Spanish economic forecasts panel: March 2018*

Funcas Economic Trends and Statistics Department

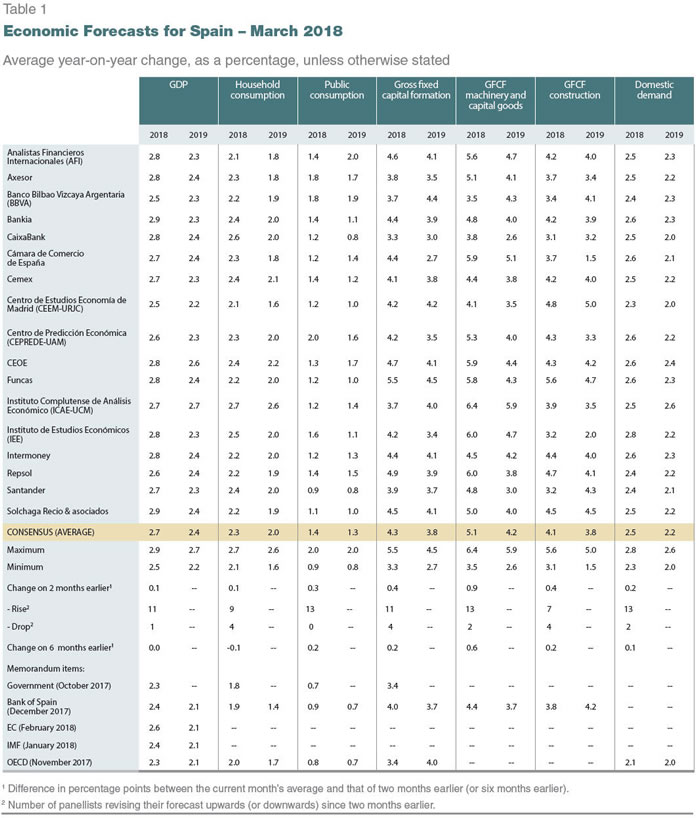

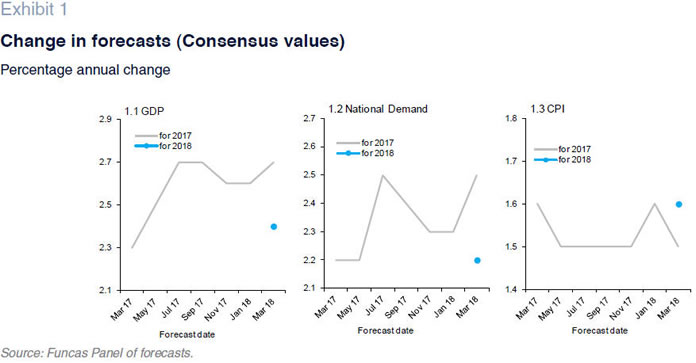

Estimated 2018 GDP growth has increased to 2.7%, up 0.1pp from the last Panel forecast

GDP growth in the last quarter of 2017 was in line with that recorded the previous quarter, at 0.7% (revised down from 0.8%). Growth for the year thus came in at 3.1%.

The indicators released to date for the first quarter suggest that this growth continues apace. The consumer confidence and economic sentiment indicators for January and February were stronger than the fourth-quarter 2017 average, as was the composite PMI. And, according to the Social Security contributor numbers, the pace of job creation is also being sustained.

The consensus forecast for 2018 is for GDP growth of 2.7%, up 0.1 percentage points from the last Panel forecast. This figure is higher than that forecast by the international organisations, the Spanish government and the Bank of Spain.

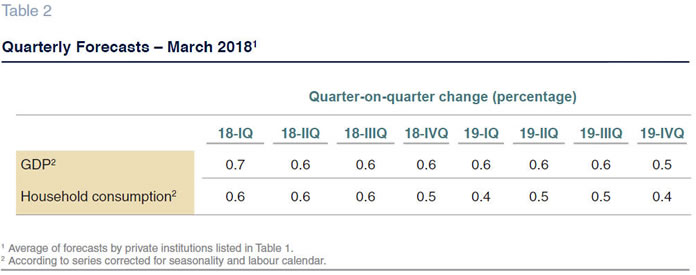

National demand is expected to contribute 2.4 percentage points to that growth, which is 0.2 percentage points up from the January forecasts. The upwards revision to the forecast for growth in investment stands out. As for the foreign sector, current forecasts point to a contribution of 0.3 points, down 0.1 percentage points. Growth is expected to be even from one quarter to the next, specifically 0.7% in the first quarter and 0.6% in each of the last three quarters of 2018. The slight slowdown originally anticipated for the end of the year is no longer being forecast.

