The CoCos (AT1)

market in Spain and Europe

Contingent convertible bonds, also known as CoCos, have grown in popularity following the introduction of the Single Resolution Mechanism since they qualify as additional tier-1 capital (AT1) for European banks. While these bonds provide higher yields than other investment grade paper, there are certain risks associated with them that warrant closer analysis.

Abstract: In the wake of the financial crisis, the Single Resolution Mechanism was introduced in order to avoid future cases of public bailouts of European financial institutions. This in turn has driven the development of new financing instruments. Of particular note is the growing popularity of contingent convertible bonds, known as CoCos for short. These bonds qualify as additional tier-1 capital (AT1) and pay their holders coupons. In the case of a so-called “trigger event”, the bonds are subsequently converted into shares. While CoCos offer investors higher yields than other investment grade paper in Europe, there are numerous risks associated with the bonds relating to: i) the potential for conversion into shares, ii) the possibility of not collecting on agreed-upon coupons in the event of regulatory capital shortfall; and, iii) whether or not a bank decides to exercise its call option. Looking forward, there is good reason to believe that, assuming capital buffers remain robust, the price for CoCos will be relatively unscathed by both geopolitical risks and low profitability in the banking sector.

Introduction

Thanks to the introduction of the Single Resolution Mechanism, there is now a hierarchy of capital instruments for loss absorption purposes (bail-in) designed to avoid future public bailouts of vulnerable financial institutions. Under the new regime, the first to absorb losses in the event of a bank resolution are the holders of the entity’s ordinary shares and reserves (common equity tier-1) or other instruments considered additional tier-1 capital (AT1). The latter category includes preferred shares and CoCo bonds that are the subject of this paper. There are also additional instruments that may be required to absorb losses, such as subordinated bonds (tier-2 capital) and senior unsecured bonds.

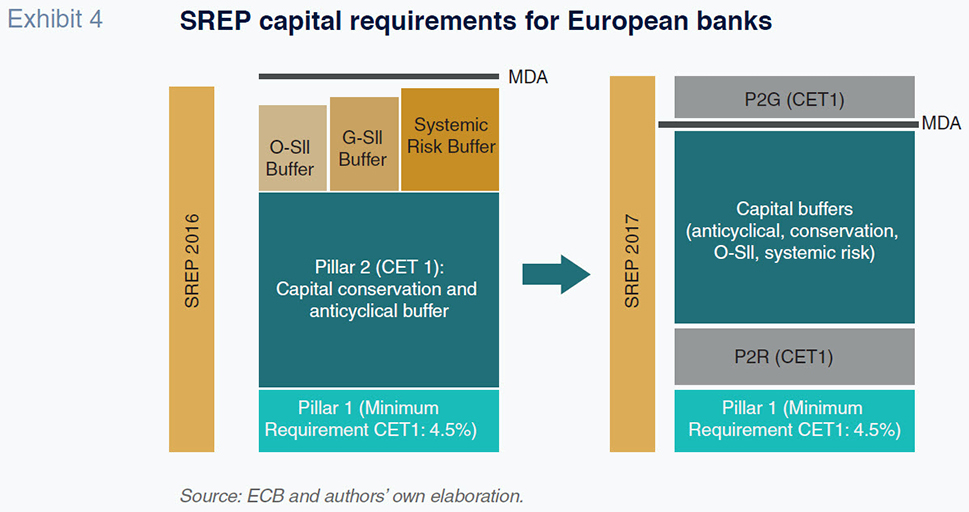

Regulators require banks to hold minimum levels of capital to cover unexpected losses that can arise from either a bank’s business model or global risks. These capital buffers define the minimum capital ratios, as will be discussed further in this paper (see Exhibit 4).

As a result of the increase in capital requirements, European banks have been forced to tap the capital markets. It is against this backdrop that CoCos have been growing in importance.

Key characteristics of CoCos

Convertible contingent bonds, or CoCos for short, have played a significant role in the recapitalisation of the banks in Spain and Europe in the wake of the financial crisis. The main characteristics of these instruments are: (i) they are perpetual instruments; and (ii) they may be converted into shares in the event of a defined contingency whereby the issuer’s common equity tier-1 (CET1) capital falls below a certain threshold resulting in the so-called “trigger” event.

It is therefore important to begin by categorising these instruments and describing how they function.

