Spanish economic forecasts panel: September 2018*

Funcas Economic Trends and Statistics Department

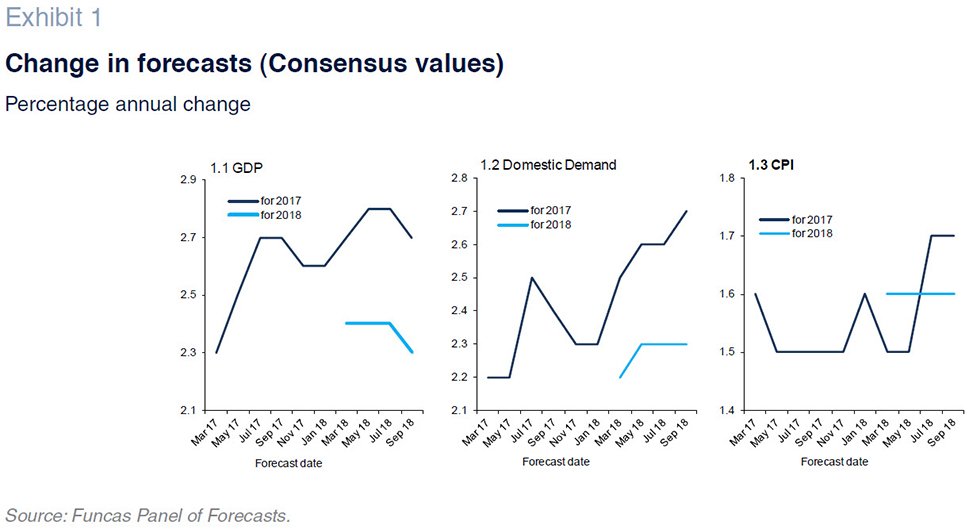

GDP growth expected at 2.7% in 2018, 0.1pp down from the last survey

Second-quarter GDP growth came in at 0.6%, 0.1pp lower than our Panel members were estimating. It is worth highlighting the slowdown in private consumption and export growth. Investment, in contrast, rebounded strongly.

The consensus forecast for third-quarter GDP growth is 0.6% (no change from the last survey). For 2018 as a whole, the consensus forecast is currently for growth of 2.7%, down 0.1pp from the last Panel forecast. The expected composition of that growth has shifted: net exports are now expected to contribute 0.1pp and domestic demand 2.6pp, down 0.2pp and 0.1pp, respectively. The forecast for growth in private consumption has been shaved by 0.1pp, while the estimate for growth in public consumption has been revised upwards by 0.3pp. Forecast investment in capital goods has also been increased considerably. However, the biggest change in forecasts affects exports which are now expected to grow by 2.9%, down 1.2pp.

The forecast for 2019 has also been cut by 0.1pp to 2.3%

The consensus forecast for GDP growth in 2019 has been trimmed by 0.1pp to 2.3%. Net exports are now expected to make a smaller contribution, albeit still positive. Growth in all of the components of domestic demand is expected to ease, especially private consumption. By quarter, the analysts expect growth to slow after the second quarter (Table 2).

Inflation at 1.7% in 2018 and 1.6% in 2019

Inflation has ticked higher, from around 1% at the start of the year to roughly 2.2% in recent months, as a result primarily of higher prices for energy products and unprocessed food. Price growth is expected to ease in the final months of the year.

The consensus forecast for average inflation in 2018 is unchanged at 1.7%; the forecast for core inflation has been revised downward by 0.1pp to 1.1%. The headline inflation rate is expected to dip to 1.6% in 2019, while core inflation is forecast to rise to 1.3%. The year-on-year rates of change in December of this year and next are currently forecast at 1.8% and 1.4%, respectively (Table 3).

The unemployment rate is coming down, albeit more slowly

According to the Social Security contributor figures, the rate of job growth weakened in July and August, extending the pattern of easing initiated in the second quarter of 2017. All sectors are losing momentum.

The consensus forecast for growth in employment is unchanged at 2.4% for 2018; the forecast for 2019 has been lowered by 0.1pp to 1.9%. Using the forecasts for growth in GDP, job creation and wage compensation yields implied forecasts for growth in productivity and unit labour costs (ULC): the former is expected to register growth of 0.3% in 2018 (down 0.1pp from the last survey) and 0.4% in 2019, while ULCs are expected to increase by 0.7% in 2018 and by 1.2% in 2019.

The average annual unemployment rate is expected to continue to decline to 15.3% in 2018 and 13.7% in 2019 (up 0.1pp from the last survey).

