Lagging productivity and the need for structural reforms in Spain

Spanish productivity has lagged both the US and eurozone for the past two decades due to lower investment in key areas, such as technological and human capital, among others. Although the European recovery funds should facilitate investment in areas like digitalisation, structural reforms will also be necessary to boost Spain’s productivity growth.

Abstract: For the past two decades, Spain’s economic growth has been underpinned by the accumulation of factors of production, with productivity undermining growth. In fact, since 2000, total factor productivity (TFP) has fallen by 14.7%, which helps explain why GDP per capita in Spain trails the eurozone average by 18.5%, with productivity per hour worked also lagging by 14.1%. Behind that poor performance in productivity lies scant investment in its determinants, as illustrated by the fact that Spain lags the European average in variables, such as its stock of technological capital relative to GDP (66.1% lower), its stock of human capital (4.2% lower), its stock of public capital (26.6% lower per capita) and its stock of productive capital per employee (29.9% lower), among others. The COVID-19 crisis has served to exacerbate Spain’s productivity problem, with the loss of work and falling TFP contributing to the marked decline in 2020. In order to reverse this trend, structural reforms alongside the deployment of European recovery funds will be necessary. Among the investments contemplated, those aimed at boosting digitalisation are imperative given the productivity gains associated with digital transformation.

Introduction [1]

It is widely known that the Spanish economy has been suffering from low productivity, which has weighed on growth for decades. Spain’s poor productivity metrics help explain why the country’s per-capita GDP (barometer for material wellbeing) is 18.5% below the eurozone average. To stimulate growth, it is therefore necessary to boost productivity, which in turn requires structural reforms, i.e., those that work on the supply side of the economy. Against that backdrop, it makes sense to support the economic recovery from the COVID-19 crisis with investments that lift the country’s potential output (such as those aimed at the digital transformation of the business sector). It is also essential that the European Commission conditions receipt of its Next Generation EU funds on effective implementation of structural reforms, including the reform of the pension system (needed to reduce the structural public deficit) and the labour market (to reduce the natural or long-term rate of unemployment).

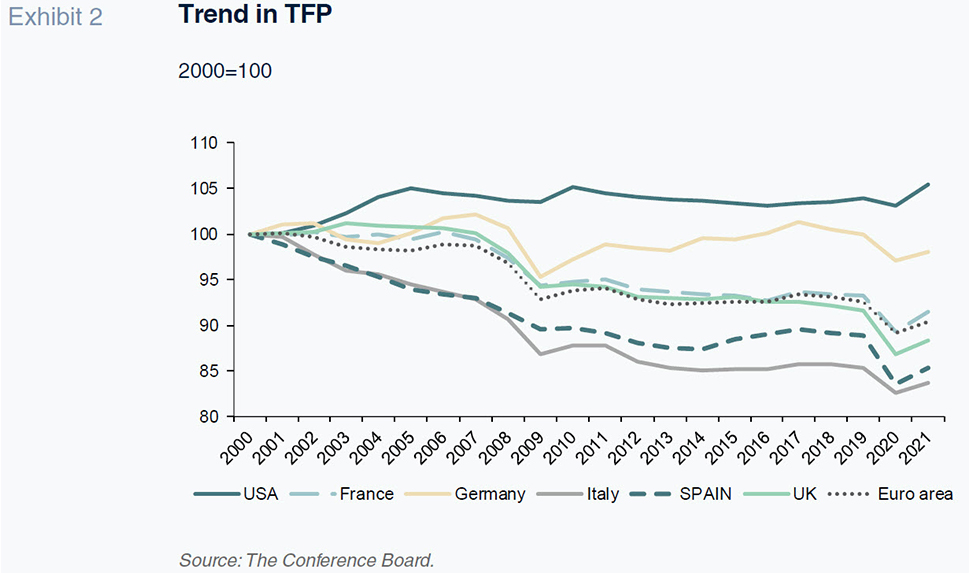

During the last two decades, the Spanish economy’s productivity (measured using total factor productivity –TFP– as a proxy) has fallen by 14.7%. The problem is common across the eurozone economy (although the loss of productivity is more pronounced in Spain) and contrasts with the TFP gains sustained in the US, where GDP per capita is 34.5% higher than in the eurozone. Many factors contribute to Spain’s low productivity, including its low investment in R&D, its smaller stock of human capital, depleted stock of infrastructure and inefficient labour market.

