Spain’s sluggish post-pandemic recovery

Spain’s economic recovery is proving weaker than initially predicted, with 2021 growth now projected to come in 1.2 percentage points lower than in the previous forecast. Inflation will continue to be a key source of risk, with the potential to further undermine household and business purchasing power.

Abstract: Recent indicators point to a bumpy post-COVID-19 recovery for Spain. After announcing a buoyant initial estimate of 2.8%, Spain’s National Statistics Office, the INE, then slashed its second-quarter GDP growth figure to 1.1%. Furthermore, the preliminary estimate of 2% for the third quarter came in lower than generally expected. Some statistical oddities surround these numbers: the adverse trend in private consumption contrasts with the pronounced recovery in domestic tourism, while the the collapse in investment in housing is not consistent with the healthy momentum recorded in the property market. In any case, it seems that Spain’s recovery is not as vigorous as predicted: growth is projected to reach 5.1% in 2021, compared to 6.3% in the Summer forecast. This is due to a lower level of private consumption, which is only partially offset by stronger export growth. Inflation, which has eroded household and business purchasing power, may remain relatively high until the Spring.

Introduction

The Spanish economy continues to recover, thanks to the post-COVID-19 rebound, fuelled by Spain’s high vaccination rate. Job creation is also a source of good news. Nevertheless, the economic results are falling short of expectations and are less impressive compared to other European countries. The aim of this article is to analyse the lag in the recovery, discuss the prospects for the year ahead, and highlight the key risks facing the Spanish economy.

Growth falling short of expectations

The impact of the pandemic on the collection of statistics is making it harder to interpret Spain’s economic performance this year. After announcing a buoyant initial estimate of 2.8%, Spain’s National Statistics Office, the INE, then slashed its second-quarter GDP growth figure to 1.1%. Furthermore, the preliminary estimate of 2% for the third-quarter came in lower than several analysts expected. It should be noted, however, that the third-quarter figure remains provisional and could still be revised by the INE. It should therefore be interpreted with caution.

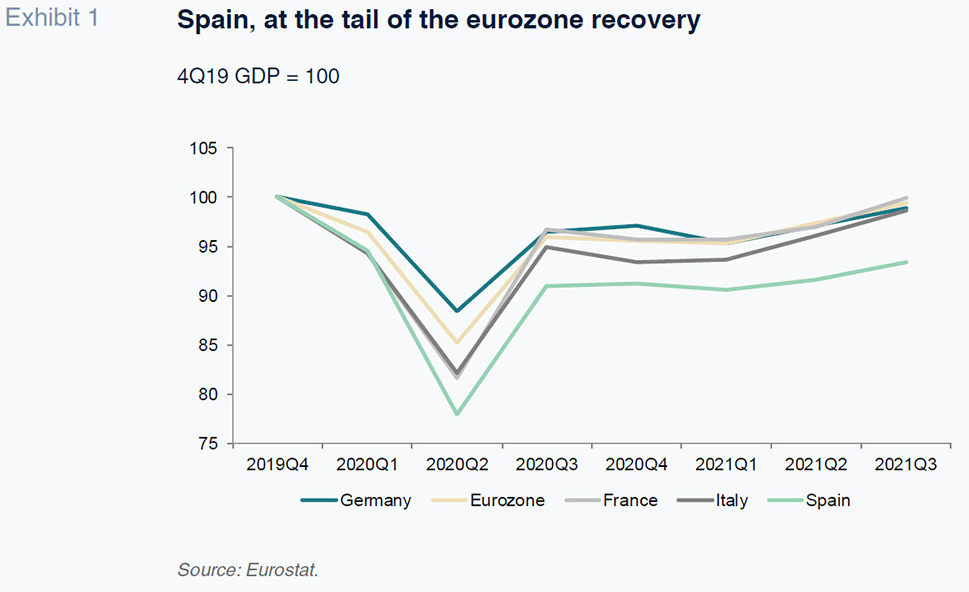

Nevertheless, all signs suggest that the recovery is proving more sluggish than expected and much slower compared to the rest of the eurozone. As of the third quarter, eurozone GDP was just 0.5% shy of fourth-quarter 2019 levels, compared to a gap of 6.6% in Spain (Exhibit 1).

