The Spanish economy in 2018 and forecasts for 2019–2021

After three years of strong economic growth, Spain’s economy is starting to lose steam. Regaining speed will, in part, depend on external factors related to the global economy, together with pushing forward on domestic reforms.

Abstract: In recent years, the Spanish economy has grown by more than 3% while also managing to maintain a substantial current account surplus. However, this pattern of strong growth with external surplus is losing momentum, due in large part to a cooling European economy and the deteriorating international context. The Spanish economy is expected to register relatively strong growth in 2019. However, external shocks, such as trade tensions, the imbalances weighing on China’s economy, a highly leveraged global economy and a surge in anti-European populist movements, could unleash a crisis of confidence and drain global growth more intensely than is currently anticipated. In such circumstances, Spain’s high public deficit would leave scant room for deploying anti-cyclical fiscal policies. Domestically, maintaining momentum on the reform agenda will be necessary to support Spain’s growth cycle, create jobs and remedy inequalities.

Introduction

Economic growth in Spain has been lagging since the start of 2018, when the three-year recovery began to lose steam. Although the slowdown has been gradual—Spain continues to outperform the European average and create jobs—it is worth examining whether this phase of growth is sustainable.

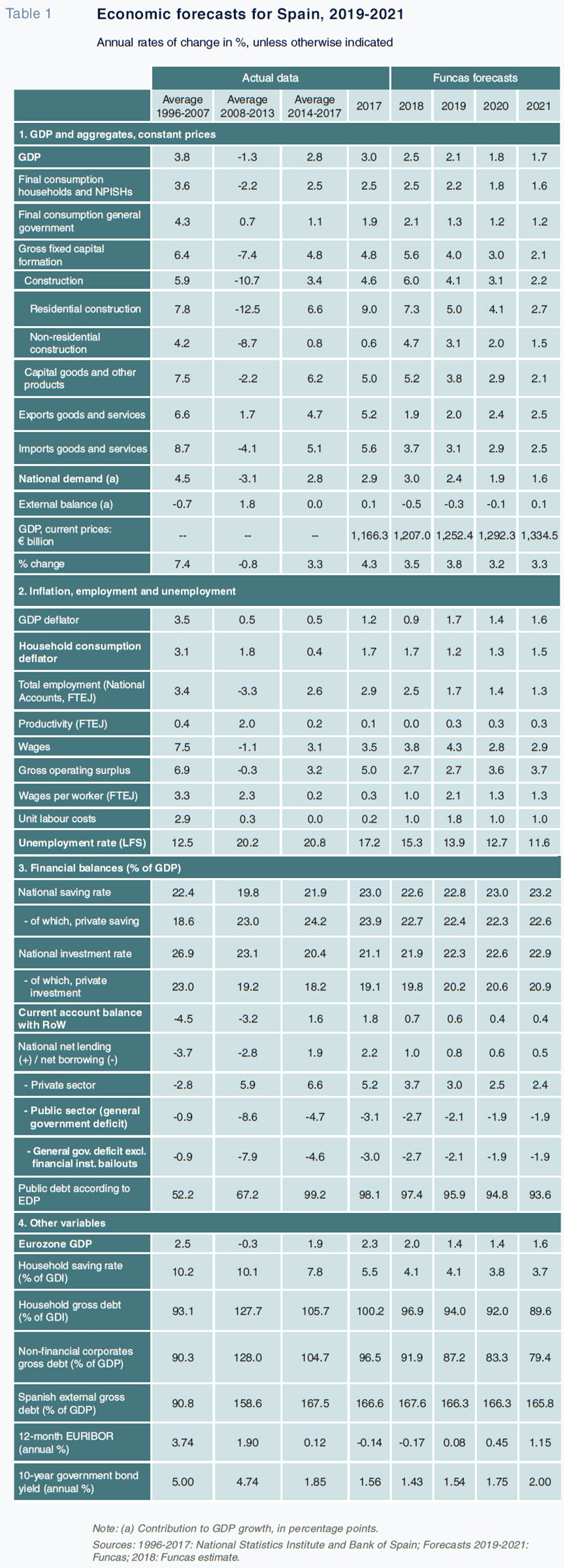

This analysis is underpinned by key takeaways from 2018 and forecasts for 2019–2021, which update and expand on earlier forecasts for 2018–2021 (Torres and Fernández, 2018). The three years covered by this forward-looking analysis is the time horizon considered appropriate for testing the Spanish economy’s resistance to potential shocks (ESRB, 2018).

