Europe’s housing market: Historical trends and new challenges

Europe has experienced an uneven recovery in housing prices, with the emergence of real estate investment activity undermining the affordability of both rental and sales prices in major European city centres. However, another underlying factor, namely short-term tourist rentals, has proven particularly controversial, in the case of Spain, causing tension between municipal governments and anti-trust authorities.

Abstract: The European housing market has undergone an uneven recovery across the EU since the recent financial crisis. In countries, such as Spain and Ireland, the data indicate that a gradual recovery in housing prices began in 2014. However, other countries like the UK have experienced a much swifter market recovery. This has contributed to the impression that the Spanish and many EU housing sectors are on the rebound again. This situation has led to a deterioration in housing affordability. One explanation for this is the concentration of real estate investment activity in large cities, which has been driven by low interest rates and a lack of other investment opportunities. This activity has put pressure on both housing sales and rental prices in densely populated markets. It is also worth noting that price increases have occurred alongside the emergence of new online tourist accommodation platforms. While their impact is probably more pronounced in the hotel sector, in the case of Spain, these platforms have nonetheless initiated a confrontation between local governments and anti-trust authorities over their effect on housing affordability and the extent to which they should be regulated.

Introduction

Housing affordability has become a key topic of debate in Europe. Rising sale and rental prices as well as speculative moves in the housing market are historical trends in an industry subject to cyclical ups and downs. On the other hand, the competition from new online accommodation platforms and the housing affordability gap between generations constitute new challenges.

Usually, a financial crisis is followed by a correction in the housing market thereby improving affordability. While there was a price correction in many countries after the most recent financial crisis, housing costs have continued to rise in densely populated cities. It would require exhaustive analysis beyond the scope of this paper to identify the exact reasons for this phenomenon, however, low interest rates and scant investment opportunities are contributing factors. Numerous international investment funds (including some sovereign funds) have capitalised on medium- and long-term investment opportunities in major European property markets. Many of the properties purchased were foreclosed on by the banks and then sold off to reinforce the banks’ capital structures. This means that the bulk of these properties have re-entered the housing market with high rents. In many instances, these transactions were carried out by investment vehicles such as REITs (SOCIMIs is the Spanish acronym), thereby benefiting from a favourable tax treatment.

This paper analyses the state of play in the EU housing market with a particular focus on the Spanish market. Spain is worthy of analysis for at least three reasons. Firstly, its experience during the financial crisis was intrinsically linked with its real estate sector. Secondly, like other European countries, housing has become less affordable in Spain. Thirdly, there is marked tension between online accommodation platforms and the Spanish rental market. It is worth highlighting the fact that governments of all levels as well as anti-trust authorities have issued conflicting opinions on this issue. Consequently, this tension has become a topic of debate and is widely cited as a key reason for the rise in rental prices.

Although there are no official figures available in Spain, private sector data, such as those collected by Fotocasa, indicate that rental prices saw a record year-on-year increase of 8.9% in 2017. The results of a forward-looking study compiled by Fotocasa showed that only two out of every ten Spaniards now “firmly” believe that renting is a waste of money, while four out of ten think the rental market will continue to grow.

There are multiple theories regarding Spain’s increase in rental prices. One potential explanation is that the rise in sales’ prices has pushed up demand in the rental market. Recently, however, criticism has focused on the use of houses for short-term tourist rentals. As a result, some large cities have introduced regulations that penalise or ban the marketing of popular collaborative web platforms such as Airbnb. This has led to a conflict between municipal governments that have introduced these measures and anti-trust authorities which oppose them. In August 2017, Spain’s anti-trust authority, the CNMC, published a study that examined how these short-term holiday rentals might best be regulated. In general terms, this report concludes that the benefits associated with online rental platforms outweigh any negative effects. Nevertheless, others have remained unconvinced and have advocated for the use of price controls (price caps or restricted areas).

Housing prices in Spain: Relative reheating

As shown in Table 1, housing prices have performed unevenly across the EU. Looking at the quarter-over-quarter changes in prices between the first quarters of 2017 and 2018, it becomes clear that housing prices have behaved erratically, with ups and downs that are not only attributable to seasonal factors but also indicative of a market whose medium-term trend has yet to be defined. In countries, such as Spain, Ireland and the UK, where the real estate bubble triggered a sharp price correction, the market has since exhibited strong growth. Nevertheless, the recovery has been punctuated by peaks and troughs, with the former dominating. Ireland stands out with growth in housing prices exceeding 5% in some quarters. In other countries, such as Germany and France, previous concerns over “reheating” have abated as prices have cooled off or even contracted.