Spain’s lower growth rate compared to its neighbours is attributable not only to the relatively high weight of international tourism in the Spanish economy, the variable taking the longest to normalise, but also to the country’s less dynamic domestic demand. More specifically, private consumption actually fell back in the third quarter, while investment in residential construction has been falling sharply for four straight quarters, a real outlier in the European context. Spain’s households set aside extra savings during lockdown, but remain cautious relative to their European peers. Spanish households are holding on to those savings in the face of lingering uncertainty, which has been accentuated by rising inflation trends. Household bank deposits, which had registered disproportionate growth in 2020, continue to increase, albeit at a more moderate rate.

Another contributing factor is the delay in investing the European recovery funds. According to a Funcas tally of the tenders published to date by the various ministries and other central government bodies, the aid approved so far amounts to 840 million euros. Adding in the tenders announced and pending adjudication, the total rises to less than 5 billion euros, which is far from the 27 billion euros budgeted for this year.

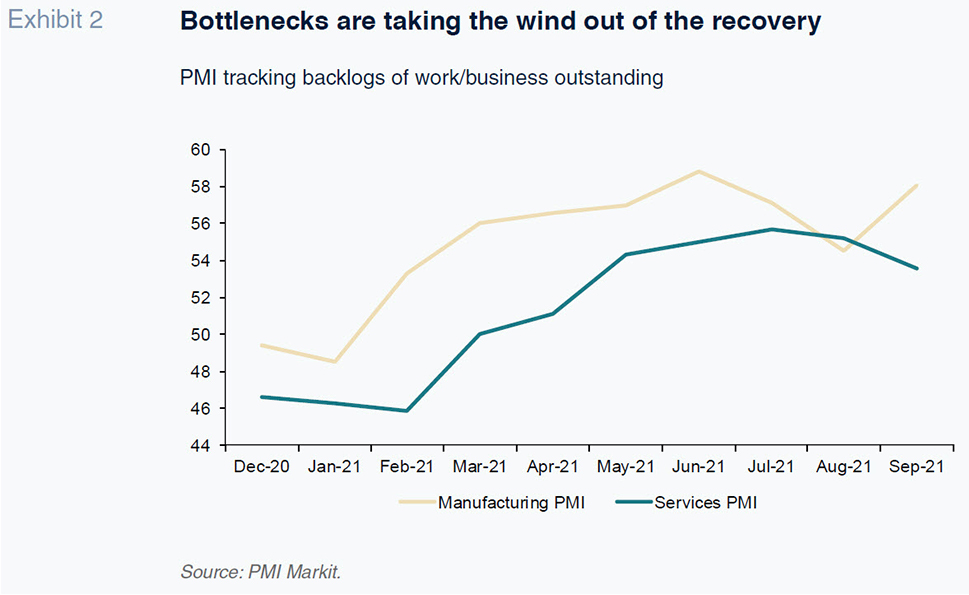

Not only has the economy disappointed throughout the first three quarters of the year, the fourth quarter is not looking too promising either. The loss of household purchasing power as a result of higher inflation and the scarcity of supplies in manufacturing are weighing on growth (Exhibit 2). If the third-quarter result is confirmed by the INE, GDP growth this year will come in well below the level expected at the onset of the recovery (in March, the analysts’ consensus forecast pointed to growth of 5.9% in 2021 [Torres and Fernández, 2021]) and even below the growth anticipated for the eurozone as a whole (5%, according to the European Commission’s forecasts). [1]

However, that result is still provisional and could be revised substantially. In fact, the adverse trend in private consumption contrasts with the pronounced recovery in domestic tourism, which in the middle months of the year surpassed pre-pandemic levels, and the sharp growth in credit card spending. By the same token, the collapse in investment in housing is not consistent with the healthy momentum in the property market, with house sales at their highest level in 12 years.