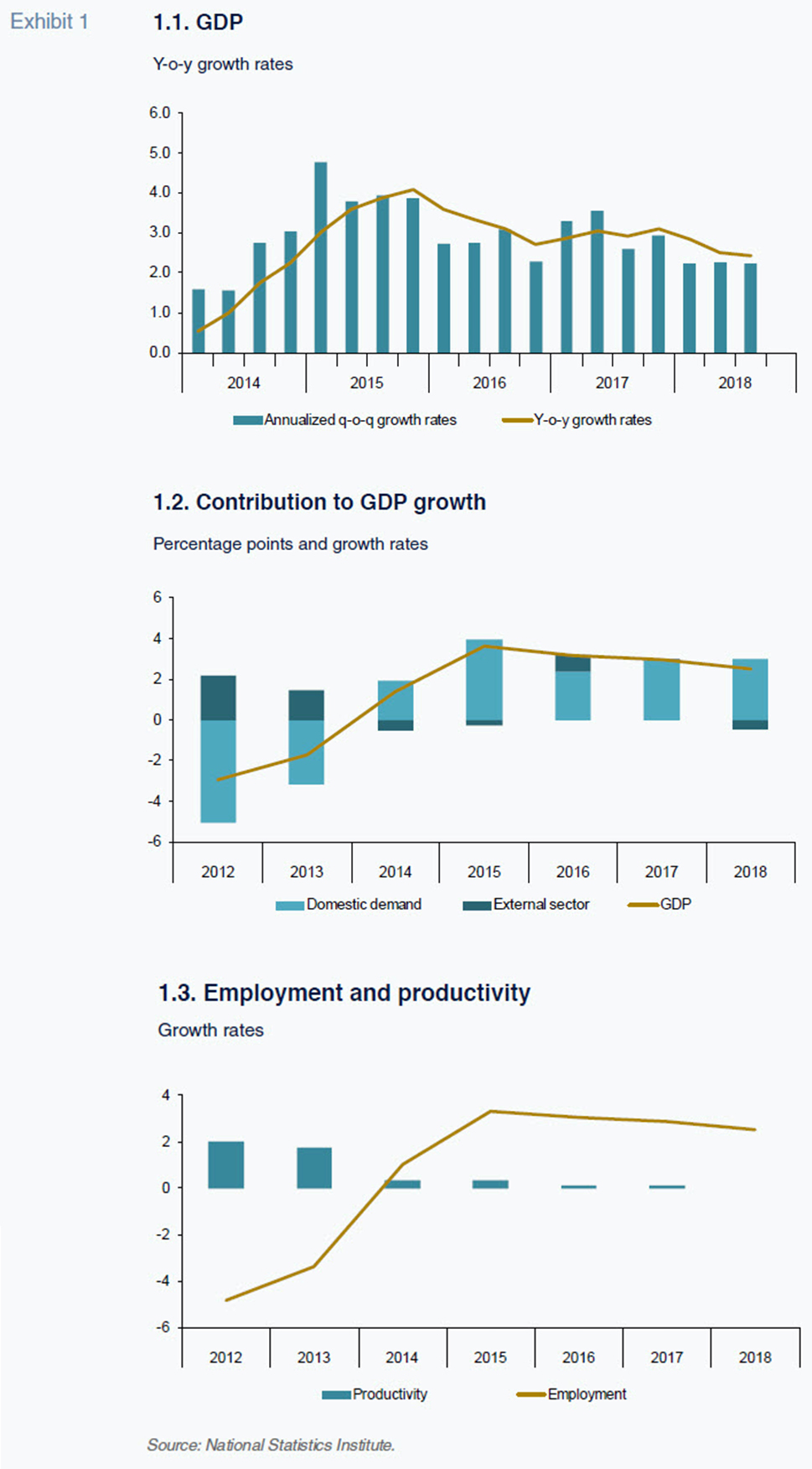

The forecasts pay special attention to the trend in the current account, not just GDP growth. Indeed, in recent years, the Spanish economy has grown by more than 3% while also managing to maintain a substantial current account surplus. This is important from both a market confidence and financial sustainability standpoint, as all previous recessions have been preceded by a sharp deterioration in the balance of payments.

There is another scenario worth considering as well, one articulated around a reform agenda. This policy simulation examines the impact on growth and the current account, as well as the Spanish economy’s key weaknesses: unemployment and public deficit.

The Spanish economy in 2018

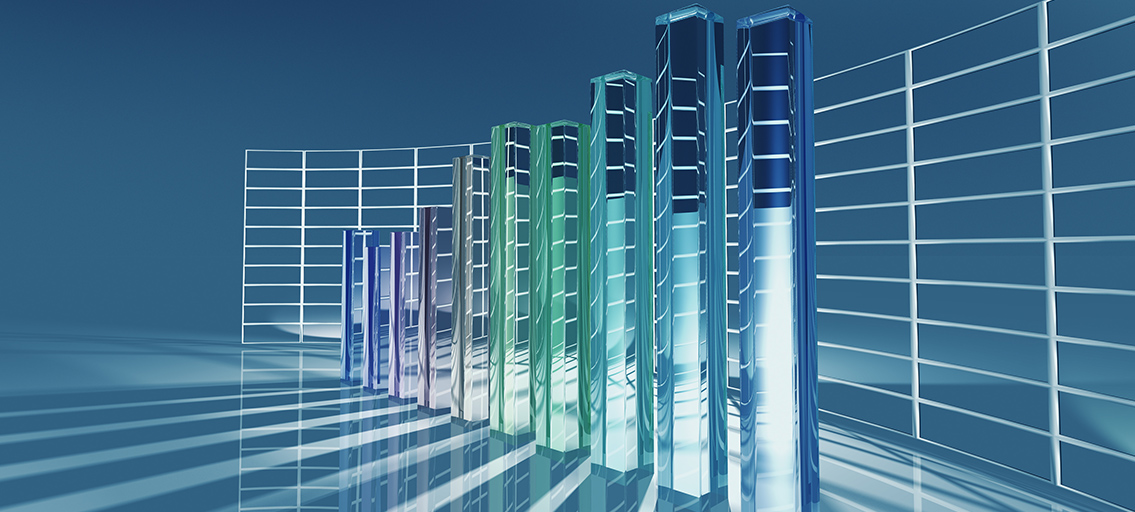

Although not all fourth quarter indicators are in yet, the Spanish economy is expected to have grown by 2.5% in 2018. Whereas the quarterly rate of growth was steady at 0.6% in the first three quarters of the year, indicators point to faster growth of 0.7% in the fourth quarter. These rates are high relative to the eurozone, but down year on year, which is why growth is tracking lower than in 2017, when the economy expanded by 3% (Exhibit 1.1).

Growth is in line with both the year-end Funcas forecasts and the consensus forecasts of the group of analysts tracked by Funcas (although those forecasts were revised upwards during the first half of 2018, they were cut in the second half). There are nevertheless significant differences in these forecasts in terms of the composition of growth.

The expectation was that growth would slow primarily from an easing of domestic demand, specifically consumer spending, while foreign demand would continue to have a positive impact. However, domestic demand has held up remarkably well, with growth even accelerating from 2017, driven by higher momentum across the board. Rather, the slowdown is entirely attributable to deterioration in the foreign sector, where the net contribution to growth has gone from slightly positive in 2017 to detracting from growth around 0.5pp in 2018, shaped by a sharp downturn in exports of both goods and services (particularly tourism and non-tourism services) (Exhibit 1.2).

