Global economy: Resilience in the midst of the storm

Although the global economy has demonstrated significant resilience in recent quarters, key risks related to geopolitical tensions, financial stability and policy mismatches remain, clouding the economic outlook for the medium-term. In the transition to the new normal, the hope is that the global economy will outperform currently lackluster previsions.

Abstract: The global economy has demonstrated significant resilience in recent quarters. However, the economic backdrop remains highly uncertain, marked by key risks related to geopolitical tensions, financial stability and fiscal-monetary policy mismatches. The good news is that we have dodged recession fears that loomed in the wake of the sharp increase in energy prices during the summer of 2022 and that inflation has been responding well to central banks’ monetary policy tightening. The bad news is that the outlook for the medium-term is not too optimistic. For example, the IMF is forecasting global growth of 3.1% for the end of the decade – half a point below the medium-term estimate expected before the pandemic and nearly two points below the growth expected before the Global Financial Crisis of 2008, foreshadowing stagnation in potential output at current levels. Hopefully, the normalisation of the business cycle following the recent years of turbulence, and the major structural changes that are already underway (AI, demographic trends, etc.), could open the door to outperformance of these lacklustre forecasts.

Introduction

Four years on from the onset of the pandemic, the global economy is still trying to fix the mismatches between supply and demand that have accumulated in the interim, whose most remarkable outcome has been the intense and surprising bout of inflation unleashed in the first half of 2021. This has introduced obstacles into the path of economic agents’ and investors’ decisions for the last three years and obliged the central banks to respond decisively. The good news is how resilient the business cycle is proving in the midst of such a complex economic and geopolitical environment and how well inflation has reacted to the increase in interest rates. Now that the imbalances between supply and demand have dissipated, the economy is entering a phase of transition to a new normal, in which key variables such as potential output and neutral interest rates will be affected by the impact of economic policy with multiple objectives (autonomy, energy transition, etc.), and the macro underlying trends that will shape global economy going forward (demographic changes, artificial intelligence, etc.).

Resilience in the face of complexity

In 2023, global output of goods and services in current dollars (aggregated at market exchange rates) amounted to 105 trillion dollars, [1] nearly 17 trillion dollars more than in 2019 (+19%). In constant prices, the cumulative increase is much narrower (+8.7%), reflecting the significant increase in inflation since 2021. That is nevertheless a remarkable performance considering the series of shocks that have unfolded since the beginning of this decade: the biggest health crisis in the last century; global supply chain friction on account of transport and logistics bottlenecks; dramatic intensification of geopolitical risk with two live conflicts of high strategic importance (Ukraine and Middle East); and heightened trade uncertainty associated with the search for strategic autonomy by the super powers, raising the risk of a return to division around trading blocs in extreme scenarios. As a result, still fresh from the scars left by the Global Financial Crisis, during the last three years, economic agents have had to adapt to an environment marked by considerable instability in which changes of a more structural nature are beginning to materialise.