The banks began issuing CoCos back in 2013 following the publication of Regulation EU 575/2013 (the CRR) and the Bank Resolution and Recovery Directive (BRRD). These regulations were introduced with the aim of shoring up banks’ capital ratios. Given that CoCos qualify as AT1 capital for solvency purposes, banks began to rely on these instruments in order to meet their new capital requirements.

CoCos are hybrid instruments that combine elements of equity and fixed-income instruments. They are regular bonds that include the possibility of automatic conversion into equity in the event of a specific contingency. If such a situation arose, their holders would receive a specific number of shares (set out in the issue prospectus) in exchange for the face value of their bonds.

Under applicable regulations (Articles 52 - 55 of the CRR), for a contingent convertible bond to qualify as additional tier-1 capital for solvency purposes, it must meet the following characteristics:

- The instruments must be perpetual and fully paid up;

- The issuer may call, repurchase or redeem them after five years with the express authorisation of the supervisory authority;

- Coupon payments have to be suspended under certain circumstances, such as a shortfall of profits or reserves, at the behest of the supervisor if the latter deems that their payment could impair the entity’s solvency or for other reasons at the discretion of the issuer, insofar as stipulated in the prospectus. The suspension of coupon payments does not imply the accrual of amounts unpaid nor is it considered a default event;

- The bonds must include provisions specifying that if a trigger event occurs, the securities must be written down on a temporary or permanent basis or mandatorily converted into ordinary shares of the issuer (CET1). The terms of the issue must also establish the conversion rate, a limit on the amount of conversion and the range for conversion into equity should the trigger event occur.

Article 54 of the CRR refers to the conversion or write-down of AT1 instruments when the CET 1 ratio falls below certain pre-established thresholds, i.e., the contingency or the “trigger” event referred to previously. For the instrument to convert automatically into ordinary shares, the issuer’s CET1 capital must fall to the specified trigger level, which is 5.125% of the entity’s risk-weighted assets for minimum regulatory capital purposes. However, that 5.125% is simply the minimum prescribed in prevailing capital regulations and the issuers and supervisor are free to set a higher trigger level.

