Snapshot of the FinTech sector in Spain

Spain has seen a five-fold increase in its number of FinTech firms, many of which are the result of ambitious entrepreneurs whose solutions are supporting the digitalisation of Spanish SMEs. Although FinTech firms were expected to compete directly with established banks, the two sectors increasingly collaborate through funding and innovation labs.

Abstract: The FinTech sector has sustained considerable growth in Spain in recent years, measured by both the number of players and the private investment it has attracted. In fact, FinTech firms raised 192.93 million euros in 2019, equivalent to an average of over 4 million euros per round of financing. Most firms are the result of entrepreneurial activity based in Spain’s largest cities, such as Madrid, Barcelona and Valencia. Specifically, 93% of existing FinTech firms were established by groups of entrepreneurs, with just under 7% founded within an existing enterprise. The sector is primarily concentrated around four segments: credit, payments, investments and personal finance management. Many of these offerings are B2B solutions, with FinTech firms supporting the digitalisation of Spain’s SMEs. While the initial expectation was that the Fintech players and banks would compete, there has been a marked shift towards collaboration among these two types of firms. Most notably, the banking sector frequently invests in FinTech start-ups and sponsors accelerators or incubators to support these firms in the early stages of their development.

Introduction

Although the financial sector had already begun to embrace technology in the run-up to 2007, the financial crisis accelerated this trend. The post-crisis years were shaped by the proliferation of new financial services firms with business models based on technology solutions aimed at enhancing the customer experience.

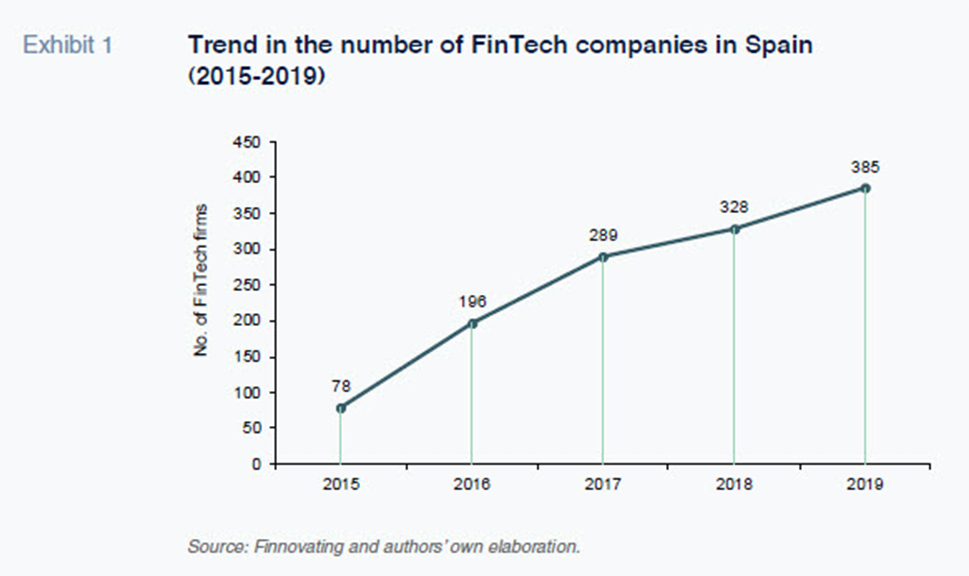

The Spanish FinTech phenomenon has left a considerable mark. As illustrated in Exhibit 1, the sector has grown from 78 companies in 2015 to 385 in 2019- a nearly five-fold increase. The types of financial services offered have also become more diversified. Although credit and payment service providers continue to dominate, new players have emerged in personal finance management and the foreign currency arena. In some instances, FinTech players have gradually added new financial services, morphing into so-called ‘neobanks’ (digital-only banks).