The modest recovery in GDP also does not chime with the recovery in employment. The gap in the number of hours worked in 3Q21 versus 3Q19 was just 3.5%, almost half compared to the output gap. As for the number of social security contributors, the average for the third quarter, excluding those on furlough and the self-employed on benefits, was just 2.3% below pre-pandemic levels.

As already noted, one the factors weighing on demand is the sharp pick-up in inflation, which has eroded household purchasing power. [2] Inflation rose steadily throughout the third quarter to reach 5.5% by October, driven by higher energy prices, especially electricity, as well as stronger food prices. Although the core inflation rate has also edged higher, it stood at a relatively subdued 1.4% in October.

Elsewhere, the spiralling cost of commodities and shipping, coupled with parts scarcity, have sent industrial costs rocketing. The growth in the industrial price index reached 23.6% in September, a level not seen since 1977, foreshadowing possible second-round effects on consumer price inflation.

Lastly, on the public finances front, revenue is performing surprisingly well in light of the still-considerable shortfall in taxable income by comparison with pre-pandemic levels. Revenue to August from current-year taxation on income and assets and from social security contributions is considerably above that of the first eight months of 2019, with only VAT receipts trailing slightly. By comparison with 2020, consolidated revenue (excluding the local authorities) was tracking 27 billion euros higher year-on-year. Expenditure, meanwhile, was 2.5 billion euros higher, despite the reduction in benefits from the drop in unemployment and in the number of people on furlough. The combination has driven a 24.5 billion euro reduction in the deficit to 55 billion euros.

The cut stems mainly from a weaker than expected (0.6 percentage points lower) contribution by internal demand to 2021 GDP. Private consumption is the main factor, with households seeing their real income drop as a result of the spike in prices. Disposable income is now expected to stagnate in real terms, whereas we were previously forecasting growth of 1.7%. We are also forecasting lower growth in investment, due to the squeeze on business margins on the back of the rise in production costs. Conversely, we have revised our forecast for public consumption higher to reflect government spending on staff.

A strong performance in exports should offset the loss of global economic momentum. We are expecting net trade to contribute 0.4 percentage points to GDP growth in 2021, up from 0.3 percentage points predicted in July. We think export growth will continue to top import growth, with Spanish exports gaining market share thanks to strong competitive positioning in the case of goods and non-tourism services and a rebound in tourism towards the end of the year.

In 2022, we are forecasting GDP growth of 6%, up 0.2 percentage points from our July forecast, thanks to two factors. The first, assuming gradual supply chain normalisation, is an easing of the inflationary pressures that are presently eating into household and business purchasing power. The second relates to investment, primarily in construction and, to a lesser degree, capital goods.

