The Spanish economy:

Scenarios for 2018-2020

The correction of a number of key macroeconomic imbalances in the wake of the crisis has strengthened the country’s ability to withstand potential shocks over the medium-term; thus, a recession would be averted even in the most adverse scenario considered in this paper. Nonetheless, the still high level of public debt combined with pervasive job precariousness remain key medium-term vulnerabilities that need to be addressed.

Abstract: The Spanish economy’s current growth cycle is the most balanced in recent economic history. In the past, growth had been accompanied by external imbalances, relatively high inflation and an erosion of competitiveness that ultimately triggered fresh recessions. Evidence suggests, however, that today’s Spanish economy is significantly better positioned to withstand external shocks. From the formulation of four scenarios for the period 2018-2020, we conclude that in all of them, the Spanish economy would continue to grow until 2020 and even under the most adverse scenario, would not fall into a prolonged recession. In the central scenario, activity would approach its noninflationary potential by the end of 2020 and the unemployment rate would drop to around 10%. Some Autonomous Regions (Balearic Islands, Basque Country and Navarre) would be close to full employment. This increased resilience of the Spanish economy is due to a combination of factors, including: i) the improved financial position of non-financial enterprises; ii) a healthier post-crisis financial sector; and, iii) the country’s favourable competitive position. Nevertheless, in all scenarios, public debt and unemployment remain the main medium-term challenges, highlighting the need for additional reform.

Introduction

In recent years, the Spanish economy, in addition to growing at levels in excess of 3%, has managed to maintain a substantial trade surplus and kept inflation in check, contributing to the relatively favourable competitive positioning of its enterprises. As a result, the current growth cycle is the most balanced in recent economic history. In the past, growth had been accompanied by external imbalances, relatively high inflation and an erosion of competitiveness that ultimately triggered fresh recessions.

The main purpose of this paper is to analyse the robustness of the current growth cycle in response to potential macroeconomic shocks, whether positive or negative. The ability to extend balanced growth would also help to absorb the legacy of unemployment and indebtedness left by the crisis.

Lastly, this analysis is conducted in the context of the stress tests initiated by the European Banking Authority (EBA) and changes in European accounting regulations – particularly the entry into force in 2018 of IFRS 9 – which make it necessary to model risk scenarios to evaluate the financial sector’s and broader economy’s ability to withstand potential shocks

[1].