The evolution of Spain’s FinTech sector includes a changing relationship with the country’s banking sector. Initially, Fintech players and banks were seen as direct competitors. However, over the last few years these firms have increasingly collaborated together. Where competition persists, evidence suggests that it is oriented around intellectual property. Indeed, over the past few years, Spanish financial institutions have invested in Spanish FinTech companies, either by taking direct equity interests or fostering FinTech incubators and accelerators.

Overview of the Spanish FinTech ecosystem

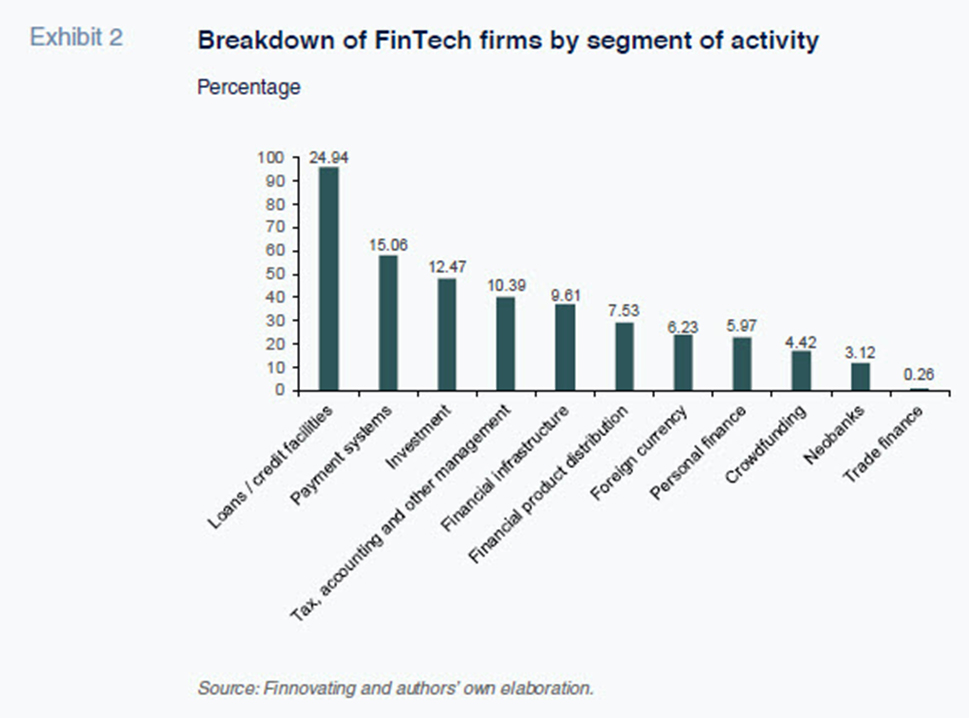

One of the unique characteristics of the Spanish FinTech landscape is the broad spectrum of financial intermediation activities performed by the 385 FinTech enterprises. Exhibit 2 shows the breakdown of FinTech firms by activity. We identify 11 types of financial services. As shown in Exhibit 2, the majority are lenders. A total of 96 FinTech companies, one out of every four, are active in this segment. A high percentage (15.06%) of FinTech firms is devoted to payments. This category includes all the firms that provide, whether directly or through other entities, retail electronic payment services. Many of these FinTech firms are certified by the National Securities Market Commission (CNMV) as electronic money and payments institutions.

Another 12.47% are active in the investment arena. This category includes FinTech firms that provide investment advisory services on an automated basis, automated management services, investment networks, and trading platforms. Lastly, the number of firms offering accounting, tax and other management activities, which currently account for 10.39% of the total, has been growing. Exhibit 2 shows the concentration of Spanish FinTech firms –62.86%– in the above four categories: lending, payments, investment and tax/accounting.

Exhibit 2 further highlights a unique characteristic of the Spanish FinTech sector. While Europe stands out for the proliferation of crowdfunding platforms, in Spain there are just 17 FinTech firms –less than 5% of the total– of this kind. Exhibit 2 also evidences the advent of the ‘neobanks’. In many cases, the neobanks are FinTech firms that were set up to specialise in lending or payments and have gradually expanded their service offerings to become ‘new digital-only banks’.