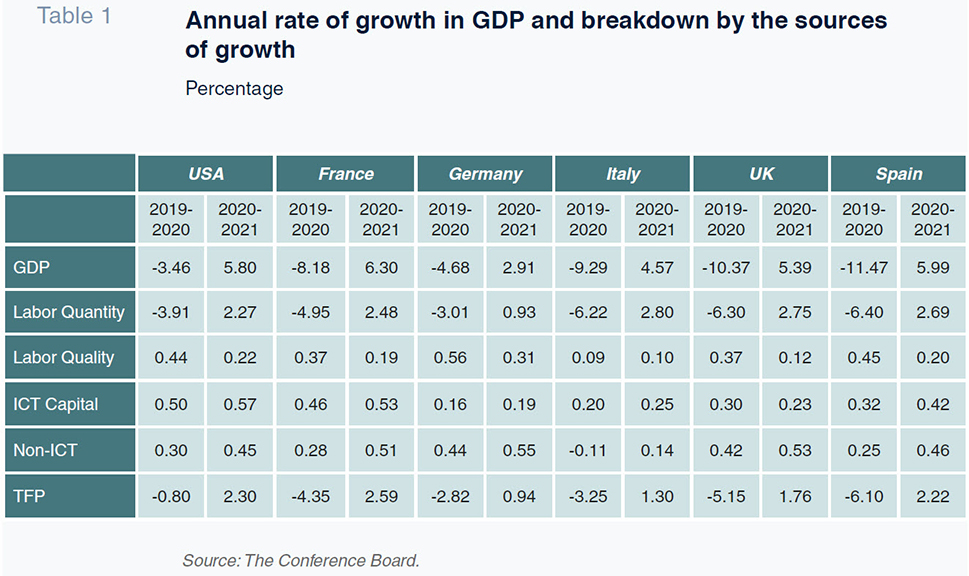

The purpose of this article is to analyse the most recent productivity figures for the Spanish economy in the international context (eurozone and US) between 2000 to 2021, including an initial analysis of the impact of the COVID-19 crisis. Using growth accounting methodology, we quantify the contribution by the accumulation of factors of production (labour and capital, distinguishing in the former instance between quantity and quality and in the latter, between ICT

and non-ICT capital) and by TFP. The results reveal the negative contribution of TFP to the Spanish economy. Hence the urgency of implementing the structural reforms needed to boost productivity. Such reforms are a prerequisite for maximising the effectiveness of the investments financed by the European recovery funds, including those aimed at accelerating the digital transformation of the business sector.

Productivity of the Spanish economy in the international context

Nobel prize-winner Paul Krugman famously stated, “Productivity isn’t everything, but, in the long-run, it is almost everything”, alluding to its importance as a source of economic growth. That is why it is so important to monitor the trend in the Spanish economy’s productivity in the international context since lower productivity is largely responsible for the gap between GDP per capita in Spain and that of other advanced economies.

