Accelerating the pace of non-performing loan reduction in Europe

Despite notable progress, European banks remain under pressure from legislative, regulatory and supervisory authorities to further reduce their non-performing loans. Within this context, European banks, including Spanish banks, are likely to continue their efforts to clean up their balance sheets.

Abstract: Since the European Commission approved its Action Plan on the Reduction of Non-Performing Loans in 2017, several institutional initiatives have emerged to achieve the Plan’s goal, notably the recently published EBA Guidelines on the management of non-performing and forborne exposures and a European Commission progress report, which includes an analysis of an ambitious proposal for an EU-wide transaction platform to boost non-performing asset sales. However, on-going pressure on banks from the European supervisor (SSM) suggests that the current pace of reductions is too slow and would fail to prevent some key economic risks from materialising down the road. Judging by the downward trend in NPLs in most European countries, it appears that this pressure has been effective and that Spain will continue to sell off non-performing assets.

European initiatives to reduce non-performing loans

As European and Spanish banking systems seek to reinforce their solvency, the reduction of non-performing loans (NPLs or NPEs), which includes non-performing and forborne exposures, has become a priority at every institutional level. Over the last several years, a host of initiatives have been set in motion to accelerate this process.

In July 2017, the European Commission and European Parliament launched the highest-level initiative to date: an Action Plan to reduce NPLs in Europe. Under the Action Plan:

- Structural reforms will pave the way to harmonise non-performance management procedures and debt recovery frameworks.

- Secondary markets for NPLs will be promoted through the development of new platforms that will establish common rules and oversight standards to eliminate the asymmetries typical to markets such as these.

- On the regulatory front, the European Banking Authority (EBA), as mandated in the Action Plan, has drawn up Guidelines [1] that stress the need for banks, particularly those with NPL ratios of five percent or higher, to include a specific action plan for managing and reducing NPLs in their overall business strategy. Banks have been asked to define ambitious yet plausible reduction targets and timeframes based on the full range of strategic alternatives available. The EBA Guidelines also identify key aspects to be included in business strategies on the governance of the NPL reduction effort, including steering and decision-making, operating model, internal control framework and monitoring of these activities.

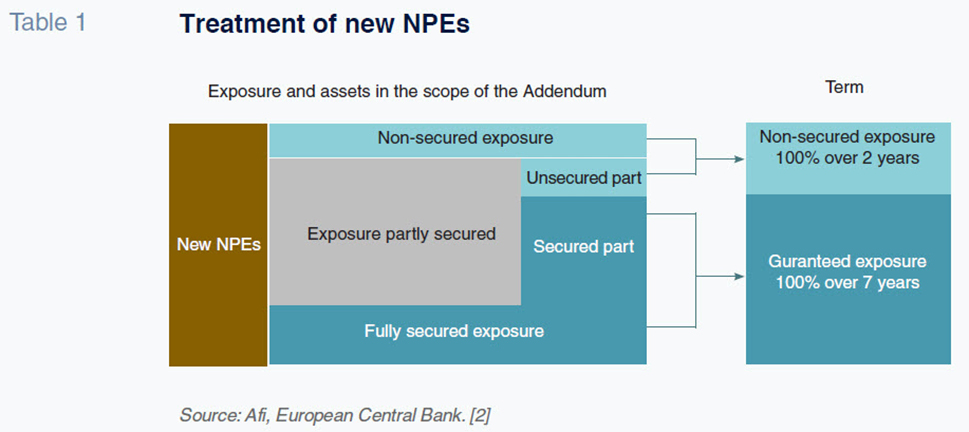

- Finally, on the supervisory front, the European Central Bank (ECB) published initial Guidance for banks on NPLs, followed by an Addendum in March 2018 that provides direction on accountability. The Addendum lays out the ECB’s supervisory expectations for individual banks on the level of prudential provisions for non-performing exposures, which are calculated based on comparative analysis and a bank’s own fundamentals. The quantitative expectations (i.e., real schedules) of any exposure reclassified from standard to non-performing (from April 1st, 2018, onwards) are shown in Table 1.

In addition to the ECB publications and the scheme depicted in Table 1, the European Commission has issued a proposal outlining its position on capital requirements for bad loans depending on the collateral banks’ hold (movable or immovable).

