The global insurance market: State of play and growth dynamics

Over the past few years, the financial crisis and low interest rates have contributed to a downward trend in the insurance sector’s earned premiums in advanced economies. While emerging markets’ high growth rates have helped offset this development, it is expected that additional relief will come as interest rates normalise and retirement savings rise in the developed world.

Abstract: Of late, growth in the insurance business has become sluggish in the developed world with earned premiums having stagnated in real terms. This trend has been shaped by the recent financial crisis and a prolonged period of low interest rates. However, these developments have been offset by dynamic earnings growth in the emerging markets, particularly China, which is currently the second-largest insurance market after the US. The significantly higher GDP growth rates in emerging economies, together with their low levels of GDP per capita, are driving substantial growth in the insurance business. Nevertheless, it is conceivable that advanced economies’ earned premiums in the life insurance segment will improve as interest rates are gradually normalised. Furthermore, it is expected that the insurance industry will benefit from a rise in retirement savings as public pension systems fail to cope with rapidly aging populations. Of particular note are the promising conditions in Spain, where the life insurance segment has room to grow.

IntroductionThe recent publication by the Swiss Re Institute of its traditional annual report on the global insurance industry (Swiss Re, 2017), along with the entity’s web-based data visualisation tool,

[1] presents an opportunity to analyse growth dynamics in the global insurance business by region and business segment. The research suggests that over the last few years, the insurance business has run out of steam in the advanced economies. However, this is being offset by strong growth in emerging economies, particularly China, which is now the second-largest insurance market in the world after the United States.