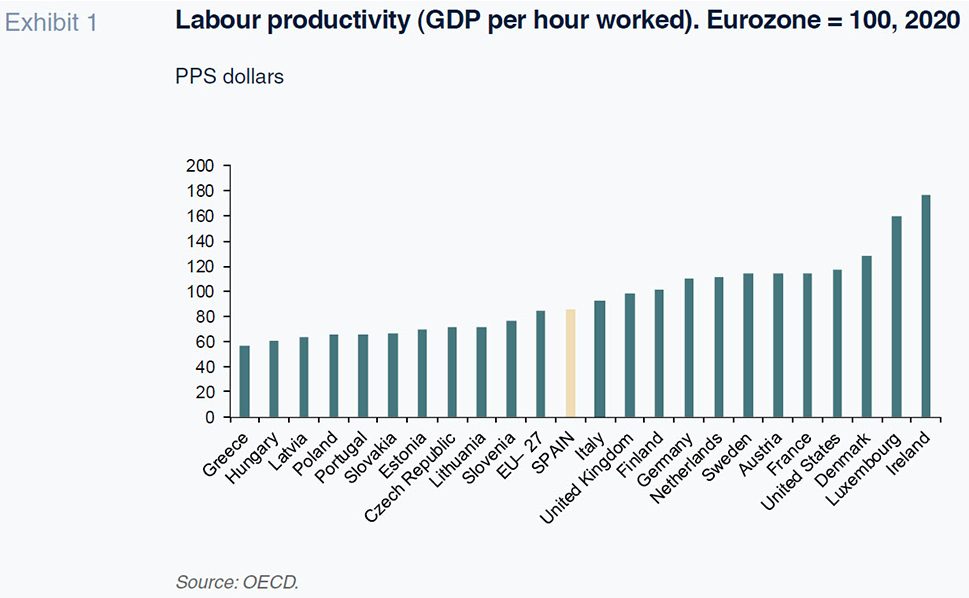

In the case of labour productivity (measured per hour worked), in 2020, Spain lagged the eurozone by 14.1% and the eurozone in turn lagged the US by 85.5%. In comparison with the main economies comprising the economic and monetary union, Spain also lags behind Germany (22%), France (25%) and Italy (7.3%). It is therefore clear that the labour productivity gap between Spain and other developed economies is one of the factors responsible for the gap in wellbeing (GDP per capita). Moreover, that productivity shortfall with respect to the eurozone average in 2020 is unchanged since 2000 (14.1%), which helps explain why the gap in terms of GDP per capita has not narrowed in the last two decades. In fact, that gap has actually widened by 3.6 percentage points between 2000 and 2020, with Spanish GDP per capita falling from 85.1% of the eurozone average to 81.5%.

A second and more rigorous productivity indicator is total factor productivity (TFP), a metric that addresses how efficiently labour and capital are used together. Consider that if employees are equipped with a bigger stock of capital, they will be able to increase output, so that their higher productivity is attributed to capital and not labour.

The database compiled by The Conference Board permits an assessment of the Spanish economy’s productivity in the international context. The database focuses on the sources of economic growth, so that it is possible to quantify the contributions of the following factors: the quantity of labour (hours worked), the quality of labour, ICT capital, non-ICT capital and TFP. Moreover, for certain variables it provides insight into the rates of growth, enabling an assessment of whether productivity in Spain is converging or losing ground with that of other economies.

Considering the period since 2000, we note that Spanish TFP has fallen by 14.7%. The problem goes back further, however, as Spain’s TFP in 2021 is 20% below that of 1990 (the earliest year for which these data are available). [2]

The eurozone has also become less productive over the same timeframe, albeit far less so than Spain. During the last two decades, productivity in the eurozone has fallen by 9.6%, which is half the contraction observed in Spain. And since 1990, the loss in Spain is similarly twice that of the eurozone. Those figures contrast with the productivity gains eked out in the US, where TFP has increased by 5.5% between 2000 and 2021 and by 8.5% since 1990.

As for the main eurozone economies, the drop in TFP in Spain (14.7% since 2000) surpasses the ground lost in France (8.5%), Germany (2%) and the UK (11.6%) but is lower than in Italy (16.3%).

Growth accounting

The sources of economic growth are twofold: the accumulation of factors of production (labour and capital) and productivity gains, enabling growth in production using the same quantity of inputs.

The information available allows us to examine the contribution by the factors of production based on their quantity relative to improvements in their quality. In the case of labour, upgraded quality adds to the stock of human capital, whereas in the case of capital, the split between quantity and quality can be approximated by distinguishing between ICT and non-ICT capital.