The forecast for 2019 is 2.4%

This was the first survey to ask for estimates for 2019. The consensus forecast for GDP growth in 2019 stands at 2.4%, which is 0.3 percentage points below the forecast for 2018. The consensus forecast for 2019 is nevertheless higher than the growth forecast for the eurozone as a whole by the European Central Bank and the European Commission. The anticipated slowdown is attributable mainly to weaker private consumption, which is expected to grow by 0.3 percentage points less than in 2018, and gross fixed capital formation, which in turn explain the lower forecast contribution by domestic demand.

Subdued inflation in 2018 and 2019

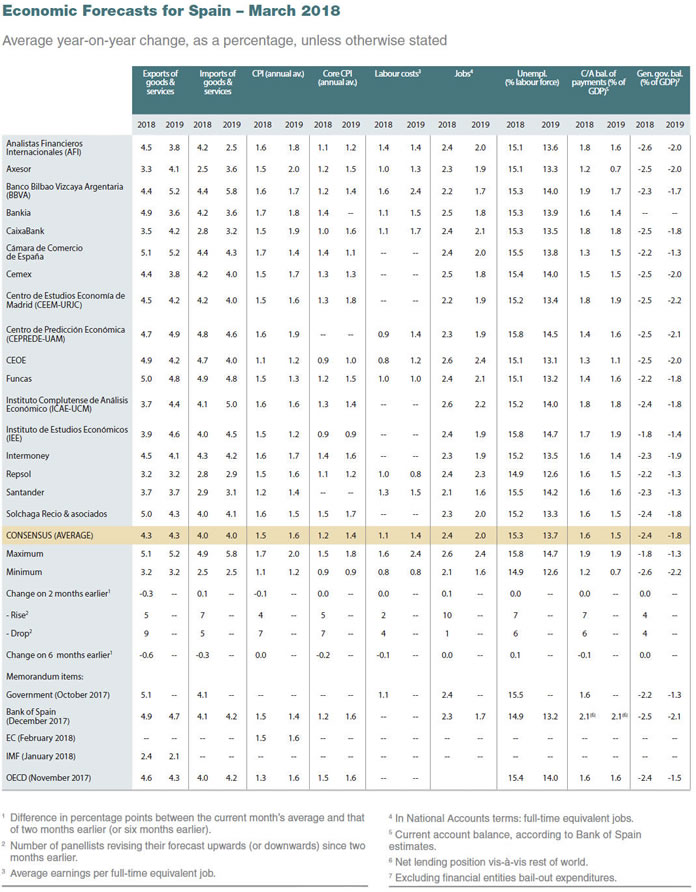

Inflation fell sharply to 0.6% in January as a result mainly of the drop in electricity prices, going on to recover in February, when the year-on-year rate climbed back to 1.1%. Having hit a high for the year of almost 70 dollars a barrel in January, oil prices have been trading at around the 65 dollar mark in recent weeks. Core inflation remains at moderate levels.

Inflation is expected to continue to firm until the third quarter, at which point it is expected to fall back to end the year at an average rate of 1.5%, 0.1 percentage points below the last set of forecasts. As for 2019, the consensus forecast stands at 1.6%; however, it is worth highlighting the lack of consensus in this respect, with the forecasts ranging from a low of 1.2% to a high of 2%. The year-on-year CPI rates forecast for December 2018 and December 2019 are 1.4% and 1.5%, respectively.

The year-on-year CPI rates forecast for December 2018 and December 2019 are 1.4% and 1.5%, respectively.

Slight slowdown in job creation in 2018

According to the Social Security contribution numbers, average growth in contributors in January and February was somewhat higher than the average monthly growth observed in the preceding months. The numbers reveal a recovery in market services, which had lost steam last quarter, a slowdown in construction and accelerated job growth in industry.

In terms of full-time equivalent jobs, growth in 2018 is estimated at 2.4%, up 0.1 percentage points from the last Panel, slowing to 2% in 2019.

Using the forecasts for growth in GDP, job creation and wage remuneration yields implied forecasts for growth in labour productivity and unit labour costs: the former is expected to register growth of 0.3% in 2018 and 0.4% in 2019 (up 0.1pp from the last Panel), while ULCs are expected to increase by 0.8% and 1% in 2018 and 2019, respectively.

