Centre-periphery integration: Building European production chains

Significant differences exist in European production chains across distinct groups of EU countries (core, southern-periphery, and eastern-periphery) in terms of trade specialisation, as well as sectoral and geographic focus. However, overall, EU integration has led to an intensification of international fragmentation strategies of production and the formation of transnational networks.

Abstract: This paper examines the recent evolution and configuration of cross-border production chains in the EU by looking at trade in parts and components. The analysis seeks to establish the main countries and sectors involved, and the geographical patterns of these networks that have emerged as European integration has advanced. In particular, it looks at the role played by the EU’s core economies and those of the southern and eastern periphery. The results show the existence and growing importance of cross-border production chains with a strong regional dimension where Germany plays a central role, as well as the existence of strategies of fragmentation of production towards the southern peripheral economies, such as Spain and Portugal (particularly in sectors such as motor vehicles), and more recently towards the eastern periphery (in the industries of telecommunications apparatus and equipment).

[1]

Introduction

Since the turn of the century, global trade has been exposed to a highly competitive environment that has encouraged the emergence of new production and organisation strategies. These include, in particular, the international fragmentation of production, driven by improvements in information and communication technology, lower transport costs, the progressive liberalisation of trade, and the increased number of countries taking part in global trade, with growing presence of low wage countries.

This strategy enables companies to segment their value chains into physically separable phases or tasks that are then relocated to ever more scattered geographical locations. By doing so, they are trying to locate the different phases of the value chain in the most efficient location,

i.e. where the relative costs are low and where they have a favourable environment for production. The natural outcome of the spread of this strategy is for transnational production networks to take hold and expand. This translates into more intensive trade and tighter economic links between countries. These production networks are therefore the result of exploiting companies’ comparative advantages at each stage of the value change and of applying new, more efficient, organisation and

planning processes (Arndt and Kierzkowski, 2001).

The emergence of new players in global trade, with clear cost advantages, has had a clear influence on the process of network creation and/or reorganisation. These new players include the economies of South-East Asia, and closer to home, those of Eastern Europe, which recently joined the European Union (EU). Specifically, they have encouraged companies in the EU’s more mature economies to adopt strategies of fragmentation, dispersing their value chains beyond their national borders, with a view to exploiting cost and location advantages of the new Member States on the eastern periphery, just as they did with the countries on the southern periphery in the eighties.

The aim of this study is to contribute to the still somewhat scant empirical literature on EU production networks by investigating their configuration and analysing how they have evolved in the recent past (1995-2010) by examining parts and components trade.

[2] For the purposes of this analysis, 12 EU economies have been selected. These have been classified as core economies with the greatest economic weight in the EU context (Germany, France, Italy and the United Kingdom); economies of the southern periphery (Spain, Portugal, Greece and Ireland); and economies of the eastern periphery (the so-called Visegrad countries of Poland, the Czech Republic, Slovakia and Hungary). This study will make it possible to determine how the existence of different comparative advantages within the EU has stimulated the creation of transnational production chains in which some Member States are particularly active. It will also try to identify the geographical pattern of these production chains and what industries are involved in these cross-border networks spanning various European countries.

This paper is subdivided into six sections. After the introduction, the size and evolution of parts and components trade in Europe’s core and peripheral countries is studied in order to ascertain the extent to which production has been fragmented and the degree of integration in cross-border production networks. The subsequent section will focus on exploring each country’s form of integration in these networks, as a function of the prevalence of specialisation in the manufacture and export of parts and components or in their import. The next section looks at the types of sector networks that are most involved in this process. The following section looks at the spatial configuration of European networks by studying the geographical pattern of the parts and components trade. The paper ends with some concluding remarks.