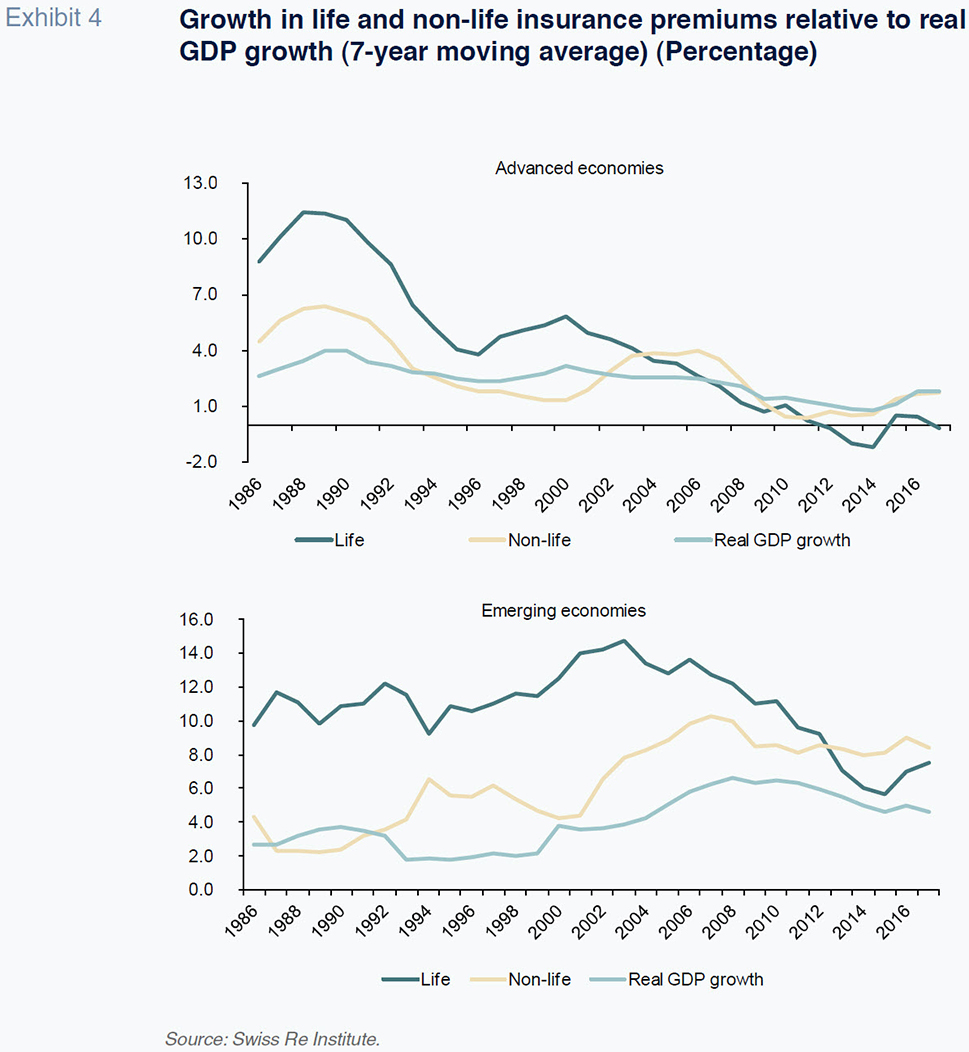

Although the purpose of this article is not to analyse the factors underpinning these trends, it is clear that the recent financial crisis has had a unique impact on life and non-life insurance in advanced economies. The prolonged period of low rates necessitated by the crisis has had an adverse impact on growth in the life insurance sector. Nevertheless, low birth rates and longer life expectancies in advanced economies have undermined the ability of public pension systems to cope with the shortfall in savings, thereby presenting a promising opportunity for the life insurance industry.

Conversely, the very nature of emerging economies has led to a significant expansion of these countries’ insurance markets. Specifically, financial conditions have contributed to elasticities of demand greater than one. Moreover, income growth in emerging economies, especially China, has been particularly strong.

In this paper, we first analyse the global dynamics of the insurance industry. We then focus on the relative performance of the three major blocks of advanced economies and conclude with an analysis of Western Europe, which includes the Spanish insurance sector. Notably, Spain’s insurance industry ranks fifteenth worldwide with a share of total direct insurance premiums of 1.5%.

