The Spanish economy in response to potential shocks

While baseline scenarios suggest the Spanish economy’s performance will remain positive, especially when compared with the rest of Europe, relatively low probability heightened risk scenarios developed in this paper highlight areas of potential weakness. That said, Spain’s economy is stronger than it was at the start of the Great Recession, indicating the impact of potential adverse shocks would be less harmful than previously experienced.

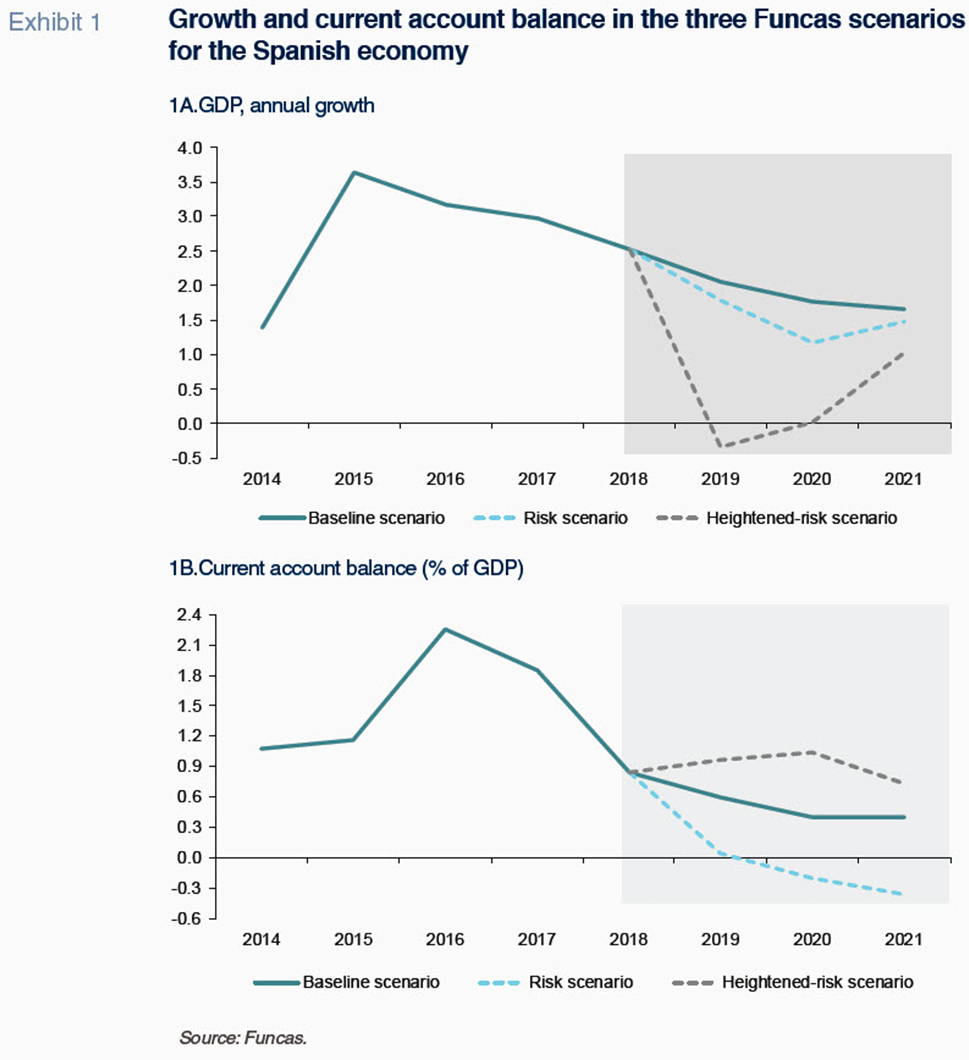

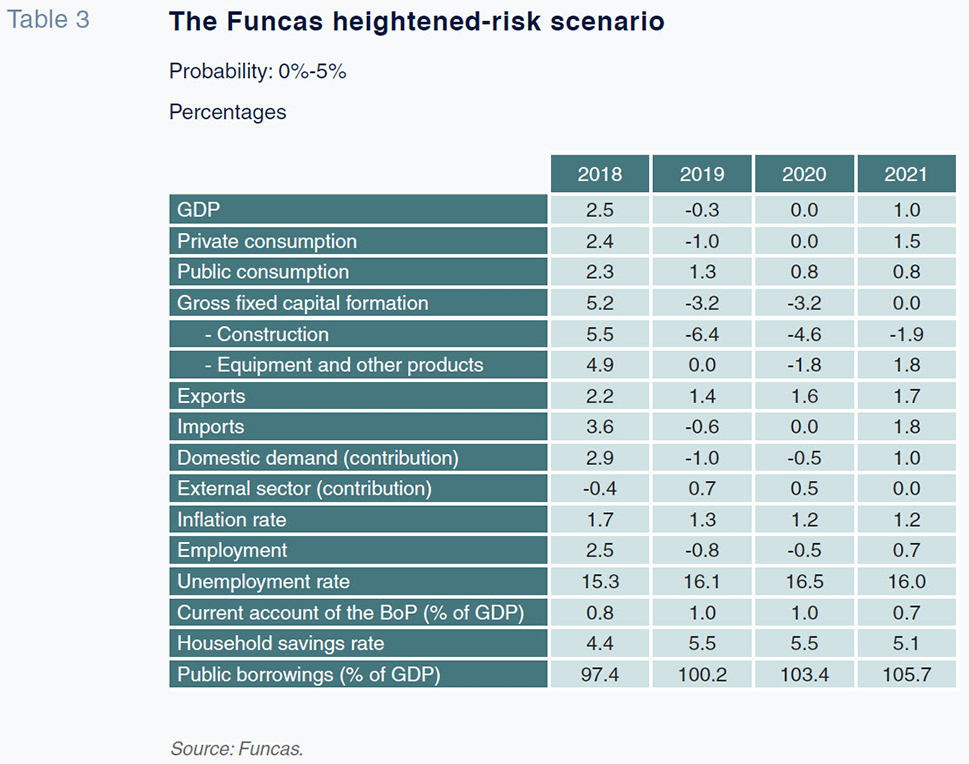

Abstract: The current baseline scenario is for positive, albeit slower, economic growth of 2.1% in 2019. However, given the risk of further international tensions, it is useful to consider how the economy might fare under a potential materialization of more adverse circumstances. In order to do so, two relatively low probability stress scenarios are modelled. The first consists of weaker global and European growth, as well as a sharp increase in oil prices, while the second amplifies these effects and adds a major financial shock of a similar magnitude to the one that triggered the sovereign debt crisis almost a decade ago. In the first risk scenario, it is estimated that Spanish growth would fall to 1.8% in 2019, resulting from weaker exports and a slower pace of job creation and consumer spending. While the economy would see a more dramatic reduction in growth in 2020, a tepid recovery would follow in 2021. In the extreme risk scenario, which adds to the previous one a financial shock, the economy would enter a recession in 2019. It would begin to stabilise in 2020, with moderate growth returning in 2021. Significantly, there would be a rise in public borrowings over the entire projection period, peaking at 105.7% of GDP, a record high. However, the overall impact would be less severe than experienced in the sovereign debt crisis, due to the stronger financial health of Spain’s private sector and the absence of any evidence of a bubble nor of credit propping up present employment levels. Despite an overall improved resilience, Spain has reduced capacity to deploy fiscal stimulus in response to shocks. Another vulnerability is the high level of oil dependency under the current energy model.