The current account remains in surplus

To June, Spain presented a current account surplus of 86 million euros, below the 5.75 billion euro surplus recorded in the first half of 2017, shaped by the drop in the trade surplus and increase in the income deficit.

Consensus forecasts for the current account balance point to a surplus equivalent to 1.4% of GDP in 2018 and 1.3% in 2019. Both estimates have been trimmed by 0.1pp since the last survey.

The public deficit will be larger than estimated

The public deficit to June (at all levels of government except for the local authorities) was 4.2 billion euros lower year-on-year thanks to faster growth in revenue relative to spending. The improvement came at the state, Social Security and regional government levels.

In the wake of the relaxation of the deficit targets, most members of the Panel believe that Spain will deliver on its target this year but not next. The consensus forecast for the 2018 deficit stands at 2.7% of GDP (up 0.2pp from the last survey); for 2019 it stands at 2%, 0.2pp above the new target.

Less benign external environment

The global economy continues to expand but growth is slowing and there are major differences from one country to the next. The normalisation of monetary policy underway in the US has prompted appreciation of the dollar with an impact on capital flows and the currency markets. The collateral damage in the emerging economies has been significant. The turbulence has affected the countries with the highest levels of dollar-denominated indebtedness, especially Argentina and Turkey. The damage has also extended to Brazil, Russia and South Africa, economies which may be bordering on recession.

Although there are also signs of weakening in Europe, they point to a soft landing. While the German engine remains dynamic, growth would appear to be easing in France. Italy is barely growing and the UK is shrouded in Brexit-related uncertainty.

The main international organisations see heightened trade protectionism as the key threat to global growth. Recent escalating tensions between the US and China are not helping to dissipate those risks. Lastly, oil prices are trading at high levels, albeit in line with those prevailing at the time of the last survey, at just under $80/barrel.

These factors are leaving the members of the Panel less optimistic about the external environment. Now, the majority believe that outside of Europe the environment is neutral or unfavourable. As for Europe, the analysts remain relatively upbeat. Their outlook for the coming months has not changed significantly with respect to the last survey. Although most of the analysts believe the external environment will remain unchanged in Europe and beyond, some think the situation will continue to deteriorate.

Interest rates expected to move gradually higher

The ECB has just lowered its forecasts for growth in the eurozone. Against this backdrop, and despite the slight uptick in inflation, Europe’s monetary authority continues to plan to gradually normalise policy. The Panel members are thus not expecting any change in the timing of benchmark rate increases compared to the last set of forecasts. They are virtually all expecting the rate hikes to begin in 2019 with most expecting this to happen in the second half of that year. Just one analyst thinks that the rate hikes will come sooner, namely in the second quarter (with none forecasting any earlier moves).

The expected increase in benchmark rates has begun to have an impact on market rates. 12-month Euribor has started to head north and the analysts believe it will be trading in positive territory from the second quarter of 2019 (no change from the last set of forecasts). The yield on Spain’s 10-year Treasury bond is expected to follow a similar pattern, increasing to nearly 2% by year-end 2019. That would still be a relatively low rate of interest, in line with what the economy demands.

Euro depreciation against the dollar may continue until 2019

The gap between European and US interest rates has impacted the capital markets and continues to exert pressure on the exchange rate. The euro is trading at around 1.16 dollars, which is similar to the rate prevailing at the time of our last publication. This means that it has depreciated by 7% from its annual high. The majority of analysts believe that the rates observed during the early part of this year will not be revisited until the end of 2019.

The majority of analysts believe that fiscal policy should be either neutral or tighter

The analysts’ assessment of monetary policy has not changed. All of the Panel members view it as expansionary and the majority think it should remain so during the months to come (no change from the last survey). Just one analyst believes that monetary policy should be more contractionary.

Fiscal policy, meanwhile, sparks a diversity of opinion. The analysts are split as to whether fiscal policy is expansionary or neutral. There is greater consensus regarding the appropriate direction for fiscal policy. Most analysts call for fiscal policy neutrality; four think it should be tightened; no-one believes it should be more expansionary (no major changes since our last Panel survey).

* The Spanish economic forecast panel is a survey of eighteen research services carried out by Funcas and presented in Table 1. The survey has been undertaken since 1999 and is published every two months during the first fortnight of January, March, May, July, September and November. Panellists’ responses to this survey are used to create consensus forecasts, which are based on the arithmetic mean of the eighteen individual forecasts. For comparison purposes the Government, Bank of Spain and main international institutions’ forecasts are also presented; however, these do not form part of the consensus.