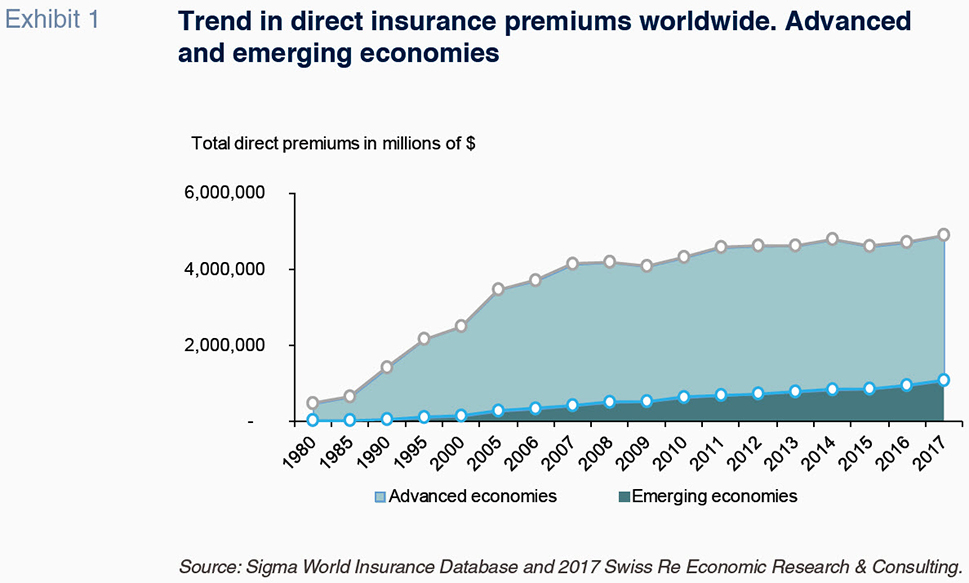

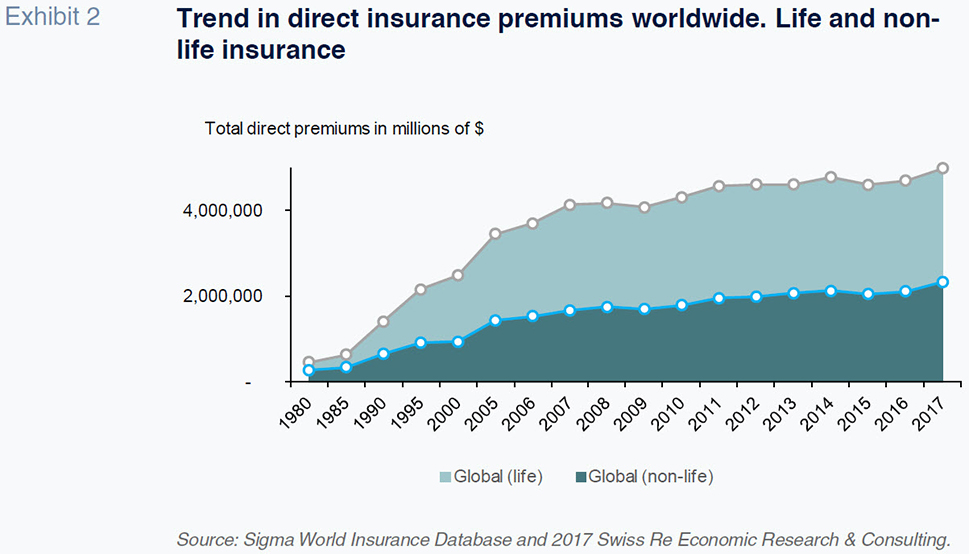

General dynamics: Advanced and emerging economiesAs shown in Exhibits 1 and 2, premiums earned in the global insurance market amounted to close to 5 trillion dollars in 2017.

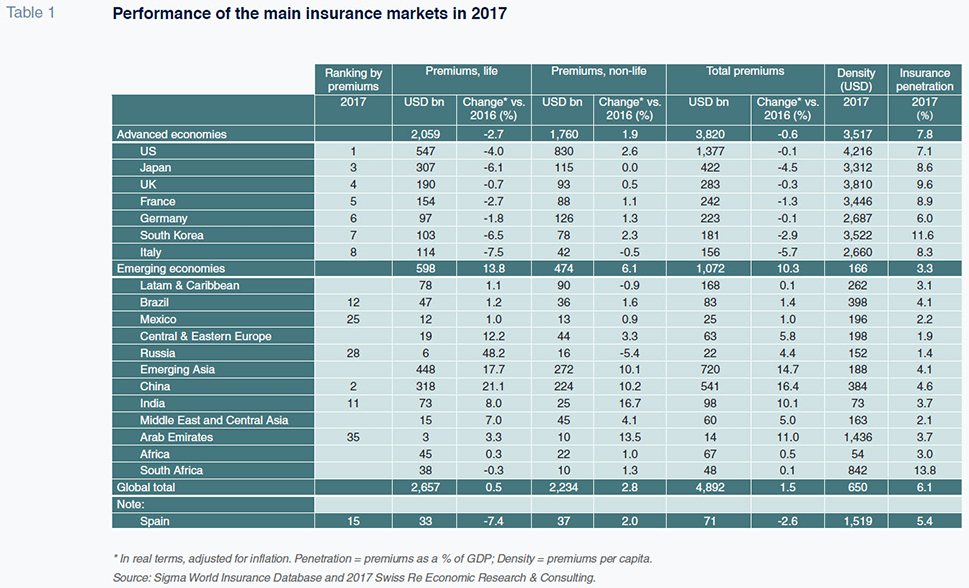

In real terms (discounting inflation), premiums registered growth of 1.5% in 2017, which is similar to the average annual rate of 1.4% between 2007 and 2016. Of note is the negative impact the recent economic and financial crisis had on these figures. As such, the real growth rates contained in Table 1 are relatively low by historical standards.

Growth in premiums is primarily being driven by the emerging economies (+10% in 2017 and 8.4% on average between 2007 and 2016), with China clearly spearheading this growth (+16%). By contrast, growth in premiums in advanced economies has stagnated in real terms (-0.6% and 0.3% respectively) due to the downward trend in the life insurance sector.

Globally, the non-life insurance segment has exhibited stronger growth in premiums (2.8% in 2017 and 2.1% between 2007 and 2016) compared to the life insurance segment (0.5% and 0.9%, respectively). However, this divergence between the emerging and advanced economies is evident in both segments.

Measured in terms of premium volumes, the insurance business has experienced far higher growth in emerging markets. This is especially true in China, which represents half of all of the insurance business in this market. Nevertheless, advanced economies still accounted for nearly 80% of all premiums written in 2017. This is consistent with the insurance penetration level (premiums/GDP) in those economies, which at 7.8% is more than twice that of the emerging markets (Exhibit 3).