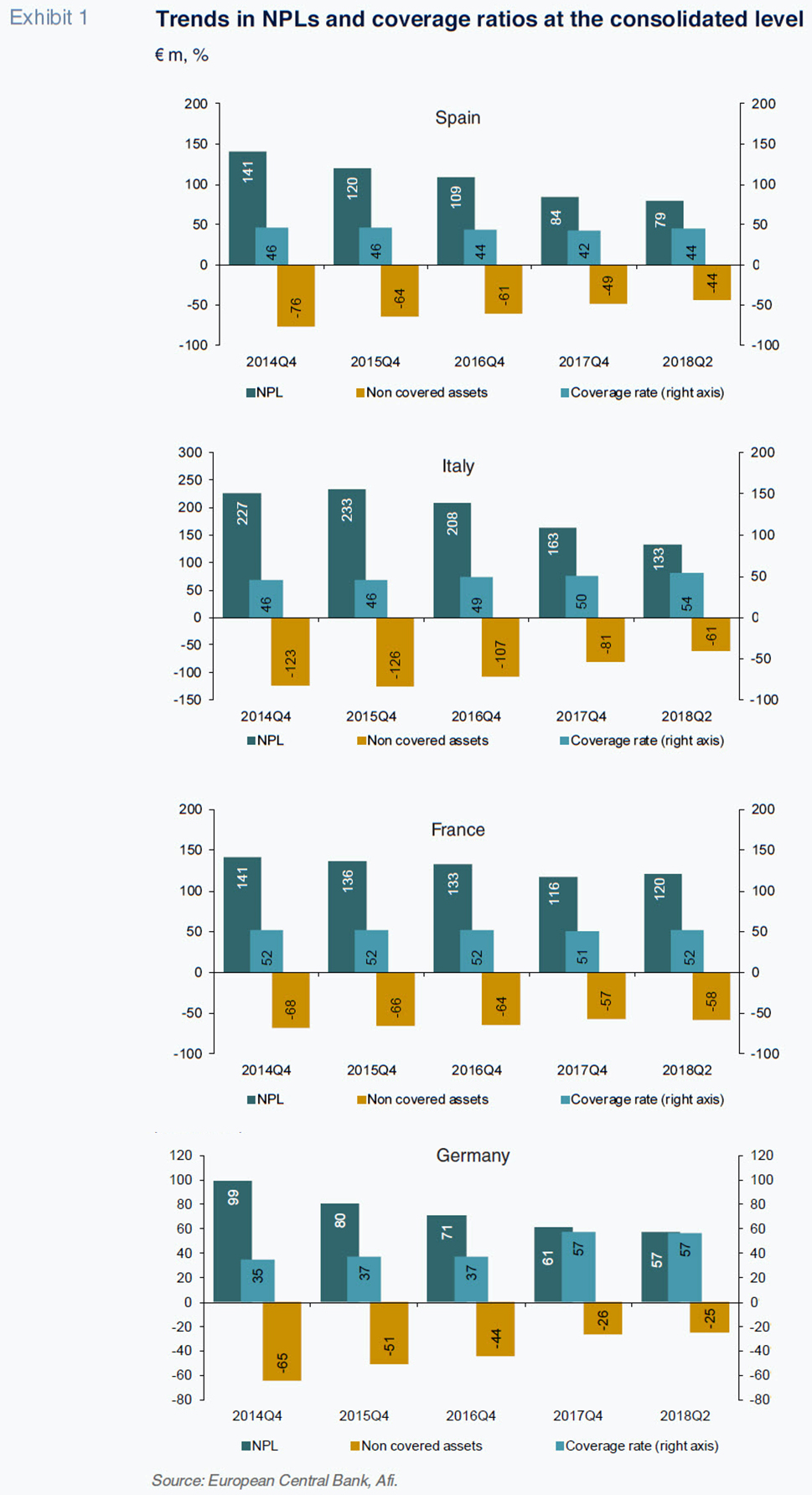

All these legislative, regulatory and supervisory initiatives have put pressure on banks to accelerate efforts to reduce NPLs. Judging by the downward trend in NPLs in most European countries (see Exhibit 1), it appears that this pressure has been effective.