Key assumptions

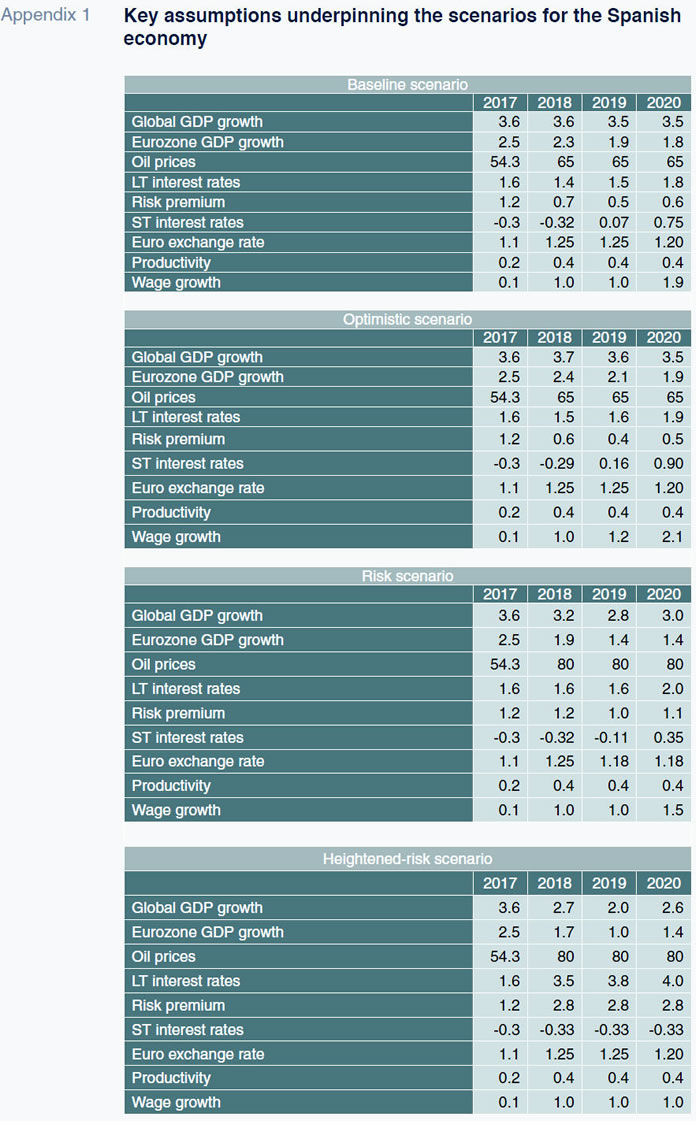

To evaluate the strength of the current growth cycle, we analysed four scenarios for 2018-2020, a period of time that lends itself to forecasting with a reasonable degree of confidence. What differentiates these scenarios from each other are the assumptions made regarding the external environment and the home market context (Appendix 1). The scenarios thus contain different assumptions regarding global growth, interest rates, oil prices and the situation in Catalonia.

In the baseline scenario, the favourable international environment is assumed to continue until 2020 both within and beyond the eurozone. Oil prices are modelled close to the average observed in recent weeks. Benchmark interest rates are assumed to start to rise from the end of 2018, albeit with a limited impact on the 10-year yield on Spanish sovereign bonds thanks to a slight reduction in the risk premium, driven by stronger investor confidence. The euro exchange rate is expected to remain stable at current levels (1.25 dollars per euro), easing somewhat in 2020 towards its equilibrium level, estimated at 1.20 dollars. The situation in Catalonia is assumed to normalise gradually so that the impact on growth in Spain as a whole will be 0.3pp, mainly via consumption and tourism, in keeping with the figures observed in recent months.

This scenario assumes continuity of prevailing macroeconomic policy (gradual normalisation of ECB policy and compliance with fiscal deficit targets), which is considered fairly probable. The formation of a broad coalition in Germany lends greater credibility to the monetary policy assumptions. Elsewhere, some of the global risks (bursting of the credit bubble in China, protectionism, protracted recession in Brazil and other emerging markets) and Europe-specific risks (economic situation in the eurozone) have dissipated. However, uncertainty regarding Brexit lingers and there is new concern in the wake of the Trump administration’s fiscal policy decisions and their more than probable impact on the deficit and inflation and the reaction by the Federal Reserve. Overall, the probability assigned to this scenario materialising is 60 to 70%.

For the

optimistic scenario, we used the average growth forecast of the five most upbeat analysts (oil prices and the euro exchange rate assumptions are unchanged from the baseline scenario however)

[2]. Moreover, the tension in Catalonia is expected to dissipate rapidly in this scenario, cancelling out the 0.3pp erosion modelled in the baseline scenario. This would in turn lead to a ratings upgrade for Spanish sovereign debt.

The probability that this scenario will materialise is lower than for the baseline scenario. Some countries such as Germany, the US and Japan are nearing full employment, which may impede faster growth. On the other hand, digital transformation could drive productivity gains not witnessed to date. On the domestic front, it would seem improbable that the tension in Catalonia will disappear altogether in the absence of reforms to address the regional financing regime and institutional fit, areas of complexity that will take time to resolve. Bearing in mind the various parameters, this scenario’s probability of occurrence is estimated at between 15% and 25%.