The average annual unemployment rate is expected to continue to come down – to 15.3% in 2018 (no change from the last Panel) and to 13.7% in 2019.

Another ample current account surplus forecast for 2018

According to provisional figures, the current account surplus amounted to 19.8 billion euros in 2017, down 1.7 billion euros from 2016, shaped by a reduction in the trade surplus that was not fully offset by the narrower income deficit.

The consensus forecasts point to a slight reduction in the surplus to 1.6% of GDP in 2018 and 1.5% in 2019.

The public deficit looks set to narrow, but missing the targets

In the first 11 months of the year, the deficit at all levels of government except for the local corporations stood at 24 billion euros, down 36% year-on-year. The improvement came at the central and regional government levels. The latter recorded a surplus of 1.2 billion euros. In contrast, the Social Security Funds deficit widened, albeit due to a reduction in the transfers received from the state’s public employment service (SEPE for its acronym in Spanish). The Social Security System’s deficit declined thanks to faster growth in revenue from contributions relative to benefits.

The Panel of analysts is expecting the deficit to come down over the next two years. The forecast for 2018 is for a deficit of 2.4% of GDP (unchanged from the last Panel), declining to 1.8% in 2019, which would imply a shortfall with respect to the targets of 0.2 and 0.5 percentage points, respectively.

Positive outlook for the global economy, albeit clouded by rising tensions among trading partners

The OECD has revised its forecasts for global growth upwards. It is now forecasting growth of close to 4% this year and next. And all the major economies are expected to extend their growth. The US is set to benefit in the short term from the recently announced corporate tax cuts, which might prompt the Federal Reserve to take more decisive action than initially contemplated. The Chinese economy appears to be absorbed by the issues posed by excessive leverage in the corporate sector. Meanwhile, the recovery is expected to gain traction in Argentina, Brazil and other Latin American countries that are emerging from their recessions of recent years. Lastly, momentum in the eurozone’s economy is healthy. Consumer and business confidence indicators remain strong, at levels consistent with growth of over 2% in the next couple of years. The trade tensions arising in the wake of the tariff hikes announced in the US pose the biggest threat to this favourable scenario.

Overall, virtually all of the Panel members view the international climate as favourable and expect it to remain so in the months to come, both within and beyond the EU. Just three analysts are expecting the international environment to deteriorate.

Long-term rates expected to move higher

The ECB continues to signal the looming normalisation of monetary policy. For the time being, it has left its key benchmark rates (the main refinancing operations, the marginal lending facility and the rates on the deposit facility) intact. This stability is evident in the 3-month Euribor rate (the interest rate that indicates the cost of short- term interbank lending), which remains at ultra- low levels, albeit marginally higher, at -0.33%. Almost all our Panel members view this level as low and the majority believe that these favourable credit conditions will continue in the months to come.

In recent weeks, investors have been active in the sovereign bond markets. This has driven down the yield on the Spanish 10-year bond, which is trading clearly under the 1.4% mark. The risk premium over the German Bund has also narrowed since the last Panel. The Panel members consider that long- term interest rates remain low. However, the majority expect bond yields to rise in the coming months.

Potential euro appreciation against the dollar

The euro has been trading at around 1.23 dollars, implying no significant movement since the last Panel. The momentum being displayed by the European economy coupled with the prospect of rate hikes continues to prop up demand for the euro.

Most of the analysts believe that the euro is trading at close to equilibrium levels and that it will stay steady at current levels in the months to come. However, some are forecasting currency appreciation.

Neutral fiscal policy and expansionary monetary policy

The analysts’ assessment of prevailing macroeconomic policies is unchanged since our last publication. The majority believe that fiscal policy is neutral and

that this is the correct stance. Some call for a more restrictive fiscal policy.

As for monetary policy, all of the analysts continue to view it as expansionary. None of the analysts are expecting monetary tightening in the coming months, as was the case in our last Panel publication.

The Spanish economic forecasts panel is a survey run by Funcas which consults the 17 research departments listed in Table 1. The survey, which dates back to 1999, is published bi-monthly in the first fortnights of January, March, May, July, September and November. The responses to the survey are used to produce a “consensus” forecast, which is calculated as the arithmetic mean of the 17 individual contributions. The forecasts of the Spanish Government, the Bank of Spain, and the main international organisations are also included for comparison, but do not form part of the consensus forecast.