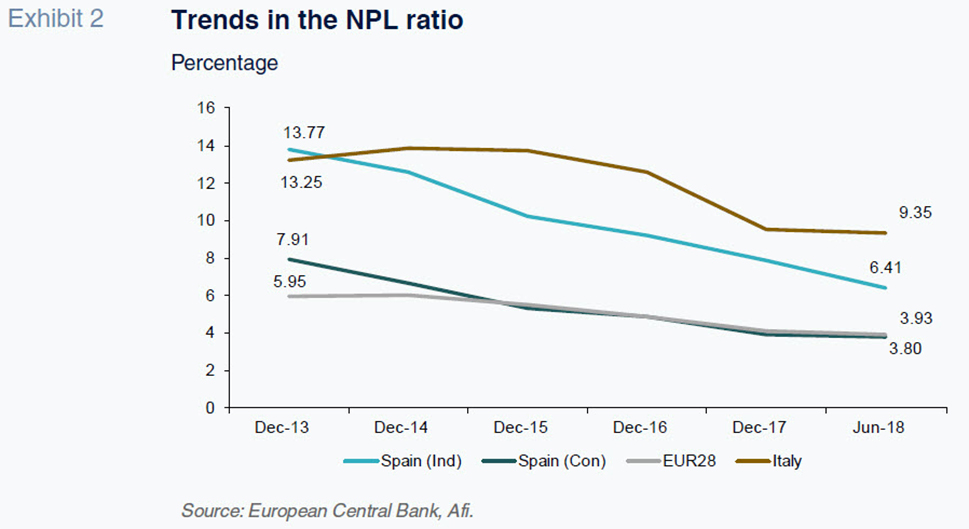

If the Spanish figures are analysed at the individual level (without the banks’ international businesses, or the consolidated level), as in Exhibit 2, we can see that the balance sheet clean-up effort has been even more intense. The NPL ratio has dropped by seven points from a high of nearly 14 percent in 2013 to 6.4 percent as of June 2018.

NPL flows in Spain

Although the data shows that NPLs in Spain have dropped significantly, the ratio is still considerably higher than the European average. What still needs to be done?

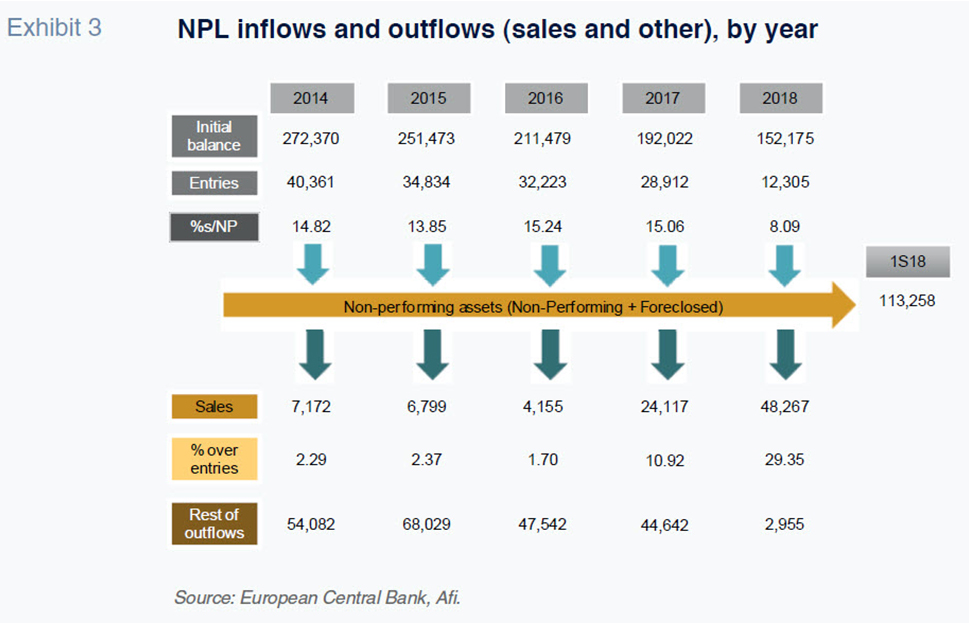

Exhibit 3 breaks down trends in non-performing exposures (non-performing and forborne) in Spain into inflows (new NPLs) and outflows, distinguishing between outflows caused by the sale of portfolios and all other outflows, a category that includes recoveries and write-offs.

