Deficit reduction: Insufficient progress and low probability of improvement

Spain’s public deficit targets have been repeatedly relaxed. While it is not yet certain what form the 2020 General State Budget will take, analysis suggests the coalition’s expenditure measures will need to be met by additional efforts on the revenue-generation front or cuts in other spending programs.

Abstract: Due to both economic and political pressures, Spain has repeatedly pushed back its deficit targets. Unfortunately, the total public deficit will not come down substantially in 2019 compared to 2018, as expenditure has continued to grow. Moreover, although the government failed to pass its general state budget for 2019, it did push through increases in public sector wages, pensions and unemployment benefits by way of decree. To put the situation into context, with a public debt-to-GDP ratio of 98.9%, Spain is the seventh most indebted European nation, well above the eurozone (86.4%) and EU-27 (80.5%) averages. Looking forward, the 2020 state budget has yet to take shape. However, initial estimates show that while announced tax increases could boost revenue between 0.3% to 0.4% of GDP, implementation of the expenditure measures contained in the coalition agreement will require paring back other spending initiatives or additional measures on the revenue-generation front.

[1]

2019: Deficit reduction, insufficient progress

Budget planning in Spain has been characterized by laxness and ongoing revisions to public deficit targets for the past decade. Established targets have been repeatedly revised to reflect the reality of budget outcomes These revisions are due to both economic and political considerations including changes of government, no-confidence votes, budget carryovers, etc. Either way, the reality is that the end goal of a balanced budget has been repeatedly pushed back.

For example, the 2012-2015 Stability Programme was designed to deliver a total public deficit in terms of gross domestic product (GDP) of 1.1% by the end of the period, starting from the deficit forecast at the time for 2011 of 8.5%. Two years later, when the Programme was updated for 2014-2017, the target for 2015 had already been revised upwards to 4.2% and the target of 1.1% had been pushed back to 2017. Today, that goal is still a long way off.

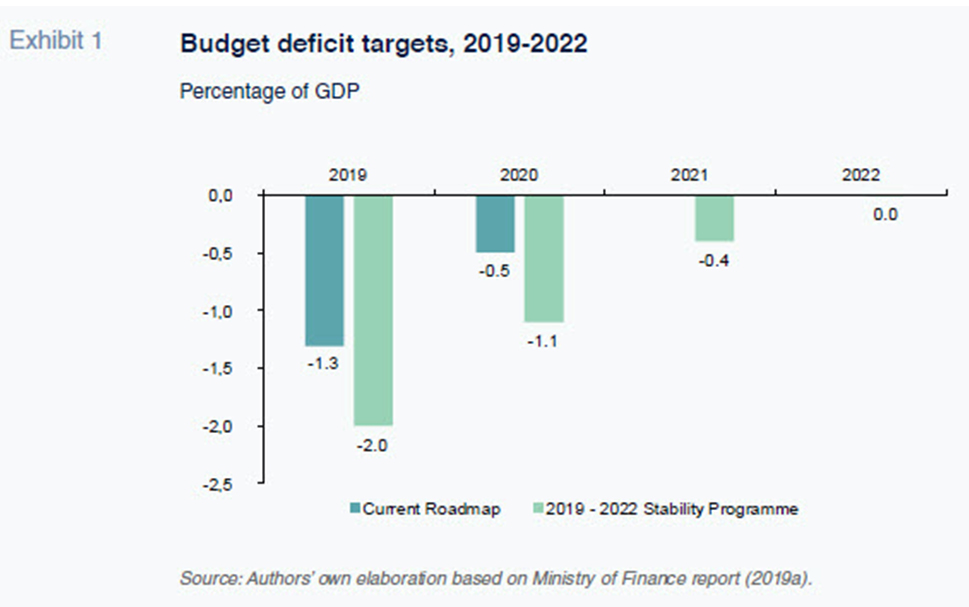

The current deficit-cutting roadmap was approved by Spain’s Cabinet on July 7

th, 2017, (and subsequently ratified by the Parliament) for 2018-2020. In July 2018, the Government tried to revise it upwards, but the new figures did not secure a majority vote in the Senate, thus they were dismissed. Subsequently, the Stability Programme was updated for 2019-2022, once again raising the deficit target for 2019, despite the change not having been ratified by the legislative process. Exhibit 1 presents the current actual targets and those included in the most recent proposed updates, referred to above. The target of 1.1% has been delayed to 2020 and the probability of achieving it on schedule is extremely unlikely.

