The future of blockchain in the European banking system

For European banks, the potential benefits of using blockchain technology do not diminish the controversy surrounding it. From scalability challenges to the “blockchain trilemma” of recording information correctly, cost efficiently and in a decentralised way, the European banking industry is navigating the risks and regulatory issues of blockchain as it takes a global lead in the adoption of this new technology.

Abstract: Blockchain technology has sparked intense debate in recent years. In the financial industry, this debate has centred almost exclusively on the rise, and more recently on the relative decline, of cryptocurrencies and the risks of these instruments. However, blockchain technology has far wider implications for markets and banks. To get in front of emerging challenges, the European banking industry has spearheaded some key blockchain-based platforms, including for trade finance. These initiatives have recently been backed by the European Commission, which made the financial applications of blockchain technology a central part of its 2018 FinTech Action Plan.

What is blockchain?

Blockchain is probably the most talked- and written-about technology of recent years. Although configurations can vary, blockchain can be understood as a distributed ledger technology (DLT) in which information is recorded in a large ledger in “blocks” that are linked and encrypted to be secure and unalterable. Blockchain’s key virtue is decentralisation, which enables information to be recorded without the need for intermediaries. It is paradoxical, then, that financial institutions –the ultimate “middlemen”– stand to benefit from blockchain disintermediation.

Applications of blockchain in the European banking sector

The trajectory of blockchain in the European banking industry has been marked by several distinct phases. 2017 was a year of experimentation and strategic configuration, while 2018 was devoted to testing the technology and rolling out DLT-based initiatives. Will 2019 be the year blockchain technology finally takes off in Europe’s banking sector?

It is hard to be certain, but Europe finds itself at an interesting juncture. While BigTech players in Europe have been scarce, European banks have emerged as leaders in the adoption of these new financial technologies (mainly via cooperation platforms). Meanwhile, regulatory initiatives have been developed to promote, or at least provide, legal protection for blockchain applications in the EU.

Throughout 2018, the European Commission pursued several initiatives that suggest blockchain may play a key role in the configuration of the Digital Single Market (DSM), a target that the banking industry is working to meet. It was hardly surprising when the EU invited major European firms and start-ups to a DSM forum in 2018 to create the International Association for Trusted Blockchain Applications (IATBA), in which Spain and its banks are strongly represented. The EU expects the IATBA to be fully operational by the first quarter of 2019 and to become the public face of technological cooperation and development in the region, competing with Asia and the US in the DLT arena.

Recent blockchain initiatives in Spain’s banking industry and beyond

Europe’s banks have pioneered some of the world’s most important DLT-based platforms, with Spain’s financial institutions playing an important role in most of them. In 2018, some Spanish banks began promoting blockchain transaction use cases in certain fields, such as asset securitisation and loan approval. To an extent, these initiatives have been test environments for analysing how these types of transactions can be sped up, at what cost and at what level of security.

Early results appear promising. As in other areas of technological uptake, these initiatives are not only being led by the supply side, but also by growing demand from non-financial corporates for blockchain-based banking services. In a 2018 Cognizant survey of 1,570 senior executives at large European firms, 42% said they expected that banking and financial services would be where blockchain would have the biggest impact in the coming years (Cognizant, 2018).

Perhaps the best example to date of DLT addressing corporate demand for more agile financial services is in large-scale trade finance. In a field where bookkeeping, financing and payment transactions for large-scale exports can take days and even weeks to close (a single transaction can involve multiple firms across the globe), international banks have begun to cooperate. Spearheaded by European banks, this collaboration has enabled trade transactions to be automated and monitored as never before.