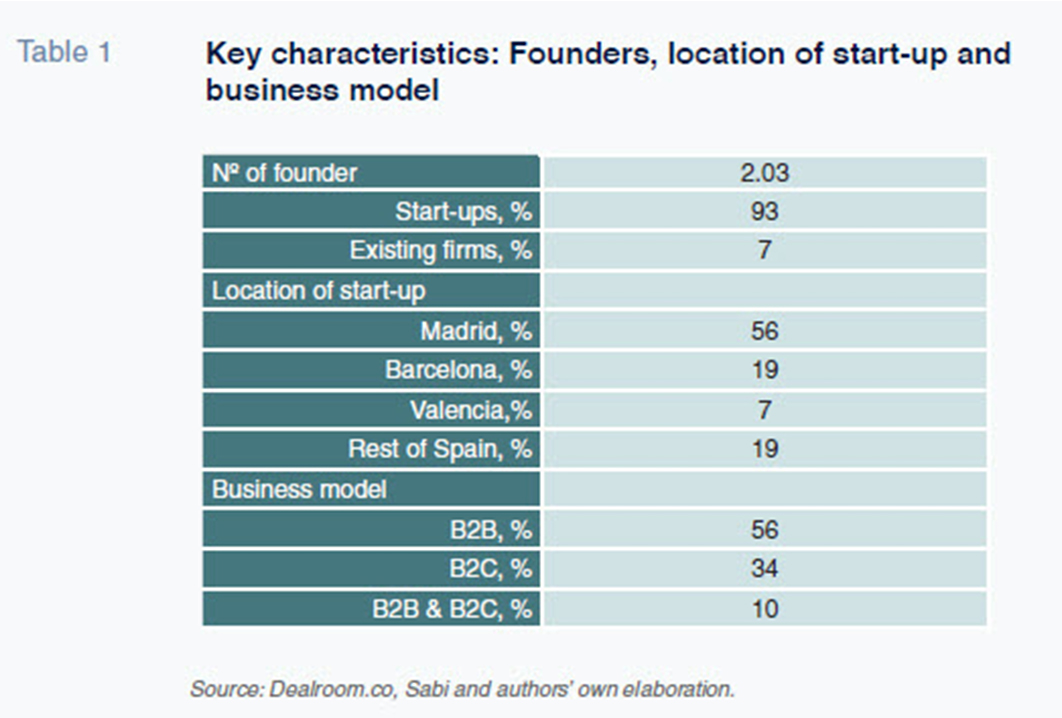

Table 1 depicts some of the key characteristics of Spain’s FinTech players in terms of their founding and business models. On average they have 2.03 founders. The vast majority are the result of individual entrepreneurship. Indeed, 93% of existing FinTech firms were established by groups of entrepreneurs, with a broad range of professional backgrounds. These entrepreneurs shared the common aim of developing innovative ideas in financial digitalisation. Only a small portion –under 7%– were founded within an existing enterprise.

Table 1 also evidences how geographically concentrated these firms are. Over half of all existing FinTech firms (56%) are located in Madrid. Another 19% reside in Barcelona and 7%, in Valencia. Just two out of every 10 FinTech firms are located outside of these three provinces. Unquestionably, these hubs’ dynamic business landscapes, economic strength and relatively greater opportunities for scaling up are the reasons for their ability to attract the bulk of Spain’s FinTech activity. Moreover, some of these regions have actively pushed the creation of FinTech hubs.

As for their business model, Table 1 reveals that 56% of FinTech firms target their activities at other firms, offering intermediation services or interim financial solutions. In many cases, FinTech firms’ customers are small and medium-sized enterprises (SMEs). As a result, many FinTech firms are supporting SMEs’ digital transformation though services, such as electronic payment platforms that enable SMEs to sell their products and services online. Some 34% of FinTech firms clearly target end customers. These firms essentially facilitate personal finance/wealth management and investment.