Barring unforeseen developments in the comprehensive budget settlements for 2019, which should be disclosed in March 2020, the total public deficit will not come down substantially in 2019 compared to 2018. By extension, this implies an increase in the structural deficit. The deficit recorded in 2018 was 2.5%. The consensus forecast published by Funcas calls for a deficit of 2.4% in 2019, with the analysts forecasting that metric within a range from 1.9% to 2.6% (Funcas, 2020).

Indeed, the monthly settlement figures available to October (Ministry of Finance, 2019b) point to a deterioration in the deficit compared to the first 10 months of 2018. Excluding the local authorities, the deficit was running at 1.41% compared to 1.08% in 10M18. If we use the figures for the first three quarters, in order to include local government numbers, the outcome is also worse: 1.47% in 9M19 vs. 1.2% in 9M18.

The deterioration is primarily attributable to expenditure. Although the government failed to pass its general state budget for 2019 (2019 GSB) resulting in an extension of the 2018 GSB, it did push through increases in public sector wages, pensions and unemployment benefits by way of decree. That said, the changes made in 2018 had a positive impact in the last quarter of 2019 affecting social security contributions and the instalment payment system for corporate income tax. These developments suggest that the year-end figures may be less negative than initially anticipated. The Bank of Spain’s most recent calculations (2019) point to a 2019 deficit of 2.5%, which coincides with the figure estimated by Conde-Ruiz, Marín and Rubio Jiménez (2019). Elsewhere, Funcas (2019) is also predicting a deficit in line with that of 2018 (2.5%)

Spain’s independent fiscal institution, the AIReF (2019a), is a little more optimistic. In addition to the above-mentioned last-quarter revenue boost, the AIReF, in its base-case scenario, is forecasting a deficit of 2.2%. However, the target of 2% is considered “improbable”.

By level of government, the figures point to a significant shift in responsibility for the failure to deliver the fiscal stability targets (Ministry of Finance, 2019b). The central government has improved its performance considerably. As of October 2019, its deficit had decreased from 0.73% in the first 10 months of 2018 to 0.58%. In contrast, the regional governments’ finances had deteriorated substantially, moving from a surplus of 0.14% to a deficit of 0.35%. Elsewhere, the local authorities’ surplus has narrowed while the deficit at the social security level has increased slightly. The main reasons for the disparate performances at the central and regional government levels lie with: (i) the lag in executing advance payments to the regional governments; and, (ii) the impact of the change in the VAT management system introduced in 2017 with the rollout of the so-called Immediate Supply of Information regime.

By year-end, the first factor should reverse, reducing the regional governments’ deficit and increasing that of the central government, as the advance payments made in December were well above usual. On the contrary, the VAT impact will not be reversed. The switch in management regime will translate into a drop in revenue for the regional governments, which the central government will keep, equivalent to 0.2 percentage points of GDP in 2019. The government formed in the wake of the no-confidence vote of June 2018 previously announced that the VAT impact would be neutralised. As a result, the regional governments prepared their budgets for 2019 with that funding in mind- around 2.5 billion euros. However, the challenging political environment and carryover of the 2018 budget have meant that offset did not occur, thereby undermining the regional governments’ finances.

