The new SME finance landscape: The rise of alternatives to bank lending

SME access to multiple and stable sources of finance has become essential for fostering growth and investment in Europe after the crisis. To this end, one of the overriding objectives of the European Commission´s recently published Action Plan on Building a Capital Markets Union (CMU)

[1] is to boost the benefits for the economy from increased reliance on capital markets and non-financial intermediaries.

Abstract: Spanish SMEs have faced extreme difficulties in accessing bank finance as a result of the severe credit crunch and large-scale financial sector restructuring and recapitalisation. This has fuelled the – largely spontaneous – development of numerous alternatives to the banking channel, which are already well established in other economies, such as the US, and readily accessible to larger companies. Alternatives include equity financing options, such as crowdfunding or venture capital for smaller firms, as well as alternative exchanges and private-equity for larger-scale entities. On the debt side, non-bank financing alternatives include debt crowdfunding platforms for smaller firms, together with fixed-income exchanges, such as MARF for medium-sized companies.These alternatives have encountered strong institutional support. At the same time, complementary initiatives, related to securitization and the covered bond market, have been undertaken at the EU level to ensure continued liquidity of funding instruments for banks themselves. In parallel, new macroprudential measures have been introduced in order to help create a healthier, less indebted and more stable financial system.

Foreword

Traditionally, European companies have relied on banks for their financing. Alternatives such as capital markets and direct investor financing have been less successful options for facilitating credit flows against the backdrop of an efficient financial system and abundant liquidity. In tandem, average company size, with the European economy dominated by SMEs, has posed an additional barrier in terms of access to financing alternatives.

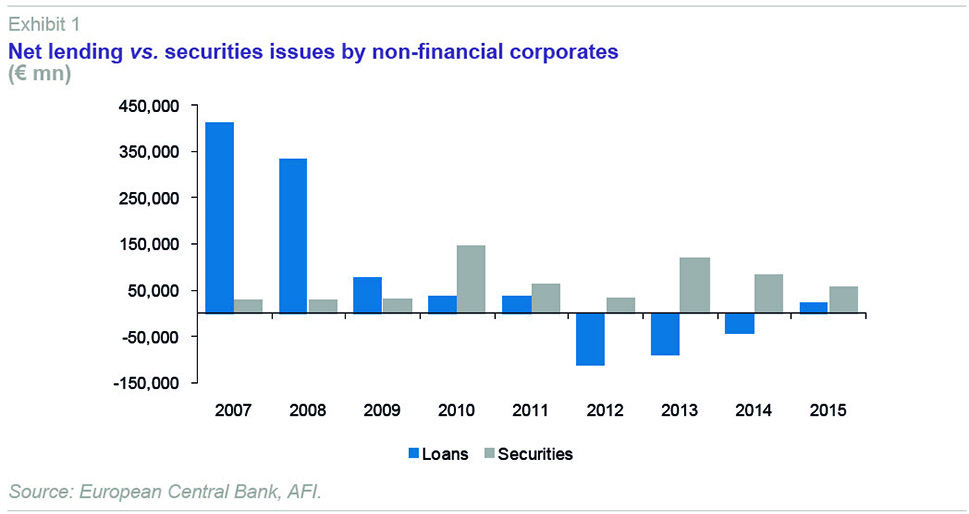

With the onset of the crisis in Europe, part of this financing paradigm was called into question and alternative financing targeting different company segments began to attract more attention. This article analyses the role of these financing alternatives in the context of the recovery underway in corporate bank lending.