The risk scenario is based on a less favourable international climate. Accordingly, it uses the average global growth forecast of the five most pessimistic analysts as well as assuming oil prices of $80 per barrel, closer to the upper end of the range in the futures market. The euro is assumed to be weaker in 2019 and 2020 than in the baseline scenario assuming that the less benign global economic situation would drive investors to seek refuge in the dollar. This scenario assumes that the tension in Catalonia continues, aff investment in the region (in addition to the impact on consumption and tourism modelled in the baseline scenario). Investment in Catalonia accounts for 16.5% of the national total. Extrapolating the growth in this variable in the first three quarters of 2017 points to estimated growth of 4.5% in 2017, which means that Catalonia contributed 0.7 points of growth in investment in Spain. Therefore, if we assume for our risk scenario that growth in investment contracts by half, Catalonia would contribute 0.35 points less to growth in nationwide investment relative to the baseline scenario.

This scenario cannot be ruled out in light of uncertainty regarding macroeconomic policy in the US and the rollback by the developed world’s central banks of their ultra-lax monetary policies. Elsewhere, geopolitical tensions could drive oil prices higher. On the home front, the biggest risk is that of the chronification of the Catalan conflict and prolonged paralysis of the reform thrust. Overall, the probability assigned to this scenario materialising is 10% to 15%. The low likelihood of a slowdown in global growth coinciding with a sudden increase in oil prices is what makes the probability of occurrence of this scenario lower.

Lastly, we modelled a heightened-risk scenario, which combines an increase in oil prices similar to that of the last scenario and a financial shock similar to that underpinning the EBA’s macroeconomic projections. It assumes an increase in financial uncertainty in the US, triggering a flight to safety.

The EBA’s projections are based on a hypothetical increase in US Treasury yields that would weigh on yields in Europe. In Spain, the impact would be an increase in the risk premium compared to the baseline scenario. However, the EBA’s report does not explain how it calibrates the shock or the reaction in the European markets. In this respect, the scenario modelled by Funcas is more specific, as it assumes a shock of a similar magnitude to that of 2011. That year, financial turbulence choked off credit and drove the risk premium to 278 points (which is more than double the level modelled by the EBA). In addition, in a context of high volatility, the European economy saw its growth rate contract by 0.6pp, with the international economy contracting by 1.2pp. The pessimistic Funcas scenario combines this dual interest rate and international trade shock, calibrated in proportion to that of 2011.

The lessons learned from the crisis, coupled with the current dynamism in the global economy, make this scenario highly improbable. It is assigned a probability of occurrence of 0% to 5%.

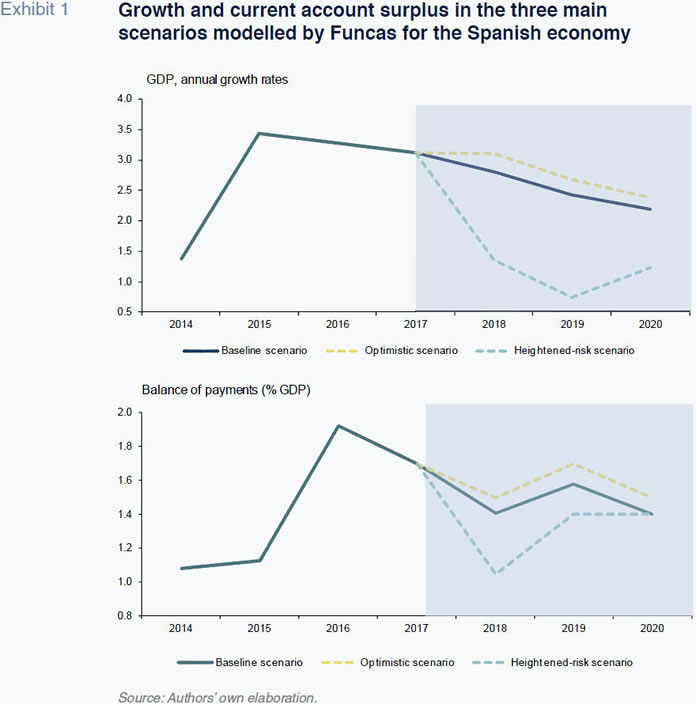

The resultsExhibit 1 illustrates the key results of the simulations. In all instances, even the heightened-risk scenario, the Spanish economy would continue to grow until 2020. Furthermore, this growth would not prompt an imbalance in the external accounts

– the key factor unleashing prior recessions

– or an unsustainable uptick in inflation.