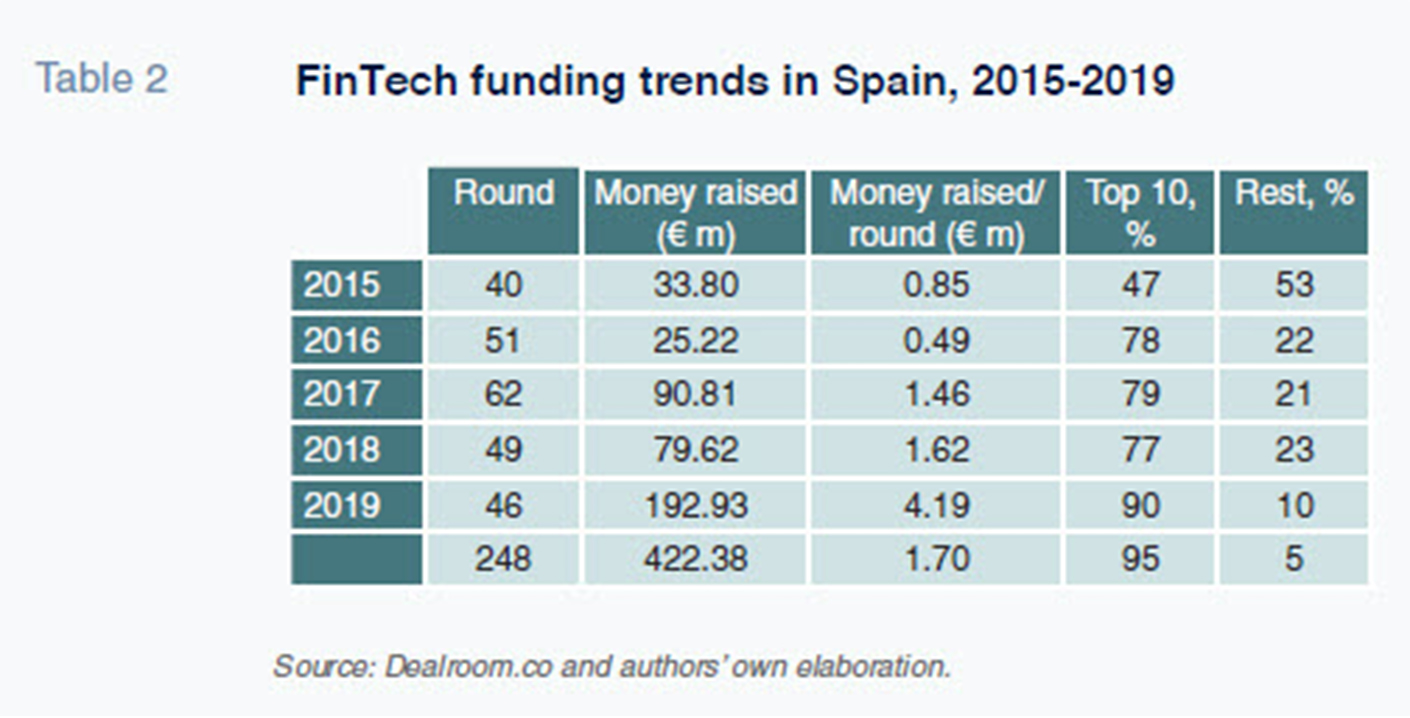

Another noteworthy aspect of Spanish FinTech firms is their funding structure, which is key to their ability to grow and achieve the scalability needed to generate profits. Table 2 shows how Spanish FinTech firms have been financing their growth. There have been 248 rounds of financing, raising over 400 million euros, since 2015. Over half of those rounds have taken the form of seed capital or venture capital, the key difference between the two being the relatively larger investment size associated with the latter.