Diversity of non-bank financing sources in Europe

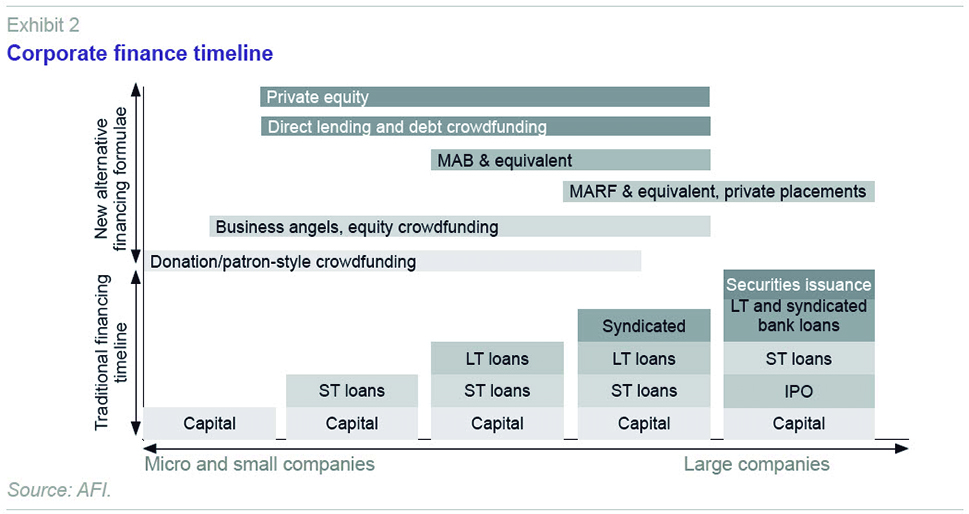

A company’s financing cycle usually begins with the equity injected by the business owner him or herself and the financial support provided by relatives and other close contacts. Later, companies tend to resort to bank financing, typically short-term paper, and, later still, long-term loans to finance their investments. When the scale of a company’s debt reaches a certain magnitude, other bank instruments, such as syndicated loans, come into play. Lastly, when a company reaches maturity and builds sufficient scale, a new phase of corporate finance begins, marked by the ability to issue shares or bonds in capital markets.

However, new forms of financial intermediation have begun to develop since the recent crisis in Europe, meeting companies’ and investors’ needs alike. These forms of financial intermediation, which fall under the so-called ‘alternative’ category insofar as they represent an alternative to traditional bank financing (even though many are ultimately dependent on banks), bring the investor base into earlier stages of business development, in turn boosting these businesses’ growth potential.

Alternative financing is not so different from bank financing. Direct investors obtain funds in a similar way to how the banks take in deposits; they assume the borrowers’ credit risk; they play with maturity structuring; and they leverage themselves to finance their investments in assets. However, their development leads to risk diversification by diminishing the financial system’s exposure to the real economy and, vice versa, reducing corporate dependence on the banking system.

Alternative sources of financing may take the form of debt or equity and cover a range of financing needs for different types of businesses. They bring additional benefits for the company, such as greater visibility, financial and management acumen and enhanced corporate governance and transparency practices.

Equity financing

Options designed to strengthen companies’ capital position include, notably, private equity and other early-stage sources of equity (such as business angels and equity crowdfunding), on the one hand, and the issuance of shares on official or alternative stock markets, at the other end of the spectrum.

Private equity is an important source of financing, particularly for smaller-scale companies and riskier or more innovation-based projects without ready access to capital markets or bank financing. In turn, there are several categories of private equity:

- Venture capital: private equity targeted at enterprising, early-stage companies with high growth potential (often related to technological innovation).

- Enterprise capital: private equity targeted at more established and consolidated companies in order to fund international expansion or value creation strategies.

- Buyouts: injection of private equity in order to acquire the targets outright.

Despite growth in recent years, private equity remains less developed in Europe than in the US. According to the European Private Equity and Venture Capital Association (EVCA), private equity investment in European companies rose by 14% in 2014 to 41.5 billion euros, with a total of 5,500 companies receiving equity, roughly 80% of which fall into the SME category. By comparison, private equity in the US amounted to around 150 billion euros.