Conversely, housing prices in Croatia, Latvia, Lithuania, Hungary and Iceland have exhibited less stable growth rates. Spain falls somewhere in the middle with average or moderate growth that is consistent with a gradual sectoral recovery.

The long-term trend is more apparent in year-on-year price changes. Table 2 outlines these trends from 2015 to the first quarter of 2018. Latvia, Iceland, Slovenia, Ireland, Portugal, Slovakia and Hungary posted double-digit annual growth rates in house prices during 1Q 2018. Here again Spain lies somewhere in the middle, having recorded year-on-year price growth of 6.2% in the first quarter. This stands slightly above the eurozone (4.5%) and EU averages (4.7%). In terms of sustained price contractions, Italy’s growth rates are particularly noteworthy.

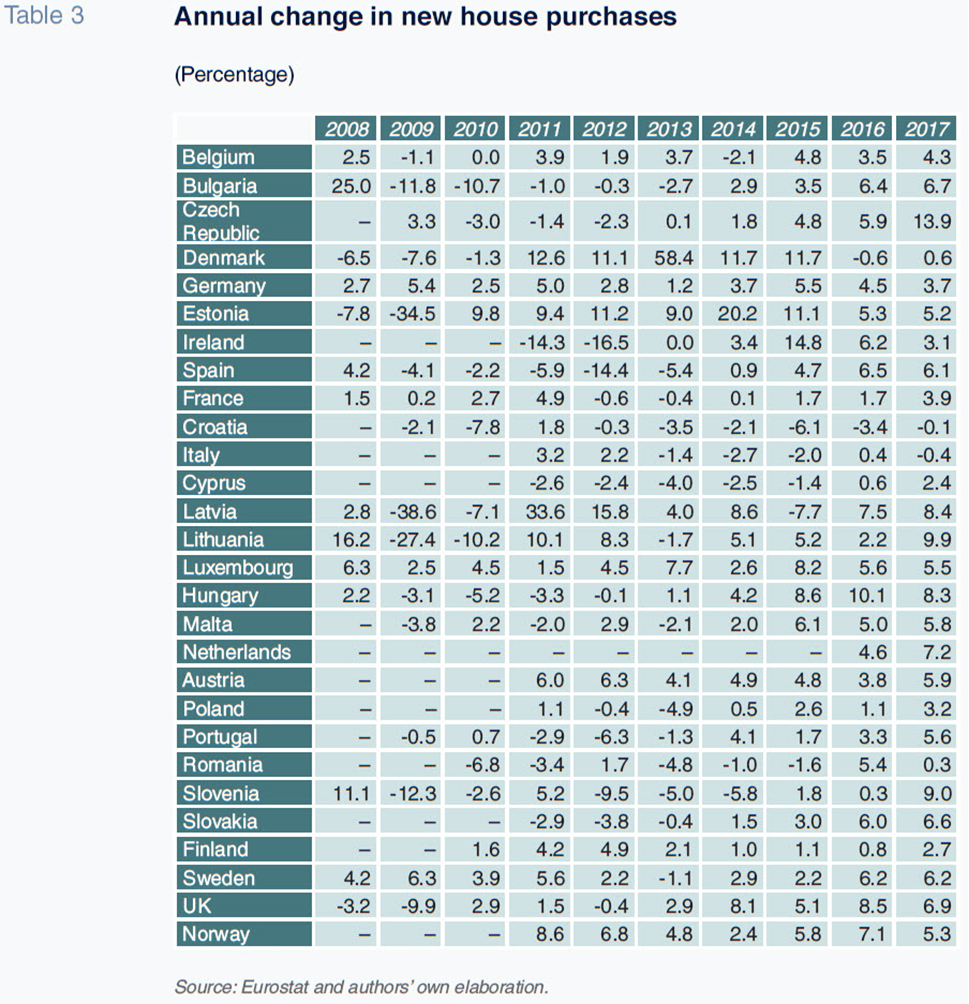

The variability observed in house prices is mirrored in transaction volumes, for which we have a longer series of methodologically-homogeneous data. House purchases during and since the crisis (2008-2017) offer compelling insight into the correction of various housing markets. It is worth highlighting that in the UK, where the financial crisis was preceded by a housing price bubble , the appetite for home-buying returned relatively quickly. This is made evident by the fact that, with the exception of 2012, home purchases have risen year-on-year since 2010 (Table 3). However, the rate of change in Spanish and Irish house purchases didn’t return to positive territory until 2014. In certain countries like Estonia, Latvia and Lithuania, which saw house purchases contract sharply during the crisis, there has also been a considerable recovery in transaction volumes in recent years. While the size of the decline in house purchases in Italy is not particularly remarkable, it has continued unabated, suggesting that the Italian property market remains depressed. Germany stands out for its stability with transaction volumes registering growth of between 2% and 5%.