However, this gap has been narrowing in recent years, a phenomenon that is all the more noteworthy considering that GDP growth has been much higher in emerging markets. In other words, the elasticity of the change in premiums to that of GDP is considerably higher in emerging economies than in advanced markets. This is consistent with the lower level of GDP per capita in the former and underpinned by empirical evidence, which suggests the density and penetration of insurance coverage increases with a country’s income levels (Exhibit 4).

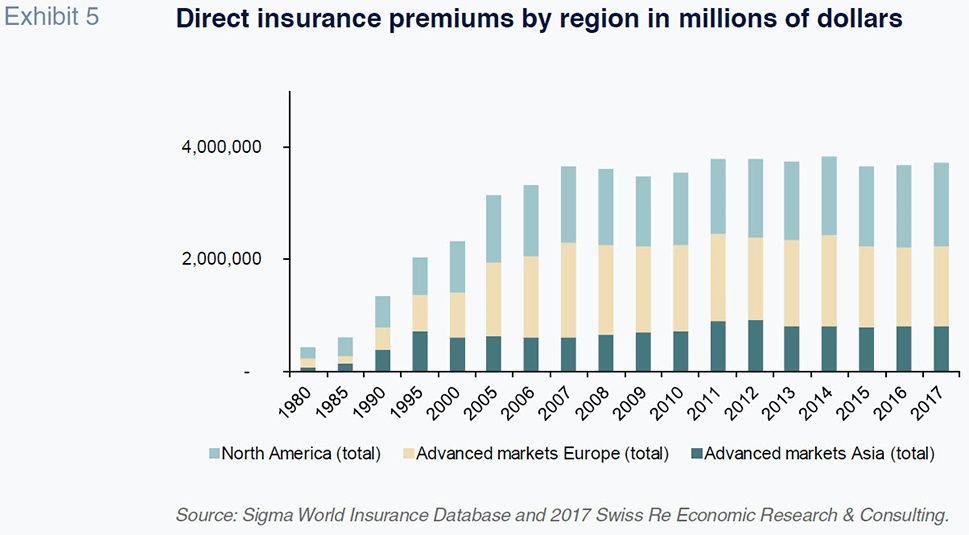

Dynamics in the three major blocks of advanced economiesThe bulk of the insurance business is concentrated in three major blocks of advanced economies. North America, Western Europe and the developed Asian economies account for 31%, 29% and 22% of global premiums, respectively. Other than the rotation between North America and Western Europe at the top of this ranking, the relative movements in these mature markets have not been particularly remarkable (Exhibit 5).