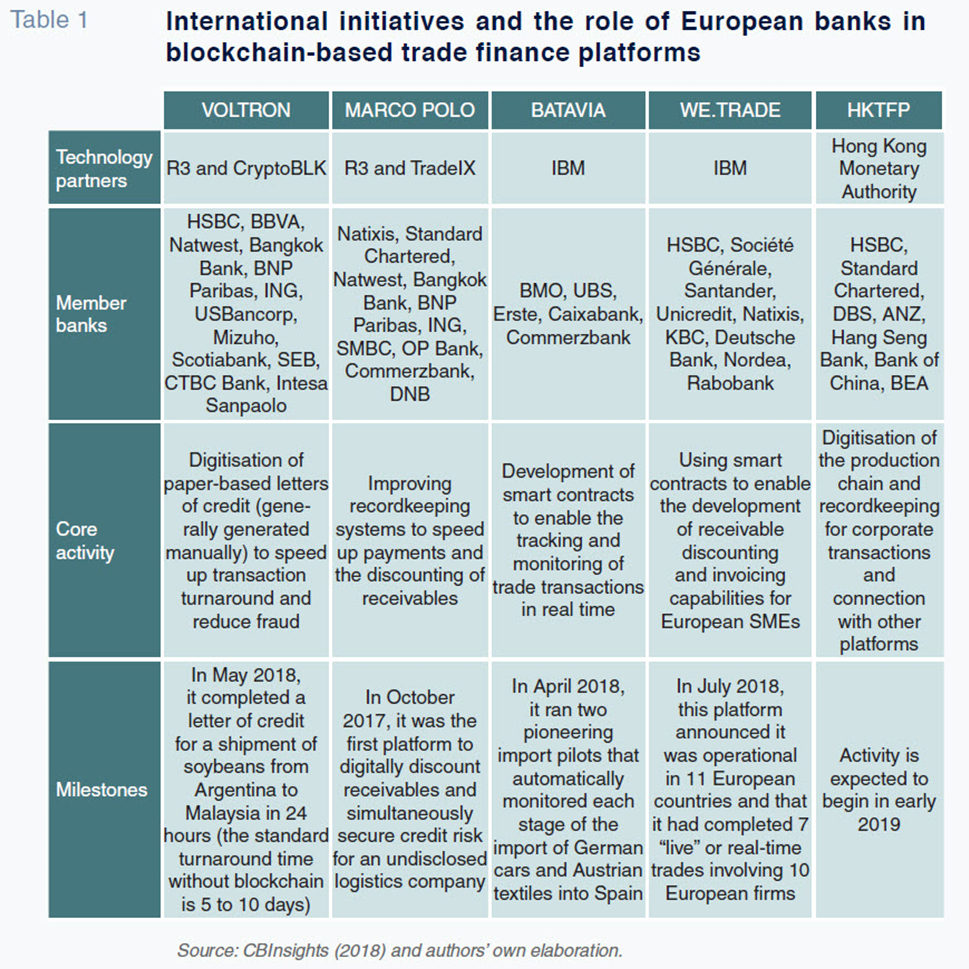

Table 1 shows the world’s top five trade finance platforms. Four of the five are markedly European in profile (three of the five include Spanish banks): Voltron, Marco Polo, Batavia and We.Trade. The fifth, the Hong Kong Trade Finance Platform (HKTFP) was developed by the Monetary Authority of Hong Kong and is expected to be operational in 2019.

These platforms cover multiple activities, from transaction payments and credit underwriting to the execution of trades via smart contracts, all at speeds that allow transactions to close within 24 hours. Although it is too soon to tell, a growing share of global trade will likely be channelled through these platforms thanks to cooperation between technology firms and financial institutions. This collaboration is strengthened further by cooperation among the various platforms themselves, with some banks participating in more than one platform at the same time.

As Table 1 shows, DLT-based trade finance is currently dominated by large financial institutions, but there are also initiatives at the national level involving smaller players and technology providers. One example in Spain is the alliance of Cecabank and Grant Thornton, which created the country’s first Blockchain Banking Consortium in May 2017, Niuron. The Niuron platform includes eight banks (in addition to Cecabank) that share banking apps based on blockchain technology: Abanca, Bankia, Caixabank, Caixa Ontinyent, Ibercaja, Kutxabank, Liberbank and Unicaja Banco. Niuron has two objectives: 1) to provide an observatory from which to monitor the technology and generate technical, legal and business know-how; and, 2) to back joint, blockchain-based banking initiatives aimed at transforming the sector, from biometric identification to data protection or regulatory compliance.

The blockchain trilemma

Given the possibilities blockchain offers for the banking industry and the success of many of the pilot initiatives outlined above, why has this technology not seen faster development and uptake? The answer lies with the original vehicle for blockchain: cryptocurrencies. Their volatility, alternative uses (which authorities cannot always control) and, above all, the recent and significant loss of value and confidence, have created some unease in the market.