Determining what countries make up cross-border European networks

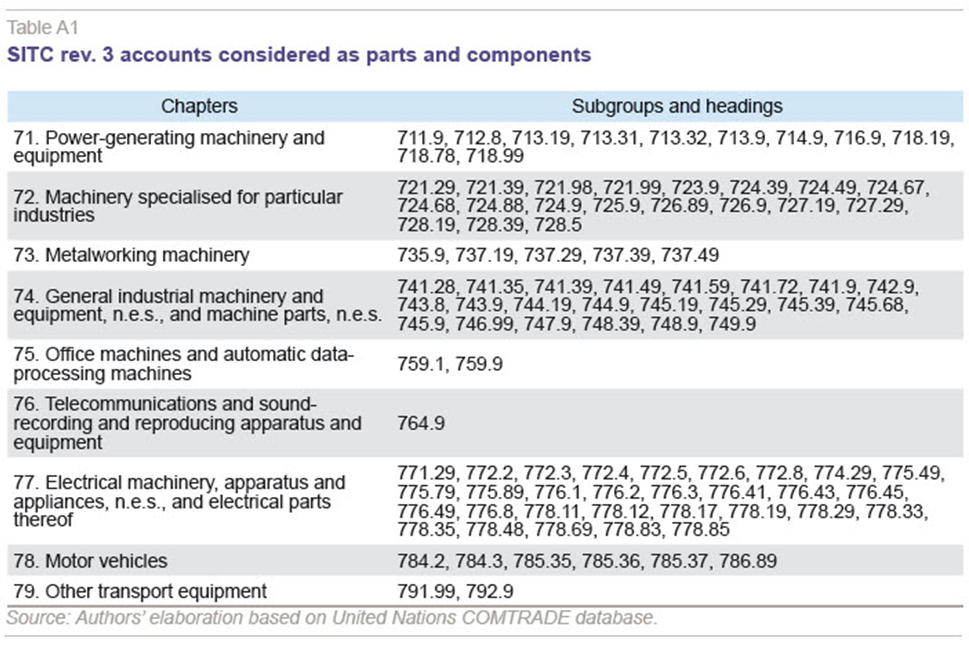

An approximate idea of the phenomenon of transnational production sharing in EU countries can be obtained by analysing the relevance and evolution of parts and components trade. This, by its nature, being a trade in intermediate goods, means that transnational exchanges of parts and components necessarily involve goods which are subsequently incorporated in manufacturing or assembly in another country. It is possible to distinguish between parts and components and finished goods using the breakdown of production given by the Standard International Trade Classification (SITC), as Yeats (2001) and Athukorala (2005) did in their pioneering studies. Following in their footsteps, we have used SITC Rev. 3, which disaggregates parts and components and final goods in category 7 “Machinery and transport equipment,” which accounts for one of the largest shares of global trade in goods (around 40%). The breakdown of the items considered parts and components is shown in Table A1 of the statistical annex.

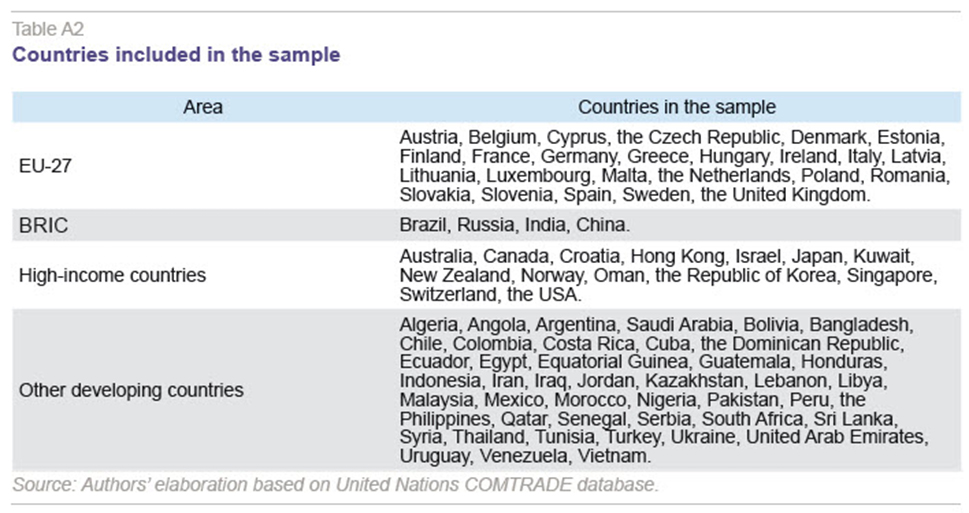

Data on trade in parts and components come from the United Nations COMTRADE database. A sample of 90 economies was selected as the source and destination of parts and components (Table A2 in the statistical annex), accounting for 97% of total parts and component trade by the selected European countries.

