The 2018 EU stress tests: A behind-the-scenes analysis

In November, the EBA published the results of its EU-wide annual stress tests, which showed that broadly speaking, the European banking sector is becoming more resilient to potential adverse scenarios. That said, persistent worries over Italy’s commitment to fiscal discipline and a weakened UK banking system are reasons for concern.

Abstract: In early November, the European Banking Authority (EBA) announced the results of its stress tests of the European banking sector. This announcement has coincided with a period of uncertainty in both the global and European securities markets. Looking more closely at the stress tests, it becomes apparent that most of the European banks, including those in Spain, are better capitalised to withstand potentially adverse macroeconomic scenarios. Specifically, of the 33 entities directly supervised by the ECB, an adverse scenario would result in a decrease in the fully-loaded CET1 ratio from 13.7% in 2017 to 9.9% by 2020, which is an improvement from the equivalent adverse scenario ratio of 8.8% in 2016. In the case of Spain, the percentage impact on fully-loaded CET1 estimated in the adverse scenario is below the European average. That said, both Italy and the UK were notable exceptions, suggesting that these banking systems may encounter difficulties in overcoming adverse economic conditions.

Introduction

Fall 2018 has continued to produce considerable challenges for Europe’s banks, with political and sovereign risk a key source of instability. Tensions between the Italian administration and the EU’s governing bodies have led the European Commission to reject a member state’s budget for the first time in history. In response, the markets have interpreted the lack of commitment to fiscal discipline as a growing sovereign risk. These developments have resulted in contagion to the banking sector via the Italian banks’ public debt holdings and have raised questions –as yet unresolved– regarding the quality of their assets and the implications for their solvency.

Observers had hoped that the publication of the European Banking Authority’s (EBA) stress tests on November 2nd would heighten transparency and provide the market with hard data that confirmed, a decade after the collapse of Lehman Brothers, that financial stability in Europe had finally been achieved. This expectation was only partially met, however. Although most of Europe’s regional banking sectors demonstrated they could withstand the adverse economic scenarios modelled for the tests, the ability of certain banks in certain countries to remain solvent in those scenarios was called into question. The Italian predicament was largely to be expected; less so the case of the UK, which comes at a particularly delicate moment with Brexit in the near-term horizon.

This paper analyses the results of the stress tests with the aim of identifying where the potential risks lie and pinpointing the key cross country differences. This “behind the scenes” analysis will go beyond the headlines to discover why doubts, expressed in market valuation, about Europe’s banks continue to persist.

The stress tests were performed on 48 EU banks that were deemed systemic. Those banks represent approximately 70% of the EU banking sector’s total assets. Of the 48 entities, 33 fall under to the Single Supervisory Mechanism (SSM). The purpose of the stress tests is to evaluate the resilience of the major European banks in the case of a hypothetical deterioration in macroeconomic and market conditions. As was the case with the 2016 tests, the exercise did not set a minimum capital threshold that could be interpreted as a “pass” or “fail” (which would certainly be useful, albeit controversial timewise). This impedes the ability of analysts to definitively interpret a decline in a bank’s capital levels as cause for concern.

While the EBA designs the stress test methodology, it is up to the ECB and national central banks to run the tests and oversee their quality. The projections are drawn up for each entity over a three-year period (from December 2017 to December 2020) under two scenarios: a baseline scenario and an adverse scenario, whose criteria were determined by the European Systemic Risk Board (ESRB), the ECB, the national central banks and the EBA itself. It is worth highlighting two key features of the tests that either limit their comparability or introduce aspects not previously contemplated:

- The baseline and adverse scenarios are country specific.

- For these stress tests, the asset projections apply International Financial Reporting Standard (IFRS) 9, which took effect on January 1st, 2018. IFRS 9 is a far-reaching accounting measurement standard with particular importance with respect to the credit risk assumptions. Specifically, IFRS 9 aims to reduce uncertainty regarding the provisions recognised by the banks to cover loan losses. The most importance aspect is the replacement of the former incurred-loss approach (under which the banks recognised provisions when the losses were already being incurred) with the expected-loss model (provisions are recognised from when it is estimated that a loss may be incurred). Although this is a technical matter, analysis of which lies beyond the scope of this paper, it is worth noting that in the case of the Spanish banks, application of IFRS 9 has not had a significant impact on asset valuations, relative to other banking systems, such as in the UK, where it has had the effect of increasing impairment provisions.

Stress tests methodology

As noted above, there are substantial differences in the macroeconomic scenarios modelled for each country. For example, in Sweden, the adverse scenario implies a cumulative (over the three-year projection period) contraction in GDP of 10.4% and in real estate prices of 49.4%. In Hungary, however, the same scenario contemplates a cumulative contraction in GDP of just 0.2%, while real estate prices remain stable.

