Spanish economic forecasts panel: May 2019*

Funcas Economic Trends and Statistics Department

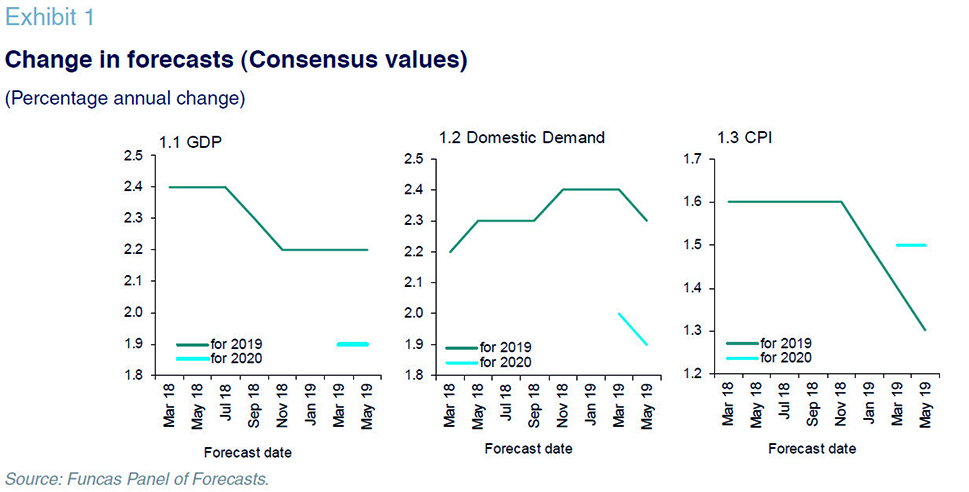

GDP is estimated to grow by 2.2% in 2019, unchanged from the previous forecast

The Spanish economy grew by 0.7% in the first quarter of 2019, according to the provisional numbers, 0.2 percentage points above the consensus forecast. The contribution of domestic demand increased to 0.5 percentage points, and the remaining 0.2 percentage points came from external demand, due to a bigger drop in imports than in exports. Looking to the start of the second quarter, the few indicators already available indicate a deterioration compared to the first-quarter averages (PMI and confidence indices), except for job creation (Social Security affiliation numbers).

The consensus forecast for GDP growth in 2019 is unchanged at 2.2%, despite the fact that six analysts have raised their estimates and two have cut them. The projected quarterly profile is unchanged at 0.5% for each quarter.

Domestic demand is expected to contribute 2.3 percentage points, down 0.1 percentage points from the last set of forecasts. The revised estimates for growth in investment and consumption are particularly noteworthy. The former have been revised upwards, particularly investment in machinery and capital goods, while the latter have been cut, in terms of both public and private spending. The foreign sector is expected to detract from GDP growth by 0.1 percentage points, marking a slight improvement from the last Panel estimates. This is due to the larger reduction in import growth relative to exports.

Growth for 2020 also unchanged at 1.9%

The consensus forecast for GDP growth in 2020 is unchanged at 1.9%, in line with the soft landing which is expected to materialise as from the third quarter of 2020 (Table 2). This forecast coincides with that of the Spanish government, the Bank of Spain and the leading international organisations.

The anticipated economic deterioration is attributable to panelists’ prediction of a lower contribution by domestic demand, driven by a broad-based slowdown in investment, as well as in both private and public spending. The foreign sector’s contribution is expected at zero.

Subdued inflation in 2019 and 2020

Inflation picked up slightly during the first four months of 2019 due to higher oil prices and the timing of the Easter break (April). Specifically, oil prices started the year at around $50 per barrel and proceeded to trade at around $70 per barrel in April. The euro also weakened against the dollar during the period.

Nevertheless, the consensus forecast for average inflation this year has been trimmed by 0.1 percentage points to 1.3%. Inflation is expected to fall back from current levels and then hold steady during the central months of 2019 before rising again near the end of the year to a year-on-year rate of 1.6% in December (Table 3), up 0.2 percentage points from the last set of forecasts. In 2020, inflation is expected to come down slightly to average 1.5% (unchanged from the last report) and then end the year at 1.3% year-on-year. Core inflation is estimated at 1% and 1.2% in 2019 and 2020, respectively.

Strong job creation

According to the Labour Force Survey (EPA for its acronym in Spanish), employment increased by 0.8% in the first quarter, adjusted for seasonal effects. The unemployment rate declined to 14.7%, two percentage points less than a year ago.

The growth in the number of Social Security contributors was slightly lower than the data from the EPA. However, that growth accelerated in the months of March and April, as did the rate of decline in registered unemployment, pointing to a strong second-quarter performance.

According to the consensus forecasts, employment will increase by 2% in 2019 and 1.7% in 2020, up 0.1 percentage point from the last estimates for both years. Based on the forecasts for growth in GDP, job creation and wage compensation, it is possible to derive implicit forecasts for growth in productivity and unit labour costs (ULCs). Thus, productivity would grow by 0.2% in 2019 and 2020 (down 0.1pp from the last set of forecasts) and ULCs would grow by 1.6% in both years (up 0.2pp).