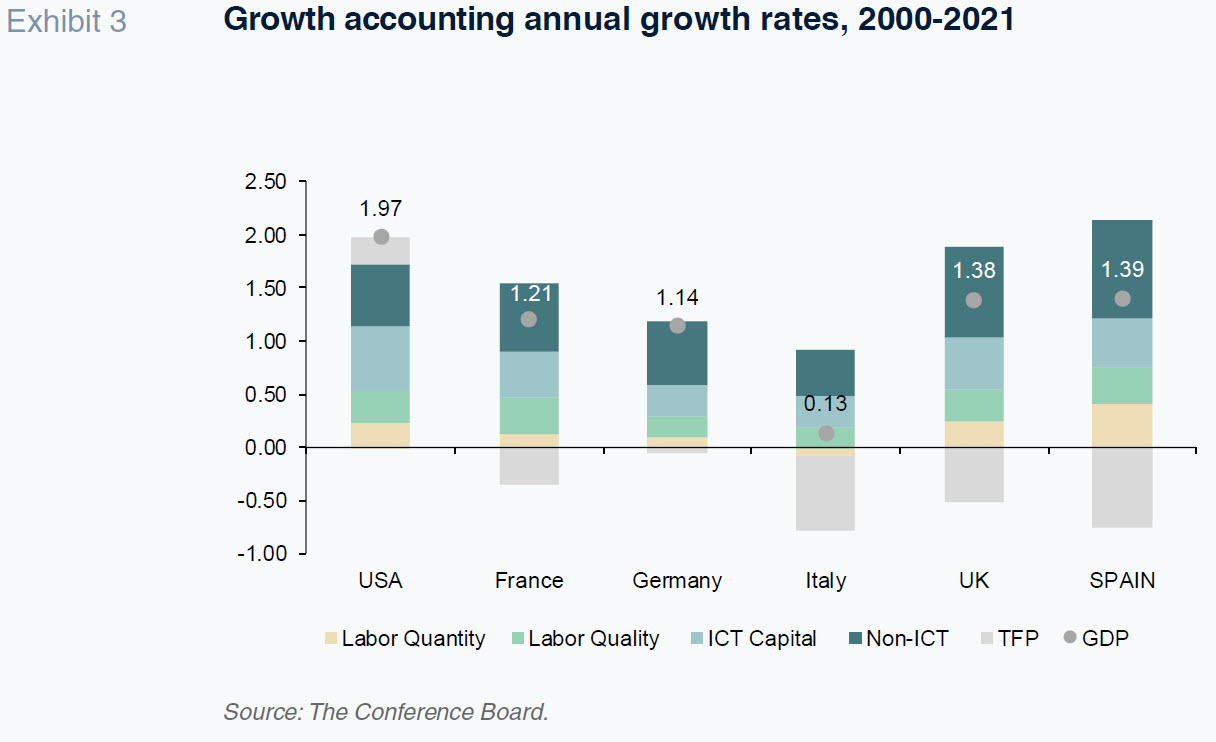

On average, between 2000 and 2021, Spanish GDP increased by 1.3% per annum. Unfortunately, TFP detracted from that growth, falling at a rate of 0.75%, which adds up to a negative contribution of 53.5%. The factor making the biggest contribution to GDP growth is Spain’s investment in conventional or non-ICT capital (annual growth of 0.93%), with a contribution of 66.6%. That factor is followed by investment in ICT capital (+0.45%; +32.6%) and growth in the number of hours worked (+0.41%; +29.1%), while the improvement in the quality of work (human capital) is the factor making the smallest contribution (+0.35%; +25.2%).

The patterns in the Spanish economy’s sources of growth are replicated, with greater intensity, in Italy, where TFP has fallen at a similar pace as in Spain but in the context of very scant GDP growth between 2000 and 2021. In Italy, too, investment in ICT capital lags investment in conventional capital.

One trend shared across France, Germany, Italy and Spain is that TFP has fallen since 2000 (albeit much less sharply in Germany). Another common trait among these economies is the fact that the contribution to growth by non-ICT capital is bigger than that of ICT capital. That is also true of the UK, a former EU member state.

What is the reason for Spain’s low productivity?

Economic theory and empirical evidence have established the variables that drive productivity gains. Those variables include investment in R&D, intangible assets, employee training (human capital), infrastructure that shapes businesses’ production costs (such as transport), businesses’ productive capital, etc.