Introduction

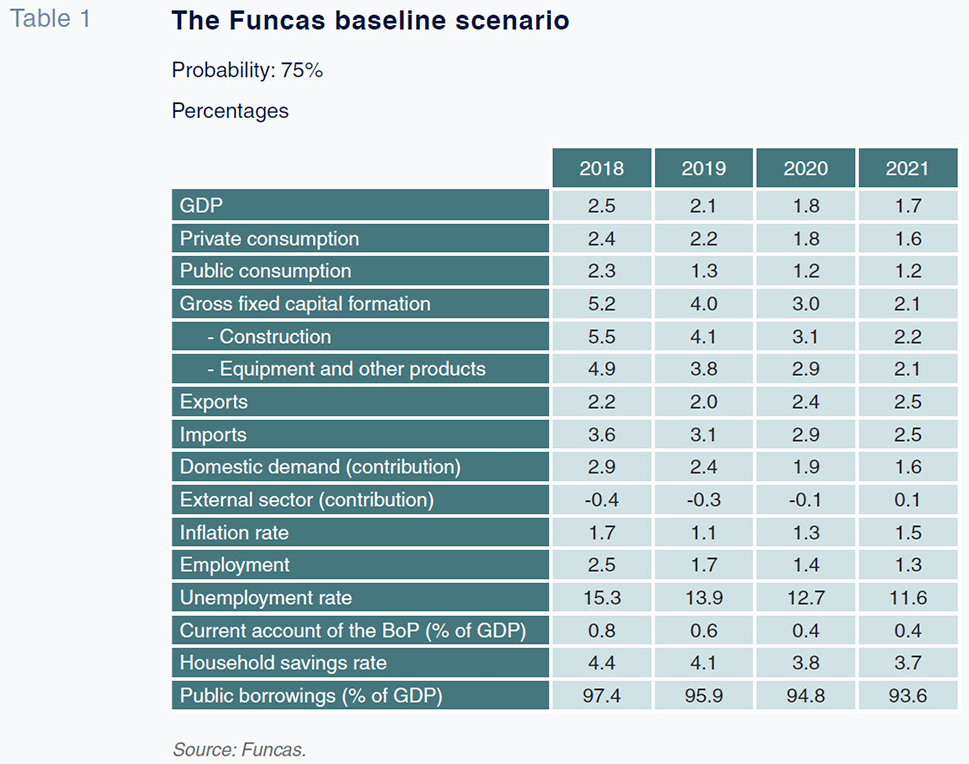

Following five years of growth since the start of the recovery, the Spanish economy’s fundamentals remain relatively solid. While observers expect the pace of growth will slow, the expansion has not generated imbalances in the private sector nor are there domestic indicators that suggest growth is likely to completely stall. In our baseline scenario, GDP is forecast to grow by 2.1% in 2019, slowing gradually in subsequent years as it converges towards its level of potential output growth (Table 1). As a result, unemployment and public borrowing -the key imbalances in the Spanish economy- should continue to shrink. Spain is expected to continue to record a trade surplus throughout the projection period, albeit smaller than in recent years.

However, these forecasts are based on the assumption of a stable external environment, marked by continued but slowing global growth (higher than during the years of crisis) and historically low interest rates. The purpose of this paper is to assess how the Spanish economy would perform if the international context and/or financial conditions were to prove less benign. [1] Firstly, we analyse the impact of weaker growth on the global and European economies and an increase in oil prices. For that risk scenario, we take the most pessimistic forecasts for international trade and oil prices, which would constitute a trade shock. Secondly, to model a scenario of heightened risk, we layer a financial shock onto the trade shock scenario. The financial shock is approximated by an increase in interest rates and risk premia of a similar magnitude to that which triggered the sovereign debt crisis in 2010-2012. Lastly, the article draws from the analysis some considerations about the Spanish economy’s strengths and weaknesses.

Note that the entire simulation exercise is conducted under the assumption of ‘no policy changes’, i.e., assuming that no new economic policy measures are taken during the projection period.

