unusually weak export performance during the first three quarters of the year, particularly in those markets outside of the EU as well as with the spike in oil prices. The export markets that slowed the most include Brazil, Canada, the US, Mexico, Morocco and Russia. One reason for this is the appreciation of the euro against these countries’ currencies, an effect that was particularly pronounced amongst the BRICS In other cases, such as the US and Japan, this appreciation occurred in 2017, but its effects didn’t fully materialised until 2018.

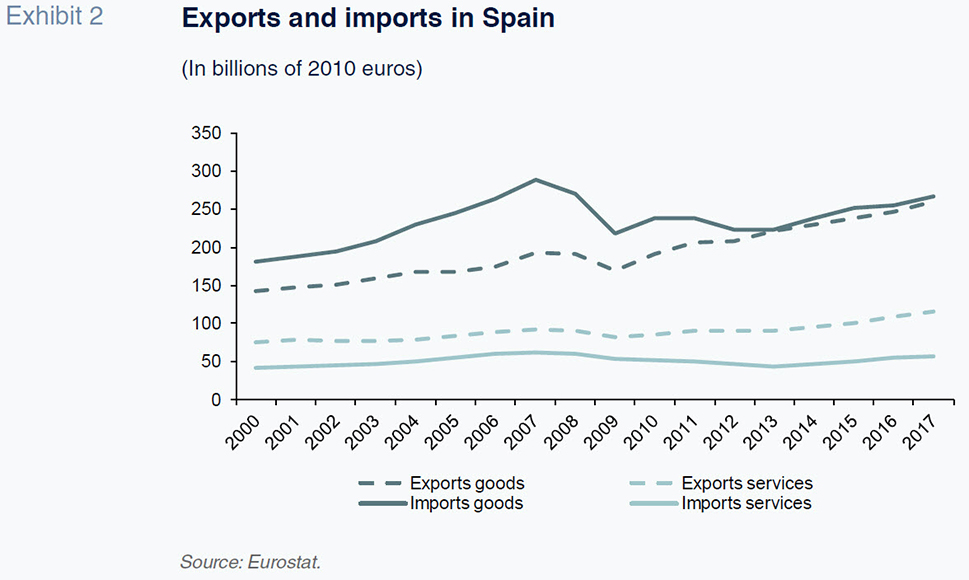

This positive trend in the balance of trade of goods and services has not only derived from the growth in exports but also, to a somewhat surprising extent, from a remarkable and unexpected slowdown in imports. On the export side, growth since 2011 was driven almost equally by an expansion in goods

and services exports. Of note is the tremendous growth in receipts from tourism, which has topped 5% since 2011, with an annual average growth rate of 6.1% between 2013 and 2017.

[1] The slowdown in imports was similarly underpinned by an easing of both goods and service imports (Exhibit 2).

The surprising export story

The recent trend in exports has taken both economists and politicians by surprise. Between 2011 and 2017, exports of Spanish goods and services grew at an average annual rate of 4.6%, which is faster than the notable growth registered during the boom years prior to the crisis (2001-2007: 3.9%). Moreover, the export boom came at a time of slowing global trade, which has eased from rates of over 7% up until 2007 to rates of less than 4% since 2011. Growth in global trade hit its lowest level in 2015 and 2016, averaging 2.6%. This is especially significant given that it was below global GDP growth, something that had rarely happened in the previous decades.

[2]

