Spanish sovereign debt markets: Developments in hedging strategies and recent trends in risk premium

The recent widening in Spanish sovereign spreads is being driven by specific factors apart from prevailing political uncertainty. The lack of liquid hedging instruments in the futures market has played a part.

Abstract: Against the backdrop of a relatively benign medium-term economic outlook, the spike in the Spanish risk premium in recent months appears largely related to the political uncertainty generated by the electoral climate in Catalonia and the Spanish state as a whole. However, the relative underperformance of Spanish bonds is also attributable to the lack of liquidity and depth in their natural and perfect hedge (MEFF/BME-traded futures contracts with the sovereign or ‘notional’ bond as the underlying asset). This is a crucial factor for principal sovereign bond investors. It is likely that the creation of a Eurex-traded futures contract over the Spanish bond at the end of October 2015 will reduce this disincentive to invest in Spanish debt, driving an improvement (assuming no changes in the other key drivers) in yields relative to other markets.

Renewed but moderate pressure on Spanish sovereign debt

Having narrowed continually for over two and a half years, in recent months, particularly since the start of the summer, the Spanish sovereign bond spread has come under renewed pressure relative to its German counterpart. Although the widening has been far less pronounced than during the worst episodes of the sovereign debt crisis (which was at its height in the summer of 2012), and is confined to medium– and long-term maturities (the yields on short-dated paper have barely moved), it does constitute a turn of events warranting analysis of the underlying factors.

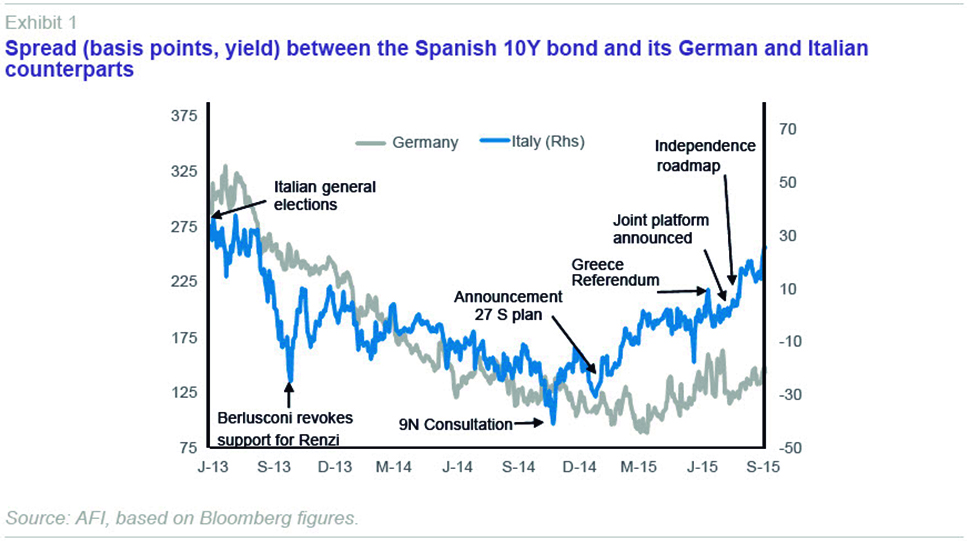

One noteworthy aspect of this reversal in spread tightening relative to the Bund is the fact that the Spanish spread is also widening with respect to other eurozone sovereign issuers, such as Italy, relative to which it had been trading at far narrower spreads until a few months ago. Italian bonds were trading at a marked premium to Spanish bonds at the end of 2014; however, in recent months, the Italian treasury has been financing itself on better terms than its Spanish counterpart. At the beginning of September, the spread between Spanish and Italian bonds stood at around 20bp, marking the highest level since mid-2013.

