Unit labour costs and the evolution of the Spanish manufacturing industry between 2000 and 2014

Although Spain´s manufacturing sector suffered cost-competitiveness losses throughout the growth phase and early years of the crisis, falling wages during subsequent years may be underpinning the sector´s more recent recovery. At the same time, breaking down performance into export-oriented industry segments and ones that serve the domestic market reveals a need to strengthen the latter.

Abstract: During the economic expansion from 2000 to 2007, the Spanish manufacturing industry’s cost-competitiveness deteriorated as a result of rising unit labour costs (ULCs). However, this only affected industry segments catering to the domestic market, whose prices rose in line with ULCs in order to protect profit margins. The result was a loss of market share to imports, which helps explain the small size of the sector and its limited capacity to respond to rising domestic demand. This has translated into a pattern of economic growth that produces imbalances. Hence, for the Spanish economy to grow in a more balanced and sustainable way, the industrial sector’s share of the economy needs to grow and gain market share against imports in the domestic market, so demand growth can be translated more directly into GDP growth. By contrast, the competitiveness of export-oriented industries, in terms of costs and products, progressed more favourably. Consequently, Spanish exporters’ market share has done well relative to global exports. Falling wages during the crisis years could be driving manufacturing’s recent take-off, although it is still too early for definitive conclusions.

Introduction

One of the characteristic features of Spain’s economic cycle is that when the economy grows, the contribution of the external sector to growth turns negative. This pattern, which is once again manifesting itself in the current recovery, is a consequence of the high elasticity of imports to domestic demand rather than an insufficient export capacity. This elasticity ultimately reflects the inability of Spain’s manufacturing industry to respond to growing domestic demand. As well as slowing growth by diverting domestic demand towards imports, this pattern causes imbalances, such as the balance of payments deficit or foreign debt.

For the economy to grow in a more balanced and sustainable way, the industrial sector’s share of the economy needs to grow (it currently represents 13% of GVA compared to a euro area average of 16%) and it needs to gain market share against imports in the domestic market, so that demand growth can be translated more directly into growth of Spain’s GDP. For this to happen, the sector needs to gain competitiveness and become more attractive as a destination for productive investments.

This article analyses the possible relationship between the loss of cost competitiveness during the years of expansion and the performance of the manufacturing industry during this period. It also looks at the possible effect of falling wages during the crisis on the sector’s growth potential and its role as a motor for growth, and therefore, on the capacity of the Spanish economy to generate more balanced growth.

Evolution of cost competitiveness in the Spanish manufacturing industry from 2000 to 2014