Growth in private consumption is expected to be very similar to that observed in 2017. In nominal terms, growth in this heading slowed due to lower inflation, but outpaced growth in gross disposable household income (GDHI), as has been the case since the start of the recovery. This caused household savings to dip further, to 4.1% of GDHI, a record low since the beginning of the series in 1999.

A drop in household savings, coupled with growth in household investing, increased the household borrowing requirement to 1.4% of GDP (Exhibit 5.1). Having recorded a net lending position from the start of the crisis until 2016, Spain’s households have been net borrowers since 2017. Nevertheless, household leverage continued to come down (Exhibit 6), even though growth in consumer credit was healthy. Although it is too soon to talk about an imbalance, the borrowing requirement of Spanish households continues to rise and soon their leverage will, too. These variables should be monitored.

Investment in capital goods also proved more dynamic than anticipated, growing more than in 2017. This variable continues to be underpinned by healthy balance sheets, low interest rates and a recovery in corporate profit margins (which nevertheless remain below pre-crisis levels according to the Bank of Spain’s numbers). As has been the case since 2009, on aggregate, firms funded this investment effort from internally generated funds. Indeed, Spain’s corporates were net lenders once again in 2018 (Exhibit 5.2). As a result, their borrowings continued to decline relative to GDP and currently stand below the eurozone average (Exhibit 6).

Investment in construction accelerated in 2018 thanks to non-residential construction, primarily public works; and although housing construction decelerated, it remained strong. The real estate market remained buoyant: house sales registered 11% growth to September and house prices increased by 3.2% in the first nine months of the year, according to the Ministry of Public Works figures, or 6.7%, according to the National Statistics Institute. However, this trend fluctuated by region, with price increases of over 10% in Madrid, Barcelona, Palma de Mallorca, San Sebastián and Málaga, while other regional capitals saw lower growth and even price contraction (Ministry of Public Works, 9M18).

Growth in exports slowed significantly across the board for goods and services, particularly tourism and non-tourism services, with growth estimated at 1.9% compared to 5.2% in 2017. In goods exports, the slowdown was more pronounced than the easing in global trade or imports from Spain’s export markets. Growth in imports was 3.7%, in line with the average elasticity relative to final demand observed in recent years. As a result, growth in imports outpaced that of exports, with net trade detracting from GDP growth.

This negative contribution, coupled with higher oil prices for much of the year and an increase in the income deficit, narrowed the surplus in the current account of the balance of payments to an estimated 0.7% of GDP, compared to 1.8% in 2017 (Exhibit 2).

The construction sector saw the strongest growth, while the manufacturing industry registered its lowest rate of growth since the start of the recovery, a sign of weak exports. The manufacturing sector’s performance was also affected when car production halted in September, triggered by the entry into force of new emissions regulations. Growth in non-market services accelerated, but slowed in all other services, due mainly to the modest expansion sustained by sectors most closely related to tourism.