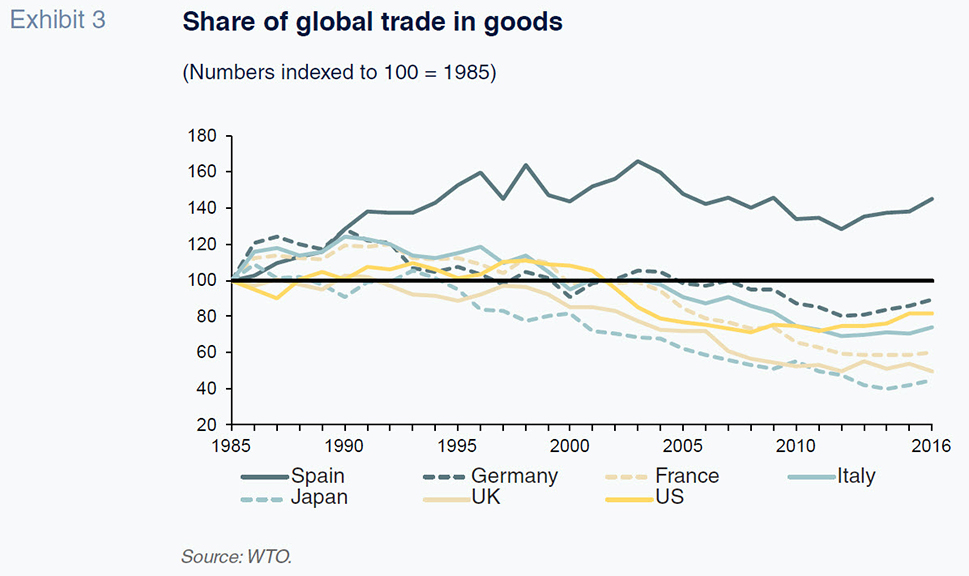

This trend is all the more surprising considering the fact that more than 50% of Spain’s exports go to the European Union, one of the regions most affected by the crisis. Another source of surprise is the fact that the growth in Spanish exports during the above-mentioned period exceeded that recorded by the other European economies, even Germany, whose export-oriented economy has an extensive footprint in Asian markets. Thanks to their new-found focus on foreign markets, Spain’s enterprises have managed to win back some of this lost share of the world trade of goods during the first years of the 2000s (Exhibit 3).

One last reason the trend in exports was unexpected is related to the widespread notion that Spanish products are not very competitive. Some observers have pointed to the daunting size of the trade deficit recorded in 2007 as evidence of this claim. In reality, the scale of the deficit was actually a reflection of excess aggregate spending fuelled by lax monetary conditions.

Some analysts have attributed the momentum in exports during the financial crisis to the drastic drop in internal demand, which forced Spain’s enterprises to seek out new markets, and reduce wage devaluation. This in turn boosted their global competitiveness. There are studies that give significant weight to these factors, such as the work of Almunia et al. (2018), which attributes the impact of the contraction to internal demand, and that of Salas (2018), which looks at the role of flexible labour market policies introduced in 2012. However, other studies argue that these dynamics had a limited impact (Prades and García, 2015; Bank of Spain, 2017; and Crespo and García Rodríguez, 2015). The 2018 slowdown in exports appears to support the thesis posited by those who emphasise the importance on the demand and price factors. However, as already noted, the 2018 developments are most likely a one-off occurrence. Exports also contracted sharply in 2012 despite currency depreciation.

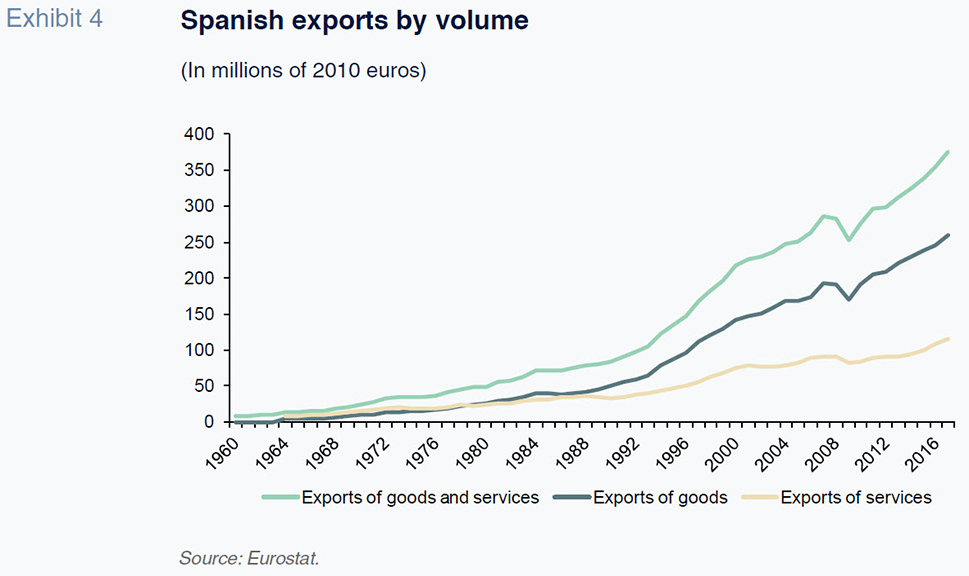

The idea that export growth in the years since 2010 is part of an upward trend initiated by Spain’s membership in the EEC in 1985 is more plausible. In other words, the years of recession and subsequent recovery have barely interrupted the momentum that preceded these events (Exhibit 4). Nor have the respective contributions by the

intensive and extensive margins to the growth in exports changed meaningfully (Lucio

et al., 2018).