Qualitative considerations and emerging trends: Housing quality, gentrification and the rental market

One challenge in correctly identifying real estate trends is the difference between the prices observed in large cities relative to medium- and small-sized towns. The averages shown in the previous tables are significantly influenced by price trends in major cities. The impact is most obvious (albeit not exclusively) in the considerable reduction in the affordability of housing in these cities over a short period of time. This in turn has had a negative impact on living conditions in these cities. Eurostat data indicate that although the crisis initially drove the incidence of housing overcrowding higher, it has since corrected. This is despite the fact that prices have increased in many countries.

Table 4 compares the rates of overcrowding

[1] in 2008 to those of 2017. The ratio is very high in some of the easternmost EU member states. Specifically, it stands at over 40% in Romania, Bulgaria, Latvia, Croatia, Hungary and Poland. With an overcrowding rate of 27.8%, Italy is one of the member states where this ratio has deteriorated since the crisis. Spain, however, boasts one of the lowest rates of overcrowding (5.1%) and ranks considerably below the EU (16.4%) and eurozone averages (12.3%).

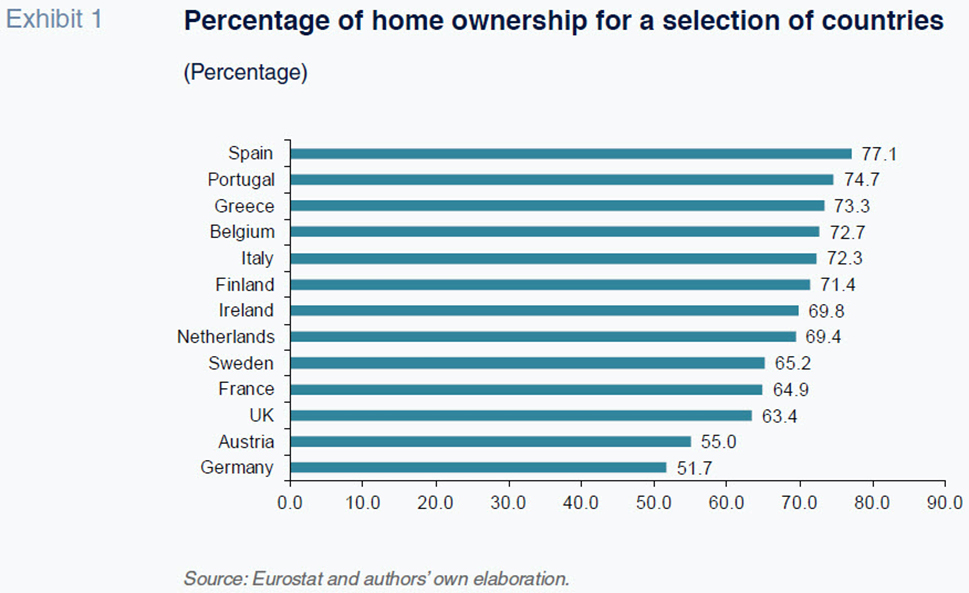

One unique aspect of these long-standing historical and cultural roots is the percentage of the population that owns their dwellings. Exhibit 1 provides this percentage for a selection of EU countries. Spain is notable for the fact that 77.1% of the population own their own home. However, the rising popularity of rentals means this figure has recently dropped from over 80%. Spain’s situation contrasts with that of other major eurozone economies such as the UK (63.4%) and Germany (51.7%), where the incidence of home ownership is lower.