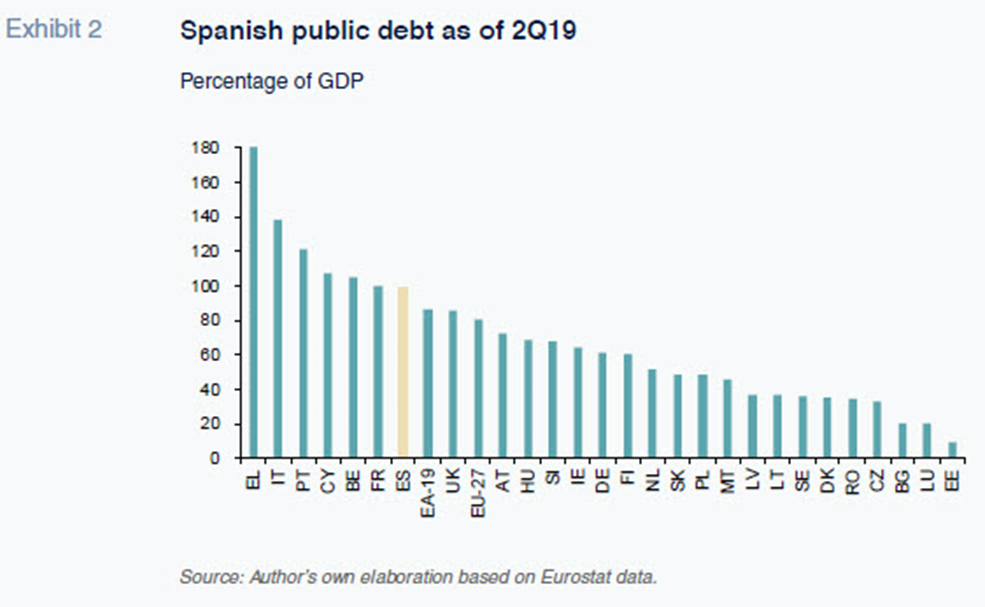

To put the current fiscal situation into context, Exhibits 2 and 3 depict, respectively, public debt at the end of the second quarter of 2019 and the structural public deficit. Spain, with a public debt-to-GDP ratio of 98.9%, is the seventh most indebted European nation, presenting leverage that is well above the eurozone (86.4%) and EU-27 (80.5%) averages. Only other southern European economies (Greece, Italy, Portugal, and Cyprus) as well as France and Belgium are more indebted.

That ratio is significantly above the European Union benchmark (60%); it massively restricts Spain’s ability to use national fiscal policy as a macroeconomic policy tool; and heightens the economy’s exposure to sovereign debt crises or rate increases.

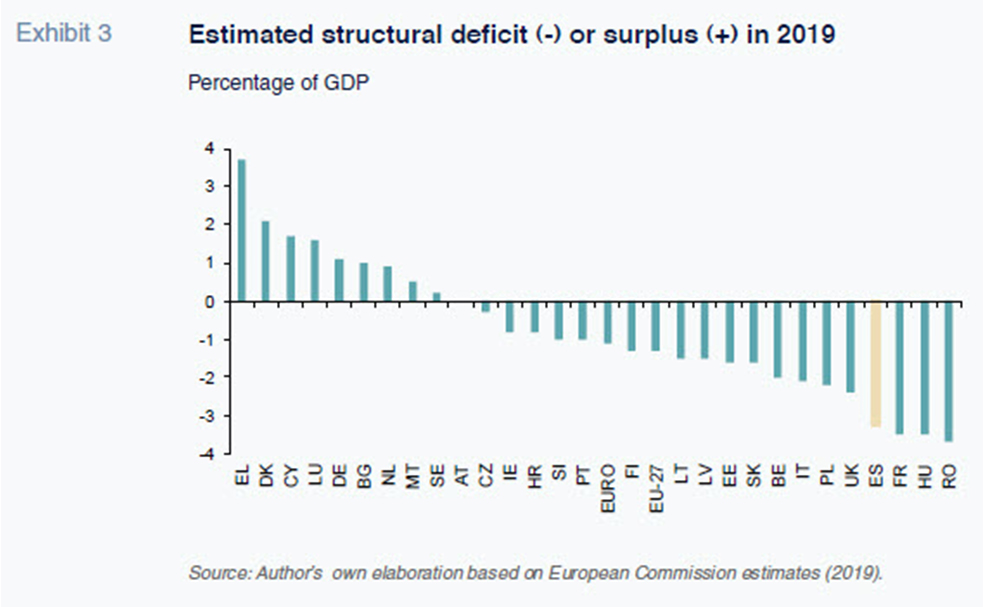

That is why it is so important to analyse deficit dynamics, which increase or reduce the stock of debt from one year to the next. Examining the structural deficit is particularly important as it eliminates the effect of the economic cycle and highlights the underlying mismatch between public revenue and expenditure. The estimate shown in Exhibit 3 corresponds to 2019 and was compiled by the European Commission. Here, Spain is one of the underperformers with only France, Hungary and Romania presenting higher structural deficits.

In short, Spain (along with Italy and, to a lesser extent, France and Belgium) faces an excessive public debt burden that the government has failed to resolve. Spain has not taken advantage of its strong growth since 2014 to reduce its debt ratio, managing only to stabilise it at around 100%. According to the AIReF (2019b), the positive impact of the growth in nominal GDP would have enabled an 18-percentage point reduction in the debt ratio by 2019 (which would put Spain in line with the EU-27 average), were it not for the structural deficit, which has almost entirely wiped out that effect.