[3]

In fact, the annual rate of growth in export sales volumes has averaged 5.3% since 1985, which is just below the 5.8% average growth in global trade. However, looking only at goods, the annual rate of growth in Spanish exports has averaged 6.3%, which is a little higher than the global rate (6.07%). This explains why Spain saw its share of world trade in goods increase considerably between 1985 and 2017, as shown in Exhibit 3. Note that the trend is not linear but rather materialises after several oscillations. Spain stands out alongside Germany for the growth in market share since 2011. Both economies have also sustained the smallest contraction in market share since the start of this century.

The contraction in Spain’s share of the world goods trade during the years immediately following the crisis is attributable to two key factors: (a) the growth in Chinese exports since China joined the WTO in 2001 (prompting all of the advanced economies to lose share); and (b) excessive dependence on the European Union markets at the start of this century (nearly 70%), years during which the EU’s contribution to growth in international demand for goods declined (Álvarez and Myro, 2018).

In response to this adverse situation, Spain’s enterprises began to diversify their export markets, embarking on a gradual reduction in the concentration of their EU sales to 62.9% by 2014. This new strategy enabled them to tap the growth in demand from emerging markets when the crisis erupted and is largely responsible for the surprising export performance in recent years. As well, the continuity of emerging markets’ growth during the initial years of the crisis stimulated further market diversification.

[4]

As explained in the Uppsala Model, these events are fairly common for a country as new to exporting as Spain. Spanish exporters turned first to the most favourable markets and later set their sights on more distant and less familiar markets.

The prolonged expansion in Spanish exports has also been driven by several other key factors: a) a product supply mix with a variety of technological content that is increasingly in line with the structure of global demand (Myro, 2015); b) the growing sophistication of the products exported (Álvarez and Vega, 2016); c) an improvement in quality across the spectrum of goods supplied; d) a good combination of old and new markets; e) a well-populated group of leading enterprises, which boast relatively high efficiency levels and have already breached the most advanced frontier of international expansion, namely the establishment of subsidiaries in a broad number of countries (Esteve and Rodríguez, 2014); and, lastly, f) Spanish enterprises’ increasing capacity to join global supply chains, injecting stability into their sales abroad (Gandoy, 2015).

The growth in Spanish exports has not only had a positive impact on the trade deficit and the sustainability of industrial production, but has also led to an increase in the size and productivity of the Spanish exporters, enhancing their ability to compete (Eppizin et al., 2015; Serrano and Myro, 2017).

In light of the above, what is the outlook for export growth in the years to come?

There is little doubt that exports will grow at least in line with international trade, as has been the case for the last three decades. Assuming the moderate growth in global trade being forecast by the IMF for the coming years –around 4% per annum– and an even split between the EU and the rest of the world destination-wise, Spanish exports would trend in line with that figure.

However, between 2011 and 2017, exports of Spanish goods registered annual volume growth of 4.6%, outstripping the growth in foreign demand (3.5%) by more than one percentage point. If this differential were to persist, Spanish goods exports could register growth of over 4%, pushing up the rate of growth in aggregate exports of goods and services. However, this differential could well be offset by a slowdown in tourism.

There are sufficient reasons to expect Spanish goods exports to grow faster than global demand. Spain still has highly competitive industrial sectors which are relatively inward-looking, such as the food industry. As well, Spanish companies have room to expand in the Asian, North American and Northern European markets. Moreover, there is significant scope for Spanish companies to increase their penetration of global value chains.

[5] Currently, Spanish exports remain overly dependent on a comparatively small number of products (Easterly, 2000). Thus, Spain’s exporters have room to increase the number of products they export and the value of their products as they converge towards the European Union average.