Some economists have focused their criticism on the correction of digital currencies’ valuations. While blockchain advocates insist that it is not the application (currency) that counts, but the underlying technology (blockchain), critics have countered that defence. The Project Syndicate blog recently stated:

In reality, blockchain is one of the most overhyped technologies ever. For starters, blockchains are less efficient than existing databases. When someone says they are running something “on a blockchain,” what they usually mean is that they are running one instance of a software application that is replicated across many other devices. The required storage space and computational power is substantially greater, and the latency higher, than in the case of a centralized application. Blockchains that incorporate “proof-of-stake” or “zero-knowledge” technologies require that all transactions be verified cryptographically, which slows them down. Blockchains that use “proof-of-work,” as many popular cryptocurrencies do, raise yet another problem: they require a huge amount of raw energy to secure them. (Roubini, 2018).

And, ironically:

For the moment, the real question is if and when global regulation will stamp out privately constructed systems that are expensive for governments to trace and monitor. Any single large advanced economy foolish enough to try to embrace cryptocurrencies, as Japan did last year, risks becoming a global destination for money-laundering. (Japan’s subsequent moves to distance itself from cryptocurrencies were perhaps one cause of this year’s gyrations.) In the end, advanced economies will surely coordinate on cryptocurrency regulation, as they have on other measures to prevent money laundering and tax evasion. (Rogoff, 2018).

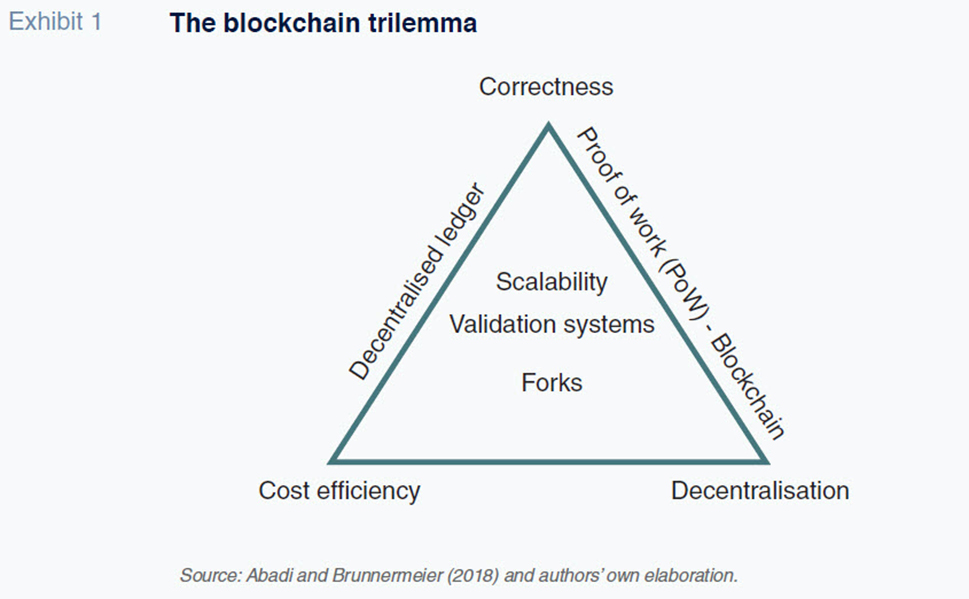

The shadow cast by cryptocurrencies is not the only problem facing DLTs. The blockchain economy itself faces technological limitations that can be summed up by the “blockchain trilemma” (a term coined by economists Abadi and Brunnermeier, 2018) or the “scalability trilemma” (originally described by Ethereum founder, Vitalik Buterin [2015]). The blockchain trilemma is illustrated in Exhibit 1.

Because the blockchain is written by anonymous users, consensus is reached by making the ledger publicly viewable and verifiable. As Exhibit 1 shows, a DLT should ideally record all information correctly and in a cost-efficient, decentralised manner that avoids concentration of power.