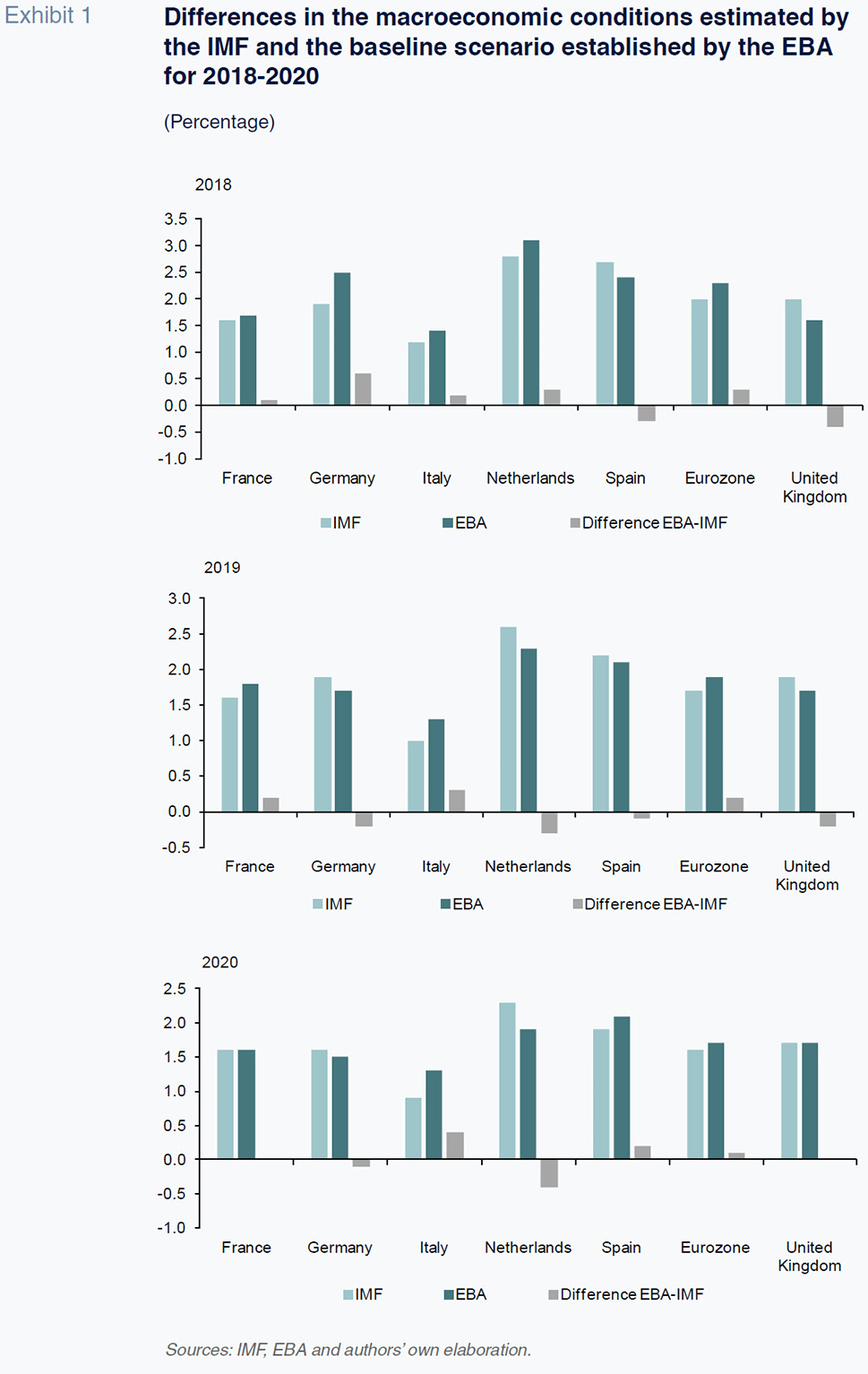

What is clear is that the entities tasked with designing the benchmark macroeconomic projections have given greater weight to short- and long-term risks in some countries than other international economic forecasters such as the IMF. As shown in Exhibit 1, the baseline scenario already reveals these estimate differences. The EBA, for example, projects growth that is 0.3, 0.2 and 0.1 percentage points above the growth estimated by the IMF for the eurozone in 2018, 2019 and 2020, respectively. However, the change in GDP modelled by the EBA is lower than that assumed by the IMF in Spain and the UK in 2018 and 2019. It is also lower in Germany and the Netherlands in 2019 and 2020.

