Spain’s regional financing system in times of economic growth: Good results temper demand for reform

Despite shortcomings in Spain’s regional financing system, the push for reform has weakened due to numerous factors related to the economic recovery and the general difficulty of reaching consensus. Current conditions suggest that if reform does take place, it will be piecemeal, notwithstanding the potential risks associated with such a strategy.

Abstract: The regional financing system has been generating positive results (on an accrual basis) since 2014, in contrast with the prior period which, with the exception of 2010, was characterised by economic contraction. The improved performance, tied to the economic recovery, has had an even bigger impact in budgetary terms, given that the payments on account in 2014-2015 did not reflect the economy’s real dynamism. The aggregate of the payments on account, coupled with the definitive settlements received in 2016 and 2017, registered year-on-year growth of 9.5% and 7%, respectively. This improved regional fiscal performance has been particularly apparent in Catalonia, Murcia, Valencia, the Canary Islands, the Balearic Islands and Madrid. The recent positive fiscal dynamics –as evidenced by compliance with regional deficit targets– together with the difficulty for regional governments to reach agreement - has slowed reform momentum. Lastly, the panorama is further complicated by divisions on the delicate issue of potential regional debt restructuring, not only in the academic field but also within the regional governments themselves.

Introduction

Although the conditions for reform negotiations have been propitious, the debate surrounding Spain’s regional financing system (“RFS”) appears to have quieted in the last year. The country’s strong economic performance has expanded overall tax receipts (including those of the state) while simultaneously improving the prospects for a fresh transfer of resources from the state to the regional governments in order to increase the coverage of fundamental public services.

[1] In addition, both experts and members of the government began discussing the need for debt restructuring, which garnered some controversy due to concerns about moral hazard and the advisability of regional governments gradually making their way back to the capital markets.

Two specific factors have, however, undermined expectations for reform:

- Agreement by all stakeholders is required to initiate reform [2] and the political climate does not guarantee that consensus will be easily reached. This is made all the more challenging by the fact that agreement would have to be reached at a time when other demands are being made on government funds, including reform of Social Security Funds.

- The current, positive dynamics in the financing system are reversing the adverse legacy of Spain’s economic contraction. This uptick in growth is having a particularly beneficial impact on the regions that were previously the most vocal proponents of reform.

This paper analyses the rebound of Spain’s regional financing system and assesses the extent to which the regions benefit from this positive performance.

Trends in RFS definitive settlements and their budgetary impact

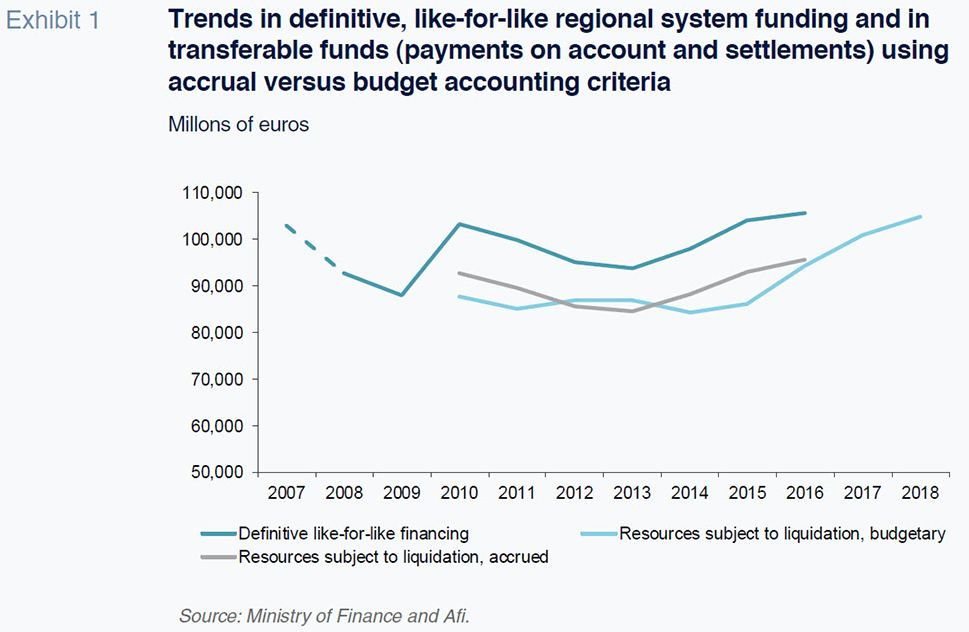

Examining the definitive regional financing system settlements on like-for-like terms (eliminating coverage of competencies that are unique to certain regions), the results available up to 2016

