Labour market challenges in Spain

The performance of Spain’s labour market has improved, approaching European standards, supported by a mix of reforms and demographic changes. Jobs are now much more resilient to recessionary pressures; yet, two key weaknesses remain, namely the relatively low chances for re-employment for jobseekers, making unemployment relatively persistent, and difficult school-to-work transitions which contribute to nurturing high youth under-employment.

Abstract: The labour market has been typically one of the chief weaknesses of Spain’s productive model. In the last five decades, the unemployment rate has only been in the single digits for a brief period of time before the onset of the financial crisis, fuelled by an unsustainable credit bubble. Moreover, Spanish unemployment has been higher than the rates observed across its European peers virtually non-stop since harmonised data exist. One of the main causes of this long-standing blight is excessively procyclical employment creation and destruction: traditionally, recessionary episodes have led to disproportionate job losses, which are hard to recover during periods of growth. Recently, however, the performance of Spain’s labour market has improved, closing in on European standards, likely a result of a mix of reforms and demographic changes. In particular, employment has become much more resilient to recessionary pressures. Yet, two key weaknesses remain. First, shortcomings in placing jobseekers make unemployment relatively persistent. In Spain, it is not easy to come off the dole queue, a phenomenon that affects less-skilled workers and women looking to rejoin the labour force after maternity leave. Hence the high rate of long-term unemployment. Second, the transition from education to work is difficult, as witnessed by a high rate of youth unemployment by European standards. Also, many young people who do work are over-qualified for the jobs they perform. Given the importance of addressing these challenges to maintaining employment growth and closing the social divide, it will be critical to tackle this sizeable but urgent issue, particularly in light of the pace of technological transformation, accelerated by the deployment of artificial intelligence.