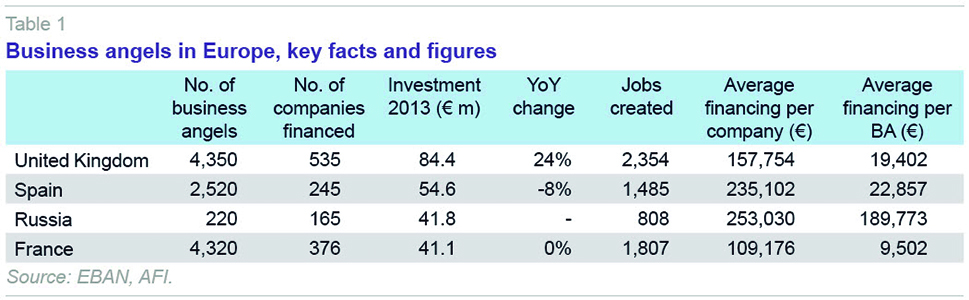

Meanwhile, the money injected by business angels and via equity crowdfunding surpassed 5.5 billion euros in 2013 (the last year for which data are available). The UK is the leader in this segment, followed by Spain, Russia and France.

Share placements are the other key – and undoubtedly the most important – source of corporate equity financing. Capital market equity raised by non-financial corporates is relatively small. According to European Commission (EC) figures, of Europe’s 23 million SMEs, just 11,000 or so are listed on an official stock exchange or a multilateral trading facility (such as Spain’s alternative stock market, the MAB).

There are many cultural factors behind European companies’ relatively greater aversion to having third parties among their shareholders, particularly on the part of family-run companies, and to pursuing a stock-market listing, usually associated with stringent reporting and disclosure obligations.

Other aspects, such as the costs of issuing shares and preparing the required listing documentation, company size and the creation of dedicated internal relations departments have also impeded greater consolidation of this form of financing in the past. However, the advent of organised trading facilities has proven a game-changer by proving effective at facilitating capital market access for smaller cap companies.

In Spain, we have the example of the MAB, the Spanish acronym for the alternative stock exchange, which was set up by Bolsas y Mercados Españoles (BME) in 2009. Since then, it has enabled growth companies to raise 392 million euros in equity financing. In 2015, this exchange’s average trading volume was 48.35 million euros.

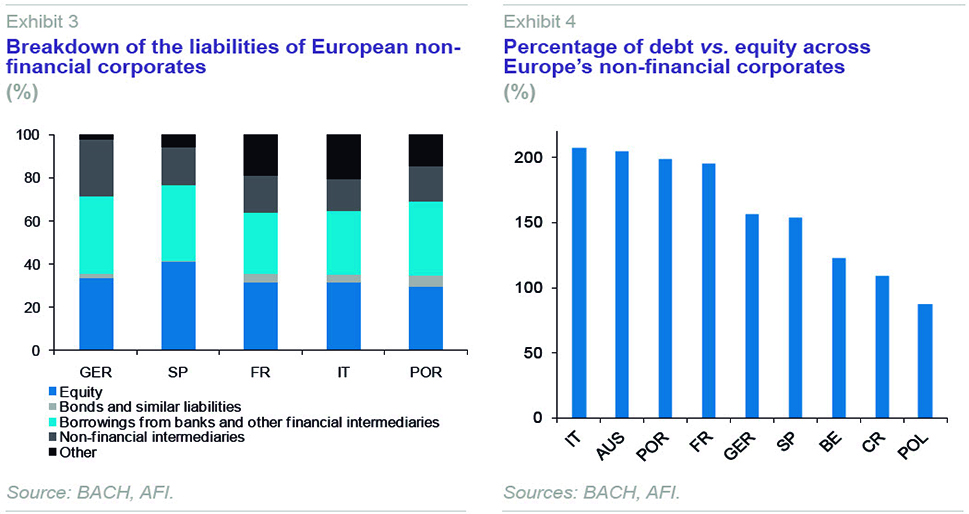

Lastly, in terms of the equity versus debt dichotomy, the asymmetric tax treatment of this source of financing, favouring debt, has and continues to play a significant role in most companies’ preference for debt and, in the case of European issuers, bank debt. However, as evidenced during the recent crisis, higher leverage weakens the corporate landscape and increases exposure to the economic cycle.