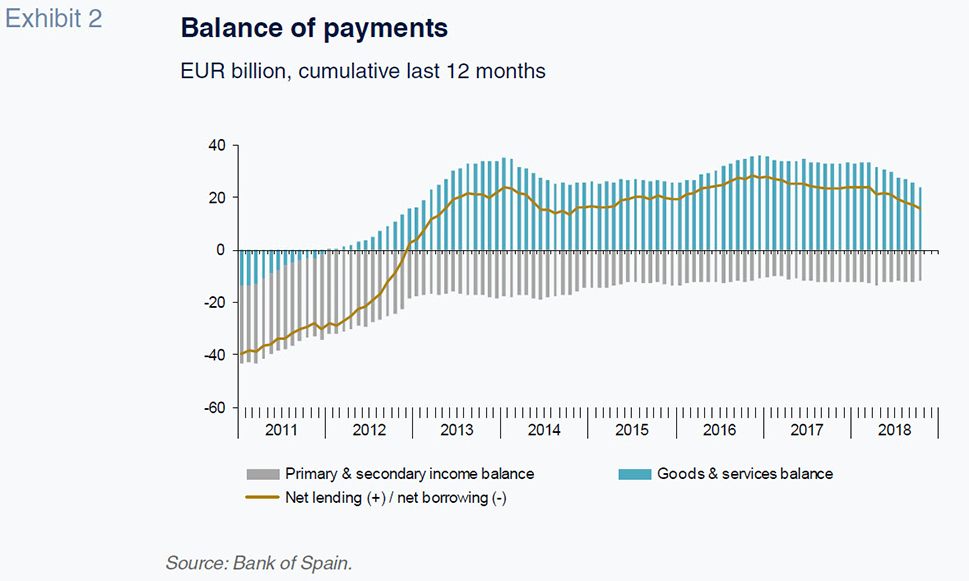

The number of full-time equivalent jobs increased by 2.5%, implying zero growth in apparent labour productivity (Exhibit 1.3). Employment growth was highest in the construction sector. According to the

Labour Force Survey (EPA), pending fourth quarter numbers, employment is also expected to have increased by 2.5% (Exhibit 3.1). The active population contracted slightly (for the first time since 2011), while the average unemployment rate was 15.3% (the lowest since 2008), which by most estimates is right around the NAWRU.

Social Security contributor numbers point to higher growth in employment in 2018: 3.1% (Exhibit 3.2). Sharp growth in the number of contributing wage earners on indefinite contracts stands out at 4.8%, having accelerated year on year, compared to 3.6% growth of those on temporary contracts, which contracted. These trends—acceleration in indefinite arrangements versus deceleration in temporarily arrangements—are also evident in the EPA numbers, although less pronounced.

The overall public deficit is estimated at 2.7% of GDP, down 0.3pp from 2017. Tax revenue increased by more than expected, around 6%, but spending also registered sharp growth, particularly pension expenditure. Public employee remuneration and public investment also increased, but to a lesser extent. The ratio of public borrowings to GDP ended the year at 97.4% (Exhibit 7).

International context and macroeconomic policy: The outlook

for 2019–2021

A deteriorating international environment

The international environment has deteriorated unexpectedly. In addition to the trade row between the US and China, the world’s two largest economies, protectionist measures have been proliferating, weakening global trade. This situation is making things harder for the Chinese government, which is also tackling a sharp slowdown in domestic demand. Elsewhere, rate tightening by the Federal Reserve is pushing up borrowing costs for emerging economies most exposed to dollar-denominated debt, particularly Argentina and Turkey.

In light of these factors, the global economy is expected to slow. Both the World Bank and the IMF have cut their forecasts for global GDP growth. These forecasts have been factored into the scenario contemplated by Funcas, which assumes growth in export markets of 3.5% in 2019 and 2020 (down 0.2pp from the last set of forecasts) and 3.8% in 2021.

The European economy has also cooled, as evidenced by prevailing economic sentiment, consumer confidence and industrial output indicators. Italy has just entered into recession as a result of the pressure on its risk premium, the uncertainties surrounding its public deficit roadmap amidst high public borrowings, and the banks’ still high non-performing loan ratios. In France, the economy has slumped as a result of the gilets jaunes movement.

But the biggest surprise has come from Germany, the country most exposed to the trade tensions. The German economy contracted in the third quarter of 2018 and has failed to show significant signs of recovery since. Moreover, Germany’s companies are finding it hard to hire skilled labour as unemployment nears all-time lows. Finally, the uncertain denouement of Brexit is also weighing on the European economy, particularly the UK, one of Spain’s main trading partners, which is registering very low growth.

As a result, the growth forecasts for the eurozone have been trimmed to 1.4% for 2019, 0.2pp down from the last set of forecasts. The region is expected to post similar growth in 2020 and then stage a slight recovery in 2021.