Employment has become much less pro-cyclical

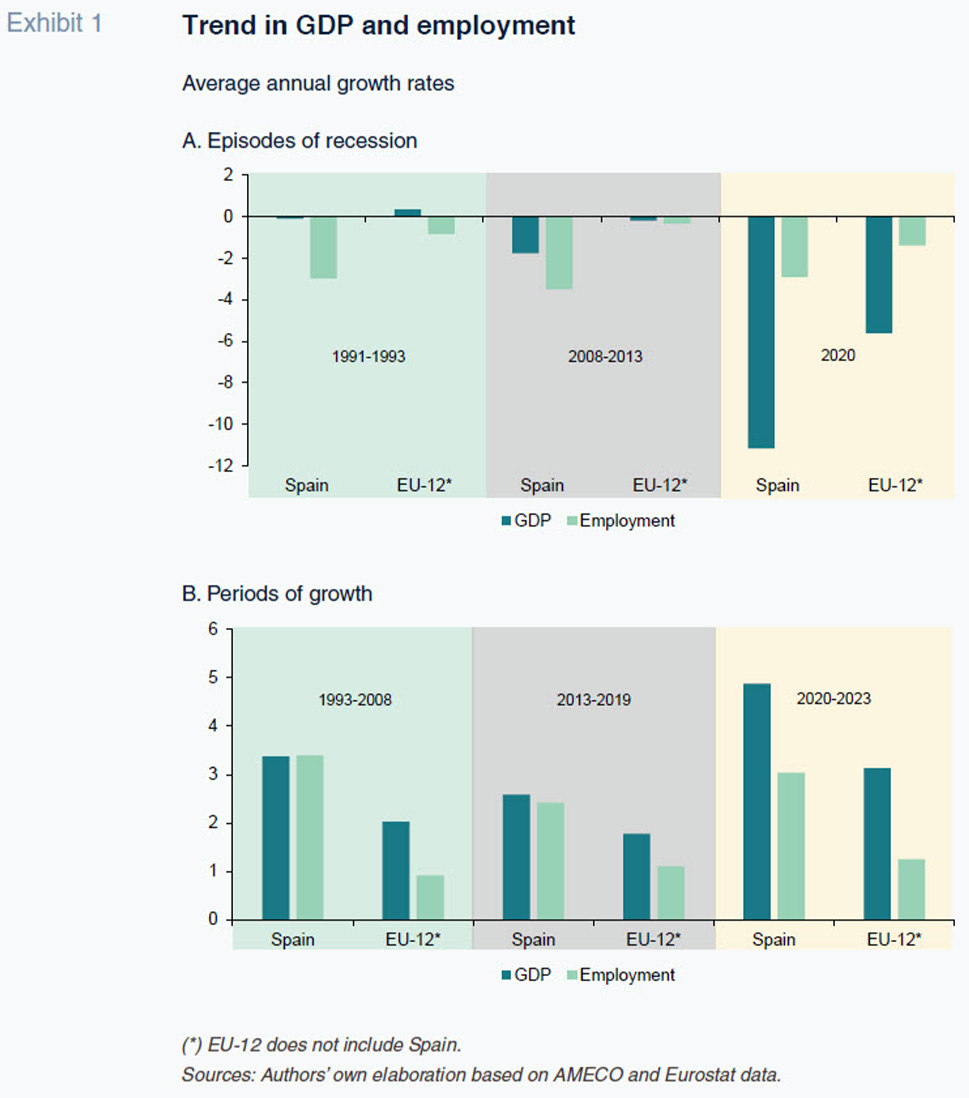

The good news is that the labour market clearly responded better to the crisis induced by the pandemic than to earlier recessions. This time, employment decreased by less than economic activity (Exhibit 1) and recovered within less than two years. During the financial crisis, employment contracted by much more than GDP. Even during the short recession at the start of the 1990s (GDP slowed suddenly, growing a mere 0.9% in 1992 before contracting by 1% in 1993), employment plummeted (-5.8%).

Unlike in the past, the cyclical behaviour of employment is similar to that observed in the rest of Europe. In 2020 more jobs were destroyed in Spain than in the EU on average but Spanish GDP also contracted by proportionately more, yielding a similar reduction in employment for every point of GDP lost. Likewise, during the ensuing expansionary period, the recovery pattern has been in line with the European average: the correlation between job creation and GDP growth is even slightly above that average.

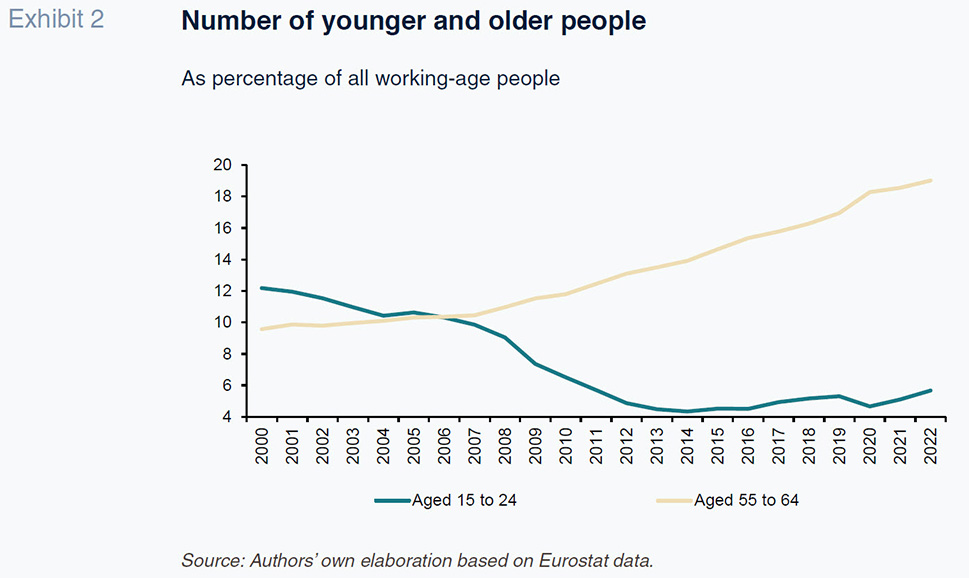

One explanation is the furlough scheme, cushioning the impact of the pandemic while also facilitating the subsequent recovery. There are demographic trends at play too, possibly encouraging companies to hold on to employees in the face of a rising deficit of young people entering the job market relative to the cohorts nearing retirement age (Exhibit 2).