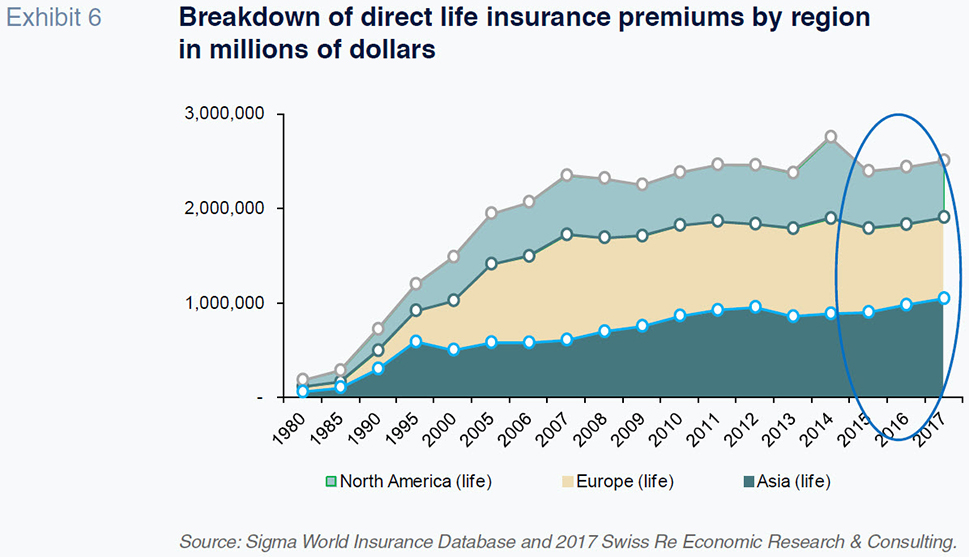

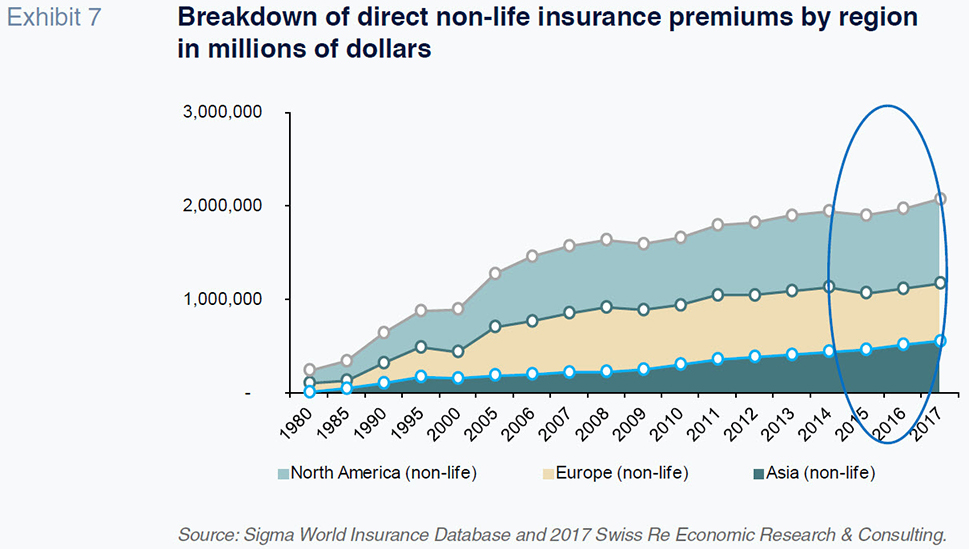

It is worth highlighting that there are differences in the relative importance of each region in the life versus the non-life insurance segments. The North American non-life insurance market accounts for 40% of total worldwide premiums in this segment, compared to just 23% of life insurance premiums. On the other hand, Western Europe’s share of the global life insurance market stands at 32%. However, it makes up just 26% of the global non-life insurance segment. The advanced Asian economies are even more biased towards the life insurance segment, accounting for 22% of the global market, which is nearly as big as the share commanded by North America. Yet, only 10% of the non-life insurance market is located in these countries (Exhibits 6 and 7).

Average insurance penetration rates are just over 7% in North America and Western Europe, whereas in the advanced Asian economies they exceed 10%.