Macroeconomic assumptions

Monetary policy is expected to remain expansionary during the projection period as a result of weak growth in Europe coupled with contained inflation, which is tracking well inside the annual target of 2%. The European Central Bank is expected to stick with its plans to roll back its bond repurchasing activity and to delay its benchmark rate tightening until the end of 2019 or early 2020. As a result, current forecasts contemplate an even smoother increase in long-term interest rates.

As for fiscal policy, the forecasts assume the rollover of Spain’s general state budget and layer in measures already taken, including public pay and pension increases on the spending side. On the revenue side, the numbers include the increases already decided on Social Security earnings caps and the impact on tax receipts of the increase in the minimum wage in 2019.

Note that the forecasts do not factor in the new budgetary plan recently approved by the Spanish government. That decision reflects the margin for change in the course of the impending parliamentary approval process and the uncertain timing of the effectiveness of a potential new budget (probably no sooner than the middle of the year).

Forecasts for 2019–2021

Growth is forecast at 2.1% in 2019, 0.1pp down from the last set of forecasts (Table 1). The foreign sector is expected to detract from growth by 0.3pp on the back of slower growth in exports as the global economy weakens. The current account surplus is expected to narrow to 0.6% of GDP.

Domestic demand should remain buoyant, although growing less than in previous years. The slowdown in private consumption is expected to be very slight as the reduced margin for spending from the decline in the savings rate will be partially offset by higher growth in household income as a result of several factors, including increases in the minimum wage, public sector pay and pensions. Investment in capital goods is also expected to ease due to the downturn in global economic prospects, the lack of stimulus via rate cuts and the likelihood that momentum will just run out of steam.

Despite the slowdown, the Spanish economy will continue to create jobs and the unemployment rate is expected to fall to 13.9%. Compensation per employee is expected to increase by 2.1%, the highest rate since 2009, thanks to raises in the minimum wage and public sector wages. In light of the weak forecast growth in productivity, unit labour costs are expected to increase by 1.8%, in line with the eurozone average.

The budget assumptions suggest that growth in tax revenue will outpace GDP growth, while spending should trail slightly below. That should facilitate cutting the deficit to 2.1% of GDP, down 0.6pp from 2018. Despite the correction, the deficit would still exceed the target of 1.3% (and even the government-adjusted target of 1.8%). The spending items expected to sustain the highest growth are public pay and pensions. Debt servicing costs are expected to be largely the same as in 2018 and begin to increase from 2020.

The slowdown is expected to last until 2021, when growth is forecast to be close to the Spanish economy’s potential output, which is estimated at between 1.6% and 1.7%. This would still be sufficient to push the unemployment rate down to 11.6%, only slightly above 2008 levels. Factors such as the low savings rate, the rise (albeit very moderate) in interest rates and the limits on public spending derived from the deficit are expected to gradually slow the rate of growth in domestic demand. Low growth in international markets and productivity (the key to enhancing Spain’s export competitiveness) are expected to narrow the current account surplus even more, to just 0.4% of GDP. Finally, the economic slowdown will weigh on the deficit-cutting effort. Public borrowings would remain at 93.6% of GDP at the end of 2021.

Growth in wages is expected to decrease in 2020 and 2021 relative to that forecast for 2019, heavily influenced by one-off factors, but should be higher than that seen in recent years. This, coupled with scant productivity gains, is similarly expected to drive higher growth in ULCs compared to recent growth. Overall, Spanish firms should remain competitive throughout the entire projection period.