Recently, the sector has attracted new financing mechanisms such as ‘media for equity’ arrangements. This consists of the major audiovisual groups offering FinTech firms advertising time on their television and radio channels in exchange for equity interests. It is a financing method more commonly seen in the UK and Germany but one that is beginning to proliferate in Spain, particularly for FinTech players that have surpassed certain milestones and are looking to build scale by means of mass advertising.

Although the number of financing rounds has not varied significantly from one year to the next, the highest number was recorded in 2017 (62 rounds). The amount raised has been increasing gradually. In 2019, FinTech players raised 192.93 million euros, equivalent to an average of over 4 million euros per round. Those figures evidence the sector’s traction, marked by FinTech companies with more advanced projects and a greater ability to attract private financing to continue to fund their growth. Table 2 also illustrates the concentration of that financing. The percentage of funds garnered by the top 10 rounds of financing has been increasing. In 2019, 90% of the 192.93 million euros raised was captured by the top 10 deals.

The relationship between FinTech firms and the Spanish banking sector

When the FinTech phenomenon began to take off in the wake of the crisis, the relationship between these newcomers and the banking sector was viewed through the prism of direct competition. The advent of new financial service providers in the context of growing financial digitalisation meant that FinTech players and established financial institutions saw each other as natural competitors. However, that perception has shifted over time as banks and Fintech firms have explored the possibilities of collaboration. New terms have been coined to define their relationship, including ‘co-opetition’, a portmanteau of cooperation and competition. The idea is that two competitors come together to collaborate in the hope of attaining mutually beneficial results.

