Spanish economic forecasts panel: November 2018*

Funcas Economic Trends and Statistics Department

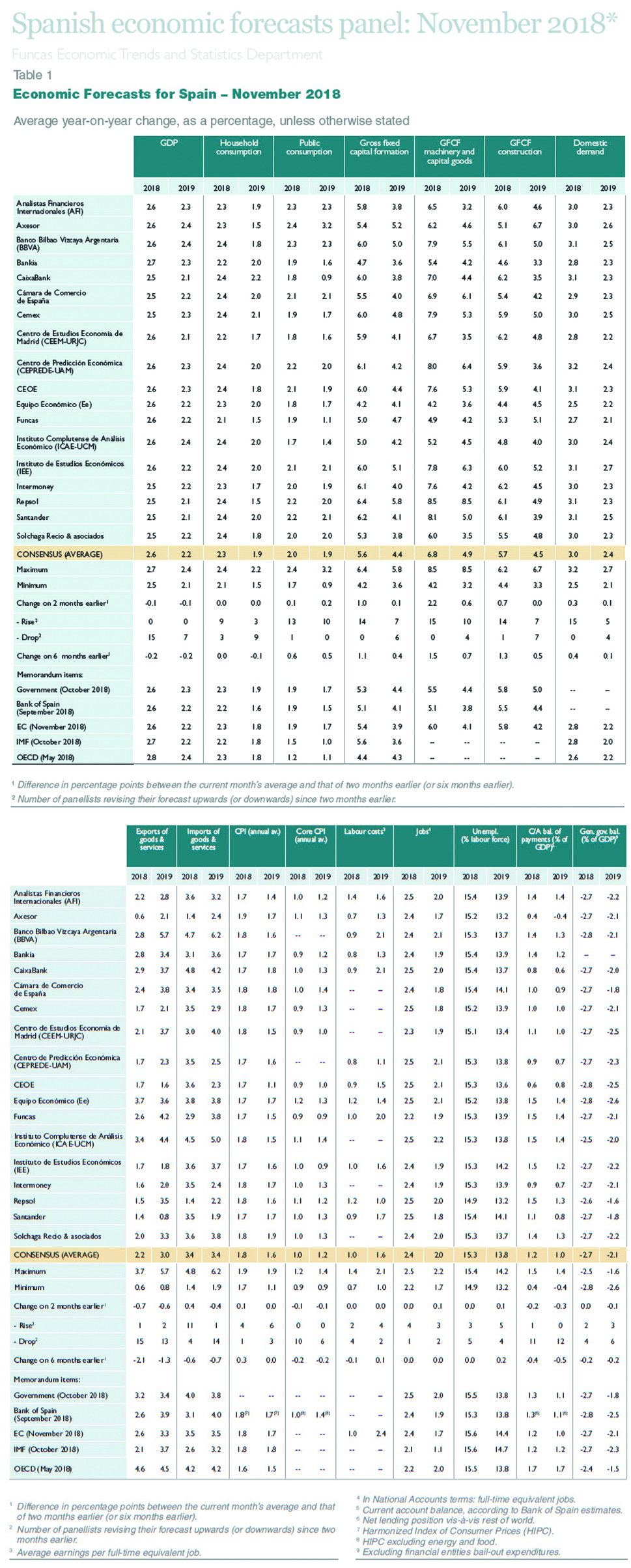

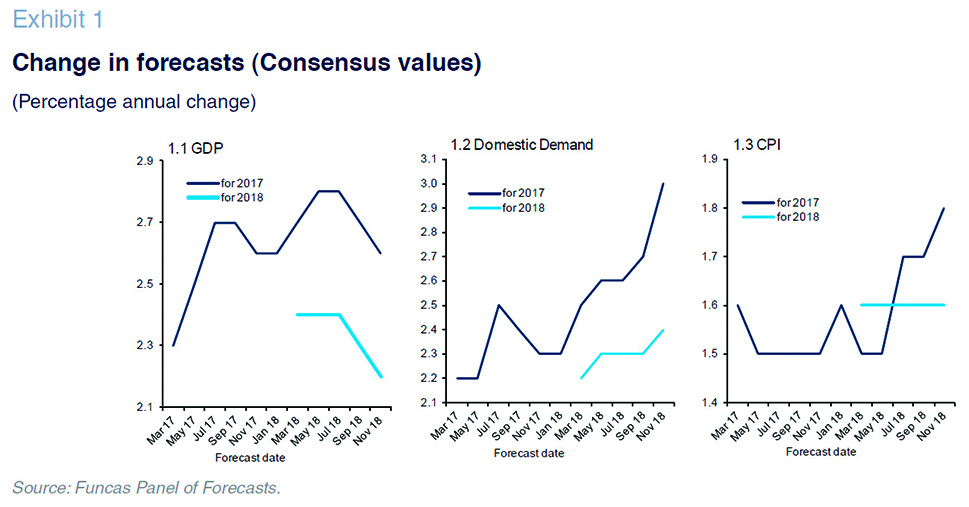

GDP growth is expected to reach 2.6% in 2018, 0.1pp down from the last survey

Spanish GDP registered growth of 0.6% in the third quarter, in line with analysts’ consensus forecast. The strength of domestic demand –public and private consumption and investment alike– took the analyst community by surprise. In contrast, trade detracted from third-quarter growth.

For 2018 on the whole, the current consensus forecast is for growth of 2.6%, down 0.1pp from the last survey. The forecast for fourth-quarter growth is unchanged at 0.6% (the lower estimate is the result of the downward revision to the first-quarter figure). Notably, 15 of the 18 analysts surveyed have lowered their estimates since September.

They have also modified the expected sources of this growth. Foreign trade is now expected to detract from growth (by -0.3pp, compared to a previous estimated positive contribution of 0.1pp), while domestic demand is expected to contribute 3.0pp (up 0.3pp). Consumer spending is expected to register growth of 2.3%, unchanged from the last survey. The forecast for public consumption has been increased by 0.1pp, with 13 of the analysts raising their estimates for this metric. The majority of analysts have also raised their forecasts for investment in capital goods. However, the most eye-catching change is the downward revision to forecast export growth, which has been cut by 0.7pp to 2.2%, while forecasted import growth has been raised by 0.4pp to 3.4%.

The forecast for 2019 GDP growth has also been cut by 0.1pp, to 2.2%

The consensus forecast for GDP growth in 2019 has been trimmed 0.1pp to 2.2%. Foreign demand is expected to detract slightly from growth (-0.1pp) as a result of the greater downward revision to export growth relative to that of import growth estimated by most of the analysts.As for the components of domestic demand, the forecasts for investment in capital goods and public consumption have been increased. The quarterly forecasts point to stable growth of around 0.5% throughout the year (Table 2).

The inflation forecast for 2018 has been increased to 1.8% and left unchanged for 2019 at 1.6%