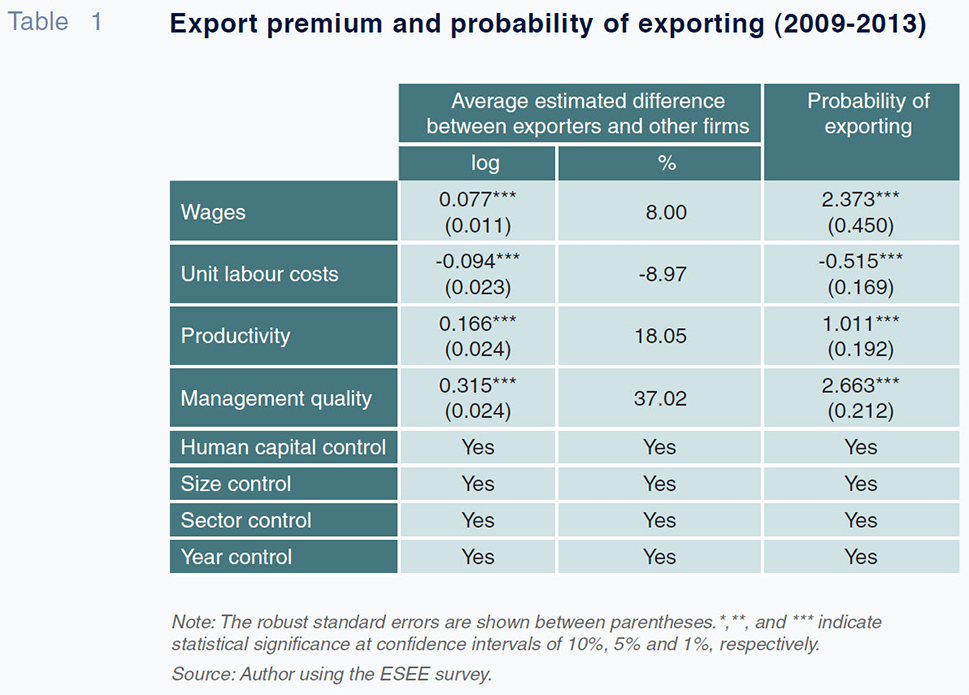

These forecasts would be higher if more dynamic industrial and trade promotion policies were adopted. According to the work of Helpman (2011), the primary factor shaping international expansion relates to companies’ productivity, which gives them the ability to support the fixed and variable costs that exporting implies. Another significant factor is firms’ management capabilities, as this helps better calculate and prevent the risks involved with penetrating foreign markets (Serrano and Myro, 2016). Less important are unit labour costs and low wages. Table 1 shows the differences in these variables between exporters and non-exporters using the Survey About Business Strategies (ESEE for its acronym in Spanish) for 2009-2013. The industrial firms that export present the highest productivity levels and are the best managed. Thanks to their high relative productivity, they also present lower unit labour costs, despite paying their employees higher wages.

The empirical evidence obtained from that same survey contains another indication of the growth potential for Spanish exports. In 2014 and 2015, 9% of the industrial enterprises included in the ESEE presented the median productivity score of the exporters but were not exporting. The non-exporters with the greatest potential to export included firms from the food, graphic arts, non-metallic mineral products and metallic products sectors.