The analyst community is also prone to comparing the macroeconomic assumptions made with those modelled in the stress tests in other jurisdictions. For example, the adverse scenario used in most instances is less severe than that modelled by the Federal Reserve in the US. The UK case merits special attention because its central bank assumes a higher cumulative GDP contraction. Interestingly, this heightens expectation regarding what the specific tests performed by that supervisory authority will reveal in December.

Of note is the fact that the stress tests do not explicitly set out minimum capital requirements. The market’s general understanding is that the minimum capital requirement is 8% in the case of core equity tier-1 (CET1) capital, modelled on a fully-loaded basis, i.e., factoring in all the capital provisions already in force and those due to take effect shortly. That 8% threshold is derived from the assumed threshold below which a given supervisory authority can be expected to intervene, particularly in the case of the entities in the SSM.

It should be emphasised that these stress tests have been run under the scope of the new Banking Union capitalisation rules. As a result, the market believes that some of the entities presenting a capital shortfall in the adverse scenario could embark on “precautionary recapitalisation”. In the case of the SSM, these intervention measures could involve imposing losses on holders of hybrid capital instruments (e.g., convertible shares or CoCos) or limits on the distribution of dividends, for example.

Spanish and EU banks’ overall stress tests performance

Looking at the results of the 2018 stress tests, it is important to highlight that the starting capital level (

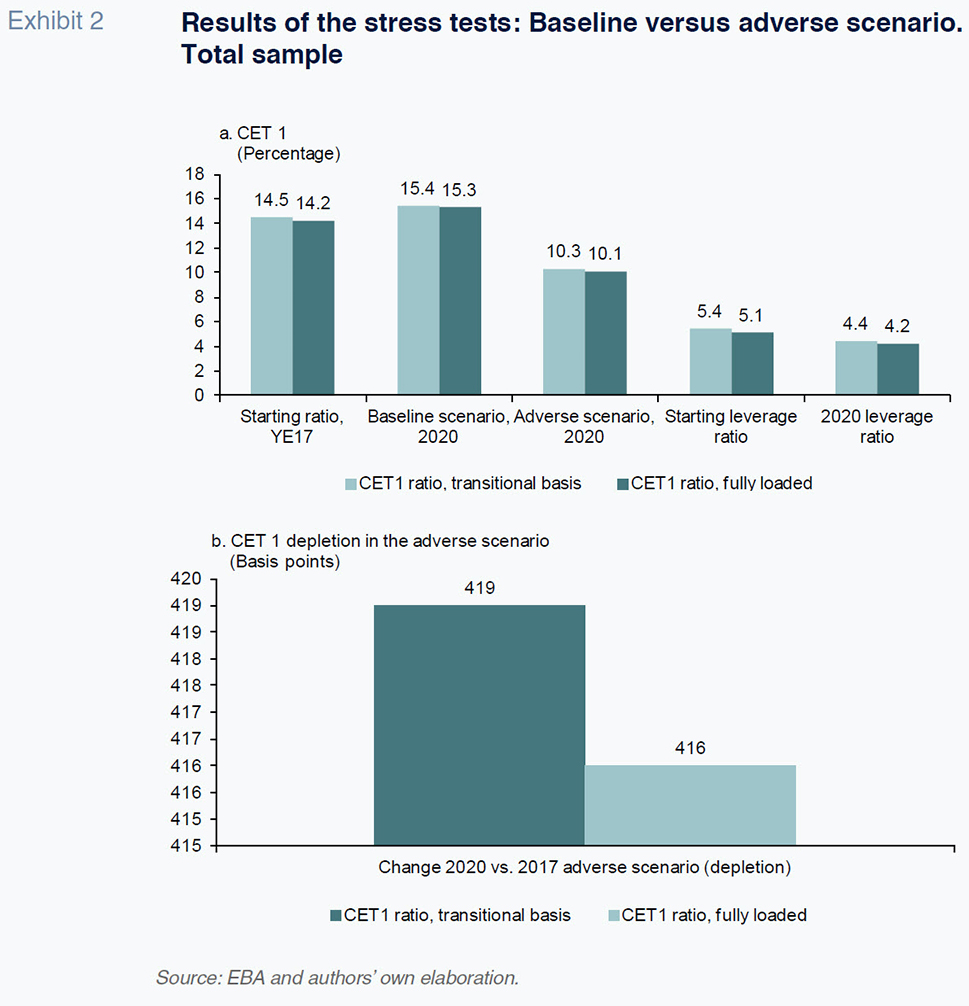

i.e., solvency as per the financial statements as at year-end 2017) is higher than that observed in previous tests. This suggests that the broader trend remains one of capital build-up, with capital buffers increasing relative to the minimum requirements. A different matter is whether the ability to withstand adverse scenarios has improved, and to what extent those scenarios are plausible. As shown in Exhibit 2, the fully-loaded CET1 capital ratio for the 48 entities as a whole stood at 14.2% at year-end 2017 (14.5% factoring in only the transitional arrangements currently in effect). It is important to note that that ratio falls to 14% if modelled