Elsewhere, the labour reforms of 2021, which restricted the use of temporary hiring to certain situations covered by law, have clearly reduced the incidence of temporary work, possibly also helping to mitigate the procyclical nature of the labour market. Using the Labour Force Survey (LFS) figures, the percentage of job holders in temporary work as a percentage of total wage-earners decreased from around 26.5% between 2016 and 2019 to 17.1% in 2023. Using the Social Security figures instead, that percentage decreases from close to 30% to 13.5%.

Between 2019 and 2023, the number of workers on temporary contracts (according to Social Security registers) decreased by 2.1 million, or nearly 50%, while the number of workers on permanent contracts increased by 3.3 million. Of the latter, 556,000 are so-called fixed-discontinuous contracts [1] (note that at any given point in time this figure only tracks the contributors registered as fixed-discontinuous employees that are active at that moment), indicating that there has indeed been a significant shift from temporary to permanent arrangements even though a good amount of the latter continue to perform work that is temporary or seasonal in nature.

Elsewhere, the conversion of temporary employment to ordinary permanent employment does not necessarily mean that all those affected enjoy greater job stability. A recent study shows that a reduction in temporary contracts does not necessarily imply an equivalent reduction in effective or empirical temporary work (Fedea, 2023). In other words, the percentage of employees experiencing short spells of employment and frequent transitions from one job to another has decreased, suggesting that a good number of short-duration hiring that previously took the form of temporary contracts is currently taking the form of permanent contracts that are terminated after just a few days or months.