The surprising import story

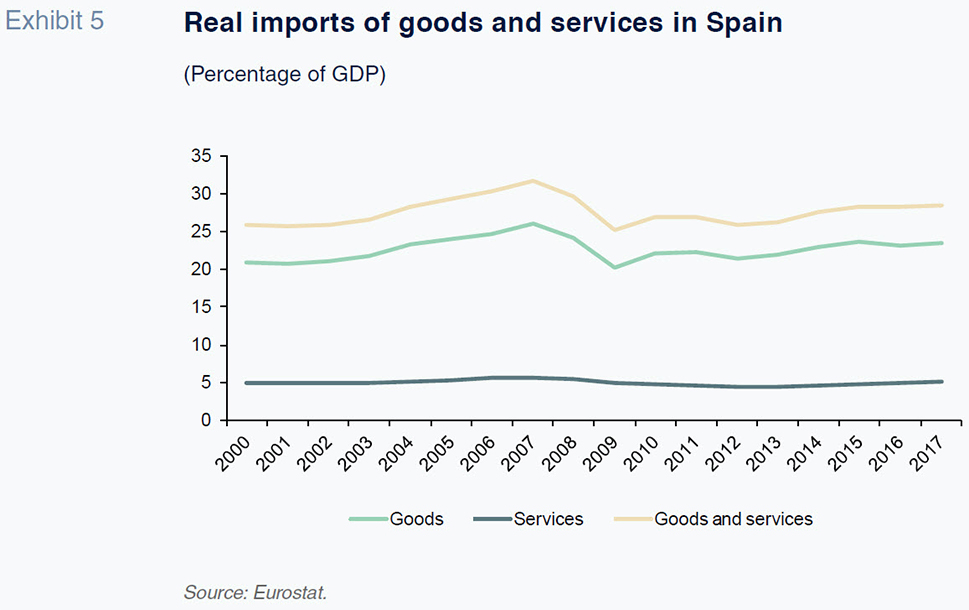

If the recent trend in Spanish exports has been surprising, the import dynamic has been even more astonishing, with imports having grown by less than was expected. Based on the pattern during the growth years prior to the crisis, the general consensus was that imports would increase their percentage weight in GDP. However, this metric has been relatively stable (Exhibit 5).

In order to assess the outlook for growth in imports for the coming years, it is important to understand the long-term drivers of import growth. Since Spain joined the EEC, the volume of goods and services imported has been growing at a high average rate of 6.9%, nearly one-and-a-half percentage points above that of exports (5.2%). At 7.3%, imports of goods have grown even faster, while growth in service imports has averaged 5.4%. Considering that during this same period final demand grew by an annual average rate of 3.1%, total imports have increased 2.2 times more than final demand, a multiple that increases to 2.3 times in the case of goods.

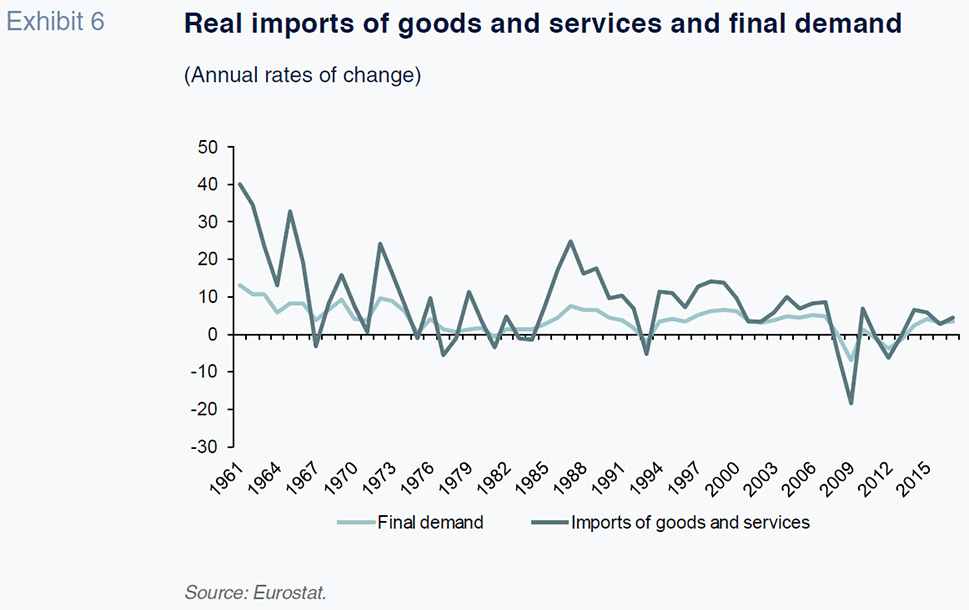

Those figures fit well with the income elasticity estimated in García

et al. (2009) of 2.2 for all regions and 2.5 for imports from the EU. However, these are averages. In reality, the relationship between final demand and imports of goods and services are considerably less stable than the above-mentioned elasticity estimates (Exhibit 6). Until Spain joined the EU, growth in imports was more in line with that of final demand, albeit with major swings from one year to the next. Membership of the EU would appear to have intensified Spain’s dependence on foreign goods, particularly in the long period of growth between 1985 and 2000. Since then, however, imports have reacted more moderately to growth in final demand.