Political uncertainty driving increasing spreads

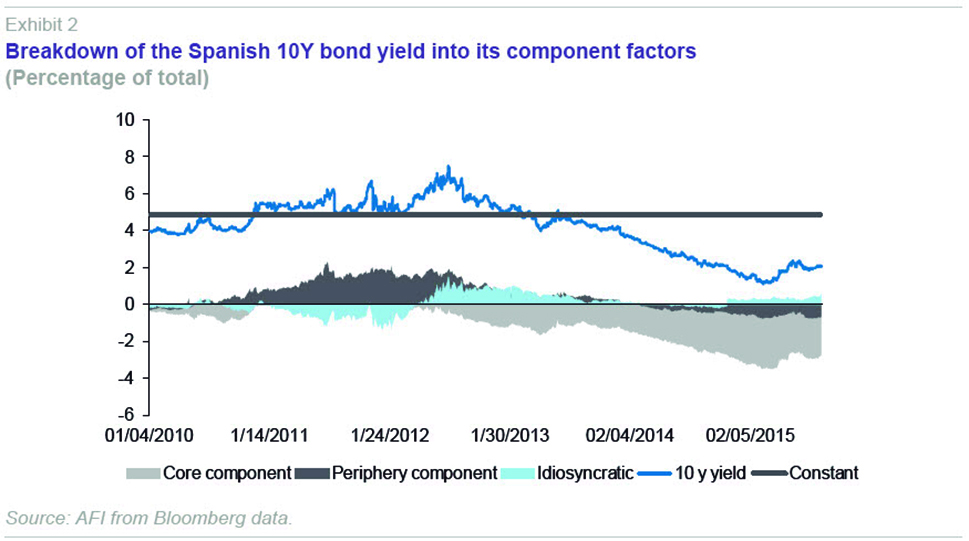

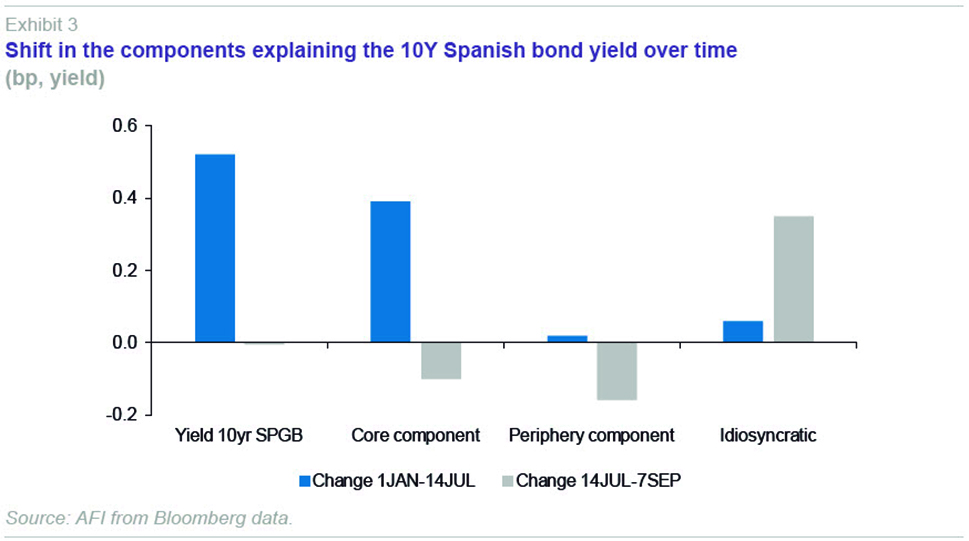

Analyzing the factors behind the trend in the 10Y Spanish bond yield sheds compelling light on what could be dictating the spread widening phenomenon. The model used breaks the 10Y yield down into a component tied to the trend in benchmark rates in the eurozone (German sovereign debt), another which captures the risk attributable to episodes of stress in the periphery (concentrated in Greece in recent months) and a third and residual factor associated with idiosyncratic factors that are specific to Spain. As shown in Exhibits 2 and 3, it is precisely this third ‘idiosyncratic’ factor which has gained explanatory power in recent months, particularly since the start of the summer (although this factor has been clearly pushing Spanish 10Y spreads wider since the start of the year).

In the absence of major macroeconomic risks (at least over the short and medium term, defined as the next 24 months), we need to look at other variables to pinpoint the source of the specific risk behind (or at least largely behind) the underperformance of Spanish bonds. The political uncertainty surrounding regional Catalan elections that took place on the 27

th of September – a ‘

de facto’ referendum – and the lack of visibility on how a stable government will be formed in Spain in the wake of the general elections in December (given vote fragmentation), are the most likely underlying causes of the spike in idiosyncratic risk.