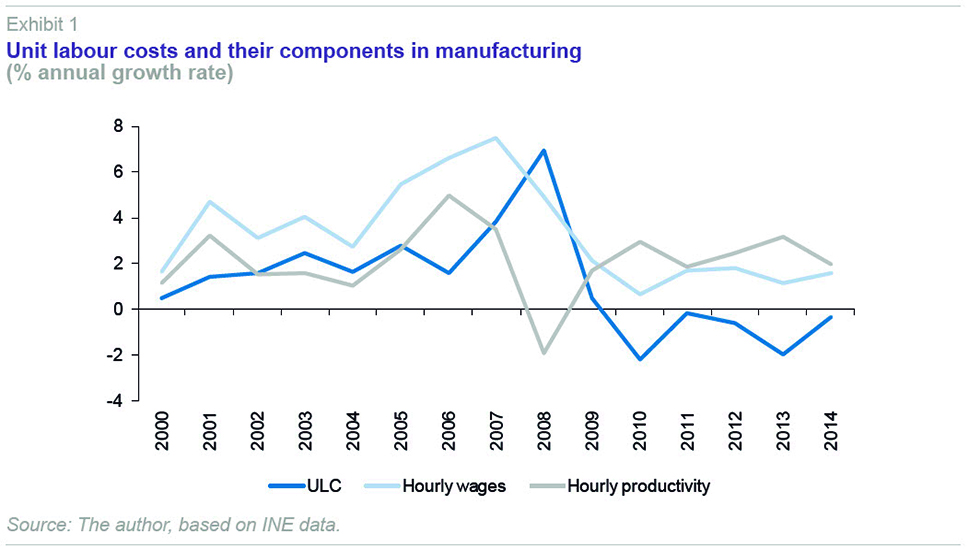

As is well known, unit labour costs (ULCs) are defined as the ratio of total labour costs to real output. Exhibit 1 shows the evolution of the two components of ULCs in the Spanish manufacturing industry between 2000 and 2014. As of 2000, throughout the economic expansion, wage growth outpaced productivity, causing ULCs to rise steadily. Thus, between 2000 and 2007 (the most recent year in which there was growth in industrial activity) the sector’s ULCs rose by 16.2%. Comparing 2000 and 2009, the increment in ULCs was 24.9%, as the upward trend persisted, and even intensified, during the early years of the economic crisis (2008 and 2009).

The pattern changed in 2010, and although wages continued to rise in nominal terms throughout the recession (according to national accounts figures), they grew more slowly than productivity. As a result, between 2010 and 2014 ULCs in the manufacturing industry fell by 5.3%, although they remained higher than in 2007.

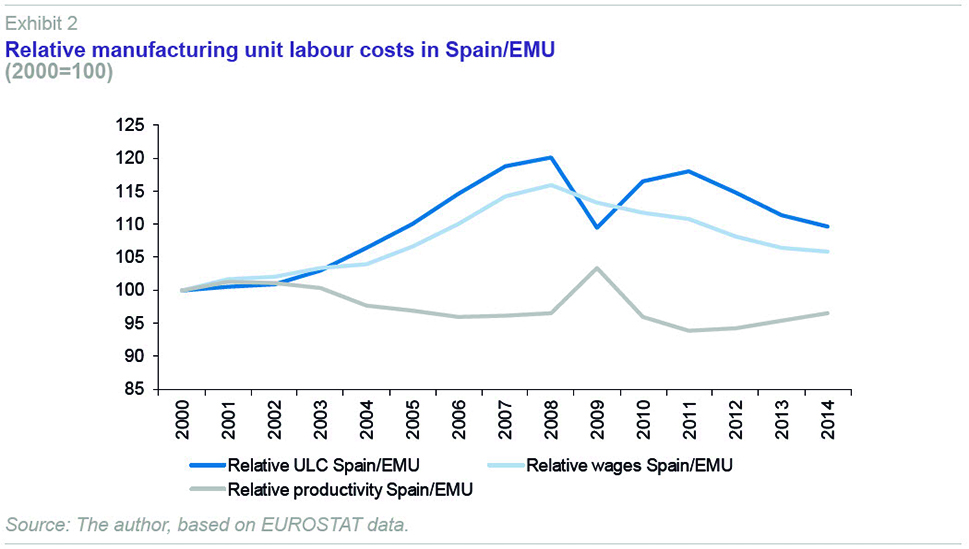

Exhibit 2 compares the evolution of nominal manufacturing ULCs in Spain, and its components, with the euro area average. From 2000 to 2008, Spain’s ULCs grew by 20.2% more than the euro area average, as a result of relative wage growth and declining relative productivity. From 2008 onwards, there was a relative drop in ULCs of 8.7%, basically as a result of the drop in relative wages, enabling almost half of the cost competitiveness lost in the previous phase to be regained.

