Recent evolution of enterprises’ access to bank finance: Spain in the European context

Spanish SMEs’ access to finance and financing conditions deteriorated significantly throughout the crisis, exacerbated by financial fragmentation in European markets. Since then, however, their access to credit has progressively improved.

Abstract: SMEs in Spain account for 99.9% of businesses and contribute 73% to employment and 63% to GVA, making it extremely important that SMEs be able to access bank finance, their main source of credit, on favorable terms. Conditions on which Spanish SMEs were able to access finance worsened drastically with the onset of the crisis and reached worrisome levels in 2012 with European financial market fragmentation. But since then, according to ECB survey data, Spanish SMEs´ access to credit has progressively improved. Specifically, the latest ECB survey on enterprises’ access to financing, published in June 2016, shows that access to bank credit has improved in Spain. Access to finance is no longer a major problem for Spanish SMEs and availability of bank loans and some conditions, such as interest rates and loan/credit size, have also improved (albeit collateral requirements and fees appear to be on the rise). If progress continues to be made towards European Banking Union, the economic recovery consolidates, and the ECB’s liquidity support and monetary measures are effective, enterprises’ conditions of access to bank credit should continue to improve.

[1]

SMEs play a key role in Europe’s business structure yet they continue to face constraints obtaining finance. For this reason, since 2009, the European Central Bank (ECB) has been tracking the issue of SME access to finance through its six-monthly “Survey on the access to finance of enterprises in the euro area” (ECB, 2016a). The survey offers aggregate information on euro-area averages, with a breakdown by country and firm size. This is essential information when analysing the importance of business size in determining financing conditions and the differences that exist between countries.

The outbreak of the international financial crisis in 2007 resulted in a tightening of borrowing conditions for businesses and broke the trend towards financial integration that began in 1999 with the launch of the euro. But it was the sovereign-debt crisis in 2010 that segmented the European financial market most, with fragmentation reaching a peak in the summer of 2012. The subsequent divergence in borrowing conditions (affecting both public and private borrowing) between countries badly hit by the crisis and those that were relatively unscathed lead the ECB, the European Commission, the European Council and the Eurogroup to unanimously back the so-called four presidents´ report, which contemplated the creation of a European banking union (European Council, 2012). With the announcement of the banking union project, together with the ECB´s measures, financial fragmentation began to narrow.

The ECB’s latest report in April 2016 on European financial market integration (ECB, 2016b) highlights that since mid-2012, the integration processes has recovered, although still remaining well below pre-crisis levels. In the case of banking markets, there are still major differences between peripheral countries and other euro-area countries in terms of their conditions of access to credit.

The ECB’s reports offer a similar view on firms’ access to finance: the crisis represented a deterioration in access to finance that was much more intense in those countries worst affected by the sovereign-debt crisis. Although conditions have improved, such that in the most recent survey in June 2016 only a small percentage of European SMEs (10%) reported access to finance as their main problem, major differences persist between countries, with a range of variation between a minimum of 6% (Austria) and a maximum of 31% (Greece).

Against this backdrop, this article sets out to analyse Spanish firms’ conditions of access to bank finance relative to the euro area, using the ECB’s most recent survey, which was published in June 2016 and covers the period from October 2015 to March 2016. Before comparing the situation of SMEs, the ECB reports information on firm size, which allows us to compare the position of SMEs (less than 250 employees) and large firms. Within the SME category, it distinguishes between microenterprises (up to 9 employees), small businesses (between 10 and 49 employees) and medium-sized enterprises (between 50 and 249 employees). We will focus here on the period between the second half of 2012, which coincides with the Four Presidents’ Report supporting EMU, and the turning point in the process of reversing financial fragmentation.

Once again, the results show the importance of firm size in determining the conditions of access to finance, with the smallest firms (micro-enterprises, having less than 10 employees) facing the worst conditions. Access to bank finance has improved so strongly that in the ECB’s most recent survey, only 10% of Spanish SMEs considered it their biggest problem — a percentage similar to that in other euro-area countries. Conditions have also improved in terms of lower interest rates and larger average credit line and loan sizes. However, more businesses consider additional costs of borrowing (such as fees and commissions) and collateral requirements to have increased than consider them to have decreased. The greater availability of credit is set to continue as the difference between the percentage of Spanish SMEs expecting credit to increase over the coming months and the percentage anticipating that it will drop is 27.7 pp, almost three times the figure for euro-area SMEs.