pro forma with the application of IFRS 9 in 2017. If the macroeconomic climate were to unfold as currently forecast (the baseline scenario), the banks’ CET1 ratios would increase to 15.4% (transitional) or 15.3% (fully loaded) in 2020. However, when the adverse economic scenario is modelled, 2020 capital ratios decline by 416 basis points (4.16 percentage points) with respect to year-end 2017 levels. Additionally, the EBA projects that the banks analysed would sustain leverage ratio depletion over the projection period, reducing the ratio from 5.1% to 4.2% on average, assuming full implementation of the planned regulatory requirements (fully loaded).

In the press releases of November 2nd, the EBA flagged certain statistics which suggest that the Single Supervision Mechanism is fostering an improvement in the resilience of eurozone banks. In the case of the 33 entities supervised directly by the ECB, the fully-loaded CET1 ratio would decrease from 13.7% in 2017 to 9.9% by 2020 in the worst-case scenario, i.e., a drop of over 380 basis points. In 2016, the equivalent adverse scenario ratio was 8.8%. “The outcome confirms that participating banks are more resilient to macroeconomic shocks than two years ago. Thanks also to our supervision, banks have built up considerably more capital, while also reducing non-performing loans, and among other things, improving their internal controls and risk governance,” said Danièle Nouy, Chair of the ECB’s Supervisory Board. “Looking ahead, the test helps us to see where individual banks are most vulnerable and where clusters of banks are most sensitive to certain risks.”

It should be stressed that the capital depletion over the three-year stress period in the adverse scenario was 3.3 percentage points in 2016 compared to 3.8 percentage points in the November 2018 exercise. However, the banks’ stronger capital buffers at the time of these stress test improved the resilience of the system as a whole, while the assumptions underpinning the adverse scenario were more severe than in 2016. The assumptions included a contraction in eurozone GDP of 2.4% and corrections in real estate and share prices of 17% and 31%, respectively. As mentioned earlier, application of IFRS 9 also impacts the relatively higher depletion of capital.

The EBA press releases also highlight the growing importance of the transparency exercises conducted in each country by the competent supervisory authorities. These exercises, known as the Supervisory Review and Evaluation Process (SREP), are used to determine the banks’ Basel III Pillar 2 requirements and are conducted annually. Even though the ECB coordinates these tests, there is widespread concern that these transparency exercises have been more stringent in some jurisdictions than others. This was the case in the Spanish banking sector in the years immediately following the crisis as well as in the most current exercises.

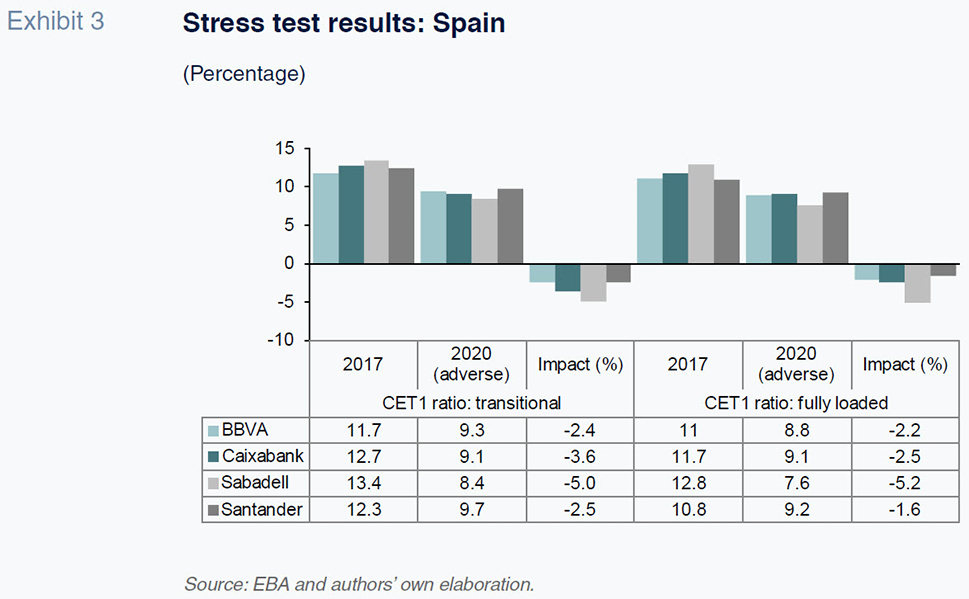

The results of the 2018 stress tests for the Spanish banks –BBVA, Caixabank, Sabadell and Santander– have reinforced their perceived solvency and resilience. The percentage impact on fully-loaded CET1 estimated in the adverse scenario is below the European average. The one notable exception is Banco Sabadell, where capital depletion is estimated at 5.2 percentage points, in line with the European average.