A good proxy for this Spain-specific factor can be found in the trend in the spread between benchmark Catalan bonds due June 2020 and those issued by the Spanish Treasury. The Catalan bonds have gone from trading at similar spreads to those of other regions (at equivalent maturities) until mid-2014 to a premium of close to 200 basis points today. Despite the reduced liquidity of most regional bonds, the divergence in the price of Catalan bonds compared to those of other regional issuers with similar credit ratings (Andalusia or Valencia) reflects this element of idiosyncratic risk.

Illiquid hedging factors into widening spreads

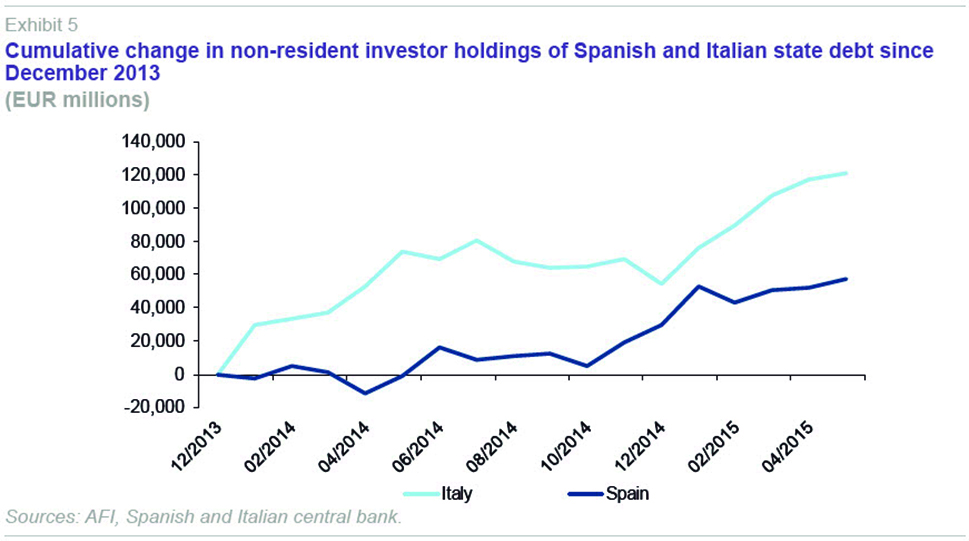

The underpeformance of Spanish bonds in the secondary markets versus Italian paper, which had already begun before the Spanish spread started to widen relative to the Bund (Exhibit 1), may also be driven by more technical issues, which could be luring investors towards the Italian market. As shown in Exhibit 5, the balance of debt holdings by non-resident investors has increased far more significantly in the Italian market than in the Spanish market since the end of 2014. This trend clearly illustrates the fact that the marginal buyer of peripheral EMU debt has been more inclined to build exposure to Italian rather than Spanish debt.

The shift into Italian debt initiated during the fourth quarter of 2014 may have been boosted by dominant market sentiment that the ECB would become more active in terms of its monetary policy, as was later borne out by the start of the massive debt buyback programme announced in January 2015, scheduled to remain in place until at least September 2016. Against this backdrop, investors have displayed a clear-cut preference to buy, within a given credit-rating bracket, the public debt of issuers offering a little bit extra on yield (known as yield pick-up strategies).

In addition to the other factors described above, the availability of a liquid market for a natural hedge (understood as a perfect hedge), specifically long-term bond futures, may have played a meaningful role in the underperformance of Spanish debt relative to that of other issuers. In short, for a similar level of credit risk in the underlying asset (the debt in the form of fixed-coupon bonds), institutional investors, from banks to asset managers and insurance companies, generally prefer to build positions in assets which enjoy a liquid and perfect hedge against adverse movements in interest rates (movements which have an adverse impact on bond prices).