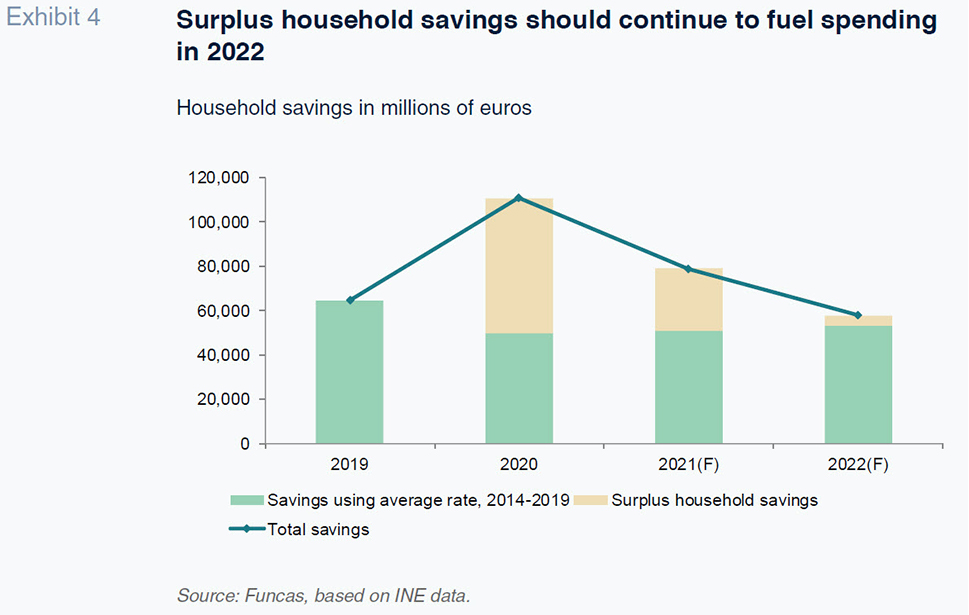

Internal demand will be the main driver of growth, contributing an estimated 5.4 percentage points of the total, up 0.1 percentage points from July. We have revised our estimate for private consumption growth considerably upwards, reflecting the carryover to 2022 of some of the release of pent-up demand that was initially estimated for this year (Exhibit 4). The pick up in private spending should also be underpinned by the anticipated growth in household disposable income in real terms (2%, up 2 percentage points from 2021), thanks to the anticipated end of the current bout of inflation as from the spring. Elsewhere, we have layered in the main budget assumptions, which indicate that public consumption will be somewhat less expansionary than anticipated in July. Lastly, we think investment will be the fastest-growing component of domestic demand, buoyed by enhanced implementation of the recovery programme funded from European funds, and an improvement in the gross operating surplus of the business sector (which is expected to return to pre-crisis levels in real terms).

The net positive contribution of international trade is expected to increase to 0.6 percentage points (up 0.1 percentage points from our July forecasts) with a strong performance expected by all export sectors. Overseas tourism should be particularly strong, possibly returning to 90% of pre-crisis levels by year-end 2022.

The higher cost of electricity and other energy costs, coupled with supply chain bottlenecks (e.g., semiconductors, metals and minerals), will continue to shape the trend in inflation. We have revised our personal consumption deflators upwards to 2.7% in 2021 and 2.2% in 2022. Assuming reduced pressure via energy and non-energy costs from the spring, both internal prices (the GDP deflator) and salaries would remain under control and therefore help curb inflationary pressures.

Elsewhere, despite the deterioration in the terms of trade, Spain will continue to present a current account surplus, which is expected to widen as international tourism recovers. Moreover, Spain is expected to receive sizeable sums under the NGEU programme, fuelling a growing net lending position. That outcome reflects the sharp rise in national savings, to record levels in terms of GDP.

The improvement will trickle down to the job market, so that we are now forecasting that employment (in labour force survey terms) will return to pre-crisis levels by the end of 2022. However, the upward trend in the active population will leave unemployment at 14.6% at the end of next year, which is still well above pre-pandemic levels. That estimate assumes that most of the people still on furlough will lose their jobs or leave the labour market.

The recovery will also benefit the budget deficit, thanks to growth in revenue powered by the rebound in economic activity and a reduction in pandemic-related expenditure needs. Meanwhile, the ECB’s debt purchases, coupled with low benchmark rates, will continue to alleviate the state’s financial burden –even though we are forecasting a gradual increase in Treasury bond yields. Altogether, we are estimating a public deficit of 6% in 2022, which is one percentage point higher than the official budget target. Public debt will also remain extremely high, at close to 117% of GDP.