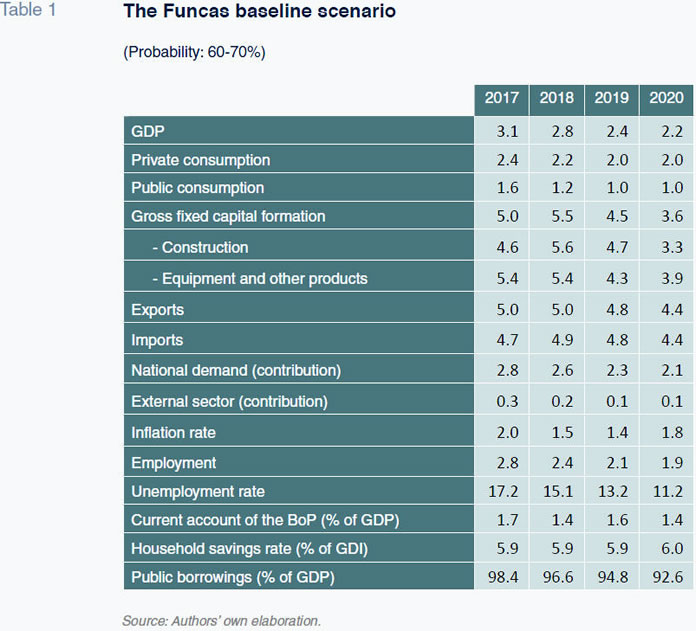

The

baseline scenario foreshadows a gradual slowdown in the Spanish economy (Table 1)

[3].

Private consumption would slow as the demand pent up during the middle years of the crisis is satisfied. So, as the rebound effect peters out, private spending would revert to growing in line with household income, putting an end to the outperformance of recent years. The household savings rate would remain constant at close to its equilibrium rate, estimated at 6% of disposable income. Investment would remain dynamic, albeit possibly easing in the wake of monetary policy normalisation from 2019. Even though the external sector would continue to make a positive contribution, this would decline somewhat relative to the early phase of recovery as imports regain their historical elasticity. Elsewhere, the separatist movement in Catalonia would undermine overall Spanish growth by 0.3pp in 2018, with this adverse impact narrowing over the rest of the projection period.

In contrast to prior episodes of growth, this phase of growth would be sustainable, marked by a solid surplus in the external accounts and core inflation of under 2%, in line with the eurozone average. Although public borrowings would remain one of the Spanish economy’s key challenges, leverage would trend lower.

By the end of 2020, growth would be nearing its non-inflationary potential while unemployment would have fallen to close to 10%. Some regions (Balearics, Basque region and Navarre) would enjoy near full employment which could facilitate real wage growth in keeping with productivity. However, in the absence of reforms, the quality of jobs would remain suboptimal.

