The climate change challenge for the Spanish economy

The Spanish economy is making progress on reducing its greenhouse gas emissions and energy intensity, while increasing renewable energy generation. Given its energy dependence, as well as its abundance of renewable energy sources, accelerating the transition towards a low-carbon economy represents a future insurance policy and an opportunity.

Abstract: Preliminary estimates of the European Environment Agency (EEA) show greenhouse gas emissions in the European Union decreased by 2% in 2018, having edged 0.6% higher in 2017. Although a positive trend, scenarios envisioned by the European Environment Agency indicate the EU would still miss its stated target of a 40% reduction by 2030. The advancement of climate change will involve structural shocks with effects in the medium and long-term. However, climate change and the actions taken to stall it are bound to have a growing impact on macroeconomic performance, too. In Spain, the government estimates that emissions decreased by 2.2% year-on-year in 2018, thanks to reduced emissions by the electricity sector, partially offset by growth in emissions in transport. Similarly, there has been an increase in the share of renewable energy and a decrease in the intensity of energy usage. Nevertheless, Spain’s agricultural, energy and tourism sectors remain highly exposed to climate change. Thus, it is imperative that the country make further advancements by taking advantage of its relative abundance of renewable sources, which will also mitigate the economic cost of its dependence on imported oil and gas.

Introduction

The recent trend of rising greenhouse gas (GHG) emissions and the materialisation of the initial effects of climate change have focused attention on their macroeconomic impacts. However, this slow process is characterised by persistent effects that are hard to model. The Twenty-Fifth UN Climate Change Conference of Parties (COP25) held in December 2019 in Madrid highlighted the need for investment in accelerating the transformation towards a low-carbon economic model. General macroeconomic weakness provides an additional impetus for linking macroeconomic dynamics and efforts to stem climate change.

The most recent data on global greenhouse gas emissions have caused alarm. Having remained steady between 2014 and 2016, emissions spiked the following two years, largely driven by the emerging economies. According to the IMF, the emissions of the G-7 economies, excluding the United States, declined in 2018. In the most recent update of his integrated assessment model of climate change, Nobel Prize-winner William Nordhaus concludes that the trends in emissions and carbon prices are far from the progress needed to deliver the targets laid down at the Paris COP. He also flags the degree of high uncertainty regarding the macroeconomic impacts, which only reinforces the pressing need for more aggressive policies.

In a symbolic move, the European Parliament and the Spanish government (just recently) have declared a climate emergency. The European Commission has also presented the broad lines of the so-called European Green Deal, an ambitious project aimed at boosting the transformation of the bloc’s growth model in order to deliver GHG neutrality in 2050. In its 2021-2030 Integrated Energy and Climate Plan, the Spanish government has set targets for reducing greenhouse gas emissions and increasing renewable energy and energy efficiency.

Climate change involves structural shocks with effects in the medium and long-term. However, climate change and the actions taken to stall it are bound to have a growing impact on macroeconomic performance. Developments in the European automotive industry since new emission testing regulations took effect in September 2018 is a good example. In Spain, there are idiosyncratic factors that accentuate the macroeconomic ramifications of climate change due to the country’s exposure to its adverse effects and the opportunities presented by energy transition.