This analysis reveals that banks have indeed been successful in reinforcing their balance sheets: total non-performing exposures have declined from 272 billion euros at the start of 2014 to an estimated 113 billion euros by mid-2018, a net reduction of 160 billion euros.

This net reduction in non-performing assets is even more noteworthy given that, year on year, banks have sustained inflows of NPLs to the tune of 40 billion euros in the initial years after the crisis and around 30 billion in later years. It is surprising that the pace of new NPLs has remained so buoyant in recent years, given that they have been marked by annual GDP growth of over three percent, a significant drop in unemployment, a recovery in property prices and interest rates close to zero.

Two factors may have caused this apparent paradox: (i) at the time of the crisis and immediately afterwards, banks may have delayed recognition of non-performance to contain the rise in their NPL ratios; or, (ii) out of caution, may have anticipated a reclassification trend for loans that were not technically non-performing, but would likely be soon.

Despite this paradox, it is clear that the derecognition of forborne exposures more than offset the recognition of new NPLs, and that this effort was sufficient to generate a significant (160 billion euro) reduction in the overall stock of non-performing exposures from the series high.

Looking again at the trend in outflows, it is worth highlighting the contribution made by the sale of portfolios of non-performing assets. An estimated 120 billion euros of non-performing assets have been sold in this manner, with a little over 80 billion euros in the last 18 months alone, clear evidence of the pressure exerted by regulatory and supervisory authorities.

Institutional pressure to continue reducing non-performing exposures

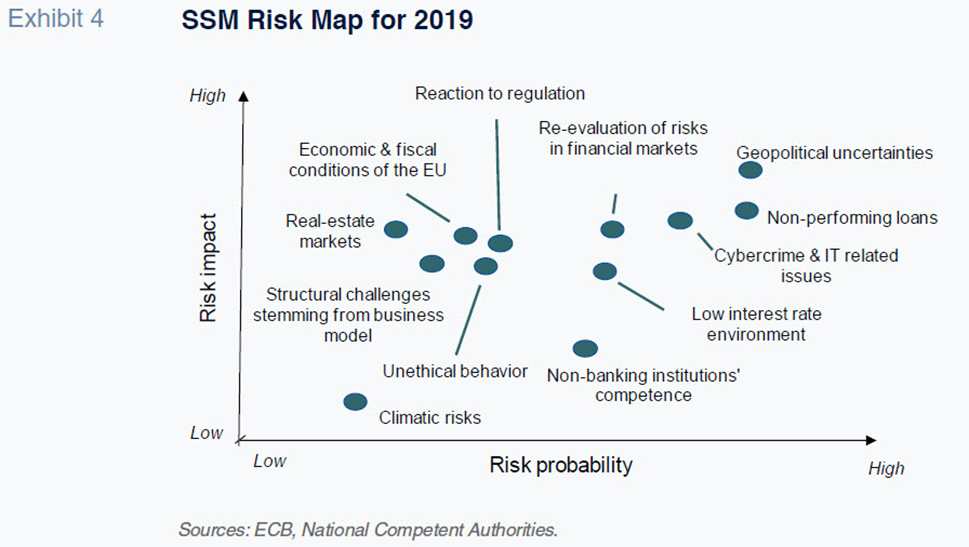

Judging by the European supervisor’s (SSM) persistent non-performance concerns, evident in its Risk Map for 2019 (see Exhibit 4), this institutional pressure is likely to continue.

This unwavering concern and pressure on the banks from the SSM implies scant recognition of the efforts of European banks, particularly Spanish entities, to accelerate the reduction of non-performing assets.