The average annual unemployment rate is expected to continue to decline to 13.8% in 2019 and 12.7% in 2020 (down 0.1pp from the last survey in both years).

Narrowing external surplus

According to the revised figures, Spain recorded a current account surplus of 11.3 billion euros in 2018, down 48% from 2017. In the first two months of 2019, the trade balance deteriorated year-on-year, while the income deficit widened, so that the current account deficit deteriorated by 1.9 billion euros.

The consensus forecasts continue to call for a current account surplus of 0.7% of GDP in 2019 and 0.6% in 2020.

Slight reduction in the public deficit but targets expected to be missed

Spain’s public deficit was equivalent to 2.5% of GDP in 2018, compared to 3% the year before. The improvement was driven by higher growth in revenue relative to expenditure and came at the central and regional government levels. In the first few months of 2019, the state and Social Security deficits have both deteriorated year-on-year, whereas the regional government deficit has narrowed.

The analysts expect the public deficit to decline to 2.3% of GDP in 2019 and 1.9% in 2020, down 0.1 percentage point from the last set of forecasts. Those numbers would imply missing the government’s targets by 0.3 and 0.8 percentage points, respectively. Relative to the official targets agreed upon with the EU, this would be a deviation of 1.0 and 1.4 percentage points, respectively for 2019 and 2020.

Less propitious external environment, particularly in Europe

Since the last report, the downturn in the global economy has been confirmed. Global trade is feeling the effect of the tensions between the US and China and may be growing at less than 3% (versus 4% in 2018). Low global manufacturing PMIs and weak order intake numbers in recent months suggest industry is being affected by the slowdown in trade. As a result, in its recent Spring projections, the European Commission cut its estimates for global growth this year by 0.3 percentage point, to 3.2%.

Europe has become one of the main sources of global economic weakness, as anticipated in the last Panel. For 2019, the European Commission is currently forecasting growth of 1.4% in the EU and 1.2% in the eurozone, down from 2018 by 0.6 and 0.7 percentage points, respectively. Economic data also point to a weak German economy and a slow emergence from recession in Italy. On the plus side, the British economy is faring better than many expected in the face of ongoing Brexit uncertainty.

The weaker external climate, particularly in Europe, is evident in analysts’ assessments. Most believe that the European context is unfavourable for the Spanish economy and will remain so over the coming months (no major changes from the March report). All of the analysts, bar one, are neutral or pessimistic about the climate outside of the EU, with the majority anticipating that these dynamics will continue for the next few months.

Monetary policy is viewed as expansionary and expected to remain so by most analysts

The ECB is sticking to its expansionary policy, in response to ongoing economic developments and the trend in inflation, which, despite the oil price rally, remains significantly below the targeted level of 2% for the eurozone as a whole. Markets do not expect the main refinancing operations rate to enter positive territory before the second quarter of 2020. The ECB has also announced an extension of the Eurosystem policy of reinvesting in public debt securities over the coming months, while signalling that the future withdrawal of these quantitative-easing measures will be gradual. It has also announced plans for a third round of targeted longer-term refinancing operations (TLTRO-III), as from September. 12-month Euribor remains in negative territory, having decreased slightly from the rate prevailing at the time of the last report.

The expansionary nature of monetary policy is reflected in the analysts’ feedback. Nearly all believe that the ECB’s key intervention rate will stay at 0% all year. The benchmark rate is forecast to rise to just 0.28% by the end of 2020, a trend unchanged from the March estimates. Likewise, the Euribor is not expected to rise until early 2020, ending the year at under 0.3% (no major change from the last set of forecasts). The yield on 10-year Spanish government bonds is expected to stand at 1.43% at the end of 2019 (down 24 basis points from the March assessment) and at 1.69% at the end of 2020 (down 19 basis points).

Slight euro appreciation expected against the dollar

The euro has been depreciating against the dollar since March and is currently trading at around 1.12, down 7% year-on-year. That trend reflects portfolio recalibration triggered by the spread in interest rates between both sides of the Atlantic, as well as relative positioning in the economic cycle. Given that economic conditions are expected to converge somewhat over the coming quarters, analysts believe that the euro could make up some of the ground lost. The consensus forecast is for an exchange rate of 1.19 at the end of 2020 (close to the March forecast).

All of the analysts see fiscal policy as expansionary

All of the analysts, except two, continue to characterise monetary policy as expansionary. In light of the economic downturn and absence of inflationary pressure, most analysts also believe the current monetary policy is appropriate. There is less unanimity about the appropriateness of prevailing fiscal policy. Whereas all analysts agree that it is expansionary, thirteen consider that it should be neutral, while five think it should be tightened (no change from March report).

The Spanish Economic Forecasts Panel is a survey run by Funcas, which consults the 18 research departments listed in Table 1. The survey, which dates back to 1999, is published bi-monthly in the months of January, March, May, July, September and November. The responses to the survey are used to produce a “consensus” forecast, which is calculated as the arithmetic mean of the 18 individual contributions. The forecasts of the Spanish Government, the Bank of Spain, and the main international organisations are also included for comparison, but do not form part of the consensus forecast.