[1]

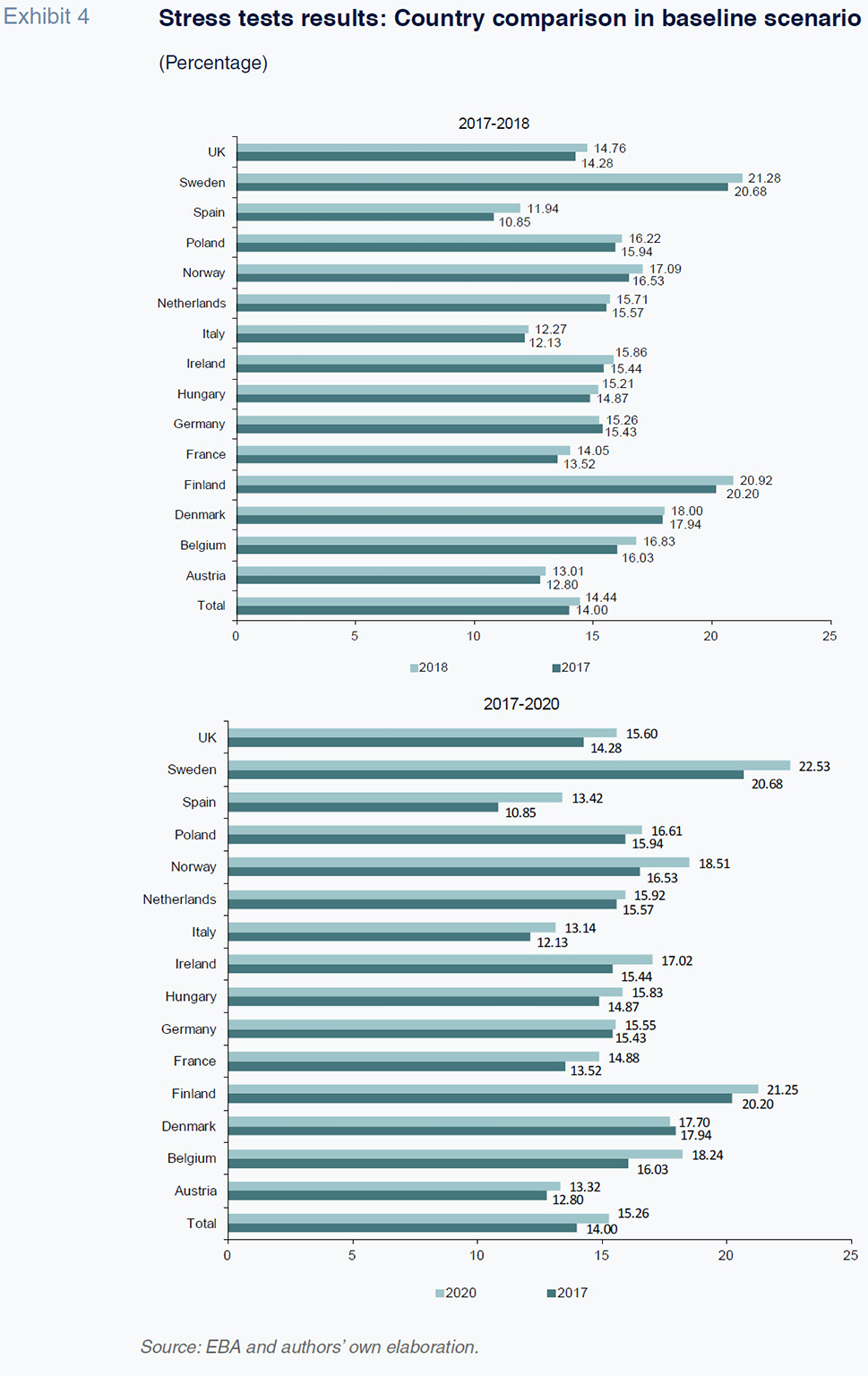

A comparison of the baseline scenario results of the Spanish banks and their European counterparts (Exhibit 4) suggests that even though the Spanish banks start the test period with a relatively lower capital buffer, their convergence with the average European fully loaded CET1 ratio would accelerate.