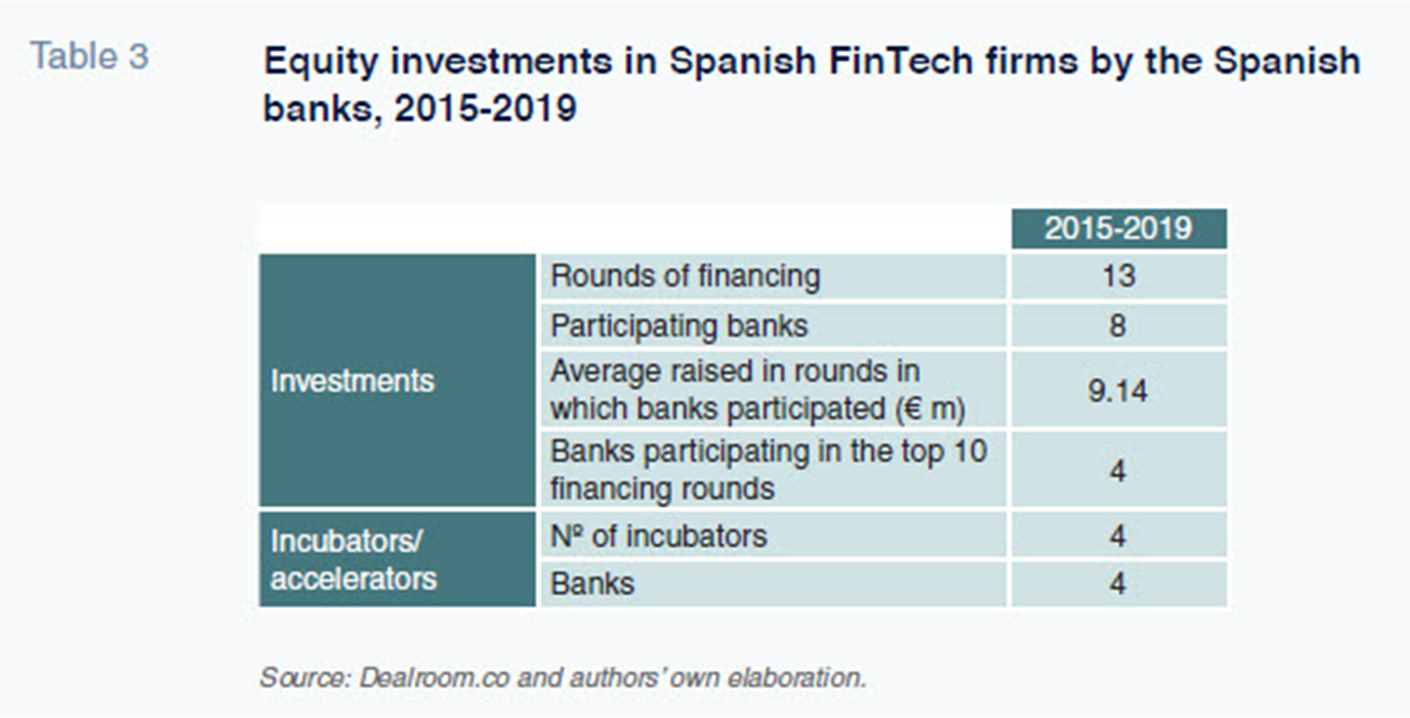

In parallel, the banking sector has learned from FinTech’s innovation thrust. For example, banks have invested in many FinTech firms. Table 3 shows that between 2015 and 2019, 8 financial institutions participated in 13 rounds of financing. That figure remains small by comparison with the total number of rounds during the period (248) but is concentrated during the last two years. This trend echoes the recent shift in the configuration of FinTech-bank relations, with the traditional banks emerging as prominent investors since 2018. Moreover, the money raised in these rounds is above the period average (9.14 million euros). Half of the investor banks participated in the 10 largest financing rounds, mostly at the earlier stages of development.

The Spanish banking sector’s role in the FinTech sector also consists of providing logistics and financial support during the earliest stages of development via incubators or accelerators. These vehicles act as digital innovation hubs in which selected projects are given the opportunity to thrive in a collaborative arrangement with the bank. The aim is to create technological solutions that support emerging business models. At present, there are 4 active FinTech incubator projects spearheaded by Spanish financial institutions. The pioneer incubator was set up in 2016 –it was named “Bankia FinTech by Insomnia” and located in Valencia– and has completed a total of 5 calls for participation, nurturing the development of more than 50 FinTech start-ups.

Conclusion

In this paper, we have analysed developments in the Spanish FinTech sector and its relationship with conventional banks. The main conclusions are:

- The Spanish FinTech ecosystem is currently five times the size it was in 2015. That growth has been accompanied by diversification in the range of financial services offered by these firms. Although still less significant in quantitative terms as compared to the traditional banking sector, it provides the climate for noteworthy innovation and technological development.

- Over half of Spain’s FinTech firms (62.86%) are concentrated in four lines of business: lending, payments, investment and tax/accounting. Moreover, the majority are the result of start-ups, created in Spain’s biggest cities (Madrid, Barcelona and Valencia), with business models targeted at servicing other firms (B2B).

- The Spanish FinTech sector has attracted 422.38 million euros of investment since 2015. An analysis of this financing shows the coexistence of smaller FinTech players at the initial stages of development that have a limited ability to attract private financing and more established firms capable of drawing large sums of money to fund their growth.

- Banks have gradually increased their presence in the FinTech sector, taking direct equity interests in FinTech firms and establishing incubators and accelerators to foster the growth of earlier stage start-ups. Such activity has grown most notably since 2018.

Overall, the FinTech sector has developed considerably in Spain in terms of the number of players and their ability to attract ongoing funding. It is marked by a shift towards models of ‘co-opetition’ with the banking sector, in which the banks and more developed FinTech firms strike collaboration agreements, albeit continuing to compete in certain niche areas.

Santiago Carbó Valverde. CUNEF, Bangor University and Funcas

Pedro Cuadros Solas. CUNEF and Funcas

Francisco Rodríguez Fernández. University of Granada and Funcas