With these aims, this article is structured as follows: The next section looks at the importance of access to banking credit among the main problems facing businesses. The subsequent section analyses the changes in the availability of bank loans and enterprises’ opinion of banks’ willingness to lend. The following sections offers evidence on the changes that have taken place in the conditions of access to bank finance in terms of interest rates, other costs of borrowing, collateral requirements, and loan and credit line size. We then examine firms’ expectations regarding bank loans availability over the next six months, and we close the article by presenting some main messages and conclusions.

What is the main problem faced by Spanish businesses?

A clear indicator of the tougher financing conditions for Spanish SMEs at the start of the crisis was the high proportion that considered it their biggest problem, ahead of finding customers or the strength of competition. Specifically, in the second ECB survey referring to the second half of 2009, access to finance became the main problem for 34% of Spanish SMEs (compared with 19% in the euro area), 2.6 percentage points (pp) ahead of the problem of finding customers.

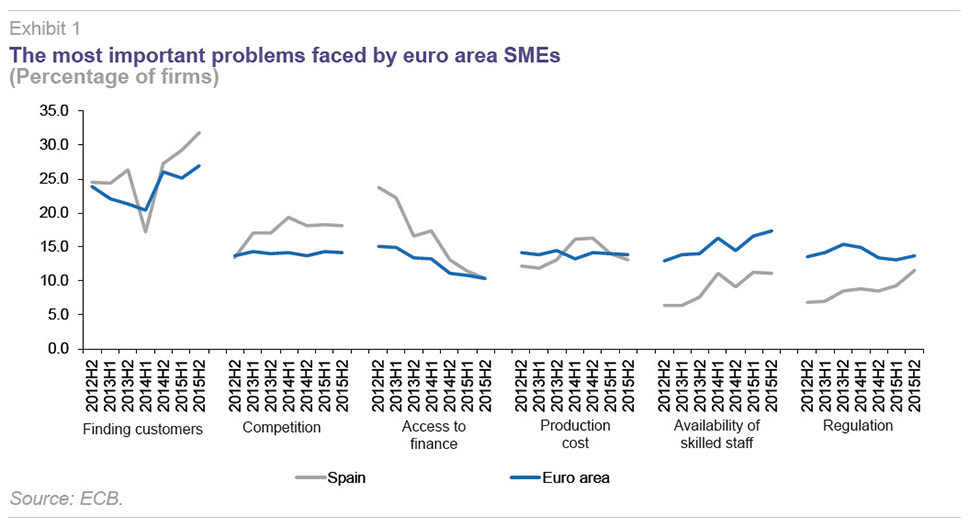

In the latest survey, recently published with data for 2016 (Exhibit 1), the main problem Spanish SMEs face is finding customers (reported by 31.7% of businesses, 4.8 pp more than those elsewhere in Europe), followed at a distance by competition. Access to finance is only the main problem for 10.3% of SMEs, behind that of production costs (13%), regulation (11.5%) and the availability of skilled staff or experienced managers (11.1%). Therefore, of the problems indicated in the latest ECB survey, access to finance is currently the least important, with a value similar to that of other euro-area SMEs for the first time since the ECB starting reporting this information.

One point that stands out in the latest survey is that the biggest difference between Spanish SMEs and those elsewhere in the euro area in terms of their most serious problem is the availability of skilled staff or experienced managers, where Spain is 6.2 pp below the euro-area average. The fact that Spain has the second highest unemployment rate in the euro area, behind only Greece, undoubtedly contributes to this.