Debt financing

As for the debt-based financing alternatives, two major categories are worth highlighting: (i) direct lending and debt crowdfunding for smaller-sized companies; and (ii) access to alternative corporate debt platforms (such as Spain’s MARF) and official fixed-income exchanges for medium-sized companies.

Direct lending is usually targeted at companies with insufficient creditworthiness to tap bank financing (e.g., due to high leverage or issues related to the economic cycle), which are therefore willing to offer investors a higher return.

Private placements are one such form of direct lending. Private placements offer an alternative to public placements and syndicated loans. For these placements, qualified investors are contacted individually or in small groups to determine their investment appetite.

The largest private placement market is that of the US, where the annual issuance size is nearly 40 billion dollars. Europe’s private placement markets are far more fragmented. However, there is an industry initiative,

[2] which has the EC’s backing, as enshrined in its CMU Action Plan, to develop a pan-European private placement market. In total, this market is estimated to provide Europe’s companies with around 15 billion euros of financing.

The key advantages of a private placement include issue size and longer maturities (sometimes in excess of 10 years). Moreover, the fact that the placements are private means there are no disclosure, registration or approval requirements.

Lastly, in terms of the debt markets, as has been the case on the equity side of the equation, capital markets have traditionally been reserved to large-scale companies with sufficient financing needs to cover the markets’ benchmark issue size. However, the recent development of alternative corporate debt markets is enabling more medium-sized companies to tap capital markets. This is the case of Spain’s MARF, the acronym in Spanish for the alternative fixed-income exchange, created at the end of 2013 in line with the trend in other European markets, such as Nordic ABM in Norway, BondM in Germany, Alternext in France and the Netherlands and Extramot in Italy.

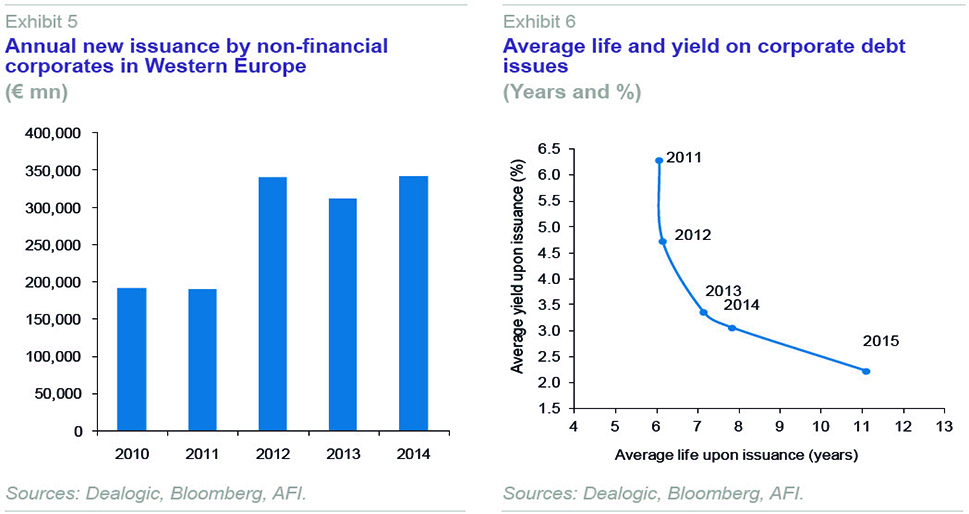

In the current low interest rate environment, a growing number of European non-financial corporates have placed bonds publicly: in 2014, issuance volumes approached 350 billion euros, which was nearly twice the level of 2008. Among these figures, it is worth highlighting the significance of alternative exchange issues by first-time issuers, both large and medium-sized.

In addition to the interest rate environment, bond issues generally offer issuers greater flexibility relative to the covenants assumed in exchange for bank loans, can be longer-dated and are often articulated as a single bullet repayment at maturity. Given that these issues are public, the use of proceeds, which can vary hugely, must be disclosed to investors and the broader market.