Relative situation in Spain

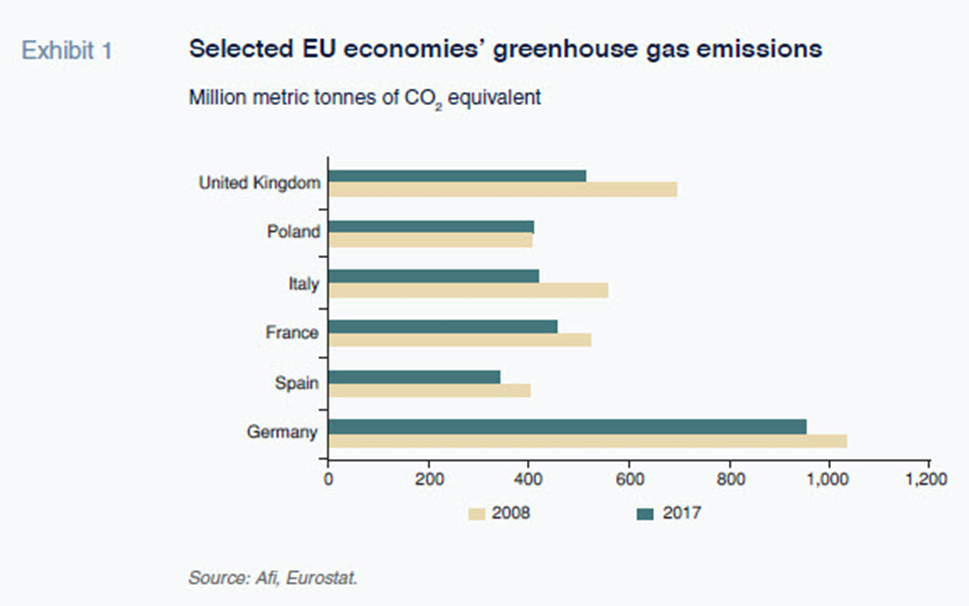

According to the preliminary estimates of the European Environment Agency (EEA), greenhouse gas emissions in the European Union decreased by 2% in 2018, having edged 0.6% higher in 2017. The estimated 2018 reading marks a 23% decline from 1990 levels, which is ahead of the EU’s target for a 20% reduction by 2020. With the commitments already announced, member states believe that a no-change-policy scenario would result in a 30% cut in emissions by 2030. However, proposed additional measures could result in a 36% reduction in 2030 (in all instances with respect to 1990 levels). Although a positive trend, each scenario means the EU would miss its stated target of a 40% reduction by 2030.

In Spain, emissions reached a bottom in 2013. Since the economic recovery began, emissions levels have varied, trending higher until 2017. Last July, the government estimated that emissions had decreased by 2.2% year-on-year in 2018, thanks to reduced emissions by the electricity sector, partially offset by growth in emissions in transport.

It is worth considering the varying contributions of Spain’s main sectors. Despite the scant weight of the manufacturing industry in the Spanish economy (just 12.1%, compared to 23.1% in Germany and 14.8% in Sweden), it is responsible for 23.7% of total emissions, a percentage that is well above the EU average. The private transport sector also stands out negatively in both absolute and relative contribution terms. On the other hand, higher temperatures in Spain mean that emissions caused by central heating are not particularly high.

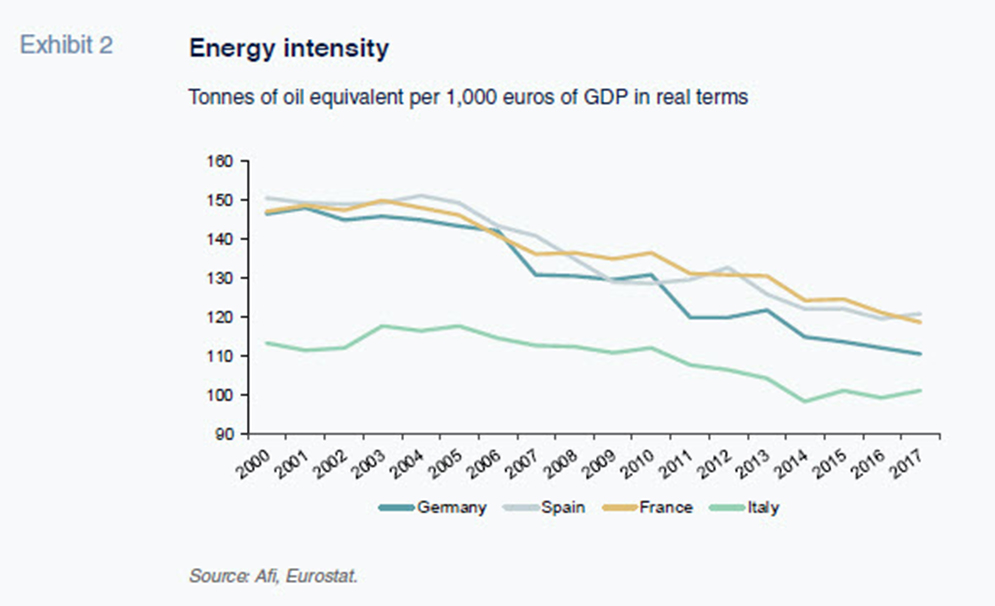

The trend in emissions depends on GDP and population growth as well as two key energy sector parameters: energy intensity and the use of renewable sources. The former affects the demand for energy relative to GDP, while the latter determines the emissions generated in meeting that demand. The Spanish energy sector has been improving its performance on both fronts, which has had a positive impact on emissions. However, relative to other European economies, the Spanish economy still has a long way to go in terms of making more efficient use of energy and configuring a more carbon-friendly energy mix.