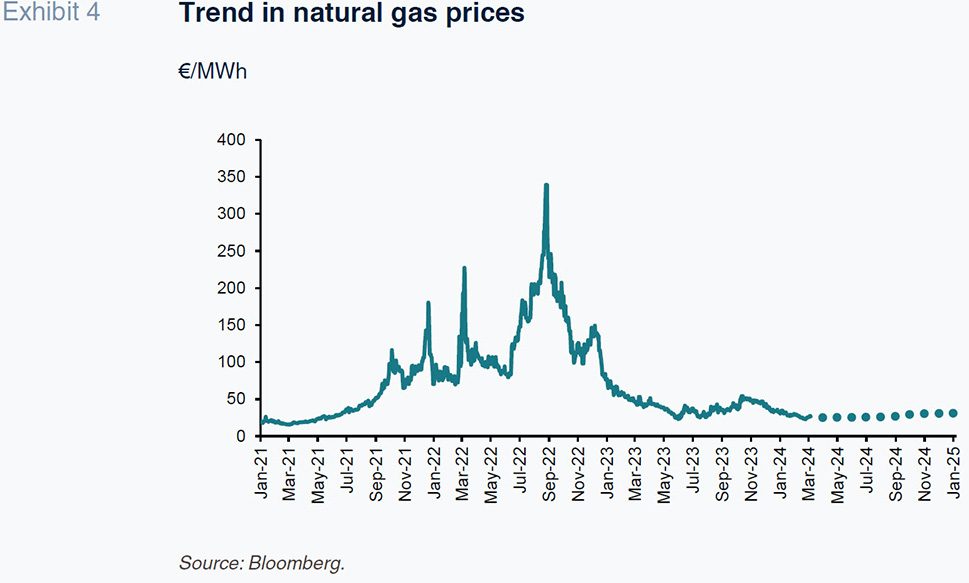

Despite that backdrop, in 2023 the global economy delivered a much better combination of growth and inflation readings (3.1% and 6.8%, respectively) than was expected at the start of the year, when forecasters were still unsure about the energy situation created by the closure of the main gas pipelines between Russia and Northern Europe in the summer of 2022, driving natural gas prices (TTF) to close to 350 euros/MWh.

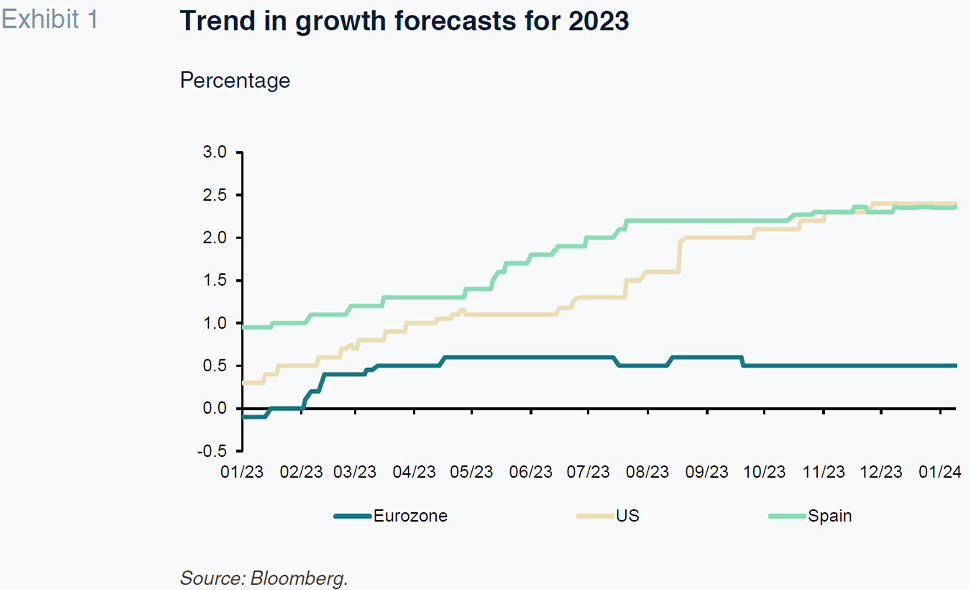

The improvement in forecasts throughout the year was particularly noteworthy in the US

[2] and Spain, where growth averaged 2.5% in 2023, compared to consensus forecasts a year ago of under 1%, foreshadowing stagnation and even recession during the winter months, an interpretation likewise gleaned from other indicators such as the negative slope of the rate curve. As a result, the likelihood of a soft landing in 2024 has become increasingly plausible. That is borne out by the sentiment indicators, such as the global composite PMI reading, which in February notched up its fourth consecutive monthly increase to 52.1 points (the highest level since June 2023), a level compatible with global growth of close to 3%.

Therefore, in an environment marked by an accumulation of negative shocks (polycrisis/permacrisis) and intense and coordinated monetary tightening for the last two years,

[3] the good news is the resilience of the global business cycle, resilience defined as “the capacity to withstand or to recover quickly from difficulties” (the first definition in Oxford Languages). Indeed, the chairman of the Federal Reserve recently acknowledged that from an historical perspective, the interest rate increases of the past two years are having an unusual effect on growth and, especially, employment, particularly considering the fact that the transmission of monetary tightening to the real economy through the credit channel is already very advanced, as the central banks have admitted recently.