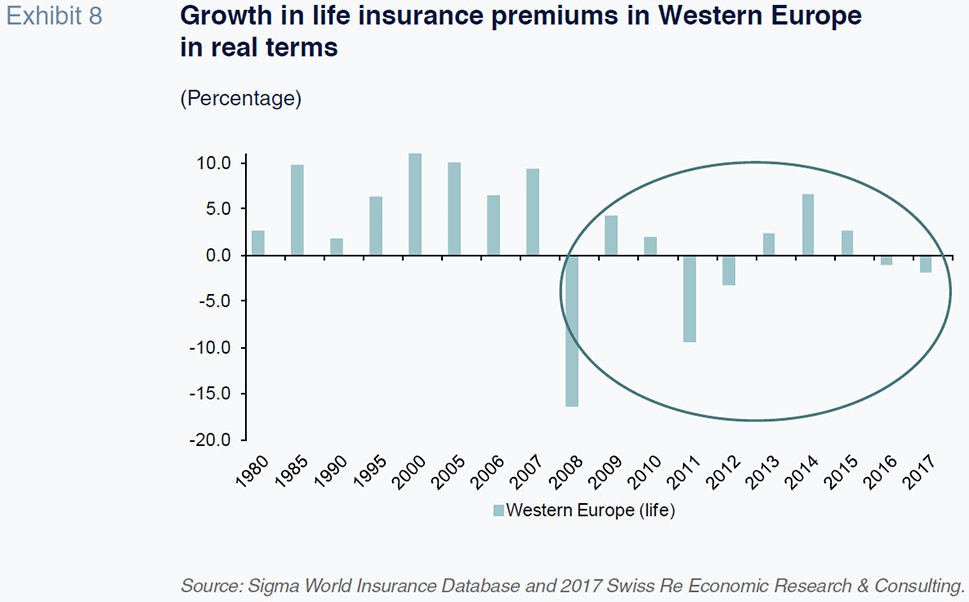

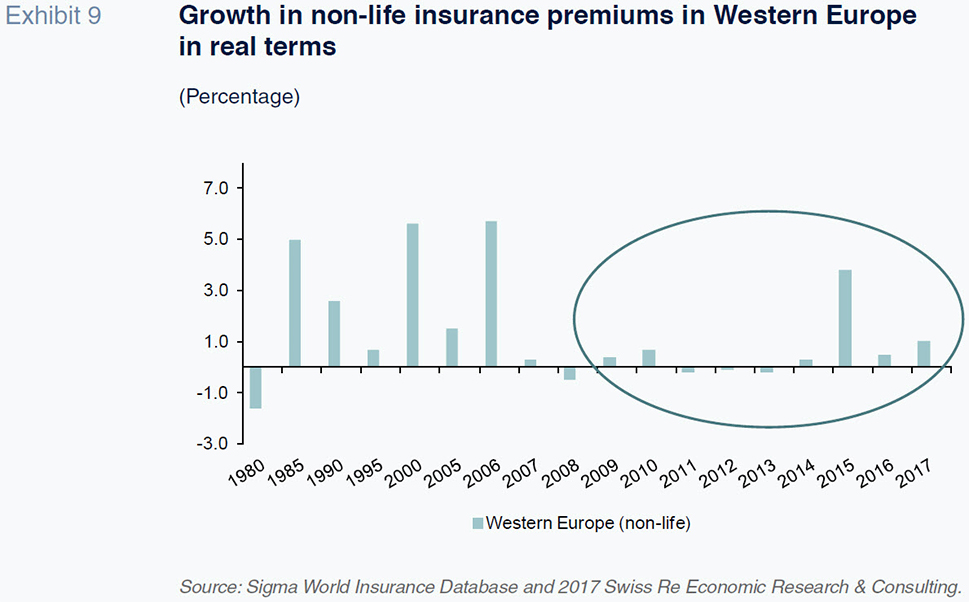

Dynamics in Western EuropeThe structural changes that have taken place globally due to the recent financial crisis are especially apparent in Western Europe. Not only have the real growth rates in the life insurance business been low or even negative over the past decade, but they’ve also exhibited a high degree of volatility. Although growth in the non-life insurance segment has been much more stable, it has trended significantly below the levels observed in previous decades (Exhibits 8 and 9).