The issue is that no ledger to date has been able to satisfy these three conditions simultaneously. Many blockchain applications fail to reach sufficient operating scale to reduce their energy consumption and other costs (computing, verification, time) below the costs of centralised ledgers. Scalability is also important to verify that records (a financial transaction, for example) are correct. However, not all potential users will have access to the computing capabilities needed to verify the algorithms in various parts of the blockchain, thus limiting its size and, sometimes, decentralisation. This issue is further complicated when verification technology is divided into one or more technologies or the verification protocol of a blockchain network is changed. This phenomenon is known as a “fork” and is a common problem with cryptocurrencies that have several versions.

Without being too technical, verification implies (among other issues) the ability to add a “solution” to the algorithm so that the blockchain can continue to be written. Blockchain provides the “proof of work” that verifies the correctness of the information recorded. Other protocols, such as “proof of stake” have been put forward to enable faster verification. Proof-of-work systems sometimes make it too costly to verify records. Although costs are lower with a proof-of-stake system, decentralisation is lost (as this protocol implies fewer participants and more centralised control) — another example of the trilemma.

It has been suggested that in certain contexts, centralisation could be the “lesser evil”, or the part of the trilemma that could be “sacrificed”. Specifically, the concentration of verification systems could make sense when transactions are relatively delimited among a smaller group. However, this route breaks with an essential part of the DLT philosophy (decentralisation) and introduces possible market power rents more typical of intermediation.

In the financial sector, it could make sense to sacrifice some decentralisation in exchange for an equivalent cost savings in markets where competition is already high. In the banking industry, for example, margins have fallen considerably and competition has increased due to, among other things, the push for digitisation, growing competition from non-banks and cost cutting. The trade finance example presented earlier suggests the potential for significant efficiency gains, even at the price of using somewhat more centralised protocols.

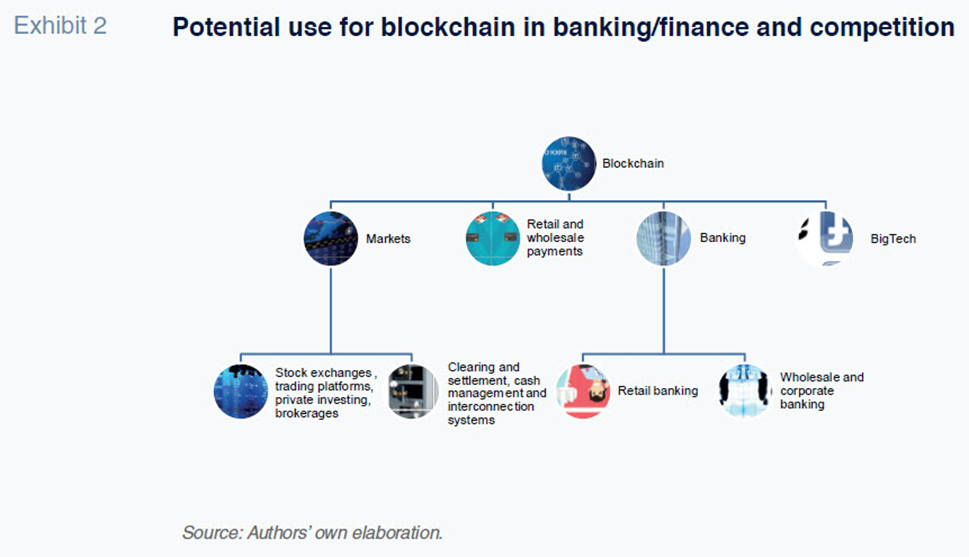

As shown in Exhibit 2, there is a range of possible applications for blockchain in banking and finance. In the markets, blockchain can make equity trades faster and more secure, paving the way for more open and competitive trading. It could also make it easier to verify private investments and provide access to more potential suppliers. It too enables the development of more secure or complementary asset clearance, settlement and custody systems. Paradoxically, blockchain could even make it possible to manage and account for something as unelectronic as cash more efficiently, enhancing traceability and ownership recordkeeping.

Payments is another area of significant development for DLTs. The limitation in this case is the failure of cryptocurrencies like Bitcoin to live up to their expectations. The utility of cryptocurrencies as a store of value or speculative asset may be up for debate, but there is general consensus that they have not worked as a means of payment. Regardless, the large card operators and other electronic payment instruments are already developing and testing blockchain technology to shorten settlement times for national and, above all, international payments. Payments may be ripe for blockchain expansion in the near future.