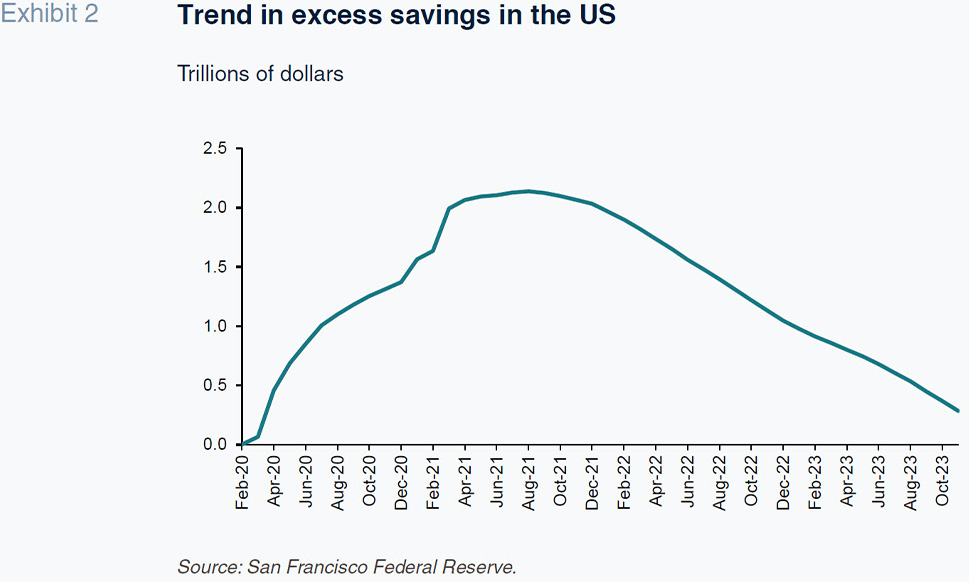

The factors behind this gradual improvement in the economic situation include the let-up in energy prices, labour market resilience and growth in disposable income in real terms thanks to pay increases and the reduction in inflation. It is also worth noting the flexibility and ability to adapt to the uncertainty displayed by the economic agents and the forcefulness with which economic policy has responded to the succession of obstacles cropping up in the business cycle since 2020. In the US alone, the extraordinary savings set aside by households thanks to government aid during the months of the pandemic topped 2 trillion dollars (8% of US GDP) at one point. That buffer is not yet fully depleted, proving extraordinary support for private spending.

In addition to the above-mentioned cyclical resilience and ability to adapt, other noteworthy economic developments in recent quarters include: (i) regional divergences, split between solid economic performance in the US and many of the emerging markets and weakness in China and, in particular, the eurozone (with the exception of the odd peripheral economy like Spain); (ii) sector differences marked by weak manufacturing outside of the technology sector, in contrast to strong momentum in services; (iii) the robustness of the labour market, which has hardly been dented by monetary tightening,

[4] (iv) strong public and private spending, whereas investment has yet to take off, despite the support of expansionary fiscal programmes (IRA, NGEU,

etc.) and the rebound in defence spending;

[5] (v) the first signs of a deviation in trade flows to countries such as Mexico and Vietnam, which could emerge as platforms that prevent the barriers implied by the search for strategic autonomy; and, (vi) mediocre productivity gains (with the exception of the odd very recent signal in the US), shaped by short-term labour hoarding in light of the difficulties in finding labour in many segments of the economy.