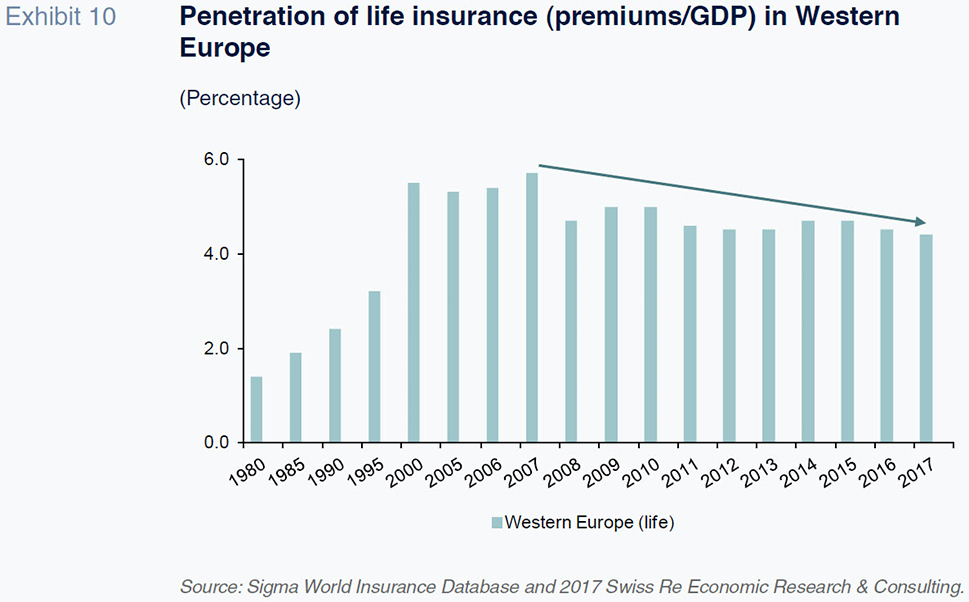

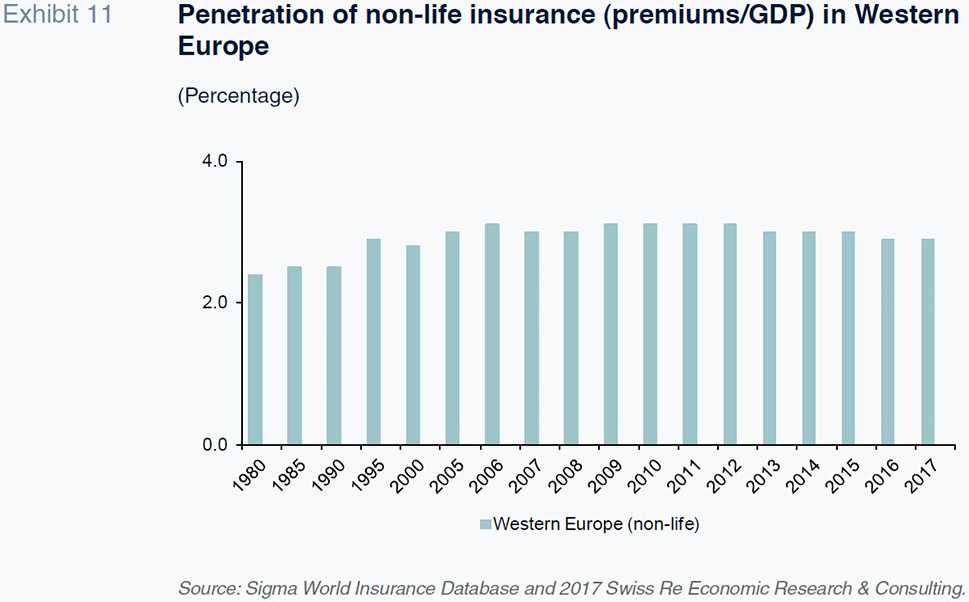

This relative stagnation (in real terms) has led to a decline in the insurance penetration rate, shaped predominately by the contraction of the life insurance business. In this segment, penetration has fallen from a high of 5.7% of GDP in 2007 to 4.4% in 2017, when premiums contracted in real terms for the second year in a row. Considering the relatively stable non-life insurance business, which has maintained a penetration of close to 3%, the overall insurance penetration rate stands above 7% (Exhibits 10 and 11).

However, there is a considerable difference in the penetration rates across Western Europe. At the top of the ranking, with rates of around 10%, are Finland, Denmark, the UK and the Netherlands; at the bottom end lies Spain with a penetration rate of under 5.5%.