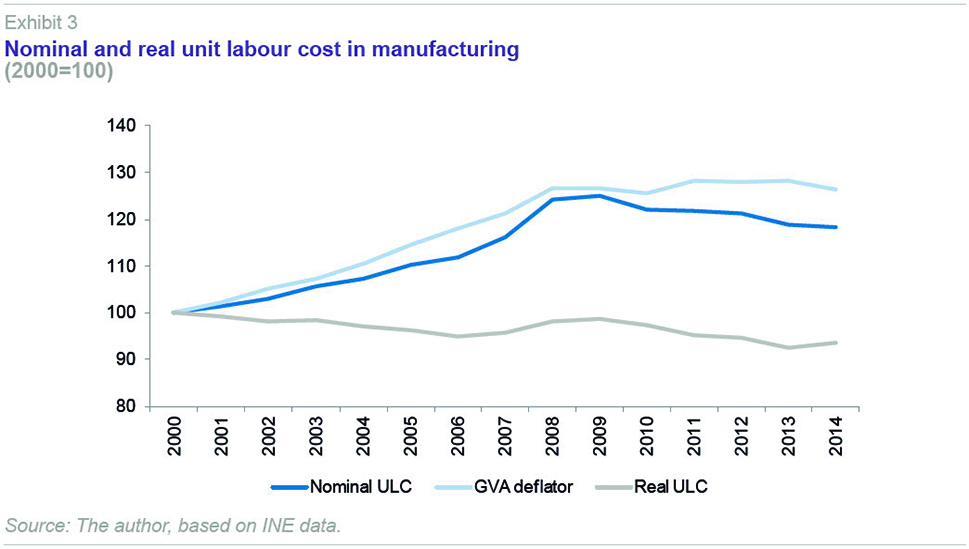

Nevertheless, during the growth phase, the prices charged by the manufacturing industry, measured by the variation in the sectoral GVA deflator, grew even faster than ULCs: 21.3% between 2000 and 2007, compared with the 16.2% growth in ULCs already mentioned (Exhibit 3). In other words, despite strong growth in nominal ULCs, in real terms, ULCs fell during the period, as the prices charged by firms rose faster. This implies that during this period, business’s profit margins rose despite the loss of cost competitiveness relative to the euro area.

However, this overall result masks a significant divergence between export-oriented and domestic -market-oriented manufacturing segments, as export prices rose much less than prices charged in the domestic market, and ULCs evolved very differently in the two sectors.

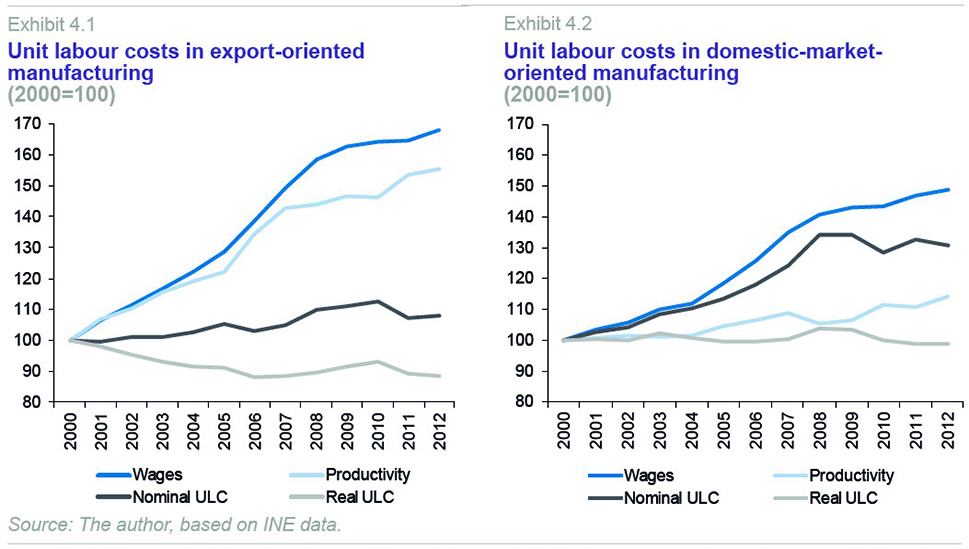

Thus, if we consider export-oriented branches to be those selling more than 40% of their output abroad,

[1] nominal ULCs in this group grew by 4.8% between 2000 and 2007, well below the 24% growth in the domestic-market-oriented sector. This was the result of much more vigorous productivity growth (42.6% compared with 8.7%) and occurred despite faster wage growth (49.4% compared with 34.8%) (Exhibits 4.1 and 4.2).