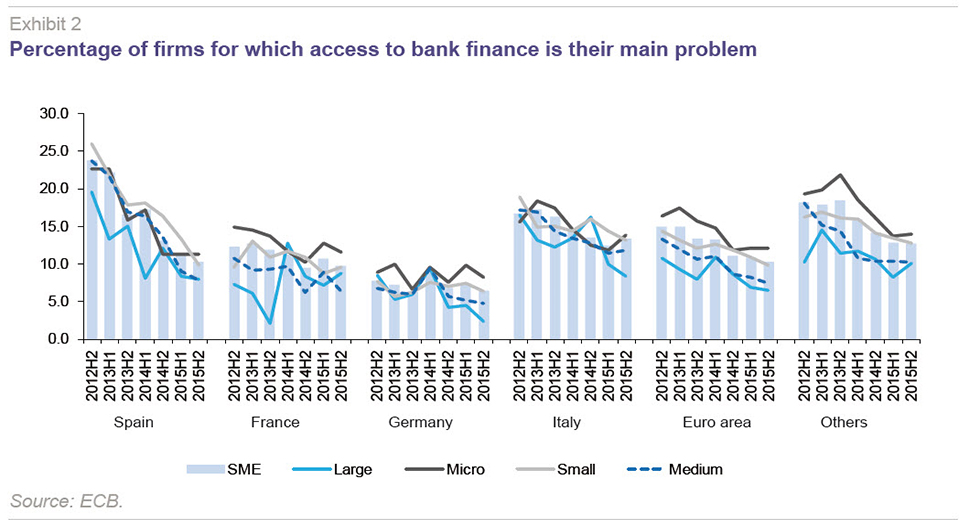

Focusing on access to finance, Exhibit 2 shows information from the main euro-area countries (Germany, France, Italy and Spain), and the averages for the euro area and other countries, distinguishing between different sizes of business.

Spain’s SMEs have seen their situation improve most since 2012, with the number identifying access to finance as their main problem falling by more than half (from 23.8% to 10.3%). As noted, the percentage is currently similar to the euro-area average, and below the figure for Italy, although 4.9 pp higher than in Germany and 0.6 pp higher than in France.

One point that stands out is that there has been a narrowing of the gap between SMEs and large corporations in Spain in terms of their perception of access to finance as being their main problem. In the latest survey, this gap was 2.4 pp, compared to a difference of 9.2 pp in the first half of 2014. This is now smaller than the euro-area average (a gap of 3.8 pp), Germany (4.1 pp) and Italy (5.1 pp), although it is higher than in France (1 pp).

There has also been a significant improvement in the case of large Spanish corporations, as between 2012 and 2016 the percentage reporting access to finance as being their main problem has dropped from 19.6% to 7.9%. Nevertheless, despite the drop, the percentage still exceeds the euro-area average (7.9% vs. 6.5%), and is above the figure for Germany (2.3%). However, it is below that for France (8.7%), Italy (8.3%), and the other countries (10.1%).

Although in general terms SMEs are considered to be at a disadvantage compared to large corporations when it comes to obtaining finance, SMEs as a group comprise businesses of a variety of difference sizes. In Spain, microenterprises (fewer than 10 employees) are particularly significant, accounting for 94.6% of all Spanish SMEs and for 41.6% and 55.4% of SMEs’ gross value added and employment, respectively.

In both Spain and the euro area, the percentage of micro-enterprises pointing to access to finance as their main problem exceeds that of other business sizes. In Spain, the figure is currently 11.4%, compared with a 10.3% average for SMEs. This is 3.6 pp higher than the case of medium-sized businesses. In this latter type of firm, the percentage is similar to that of large corporations, although the difference rose to over 8 pp in the first half of 2013. Consequently, within SMEs it is the smallest firms (those with fewer than 10 employees) that have the biggest difficulties accessing finance. In any event, since the second half of 2014, the percentage of Spanish micro-enterprises that identify access to finance as their main problem is less than that of their European peers, the current difference being just 0.7 pp (11.4% vs. 12.1 %).