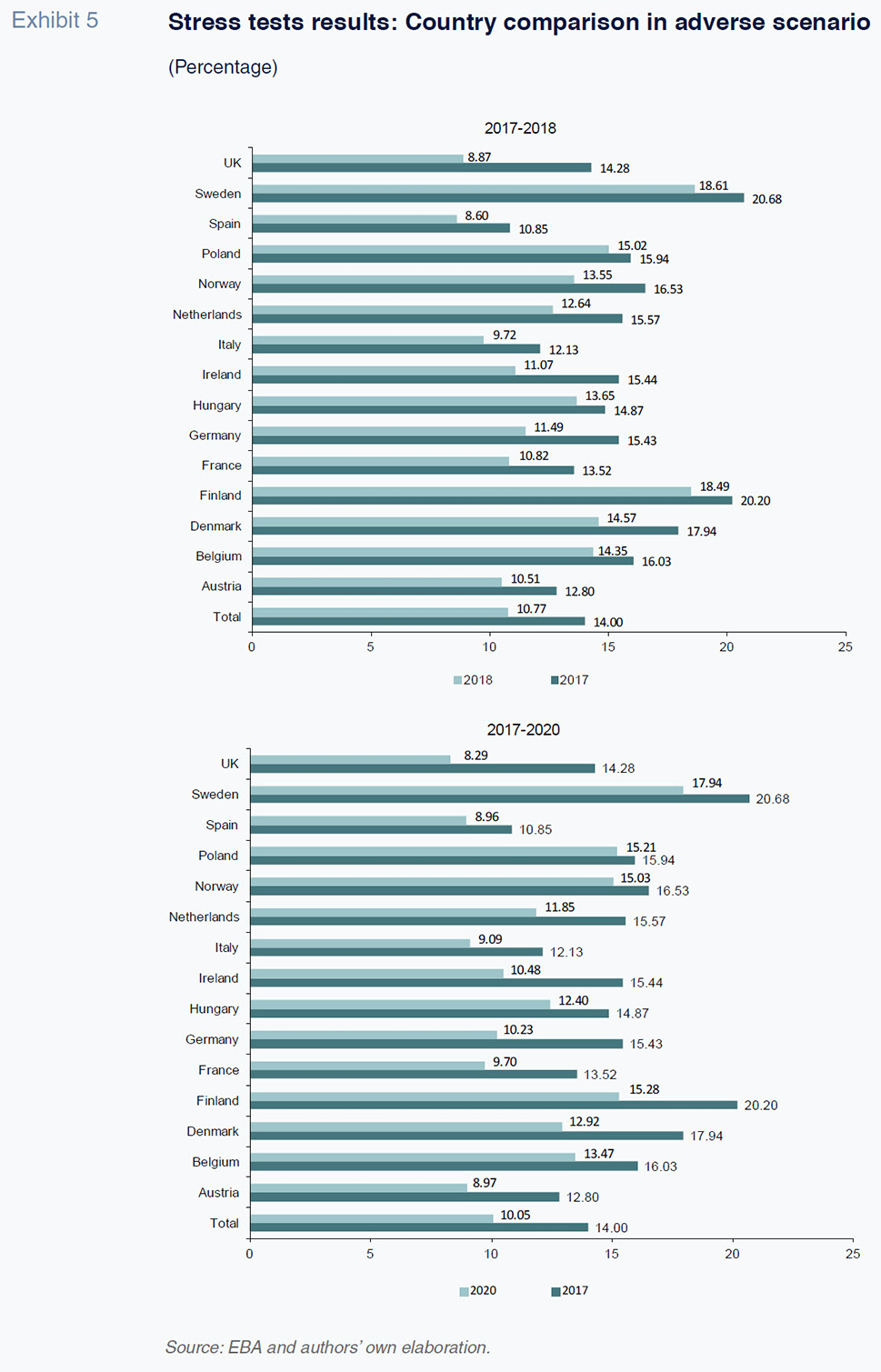

As for the adverse scenario (Exhibit 5), the Spanish banks stand out for their resilience and improved asset quality. Despite starting with a lower fully-loaded CET1 ratio, their asset quality would stand at 8.96% in the worst case scenario, which is above the regulatory threshold and above the average for other countries, such as the UK (8.29%).