The rate of inflation rose to 2.3% in September and October due to higher energy prices; core inflation, however, continued to hover at around 0.9%.

The forecast for average headline inflation in 2018 stands at 1.8%, up 0.1pp from the September forecast, with inflation expected to ease in 2019 to 1.6%. Core inflation is forecast at 1% in 2018 and 1.2% in 2019, down 0.1pp in both years from the last set for forecasts. The year-on-year rates of change in December of this year and next are currently forecast at 1.9% and 1.4%, respectively (Table 3).

Despite a slowdown in employment growth, the unemployment rate is declining

According to the economically-active survey (EPA), the rate of growth in employment slowed in the third quarter. Nevertheless, unemployment fell to 14.6%, which is down nearly two percentage points year-on-year. Elsewhere, growth in social security contributor numbers remained strong in October, facilitating a sharp drop in unemployment.

The consensus forecast for growth in employment is unchanged at 2.4% for 2018, but the forecast for 2019 has been increased by 0.1pp to 2%. Using the forecasts for growth in GDP, job creation and wage remuneration yields implied forecasts for growth in labour productivity and unit labour costs (ULCs). Specifically, the former is expected to register growth of 0.2% in both 2018 and 2019 (slightly less than in the previous set of forecasts), while ULCs are expected to increase by 0.8% in 2018 and by 1.4% in 2019.

Lastly, the rate of unemployment is expected to fall to 15.3% in 2018 and to 13.8% in 2019 (the latter is 0.1pp higher than in the last survey).

External surplus continues, albeit waning

The trade surplus is waning due to the decreasing contribution by exports coupled with the rising cost of energy imports. As a result, to August, Spain presented a current account surplus of 3.8 million euros, below the 10.6 billion euro surplus recorded in the first eight months of 2017, driven by the deterioration in the trade balance and a slight increase in the income deficit.

The consensus forecasts currently point to a current account surplus equivalent to 1.2% of GDP in 2018 and 1% in 2019, 0.2pp and 0.3pp below the last forecasts, respectively.