Trends in the CoCo market

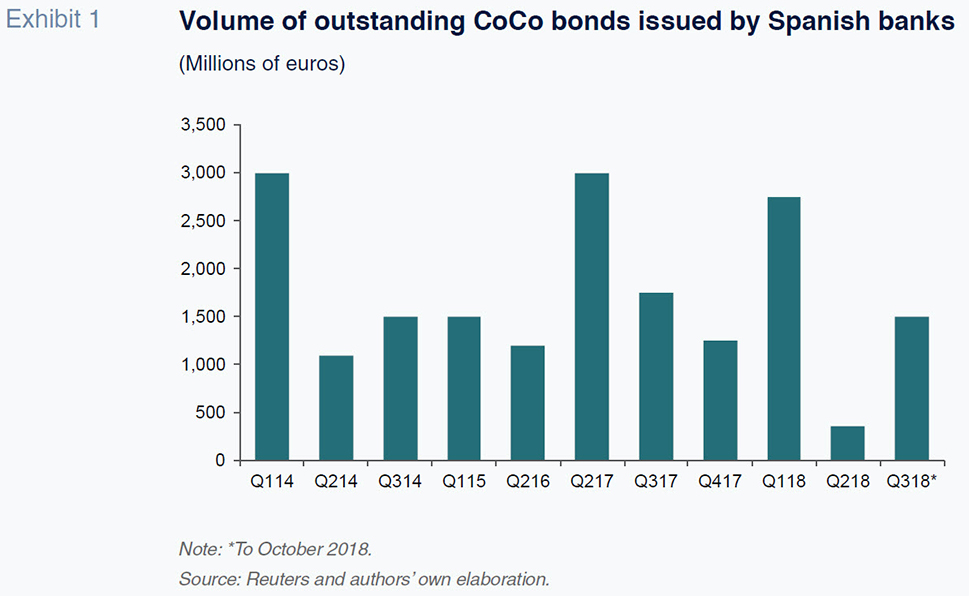

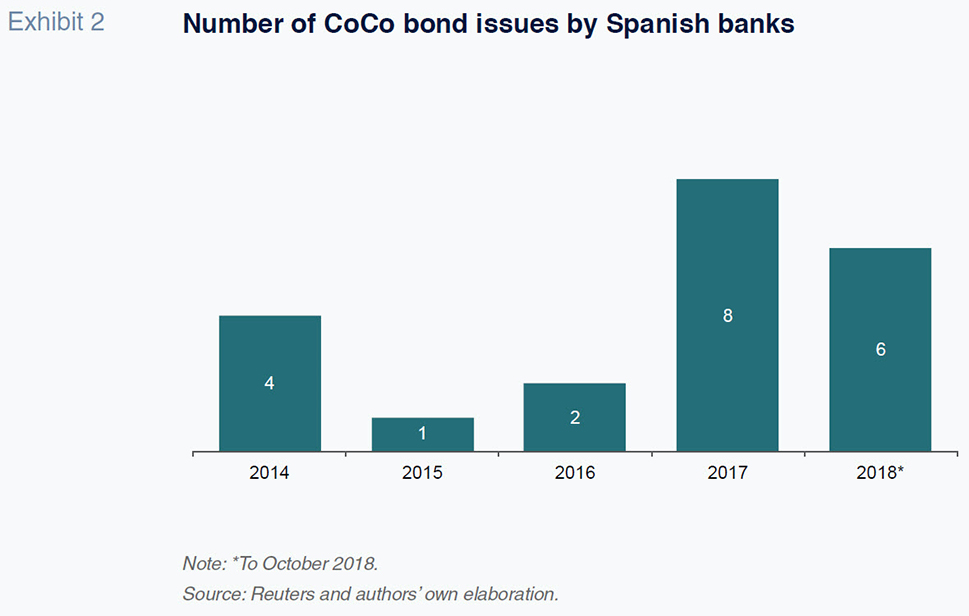

Banks in both Spain and across Europe are increasingly issuing CoCos. As shown in Exhibit 1, the volume of outstanding CoCo bonds issued by Spanish banks stands at just over 18.8 billion euros (21 issues), which translates into an average issue size of approximately 1 billion euros.

It is worth noting that the Spanish banks became most active in this segment from the second quarter of 2017, mainly as a result of the new MREL requirements and the improvement in financial conditions.

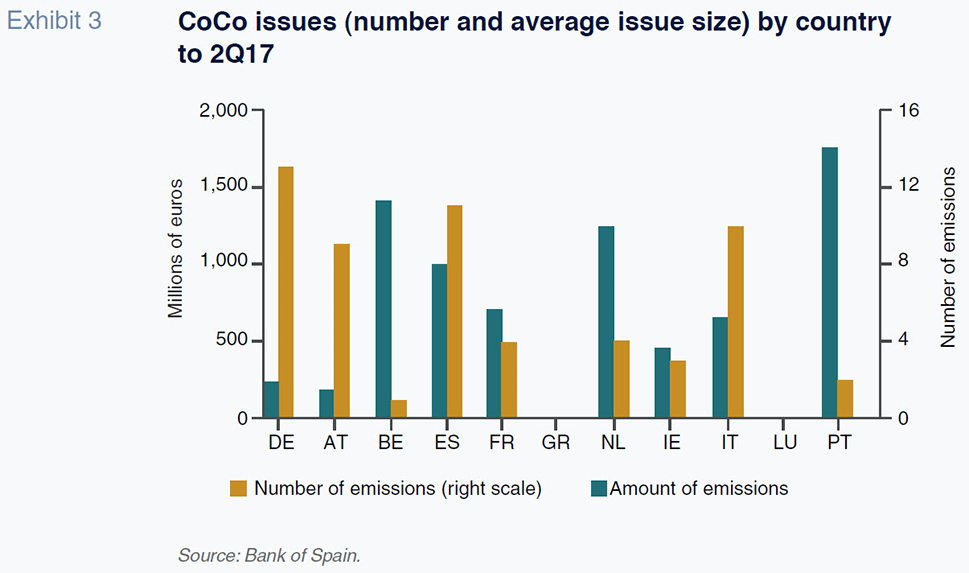

As for the CoCos issued in the rest of Europe, we note that the Spanish banks, together with their German counterparts, have been the most active issuers. By mid-2017, there had been 13 issues by German banks and 11 by Spanish banks. However, the average size of the Spanish banks’ issues is much bigger than that of the German banks, which amounts to 250 million euros.

Risks for CoCo investors

Coco bonds’ biggest draw is their high yields, especially given the protracted ultra-low fixed-income yields for investment grade paper in Europe. While the higher yield offers greater protection against future rate hikes, CoCos contain risks that warrant thorough analysis.

