SOCIMI impact on Spain´s real estate market

Only several years in existence, Spain´s listed real estate investment vehicles, known as SOCIMI, are generating a lot of attention and channelling significant sums of both local and foreign investment into Spain´s real estate market. Although it is still too premature to draw definitive conclusions, if current investment trends continue, the recent recovery in the real estate sector could expect to gain further momentum.

Abstract: There are currently 19 SOCIMI – real estate investment vehicles – listed on Spain´s stock markets. Between them, they boast a market capitalisation of over 7 billion euros and total assets of more than 9 billion euros. Based on 2015 figures, two-thirds of the increase in the real estate sector’s market cap since the lows of May 2012 is attributable to SOCIMI. Although it is still too soon to draw conclusions regarding SOCIMI’s real merit in reactivating the Spanish real estate market, the momentum in these entities’ share prices, their substantial market caps and their recent investments in rental properties (offices, retail premises and hotels) suggest that SOCIMI’s investors are expecting their properties to revalue – mirroring the trend in the sectors of the economy underpinning the recovery underway.

Regulation of Spain’s SOCIMI, listed real estate investment vehicles, broadly equivalent to REIT, or Real Estate Investment Trusts, dates back to 2009; however, it was not until 2013 that they emerged as major vehicles for investing in real estate in Spain. Since then, almost 20 of these entities have become listed, channelling a significant sum of investment into real estate assets (generally non-residential) and attracting international investors to the construction and real estate services sectors once again. This article analyses these vehicles’ main characteristics and takes a look at their recent stock market performance and their role in reactivating this important sector of the Spanish economy.

SOCIMI penetration of the Spanish real estate market

Spain introduced SOCIMI in 2009

[1] with the overriding goal of injecting liquidity into real estate assets against the backdrop of a widespread recession, which had hit the real estate market particularly hard. However, it was not until 2013, which is when the original regulations were amended,

[2] that these vehicles began to take off. As mentioned above, SOCIMI are similar in structure to REIT, developed earlier in the US and other European markets, such as the UK and France.

The corporate objective of a SOCIMI is to “invest, directly or indirectly, in urban real estate assets, including housing, retail premises, residences, hotels, garages and offices, among others, for the purpose of renting them.” They operate by raising financing from investors – institutional and/or retail investors – which they then invest in properties earmarked for rental.