Availability of bank loans

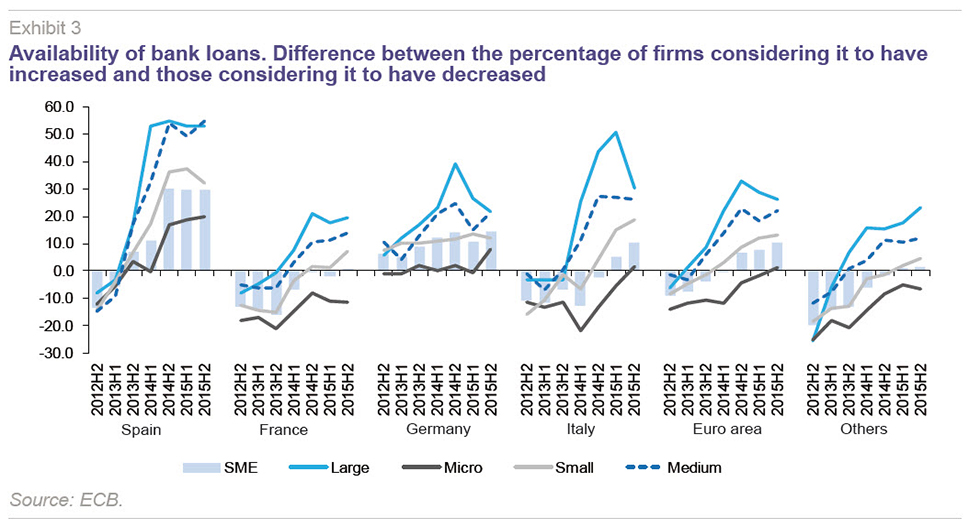

As well as determining the percentage of firms that report access to finance as their main problem, another question of interest addressed in the ECB survey is enterprises’ opinion as to whether banks are making credit more or less readily available. Specifically, we will focus on the difference between the percentage that considers availability to have increased and the percentage that considers it to have decreased (net response percentage).

As Exhibit 3 shows, the availability of bank loans has improved considerably in Spain since mid-2012, to the extent that SMEs’ net response percentage has risen from a negative value of -13.3 pp (the biggest percentage drop in the availability of credit) to a positive value of 29.8 pp.

The improvement is such that in the latest survey, the net response percentage is triple that of the euro area and much higher than in the other countries in the survey. In fact, it is the highest value of any country in the euro area.

[2] Since the second half of 2014 three successive surveys have shown the net response percentage of Spanish SMEs to be around 30 pp.

Once again, size makes a difference when it comes to obtaining bank finance. Among large Spanish firms, the net response percentage was also negative up until the first half of 2013, but since then, the availability of finance has recovered more strongly than among SMEs, to the extent that in the latest survey the net response percentage was 52.7 pp, as just 3.6% considered the situation to have worsened (against 56.3% who saw an improvement). Since the start of 2014, the net response percentage among large corporations has been over 55 pp. In the latest survey, it was twice the euro-area average and Spain’s figure was the highest of all the countries of the euro area.

Among Spanish SMEs, micro-enterprises have seen the weakest improvement in bank loan availability, although the net response percentage is increasing and has been positive since the second half of 2014. In the most recent survey, referring to the period October 2015 to March 2016, the net response percentage was 19.7 pp, 35 pp less than among medium-sized enterprises. Once again, there is no difference between the latter and large Spanish firms, such that size is no longer an obstacle for firms with over 50 employees when it comes to obtaining credit.

It is worth noting that, for the first time since the ECB began its surveys, euro area micro-enterprises saying that they are finding it easier to obtain credit outnumber those that do not, although the net percentage is just 1.4 pp. Compared with this low percentage, the recovery in credit to Spanish micro-enterprises has been much stronger, with a net percentage of 18.3 pp.

In short, as far as the availability of bank loans is concerned, all Spanish firms, regardless of their size, have seen a bigger improvement than their euro area peers, although it has to be borne in mind that Spain has emerged from a situation in which the impact of the crisis on credit was worse than elsewhere.