The alternative corporate debt markets offer issuers a broad range of financing opportunities due to the scope for tailoring their structures in terms of maturities, repayment regimes, collateral and covenants.

Alternative corporate debt markets are classified as unregulated exchanges although they are managed by official exchanges. MARF, for example, is managed by BME. They are organized as multilateral trading facilities (MTFs), which makes them more flexible by allowing them to tailor their rules and procedures for their issuers.

MARF alone has facilitated 22 issues by 17 issuers, enabling these issuers to raise 1.6 billion euros at an average rate of 5.6% and at maturities ranging from 5 to 25.5 years.

Lastly, as we have already mentioned, one of the biggest advantages afforded by these facilities is the access provided to more medium-sized companies with a wide range of financing needs. MARF issuers, for example, are extremely diverse: their size ranges from 32 to 765 million euros by assets and from 17 to 38 million euros by revenue.

However, the final success of MARF and the rest of alternative corporate markets will depend on the depth and liquidity of the market. Low liquidity may affect bond prices, reducing the attractiveness of this financing alternative both for companies, which will continue to depend on bank funding, and for investors, which will face higher volatility and “buy and hold” investments. Moreover, homogeneity and transparency of corporate information will become fundamental for overcoming barriers related to the smaller size of companies and issuances.

Bank financing

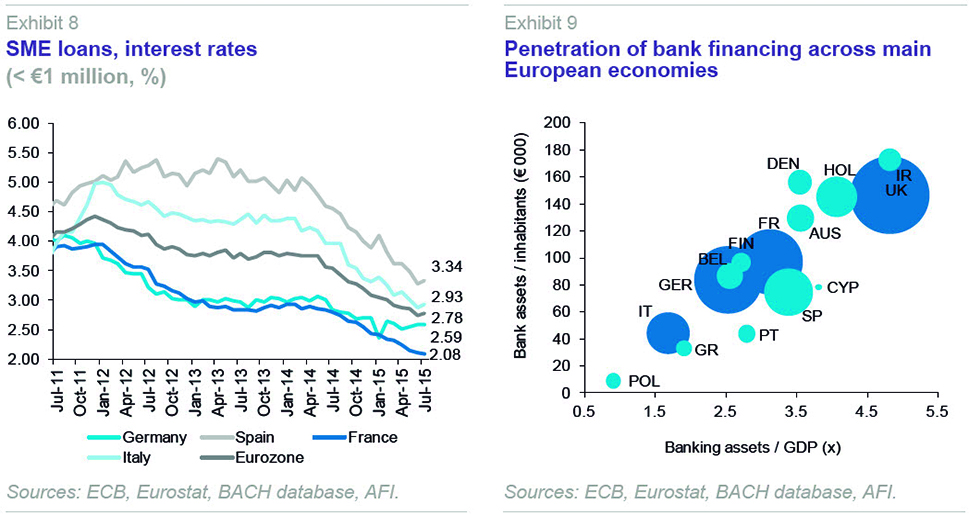

As already mentioned, Europe relies heavily on bank financing. Measured in terms of GDP, banking assets represent around 300% of GDP in the EU compared to a figure of around 60% in the US. In Europe, bank debt represents around 30% of total SME liabilities, compared to less than 10% stateside.

Following the capacity adjustment, together with balance sheet clean-up and recapitalization efforts made by banks after the crisis, corporate lending volumes have been recovering since the end of 2013, during which time they have also been becoming more flexible (in terms of maturities and rates).

However, even though most SMEs can currently access bank financing, the new challenges faced by the sector, coupled with the threat of future financial shocks, mean that it is important not to lose momentum in terms of the trend toward diversification. In this manner, if such shocks were to recur, Europe’s corporates would boast more solid capital structures and have access to financing alternatives so that their businesses would not be as affected.

Here it is worth noting that the recovery in new loans has been propped up by the liquidity injected by the extraordinary measures taken by the European Central Bank (ECB) precisely to this end.