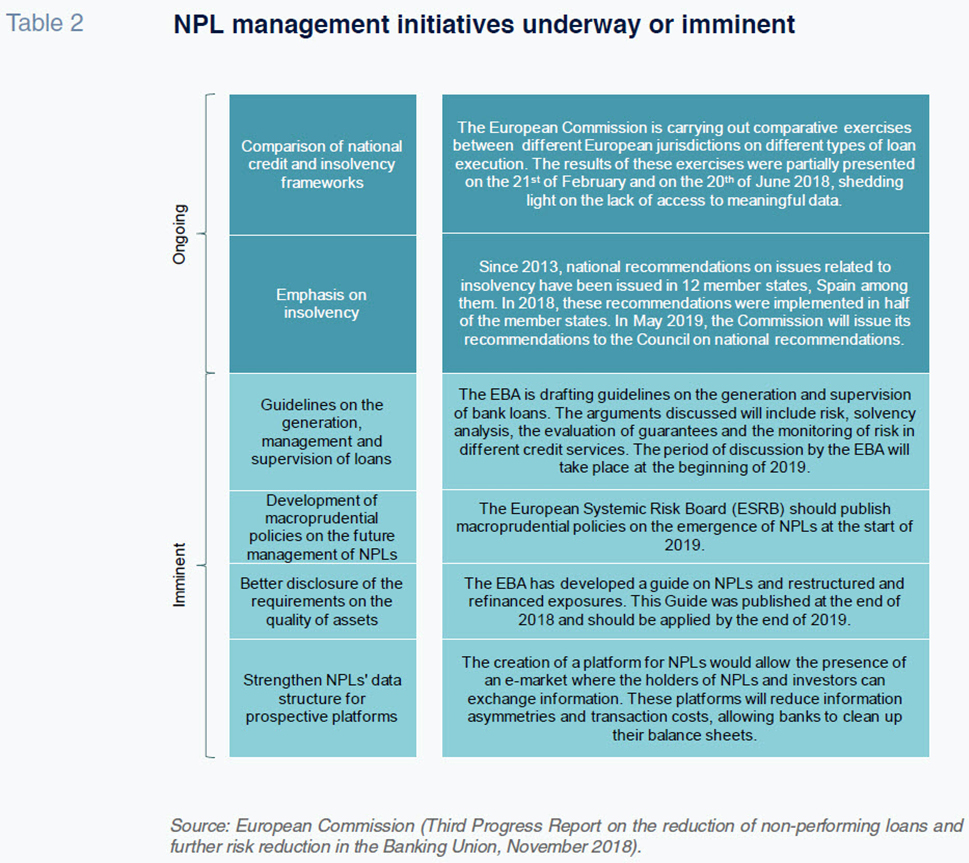

This stands in contrast to the European Commission, which at the end of 2018 published its third progress report on reducing NPLs and risks in the context of the Banking Union (see Table 2). In that report, the Commission acknowledges the significant effort made by European banks, particularly Spanish and Italian banks, and lists all the NPL management projects and initiatives either planned or underway.

Perhaps the most ambitious and interesting project to date is a proposal to create an NPL transaction platform to continue to stimulate asset sales, particularly at the level seen in 2018. Given that the NPL market is still relatively undeveloped, the Commission believes that a transaction platform would help to enhance the market, making it more efficient and liquid, correcting the problem of information asymmetry, increasing coordination among creditors and deepening the investor base.

This platform would be open to all types of professional sellers and buyers, although preferably from countries within the European Union. The idea is to provide a standard and consistent service to large investors while also improving efficiency.

To help meet this target, the European Commission has proposed an exhaustive package of measures delivered through two main initiatives (in addition to the European-wide platform): 1) drafting a legal framework at the EU level to strengthen and boost the resolution of these assets; and, 2) developing a non-binding blueprint for the creation of asset management companies (akin to SAREB, or the so-called bad bank, in Spain).

All the proposed measures point to a tough position on NPLs. This may be because the supervisor fears the current pace of correction is not fast enough to prepare for certain adverse scenarios in the European banking sector.

Two percent is considered the target “floor” for the NPL ratio and best practice in Europe. If the rate of reduction in non-performing assets over the last three years were extrapolated, it would take a long time –about another three years– to reach this threshold and banks would likely face an interruption in the economic cycle before they had finished cleaning up their balance sheets.

In short, at the current pace of convergence it would take too long to prevent some of the economic scenarios in the SSM’s risk map, or other risks that have not yet been anticipated. We can therefore expect the supervisor to continue to exert pressure on banks and will likely see Spanish banks continue to sell non-performing assets as part of this effort.

Notes

Note that at the time of the Addendum’s publication, the aim was to make schedules applicable across the board. However, in July 2018, the ECB published a note advising that the schedules would be determined at the individual level.

Marta Alberni, Ángel Berges, Fernando Rojas and Federica Troiano. A.F.I. – Analistas Financieros Internacionales, S.A.