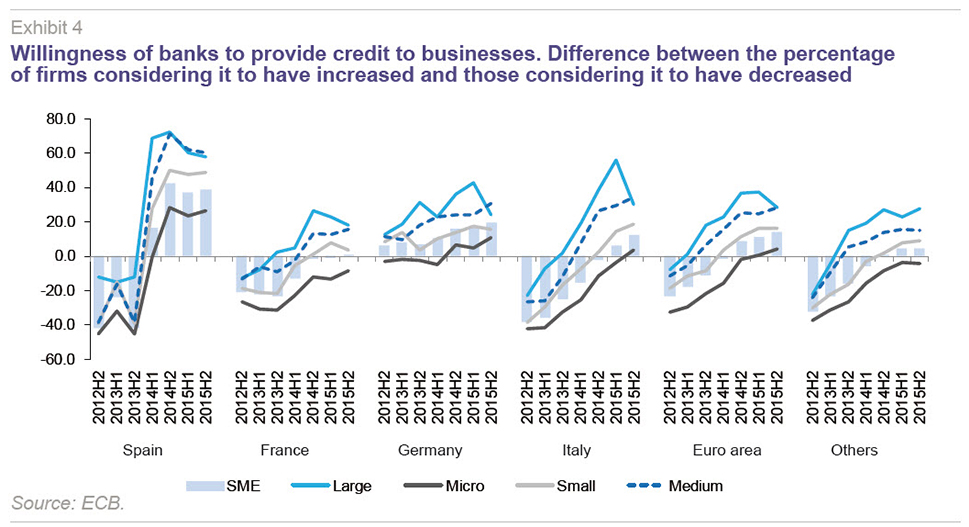

The message of the previous paragraph is corroborated by enterprises’ views of the willingness of the banks to grant finance. Indeed, banks’ willingness to give credit is one of the factors explaining the amount of credit available.

Spanish firms’ net response to this question on the ECB’s questionnaire (the results of which are shown in Exhibit 4), currently exceeds that of their European peers, with a value of 38.9 pp for SMEs (compared with 14 pp in the euro area) and 58 pp for large corporations (

vs. 28 pp in the euro area). Among SMEs, there have been no differences between medium and larger enterprises in recent years, with micro-enterprises having much lower net responses: around 22 pp since the second half of 2014. Once again, firms with more than 50 workers pay no penalty for access to finance, and there is no difference between medium-sized enterprises (50 to 249 employees) and large ones (over 250 employees).

It is worth noting that in the latest survey, for all firm sizes, Spanish firms had higher net responses than those of the euro area regarding their opinion on the increasing willingness of banks to give credit. The difference from the euro-area average went from a minimum of 22 pp among micro-enterprises to a maximum of 32 pp among small and medium-sized enterprises. As the opinions of the enterprises in the survey confirm, the banking sector restructuring and recovery from recession have increased Spanish banks’ willingness to give credit.