[3] reveal that the funding peak reached in 2007 under the previous system (on non-comparable terms) has been surpassed. From a geographic perspective, the worst years in terms of results were 2011 and 2013, after which the economic recovery took hold. In fact, excluding 2009 and 2010, the years of system ramp-up, average annual growth was higher in 2014-2016 than the average contraction during the three previous years (+4% YoY

vs. -3.1% YoY).

Another important point illustrated in Exhibit 1 is that the funds’ impact on the budget, subject to regional settlement,

[4] begins to accelerate from 2015 and peaks in 2016, thanks mainly to the trend in settlements from two years earlier (2014). The 2014 settlement was particularly high due to the significant difference between the payments on account made that year (which were in fact lower than in 2013) and actual economic dynamics, which implied far higher tax receipts than had been budgeted. This resulted in an exceptional boost for the regional budgets. In 2016, those funds increased by 10% and in 2017 by 7%. In 2018, marked by a slowdown in payments on account (from +6.4% YoY to +4% YoY), coupled with the forecast maintenance of settlement levels with respect to prior years, the budget impact eased (+3.8% YoY).

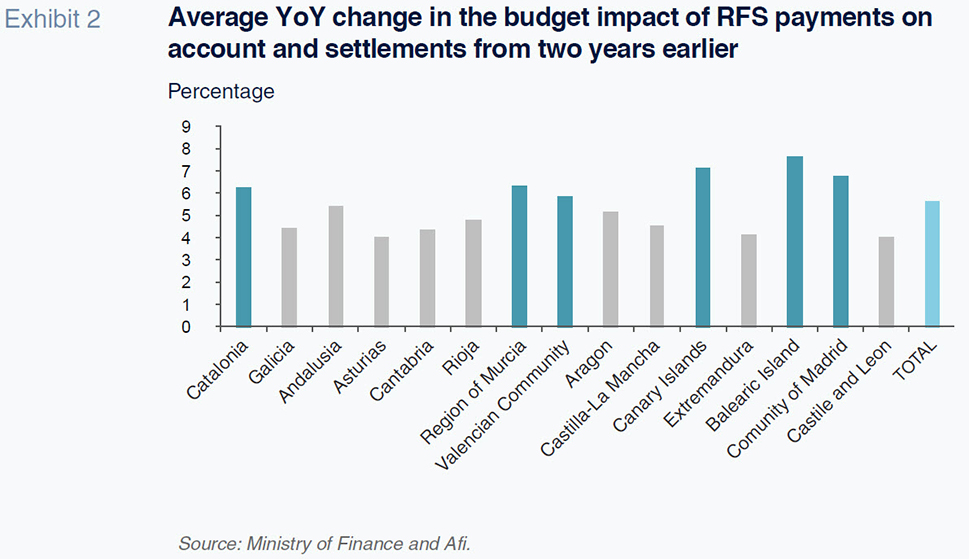

As shown in Exhibit 2, the regions that have demonstrated an above average performance as a result of this source of funding are Catalonia, Murcia, Valencia, the Canary Islands,

[5] the Balearic Islands and Madrid. Coincidentally, these are the regions that had pushed most aggressively for reform of Spain’s regional financing system.