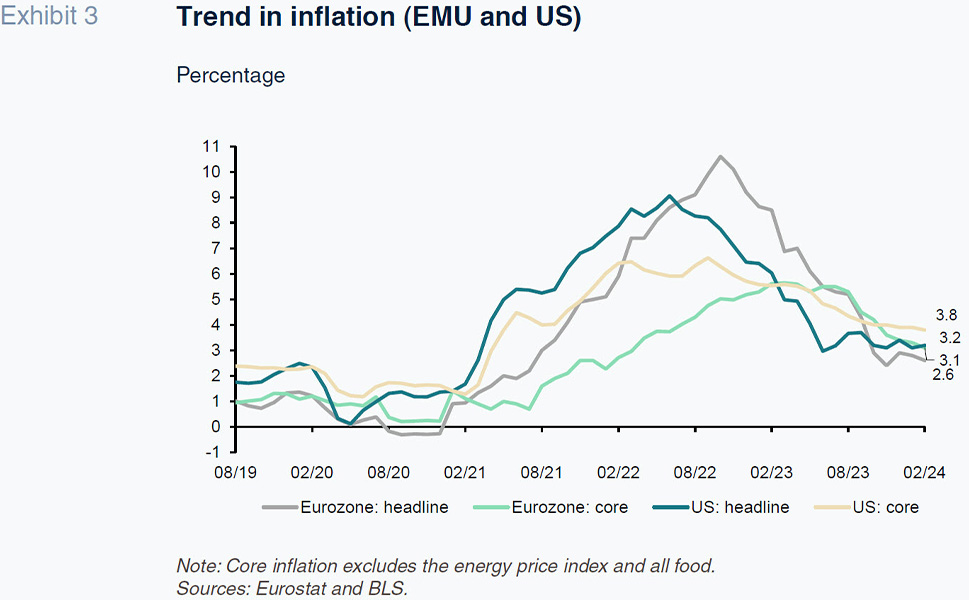

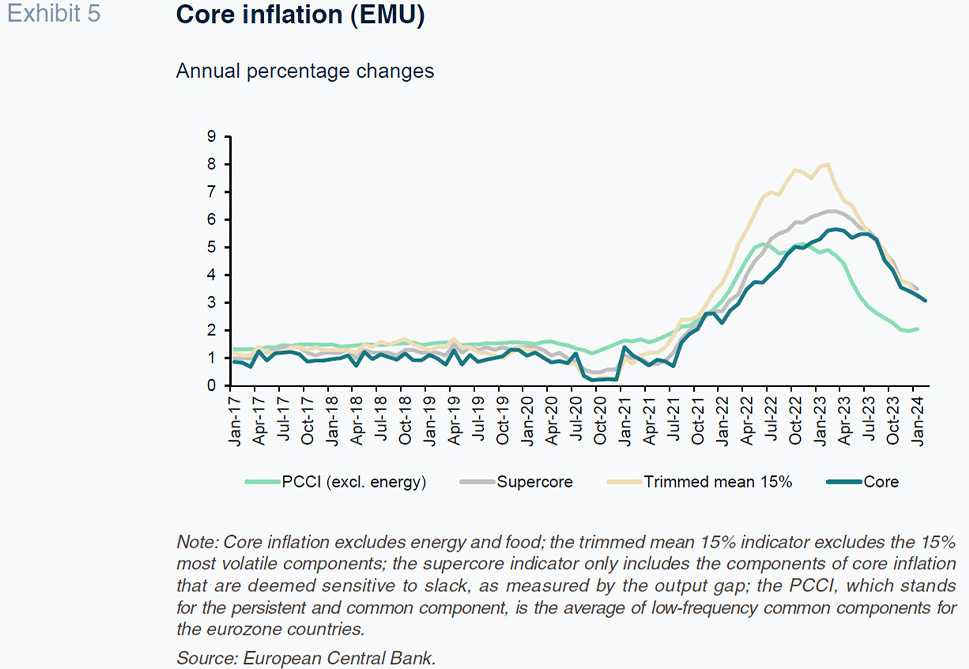

However, the real protagonist in recent years has been the intense spate of inflation, brought about by an overlap between flourishing demand and major supply disruptions. The first signs of inflationary issues were detected in the second quarter of 2021, from where inflation climbed successively to peak in the summer of 2022 (10.6% in the EMU and 9.1% in the US), forcing the central banks to act decisively. Since then, the dissipation of the direct energy shock and gradual fading of its indirect effects, coupled with resolution of the bottlenecks affecting international trade, have paved the way for a turnaround. Disinflation has made strong inroads last year or so, with headline inflation in the US and Europe easing from annual rates of 6.5% and 9.2% at the end of 2022, respectively, to 3.2% and 2.6% by February. The measures rolled out by the central banks to counteract the run-up in prices have therefore proven highly effective and have had a only moderate cost in terms of growth, suggesting that a lot of the inflation was probably caused by supply side distortions.

From now on, additional improvements in core price trends will be determined by the performance in the services headings that tend to be more stubborn (close to 4% in the EMU since September 2023) and depend on factors that are still subject to significant uncertainty, such as the trend in wages (second-round effects) and housing costs in the US. This is where the monetary authorities need a little more certainty (and confidence) before declaring the war on inflation over, despite the fact that business margins appear to be displaying an ability to absorb the pay increases.