In Spain, such a hedge does exist in the form of a futures contract over the National Bond (traded on MEFF/BME), but the market lacks the liquidity and depth needed to make it the option of choice for these investors. This forces investors to hedge their exposure to Spanish debt by writing futures contracts over underlying assets from other markets, mainly Italian (known as BTPs) and German (Bund, Bobl and Schätze for 2, 5 and 10Y German paper, respectively) bonds.

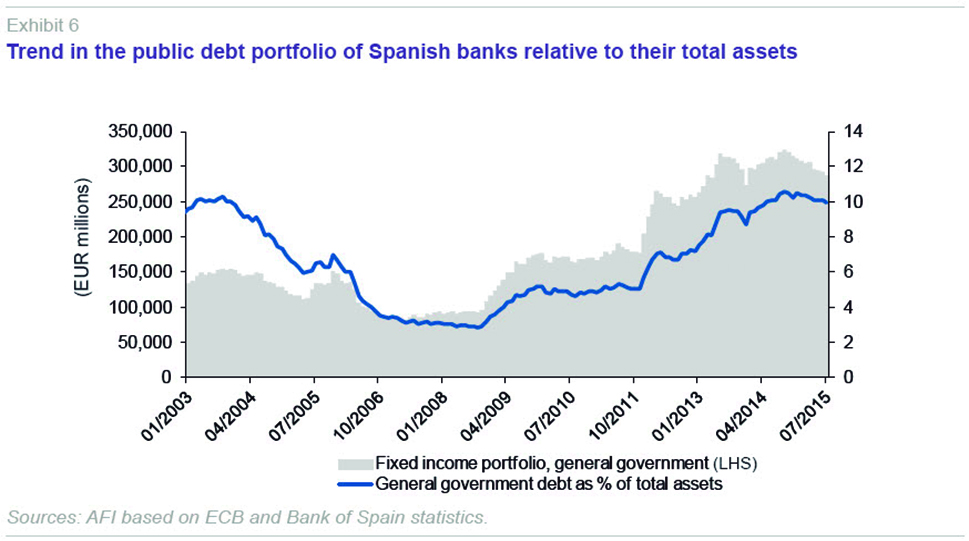

The domestic banking sector’s exposure (volume of holdings) to Spanish public debt is worth highlighting: as of July 2015 (the last ECB figure available), the domestic banks on aggregate still held close to 300 billion euros of public debt, most of which was issued by Spanish government bodies, and this exposure represented 10% of their total assets (Exhibit 6). Non-resident investors are the other major institutional holders of Spanish debt, with 350 billion euros according to Bank of Spain data as of June 2015 (held to maturity portfolio).

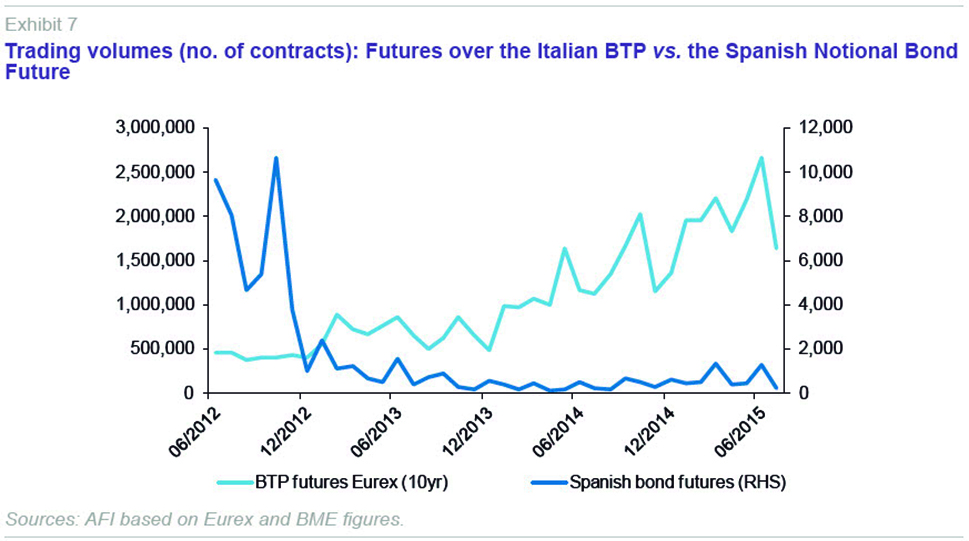

As shown in Exhibit 7, the trend in the trading volume, measured by the number of contracts written, in the Italian BTP on Eurex

