The shifting structure of customer deposits in the Spanish banking system

As a result of persistently low interest rates over the past decade, the traditional mix of deposits has shifted in favour of demand deposits at the expense of term deposits. While it is unlikely that the ECB will initiate the normalisation of interest rates in the near-term, it is worth analysing how such a scenario could impact Spanish banks’ margin recovery, given the sensitivity of improvement to banks’ management of customer funds.

Abstract: The persistence of abnormally low interest rates has had a significant impact on the structure of customer funds managed by the Spanish banking sector. That structural change has affected both the mix of off-balance sheet funds relative to deposits (with the former clearly predominating in recent years) and the breakdown between term and demand deposit. Over the last few years, the traditional mix of 60/40 in favour of term deposits has shifted towards demand deposits, which currently represent 80% of all deposits. The increased weight of demand deposits as a structural source of funding has significantly lowered banks’ funding costs. However, cautious observation is necessary, especially in the albeit unlikely near-term event of monetary policy normalisation. In such a scenario, the expected margin recovery would be extraordinarily sensitive to how Spanish banks manage their pool of deposits.

Historical analysis

The low level of the interest rates (close to zero or even negative) faced by the Spanish banking sector has continued to alter the structure of banks’ customer funds. This is evident in the mix between off-balance sheet funds (investment funds under management) and deposits. In terms of the latter, there has been a clear shift in the breakdown between term and demand deposits. Specifically, the share of demand deposits now accounts for 80% of all bank deposits.

These dynamics have enabled the banks to minimise their funding costs in the total absence of liquidity concerns. This is due to the downtrend in outstanding loans coupled with the virtually unlimited ability to tap funding from the European Central Bank (ECB). However, the increased weight of demand deposits as a structural source of funding also implies a source of vulnerability in the unlikely event of monetary policy normalisation in the near-term. Under this scenario, the expected margin recovery would be extraordinarily sensitive to how the banks manage their pool of deposits.

Our analysis of the trend in customer funds in the Spanish banking sector begins a full decade ago in the weeks prior to the collapse of Lehman Brothers. The observed trend in customer funds correlates with interest rate movements, which clearly underpinned the shift in the structure of customer funds.

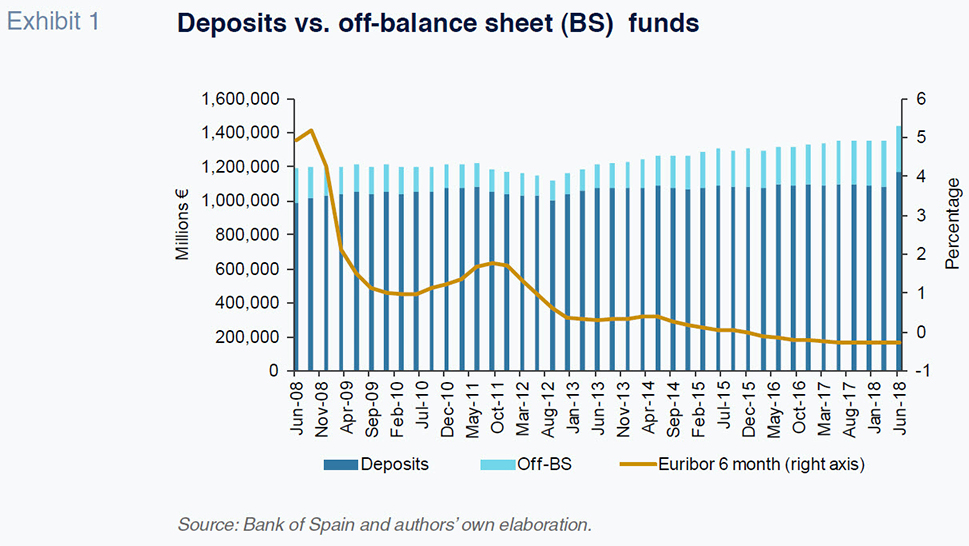

Exhibit 1 depicts the trend in the mix between customer deposits and off-balance sheet funds for the Spanish banking system over the specified time period. At around 1 trillion euros, customer deposits have been virtually stable throughout the entire decade, whereas all of the growth in customer funds has come via investment funds, which have more than doubled from just over 100 billion euros in 2008 to almost 280 billion euros by mid-2018. It is clear that the drop in benchmark rates has played a key role in this shift from savings to funds, to the detriment of deposits. This trend is represented in the exhibit by the 6-month Eurobor rate, which has been trending very close to or even below zero for the past five years.