Terms and conditions of bank loan financing

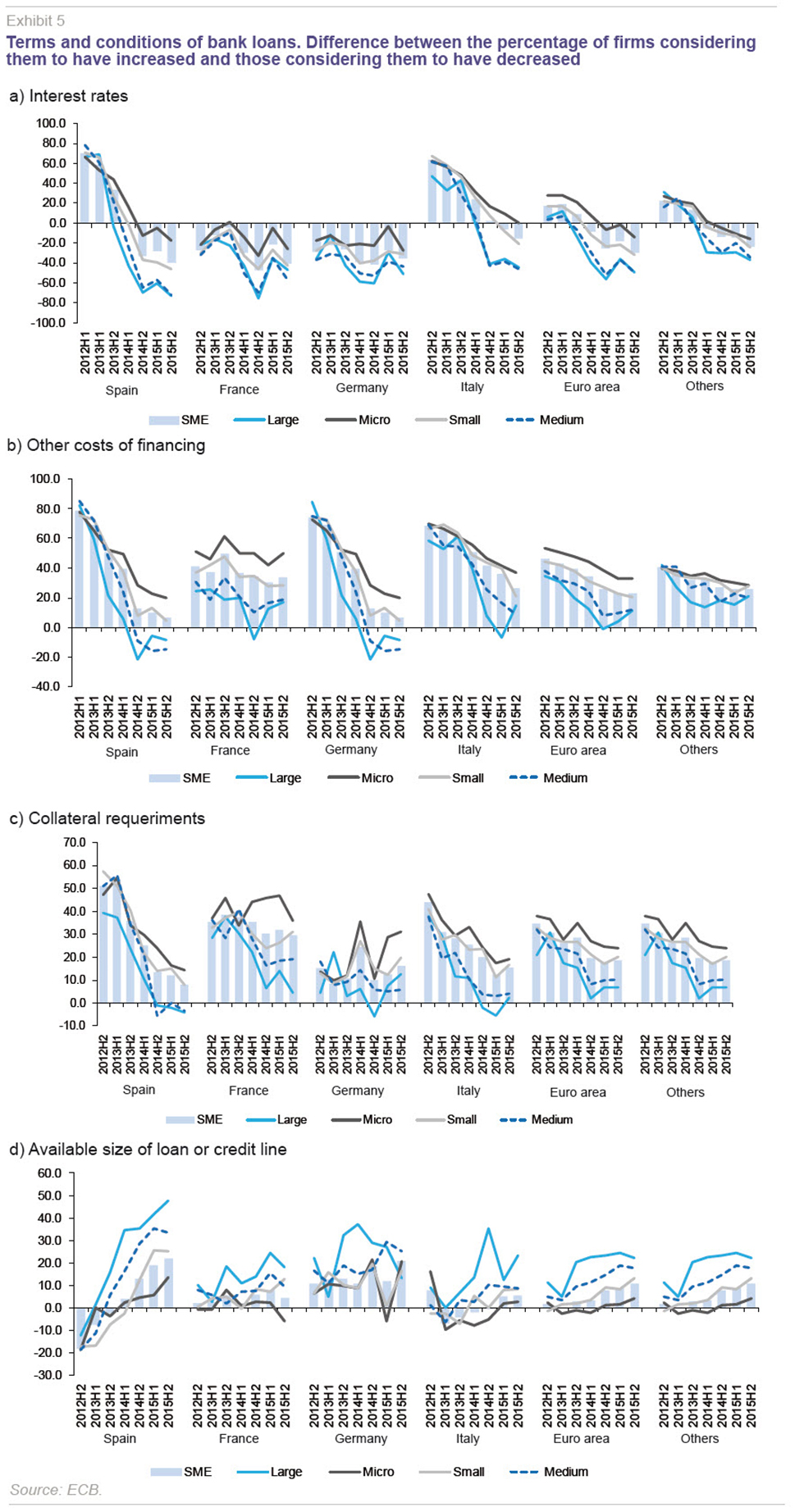

The greater availability of bank loans for Spanish businesses has been apparent since mid-2013, coinciding with the end of the recession. It has also been accompanied by an improvement in some, but not all, of the conditions on which credit is given. In the case of SMEs, the latest survey shows lower interest rates and an increase in the size of loans offered. However, there has also been an increase in collateral requirements and other financing costs have risen (such as charges, fees and commissions).

Specifically, the latest survey, referring to the period October 2015-March 2016, yields the following results in the case of Spanish SMEs (Exhibit 5):

- The difference between the percentage of SMEs considering interest rates to have increased and the percentage thinking they have dropped is -39.6 pp, a bigger figure than in the past two surveys, in absolute terms. From 2012 until the first half of 2014 the net response percentages were positive, such that more firms considered interest rates to have risen than to have fallen. Since then, firms considering interest rates to have fallen have predominated. In the most recent survey, the net percentage exceeded euro-area SMEs’ average in absolute terms (-30.1 pp).

- In the case of other costs of financing, although the net percentage of responses has been falling steadily since 2012, it has always remained positive. This means more Spanish SMEs consider these costs to have increased than the opposite. In the latest survey. the net percentage was 6.7 pp, although clearly below the euro area figure (22.9 pp).

- The requirement for collateral before granting finance always obtains a net positive response (although it has been decreasing over time), such that the collateral Spanish banks require SMEs to post has continued to rise. In the latest survey the figure is 8.2 pp, which is less than half the European average (18.8 pp).

- Finally, the average size of loan or credit line has increased, with a net percentage of positive responses of 22 pp in Spain compared with 10.9 pp in the euro area. Therefore, in line with the greater availability of credit, the size of loan or credit line has also increased.

For large corporations, the drop in interest rates has been more marked, with the difference between SMEs and large corporations in Spain being above the euro-area average. In the latest survey, the figure was almost twice as big among large corporations (-73.4 pp) as among Spanish SMEs, which had net percentage of responses of -39.6 pp. Although interest rates have also come down for micro-enterprises, the net percentage is much smaller (-17.7 pp in Spain and -14.5 pp in the euro area).

Firm size is decisive in the case of non-interest financing costs, as in the case of Spanish micro and small enterprises, those that consider these costs to have risen predominate (with net percentages of 20 and 4.4 pp, respectively). This contrasts with the view of medium-sized enterprises and large corporations, where the majority consider these costs to have dropped (-15 and -8.7 pp, respectively). In the euro area, independent from firm size, the net percentages are positive, but decreasing with size.