Outlook for 2020

The Funcas (2019) consensus forecast for 2020 is for an overall deficit of 2.2%, with analysts’ estimates spanning a range of 1.5% and 2.8%. The Bank of Spain’s most recent forecasts (2019) point to a deficit of 2.1%, while the European Commission (2019) anticipates a 2.2% deficit. These figures are well above those projected in the roadmap depicted in Exhibit 1. The most recent fiscal consolidation roadmap approved by the Spanish Parliament targets a deficit of 0.5%, while the 2019-2022 Stability Programme is targeting 1.1%.

Meanwhile, the fiscal landscape has become increasingly uncertain. At present there is not even a draft GSB for 2020. The lack of a sufficiently large parliamentary majority has prevented approval of the limit on non-financial spending for 2020 or the revision of the fiscal stability targets. The main reference document available at this time is the Draft Budgetary Plan for 2020 (2020 Plan), which was published and submitted to the European Commission on October 15th, 2019 (Ministry of Finance, 2019a). The 2020 Plan reflects a “no-policy-change” fiscal scenario. This entails a lack of additional measures on the revenue side with the odd intervention on the spending side, all of which will be adopted upon government formation. Specifically, this entails implementation of the agreement with the unions for the period 2018-2020 to increase public sector wages and the commitment to increase pensions at the same rate as the expected increase in consumer prices in 2020. According to the Spanish government, the result of the no-policy-change scenario would be a reduction in the overall deficit from 2.0% to 1.7%.

The European Commission did not respond favourably to this 2020 Plan for three main reasons. Firstly, according to the projections made by the EU, the 2019 Spanish deficit will be 2.3%, 0.3 percentage points above the government’s projection. Secondly, increases in public wages and pensions involve a significant increase in public expenditure of 0.4%-0.5% of GDP, such that the overall 2020 deficit would barely budge (2.2%). Finally, the structural deficit will deteriorate by 0.1 percentage points while the Stability and Growth Pact recommends a structural deficit reduction of 0.65% of GDP. The Commission therefore concluded that the Plan runs the risk of non-compliance with the provisions of the Stability and Growth Pact. It does, however, acknowledge that given the Plan’s “no-policy-change” nature, there is room for an additional deficit reduction effort. This should be included in an updated draft budgetary plan when the draft 2020 budget law is submitted to the Spanish parliament.

What can we expect from the new 2020 GSB? The investiture of Pedro Sánchez as president on January 7

th, 2020, partially reduces political uncertainty, although the parliamentary arithmetic continues to complicate the drafting and passage of a new budget, on which there will be pressure to increase spending. This is due to two dynamics. The first relates to the coalition agreement between Spain’s socialist party, PSOE, and Unidas Podemos.

[2] The second is due to the multiple bilateral agreements reached with parties with purely national interests.

There are different ways of trying to determine what direction the fiscal policy of the 2020 GSB will take. One possible approach would be to quantify the impact of the measures with an eye on spending and revenue contained in the investiture agreements. The issue, however, lies with the sheer number of agreements and the lack of precise figures. Nevertheless, Spain’s Employers’ Confederation, the CEOE, has taken a partial stab at it by focusing solely on the agreement between PSOE and Unidas Podemos. According to their calculations, expenditure and revenue is set to increase by 1.5 and 0.5 percentage points, respectively. This would push the 2020 deficit over the 3% threshold again.

[3]

There is, however, an alternative approach to this calculation. Starting from the 2020 Plan, we include the additional sources of revenue featured in the Draft Budgetary Plan for 2019 (2019 Plan), which are essentially identical to those in the subsequent draft 2019 GSB (Lago-Peñas, 2019), and then layer in the possible sources of additional tax revenue outlined in the coalition agreement. Because the 2019 Plan includes more precise calculations and measures affecting total public revenue that are absent from the agreements with other parties, these calculations are less uncertain. Such an approach gives us an idea of how much room the coalition government has to increase expenditure over and above the no-policy-change scenario underpinning the 2020 Plan, which already includes wage increases for public employees and higher pensions.