An alternative scenario: Factoring in reforms

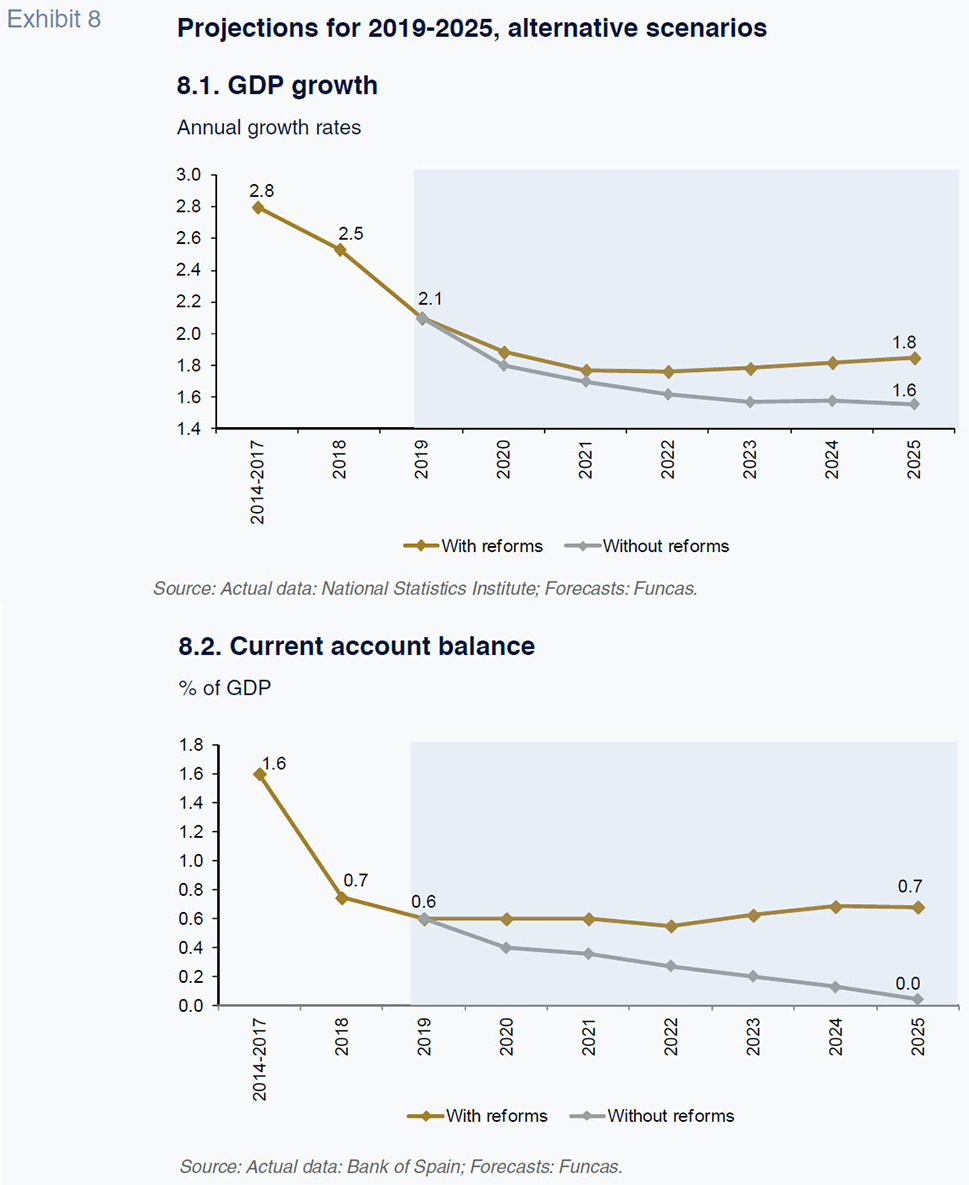

The forecasts presented here assume no specific measures will be taken to boost the economy’s long-term performance, which is why growth approaches its potential towards the end of the projection period and the current account surplus trends towards zero. However, in an alternative scenario of reforms, the prospects would improve considerably.

An alternative scenario layers in a reform agenda that would take full effect from 2020. That agenda would include reforms designed to reduce the incidence of temporary work arrangements weighing on productivity and the generation of human capital, improving how markets for goods and services work and stimulating investment in new technologies, innovation and education.

The result would be an increase in annual growth of productivity from 0.2% at present to 1% (the average rate of growth in Germany and France).