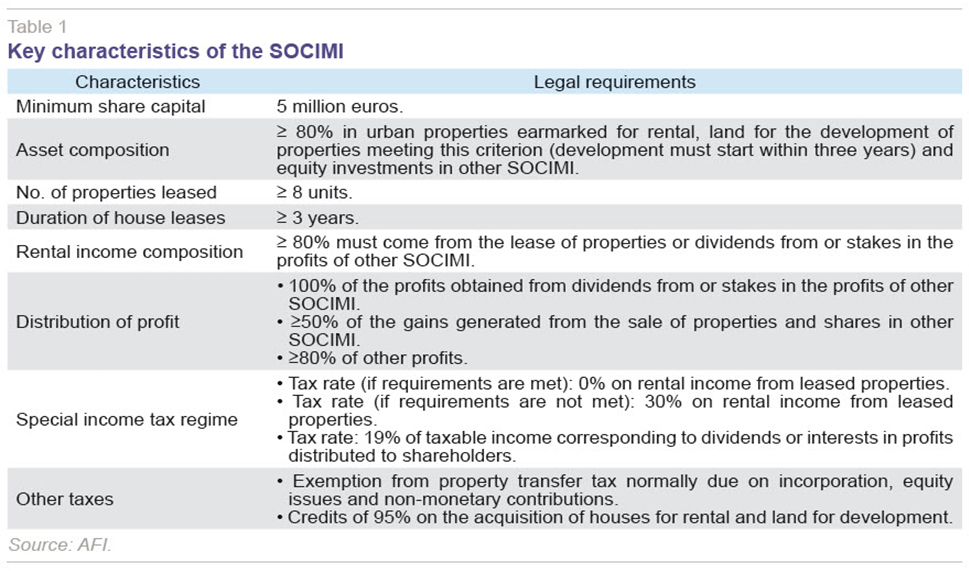

SOCIMI are public limited companies (

sociedades anónimas) that are traded on either the continuous market or Spain’s alternative stock market (hereinafter, the MaB in its acronym in Spanish). They must have share capital of at least 5 million euros and at least 80% of their assets must be real estate assets earmarked for rental. These properties must be held for rental for at least three years. There are no restrictions on SOCIMI’s leverage but they are required to distribute part of their rental income (at least 80% of rental income and 50% of gains from disposals) in the form of dividends. They benefit from a favourable tax regime, barely paying any taxes.

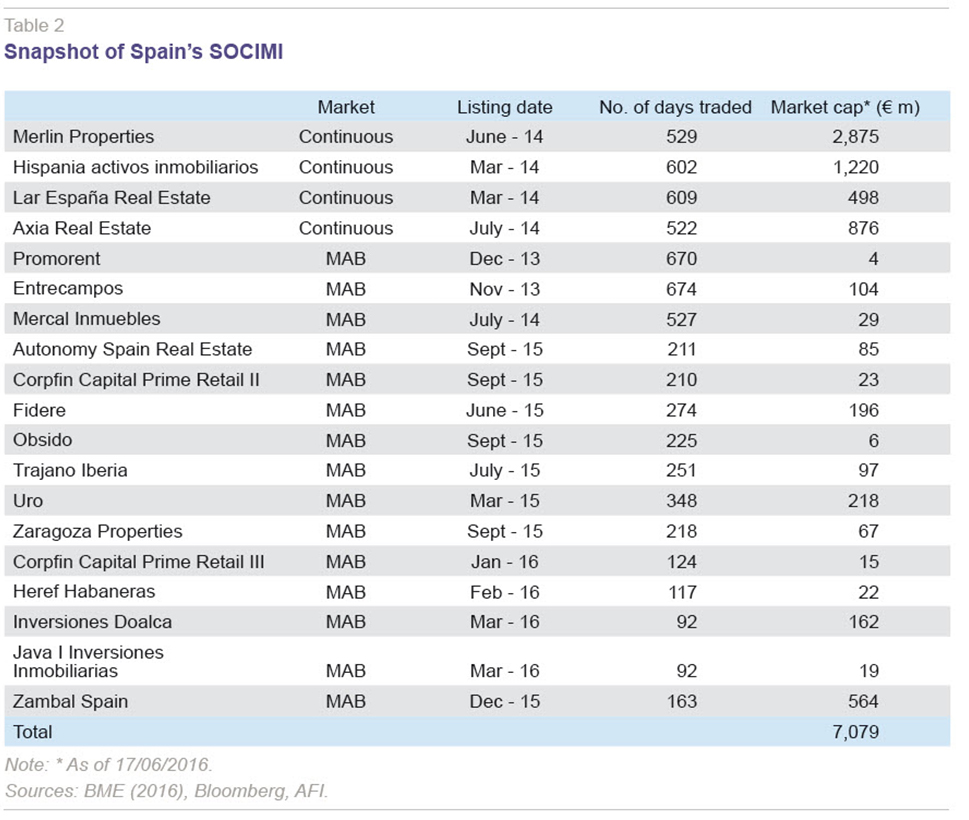

There are currently 19 SOCIMI trading in Spain, 15 of which trade on the MaB,

[3] while the bigger firms (Merlin Properties, Lar España, Axia Real Estate and Hispania) are traded on the main market. Between them, they boast a market capitalisation of over 7 billion euros and total assets of more than 9 billion euros. Based on 2015 figures, two-thirds of the increase in the real estate sector’s market cap since the lows of May 2012 is attributable to the SOCIMI.