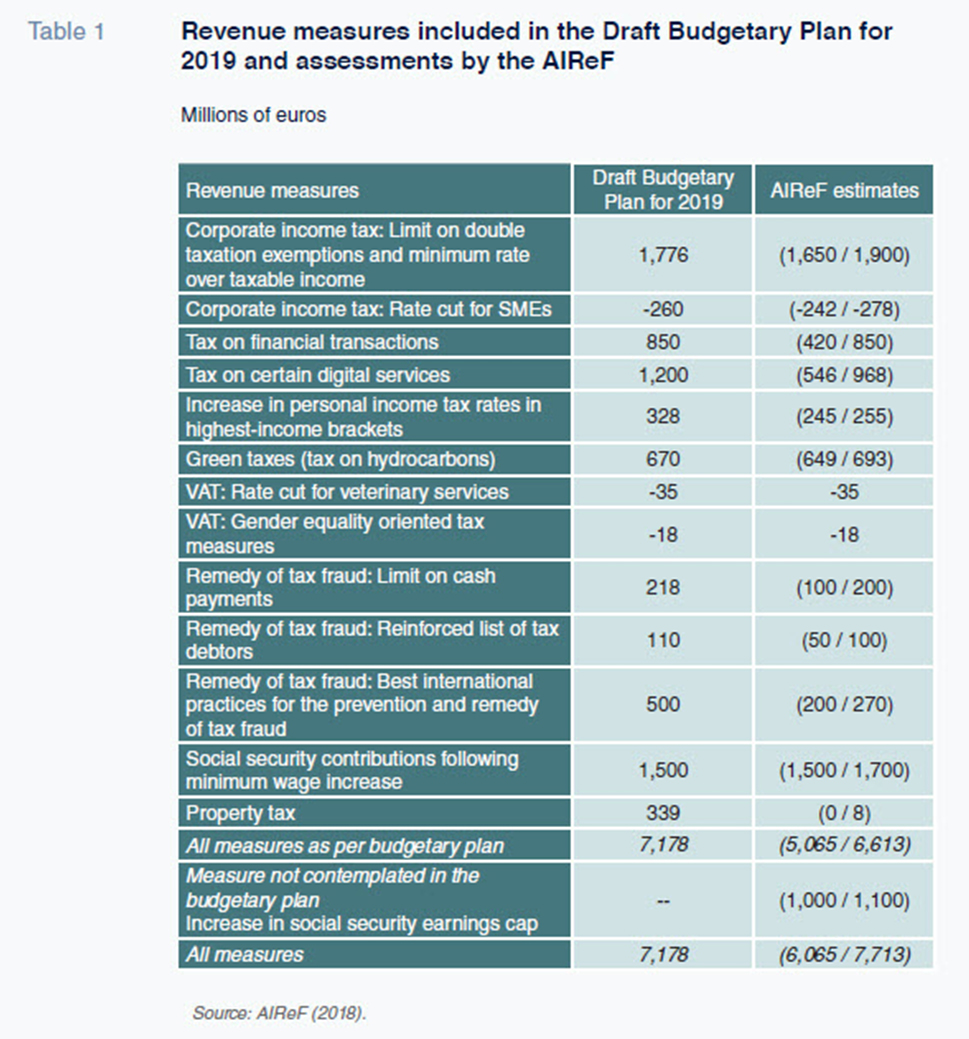

Table 1 presents the government’s and AIReF’s estimates for each of the new revenue measures included in the 2019 Plan and for the increase in the social security earnings cap, a measure only decided on by the government after it sent the Plan to the European Commission. Layering the latter measure in puts the government’s estimate for incremental revenue (7.18 billion euros) within the confidence interval projected by the AIReF (6.07-7.71 billion euros). If we subtract the increases in the social security earnings cap that were implemented despite the vote against the 2019 GSB from those figures, as well as the estimated increases from anticipated social security contributions (

i.e., after the minimum wage increase) AIReF’s interval decreases to 3.57-4.91 billion euros. All of which would imply an increase in revenue of between 0.3% and 0.4% of GDP.