The response of imports to the trend in national demand is mainly due to two factors that came to the fore between 1985 and 2000. The first relates to the growth in exports. The second is the growth in import content of final demand, which lasted until 2000 and was a result of the formidable growth in global value chains (Timmer et al., 2016).

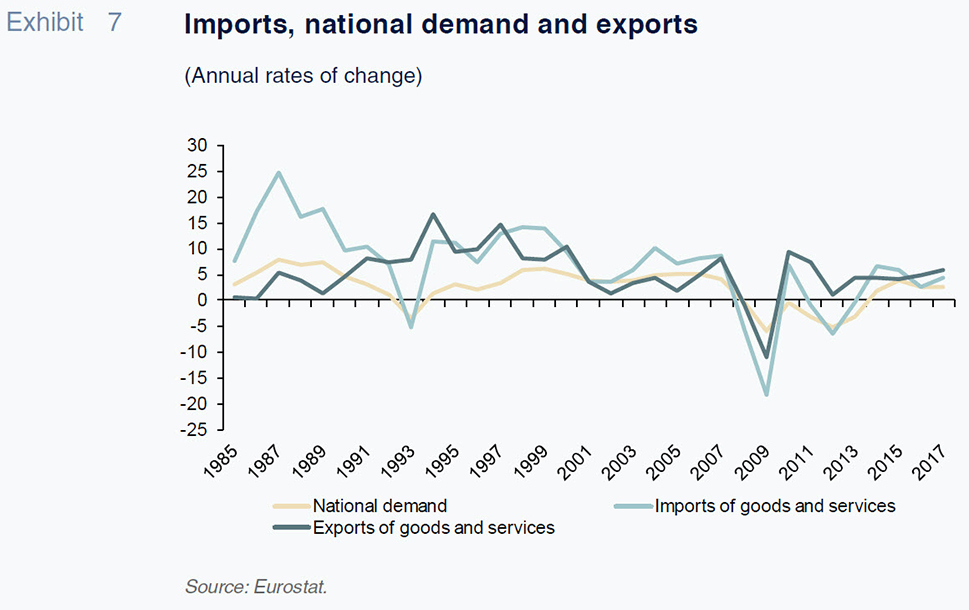

Since 1985, the noteworthy expansion in exports has triggered considerable growth in the imports needed to facilitate the production of the goods exported. The earliest estimates of the import content of Spain’s exports range between 19% and 26% (Cabrero Tiana, 2012; Gandoy, 2017 Bussière

et al., 2013), which is slightly above the content in national demand. It is easy to deduce that an annual increase in exports of goods of 11% throughout all of the 1990s had a positive impact on the import of goods and services. Therefore, the import dynamic is easier to understand when plotted against the trend in exports (Exhibit 7).

During the first few years of membership in the EEC, imports from the region soared by far more than would have been expected in light of the growth in national demand and exports. However, as time progressed, the import dynamic fell in line with the trend in these two variables. The sharp growth in imports during the second half of the 1990s would track the similarly impressive growth in exports. The subsequent slowdown of growth in the years prior to the crisis was also related to the slowdown in exports. As noted earlier, this was prompted by a shift in international demand which impacted Spain’s main market, the EU.

However, a full explanation of the trend in imports also requires analysis of a second element, namely the increase in the import content that affected the various headings of national demand as well as exports between 1995 and 2000. The increase in the import content of exports was the result of Spain’s growing penetration of global value chains. Using Gandoy (2017), the above-mentioned import content estimates suggest a very similar increase for both national demand and exports, of around seven percentage points, from 19% to 26%. This change helps explain the considerable growth in imports between 1995 and 2000. It also helps explain their slowdown from the start of this century until today, as the import content has virtually stagnated since then (falling in 2009 and going on to recover by 2011 at a level close to that of 2008). The import content estimates provided by the Bank of Spain (a continuous series from 2000) reveal a similar pattern (Bank of Spain, 2017).

Thus, it can be said that exports have radically transformed the Spanish economy since it joined the EEC, not only because of their impact on production, but also their impact on imports.

In recent years, the close correlation between the trends in imports and demand would appear to rule out the existence of any kind of import substitution effect. This is not to say such a phenomenon could not occur in the future, especially given the transformational effects the growing orientation towards foreign markets is having on the Spanish economy.

[6] However, we could also see a resurgence in the creation of value chains, which would increase import content levels.