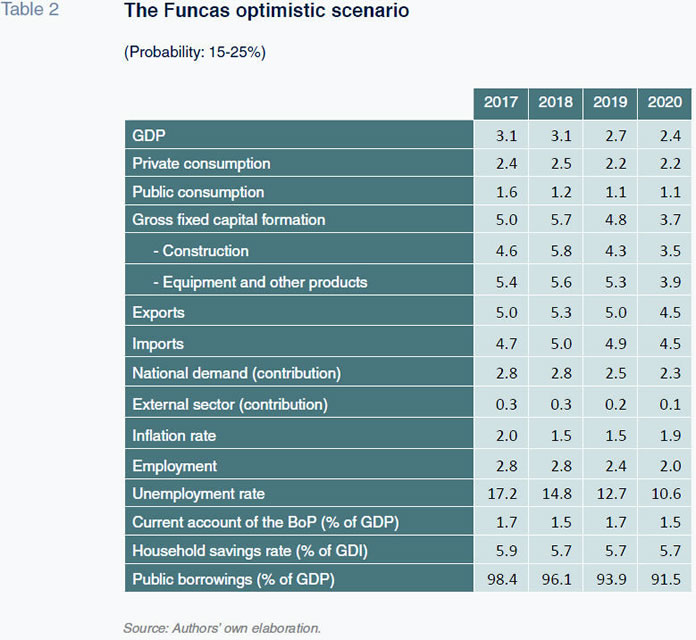

In the

optimistic scenario, the strong pace of global growth, coupled with rapid normalisation in Catalonia, would translate into an even more gradual slowdown than observed in the baseline scenario (Table 2). All imbalances (unemployment, public debt) would come down faster than in the baseline scenario, but without exerting pressure on the balance of payments or inflation.

The surplus in the current account of the balance of payments would be slightly higher than in the baseline scenario, owing to the larger external contribution to growth arising from the optimistic assumptions regarding world trade. The stronger trade surplus would be only partly offset by the increased interest payments arising from higher interest rates. Inflation, meanwhile, would only be slightly higher in the optimistic scenario. The sharp increase in competition worldwide as a result of the globalisation of the economy has driven a structural reduction in inflation in the developed economies that is also evident in Spain. This structural phenomenon is expected to last, so that the elimination of idle productive capacity is not expected to exert the same pressure on prices as in the past.

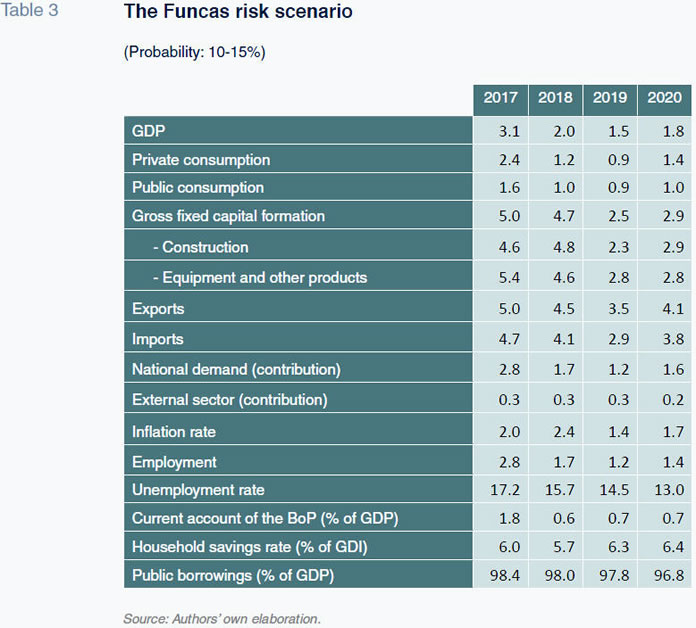

The Spanish economy would slow substantially were the

risk scenario to materialise (Table 3). The lower rate of global growth would affect its growth prospects. The impact would be higher than in prior cycles due to the greater weight of the export sector. Meanwhile, the spike in oil prices would impair the outlook for inflation and the trade balance. Lastly,

chronification of the Catalan conflict would exert upward pressure on the risk premium.

More specifically, the impact of higher oil prices on inflation would take place in 2018, which is the year in which the shock is assumed to take place. In subsequent years, oil prices are modelled flat in accordance with the scenario estimates, so that energy inflation would be nil, pushing the headline rate lower. The reduced rate of growth and attendant lower capacity utilisation rate would translate into slightly lower rates of inflation compared to the baseline scenario in 2019 and 2020. Higher oil prices would erode the current account surplus relative to the baseline scenario but not to the point of pushing it into deficit.