Soft landing in 2024? Three key factors and three risks

As the economic indicators rolled in throughout the second half of 2023, therefore, the consensus forecasts shifted decisively towards a soft landing scenario for the world economy in 2024, marked by average growth in line with that of last year (3%) and ongoing regional disparity (OECD: 1.4%; emerging economies: 3.8%). However, the first half is expected to remain pretty weak, with growth accelerating from the summer. This baseline scenario would allow for consolidation of the recovery of macroeconomic stability by closing the gap between global supply and demand at a manageable cost in terms of growth and employment. There are solid foundations for resuming potential output rates from 2025. Confirmation of the scenario being discounted by the markets and analysts at present depends on a few key developments:

- The trend in energy prices. The main factor behind the favourable combination of growth and inflation numbers in 2023 was the surprising reduction in oil (-10%) and natural gas prices (-55%), despite high levels of geopolitical risk. So far in 2024, the energy markets remain stable, and the feeling is that barring disruption due to an increase in geopolitical risk in the Middle East, supply will be capable of responding to the potential fluctuations in demand, so that prices should remain close to current levels (85 dollars per barrel of Brent and 26 euros/MWh). In sum, energy prices are proving fairly stable in a range that meets the producer nations’ expectations (needs), allows ongoing disinflation, and avoids volatility in the current account balances of the net energy importing nations. This positive outlook for such a basic assumption for forecasting scenarios is also borne out by the prices being discounted in the futures markets which, if anything, point to a degree of price correction in the coming months.

- The last mile of the disinflation process. Although inflation has improved significantly over the past year, as shown by most of the underlying indicators, it still needs to come down from 3% to 2% to reach its target. This last mile constitutes unknown territory, a journey threatened by the distortions created by the price dynamics of recent years and the unexpected impacts of each new twist in the geopolitical scenario. There is uncertainty around how long it will take to reach the targeted 2%, how volatile prices will be on that journey (it will not be a straight line) and even how stable inflation will prove once it reaches 2%.

However, despite the noise still present in price trends, the inflation momentum indicators, [6] which attempt to examine unfolding inflation dynamics, provide grounds for hope. As of February 2024, the momentum indicators for the eurozone pointed to CPI of 1.4% (US: 2.9%), core inflation of 2.4% (US: 3.8%) and services inflation of 3.4% (US: 5.7%). Applying the momentum formula to the various items of the shopping basket, we observe that the percentage of items for which inflation is running below 2.5% in Europe (57% of the total at present) has increased significantly since the end of 2022 (20%), closing in on the percentage observed before the pandemic (85%). [7] It looks, therefore, that we are well along the path towards normalisation and most projections (including those of the central banks) have inflation reaching the 2% target in the next 12 months.

- Implementation of the shift in monetary policy. Since mid-November, having certified the progress made in the disinflationary process, the outlook for monetary policy has changed, from a “higher for longer” scenario to a shift in monetary tack. Following a small adjustment in the first couple of months of this year, the market is currently anticipating rate cuts of 75-100 bps on both sides of the Atlantic (three to four rate cuts) beginning around June. The new monetary expectations have implied record revaluation (nearly 15%) for a standard financial asset portfolio (60/40) over the last four months. In addition to the wealth effect created by this rally in financial asset prices, the economic agents will start to benefit from the consequences of monetary easing from the second half and, more noticeably, in 2025. The markets are discounting a reduction in the 12-month Euribor from April of this year relative to the rate observed in April of last year (3.46% vs. 3.76%), implying a considerable tailwind for the second half of 2024.

Although these three key factors bode well for a soft landing, it is important to note that the improvement in the economic climate is framed by significant fragility, increasing scenario sensitivity to new shocks that could emerge. Above all, because the layers of risk remain challenging. For example:

- Geopolitical risk. In addition to the ongoing armed conflicts and the not insignificant risk that they could escalate (affecting growth through energy prices and expectations), in 2024, more than half of the world’s population will vote in new governments (India, European elections, Mexico, etc.) and we know that such a demanding electoral schedule can be a source of financial volatility, fiscal instability and economic fragility. More than anything because 2024 ends with presidential elections in the US and a victory for Donald Trump could open a Pandora’s box of risks. The geopolitical situation in Europe for a start, considering the obstacles a Trump administration could pose in terms of continued finance for Ukraine (the Republican Party is currently holding up funding), but above all due to the likely impact on Europe’s defence strategy, triggering significant growth in spending towards 2% of GDP. Not to mention the trade distortions caused by the 10% tariff Trump has already promised in the event of victory at the urns.