Risk scenario

In the risk scenario, the disruption resulting from trade wars and, in the case of Europe, a ‘no deal’ Brexit, together with oil prices at the upper end of the estimate range (85 dollars per barrel), would reduce growth in the global and European economies to below the levels contemplated in the baseline scenario. GDP growth in the eurozone would fall to around 1% in 2019 and embark on a modest recovery from the second half of 2020, once the impact of the above-mentioned sources of disruption had been absorbed. Although the US economy would also recover, China’s domestic imbalances would hamper its growth rate, negatively impacting the global economy (Appendix 1).

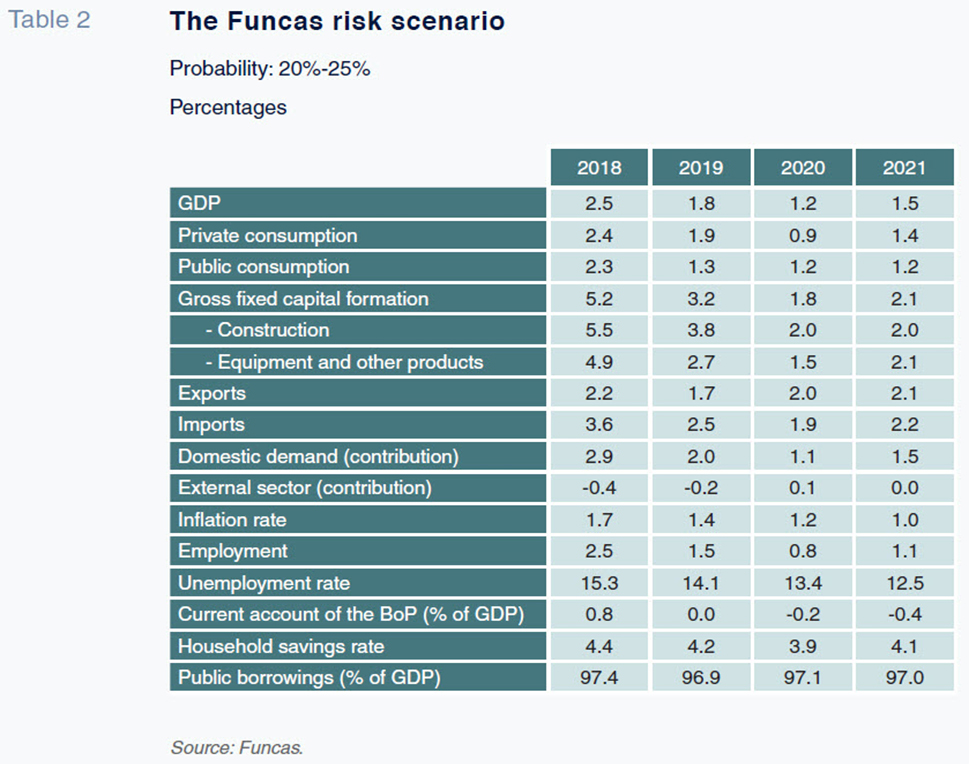

These assumptions are fairly improbable compared to those contemplated in the baseline scenario. However, recent developments in the European economy and international markets have lent weight to the warnings issued by international organisations and the European Central Bank (ECB). [2] As a result, the likelihood of the risk scenario materialising is allocated a probability of between 20% and 25%, versus a 75% probability for the baseline scenario.

In the risk scenario, the exchange rate would remain at around the recent level of 1.13 dollars per euro throughout 2019, as the delay in normalising monetary policy would impede the appreciation forecast in the baseline scenario. The improved economic outlook for 2020 would likely prompt the ECB to start increasing its benchmark rates that year, giving rise to moderate euro appreciation.

Slower growth and the financial markets’ perception of greater uncertainty would push the Spanish risk premium higher in 2019, specifically putting the yield on 10-year government bonds at an estimated 1.50%. In subsequent years, the premium would be expected to stabilize at a relatively high level, while the improvement in the medium-term outlook would continue to nudge yields towards the 2.2% mark in 2021.