In banking, there are broad possibilities in both the retail and wholesale segments. Beyond the realm of trade finance, there is scope for using distributed ledgers to improve efficiency, turnaround times and verification in areas such as:

- Real-time lending underpinned by borrower risk management based on smart contracts;

- Property valuations and verification;

- Development of tailored personal financial tools;

- Management of liquidity and cash, virtual portfolios and management of currencies/remittances;

- Audit and control of counterparty risk;

- Mitigation of operational risk; and

- Regulatory compliance.

Finally, in the environment depicted in Exhibit 2, it is important not to forget BigTech players like Facebook, Apple, Amazon, Google and Netflix. The use of DLTs is the natural next step for companies that control the key input for distributed ledgers: information. This may imply faster customer access systems for their own financial transactions, stepping up competitive pressure on the banks.

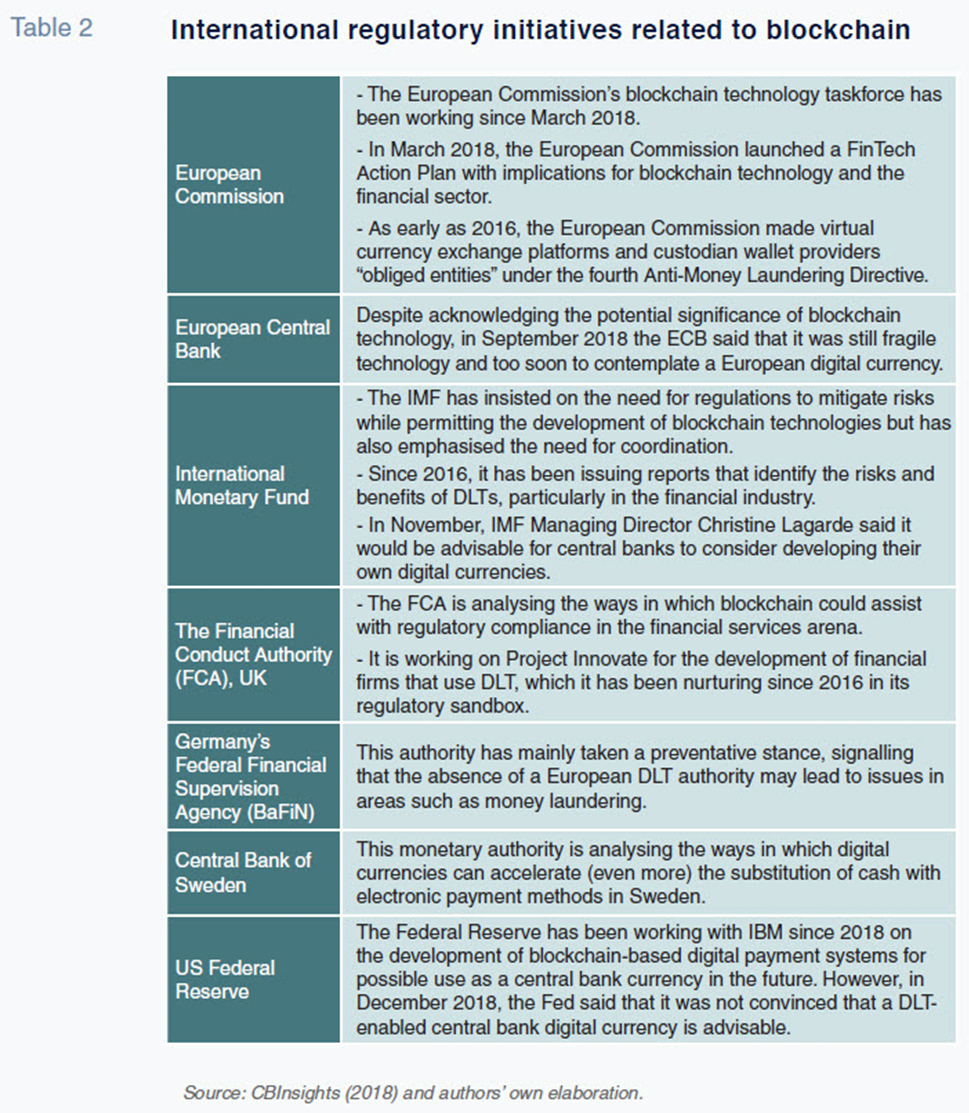

International regulation and risks of blockchain: A European perspectiveThe definitive development of blockchain technology in the European banking system will depend largely on how it is regulated. As Table 2 shows, the EU stands out in the international arena in its efforts to promote the use of blockchain technology. It is important to single out the regulatory and supervisory debate on the most extensive application of blockchain technology to date: cryptocurrencies. Although the International Monetary Fund has urged the main global central banks to make progress on creating so-called central bank digital currencies (CBDCs), both the European Central Bank and, more vehemently, the US Federal Reserve, are reluctant to go much further than experimental tests and do not deem it necessary, for the time being, to launch their own CBDCs.

However, the scope for blockchain expansion goes well beyond private or monetary authority virtual currencies. Once again, Europe stands out. In March 2018, the European Commission set up a blockchain technology taskforce, and that same month launched a FinTech Action Plan that prominently featured blockchain-based projects. Indeed, the first objective listed in the Action Plan is to enable the financial sector to make use of the rapid advances in new technologies, such as blockchain, artificial intelligence and cloud services.

While the Action Plan seeks to make markets safer and easier for new players to access, its three main objectives are to enable innovative business models to reach scale in the EU, to support the uptake of technological innovation in the financial sector, and to enhance cybersecurity and integrity in the financial sector.