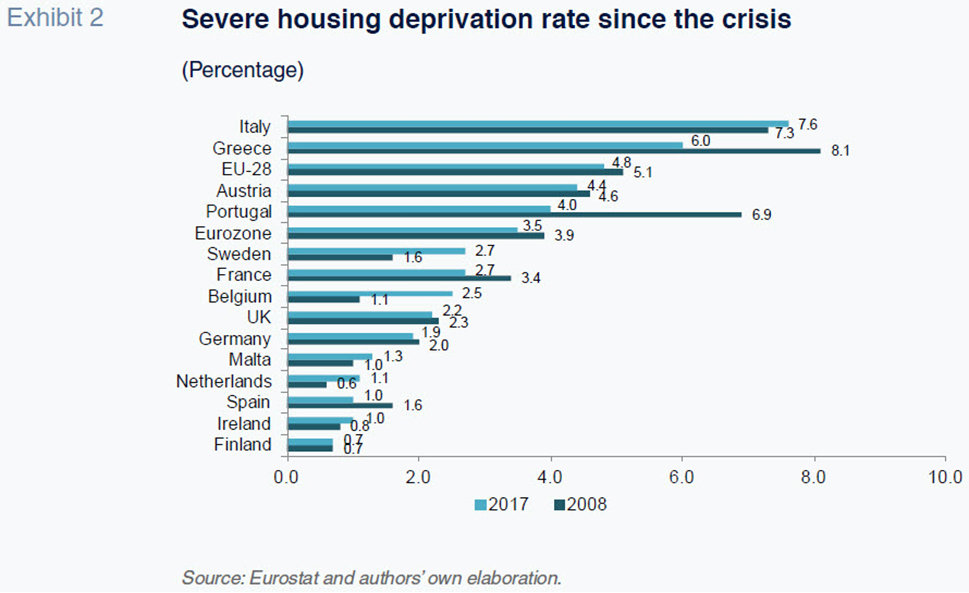

As noted earlier, the housing affordability problem is concentrated in Europe’s major cities. This issue is even more pressing in these cities’ central neighbourhoods. Many of these cities are experiencing gentrification, a phenomenon related to the rental and purchase price problems. Gentrification takes place when the highest income households gradually buy up properties for refurbishments or crowd out lower-income tenants by increasing rents. This has the effect of gradually displacing households which cannot afford the higher costs of home ownership. Gentrification is accelerating as investment funds enter to purchase large numbers of these properties. They are drawn by attractive post-crisis return prospects, which then spill over to the rental market in the form of higher prices. This has occurred alongside other financial troubles brought on by the crisis, including evictions. Eurostat tracks data on the percentage of the population experiencing severe housing deprivation.

[2] Exhibit 2 provides this rate for a sample of representative EU economies from 2008 to 2017. At 7.6%, Italy’s rate, which has increased since the crisis, is particularly alarming. The EU and eurozone averages are 4.8% and 3.5%, respectively. In other countries, such as Austria and Portugal, the rate remains around 4% but has at least come down since the crisis. Spain, on the other hand, has an average rate of 1%, making it one of the countries with the lowest incidences of severe housing deprivation.

As for prices per square metre in major European cities (Exhibit 3), it is worth highlighting the case of central London, where Deloitte estimates this figure has reached 16,538 euros. It is followed by Paris (excluding Île-de-France), at 12,374 euros per square metre. Barcelona and Madrid rank somewhere in the middle at 4,008 and 3,353 euros, respectively.

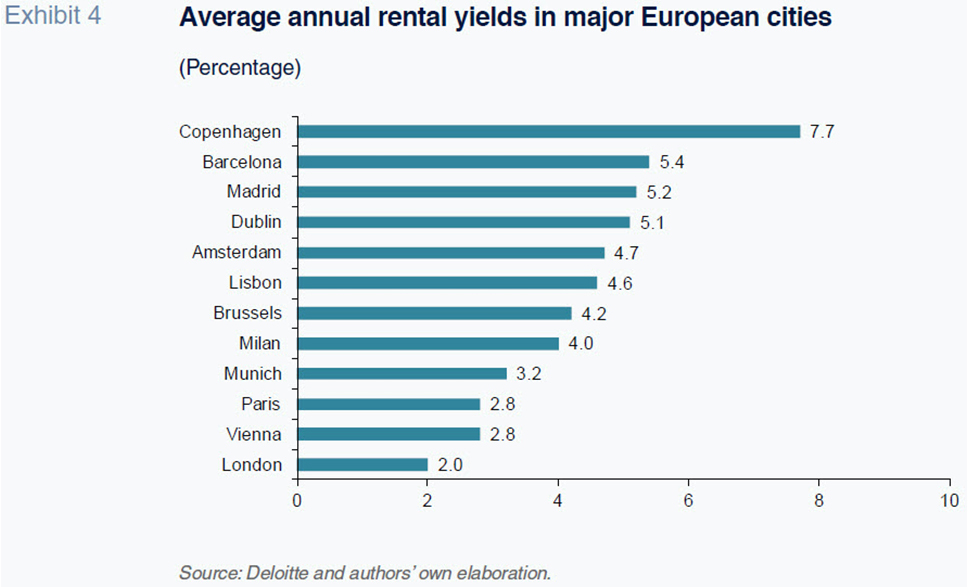

However, at 5.4% and 5.2%, Deloitte also estimates that Barcelona and Madrid are among those European cities with the highest average rental yields (Exhibit 4). Notably, these average rental yields are higher than both Paris (2.8%) and London (2%).