Risks to the outlook

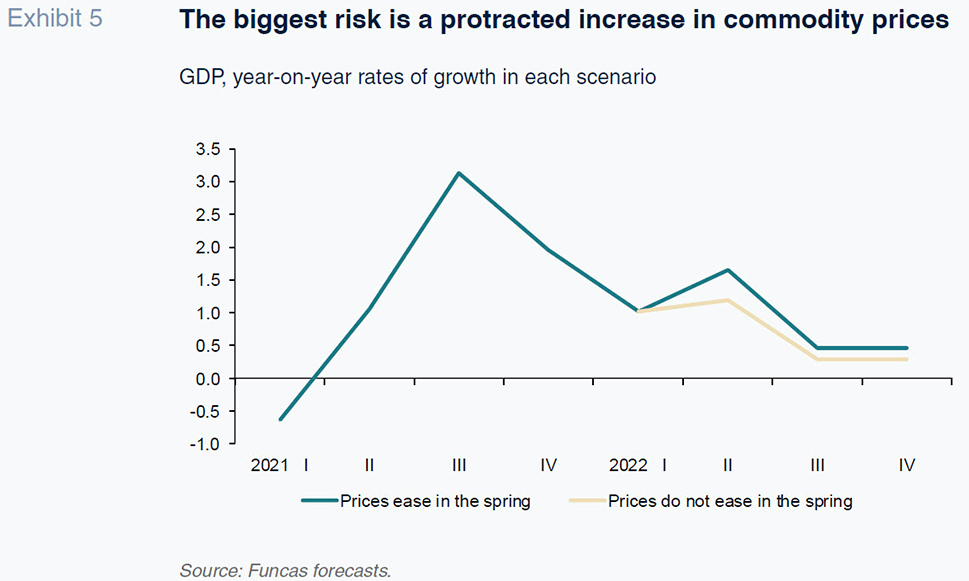

The rise in production costs is the main risk in the short-term. Should costs remain inflated for longer than we are forecasting (i.e., beyond the spring), households and businesses could face further purchasing power erosion, which would weigh on demand. That scenario should not be ruled out. The upswing in costs could also prove more persistent than anticipated. In addition to the tightness in the gas and electricity markets, we are now seeing a rally in oil prices and euro depreciation against the dollar.

Under such a scenario, the impact on the recovery could be considerable. If the anticipated reduction in energy prices from next spring does not take place, production conditions in numerous sectors would inevitably undergo significant change. Adding in second-round effects on prices, inflation would reach 2.9% in 2022 (0.7 percentage points higher than in our baseline scenario), constraining the rebound in internal demand. GDP growth would fall back by 0.5 percentage points to an estimated 5.5% (Exhibit 5).

Moreover, if inflation expectations become unanchored, the ECB could feel obliged to tighten monetary policy, which would translate into higher financing costs for the more indebted governments and sectors. In that event, the ECB’s protection would become less generous for high-deficit countries like Spain. That said, it is likely that the pre-crisis buyback programme, i.e., the Asset Purchase Programme (APP), will partially compensate for the discontinuation of the Panedmic Emergency Purchase Programme. Spain would still need to place more debt on the market and the yield on Spanish bonds would increase, as would the spread over German bonds. This would come to the fore as the ECB rolls back its purchases, after which the central bank will not be able to purchase more debt than is allowed under the capital key.

While a hypothetical shift in the monetary and financial environments would have adverse consequences on account of the probable increase in the debt service burden, it would also have positive ramifications. Namely, higher inflation would alleviate the weight of the country’s public debt in real terms. The net impact will depend on how effective Spanish economic reforms are and the emergence of an investment-friendly climate that facilitates the use of European recovery funds and creation of high quality jobs. That is the best option for boosting the country’s potential output.

Notes

Refer to the European Commission (2021).

For an analysis of inflation trends in Spain, see Torres (2021).

References

EUROPEAN COMMISSION (2021). Autumn 2021 Economic Forecast: From recovery to expansion, amid headwinds. Brussels.

TORRES, R. (2021). The spike in inflation and its impact. SEFO, 10(5), September.

TORRES, R. and FERNÁNDEZ. M. J. (2021). Outlook for economic recovery following the third wave. SEFO, 10(2), March.

Raymond Torres and María Jesús Fernández. Funcas