Only several years in existence and having proven capable of drawing remarkable interest from foreign investors (particularly in the case of those listed on the main market), the SOCIMI appear to be playing a significant role in reactivating the real estate market. The benefits the SOCIMI offer investors in terms of taxation, diversification and liquidity, coupled with the flexibility they afford as a real estate investment vehicle, mean we are likely to see continued growth in the number of SOCIMI in the years to come.

The role played by SOCIMI in shaking up the real estate market

The interest sparked by the SOCIMI in the financial community in the last two years is evident in their stock market performance. Their annualised monthly share price gain from IPO to date averages 6.0%, amply evidencing investor appetite in this segment. These vehicles unquestionably constitute a real alternative for investors in light of the performance and returns offered by other asset classes and markets. The rental yield on housing, for example, stood at 4.5% in 2015, which is far higher than the returns offered by other classes of financial assets, such as fixed income (the yield on the Spanish 10 year bond barely inched above 2% in the secondary market), term deposits (which offered annual remuneration of a scant 0.5%) and equities (1%).

This strong stock market performance is underpinned by: (i) the upward trend in rental yields; and (ii) the outlook for rental property revaluation.

Rental income is shaped mainly by the class of assets leased and where the assets are located.

First of all, virtually all of the SOCIMI’s real estate assets are located in city centres (often in prime locations) or close by (although increasingly these vehicles are looking for assets in areas further removed from centres of economic activity), typically generating higher rents than if the assets were located in other locations.

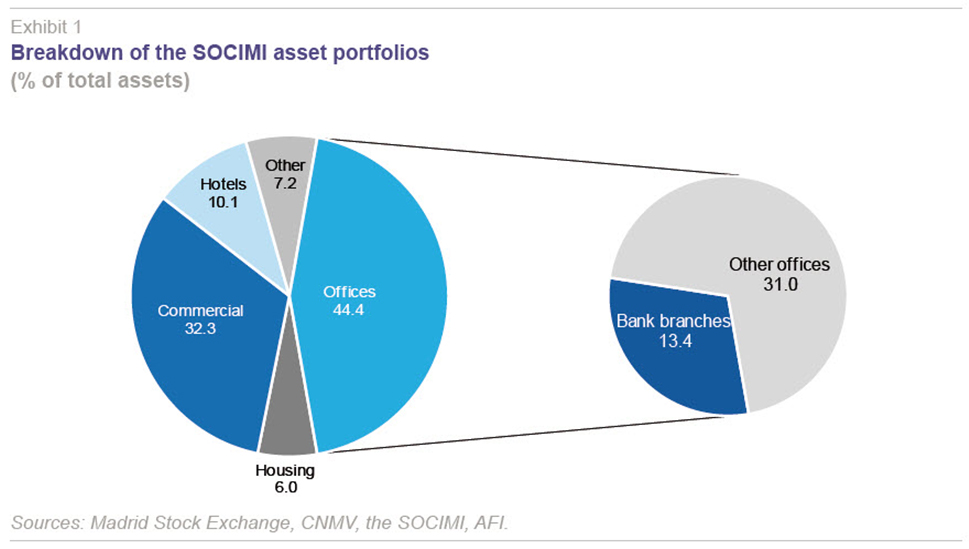

Secondly, the SOCIMI have concentrated their investments in: (i) offices (which represent nearly 45% of all leased real estate assets); (ii) retail premises (which represent nearly one-third of the total) and (iii) hotels (a little over 10% of the total), mirroring the sectors of the economy underpinning the recovery underway, in turn paving the way for relatively higher and/or rising rents. Some of the key drivers are itemised below.

In terms of the office segment, the economic recovery has boosted the creation of new jobs and new companies (employment increased by 3% in 2015, while the number of companies, according to the national statistics bureau, increased by 2.2% year-on-year) and driven growth in the profitability of Spain’s non-financial corporates (4.4% in 2015). These factors have prompted a search for more and better workplaces and renting has emerged as a good alternative to the upfront outlay required to acquire a property, particularly in the case of start-ups.