The wage growth forecast in this scenario would be lower than in the baseline scenario due to reduced upward pressure on the back of slower job growth.

Adverse international conditions would translate into lower export growth. Reduced external demand, coupled with heightened uncertainty and the growth in production costs derived from the increase in energy prices, would lower investment growth. The combination would result in a slower pace of job creation, which, coupled with the higher rate of inflation, would diminish growth in consumption. Consumer spending would also be negatively affected as residents boost their savings in the face of uncertain prospects. However, the increase in salaries as a result of the growth in public sector pay, the minimum wage hike and the increase in pensions would partially mitigate this effect. As a result, economic growth, at 1.8% in 2019, would be lower than in the baseline (Table 2 and Exhibit 1A).

In 2020, despite a slight recovery in exports, investment is forecast to continue to ease as a result of several factors. These include the adverse effect of the increase in the risk premium on interest rates, the lagged impact of the increases in labour costs introduced the previous year (the minimum wage hike and the increase in the Social Security cap) and more pronounced weakening in consumer spending. The latter would be shaped by the end of the above-mentioned salary measures, which had augmented household income. Taken together, these dynamics would slow GDP growth to 1.2%.

In 2021, GDP would experience a slight recovery, albeit remaining at a low level. The improvement would stem from stronger export performance and, above all, higher investment in capital goods, buoyed by the brighter economic outlook, a stable risk premium and a slower increase in unit labour costs. As a result, employment would recover, boosting consumption and, ultimately, GDP and job creation. The outcome would be a recovery in growth to 1.5%.