Given the trends outlined up to this point, what can we say about the outlook for imports in the coming years?

The figures for the last few years appear to show that, as for the global economy as a whole, imports depend on the rates of growth in national demand and in exports, at elasticities of close to one (assuming constant import content levels which in reality increase slightly during periods of growth and fall somewhat during recessions).

On this basis, it can be said that an increase in national demand of close to 3% would result in a very similar or slightly higher rate of growth in imports. If exports were to grow at this same percentage, or at the more probable rate of 4%, judging by the IMF’s forecasts for global demand, the trade surplus would widen, so that it would be feasible to observe sustained, high growth in tandem with a trade surplus.

Conclusions

In this paper, we attempted to assess the sustainability of Spain’s current trade surplus. In order to achieve this, we drilled down to the long-term drivers of exports and imports. Our conclusion is that there is still significant room for growth in exports in light of the existence of a large number of companies that have yet to turn to export markets, that productive sectors have so far focused largely on the domestic market, and that many markets are relatively underpenetrated by the Spanish exporters. The recent slowdown in export growth, which is more pronounced in the non-EU markets, may be a transient phenomenon. Import growth, on the other hand, has been moderate for a long period of time and this trend appears relatively stable. Furthermore, it is a development that transcends the Spanish economy and can be explained by the considerable slowdown in the creation of global value chains, which peaked in the 1990s.

In scenarios of strong GDP growth (growth of around 3%), Spain’s trade surplus may remain constant or even increase. The growth in the surplus would be even greater in the alternative scenarios of more moderate growth anticipated for the years to come. This means that if the Spanish economy continued to grow at around 3% per annum, it may be able to do so without generating trade imbalances, which would help reduce unemployment and foreign borrowings.

That being said, it should be noted that the upbeat outlook for Spanish growth and foreign trade depicted in this paper is not risk-free. The first and most important risk factor relates to oil prices, which have already made their mark this year. Another considerable risk is the appreciation of the euro. This factor has already had a negative impact on the 2018 figures, particularly in relation to the BRICS. There is also a risk that Spanish companies will face difficulties in penetrating distant and competitive markets. Unless they raise their productivity game by building a stockpile of intangible assets, it will become increasingly necessary for Spanish firms to diversify away from the EU. Elsewhere, national demand could shift back towards goods that are more intensive in imports, as the economic recovery spreads across all segments of society and average income levels rebound. Lastly, we could see fresh credit bubbles as a result of new real estate overheating.

Against this backdrop, Spain should adopt robust policies aimed at boosting labour productivity at the firm level and foster firms’ presence in foreign markets in order to support strong GDP growth in tandem with a trade surplus. This will require initiatives such as employee training policies which target innovation and international expansion.

Notes

This rapid growth has slowed in 2018, considerably detracting from the pace of growth in services exports.

This change in trend can be seen in 1982, 1983, 1985 and 2001. In addition to the financial crisis, it has been attributed to several factors, including a slowdown in the creation of global value chains and a shift in demand towards services with a lower import content (Jääskelä and Mathews, 2015; Timmer et al., 2016).

For a more detailed analysis of the trend in and drivers of Spanish exports, refer to Myro (2018).

However, the recent slowdown in emerging markets’ growth, coupled with the recovery in the eurozone, has once again increased exposure to the European market, which currently accounts for 67% of Spanish exports, according to Eurostat (foreign trade statistics; not the national accounts).

To give an idea of the potential, note that in the highly developed food sector, Spanish companies purchase more inputs from German companies for their export products than German companies buy from Spanish companies in order to manufacture the food products they then export.

In its most recent report, the Bank of Spain detects a reduction in enterprises’ importing intensity which it interprets as a possible symptom of an import substitution process (Bank of Spain, 2017).

References

ALMUNIA, M.; ANTRÁS, P.; LÓPEZ-RODRIGUEZ, D., and E. MORALES (2018), “Venting Out: Exports during a Domestic Slump”, October, mimeo.

ÁLVAREZ-LÓPEZ, M.ª E., and R. MYRO (2018), “Diversificación de mercados y crecimiento de la exportación” [Market diversification and export growth], Papeles de Economía Española, 158: 16-27.