- Fiscal risk. In general, there is a good chance that fiscal policy will remain on the expansionary path of recent years (in contrast to the contractionary bias of monetary policy), even though, after the huge efforts made to cushion the effects of the various shocks materialising since 2020, the state of the different countries’ public finances warrants a move to consolidation in the medium-term. According to the IMF’s Fiscal Monitor, the advanced economies’ public debt increased from 104.1% of their GDP in 2019 to 112.1% in 2022, with forecasts pointing to a level of 116.3% in 2028. And whereas the Stability Pact in Europe should mark the start of a change of direction, in the US it looks unlikely that either of the presidential candidates will present an election package that implies a return to budget stability in the medium-term, especially if the tax cuts coming close to expiry are renewed. Considering that fact that, according to the CBO, the US fiscal deficit is unlikely to dip below 6.5% of GDP this decade (with debt service costs at over 3% of GDP), the risks for inflation and exchange rate stability are very high. Ultimately, a fiscal policy out of sync with monetary policy is the quickest path to higher interest rates and financial market volatility.

- Financial stability. Following the failure of Silicon Valley Bank last March, a crisis quickly snuffed out by the US monetary and financial authorities, there have been no new sources of financial stress, so that the process of monetary tightening around the world has had a minimum cost in terms of financial stability. However, with monetary policy set to remain clearly contractionary for the next two years, even assuming the interest rate cuts anticipated by the markets, the question remains: Where could the next sources of instability lie? Aside from the leverage taken on by the hedge funds or the liquidity situation at certain life insurance companies in the US, commercial real estate (CRE) is the main source of concern. The recent share price correction at New York Community Bancorp (NYCB), a bank specialised in office and multifamily lending, has shone the spotlight on the issues that could emerge in a market segment affected by office vacancy rates of close to 20%, triggering price corrections in the order of 40%. The problem is concentrated at the regional banks which hold two-thirds of the exposure to CRE, which amounts to 3.5 trillion dollars, even though, according to the IMF, one-third of the American banks (small and medium-sized), representing 16% of the American banking system’s total assets, are significantly exposed to CRE. The FDIC’s estimates are a little more comforting, as it notes that although the number of banks with issues in the US has increased by 18% in the last year, the troubled banks’ total assets amount to 66 billion dollars, just 0.2% of the total, indicating they are very small in size and of scant systemic importance.

In short, the term that best defines the global economy in recent quarters is resilient. However, the economic backdrop remains highly uncertain, marked by geopolitical, financial stability and fiscal-monetary policy mismatch risks. The good news is that we have dodged the spectre of recession that loomed in the wake of the sharp increase in energy prices during the summer of 2022. The bad news is that the outlook for the medium-term is not too promising. For example, the IMF is forecasting global growth of 3.1% for the end of the decade, foreshadowing stagnation in potential output at current levels. To put that forecast into context, that is half a point below the medium-term estimate anticipated before the pandemic and nearly two points below the growth anticipated before the Global Financial Crisis of 2008. Let’s hope that normalisation of the business cycle following the recent years of turbulence, coupled with the major structural changes that are already upon us (AI), could lead to outperformance of these mediocre forecasts.

Notes

World Economic Outlook (October 2023) – IMF.

In February, the consensus forecast for average growth in the US in 2024 increased from 1.4% to 2.1%.

Average global interest rates have increased by over 400 basis point to land above 5%.

Unemployment rates are at lows in the US (3.9%) and the eurozone (6.4%).

In 2023, gross fixed capital formation increased by just 0.5% in the US and by 0.9% in the eurozone.

Annualised quarterly rate of CPI adjusted for seasonality.

The distance is smaller with respect to the average observed in 2000-2007 (65%), before the distortions caused by the Global Financial Crisis.

José Ramón Díez Guijarro. CUNEF