According to the Bank of Spain’s bank lending survey, most European and Spanish banks participated in the ECB’s targeted long-term refinancing operations (TLTRO) in the first quarter of 2015 with the aim of using the funds obtained mainly for the purpose of granting corporate loans and also refinancing other liquidity facilities extended by the Eurosystem.

There is no assurance that these stimuli will not be withdrawn – we must not forget that they are extraordinary in nature and not permanent – or that the requirements imposed under new macroprudential regulations will not affect the flow of credit in the medium term. Indeed, the banking sector’s return on equity (RoE) has fallen drastically in recent years due to more stringent capital requirements (in Spain, from 12.1% to 5.3% over six years). This could make credit more expensive, as could the trend in interest rates and the banks’ ability to tap the wholesale funding markets.

Note that a potential increase in the cost of credit would affect the smallest companies (micro-SMEs) disproportionately. These companies, which account for roughly 90% of all companies in both Spain and Europe, face greater barriers to accessing alternative financing and will inevitably continue to need bank financing to fund their businesses.

In addition to facilitating corporate access to the capital markets, it is vital to ensure the continued liquidity of the funding instruments used by the banks themselves, especially those related to the wholesale funding markets, while also fostering the use of SME collateral, all with a view to channelling fresh credit to companies.

Factoring in these considerations, the European Commission, in addition to the Capital Market Union Action Plan, has just published complementary initiatives related to securitisation (a package of two legislative proposals) and to covered bonds (a consultation paper).

Securitisation enables banks to use capital markets to fund their portfolios (usually home mortgages and consumer and SME loans). However, since the crisis began, securitisations have fallen dramatically and remain low. The idea behind the two new legislative proposals presented by the European Commission is the creation of a ‘high-quality’ securitisation market (criteria for simple, transparent and standardised securitisations) to make this instrument once again be perceived as reliable and to enhance the capital treatment of securitisations in order to stimulate their use.

Elsewhere, the EC is looking to reduce fragmentation and inefficiency in the covered bond market. The existence of dual recourse to the issuer in the case of covered bonds rendered this instrument a stable source of funding during the crisis, to which end the EC wants to open up new possibilities, including the use of new collateral, such as SME loans.

Conclusions

Rather than viewing bank financing and alternative sources of financing as in competition against each other, what is becoming increasingly clear is how complementary both types of financing are to each other.

Banks will continue to play a crucial role in fulfilling a significant portion of credit demand, in particular for the smallest companies. Consequently, it is important to ensure that they have ongoing access to stable and long-term funding tools in an effort to prevent, to the extent possible, a repeat of the dysfunctions observed during the recent crisis.

In addition, it is necessary to make companies more aware of the importance of equity financing and the advantages in terms of growth and value creation of bringing in third-party equity investors who can offer liquidity in exchange for shares. There are a host of equity financing options, which are accessible to smaller, rapidly-growing companies (equity crowdfunding and venture capital), as well as to larger-scale, high-potential companies (alternative exchanges and later-stage private equity).

Finally, on the debt front, companies need to understand that there are different providers of funds in the market and that it is important to diversify their sources of financing in order to reduce excessive dependence on any one source and to optimise their debt structures. Although bank lending will continue to represent the major debt funding source for companies, exchanges such as MARF are creating an opportunity for medium-sized companies to access the capital markets by issuing debt securities and obtaining rewards, such as longer-term financing, visibility and recognition in the process.

Many obstacles remain as regards changing the mentality of SMEs towards alternative financing. Moreover, the size of European SMEs remains the main barrier for companies to attract equity and non-bank debt, while at the same time is the main motivation for a change in their funding model, with the objective of securing higher and more stable economic growth. In this regard, the progress and achievements of the European Capital Markets Union project will be crucial.

Notes

Action Plan on Building a Capital Markets Union, COM(2015) 468, Communication released on September 30th, 2015.

ICMA Pan European Private Placement Working Group.

Irene Peña. A.F.I. - Analistas Financieros Internacionales, S.A.