The cases of Italy and the United Kingdom

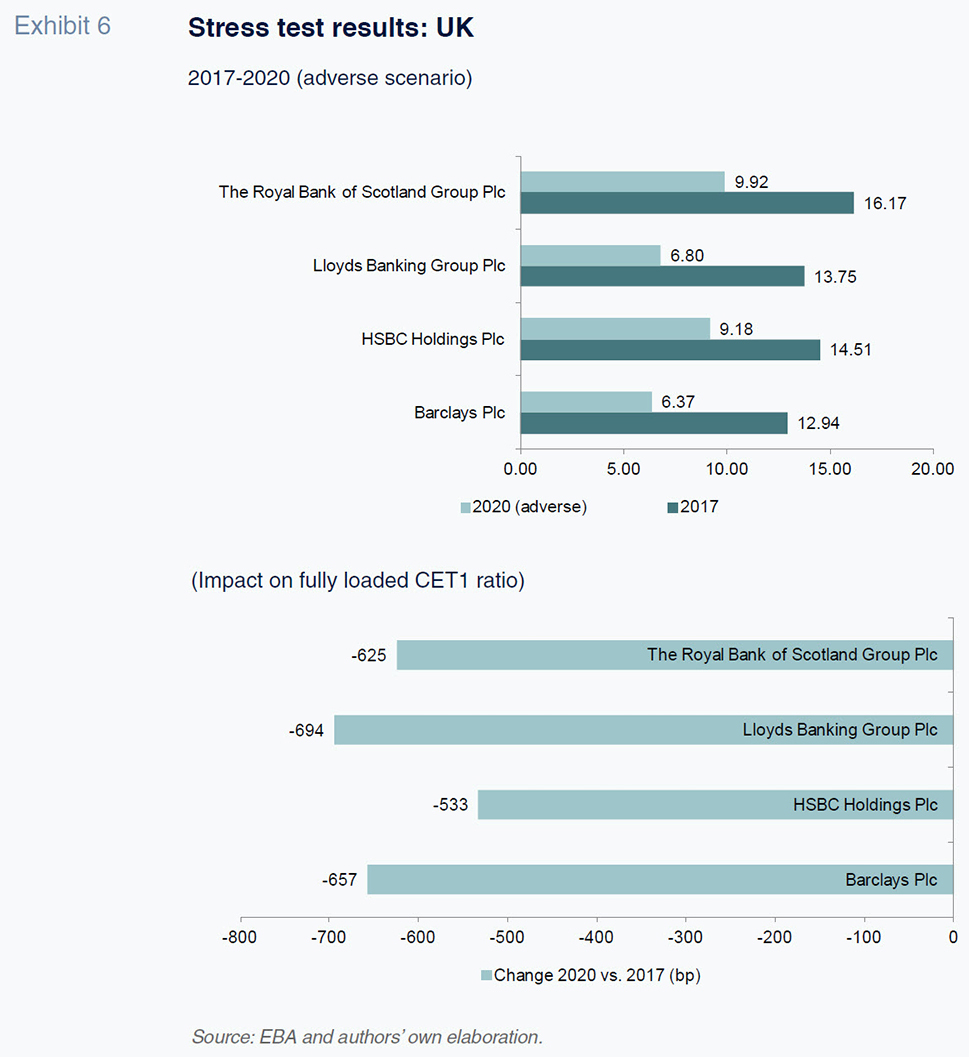

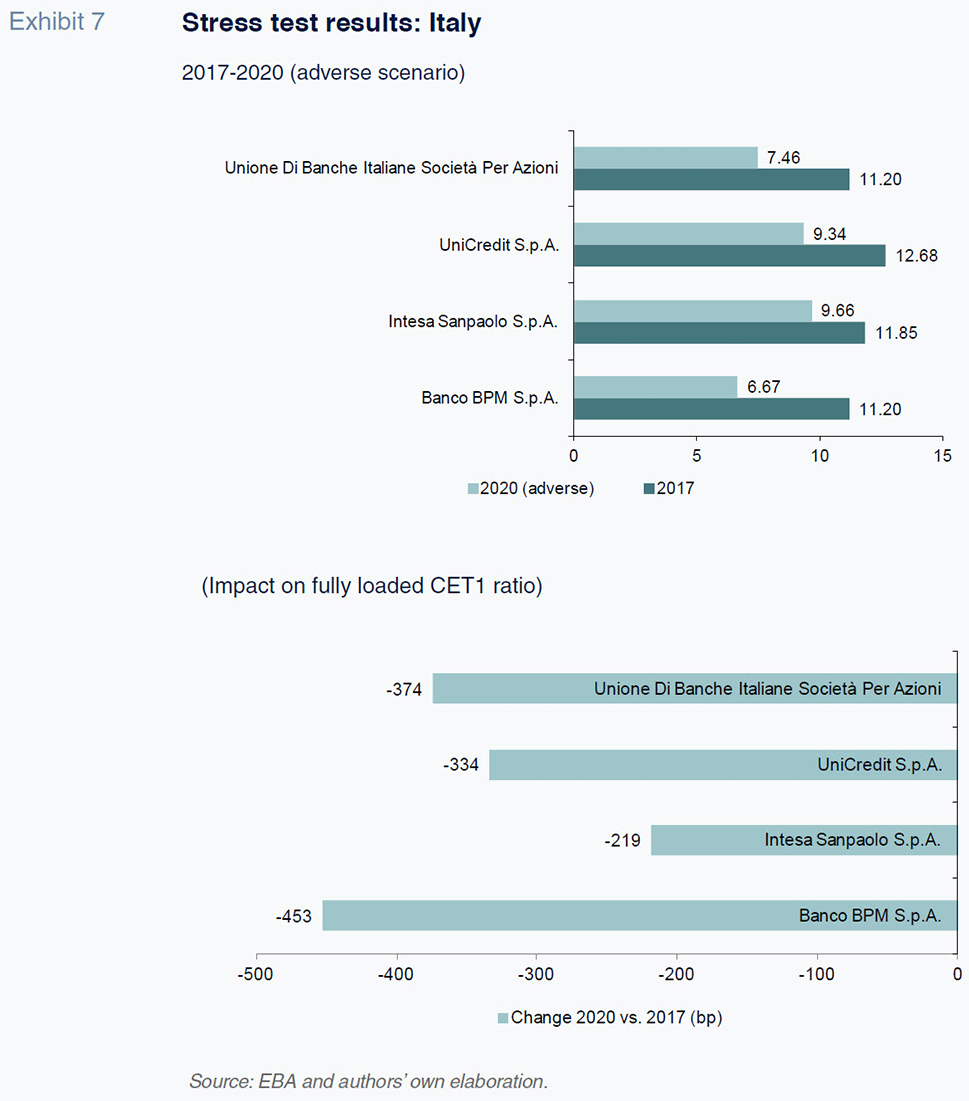

Perhaps the most noteworthy results of the stress test were the outcomes for the UK and Italy. In the case of the former, capital depletion was more than expected in the adverse scenario. As for Italy, the results do little to quell concerns about the quality of the banks’ legacy assets.

As shown in Exhibit 6, three UK banks would sustain cumulative fully-loaded CET1 capital depletion of 625, 694 and 657 basis points. This would leave two of them with ratios of 6.80% and 6.37% in 2020 under the adverse scenario, well below the 8% threshold. Of note is the fact that the adverse scenario depicted by the Bank of England in its December stress tests is expected to be even more severe, so that the impact on capital depletion could be considerably higher.

In Italy, the severity of the adverse scenario’s impact does not dramatically diverge from the eurozone average. Nevertheless, the weak starting position of some of the banks would put them below the 8% threshold by the end of the stress period. However, the biggest source of concern in this market is probably the impact on the Italian sovereign risk premium, and, by extension, the quality of the banks’ assets and their funding costs. This is due to the current conflict between the Italian administration and the European Commission over budget and fiscal discipline.

Conclusions

The results of the European bank stress tests have come at a time of market tension due to the uncertain outlook for the global economy and the eurozone, as well as specific issues in Italy. One of the consistent aims of the stress tests has been to tackle the negative feedback loop between