[1] This positive ‘shock’ would be relatively small, therefore, as the gap in economic efficiency relative to the eurozone’s two biggest economies would remain the same. Elsewhere, in keeping with international experience, the impact of the reforms would be gradual, producing measured productivity gains. Finally, there is no consensus on how much the reform effort would impact growth in productivity.

[2] This scenario should therefore be considered an estimate, and is intended more as an illustration of the macroeconomic effects of potential reforms.

Bearing these considerations in mind, the main outcomes of the productivity gains delivered by the reforms would be: (i) greater competitiveness on the part of Spanish enterprises and a stimulus for exports; and, (ii) higher returns on investment. The increased GDP deriving from these effects would trickle down to job creation and wage income, fuelling domestic demand and attenuating social deficits.

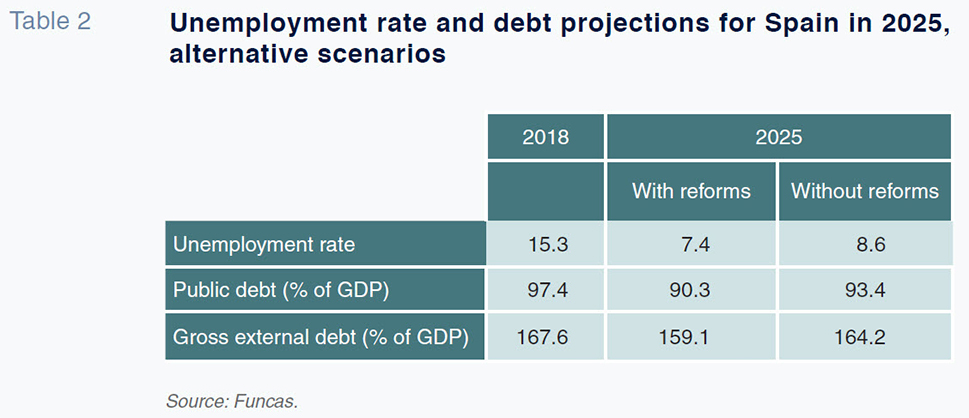

As a result, the Spanish economy would grow by around 0.2pp more in the reform scenario than in the status quo scenario (Exhibit 8.1). Elsewhere, the momentum in exports would make it possible to maintain a current account surplus (about 0.7% of GDP), a surplus destined to disappear in the absence of such reforms. Finally, the unemployment rate would be around one point lower than in the baseline scenario (Table 2). Higher growth and the ability to maintain a current account surplus would also facilitate deleveraging (as illustrated by the relatively fast reduction in public and foreign debt shown in Table 2).

Future risks to Spain’s economy

In short, the Spanish economy is expected to register relatively strong growth in 2019. However, the risk of a pronounced deterioration in the international environment has increased. Factors such as the trade row between the US and China, the imbalances weighing on China’s economy, a highly leveraged global economy and a surge in anti-European populist movements, could unleash a crisis of confidence and drain global growth more intensely than is currently anticipated. In such circumstances, Spain’s high public debt position would leave scant room for deploying anti-cyclical fiscal policies.

Another risk, this time on the domestic front, is that reform could be slow to gain the momentum necessary to prolong Spain’s growth cycle, create jobs and remedy social inequalities.

Notes

For this policy simulation exercise, the benchmark was productivity per hour worked, not GDP per person employed. It is therefore assumed that reforms would increase total factor productivity.

For an exhaustive analysis, see Cuadrado and Moral-Benito (2016).

References

CUADRADO, P., and E. MORAL-BENITO (2016), “El crecimiento potencial de la economía española,” Banco de España, Documentos Ocasionales, 1603.

EUROPEAN SYSTEMIC RISK BOARD, ESRB (2018), “Adverse macro-financial scenario for the 2018 EU-wide banking sector stress test,” January, www.eba.europa.eu

TORRES, R., and M. J. FERNÁNDEZ (2018), “The Spanish economy: Scenarios for 2018-2020,” Spanish and International Economic & Financial Outlook, number 2, March.

Raymond Torres and María Jesús Fernández. Economic Perspectives and International Economy Division, Funcas