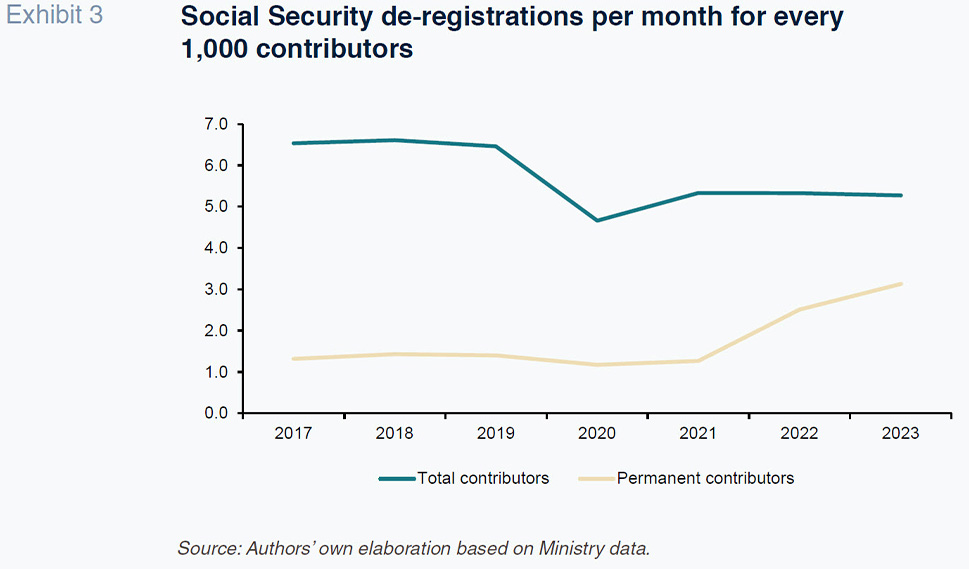

Nevertheless, the figures tracking monthly contracts signed and contributor de-registrations point to a net reduction in employee turnover despite the increase in turnover within the group of people on permanent contracts. Specifically, the number of permanent contracts signed per year for every 100 permanent contributors increased from 23 in 2019 to 52 in 2023, while the number of contributors de-registering per month increased from 1.4 for every 1,000 permanent contributors, to 3.1. Half of the latter increase originates from de-registrations due to a transfer to inactivity by people on fixed-discontinuous contracts, which is logical in light of the fact that the latter have doubled their weight in total permanent wage-earners. However, even excluding this cohort, the number of de-registrations among the remaining permanent wage-earners has increased by proportionately more than the increase in the number of permanent contributors.

It is interesting to note that the main reason for de-registering after passage to inactivity by fixed-discontinuous employees is voluntary de-registration, a pattern that was already emerging before the reforms but is increasing its share of all de-registrations at present. The other reason given for de-registration that is experiencing disproportionate growth is failure to complete the trial period. All of this suggests that, effectively, there has been somewhat of a shift in transitory hiring from temporary to permanent contracts.

However, the total number of contracts (temporary + permanent) signed by every 100 contributors has decreased considerably, from 152 in 2019 to 95 in 2023, while total contributor de-registrations per month for every 1,000 wage-earning contributors has decreased from 6.5 to 5.3. It appears, therefore, that the sharp shift in employment from temporary contracts, where the bulk of employment turnover was concentrated, to permanent contracts, where turnover is much lower, has unlocked somewhat of a decrease in turnover in net terms, despite the increase in turnover in people on permanent contracts (Exhibit 3).

Lastly, questions have been raised around the scale of job creation in light of the rise in importance of fixed-discontinuous contracts with their successive waves of registration and de-registration. However, both the LFS figures (which are scantly affected by the changes in employment contract format) and Social Security receipts reveal vigorous growth in the last two years, suggesting that employment growth is a reality.

Certainly, a full cycle will have to elapse before we can determine more precisely the true change in employment trends. From a macroeconomic standpoint, however, the flexibility introduced by the furlough scheme, coupled with reduced temporary hiring, points to a less procyclical labour market than in the past. Even so, some significant factors of weak labour market performance persist.

Long-term unemployment

A host of international studies evidence the importance of early action to reducing the risk of long-term unemployment (OECD, 2018). Motivation and human capital tend to deteriorate considerably when the job search process extends much beyond one year, reducing re-employment chances and making unemployment persistent.

The number of job-seekers who have been actively searching for work for more than one year represent 4% of the labour force, twice the European average. Although the recovery has translated into some improvement in this area, the figures suggest that the roughly one million people affected remain at considerable risk of exclusion. This situation reveals two issues that are dragging on the system.

Firstly, the public employment services that look after job-seekers have fewer human resources than in other European countries for carrying out activation and placement tasks and matching vacancies and candidates. International experience suggests that these services need at least one guidance counsellor per 100 job-seekers so as to be able to carry out the activation tasks, perform regular interviews, draw up individual placement plans and propose vacancies. However, the estimates available suggest that in Spain the ratio of counsellor-job-seeker is significantly below that threshold. Moreover, contact between employment offices and employers, while close in some regions, is notoriously sparse in others (OECD, 2015). It is therefore important to deploy local labour market prospectors and match offers across regions so as to facilitate hiring and prevent labour scarcity, which is beginning to rear its head despite still-high unemployment rates. Lastly, several employment policy experiences, some in parts of Spain and others elsewhere in Europe, highlight the potential of digital technology to improve labour intermediation. [3]