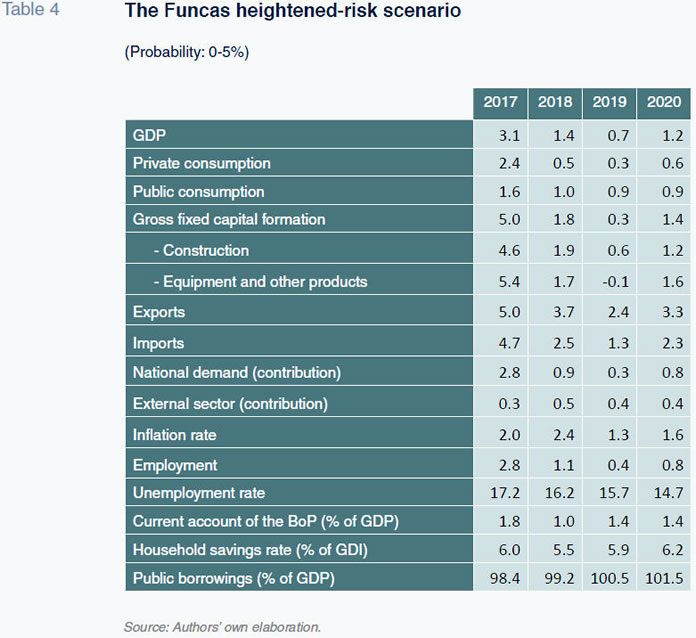

Lastly, in the

heightened risk scenario, growth would collapse on the back of the credit crunch and spike in interest rates. However, unlike what happened in 2011-2012, the economy would not enter recession (Table 4). Note that these projections are less adverse than the EBA estimates, which call for negative growth of 0.3%, 1.5% and 1.1% in 2018, 2019 and 2020, respectively.

This difference is attributable to the starting point, which is relatively favourable compared to the situation before the last crisis, circumstances the EBA projections fail to fully factor in:

- Companies are in a better financial position, with more elbow room for absorbing interest rate shocks. Between 2010 and 2017, Spain’s non-financial corporates have deleveraged by over 310 billion euros. This deleveraging eff coupled with the economic recovery, has brought their leverage ratio down to 96% of GDP, down 36 points from 2010. In 2017, these companies paid close to 13 billion euros in interest, compared to 33 billion euros in 2010. As a result, an increase in interest rates would have a smaller impact than in earlier years. Under this heightened risk scenario, in 2018 the non-financial corporates’ interest bill would increase by half as much as it did in 2011.

- Spain’s households are also better positioned to withstand a financial shock. Since 2010, they have pared back their borrowings by 170 billion euros to a level equivalent to close to one year’s gross disposable income – which nears the threshold estimated by the BIS as the proxy for being able to withstand a potential crisis [4]. In the heightened risk scenario, the household debt service burden would be lower than in 2011, as would the increase in interest payments.

- Elsewhere, the trend in the labour market, crucial for private consumption decisions and investor expectations, has changed substantially. In 2011, employment was still contracting sharply as a result of the bursting of the real estate bubble a few years earlier and the structural contraction of the construction sector. When the financial shock occurred, employment plummeted and productivity (GDP per job holder) registered annual growth of over 2%. Nowadays, however, the construction sector has completed its downsizing, so that job creation should trend more in line with growth. As a result, in the event of a fresh financial shock, employment would not play such as pro-cyclical role as in the prior crisis.

- And the healthier state of the financial sector would help to cushion an interest rate shock or a standstill in international capital flows. Liquidity and capital ratios have improved substantially. Meanwhile, the banks’ reduced exposure to sovereign debt would reduce the impact of an increase in the risk premium on their balance sheets. As a result, the banks would continue to be able to extend credit.