Banks also impose higher collateral requirements on smaller enterprises when granting credit. In medium-sized and large Spanish firms, the percentage considering banks to have reduced their guarantees is largest, with net percentages of -3.5 and -4 pp, respectively. By contrast, among other firms, there is a larger percentage stating that collateral requirements have increased, with values of 8 pp among small businesses and 14.6 pp among micro-enterprises. In relation to the euro-area average, the position of Spanish firms of all sizes has improved relative to the euro-area average, with lower net percentages.

Finally, the average size of loans or credit lines granted to Spanish businesses of all sizes has increased, although once again, the increase among micro and small enterprises has been smaller. Thus, in the latest survey, compared with a net response percentage of 47.6 and 33.4 pp for large and medium-sized business, the value among micro-enterprises is 13.7 pp. Since early 2014, firms reporting an increase in the size of bank finance have predominated, and the net percentage has increased steadily since then. At present, these net percentages are larger in Spain than in the euro area for all sizes of business.

Will the availability of bank loans increase in the future?

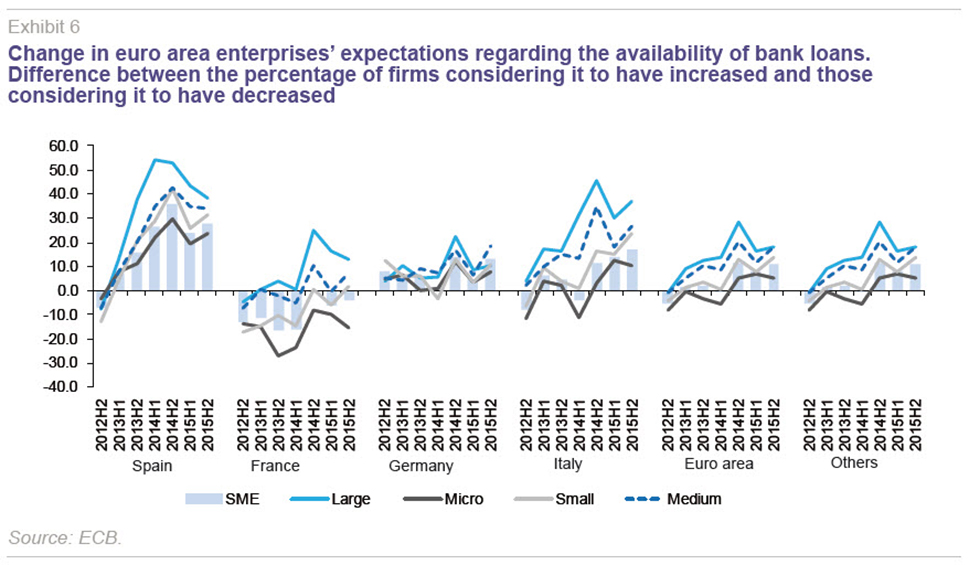

The information presented so far shows the clear improvement that has taken place in terms of Spanish enterprises’ access to credit and the conditions under which they obtain finance. Is this likely to continue improving in the immediate future? To answer this question, the ECB survey asked firms about their expectations for the next six months. Given that the most recent survey took place between March 10th and April 21st, 2016, the expectations cover the period to October 2016.

Exhibit 6 shows the net response percentages to this question. A positive value implies that an improvement in the availability of bank loans is expected, while a negative value indicates reduced availability of bank financing.

For all firm sizes, both in Spain and elsewhere in the euro area, expectations have been improving since the end of 2012, when they emerged from negative territory. In the latest survey, all net response percentages were higher in Spain than in the euro area as a whole, with a minimum difference of 16 pp among medium-sized enterprises and a maximum of 19.9 pp among large corporations.

Focusing on the case of Spain, large corporations are the most optimistic about the recovery in the availability of bank loans, as just 5.7% consider there will be less bank loans available in the next six months, compared with 43.9% holding the opposite view. Within this widespread optimism, microenterprises are the least optimistic, as for 9.1% of them, credit will become less available in the future, compared with 32.8% that believe it will be more readily available. In the case of SMEs, the net percentage of responses is 27.7 pp, 10.5 pp less than among large corporations.

Concluding remarks

In a country like Spain, where SMEs account for 99.9% of businesses and contribute 73.3% to employment and 62.8% to GVA,

[3] it is extremely important that SMEs be able to access bank finance on favorable terms. This is even more so the case bearing in mind that their small size makes bank finance by far their main source of borrowing.