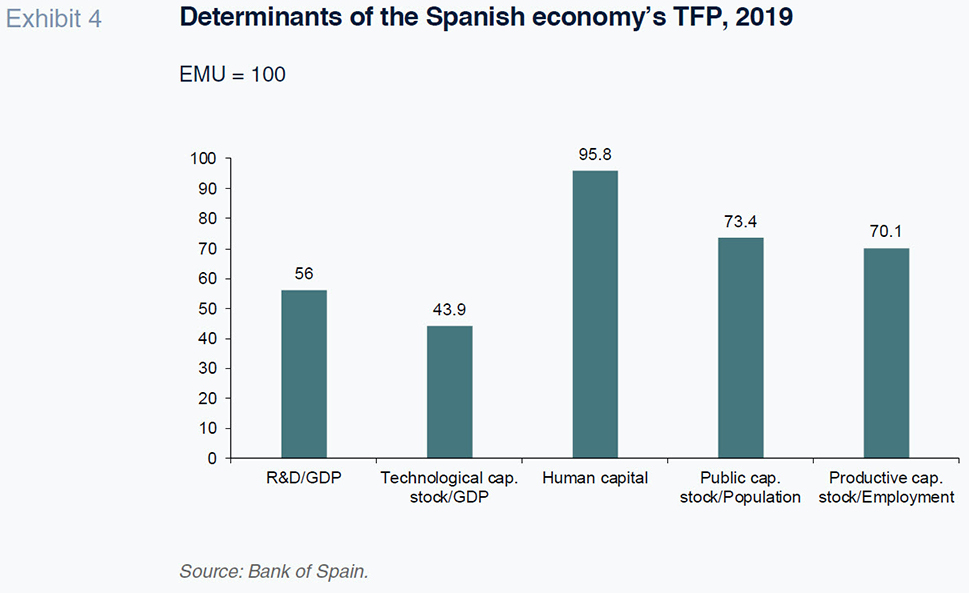

The Bank of Spain presents comparative information for those structural variables. The most recent figures, which date to 2019 and are depicted in Exhibit 4, clearly illustrate where Spain’s low productivity problems lie. Specifically, the Spanish economy:

- Invests 44% less in R&D (R&D/GDP) than the eurozone average.

- Has a 66.1% smaller stock of ICT capital than the eurozone average (as a percentage of GDP).

- Invests less in training, as is evident in the fact that its stock of human capital (indicator corrected for quality) is 4.2% smaller than the European average.

- Has a 26.6% smaller stock of public capital per capita.

- Uses 29.9% less productive capital per employee than is used on average by a eurozone worker.

The list of structural indicators reported by the Bank of Spain is broader and offers greater insight information. For example, the shortfall of investment in innovation is more pronounced in the public sector. Additionally, the number of patents applied for per capita is less than one-third of the European average. Investment in private equity as a percentage of GDP is less than half of the eurozone average while public spending on education relative to the population aged between 16 and 65 is 65% of the EMU average. The figures also corroborate Spain’s relatively smaller stock of intangible assets, those most closely related with digitalisation. [3]

How has the COVID-19 crisis affected productivity?Although the 2021 figures are estimates based on the information published by The Conference Board, it is possible to analyse how the COVID-19 crisis has impacted productivity growth and the sources of economic growth. After Spain declared a state of emergency in March 2020, its GDP contracted drastically. GDP shrank by more in Europe than in the US, with Spain topping the ranking.

[4] The expectation is that these economies will recover a lot of the ground lost in 2020, albeit exhibiting differing rates of growth from one economy to the next.

TFP, meanwhile, contracted by an estimated 6.1% in 2020, which is the biggest drop among the countries analysed. The loss of work was the key factor responsible for the contraction in Spanish GDP (55.8%), followed by TFP, which made a negative contribution of 53.1%. The forecast for 2021 is for growth in productivity, as GDP is growing faster than the factors of production. In Spain, productivity gains are projected to account for 37% of the recovery in GDP, which is close to the percentage anticipated in the US (39.7%). The recovery in employment, after the rout of 2020, is expected to make the biggest contribution to GDP growth in Spain in 2021 (responsible for 45%).

Productivity, structural reforms and the European recovery funds

Following the brutal impact of the COVID-19 crisis, Spain must take advantage of the European recovery funds (the NGEU scheme) to increase the economy’s potential output. An integral part of this challenge entails lifting its productivity. Of the various investment areas contemplated in the so-called Recovery, Transformation and Resilience Plan, which outlines the use of these funds, the section devoted to digital transformation [5] is a top priority in terms of productivity, as digitalisation unquestionably boosts productivity by rendering companies more efficient. Indeed, a recent report by the European Investment Bank (2021) shows that digitalised companies (those that have implemented at least one digital technology) are more productive. Other reports (e.g., Calvino et al., 2018 for the OECD) also show that the countries with a bigger percentage of GDP concentrated in highly digitalised sectors are more productive and present higher levels of per capita income. In the specific case of Spain, the European Commission (2020) recommends increasing investment in intangible assets (particularly software and databases) as the contribution by intangibles to growth in labour productivity in Spain is the lowest in the EU-15.