The composition of demand for energy in Spain has evolved in terms of both electricity consumption and the overall energy mix (oil/gas/coal). During the recovery, demand for energy lagged growth in GDP. Energy-to-GDP elasticity, i.e., the proportional change in demand for energy in response to a change in GDP, has fallen from 1.3 to 0.3. This suggests that for every point of growth in GDP, demand for energy increases by 0.3 points, compared to 1.3 points previously.

This improvement is attributable to two factors:

- Greater energy efficiency, which is the result of the effort being made to use energy inputs less intensely during the production processes; and,

- A change in the sectoral make-up of Spanish GDP. Since the crisis, the construction industry and the sectors that supply it (e.g., non-metallic minerals) have reduced their weight in Spanish output considerably, with service sectors that use relatively less energy taking up the slack.

The result has been a reduction in the Spanish economy’s energy intensity, measured as the consumption of energy in tonnes of oil equivalent (toe) per thousand euros of GDP. As shown in Exhibit 2, this trend is not exclusive to Spain. The major eurozone economies are also improving their energy intensity. According to a study compiled by CEPREDE, an economic forecasting centre, for Red Eléctrica de España (REE), the grid manager, the change in the composition of output among Spanish sectors is responsible for a relatively higher percentage of the reduction in energy intensity compared to the eurozone average (50%

vs. 25%). As a result, more effort will need to be made on energy efficiency. In relative terms, it is fair to say that the Spanish economy has not performed badly in terms of energy intensity, reducing this metric at a similar pace to France and by only a little less than Germany. Meanwhile, energy consumption in Spain has remained lower than in both of those economies, as well as Italy, which is logical considering the smaller size of the Spanish economy.

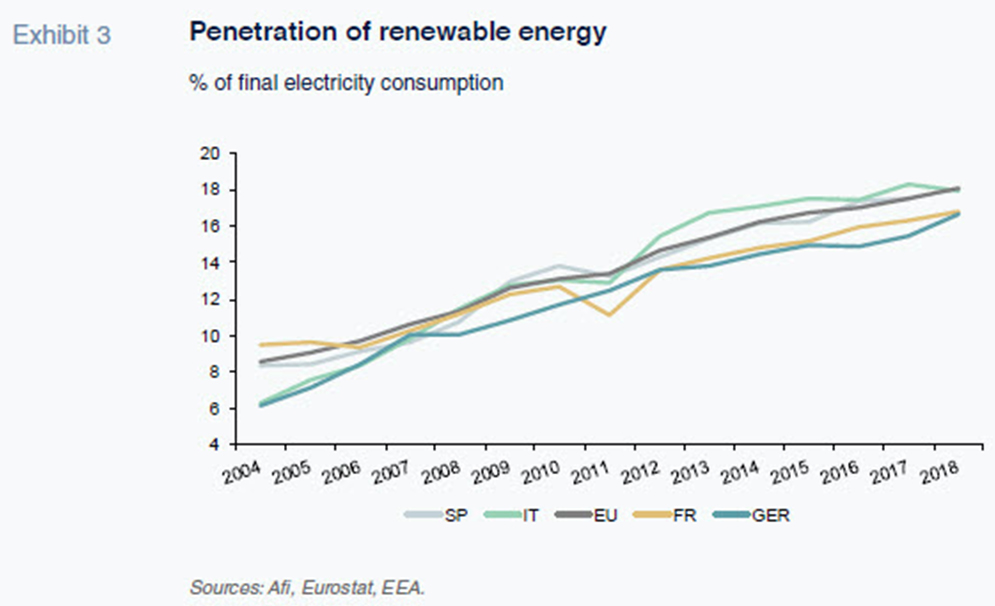

In addition to using less energy per unit of GDP, delivery of Spain’s emission-cutting targets (which could be made even more ambitious under the European Commission’s Green Deal) requires increasing the weight of renewable sources in the electricity generation mix. Renewable energy penetration in Spain, expressed in terms of total electricity consumption, is in line with the European average (17.8%

vs. 18.1%). As revealed by Exhibit 3, the Spanish level is a little higher than that of France and Germany, though still somewhat lower than that of Italy and far below penetration in Sweden, where it has reached over 50%.