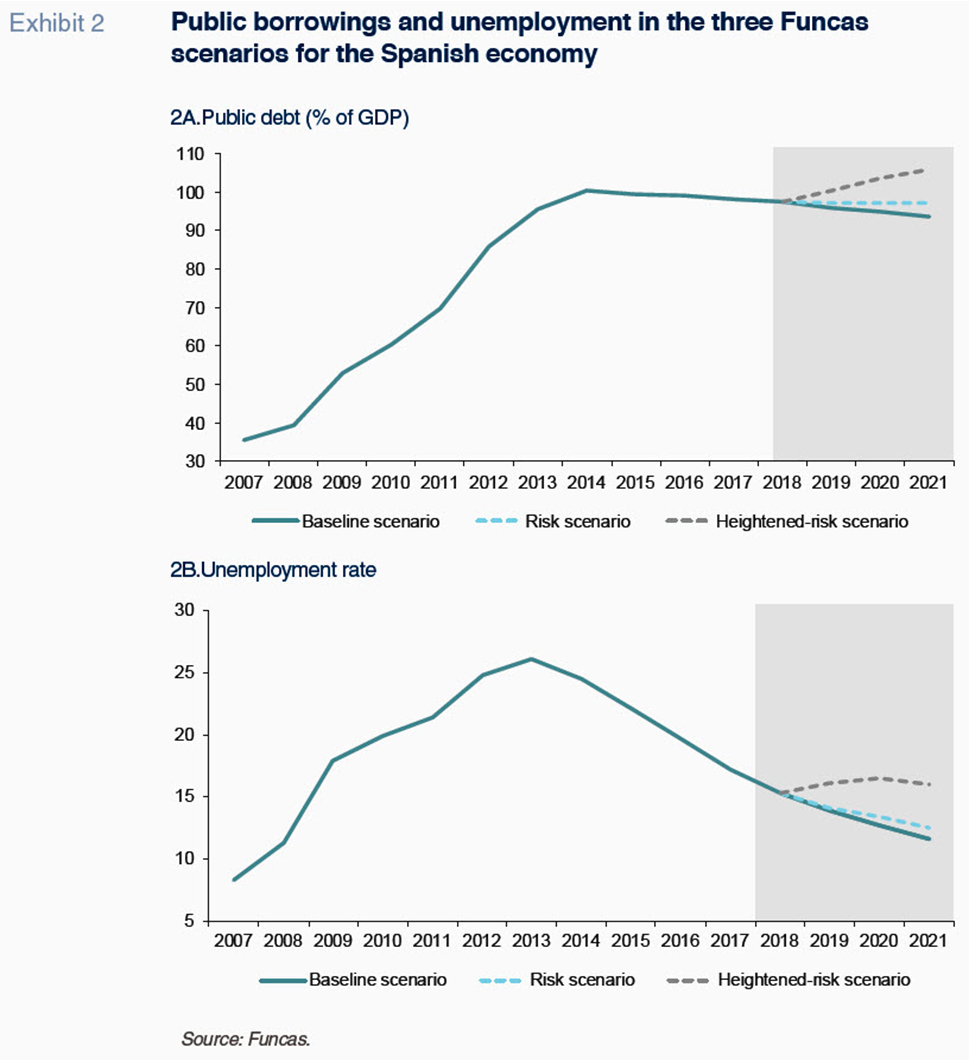

The unemployment rate would stand at 12.5% in 2021, which is nearly one percentage point above the baseline scenario (Exhibit 2B). The current account would go from a surplus to a deficit, mainly due to the high price of oil imports and, to a lesser extent, the increase in net interest payments on external debt (Exhibit 1B). Lastly, the public deficit would deteriorate to 2.6% of GDP, compared to the 1.9% estimated in the baseline scenario. Public indebtedness would come down slightly in 2019 but would climb once again in the following two years to end 2021 at 97% of GDP (Exhibit 2A).

Heightened-risk scenario

In the heightened-risk scenario, we assume a more pronounced deterioration in the external environment than in the previous risk scenario. The model relies on the most pessimistic analysts’ projections, which reflect the outcome of increased trade tensions and a marked reduction in Chinese growth. In addition, the current slowdown in the European economy would intensify, bordering on recession during the second half of 2019. Specifically, growth in the eurozone would fall to 0.8% in 2019 and 0.5% in 2020. Although the eurozone would begin to recover in 2021 with GDP growth of 1%, it would remain below its potential output growth rate.

Secondly, in the heightened risk scenario, we layer in a financial shock similar to that which took place at the time of the sovereign debt crisis a decade ago. We assume that financial fragmentation would halt eurozone capital flows in the next few months, with two implications. Firstly, the risk premium would climb to similar levels to those registered in 2011, i.e., close to 300 basis points (virtually three times the risk premium currently observed in the markets). Secondly, the private sector would face a credit crunch, which would push Spain’s households from a net borrowing position to equilibrium. Conversely, the corporate sectors’ current financing surplus would cushion the blow of a credit crunch.

The materialisation of these assumptions is improbable on account of the magnitude of the shocks modelled and the likelihood of them all happening simultaneously. As a result, the probability ascribed to the heightened-risk scenario is less than 5%.

In this weakened environment, the Spanish economy would enter recession in 2019, due to the collapse in domestic demand. Private consumption -the variable with the greatest weight in GDP- would contract as a result of the credit crunch, prompting a sharp increase in household savings (Table 3). Indeed, the household savings rate is forecast to increase by one full percentage point to 5.5%. The freeze in credit, coupled with higher interest rates, would also affect residential investment. On the other hand, investment in capital goods would manage the shock better, thanks to the corporate sector’s healthy financial situation. The downturn in international markets would take a toll on exports, which would grow by just 1.4%, similar to the rate observed in 2012 at the height of the crisis. However, in line with the predicted contraction in domestic demand and historical elasticities, imports would also decline. Consequently, trade would provide a positive net contribution to growth.