Comparing nominal ULC growth with prices, in order to analyse the performance of profit margins in each group, the GVA deflator for export-oriented branches grew by 18.3%, well above the 4.8% by which its ULCs grew, while the GVA deflator for the segments oriented towards the domestic market grew by 23.4%, slightly less than nominal ULCs. Thus, profits in the domestic -market-oriented segments did not improve, although they did not worsen significantly either, as ULC growth was virtually the same as the increase in prices charged by firms, whereas profits in exporting industry segments increased markedly. The conclusion remains unchanged even if we use the performance of export prices rather than the GVA deflator as an indicator for export prices.

In the case of domestic-market-oriented segments, the need to raise prices in line with labour costs to maintain profit margins may have undermined their competitiveness relative to imports. Moreover, profit growth in other sectors of the economy not subjected to foreign competition may have made the latter more attractive as a destination for productive investment at the expense of manufacturing. The foregoing would explain the latter’s scant output growth during the period of economic growth. Thus, GVA of the domestic-market-oriented manufacturing sector grew by 16.7% between 2000 and 2007, well below domestic demand growth, which was 34.7%, and also a long way from the growth registered in goods imports, which rose by 59.3%. The Spanish manufacturing industry had suffered a significant loss of market share to imports.

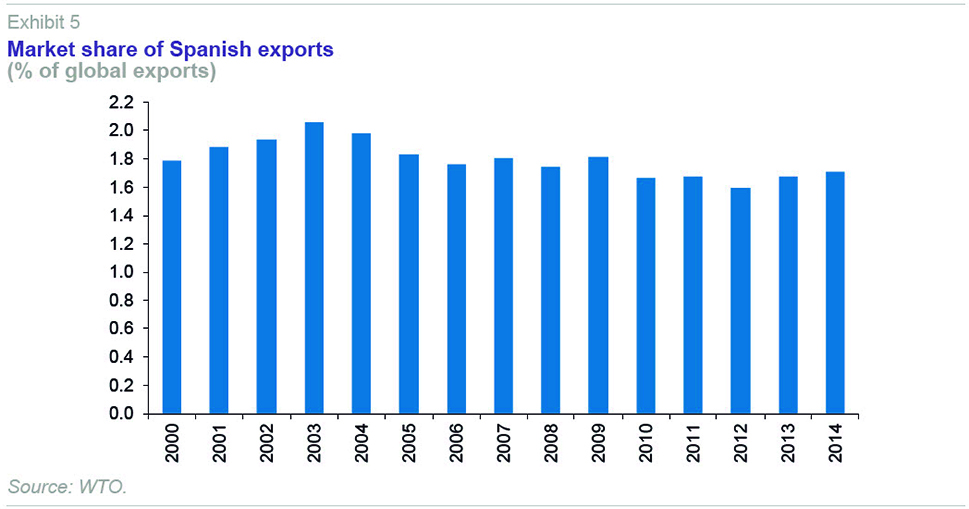

In the case of manufacturing segments oriented towards the foreign market, relative prices of Spanish exports, measured in terms of the export unit value index relative to developed countries, rose by 2% between 2000 and 2007. Thus, bearing in mind the appreciation of the euro over this same period, the loss of cost competitiveness came to almost 9%. Exhibit 5 shows how the share of Spanish exports in the global market grew between 2000 and 2003 from 1.78% to 2.06% (still benefiting from the impact of the devaluations in 1993 and 1994) and then began to decline to a minimum of 1.60% in 2012. This loss of market share was, however, less than that suffered by most developed countries, in a trend often attributed to the strong growth of China’s exports. In other words, although Spain’s prices rose faster than those of its competitors, the market share of its exports outperformed the competition. This may mean that the price increases were justified by Spain’s products being more competitive (quality, technology content, etc. although there may be other factors underlying market share trends, such as the opening up of new markets).