Spain is expected to deliver on its deficit target in 2018 but not in 2019

The public deficit to August (at all levels of government except for the local authorities) was 4.05 billion euros lower year-on-year. The improvement came at the state, Social Security and regional government levels (with the regional governments recording a fiscal surplus on the whole).

In the wake of the relaxation of the deficit targets, most members of the Panel believe that Spain will deliver on its target this year but not next. The consensus forecast for the 2018 deficit stands at 2.7% of GDP (unchanged from the last survey); for 2019 it has been increased by 0.1pp to 2.1%, which

is 0.3pp above the announced target.

Growing pessimism regarding Spain’s external environment

The outlook for global growth has been deteriorating. Growth in the eurozone was a scant 0.2% in the third quarter. Italy, facing a slump in GDP, is the focus of attention. The fallout between the Italian government and the EC authorities over the planned budget for 2019, in the context of the country’s steep public borrowings, has the markets on edge. The country risk premium (measured as the spread between Italian and German 10-year bonds) has shot up to over 300 basis points. Elsewhere, the German economy, which had already been showing signs of slowing, contracted in the third quarter. The protectionist threat, one of the main causes for the abrupt slowdown in the European economy, could continue to weigh on the economic climate during the coming quarters.

Outside of Europe, the Federal Reserve continues to tighten monetary policy in the US, with significant consequences for the US economy, which could be reaching the end of the cycle, and for the international markets. As for China, the signs of economic weakness have been confirmed; the economy is slowing more sharply than most analysts initially predicted.

The main piece of good news is the drop in oil prices, which are now trading below $70 per barrel, compared to over $80 per barrel in September when the last survey results were published. Unfortunately, the draft Brexit agreement is too new to properly assess its political viability and potential economic impact.

Overall, pessimism regarding the international context has increased since September. Just three analysts believe that circumstances in the EU are favourable (down from 10 in the last survey), while four view it as unfavourable (0 in the last survey). Moreover, virtually all the analysts expect the European environment to remain the same or deteriorate. The assessments of the international environment outside of Europe also reveal growing pessimism.

ECB continues to gradually normalise its monetary policy, despite the uptick in inflation

Despite the fact that inflation has risen to just above the target of 2%, the ECB is sticking with its path of gradual monetary policy normalisation. That path is consistent with the slowdown of growth in Europe, the stability of core inflation and the drop in oil prices (the latter pointing to a fallback in the rise in the consumer price index). The markets are pricing in the fact that this is expected to be a gradual process. As a result, 12-month Euribor remains in negative territory, at around -0.145%, which is just 0.2pp below the September trading level.

Against this backdrop, the analysts’ assessment of the pace of monetary policy normalisation over the coming months is unchanged. None of the analysts expects an increase in benchmark rates before the third quarter of 2019 (no major change since the last survey was released in September). Meanwhile, the analysts continue to expect 12-month Euribor will trade in negative territory until the second quarter of 2019. They expect the yield on Spain’s 10-year sovereign bonds to follow a similar path, rising to 1.86% by year-end 2019, in line with the last set of forecasts.

Euro depreciation against the dollar could ease in 2019

The euro has continued to depreciate against the dollar. It is currently trading at around €/$1.13, compared to 1.16 in September. This trend is attributable to the growing spread between benchmark rates in Europe and the US as well as capital flows triggered by this difference. The gradual rollback of the ECB’s monetary arsenal should mitigate this trend in the currency markets. As a result, most analysts believe that the euro could regain some of the ground lost in 2019.

Analysts view monetary policy as appropriate but believe that fiscal policy should be neutral

The consensus assessment of monetary policy remains unchanged. All of the panel members view it as expansionary and the majority think this is the correct stance for the near-term (no change from the last survey). They unanimously believe that tighter monetary policy would not be appropriate in the current environment.

As for fiscal policy, the analysts are split as to whether it is expansionary or neutral. There is greater consensus regarding the appropriate direction for fiscal policy. Most analysts continue to call for fiscal policy neutrality; six think it should be tightened; none believe it should be more expansionary.

The Spanish Economic Forecasts Panel is a survey run by Funcas, which consults the 18 research departments listed in Table 1. The survey, which dates back to 1999, is published bi-monthly in the months of January, March, May, July, September and November. The responses to the survey are used to produce a “consensus” forecast, which is calculated as the arithmetic mean of the 18 individual contributions. The forecasts of the Spanish Government, the Bank of Spain, and the main international organisations are also included for comparison, but do not form part of the consensus forecast.