sovereign risk and bank risk that took such a large toll six years ago. In Italy, the banking crisis is considered unresolved and is vulnerable to a persistent interconnection between public and bank debt. The results of the stress tests do little to allay these concerns.

As for the European banking system as a whole, the tests cannot be considered a definitive and unequivocal statement about its current state and the outlook for European banks. They do, however, reveal a general improvement in the resilience of the EU banking system, with the exceptions of the UK and Italy.

In Spain, the starting capital levels, while ample, are somewhat lower than those in other systems. However, the test results indicate that the Spanish banks are more resilient to adverse scenarios and capable of converging towards the European average.

Notes

It should be noted that Banco Sabadell, according to a notice filed with the Spanish securities markets regulator on November 3rd notes that the EBA charged the non-recurring costs associated with keeping subsidiary TSB’s platform plugged into that of Lloyds against its earnings for 2017, when that invoice has been settled, having only impacted the period between January 2017 and April 2018. It claims that the EBA “kept that sum constant for the three-year period,” as opposed to the four months for which the bank actually had to pay that fee. It also clarifies that the EBA counted the costs associated with Sabadell United Bank for the three-year stress period even though that subsidiary was sold in July 2017 and neither its earnings nor its assets are recognised in its financial statements.

Santiago Carbó. CUNEF, Bangor University and Funcas

Francisco Rodríguez Fernández. University of Granada and Funcas