Having surmounted the initial impact of higher oil prices, in 2019 and 2020 inflation would be the lowest of any of the scenarios due to the lower rate of growth in internal demand and relatively greater amount of idle capacity. The balance of payments surplus would be lower than in the baseline scenario as a result of higher oil prices but higher than in the risk scenario as the slowdown in domestic demand (and, therefore, imports) would be more intense in this instance than the slowdown in global demand (and, therefore, exports). This is because of the greater impairment of confidence and bigger increase in interest rates which Spain would sustain, as embodied by a sharp increase in the risk premium. This loss of confidence would in turn drive a high level of public indebtedness, this being one of the Spanish economy’s greatest sources of vulnerability, particularly in the event of a financial crisis.

Job precariousness is its other key vulnerability. The significant weight of temporary employment lends itself to heavy redundancies during periods of recession, more so than in other European countries, with a pro-cyclical impact on growth.

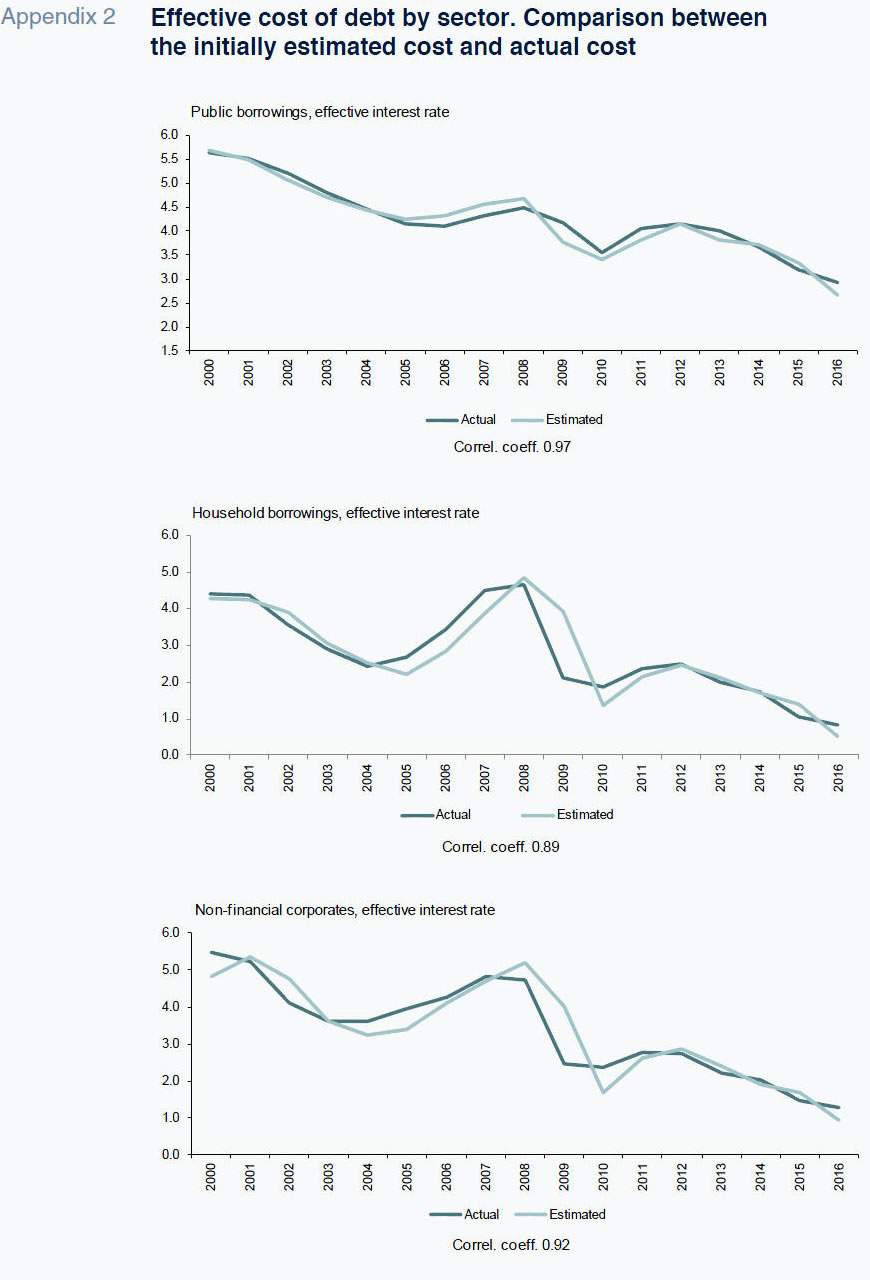

It is worth highlighting that the estimated trend in the effective cost of the various sectors’ borrowings is very relevant in terms of calculating the outcomes for the various macroeconomic variables both in this scenario and in the other scenarios modelled. Note however that the estimation method used has yielded very positive results in the past, as is shown in the correlations presented in Appendix 2.