Unquestionably, the marketing strategies pursued by the banks have also played a role. These strategies have focused on investment funds, which generate much higher fee income than bank deposits. It is worth noting that fees from the management of off-balance sheet funds have increased by over 8 billion euros during the last decade. This growth would never have been achieved if customer funds brought in had been put into deposits, given that banks have earned next to nothing for these deposits over the past five years.

Indeed, the fact that deposits have made such a scant contribution to the banks’ margins explains the liability pricing policies pursued by the banks. This in turn accounts for the relative dynamic between the two main forms of deposits: term and demand deposits.

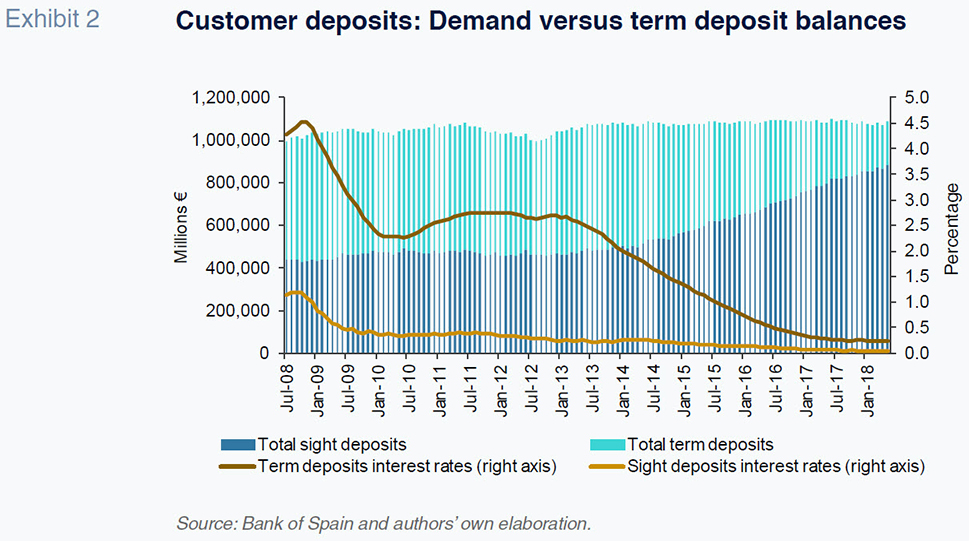

Exhibit 2 illustrates the trend in term and demand deposits, along with their average rates of return earned. Although returns have dipped for both deposits, returns on term deposits have fallen more sharply due to their higher starting level. This trend has continued to the point where the difference between remuneration on term versus demand deposits has narrowed to just 0.2%, an all-time low.

It is obvious that the convergence between interest on term and demand deposits is the main reason for the structure change in the mix between the two deposit categories. The historical trend, and one that continues to prevail in several European countries, is marked by a mix between term and demand deposits of around 60/40. This trend began to evolve towards the end 2012, when the ECB’s commitment to preserving the euro encouraged the belief amongst banks that: (i) liquidity was guaranteed via the ECB; and, (ii) this would mean that rates would remain at ultra-low levels for a protracted period of time.

It was precisely at this time that the spread between the return on term and demand deposits embarked on a period of sharp contraction. This prompted a similarly dramatic shift from term to demand deposits, insofar as the relative convenience and immediacy for demand deposit-makers was no longer penalised by a higher opportunity cost. This systematic move has continued to alter the split between term and demand deposits. Specifically, by mid-2018, 80% of customer deposits were in the form of demand deposits, a ratio never before attained in Spain or the eurozone.

This deposit structure provides a slightly skewed snapshot as it implies funding medium- and long-term assets with liabilities that can largely been redeemed on demand. That being said, the distinction is not all that meaningful considering term deposits that fetch a return of 0.20% have penalties for early withdrawal that could be virtually nil. Consequently, this can hardly be described as a secure and stable source of funding.

For this reason, the prevailing deposit structure, which is markedly biased towards demand deposits, is not a source of particular concern in terms of liquidity management. It has, however, been a driving force behind the sharp reduction observed in average funding costs, partially mitigating the sharp contraction in margins deriving from the rate panorama during the last five years (zero and even negative rates).