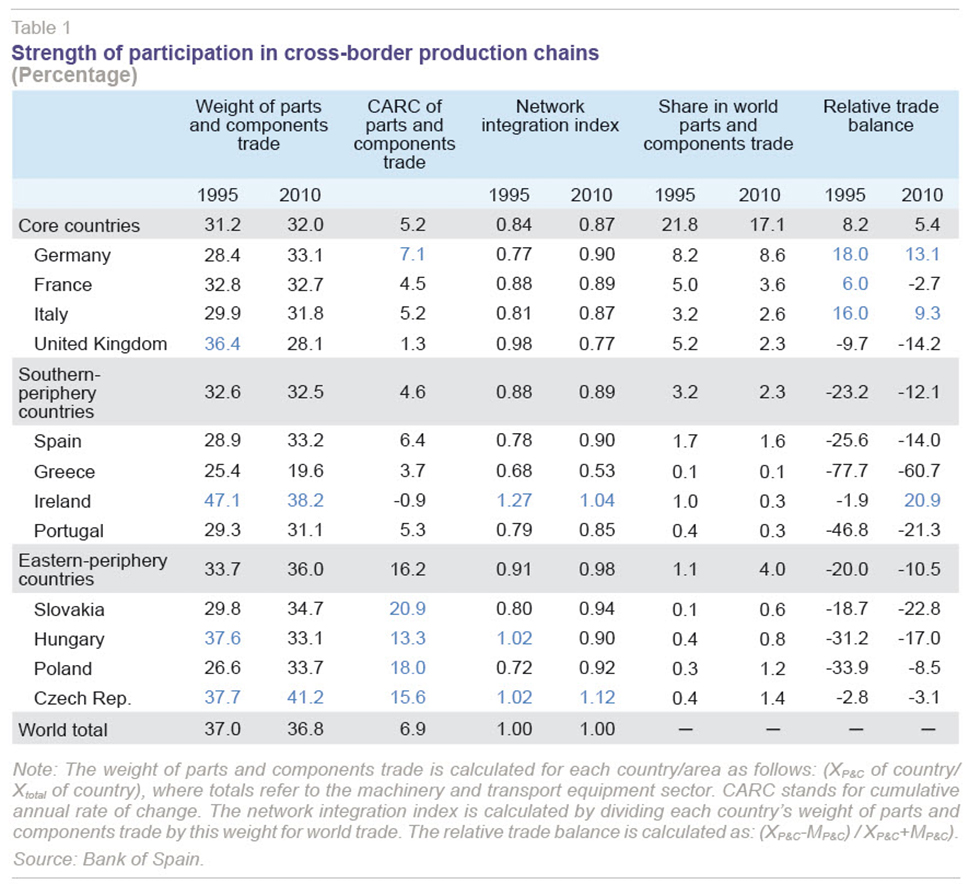

An initial indicator of the relevance of international production networks in the areas analysed is the dynamism of parts and components trade and its weight in total trade in machinery and transport equipment. The large and growing share of these flows in global trade clearly highlights the trend towards a strategy of international fragmentation of production. As can be seen in Table 1, in 2010, global parts and components trade accounted for approximately 37% of total trade in the machinery and transport equipment category, its share having remained stable since the mid-nineties. Of the European economies analysed, the only bloc to see a marked increase in the weight of parts and components trade was the eastern periphery. This is indicative of the dynamism of its integration in transnational production networks, in which all the economies of the region take part, except Hungary. In the other two blocs, the weight of the parts and components trade has been maintained, although in terms of individual countries, Germany and Spain have performed particularly strongly, advancing at a similar rate to the eastern periphery, while the increase in Italy and Portugal has been more moderate. At the other end of the scale are the United Kingdom, Greece, Ireland and Hungary, where there has been a drop in weight in the first decade of the century, suggesting a retrenchment in their integration in international production networks.

These changes in the weight of parts and components trade are the result of the dynamism of this trade in parts and components, which exceeds that of final goods. Indeed, trade flows in parts and components were highly active in the study period in all three groups of economies, and in all the Member States included in the study, except Ireland. The rate of growth was particularly high (above the world average) in Germany, and above all, in the economies of the eastern periphery, where cumulative annual rates of change are above 10% and were twice those of the world average in Hungary and the Czech Republic, and three times the world average in Poland and Slovakia.

The weight of the parts and components trade as a share of the total economy relative to the world average can be compared by calculating a network integration index, defined as the ratio between the two percentages. Thus, whereas in 1995, Ireland, the Czech Republic and Hungary stood out for their specialisation in parts and components trade relative to the world economy, in 2010, only Ireland and the Czech Republic did. This specialisation increased in the Czech Republic, declined somewhat in Ireland, and vanished entirely in Hungary. Taking the parts and components trade aggregates, other European economies in the study suffered from a lack of specialisation in this type of trade, and therefore, a lack of involvement in cross-border networks that is particularly marked in the case of Greece and the United Kingdom in recent years.

The importance of parts and components trade in each country is a first approximation to the impact of strategies of international fragmentation of production in each economy. It is also worth studying the share of a country’s trade in parts and components in world trade in parts and components, as this would show how important each country is in global production sharing. As Table 1 shows, the core countries play the biggest role, accounting for approximately 17% of global trade in parts and components in 2010, after declining considerably since 1995. Within these countries, Germany’s share of the global parts and components trade is largest, at close to 9%, and its share grew over the course of the period studied. Germany remains one of the most active participants in the process of the international fragmentation of production and in participating in and shaping production networks. Germany’s major role has been apparent since the earliest studies on production networks in the EU (Kaminski and Ng, 2001 and 2005), having positioned itself as the main trading partner in parts and components for the economies of Eastern Europe. The shares held by the remainder of the core economies do not exceed 5%. The United Kingdom has shown the sharpest downward trend.

The eastern periphery’s share of global parts and components trade comes to around 4% and has been rising in all the economies of the region. This seems to confirm Eastern Europe’s increasingly important role in international production networks, a fact that has been noted in recent studies (Martínez-Zarzoso et al., 2011; and Blázquez et al., 2013). Within this group, the strong performance of the Czech Republic and Poland stands out, having achieved a share of over 1% of the global parts and components trade in 2010. The southern periphery has a smaller presence in global trade in parts and components (just over 2%), with only Spain achieving a significant share (1.6%). The southern periphery’s share has dropped overall as a result of Ireland’s loss of share, while that of the other three economies has remained stable.

This trend in trade shares shows that in the case of the 12 European countries examined, the process of EU integration seems to have stimulated changes in the geographical configuration of international production chains. Whereas the core countries, and Germany in particular, still account for a significant share of the global parts and components trade, the countries of the eastern periphery have emerged as new members of these production networks.

In simple terms, we could try to deduce whether it is manufacturing and exports in the sector or assembling these parts and components that is more significant, based on the relative importance of parts and components exports and imports. The idea here is that, while imported parts and components must necessarily be destined for assembly into other more complex components or final goods (except those used as spare parts, which empirical literature puts at less than 10%), the sign adopted by the relative trade balance may be used as an, albeit imperfect, tool for determining which advantage prevails. In this way, a negative trade balance in parts and components indicates that imports prevail over exports and this sector or economy has advantages in assembling parts and components and a positive trade balance indicates that its advantages lie in producing and exporting them (Blázquez et al., 2011).

As can be seen from Table 1, the bloc of core EU countries is the only area in which the value of exports of parts and components exceeds that of imports. This is a feature of advanced economies which have certain technological capabilities and a highly qualified workforce. These core countries therefore concentrate on producing and exporting higher value, more complex parts and components, and importing those of lower value with less technology content. Disaggregating the analysis at the country level shows that only Germany and Italy ran a surplus in parts and components trade in 2010, with the relative trade balance in the other two core economies deteriorating.