As already noted, the main risk associated with CoCos is the conversion of the bonds into shares in the event that the issuer’s CET 1 ratio falls below a certain level. Logically, if such a trigger event occurs, a bank’s shares will be worth so little that the CoCo investor would be forced to absorb substantial losses. It is therefore important when investing in CoCos that the issuer bank has enough of a buffer relative to the trigger so that the probability of conversion into shares is as low as possible.

An analysis of some of the main CoCo issuers in the eurozone indicates that, in general, the banks’ capital buffers are fairly high, thereby reducing the probability of conversion into shares.

Another risk worth flagging is the possibility of not collecting the agreed-upon coupon in the event of a shortfall in regulatory capital. Following the division of the Pillar 2

[1] requirements by the supervisor for 2017 purposes, the maximum distributable amount (MDA) fell. The risk implicit in holding CoCos is a decline in capital below the required minimum, which would then trigger a suspension in coupon payments. As a result of the reduction in the MDA, the probability of not collecting the coupon also declined.

That said, the banks we analysed have significant capital buffers relative to that required by the supervisor, such that the probability of breaching the MDA threshold is small.

The third risk is a feature common amongst most CoCos. Specifically, from year five after the issue, the issuer is usually entitled to call the bonds. This eventuality is not a major risk in itself because if the option is exercised, the investors will recover the face value of the CoCo (or close thereto). Alternatively, if it is not exercised, the CoCo will continue to pay attractive coupons, assuming the entity does not hit the MDA trigger.

The main reason an issuer is likely to prepay an issue of this nature is to try to refinance and tap more attractive financing terms than those that existed in the market at the time of the original issue.

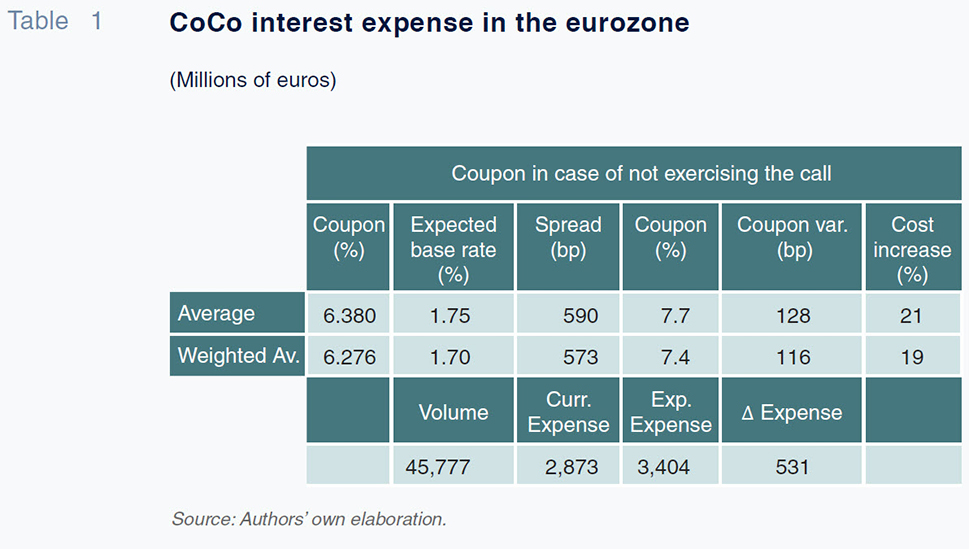

For example, the CoCos issued between 2013 and 2014, when interest rates were still relatively high compared to current rates, are likely to be prepaid in 2018-2019, to the extent they feature this option. In the event that eurozone issuers opt not to exercise their call options, they will face spreads in the coupons payable of around 600 basis points on average. This is therefore a clear incentive to prepay the “old” issues.

The average coupon on these issues was over 6%. If banks do not exercise their call options, the coupons payable would average 7.5%-8%. Despite the recent spike in spreads on these types of issues, they remain at acceptable levels and, notwithstanding our belief that those spreads and benchmark interest rates (IRSs in general) are likely to continue to rise in the coming years, the “financial” incentive to prepay is clear-cut.

Indeed, not doing so would imply an increase of over 115 basis points over current coupons, tantamount to a 20% increase in costs compared to current coupons. This would translate into an increase in related annual interest expense equivalent to over 530 million euros in the European banking sector as a whole.

This analysis reinforces the idea that in the current market conditions, it would be worthwhile for most issuers to exercise the looming call options.