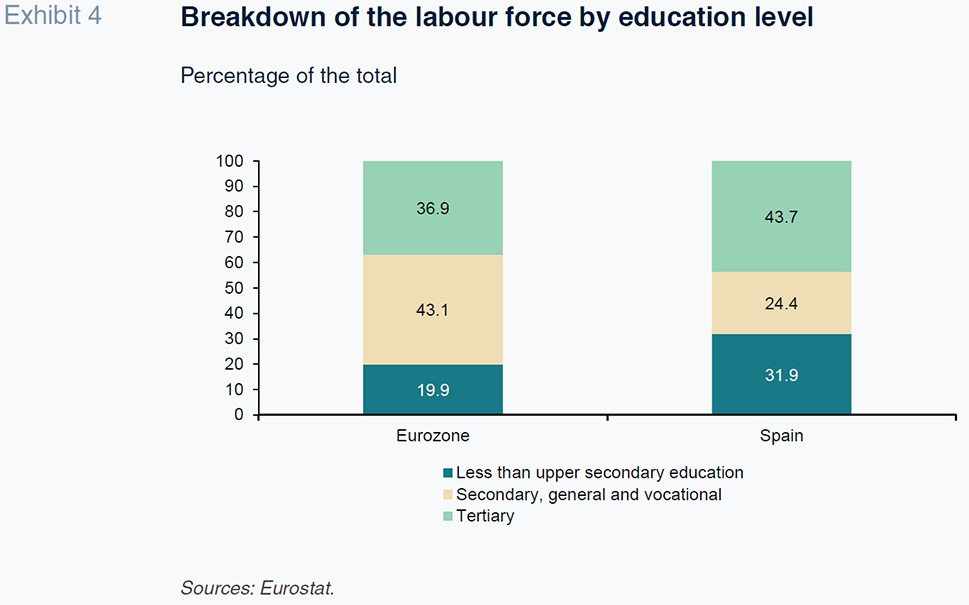

Secondly, one of the most serious structural issues affecting the Spanish labour market is the low skill set of part of the labour force, which helps explain the high rate of long-term unemployment. Nearly one-third of the Spanish labour force has not finished secondary school, compared to an average of 17% in the EU as a whole. All of which erodes the job prospects of a significant portion of job-seekers and thereby affects the structural unemployment rate, undermines productivity and increases specialisation of the Spanish economy in lower-skilled activities.

In addition, the relatively high weight of the two educational extremes – unfinished secondary schooling at one end and university studies at the other – implies a very small share of intermediate skills levels, i.e., people with secondary level education and vocational training (Exhibit 4). That helps explain the difficulty in finding work in some activities and could limit the scope for industrial growth and technological transformation of the productive system.