Final considerations: Snapshot of Spain and the rental problem

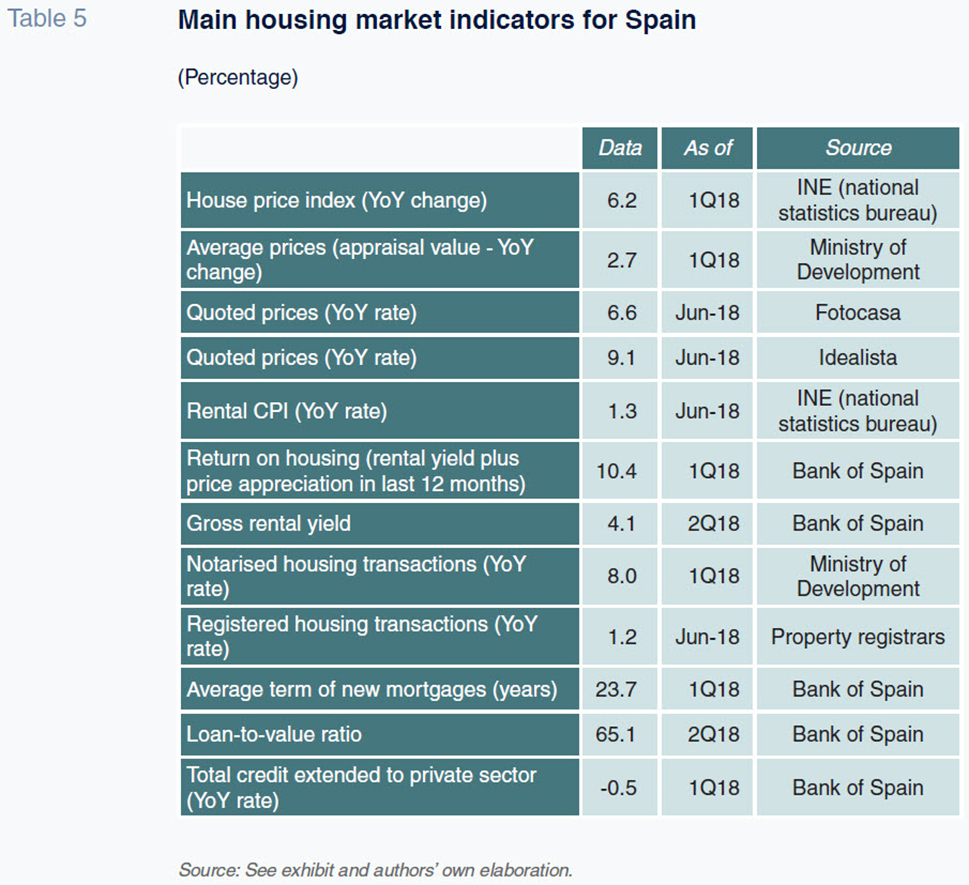

Is the growth in rental prices a new issue in Spain? Are short-term tourist rentals responsible for the changes being observed? Table 5 offers a summary of indicators aimed at providing a snapshot of the Spanish property market in 2018, with time horizons and exact sources included where appropriate. Note that in light of discrepancies in the official statistics, it was necessary to use a mix of sources in order to provide a relatively comprehensive overview of the market, particularly as regards prices. For example, there as considerable differences in the figures provided by the INE, the national statistics bureau (based on transaction deeds), and those provided by the Ministry of Development (based on appraisal values). An average estimate puts the year-on-year change in Spanish house prices between 6% and 9% as of June 2018.

The consumer price index for rental prices stood at 1.3% in June 2018, even though yields exceed that amount. The Bank of Spain estimates that if rental income and property price growth are both factored in, returns reached 10.4% during the first quarter of 2018. Looking at rentals alone, the yield falls to an estimated 4.1%.

As for purchase volumes, the rate of change depends on the source and time horizon used and the series are full of gaps. It is therefore difficult to determine whether the recovery in prices has been accompanied by a recovery in transaction volumes. A comparison between the number of mortgages versus registered house purchase contracts (not provided for simplicity) reveals that a large number of transactions are completed without bank financing, which is usually an indicator that the buyers are institutional investors rather than households.