At the other end of the scale are the groups of countries on the eastern and southern periphery, which have a marked deficit in parts and components trade, suggesting that assembly is more prevalent in these economies. In the case of the four economies of the southern periphery included in the study, the relative trade deficit in 2010 (with the exception of Ireland) improved markedly over the period studied. Ireland’s change of sign is due to the drop in imports of parts and components (the only country in the study in which this occurred). This could be a sign of a loss of competitive advantage in the assembly business relative to other emerging economies. It should be noted that since joining the EU, the eastern periphery has improved its trade balance, halving its negative balance. This positive trend would indicate that this area has managed to make progress on developing competitive advantages in the production and export of parts and components. EU membership as well as their location advantages may have fostered the emergence of a competitive auxiliary industry, and encouraged parts and components suppliers to relocate to this region so they can be close to manufacturers relocated previously here. The availability of low wage labour has contributed to this process, wage costs being below those of their European partners, and the level of qualifications often being relatively high (Martínez-Zarzoso et al., 2011; and Blázquez et al., 2011). All four countries in the eastern periphery have a negative trade balance in parts and components, the only improvement being the positive trend in Hungary and Poland.

Exploring forms of participation in transnational production chains

As mentioned in the introduction, cross-border production chains are the result of the implementation of strategies of international production fragmentation in order to exploit each location’s competitive advantages at each stage of the production process. This being so, the most appropriate means of exploring these advantages is to analyse revealed comparative advantage using the Balassa index (Balassa, 1965) for the various categories within parts and components trade. Understanding a country’s trade specialisation relative to the world for each of the parts and components trade categories included in the analysis (154 parts and components subgroups and headings) should enable us to classify countries according to their prevailing type of specialisation.

Following Kaminski and Ng (2001), these indexes are calculated separately for exports and imports of parts and components, comparing each individual country’s share of trade in each particular category (as a share of total trade in machinery and transport equipment) within the world economy:

RCA(XP&C)= (XP&C of country/ XP&C worldwide)/ (Xtotal of country/Xtotal worldwide) (1)

RCA(MP&C)= (MP&C of country/ MP&C worldwide)/ (Mtotal of country/Mtotal worldwide) (2)

If items with comparative advantages in parts and components exports prevail, this may be interpreted as a “forward” participation in cross-border networks, in that the economy actively uses international production fragmentation strategies in which specialisation in the production and export of parts and components predominates. In this case, the country would be positioned at the beginning of the cross-border production chain (upstream position). When categories with advantages in parts and components imports predominate, the intensive use of production fragmentation strategies would take place through the processing of these imported parts and components either for their incorporation in other more complex parts and components or their assembly into final goods, involving a “backward” participation in international production chains. In this case the country would be positioned in the later stages of the value chain (downstream position). When items with a comparative advantage in both facets (exports and imports) predominate, the implication is that the economy is more actively involved in cross-border production networks, and the economy also focuses on intermediate tasks of phases within this production process shared across countries. By contrast, the absence of any comparative advantages in parts and components in either the purchase or sale of parts and components abroad means the economy has limited involvement in transnational production chains.

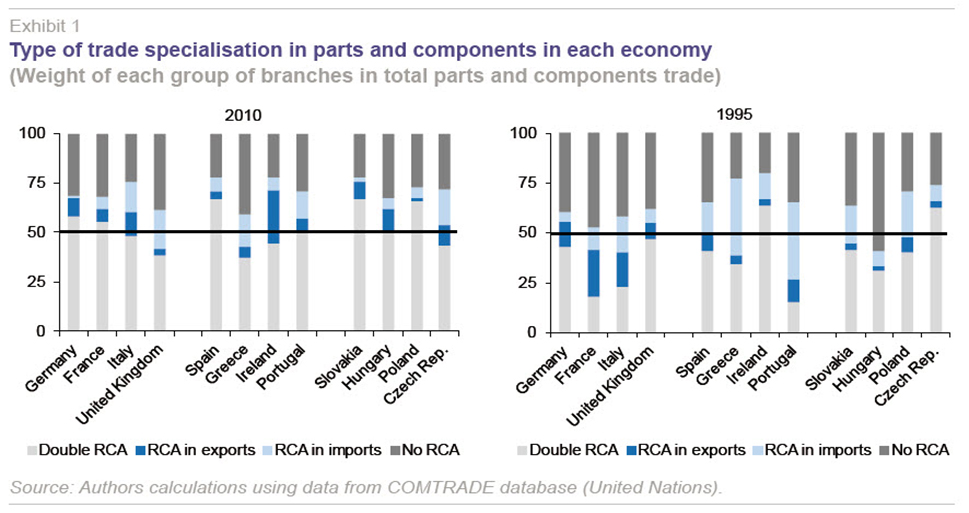

Exhibit 1 shows the significance of the parts and components trade in each European economy analysed in terms of the various parts and components items as classified in the four groups above. The information is given for the two years at each end of the study period,

i.e., 1995 and 2010.

Starting with the most recent year, it can be seen that the items with a double specialisation (i.e., in imports and exports) are central to parts and components trade in most of the European economies analysed (with the exception of the United Kingdom and Greece), where it may be inferred that they play a strong role in transnational production networks. Their prevalence in economies of the southern periphery, such as Spain, and the eastern periphery, such as Slovakia and Poland, is clear: parts and components categories with revealed comparative advantages in terms of both exports and imports account for two thirds of total parts and components trade. It is also interesting to note the case of the Irish and Czech economies, where, although parts and components categories with a double advantage predominate, they account for less than 50% of the total. In Ireland this is explained by the strong focus on branches with advantages in the production and export of parts and components (the highest in all the economies analysed, at over 25%) and in the Czech Republic by that of branches specialising in parts and components imports (with a share of close to 20%), suggesting the existence of advantages in assembly activities relating to these particular goods.

At the other end of the scale, in the United Kingdom and Greece, trade in items with a double specialisation is much less important (less than 40%), as they share the role with components for which there are no advantages. This supports the idea that these two countries are less involved in cross-border production networks.