Although the conditions under which SMEs were able to access finance worsened drastically in Spain at the onset of the crisis (particularly during the sovereign-debt crisis in 2010) and reached worrisome levels in 2012 with the fragmentation of the European market, since then, their access to credit has progressively improved.

The latest ECB survey on enterprises’ access to financing, published in June 2016, shows that access to bank finance continues to improve in Spain (the data cover the period up to March 2016; the previous survey covered April to September 2015). The following key messages emerge from this latest survey:

- Access to finance, which became the main problem for Spanish SMEs, is no longer a particularly serious issue, as only 10.3% of SMEs report it as their main difficulty, a similar percentage to SMEs elsewhere in the euro area. Right now their main problem, by far, is finding customers (reported by 31.7%, almost 5 pp more than in the euro area).

- Large corporations have always enjoyed better access to bank finance on better terms. The good news is that the extent to which SMEs lag behind them has narrowed over time. Nevertheless, SMEs comprise a set of firms of varying sizes, in which micro-enterprises (those with fewer than 10 employees) face the worst conditions for access to bank finance. Nevertheless, these conditions have also improved.

- As regards the availability of bank loans, the improvement seen by SMEs has been so strong that, in the last survey, the difference between the percentage holding the view that it had increased and those holding the opposite view was 29.8 pp, three times the average for euro-area SMEs. This is also the highest value of any country in the euro area. This net percentage is much higher among large corporations (52.7%), while micro-enterprises have the lowest percentage (19.7%). In any event, this latter value is much higher than that for European micro-enterprises (1.4 pp). This is the first time in the euro area that the percentage of micro-enterprises stating that more bank loans are available exceeds that stating the contrary.

- The conditions on which SMEs are able to access bank finance have improved substantially in terms of lower interest rates and larger loans or credit lines, and the improvement has been bigger in Spain than in the euro area as a whole. However, SMEs considering costs (such as fees and commissions) to have increased and that banks are demanding more collateral remain in the majority, although the net percentage of positive responses (rise/fall) is smaller than in the euro area. Among Spain’s medium-sized businesses and large corporations, the net percentages are negative (-8.7 and -15 pp, respectively), compared with positive values for their euro area counterparts.

- Everything seems to suggest that the availability of bank loans will continue to increase over the coming months, as the enterprises considering that it will outnumbers those considering the opposite, with a difference of 27.7 pp in the case of SMEs, almost three times the euro-area figure. Spanish firms are more optimistic than their European peers, regardless of size, with Spain’s large corporations presenting a net response percentage of 38.2 pp.

With these messages, if the stock of credit continues to drop in Spain, it is not a reflection of a problem of supply, as businesses themselves take the view that banks have become more willing to lend. Therefore, the drop, which is constantly slowing, is the logical consequence of the necessary process of deleveraging. Moreover, credit conditions have improved in terms of interest rates and average loan and credit line sizes. By contrast, the percentage of Spanish firms that consider other financing costs (such as fees and commissions) and collateral requirements to have increased remains higher.

If progress continues to be made towards European Banking Union (which should correct the fragmentation of the European financial market), the economic recovery consolidates (and with it the demand for solvent credit), and the ECB’s measures are effective (above all the forthcoming TLTRO II liquidity auctions, at rates that may be negative), enterprises’ conditions of access to bank finance should continue to improve.

Notes:

This article was written as part of the Spanish Ministry of Science and Innovation (ECO2013-43959-R) and Generalitat Valenciana PROMETEOII/2014/046 research projects.

In Greece, the net percentage is -27 pp.

The percentages in the EU are somewhat smaller than in Spain: 66.9% in terms of employment and 57.8% in the case of GVA.

References

EUROPEAN CENTRAL BANK (2016a), Survey on the Access to Finance of Enterprises in the euro area. October 2015 to March 2016, June.

— (2016b), Financial integration in Europe.

EUROPEAN COUNCIL (2012), Towards a genuine Economic and Monetary Union, Brussels June 26th.

Joaquín Maudos. Professor of Economic Analysis at the University of Valencia, Deputy Director of Research at Ivie and collaborator with CUNEF