Following the initial adjustment in the face of shocks, consumer spending would stabilise in 2020. It would then embark on a slight recovery in 2021 as credit restrictions are gradually rolled back and precautionary savings diminish. Keeping with the recovery in the European economy, the slowdown in exports would level off in 2020, seeing further improvements in 2021. As a result, investment would start to rebound that year. Overall, GDP would stabilise in 2020 and register modest growth in 2021.

Bearing in mind the assumption that fiscal policy would remain neutral, the public deficit would edge towards 5% of GDP in 2021 under the heightened-risk scenario. The result would be an increase in public debt over the entire projection period, peaking at 105.7% of GDP, a record high (Exhibit 2A).

The recession would also take a toll on the job market. A net 215,000 jobs would be lost between 2019 and 2020 and only two-thirds of those jobs would be recovered in 2021, so that the unemployment rate would stand at 16% (Exhibit 2B). Though high, the unemployment rate would be nearly ten percentage points below the peak recorded in the aftermath of the crisis.

In short, even assuming the highly adverse shocks of this scenario, the Spanish economy would fare much better than it did during the midpoint of the last crisis. That is because of two factors:

-

Fewer jobs would be lost in the Spanish economy than during the sovereign debt crisis. That event coincided with the bursting of the real estate bubble, which in turn triggered a major correction in the construction sector. This dynamic is responsible for much of the job losses during the crisis, while the rise in the risk premium compounded the trend. The spike in unemployment also made households more cautious. Out of a fear that they would lose their jobs, many families reduced their spending, thereby exacerbating the recession. The current situation is different as there are no clear signs of a bubble and credit does not appear to be propping up present employment levels in any sector. As a result, a financial shock would have a similar impact to that of an ordinary recession. Thus, in the heightened-risk scenario, employment would move broadly in line with GDP, as suggested by the elasticities associated with a ‘bubble-free’ recession. This means fewer jobs would disappear than in the sovereign debt crisis. Additionally, labour productivity would increase at an annual rate of close to 0.5% over the forecasting horizon, roughly four times less than during the crisis.

- The private sector is also in a stronger financial position than during the sovereign debt crisis. At the end of 2018, Spain’s non-financial enterprises had reduced their debt levels by no less than 320 billion euros, compared to 2010. As a result, an interest rate shock would have a significantly smaller impact than that observed a decade ago. Faced with a shock of a similar magnitude, Spain’s enterprises would economise almost 25 billion euros in interest expenses, allowing them to navigate the recession with comparatively less difficulty than in the previous downturn. In addition, Spain’s households, having deleveraged (albeit by less than in the case of enterprises), would save around 10 billion euros in interest expenses. Lastly, Spanish financial institutions are also in a relatively healthier position in terms of exposure to non-performing loans, capital ratios and liquidity.

Strengths and weakness in the face of potential shocks

In conclusion, the Spanish economy has improved its resilience to external shocks or a financial meltdown similar in magnitude to the Great Recession. The deleveraging undertaken by the private sector in recent years, coupled with the absence of bubbles or sectors in which a significant percentage of jobs is artificially propped up by credit, are important achievements that explain the improved resilience of the Spanish economy.

The flip side is that there is little room for fiscal manoeuvring in order to offset the effects of a possible shock. The public deficit and the high level of public borrowings restrict the government’s capacity to adopt stimulus measures that would damper the effects of a recession and help speed up the recovery. The markedly pro-cyclical nature of the labour market is another weakness which erodes the economy’s ability to respond to recessionary episodes. Lastly, Spain’s high dependence on oil leaves the economy vulnerable to potential swings in international markets. Spain should prioritise correcting these imbalances and adopt new reforms that would transform the energy model. Such efforts would help prolong the current expansionary phase and leave Spain less exposed to potential turbulence.

Notes

This paper updates the scenarios modelled one year ago (Torres and Fernández, 2018).

Refer to the OECD’s Economic Outlook (2019) and the ECB’s Macroeconomic Projections (2019).

Raymond Torres and María Jesús Fernández. Economic Perspectives and International Economy Division, Funcas