The general trend over the study period observed in most countries was towards a bigger commitment to the integration of transnational production chains as trade in parts and components with a double comparative advantage progressed. This trend has usually been at the expense of branches in which there is no specialisation in the intermediate goods trade. Within this common pattern of development, some specific features of performance in countries, such as France, Portugal, Slovakia and Poland stand out. Here, double specialisation has also been accompanied by a drastic reduction in the share, in the case of the French economy, of the items with advantages on the export side, and in the case of the other three economies, of the items with advantages on the import side. These changes imply a repositioning of these economies within the production networks that may be particularly positive for peripheral economies such as Portugal, Slovakia and Poland, where it can be interpreted as a decline in the competitive advantages based exclusively on assembly operations, with their rising up the value chain towards more intermediate positions based on activities making a higher contribution to national value added.

Only four countries did not share in this progress of double specialisation: the United Kingdom, Ireland, Greece, and the Czech Republic. The case of the Greek economy differs in that this fact highlights a smaller participation in international production chains, while items with no specialisation are clearly gaining ground (and those with advantages in imports are losing ground). In the other three economies, the changes are due to a repositioning within transnational production chains, with shifts in their profiles of integration within them. Thus, in the United Kingdom, the retreat of double specialisation has been accompanied by increasing advantages in parts and components imports. In Ireland, there has been a shift towards branches with advantages in parts and components exports,and in the Czech Republic in both types of items.

Identifying each country’s key sectors for cross-border production chains

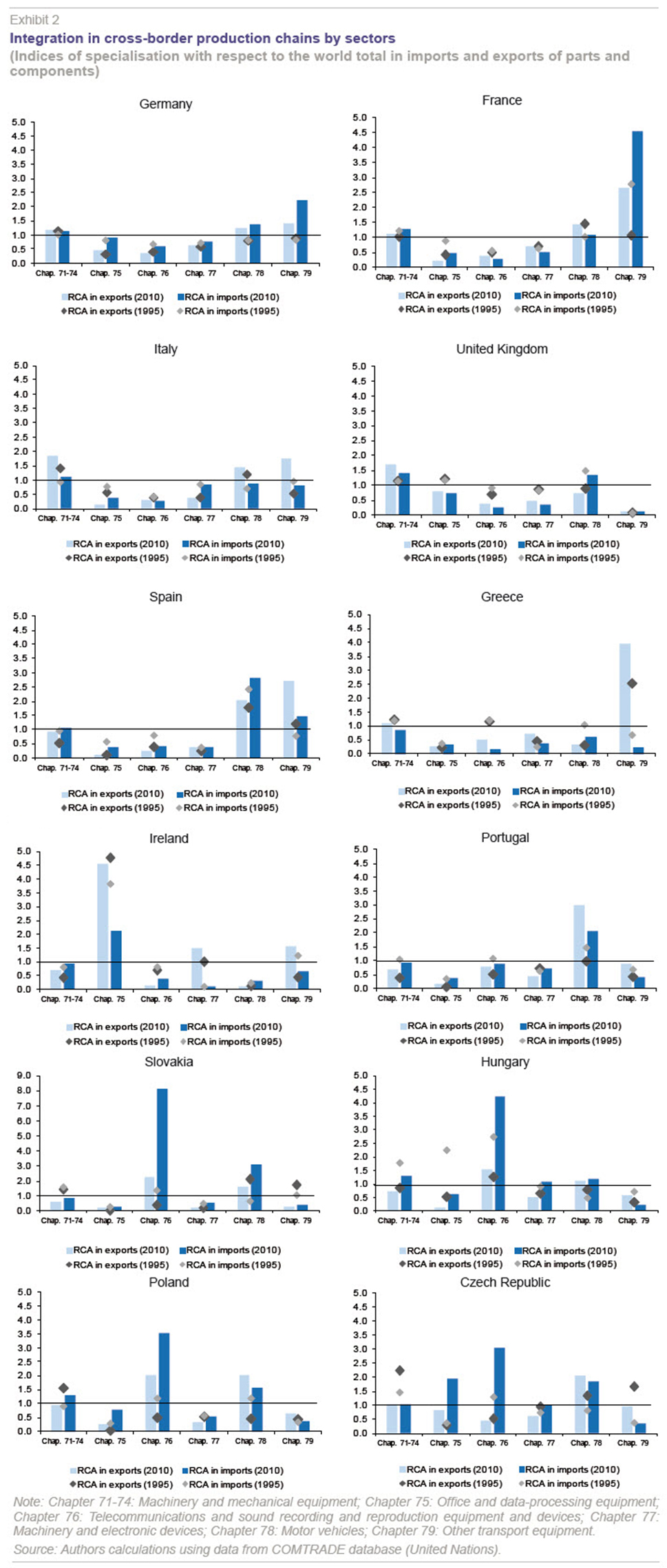

This section examines what specific industries in the EU economies examined are integrated in global shared production systems and the form of their integration. Six industries stand out in the account breakdown in the machinery and transport equipment sector (see Table A1 in the statistical annex). To perform this analysis, each industry and country’s revealed comparative advantages on both the export and import sides in 1995 and 2010 were calculated. The results are shown in Exhibit 2.