Conclusions

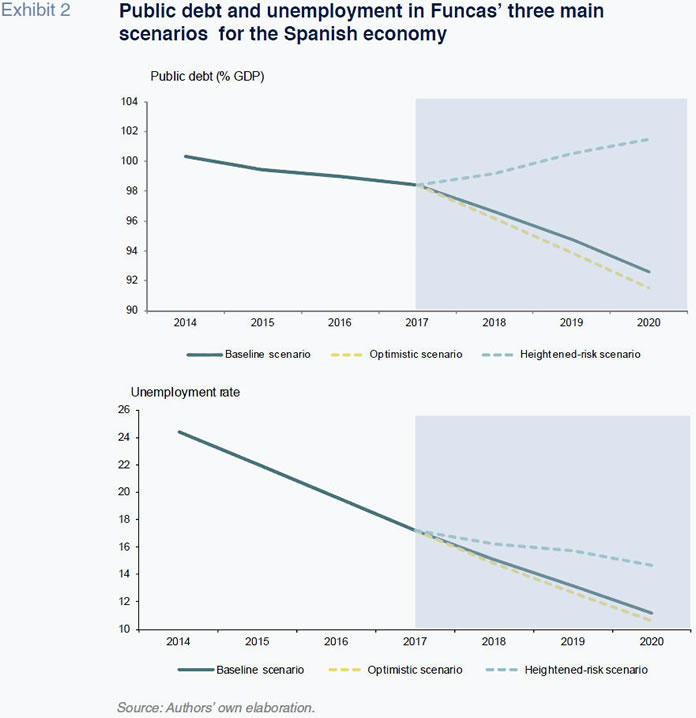

In short, all signs suggest that the Spanish economy is significantly better positioned than in the past to withstand external shocks from here to 2020. In the worst-case scenario (which combines an increase in the risk premium of the magnitude observed in 2011 and higher oil prices), economic growth would slow substantially but there would not be a prolonged recession. The result would be signifi less adverse than the projections modelled by the EBA in the context of its bank stress testing exercise. Moreover, Spain would continue to present a current account surplus even in the best case scenario, characterised by dynamic growth in domestic demand over the next three years. The Spanish economy’s ability to withstand shocks, whether positive or negative, is attributable to the improved financial health of its companies, the restructuring of the financial sector and the country’s favourable competitive positioning. Nevertheless, in all scenarios, public debt and unemployment remain the main challenges facing the country in the medium term (Exhibit 2), evidencing the need for new reforms.

The source of the forecasts of the various analysts for global and European growth is Consensus Economics (www.consensuseconomics.com).

For further details about the baseline scenario, refer to Raymond Torres and María Jesús Fernández, “The Spanish economy in 2017 and the outlook for 2018”, Spanish Economic and Financial Outlook, No. 262, January-February 2018.

Raymond Torres and María Jesús Fernández. Economic Trends and Statistics Department, Funcas