versus the Notional Bond on MEFF/BME makes it clear which instrument investors prefer when it comes to hedging their Spanish debt positions. Trading in the futures contract over the Italian BTP has surged in the last 12 months (growing at an average annual rate of 100% with monthly averages of over 2 million contracts on occasion). In contrast, trading in the futures contract over the notional Spanish bond remains very slim. Having plummeted by 65% between 2013 and 2014, trading volumes recovered considerably during the first half of 2015 in terms of the average annual rate, but from levels which are infinitely lower than those of its Italian equivalent on the Eurex (average monthly trading volumes of barely over 700 contracts).

Although there are no official figures to confirm this hypothesis, the market consensus is that roughly 30-40% of Eurex trading in futures over the Italian BTP comes from Spanish counterparties using this instrument to hedge their exposure to Spanish debt instead of the contract over the Notional Bond traded on MEFF/BME.

The sale of bond futures is not the only hedging method used by national and international holders of Spanish debt, who also resort to swaps, options and forward contracts. However, the sale of futures sets up hedges that are more dynamic over time since, as long as the market where they are traded is liquid and deep, the costs of getting in and out of the market are low, enabling investors to fine-tune the percentage of their portfolios they want to hedge depending on the asset manager’s outlook or need to control and/or limit interest rate exposure.

The risks of an imperfect hedge

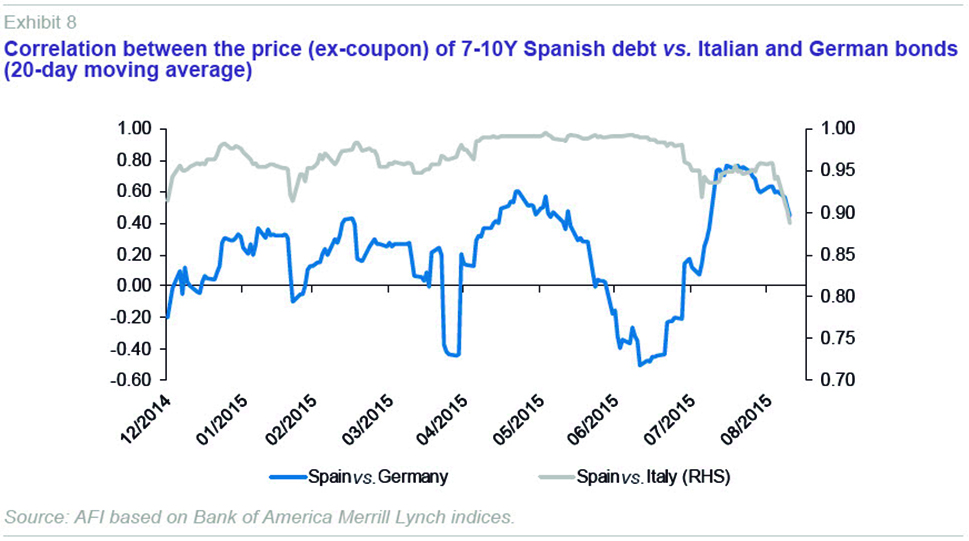

Movements in the spreads between Spanish bonds and their German and Italian counterparts mean that hedges arranged using futures written over the latter underlying issues are not optimal. For example, hedging a Spanish debt position using the contract over the Italian BTP will be (quasi) perfect, and therefore optimal, so long as the spreads between the two markets remain the same throughout the term of the hedge. Spread widening in favour of Spain will render the hedge inefficient by default, while spread narrowing will trigger a mismatch in the other direction (in this instance, favourable).

As illustrated by Exhibit 8, the correlation between Spanish prices and Italian and German prices has been wildly volatile in recent months. (Indeed, instability in the correlation factor has often times been the dominant trend since the start of sovereign debt crisis in 2010.)