The first thing that stands out is that the various European countries do not share a common sectoral pattern of integration in international production networks, even within the blocs into which they are grouped. Starting with the core EU countries, only in the case of Germany and France was there a certain degree of sectoral match, showing a double comparative advantage, indicating that they have been clearly gaining participation in networks in sectors such as other transport equipment (with a much stronger advantage in imports than exports, suggesting the two countries share a specialisation in tasks at the end of the production chain) and, to a lesser extent, motor vehicles. For its part, the double specialisation of the United Kingdom and consequently its clear involvement in cross-border production chains is limited to machinery and mechanical equipment, and this specialisation is seen to have developed during the study period. Furthermore, Italian and British companies have been making strong use of fragmentation strategies, in the former case increasingly through parts and components production and export in the machinery and mechanical equipment, motor vehicles and other transport equipment industries, and secondly, through the import of parts and components in motor vehicles, while losing significance between 1995 and 2010.

The network integration of the economies of the southern periphery is strictly limited to specific sectors. Thus, the Iberian Peninsula has been strengthening its participation in cross-border production chains in the motor vehicles industry, where it has a double comparative advantage (skewed more towards the initial phases of the value chain in the case of Portugal and the later stages in the case of Spain). In 2010, Spain also seemed to have become included in transnational production chains in the other transport equipment industry (specifically, aeronautics, according to Blázquez et al., 2011), where although there is comparative advantage in both flows, it is significantly higher in the case of exports. Ireland only appears to be involved in networks in the office and data processing equipment sector. What is more, the data show that there has been a change in its profile of specialisation in this sector since the mid-90s, reducing its advantage in imports (which would be explained by a displacement of assembly activities in these manufactures to Eastern European countries such as the Czech Republic, and to Asia, in particular) and adopting a stronger role in producing and exporting parts and components, from which it may be inferred that it has moved up the value chain. Over the period analysed Ireland also achieved an incipient advantage in the production and export of parts and components in machinery and electrical apparatus and other transport equipment. To round off the southern periphery group, Greece does not have a comparative advantage in any of the areas of production, such that it is not possible to talk of solid network integration. However, the Greek economy does have a growing commitment to fragmentation strategies in the other transport equipment sector, where it has been enjoying specialisation in exports of parts and components.

As regards the eastern periphery, the bloc’s integration in networks was clearly circumscribed to two sectors in 2010: telecommunications apparatus and equipment, and to a lesser extent, motor vehicles (having withdrawn from the machinery and mechanical equipment sector). For the first of these two sectors, the double specialisation of Slovakia, Hungary and Poland indicates a solid participation in the intermediate phases of the production process, which is clearly skewed towards assembly activities in line with its high and rising advantage in parts and components imports. In the case of the Czech economy, the competitive advantage exists only on the import side, as also happens in the office machinery and computers sector. For the motor vehicles sector, the acquisition of comparative advantages in both exports and imports of parts and components is evidence of the incorporation of the sector networks of Slovakia, Poland and the Czech Republic after their joining the European Union.