As regards the trends during the recession, as already mentioned, during the first two years of recession (2008 and 2009) ULCs continued to rise, and then underwent a correction. Prices continued to ri

se faster than ULCs, such that ULCs again dropped in real terms (

i.e. operating surplus increased again). As regards the difference between the export-oriented and domestic-market-oriented sectors, data with the necessary level of disaggregation to allow the analysis to be done are only available up until 2012. During this period, the performance of profits in each sector was the inverse of what it had been in the expansion phase: in export-oriented sectors there was no change (the rising prices charged by the sector were almost equal to the increase in ULCs), while in domestic-market-oriented branches they increased, albeit modestly. Thus, in the latter, nominal ULCs rose by 5.3% compared with a growth of the deflator by 7.3%.

This improvement in profits of the manufacturing industry segments oriented towards the domestic market is the sine qua non for the manufacturing industry to recover its attractiveness as a destination for productive investment, and thus increase its size, its market share relative to imports, and its ability to meet rising demand. That is to say, it is a necessary condition for the process of import substitution and structural transformation of the economy to begin.

Are falling wage costs bringing about a structural transformation in the Spanish economy?

It is still too early to know whether the recovery in cost competitiveness in the manufacturing industry is really bringing about this process of reallocation of resources. This is a structural change, and as such, takes a long time. However, recent developments in the sector offer promising signs. Since the Spanish economy began to recover in the third quarter of 2013, up until the second quarter of 2015, the manufacturing industry has led growth. Its GVA has risen by 6.3%, compared with GDP growth of 4.4%, something which had never happened during the 2000-2007 expansion. Moreover, this output growth was possible with growth in final demand over the period of 6.2%. Goods imports over the same period rose by 11.3%, which is still faster than the sector’s output, but the ratio between the growth of the two variables has dropped considerably since the previous phase. At the same time, the second quarter of 2015 was the sixth consecutive quarter in which the number of full-time equivalent jobs grew in this sector. Since 2000, there has not been such a long period of employment growth in manufacturing.

Obviously, this positive performance by the manufacturing industry since the start of the recovery may be deceptive, as it may just be a return to normal in the wake of the sharp fall suffered during the recession. Only time will tell if we are at the start of a process of structural transformation towards a more balanced and sustainable growth model.

Concluding remarks

During the economic expansion from 2000 to 2007, the Spanish manufacturing industry lost cost competitiveness relative to the euro area due to faster growth in domestic ULCs. Nevertheless, the prices charged by the sector rose faster than ULCs, which meant that profits rose. Additionally, the market share of Spain’s exports held up better than those of other developed countries.

These apparent inconsistencies are a result of the difference in how the export-oriented and domestic-market-oriented branches of industry behaved. Export-oriented industry performed well during the economic expansion, with strong productivity gains that allowed wages to rise faster than in domestic-market-oriented branches with almost no effect on ULCs. Firms were also able to raise prices faster than their competitors, boosting profits, without this having an adverse impact on relative market share. This suggests that their products must have also become more competitive.

By contrast, manufacturing industry segments oriented towards the domestic market saw modest productivity growth, which, in conjunction with wage rises, led to a significant increase in ULCs. This was passed on to final prices, thus maintaining profits. However, the fact that the sector’s output growth consistently fell short of growth in both domestic demand and imports suggests that domestic manufacturers very likely lost market share to imports in the domestic market.

As of 2010 there was an adjustment in wages in the industry segments oriented towards the domestic market, which in conjunction with rising prices made it possible for them to boost profits, therefore making them better able to attract investments. This could explain the sector’s strong performance since the start of the economic recovery. The so-called “internal devaluation” could have begun to have a positive effect on the sector’s growth capacity and its role as a motor of economic growth, the sine qua non for reducing Spain’s high level of elasticity of imports to domestic demand growth, and therefore for generating a more balanced and sustainable growth model. Nevertheless, although the signs are positive, it is still too early to draw definitive conclusions.

Note

The textile industry, apparel manufacturing, leather and footwear; coking and petroleum refining; chemical industry; pharmaceutical products; computer, electronics and optical products, electrical equipment and materials; machinery and equipment n.e.c.; motor vehicles and other transport equipment.

María Jesús Fernández Sánchez. Economic Trends and Statistics Department, Funcas