The risk for investors lies in the potential that the price of the CoCo could decline. The market, in relation to a specific CoCo, prices in prepayment as the call exercise date approaches, but the issuer can decide not to exercise this option. This could lead to a negative market interpretation, thereby driving down the price of the CoCo.

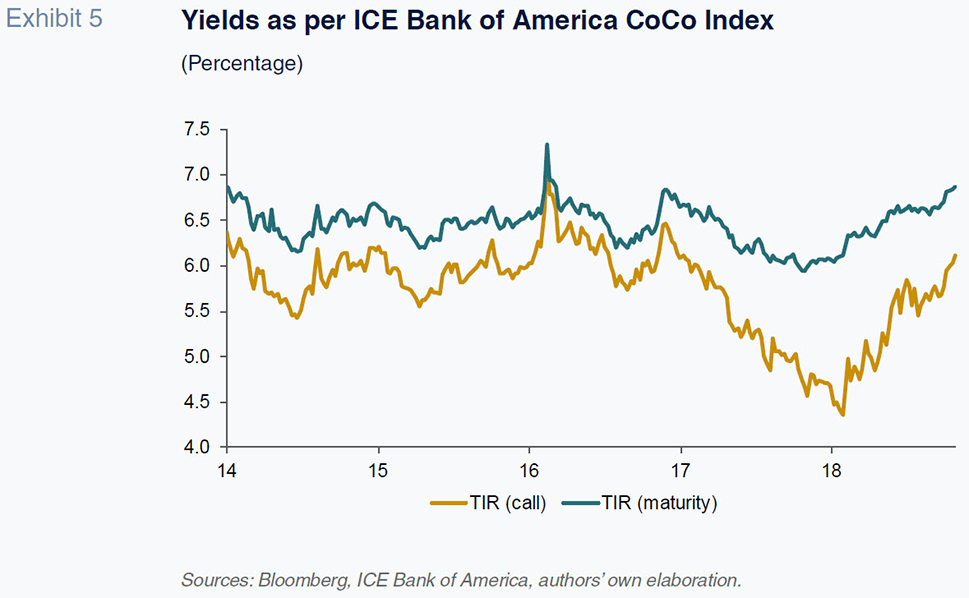

It is worth noting that the CoCos are perpetual instruments and their prepayment options mean there are different ways of determining the yield on these bonds. Specifically, the yield can be calculated to the next call date or it can be calculated as a yield to maturity (perpetuity). At present, using the ICE Bank of America CoCo Index as our benchmark, the yield to the average call date (YTC) is 6.1%, whereas the yield to maturity (YTM) is 6.9%.

If the bonds were not prepaid on their call dates, it is likely that the market would price in the possibility of widespread non-prepayment. This would probably result in the convergence of the YTC towards the YTM. Although issue-by-issue analysis is necessary, if yields were to increase in this manner, there would be a general adverse impact on CoCo prices.

Outlook for CoCo prices

The key variable to monitor in terms of the likely trend in CoCo prices is the solvency of the financial institutions. This is evident in the trend in CoCo prices in 2018 relative to equities. Whereas the European banks have seen their share prices (total return) correct by around 25% this year, CoCos have sustained much narrower price losses of approximately 5%. On the equity side, the financial sector is being adversely affected by several factors: (i) the banks’ ROEs remain low; (ii) interest rates have yet to rebound and the rate curve remains flat; and, (iii) the decline in Italian bond prices as a result of uncertainty over banks’ exposure to Italian sovereign debt.

In general, the market is taking into consideration both the prospect that banks’ profitability will remain low in the coming years (if the current interest rate environment persists) and ongoing geopolitical risks. However, CoCos, insofar as capital buffers remain high, have been relatively unscathed by the present environment.

Going forward, it will be important that banks keep those buffers at least as high as current levels. Several factors should serve as tailwinds: (i) there are regulatory incentives to keep capital levels high (completion of Basel III; creation of bank resolution mechanisms; TLAC/MREL); and, (ii) the ongoing and significant decline in non-performing assets. As a result, impairment provisions should also trend lower so that the banks’ income statements will not be affected by additional provisions.

Notes

In 2017, Pillar 2 capital was divided into the Pillar 2 Requirements (P2R), which are mandatory, and Pillar 2 Guidance (P2G), which is not mandatory but must be justified in the case of non-compliance.

Salvador Jiménez, Diego Mendoza, Alfonso Pelayo and Fernando Rojas. A.F.I. - Analistas Financieros Internacionales, S.A.