Geographical configuration of European networks

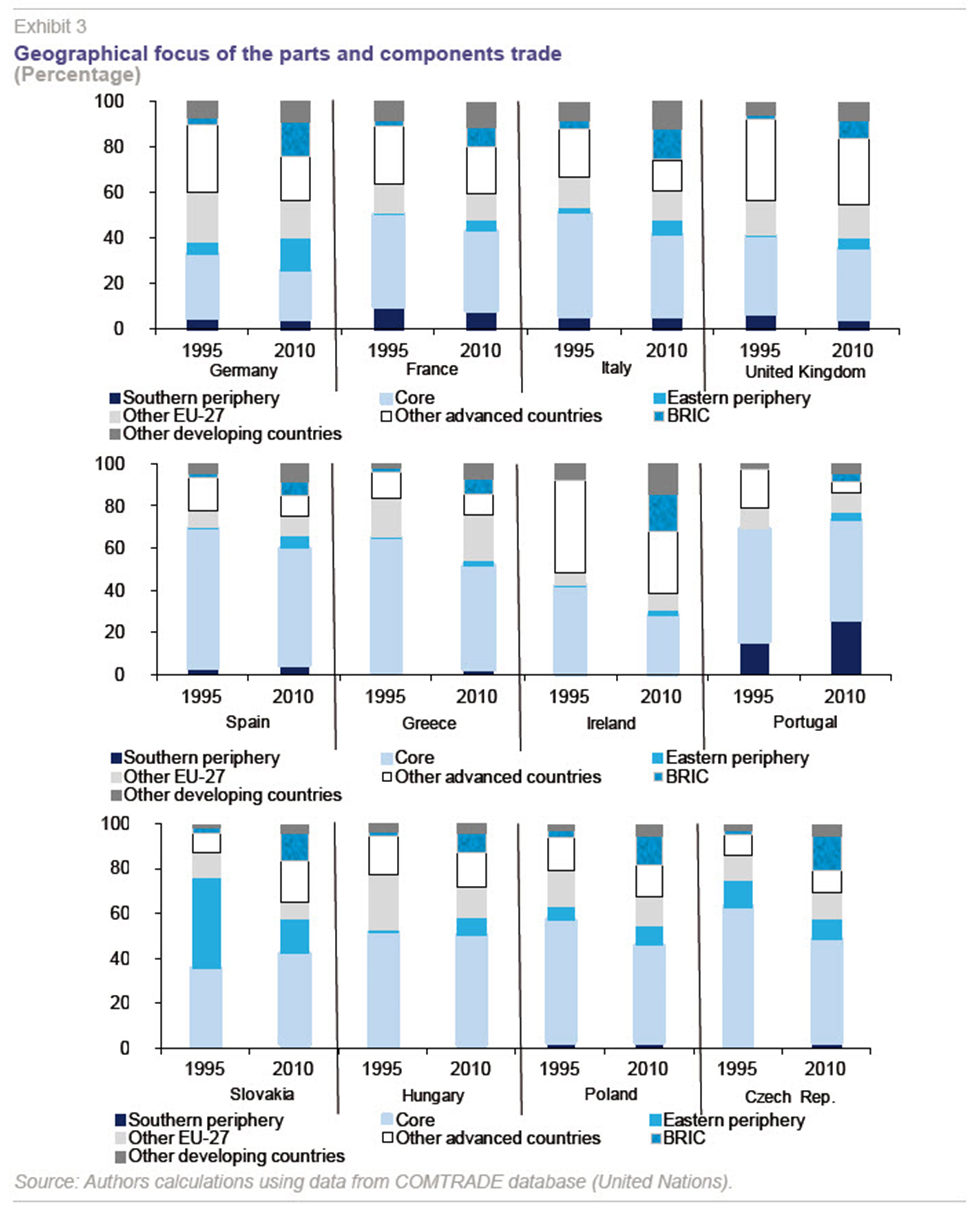

The analysis of the geographical pattern of parts and components trade for the three groups of countries in this study reveals two key matching features (Exhibit 3). Firstly, the predominance of trade with the EU-27 (with particular prevalence of trade from and to the core countries), and secondly, the significance being acquired by the BRIC countries (Brazil, Russia, India and China), mainly as a source of imports, which suggests the growing integration of these countries in global networks.

Closer analysis reveals the specific features of the different blocs. Analysing the geographical pattern of parts and components trade by the core EU economies first, we find that their trade is mainly with their EU partners, such that the EU-27 accounted for around 60% of foreign trade in the sector in 2010. This followed a slight loss of importance since the mid-90s, suggesting that these networks are primarily configured on a European scale. The weight of intra-bloc trade among these countries stands out, particularly in France and Italy, where in 2010, exchanges with other core economies accounted for 35% of the total (in the United Kingdom the figure is 30% and in Germany just over 20%). However, there has been a clear drop since 1995. It is worth noting that this decline contrasts with growing flows in the eastern periphery, particularly for Germany, which stands out as the economy that has been implementing production fragmentation strategies in Eastern Europe most energetically. Other advanced non-EU countries, which are second in importance as commercial partners in core countries’ parts and components trade have also given way to developing countries, primarily the BRICs. Germany stands out as the core EU economy with the greatest geographical diversification in its foreign trade in parts and components. At the other end of the scale, the United Kingdom’s participation is mainly focused on other core EU economies and other developed countries (particularly the United States).

The geographical pattern of parts and components trade of the countries of the southern periphery shows strong commercial links to the EU, at around 80% in 2010, except in the case of Ireland, where it is half that, due to the importance of its trade with other advanced non-European countries. Within the EU-27, the main partners are the core countries (50% again, with Ireland’s figure being around 25%), although there has been a significant loss of weight, which only in Spain and to a lesser extent in Portugal is at least partly explained by the progress made by the eastern periphery. This means that, with the exception of Ireland, the countries of the southern periphery are mainly linked into production chains with the core EU economies and that Spain and Portugal are becoming involved in networks that also link to Eastern European countries, probably in the automotive industry. The Portuguese economy has established transnational networks mainly with Spain, given the latter’s growing role as a key partner in parts and components trade. Outside of the EU, advanced economies are losing ground to developing economies. Growth in Ireland’s trade with BRICs has been particularly strong, and is related to transnational chains producing office and computer equipment, in which China also plays a role (De Backer and Mirodout, 2014).

In terms of the geographical pattern of trade in parts and components by the countries of the eastern periphery, as with the other blocs, there is a clear bias towards the EU-27 (accounting for a share of approximately 70% in 2010), despite dropping considerably since the nineties (when it accounted for 80-90%). The core EU countries remain the main trading partner (accounting for almost half of the parts and components trade), after dropping significantly in the countries that accounted for the biggest share in 1995 (Poland and the Czech Republic). In other words, as in the case of the southern periphery, networks have primarily developed with the core EU countries. Trade within the eastern periphery is only significant in the case of Slovakia, where it accounted for 40% of the total in the mid-90s, subsequently dropping significantly to levels similar to those of the other countries of the eastern periphery (10%). Flows with other EU economies have also lost ground in the eastern periphery’s parts and components trade. By contrast, the BRICs have become much more important. Having started at negligible levels in 2010, with the exception of Hungary, they were over 10% in 2010, sharing progress, albeit more moderately, with the other developing economies. It therefore seems that the countries of the eastern periphery are switching some of the parts and components trade from the EU to the BRICs, highlighting a degree of geographical refocusing of transnational production networks towards emerging economies. Recent studies, such as those of Ando and Kimura (2013), suggest that the economies of Eastern Europe are taking shape as the nexus connecting the countries of East Asia (primarily China) with those of the EU. Network integration of the economies of the eastern periphery in telecommunications equipment sectors where the countries of South-East Asia (such as China) also play a significant role could also explain the closer commercial ties between the two regions.

Conclusions

This study has examined the recent evolution and configuration of cross-border production networks in the EU through trade in parts and components, in order to establish the main countries and sectors involved, and the geographical patterns of these networks following the progress of European integration. This progress has stimulated an intensification of international production fragmentation strategies by companies in the more mature EU countries towards peripheral countries in order to leverage their cost advantages. The study has been circumscribed to three specific groups of countries: the core countries (Germany, France, Italy and the United Kingdom), the southern periphery (Spain, Portugal, Greece and Ireland) and the eastern periphery (Poland, Slovakia, the Czech Republic and Hungary).