Transition by young adults into employment

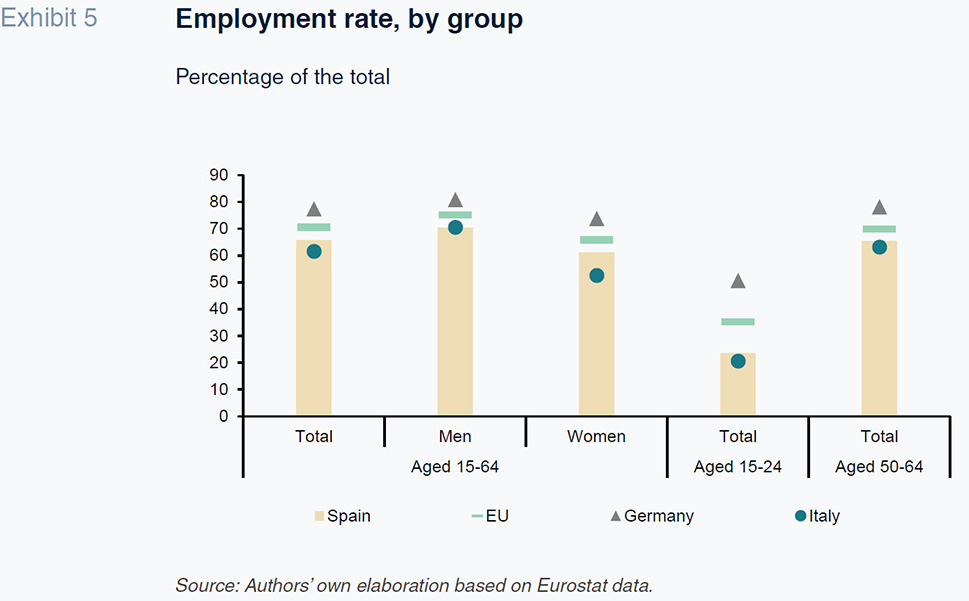

The labour market imbalances do not affect all groups alike. The key determinants are education levels, gender, and age. Among these groups, youth are disproportionately affected in Spain (Exhibit 5). A mere 24% of young people (aged 15-24) have a job, nearly 8 points below the EU average and half of the level observed in Northern European economies like Germany. While many of the young people not working are studying, some are unemployed. In general, youth unemployment has been a persistent issuing affecting the Spanish economy and society for decades.

Several factors have contributed to this situation. Firstly, the generation of youths that had to join the labour market during the financial crisis was one of the hardest hit by unemployment.

Moreover, the Spanish education system has been criticised for not aligning itself sufficiently with what the economy demands, resulting in educational gaps in many of the young people looking for work. Also related with education, more particularly the high rate of early school leavers, some Spanish youths are falling short in specific areas such as reading comprehension and the ability to solve mathematical problems, accord to the results of the PISA reports. The above-mentioned shortcomings around active employment policies are another issue. It is therefore crucial to design programmes that specifically help young people find work, including the provision of tailored training in some instances.

At the other end of the spectrum, in Spain, the percentage of working-age people with university studies is above the eurozone average. However, many of these youths cannot find jobs that match their skills, generating an issue around overqualification, i.e., a high percentage of tertiary graduates who work in jobs that demand lower skills. Spain is one of the countries where this phenomenon is most prevalent: over 35% of the young people who work are over-qualified for the job they perform, compared to less than 25% in the EU, on average (Exhibit 6).

To tackle these imbalances, we know that ‘dual vocational training’ can help young people transition into the labour market by combining classroom learning with on-the-job training. This is not enough, however. Indeed, experience shows that to successfully put the education system in touch with what the economy needs, companies need to be involved in designing the academic syllabuses. In Central Europe, the chambers of commerce play a fundamental role in this respect, providing information about the skills and knowledge in demand, while helping to broker the provision of work experience at companies. A similar eco-system in the Basque region has had encouraging results.

This highlights the importance of an education and training policy designed to keep young people in the education system, increase the presence of dual vocational training and facilitate work practice.

Pending challenges

The performance of Spain’s labour market has improved, closing in on European standards. Employment is proving less pro-cyclical, unquestionably helping to prevent excessive increases in unemployment during episodes of recession. Recent reforms, coupled with demographic changes (obliging prudent workforce management), may be behind this healthier performance.

However, the high level of long-term unemployment and the difficulties young people face in finding work evidence the persistence of significant pockets of long-term unemployment. The outcome is that, despite the scale of its unemployment, Spain is beginning to experience labour shortages, due to mismatches between skills and demand, but also gaps in public employment services. Tackling these structural factors is crucial to maintaining growth in employment and continuing to close social divides. The solutions are well-known, as are the conditions for setting them in motion, particularly in terms of cooperation among different levels of government and the social actors. The task is not only sizeable, but also an urgent one in light of the pace of technological transformation, accelerated by the deployment of artificial intelligence.

Notes

Fixed discontinuous contracts are defined as contracts that have features of indefinite contracts but with work performed discontinuously (i.e., recurrent seasonal jobs).

Social Security contributions increased by 5.2% in 2022 and over 9% in 2023, outpacing the growth in average wages per employee (compensation per wage-earner registered growth of 2.9% and 5.2%, respectively).

References

Raymond Torres and María Jesús Fernández. Funcas