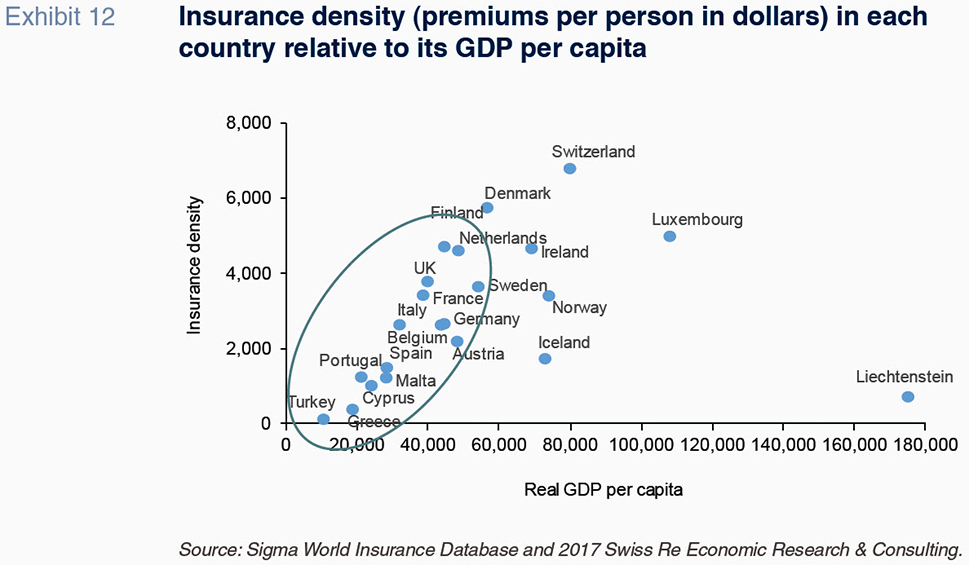

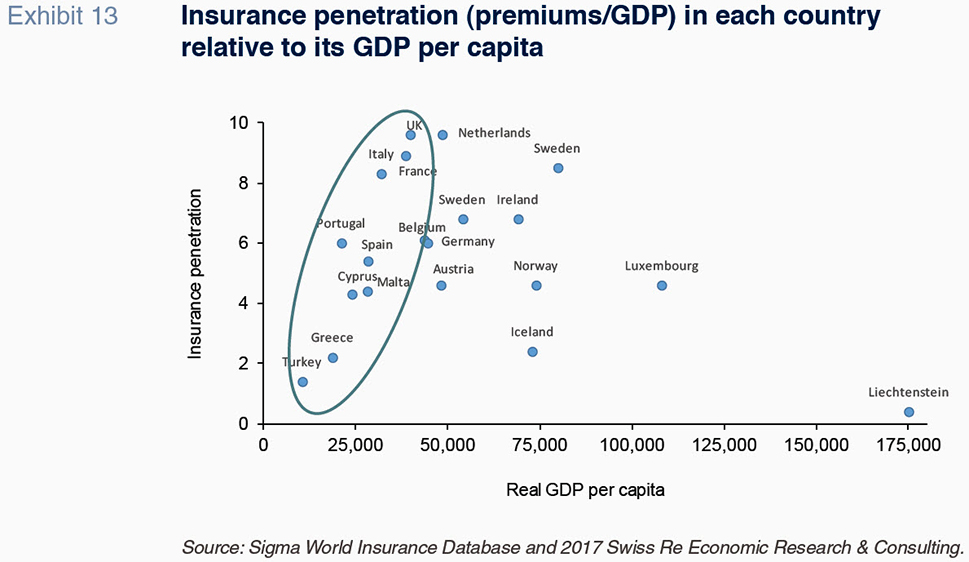

This divergence in penetration rates is largely due to differences in per-capita incomes across the region. However, as shown in Exhibits 12 and 13, the correlation is strong in countries with relatively low per-capita income levels but becomes weaker and less evident in those with incomes of over 45,000 dollars per capita.

In Spain, where the insurance market ranks 15th worldwide in terms of total direct premium volumes, the income per capita levels partially account for insurance penetration and density levels that are below other major European economies (Manzano, 2017 and Manzano, 2018). However, specific conditions in Spain provide greater opportunities for the insurance market, and in particular for the life insurance segment (Mapfre, 2018).

Despite the still lower relative penetration of the life insurance segment in Spain, if examined in historical perspective, this segment has shown a certain dynamism in the last decade. In fact, practically all of the increase in the penetration of insurance in Spain in this period is due to this segment. In a market as banked as Spain, with a huge weight of bank deposits, the zero or very low profitability in recent years of both deposits and other short-term investment alternatives has helped to shift the demand towards longer-term savings products. The life insurance business has benefiting from this trend. Although it too exhibited low returns, these have been superior to those of alternative short-term products. However, we must also emphasize the unique commercial effort by some of the leading firms in the life insurance segment.

On the other hand, from a structural perspective, and in the medium-term, the difficulties of the public pension system to maintain the purchasing power of pensions in a strained sociodemographic environment (note that public pensions in Spain have a very high replacement rate) compared to other European counterparts, and the growing awareness of pension savings, should boost the demand for products associated with the life sector - with elasticities greater than one.

Notes

All of the exhibits in this report were generated using the web tool facilitated by Swiss Re.

References

DGSFP (2018), “2017 Insurance and Pension Funds Report.”

FUNDACION MAPFRE (2018), “The Spanish insurance market in 2017.”

MANZANO, D. (2017), “Spain’s banking and insurance sectors: A contrasting story,” Spanish Economic and Financial Outlook, vol. 6, 4, ISSN 2254-3899.

— (2018), “Spain’s insurance sector: Profitability, solvency and concentration,” Spanish Economic and Financial Outlook, vol. 7, 1, Funcas ISSN 2254-3899.

SWISS RE INSTITUTE SIGMA (2018), “World insurance in 2017: solid, but mature life markets weigh on growth,” Sigma 3/2018.

Daniel Manzano. A.F.I. - Analistas Financieros Internacionales, S.A.