Spanish debt markets, as well as their main investors, urgently need a liquid and deep futures market over Spanish bonds. Spanish debt investors, whether national or non-resident, should not be exposed to basis risk as a result of volatility in the spread between Spanish bonds and German and Italian paper. The lack of such a market is costing the country a good few basis points in terms of the cost of borrowing.

There is little validity to the argument, which has been made in the past, that the sharp drop in the volume of trading in the contract over the notional bond since 2012 is attributable to investors’ reduced need to hedge as a result of the narrowing in the spread versus the German bond. The trend in trading in Italian bond futures over the same period of time, during which the Italian spread also narrowed relative to the German bond, undermines this line of reasoning.

Although the domestic sovereign bond futures market’s failure to take off may be the result of a wide variety of reasons, there is a significant level of consensus among a broad spectrum of market agents that the main reasons for the lack of liquidity and depth in this market are the following:

- The perceived lack of involvement by the various bulge-bracket Spanish financial institutions since its launch as either market makers or end users of the product.

- The virtual absence of non-residents as market makers or end users of the futures contract over the Notional Bond, the main reason for which being the existence of a three-fold concentration of ‘Spain risk’: underlying asset, counterparty and clearinghouse.

- Trading requirements for market makers removed from the reality and needs of the spot market in the underlying asset, specifically high bid-ask spreads and prices for low volumes (few contracts).

Upcoming changes to the futures market positive for Spain

Fortunately, and in response to demand from the bulk of the national and international investor community, at the end of October 2015, Eurex

[1] is going to launch a futures contract with long-term Spanish government bonds as underlying assets.

There are reasons to believe that this product launch will be rapidly successful and will inject depth and liquidity into the Spanish debt market, helping to bring down the Treasury’s borrowing costs relative to other markets and in absolute terms, all other drivers and systemic risk, whether via contagion or idiosyncratic, being equal.

In addition to the expectation that trading in Italian BTP and German Bund futures corresponding to (imperfect) hedges of positions in Spanish bonds in the spot market will shift to the new market immediately in the wake of its launch, there are other reasons to believe this market will flourish quickly. We highlight the following:

- The number of market makers and trading requirements (volume and price) on Eurex will translate into optimal liquidity, depth and price conditions.

- The scope for relative value plays among Spanish, German and Italian bonds, until now mainly confined to the spot bond market, should drive growth in trading in Eurex Bund, BTP and Spanish bond futures.

- The public bonds bought back by the Bank of Spain under the umbrella of the QE programme rolled out by the ECB in March 2015 have made this entity one of the biggest players in the Spanish debt market. The risk management strategies which the central banks are permitted to pursue (within the QE programme) make it likely that the Bank of Spain will use the Eurex futures contract over the Spanish bond to mitigate its exposure to risk on account of its Spanish debt portfolio.

Summary and conclusions

The Spanish country risk premium has come under renewed pressure in recent months. While not comparable to the episodes experienced during the worst of the eurozone sovereign debt crisis, an analysis of the unde

rlying factors contributing to the spread widening reveals that the Spain-specific component has re-emerged.

Given the current economic climate and performance, and notwithstanding structural imbalances still in need of correction (albeit of reduced scale compared to those existing pre-crisis), the underperformance of Spanish bonds cannot be attributed to current or near-term growth prospects. In our opinion, one that is shared among many market players, the cause of the recent underperformance lies with the political uncertainty associated with the elections in Catalonia and the subsequent general elections.

However, it is possible that Spanish bonds are also suffering from more technical issues, such as the lack of a sufficiently liquid market for their natural hedge. The scant use of the domestic Spanish bond futures market has driven reliance, increasingly so in recent months, on hedges using more liquid futures contracts over other sovereign issuers (principally Germany and Italy). Given the instability in the correlation between Spanish bond yields and those of Germany and Italy, this has resulted in sub-optimal hedging arrangements over the medium term. In a nutshell, the creation of a futures contract over the Spanish bond to be traded on Eurex, a product which seems pre-destined to succeed, should benefit the Spanish debt market and enable investors to benefit from a liquid hedging option.

Note

José Manuel Amor and Víctor Echevarría. A.F.I. - Analistas Financieros Internacionales, S.A.