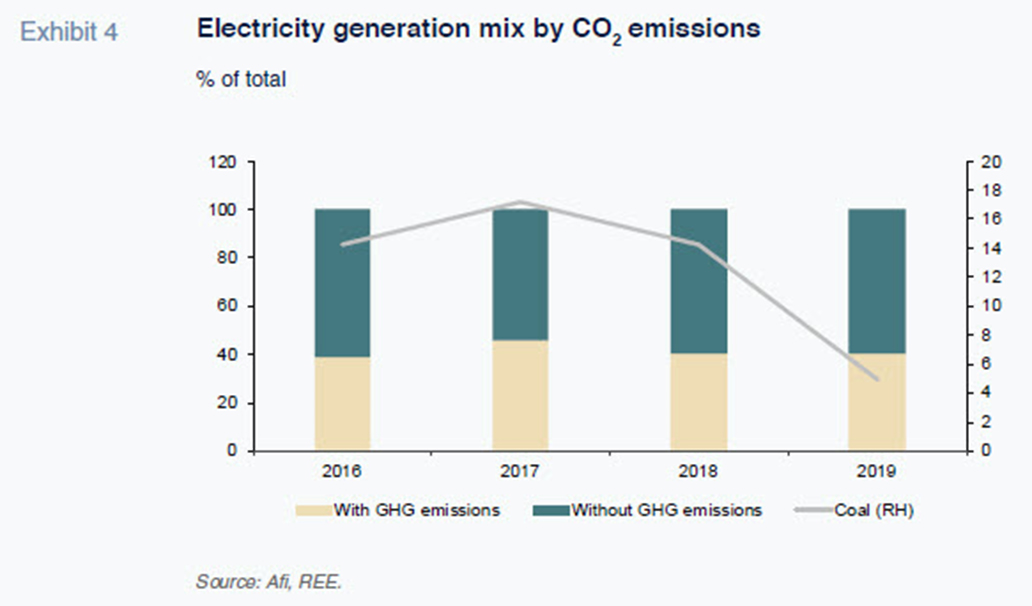

According to the most recent data published by the grid manager, Red Eléctrica, the renewable energy capacity available for the generation of electric power increased again in 2019 and currently accounts for 49.3% of total generation capacity. In parallel, coal-fired power generation capacity and usage decreased in 2019 (Exhibit 4). As a result, the percentage of electricity generation free of greenhouse gas emissions stands at 60% of the total.

Climate change impact channels and policy options

Climate change will drive an increase in average temperatures, a decrease in rainfall and more frequent extreme weather events (particularly heatwaves). Spain’s weather agency, AEMET, has analysed the 2000 figures in comparison with those of 1971-2000 and found an increase in the average temperature (particularly in the spring and summer), growth in the surface area of semi-arid climates to 30,000 km2 and a higher frequency of heatwaves (AEMET, 2019).

The national CLIVAR programme in Spain (comprised of a group of experts on climate) estimates that between 2021 and 2050, average summer temperatures in Spain could rise by between 1.1 ºC and 2.8 ºC, while precipitation could decrease by as much as 30%, irrespective of the greenhouse gas emissions scenario. It also expects the number of snowy and windy days to decline and the frequency of periods of drought to increase. Those predictions coincide with reports compiled by the European Commission’s Joint Research Centre on climate impact in the European Union, which considers Southern Europe to be the region most exposed.

These climate changes will affect several economic sectors and natural resource systems, including:

- The energy sector. In terms of resources, climate change could drive a decrease in wind power due to lower wind speeds. Hydroelectric generation could also fall as a result of lower water availability. As well, higher temperatures (albeit partially offset by higher irradiance) could also reduce photovoltaic generation. On the demand side, the composition of energy consumed would shift, marked by growth in demand for cooling and a decline in demand for heating.

- Water resources. Lower rainfall, coupled with higher evapotranspiration and lower runoff, [1] will drive a reduction in water resources, which is expected to gather traction as the century advances. The impact will be greater in the island systems and south of mainland Spain. The economic cost in terms of the impact on agricultural output and hydroelectric power generation will be considerable, and higher than the costs recorded in prior episodes of severe drought (estimated at between 0.1 and 0.2 percentage points of GDP). Moreover, if droughts were to become catastrophic, the costs could increase non-linearly, affecting sectors, such as the tourism industry.