As for the mortgage market, the volume of credit extended to the private sector continued to decline by 0.5% in the first quarter of 2018. Mortgages are currently being contracted for an average term of 23.7 years. Lastly, the average loan-to-value (LTV) ratio stands at what could be termed a prudent 65.1%.

The data above suggest that the Spanish real estate market is experiencing an uptick in rental yields and a gradual recovery (more pronounced in prices than affordability or transaction volumes) in the wake of the financial crisis. This has sparked debate about the state of the rental market, potential policies to improve housing affordability, and the role that online rental platforms may be playing in the price increases. Like other sectors, the real estate market needs incentives and rules to prevent irresponsibility from overpowering the common good. Aside from a limited degree of coastal protection, Spain has initiated few reforms of its land laws and building tax measures. There has been considerable growth in listed real estate investment funds (REITs or SOCIMIs for their acronym in Spanish), which dominate Spain’s alternative stock market. These companies benefit from tax advantages which could be fuelling speculative activity and placing upward pressure on rental prices. That said, a more exhaustive analysis would be required to confirm this hypothesis.

As for short-term tourist rentals, it is also conceivable they are affecting housing costs, though the overall impact may be less significant than often claimed. Instead, these platforms may be exerting a greater influence over the hotel sector. What is important is making sure that these rentals are legally secure and transparent tax-wise. Indeed, steps have already been taken to address these issues. For example, starting in 2019, online platforms will be required to provide Spanish tax authorities with customer data.

As a result of the controversy over how to handle tourist rentals, municipal governments in major European cities, such as Madrid and Barcelona, have imposed limits or outright bans on these rentals. However, the CNMC report mentioned earlier in this article argues that the benefits associated with these short-term tourist rentals considerably outweigh their disadvantages. Among the advantages, the anti-trust authority’s report cites the fact that these digital platforms provide the “possibility of checking and comparing the characteristics of the accommodation on offer online” and the “reduction in transaction costs by means of transaction-facilitating electronic payment systems”. It also refers to the “fact that they allow individuals to enter the market despite not having the resources of traditional firms such as sales experience or the wherewithal to accept payment, execute a contract, create a brand or hold insurance”. Lastly, the CNMC notes that the “platforms significantly reduce the long-standing issue of information asymmetry (…) thanks to the reputation tracking measures embedded, providing users with feedback about the accommodation and how it has been rated by other users”.

However, the report does acknowledge certain disadvantages. These include “those deriving from the growth in tourism, such as congestion, noise and the consumption of environmental resources”, as well as the possible effect on “the price of housing (for rent and purchase) in certain areas of the city, particularly in the city centres.” On this last and important point, it notes that there is “no conclusive evidence since, although housing prices have risen across the board in Spain in recent years, this is attributable to a number of economic factors, including tourist rentals; it is hard to ascertain just how much each factor has contributed to the price growth”.

In short, it is necessary to contemplate the state of the Spanish housing market as a whole. Absent more exhaustive analysis, tourist rentals alone cannot be blamed for a significant share of the growth in prices in either the house ownership or rental segment. What does seem certain is that although Spain remains a country of home owners, Spaniards are increasingly entering the rental housing market (particularly in big cities). Similar to other international locations, rent controls have been touted, even though the international experience with such measures is not particularly positive (Diamond et al., 2017).

As seen in other service and industrial sectors, technological transformation brings both opportunity and controversy. The challenge is to strike a balance so that the trend towards digitalisation is accompanied by fair competition, tax and employment rules.

Notes

For Eurostat, a person is considered as living in an overcrowded household if the household does not have at its disposal a minimum number of rooms equal to: one room for the household; one room per couple in the household; one room for each single person aged 18 or more; one room per pair of single people of the same gender between 12 and 17 years of age; one room per pair of children under 12 years of age.

The severe housing deprivation rate is defined as the percentage of the population living in a dwelling which is considered overcrowded, while having at the same time at least one of the following aspects of housing deprivation: the lack of a bath or a toilet, a leaking roof in the dwelling, or a dwelling considered too dark.

References

DIAMOND, R.; MCQUADE, T., and F. QIAN (2017), The Effects of Rent Control Expansion on Tenants, Landlords, and Inequality: Evidence from San Francisco. December 27th, 2017, mimeo. Standford University.

Santiago Carbó Valverde. CUNEF, Bangor University and Funcas

Francisco Rodríguez Fernández. Granada University and Funcas