Section 10 of the coalition agreement sets out the measures agreed on for increasing public revenue and guaranteeing budget equilibrium. In the case of corporate and personal income tax, the coalition agreement essentially mimics the contents of the 2019 Plan. The new taxes on certain digital services and the tax on financial transactions also feature in the 2019 Plan. The same is true of the VAT reduction and the measures for combating tax fraud. Lastly, the coalition agreement does not make any reference to increasing the net wealth tax, but does explicitly state that the government will “study the taxation of high net worth individuals with the aim of ensuring they contribute to a more just and progressive tax system”. In short, the coalition agreement does not include significant measures for boosting revenue different to those already quantified in the 2019 Plan and endorsed by the AIReF.

Let us depart from the European Commission’s estimate for the deficit in 2020 in the above-mentioned no-policy-change scenario depicted in the 2020 Plan (2.2%). Implementation of all of the revenue measures outlined to date would put the overall deficit at 1.8% in the best-case scenario. That figure would neither comply with the 2019-2022 Stability Programme target nor would it deliver the targets for reducing the structural deficit in 2020 (-0.65% of GDP).

Furthermore, the period contemplated in Transitional Arrangement One of Organic Law 2/2012 of April 27th, 2012, on Budget Stability and Financial Sustainability ended on January 1st, 2020. The limits stipulated in articles 11 and 13 of that legislation are now in full effect. Specifically, article 11 stipulates that: “no public administration may incur a structural deficit, defined as the cyclically-adjusted budget balance net of one-off and temporary measures. However, in the event of structural reforms with budgetary effects in the long term, in keeping with European legislation, Spain may incur an overall structural deficit of 0.4 percent of gross domestic product expressed in nominal terms, or the percentage stipulated in European legislation to the extent lower”. Additionally, the organic law in question implements article 135 of the Spanish constitution, which stipulates that: “Neither the State nor the Autonomous Communities shall enter into a structural deficit beyond the limits stipulated, if applicable, by the European Union for its Member States […] Ceilings on structural deficit and public debt volume may only be overrun in the event of natural catastrophes, economic recession or situations of extraordinary emergency which are beyond the State’s control and considerably harm the State’s financial situation or its economic or social sustainability, recognised as such by the absolute majority of the Congress of Deputies”.

Accordingly, it seems the implementation of the expenditure measures contained in the coalition agreement between PSOE and Unidas Podemos will require paring back other spending initiatives or additional measures on the revenue-generation front, preferably framed by a far-reaching and in-depth reform of the Spanish tax system.

Notes

The author would like to thank Fernanda Martínez and Alejandro Domínguez for their assistance.

References

AIReF. (2018). Report on the main budgetary lines of the public administrations 2019. Report 45/2018. Retrievable from www.airef.es. October 26

th, 2018.

— (2019a).

Monthly stability target monitoring. A. General Government. November 2019. Retrievable from

www.airef.es. December 26th, 2019.

— (2019b).

Debt Observatory. November 2019. Retrievable from

www.airef.esBANK OF SPAIN. (2019).

Macroeconomic projections for the Spanish economy (2019-2022). Retrievable from

www.bde.es. December 16

th, 2019.

CONDE-RUIZ, J. I., MARÍN, C. and RUBIO JIMÉNEZ, J. (2019). Déficit 2019, un año de transición [Deficit in 2019, a year of transition]. Blog entry for

Nada es Gratis. Retrievable from

https://nadaesgratis.es. December 26

th, 2019.

EUROPEAN COMMISSION. (2019a).

European Economic Forecast. Autumn 2019. Retrievable from

https://ec.europa.eu— (2019b).

Cyclical Adjustment of Budget Balances. Autumn 2019. Retrievable from

https://ec.europa.eu— (2019c).

Commission opinion on the Draft Budgetary Plan of Spain C(2019) 915 final. Retrievable from

https://ec.europa.eu. November 20

th, 2019.

FUNCAS. (2019).

Spanish Economic Forecasts Panel. January 2020. Retrievable from

www.Funcas.es. January, 2020.

LAGO PEÑAS, S. (2019). Deficit Reduction in Pain: Uncertainty Persists.

SEFO, 8(1). Retrievable from

www.funcas.esMinistry of Finance. (2019a).

Draft Budgetary Plan for 2020. Kingdom of Spain. Retrievable from

www.hacienda.gob.es. October 15

th, 2019.

— (2019b).

Budget Execution. November 2019. Retrievable from

www.hacienda.gob.es. December 23

th, 2019.

Santiago Lago Peñas. Professor of Applied Economics and Director of the Governance and Economics Research Network (GEN), Vigo University