- Agriculture and livestock. Here the impacts will be highly varied depending on the type of activity and its location. In general, however, production costs are expected to increase and conditions to become more volatile.

- Tourism. Spain’s Ministry of Agriculture, Food and the Environment (2016b) estimates that the sector’s contribution to GDP could decline by 0.86% by 2080, due to a loss of competitiveness in certain coastal areas, such as the Mediterranean and the Canary Islands, and more attractive tourism in several European countries that compete with Spain.

In general, the studies drawn up as part of the national plan for adapting to climate change underscore the uncertainty surrounding the estimation of economic impacts. This is partly because of the global emissions scenarios as well as the result of the regional and sectoral heterogeneity of the impacts. There is no doubt, however, that climate change will be a structural and persistent force that will affect economic activity in Spain over the course of this century. Moreover, the adverse impact in Spain is expected to be notably greater than in other EU countries.

It is also important to emphasise that the net economic impact of climate change will depend largely on the ability of the private and public sectors to foster the transformation of the productive system. This will require both mitigating the scope of climate change effects and facilitating adaptation to them. The 2021-2030 National Integrated Energy and Climate Plan acts as a catalyst and timeframe for that transformation in Spain. The three drivers of change contemplated in it are:

- Energy efficiency.

- Increasing the penetration of renewable sources of energy in the power generation mix.

- Electrification of the economy.

The impact assessment study accompanying the Plan (Basque Climate Centre, 2019) includes a few macroeconomic estimates. It starts from a reference or baseline scenario in which greenhouse gas emissions increase by 8% with respect to 1990 and compares that scenario with the target scenario in which emissions are cut by 20% in 2020. The main economic shock modelled in the Plan is a boost in investment of 195 billion euros compared to the baseline scenario, 80% of which would come from the private sector. However, the reconfiguration of the energy sector implies an additional positive shock via the substitution of imported fossil fuels with renewable sources. That drop in imports is permanent and drives growth in the value added generated in Spain.

The impact of these two shocks on GDP is estimated at 1.8% in 2030 and would be accompanied by growth in employment of 1.7% and a reduction in the unemployment rate of between 1.1 and 1.6 percentage points. These effects would compensate certain costs, such as those derived from divestment from nuclear and carbon power plants starting in 2025. Although the public sector would invest an additional 37 billion euros through 2030, the budgetary impact would be relatively limited, as it is assumed it would substitute other areas of expenditure (besides the fact that the growth in GDP would in turn generate additional revenue).

The Plan and its assessment highlight the areas where action must be taken to capitalise on the opportunities presented by energy transformation and efforts to mitigate the effects of climate change. Further progress must be made on reducing energy intensity and increasing the penetration of renewables. The Plan calls for a reduction in primary energy intensity of 37% between 2015 and 2030 and an increase in the penetration of renewables in final energy consumption to 42%, compared to 17% at present. However, the baseline scenario may not adequately reflect the adverse impact of the earliest effects of climate change, which will materialise over the next decade.