Retail premises, meanwhile, have benefitted from the growth in household consumption, which jumped 3.1% year-on-year in 2015. This growth in consumer spending has been channelled mainly into large retail establishments (whose sales rose by 4.1% in 2015, compared to 2.6% in the case of smaller retailers), precisely the category in which the SOCIMI have been investing during the last two years.

Lastly, the hotel segment, relatively less important in the SOCIMI’s asset portfolios, looks set to grow in weight in light of the tourist flows and expenditure benefitting the hotel sector (particularly foreign tourism). In 2015, more than 68 million tourists visited Spain (marking an all-time record) and spent nearly 3% more per visitor than in 2014. Geopolitical tensions in countries with which Spain shares certain characteristics (climate, cultural attractions, etc.), coupled with an improved hotel offering, are two of the factors drawing international tourists and the SOCIMI are beginning to take note.

As stated previously, the growth in demand for these three asset classes, which is also evident in relatively higher occupancy rates, is mirrored by the trend in the yields associated with each. According to CBRE (2016), yields continued to rise in 2015, to the tune of 4% in the case of offices (annual growth) and 5% in the case of shopping centres, albeit slowing with respect to prior years.

Strong investment in non-residential real estate assets in the past two years evidences the SOCIMI’s positive valuation expectations for these classes of properties. Recall that under prevailing sector regulations, the SOCIMI can sell these properties and benefit from the resulting capital gains three years after their acquisition and lease. In 2015, again according to CBRE data (2016), investment in these asset classes reached 13 billion euros (an all-time high), at least 40% of which was invested by the SOCIMI.

Although it is still too soon to tell definitively whether the SOCIMI are truly reactivating the Spanish real estate market, on account of their short existence, among other factors, their recent investment track records, share price performances and market caps point to upside in the valuations of the assets they are investing in. Very welcome news for the construction and real estate services sector, which continued to account for 17% of Spanish GDP in 2015, despite having contracted sharply in the wake of the crisis.

Conclusions

Although Spain first regulated SOCIMI in 2009, they did not emerge as important real estate investment vehicles until 2013. Today, a total of 19 SOCIMI are traded in Spain, four of which are listed on the main market and 15 on the alternative market.

Although it is still too soon to say to what extent the SOCIMI have contributed to reactivating Spain’s real estate market, their stock market momentum (the annualised monthly gain between their respective IPOs and today averages 6%), their sizeable market cap. (7 billion euros) and their recent investing track record (9 billion euros in real estate assets) evidence positive investor expectations regarding the valuations of the properties they are leasing (mainly offices, commercial premises and hotels).

If this proves to be the case, recent real estate sector momentum, in terms of sales, business volumes and asset prices, could gain further traction.

Notes

For further information, see Spanish Law 11/2009, of October 26th, 2009, regulating SOCIMI.

For further information, see Spanish Law 12/2012, of December 27th, 2012, enacting several fiscal measures designed to further the consolidation of public finances and shore up economic activity, the legislation which ultimately paved the way for the development of these vehicles.

The SOCIMI listed on the MaB as of June 2016 are Promorent, Entrecampos, Mercal Inmuebles, Autonomy Spain Real Estate, Corpfin Capital Prime Retail II, Fidere, Obsido, Trajano Iberia, Uro, Zaragoza Properties, Corpfin Capital Prime Retail III, Heref Habaneras, Inversiones Doalca, Java I Inversiones Inmobiliarias and Zambal Spain.

References

BME (2016), 2015 Market Report. Spain’s Securities Markets in Review.

CBRE (2016), Spain Real Estate Market Outlook 2016.

GARCÍA MONTALVO, J. (2015), “Spanish financial sector and real estate exposure: situation and outlook,” Spanish Economic and Financial Outlook, No. 248, September-October: 71-87.

PEÑA, I. (2016), “SOCIMI: Real estate market investment vehicle,” Empresa Global, No. 161, April: 39-41.

Noelia Fernández and María Romero. A.F.I. - Analistas Financieros Internacionales, S.A.