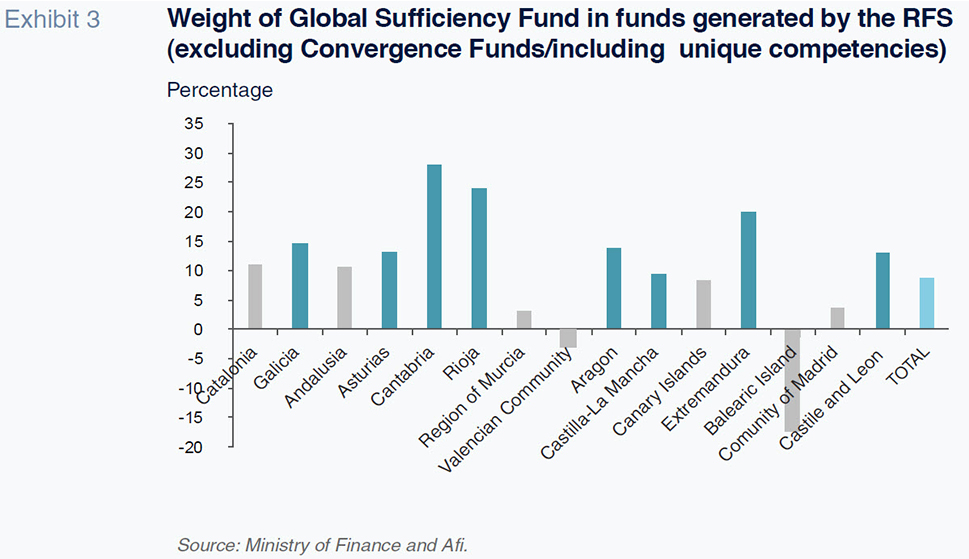

The trends at the regional government level can be attributed to different sources of funds within the RFS (Exhibit 3). The best-performing funds have been the tax-driven sources. Those corresponding to non-tax funds (Global Sufficiency Fund and Fundamental Public Service Guarantee Fund) have had a relatively weak performance. For example, the Sufficiency Fund has experienced a gradual reduction in tax receipts due to the application of article 21.2 of Law 22/2009, which regulates the regional financing system and amends certain tax rules.

[6] As a result, the regions where the Sufficiency Fund had a higher weight in RFS funding when the new system was introduced have been adversely affected. Furthermore, these same regions have benefitted less from the improved momentum in revenue (below average growth). In contrast, the strong performance in the tax receipts shared with the state has benefitted the regions with greater fiscal capacity to a higher degree.

[7]