By that same logic, it is possible that the management of liabilities, and their cost, will be a key factor in the anticipated and long-awaited recovery in margins when monetary policy embarks on gradual normalisation, benchmark rates (e.g. Euribor) definitively enter positive territory and curves steepen.

Sensitivity analysis

We have run a sensitivity analysis to estimate the impact on term and demand deposits of an uptick in benchmark rates, using a 100 basis points increase in the 6-month Euribor rate and a time horizon of now and year-end 2020 as our proxy.

The next step was to model the estimated impact on demand and term interest rates, using the 6-month Euribor rate as our explanatory variable and assuming a high pass-on rate of 95% for demand deposit rates and 94% for term deposit rates.

We performed a regression analysis of the series of outstanding demand and term deposit balances in order to obtain a historical sensitivity analysis. Having searched for the best econometric fit, the variables that accompany the trend in interest rates as explanatory variables are:

- The trend in quarterly GDP expressed in year-on-year terms;

- The trend in quarterly house prices expressed in year-on-year terms;

- The trend in the yield on 2-year Spanish Treasury Bills;

- Rates earned on term deposits (modelled using the 6-month Euribor rate);

- The incorporation of a dummy variable in 1Q18 for term deposits and in 4Q12 for demand deposits.

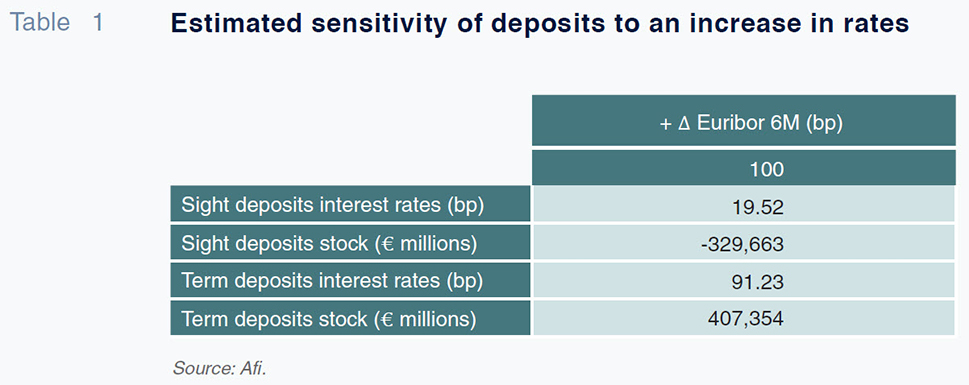

Table 1 shows the results of the sensitivity analysis in the event of a 100 basis point increase in the 6-month Euribor rate curve.

Our sensitivity analysis shows that in the event of a 100 basis points increase in the 6-month Euribor rate, with all other control variables remaining the same, the term deposit rate would increase by 91 basis points. This is due to the fact that 6-month Euribor has a bigger impact on term deposit rates than on demand deposit rates, as is observed when analysing the historical trend.

Again assuming a 100 basis points increase in the 6-month Euribor rate, the stock of demand deposits, via the rates offered on term deposits, would decrease by approximately 330 billion euros, while the stock of term deposits would increase by 407 billion euros, resulting in an aggregate net increase in deposits (term plus demand) of around 75 billion euros.

The estimates for both the stock of deposits and rates come from an econometric model applied to the last decade and therefore extrapolate a ‘reaction function’ on the part of the banks similar to that observed in the past. Such a hypothesis would be valid only in the event that rate normalisation occurs gradually (between two and four years) and with a well-defined finishing line (a ceiling on ECB rates of 1.5%). In the event of a swifter pace of rate increases, the likely eruption of a price war for stable funds –specifically, the more than 800 billion of term deposits– would translate into a much faster and more intense increase in the cost of term deposits and, by extension, average funding costs, with term deposits gaining considerable weight.

Therefore, even though monetary policy normalisation is unlikely in the short-term, such a scenario could result in widespread margin expansion. However, the improvement is likely to be highly sensitive to how the banks manage their customer funds.

Ángel Berges, Fernando Rojas and Federica Troiano. A.F.I. - Analistas Financieros Internacionales, S.A.