The analysis has highlighted the dynamism of parts and components trade in the three groups of European countries, which is indicative of a clear commitment to a strategy of international fragmentation of production and the formation of transnational networks. In the three groups of economies, the parts and components trade represents around a third of total sector trade, with the high share of Ireland and the eastern periphery (particularly the Czech Republic) standing out. It is this latter bloc that has gained in significance most. Its joining the European Union has undoubtedly facilitated its integration in these shared production systems led by the core EU countries, headed by Germany.

Analysing the trade specialisation in parts and components in these countries relative to the global economy has revealed the way in which these economies participate in these networks. Thus, it has been observed that for European economies (other than those of Britain and Greece), the bulk of trade in parts and components is concentrated in products with a double trade specialisation, i.e., both in imports and exports. This indicates close integration with networks, specifically in the intermediate phases of these production chains shared by various countries. Here Spain, Slovakia and Poland stand out, having a particularly large share of trade with double advantage. At the other end of the scale are the United Kingdom and Greece, with limited involvement in cross-border production systems, given the large share of parts and components trade in which there is no specialisation.

Looking more closely at the sector level, core countries such as Germany, France and Italy have established production networks in the motor vehicles and other transport equipment sectors in particular, where the first two play a particularly strong role in the intermediate phases, whereas Italy’s specialisation is in the earlier phases, given its specialisation only on the exports side. The southern periphery shows a more heterogeneous sector behaviour, with Spain and Portugal involved in intermediate positions in international chains in the motor vehicles sector (and also in other transport equipment in Spain’s case) and Ireland in the office and data processing equipment sector (increasingly skewed towards specialisation in exports.)The eastern periphery has made a bigger commitment to joining shared production systems, specialising in intermediate segments, in motor vehicles, and particularly in telecommunications devices. Primarily in assembly in the latter case, given the strong advantage in imports of parts and components relating to this industry.

Lastly, analysis of the geographical focus of parts and components trade has shown the eminently regional nature of the networks in which Europe’s countries take part, with strong predominance of trade with other EU member states (in which the core countries stand out). Nevertheless, this predominance has flagged somewhat since the mid-90s, while the BRIC countries have gained in importance. This suggests a degree of diversification in the geographical configuration of Europe’s production networks, and responds to the search for new locations with higher cost advantages where the Chinese economy plays the leading role.

Notes

This research has benefited from the support of the researcher training starter project granted under the agreement between the Toledo Provincial Council and the University of Castile-La Mancha (UCLM) to support research activity on the Toledo campus, and the UCLM research groups funding programme.

Similar descriptive analyses for the EU based on parts and components trade (although looking at a different selection of EU countries) can be found in the papers by Ando and Kimura (2013), Guerrieri and Vergara Caffarelli (2012), and, for Spain, in Blázquez et al. (2011). A new line of research has recently opened up in which the participation of global production chains is studied from trade measured in valued added terms with information from international input-output tables; Stehrer and Stöllinger (2015) and Amador et al. (2015) are studies for Europe taking an approach similar to ours but using this new methodology.

References

AMADOR, J.; CAPPARIELLO, R., and R. STEHRER (2015), “Global Value Chains: A View From the Euro Area,” European Central Bank, Working Paper, no. 1761.

ANDO, M., and F. KIMURA (2013), “Production linkage of Asia and Europe via Central and Easter Europe,” Journal of Economic Integration, vol. 28, no. 2: 204-240.

ARDNT, S., and H. KIERZKOWSKI (2001), Fragmentation, new production patterns in the world economy, Oxford University Press, Oxford.

ATHUKORALA, P. (2005), “Product fragmentation and trade patterns in East Asia,” Economic Paper, vol. 7, no. 3: 233-256.

BALASSA, B. (1965), Trade liberalization and revealed comparative advantage, The Manchester School of Economics and Social Science, no. 33: 99-123.

BLÁZQUEZ, L.; DÍAZ-MORA, C., and R. GANDOY (2011), “El comercio de partes y componentes: una aproximación a la posición española en las redes de producción internacionales,” Principios, no. 18: 31-36.

— (2013), “Production networks and EU enlargement: is there room for everyone in the automotive industry?,” Eastern European Economics, vol.51, no.3: 27-50.

DE BACKER, K., and S. MIROUDOT (2014), “Mapping Global Value Chains,” ECB Working Paper, no. 1677.

GUERRIERI, P., and F. VERGARA (2012), “Trade openness and the international fragmentation of production in the European Union: the new divide?,” Review of International Economics, vol. 20, no. 3: 535-551.

KAMINSKI, B., and F. NG (2001), “Trade and production fragmentation: Central European Economies in EU networks of production and marketing,” Policy Research Working Paper, no. 2611, Banco Mundial.

— (2005), “Production disintegration and integration of Central Europe into global markets,” International Review of Economics and Finance, vol. 14, no. 3: 337-390.

MARTÍNEZ-ZARZOSO, I.; VOICU, A., and M. VIDOVIC (2011), “Central East European Countries’ accession into the European Union: role of extensive margin for trade in intermediate and final goods,” Empirica, vol. 42, no. 4: 825-844.

STEHRER, R., and R. STÖLLINGER (2015), “The Central European Manufacturing Core: What is Driving Regional Production Sharing?,” FIW Research Reports 2014/15, no. 02.

YEATS, A. (2001), “How big is global Production sharing?,” in ARDNT, S., and H. KIERZKOWSKI (Eds), Fragmentation, new production patterns in the world economy, Oxford University Press, Oxford.

Statistical Annex

Carmen Díaz-Mora and Erena Mª García López. University of Castile-La Mancha