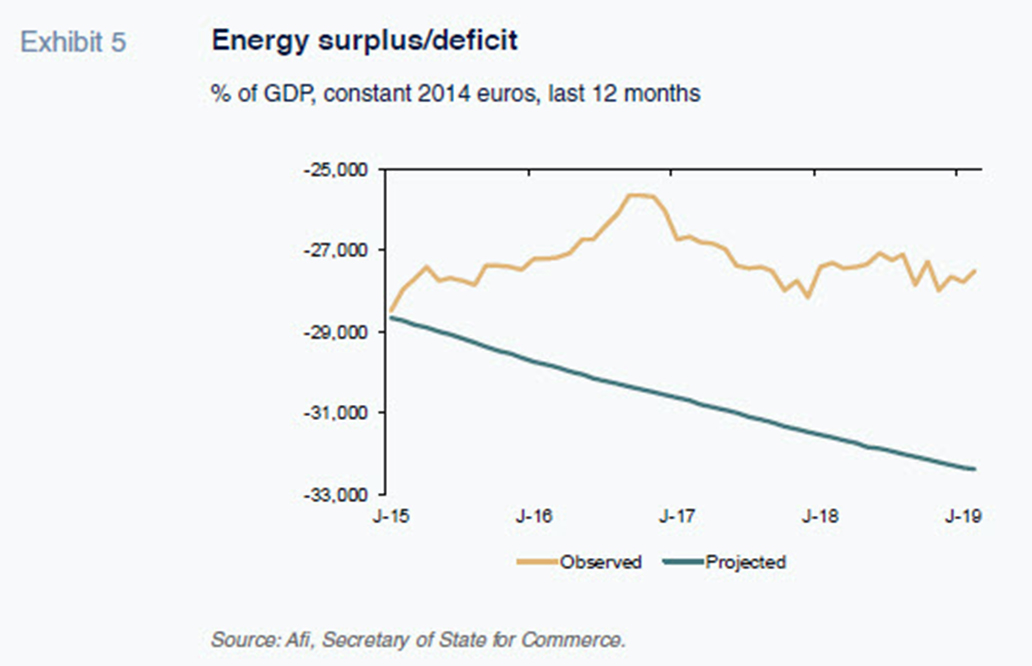

In Spain, the effect of reducing the economy’s energy dependence, which has been a considerable burden for its balance of trade, is of particular interest. We estimate the gain unlocked by the recent progress on reducing energy intensity and the boost in generation from renewable sources at 15 billion euros since 2015. If the energy deficit, volume-wise, had remained at around 3% of GDP since 2015, the deficit would today stand at over 32 billion euros. Although modest, it is a recurring impact and should therefore be considered a positive effect associated with the energy transition.

Conclusion

The recent progress on energy transition and emission-cutting in Spain has been shaped by the consequences of the climate crisis as well as both the structural and sectoral realignment of the economy triggered in its wake. A more pronounced change in the energy generation mix and further advances on energy efficiency could accelerate this progress in the coming years. Greater transformation would enable Spain to take advantage of its relative abundance of renewable sources and mitigate the economic cost of its dependence on imported oil and gas.

However, the Spanish economy is relatively exposed to climate change. The magnitude is very hard to quantify and is subject to significant uncertainty. Moreover, it is safe to say that climate change will be a persistent force in the decades to come, affecting some of the foundations of Spain’s economic model. The push from the European Green Deal for policies that accelerate the transformation of the European economy and their transfer to Spain via the Integrated Energy and Climate Plan represents an opportunity to prepare for and mitigate the net impact down the line.

Notes

Runoff is the part of the water cycle that flows over land as surface water instead of being absorbed into groundwater or evaporating. It is essential to the process of collecting water.

References

AEMET. (2019).

Efectos del cambio climático en España [Effects of climate change in Spain].

http://www.aemet.es/es/noticias/2019/03/Efectos_del_cambio_climatico_en_espanhaBASQUE CLIMATE CENTER. (2019).

Impacto económico, de empleo, social y sobre la salud pública del Borrador del Plan Nacional Integrado de Energía y Clima 2021-2030 [Economic, employment, social and public health impact of the Draft 2021-2030 National Integrated Energy and Climate Plan].

CEDEX/MAPAMA. (2017).

Evaluación del impacto del cambio climático en los recursos hídricos y sequías en España [Assessment of the impact of climate change on water resources and droughts in Spain].

CLIVAR-ESPAÑA. (2019). Climate over the Iberian Peninsula. Executive summary based on

CLIVAR Exchanges No. 73. Special Issue on climate over the Iberian Peninsula.

MAGRAMA. (2016a).

Impactos, vulnerabilidad y adaptación al cambio climático en el sector agrario [Impacts of, vulnerability to and adaptation for climate change in the agricultural sector].

— (2016b).

Impactos, vulnerabilidad y adaptación al cambio climático en el sector turístico [Impacts of, vulnerability to and adaptation for climate change in the tourism sector].

RED ELÉCTRICA DE ESPAÑA. (2019).

Demanda eléctrica y actividad económica: ¿cambio de paradigma? [Demand for electricity and economic activity: paradigm shift?]. February 2019.

https://www.ree.es/sites/default/files/downloadable/demanda-electrica-actividad-economica_0.pdf

Gonzalo García and David del Val. A.F.I. - Analistas Financieros Internacionales, S.A.