The investments planned under the recovery scheme are a necessary step but are not sufficient on their own to maximise their impact. In parallel, Spain needs to implement structural reforms, namely those that work on the supply side of the economy and pave the way for increasing potential output. The 102 reforms contained in Spain’s Recovery, Transformation and Resilience Plan are very necessary, especially those related to boosting the stock of human capital, investing in science and innovation, increasing the stock of ICT technology and rendering the country’s public finances sustainable. Spain fares poorly along all those variables by international standards. Closing the gap between Spain and the most developed economies (or the eurozone average) in each is therefore the best way of also narrowing the divide in productivity and wellbeing. This must be done in parallel with fiscal reforms to tackle the high structural deficit, labour reforms to reduce the high rate of structural unemployment, and pension system reforms to ensure its long-term sustainability.

Notes

This paper falls under the scope of research projects ECO2017-84828-R (Spanish Ministry of the Economy, Industry and Competitiveness) and AICO2020/217 (Valencian Government).

The trend in TFP gleaned from The Conference Board (TCB) database differs substantially from that provided by the European Commission’s AMECO database, a difference that is attributed to several potential factors. TCB measures employment more rigorously, as it uses the number of hours worked rather than the number of employees. TCB also factors in the quality of labour (human capital). That latter component –human capital quality– has a downward effect on TFP, as this is estimated as a residual (that is, by the difference between GDP growth and that of production factors), thus the significant increase in human capital that has taken place in Spain in recent decades has reduced TFP growth when the quality of work is taken into account. The definition of capital also differs. That used by TCB follows the calculation standards in growth accounting (using “productive capital” rather than “net capital” and appropriate deflators for measuring the trend in ICT capital, etc.). In addition, TCB analyses the contribution by ICT and non-ICT capital separately.

The list of variables underpinning productivity is even longer as productivity is additionally influenced by a series of factors, such as: access to financing; regulatory matters (which affect the ease of doing business and business growth); institutional quality; the workings of the labour market; business dynamism, etc. The European Commission (2020) highlights the importance of structural change, low investment in intangibles, the impact of zombie firms and business cycle dynamics in explaining why Spain presented the second-lowest growth in labour productivity between 1970 and 2016.

According to Spain’s statistics office, the country’s GDP contracted by 10.8% in 2020, a figure that has yet to be updated in The Conference Board’s database (-11.5%).

Of the 10 structural reform levers articulating Spain’s Recovery Plan, Lever V (Modernisation and digitalisation of industry and SMEs, entrepreneurship and business environment, recovery and transformation of tourism and other strategic sectors) accounts for 23% of all the aid to be received (16.08 billion euros out of a total 69.53 billion euros). In addition to those direct investments in digitalisation, a further 1.05 billion euros of investments have been earmarked to Lever I “Green and digital transformation of the agri-food and fisheries industries”, 3.59 billion euros to the “National Plan for Digital Skills” (Lever VII) and 1.65 billion euros to the “Modernisation and digitalisation of the education system, including early education from age 0 to 3” (also Lever VII). As a result, one-third of the investments to be financed from the NGEU grants are articulated around digital transformation.

References

CALVINO, F., CRISCUOLO, C., MARCOLIN, L. and SQUICCIARINI, M. (2018). A taxonomy of digital intensive sectors. OECD Science, Technology and Industry Working Papers, 2018/14. OECD Publishing.

THE CONFERENCE BOARD (2021). The Conference Board Total Economy Database™. Growth Accounting and Total Factor Productivity, 1990-2021. August 2021.

EUROPEAN COMMISSION (2020). Productivity in Europe. Trends and drivers in a services-based economy. JRC Technical report.

EUROPEAN INVESTMENT BANK (2021). Digitalisation in Europe 2020-2021. Evidence from the survey in the EIB investment survey.

GOVERNMENT OF SPAIN (2021). Recovery, transformation and resilience plan.

Joaquín Maudos. Professor of Economic Analysis at the University of Valencia, Deputy Director of Research at Ivie and collaborator with CUNEF