ÁLVAREZ LÓPEZ, E., and J. VEGA CRESPO (2016), “La sofisticación de las exportaciones españolas” [Sophistication of Spanish exports], Economics Blog - Aldea Global, April 14th.

BANK OF SPAIN (2017), Annual Report 2016: 91-121.

BUSSIÈRE, M.; CALLEGARI, G.; GHIRONI, F.; SESTIERI, G., and N. YAMANO (2011), “Estimating trade elasticities: Demand composition and the trade collapse of 2008-2009”, WP, 17712, NBER.

CABRERO, A., and M. TIANA (2012), “Contenido importador de las ramas de actividad en España” [Import content by sector in Spain], Economic Bulletin of the Bank of Spain, February: 45-68.

CRESPO, A., and A. GARCÍA RODRIGUEZ (2015), “¿Ha mejorado la competitividad exterior gracias a la devaluación interna?” [Has the internal devaluation translated into enhanced foreign competitiveness?], Papeles de Economía Española, 150: 114-126.

EPPIZIN, P. S.; MEITHALER, N.; SINDLINGER, M., and M. SMOLKA (2015), “The Great Trade Collapse and the Spanish Export Miracle: Firm-level Evidence from the Crisis”, Economics Working Papers 2015-10, Aarhus University.

ESTEVE, S., and D. RODRIGUEZ (2014), “Características de las empresas que realizan IED. Empresas multipaís y empresas multiproducto” [Characteristics of firms that undertake FDI. Multi-country firms and multi-product firms], in Myro, R. (2014), España en la inversión directa internacional [Spain and Foreign Direct Investment], Instituto de Estudios Económicos, chapter 7: 301-329.

ESTEVE PÉREZ, S.; DE LUCIO, J.; MINONDO, A.; MÍNGUEZ, R., and F. REQUENA (2017), “The link between previous experience and survival of new export relationships in Spain,” Spanish Economic and Financial Outlook, Vol. 6, No. 3. May 2017.

GANDOY, R. (2014), “La implicación española en cadenas globales de producción” [Spain’s role in global production chains], in Alonso, J. A., and R. Myro (dirs.), Ensayos sobre economía Española, Thomson-Reuters.

— (2017), “La dependencia importadora de la economía española” [The Spanish economy’s dependence on imports], Estudios de Economía Aplicada, Vol. 35-1: 111-132.

GARCÍA, C.; GORDO, E.; MARTÍNEZ-MARTÍN, J., and P. TELLO (2009), “Una actualización de las funciones de exportación e importación de la economía española” [An update on the Spanish economy’s export and import demand functions], Occasional Papers, 0905, Bank of Spain.

HELPMAN, E. (2011), Understanding global trade, Harvard University Press, Cambridge.

JÄÄSKELÄ, J., and T. MATHEWS (2015), “Explaining the slowdown in global trade”, Bulletin September Quarter 2015, Reserve Bank of Australia: 39-46.

LUCIO, J.; MÍNGUEZ, R.; MINONDO, A., and F. REQUENA (2018), “Is Spain experiencing an export miracle?,” Spanish Economic and Financial Outlook, Vol. 7, No. 4, July 2018.

MYRO, R. (2015), España en la economía global. Claves del éxito de las exportaciones españolas [Spanish exports: key success drivers], RBA, Barcelona.

— (2018), Economic growth with an external trade balance: A new scenario for the Spanish economy, EuropeG, Policy Brief, 13.

PRADES, E., and C. GARCÍA (2015), “Actualización de la función de las exportaciones españolas de bienes” [Updated demand function for Spanish goods exports], Economic Bulletin, April: 31-39, Bank of Spain.

SALAS, J. (2018), Drivers of Spain’s Export Performance and the Role of the Labour Market Reforms, IMF, mimeo, September.

SERRANO, J., and R. MYRO (2016), “Management Quality and Firm Heterogeneity in International Trade”, mimeo.

— (2017), “From domestic to exporter, what happens? Evidence for Spanish manufacturing firms, mimeo.

TIMMER, M. P.; LOS, B.; STEHRER, R., and G. J. DE VRIES (2016), “An Anatomy of the Global Trade Slowdown based on the WIOD 2016 Release”, GGDC Research Memoranda, 162, University of Groningen.

Rafael Myro. Universidad Complutense, Madrid