The UK has been home to regulatory and supervisory pioneers. The Financial Conduct Authority (FCA) has created laboratories to simulate the market launch and oversight of FinTech companies, or the so-called “regulatory sandbox”. Projects that analyse how blockchain could assist with regulatory compliance in financial services are a particularly important part of this endeavour. Within the sandbox, the FCA is running Project Innovate, which is targeted specifically at financial firms that use DLT.

These testing grounds, action plans and nascent regulations on the use of blockchain in banking and finance also consider the risks that must be managed for appropriate uptake of these technologies. First, they share the industry’s concerns about profitability. To the extent that the proposed applications or solutions involve too many costs (mainly due to scalability problems), market launches will not be viable. However, applications and platforms that do not allow for a certain degree of standardisation and interoperability do not appear to be very viable. Once again, scalability is the issue. If the technology cannot be shared among operators or platforms, or is so exclusive as to create incompatibilities among competitors, large-scale adoption is unlikely (demand-wise).

Finally, the supervisors have their eye on how blockchain could introduce new risks to financial stability, especially in terms of counterparty and operational risks if the proposed applications fail. However, they are also looking at potential benefits in the areas of privacy, compliance and transparency from an oversight standpoint.

References

ABADI, J., and M. BRUNNERMEIER (2018),

Blockchain Economics, mimeo, Princeton University,

https://scholar.princeton.edu/sites/default/files/markus/files/blockchain_paper_v3g.pdfBUTERIN, V. (2015),

Notes on scalable blockchain protocols, mimeo,

https://github.com/vbuterin/scalability_paper/blob/master/scalability.pdfCBINSIGHTS (2018),

How Blockchain Could Disrupt Banking,

https://www.cbinsights.com/research/blockchain-disrupting-banking/COGNIZANT (2018),

Blockchain in Europe: Closing the Strategy Gap,

https://www.cognizant.com/whitepapers/blockchain-in-europe-closing-the-strategy-gap-codex3320.pdfROGOFF, K. (2018),

Betting on Dystopia, Project Syndicate,

https://www.project-syndicate.org/commentary/cryptocurrencies-are-like-lottery-tickets-by-kenneth-rogoff-2018-12ROUBINI, N. (2018),

The Blockchain Pipe Dream, Project Syndicate,

https://www.project-syndicate.org/commentary/blockchain-technology-limited-applications-by-nouriel-roubini-and-preston-byrne-2018-03?barrier=accesspaylog

Santiago Carbó Valverde. CUNEF, Bangor University and the Funcas Observatory of Financial Digitalisation

Francisco Rodríguez Fernández. Granada University and the Funcas Observatory of Financial Digitalisation