Trends in other regional funds that do not originate with the RFS

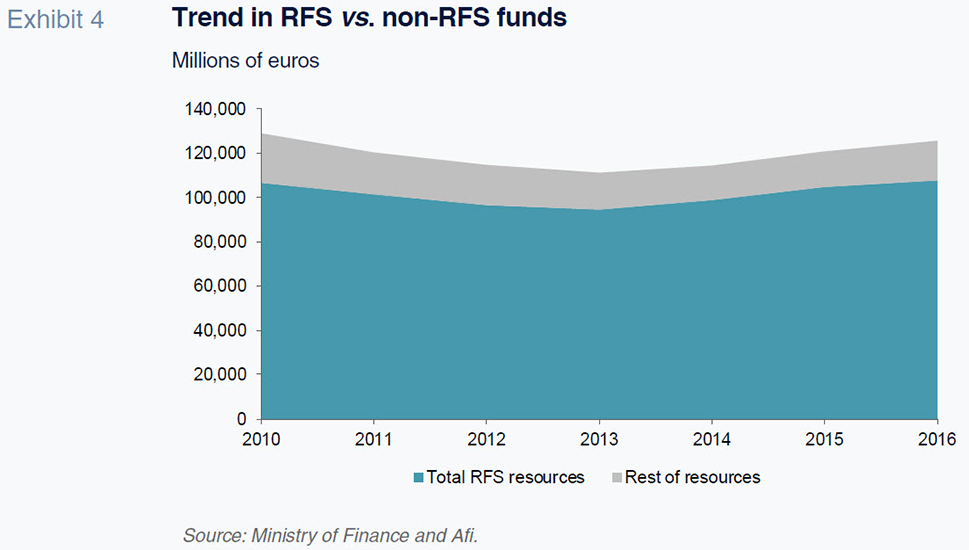

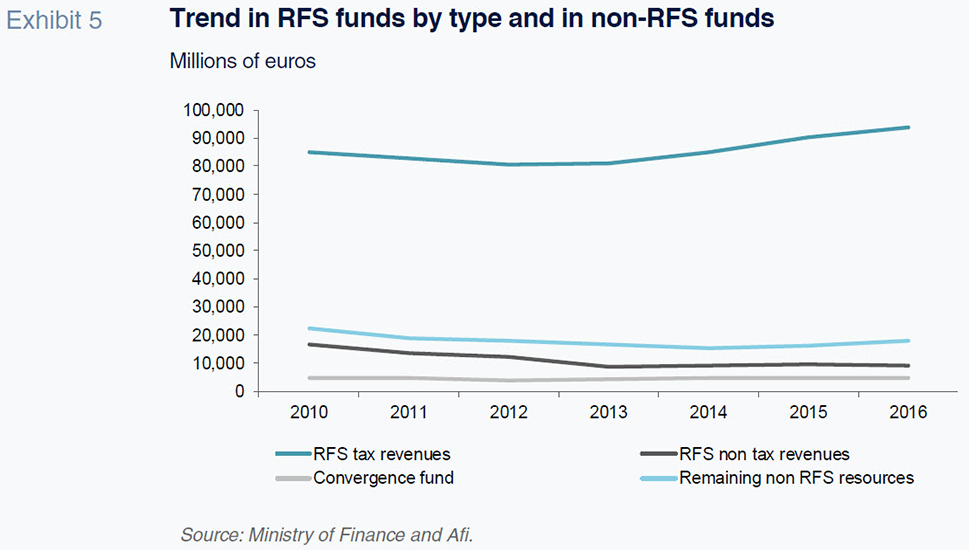

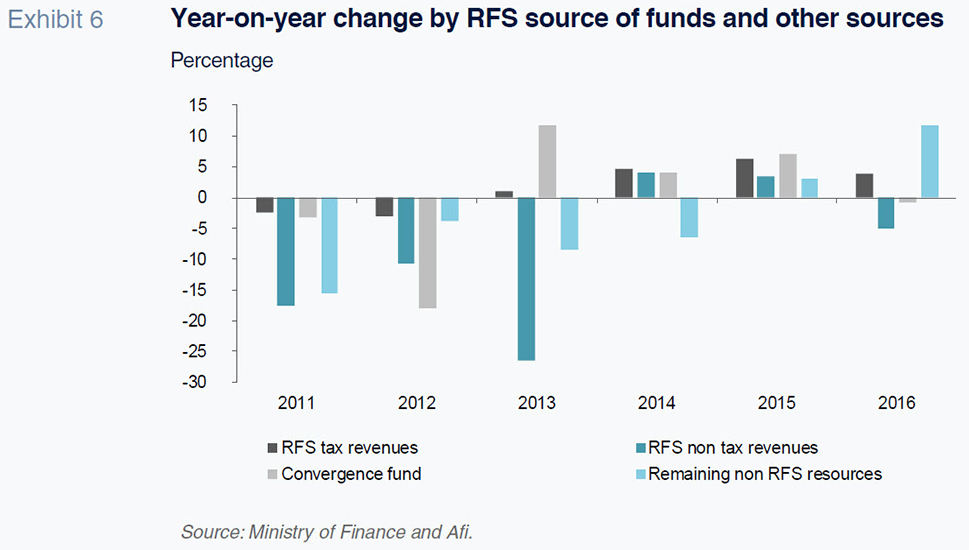

It is also important to consider whether this increase in funding has been accompanied by equivalent growth in the funds unconnected with the RFS (other taxes such as regional taxes, wealth tax, the levy on bank deposits, the Interterritorial Compensation Fund, grants, EU funding,

[8] etc.). As shown in Exhibits 4 and 5 below, the other sources of funds have been characterised by a more consistent downward trend. This was especially pronounced in 2011 and 2013, followed by a timid recovery in 2015 and a sharper rebound in 2016.

In terms of total funds (RFS and non-RFS), the regional governments have gone from having 128.9 billion euros of funding in 2010 to 125.6 billion euros in 2016. Although a big picture analysis shows a reduction of 2.6% in the years analysed, it breaks down into an average annual contraction of 4.8% between 2011 and 2013, followed by an average recovery during the next three years of 4.2% year-on-year.

Conclusion

The current regional financing system was due for its five-year review so that the Fiscal Policy Board could assess possible modifications. Allowing for a margin of at least one year for the preparation of ad-hoc studies, that review is at least three years behind schedule.

The regional governments and regional financing experts have used that extra time to perform multiple diagnoses and study possible reforms. Notably, this has been spearheaded not only from within the government, but also by think-tanks, the Permanent Assessment Committee and the Expert Committee. However, the key points surrounding future negotiations remain contentious. The first set of anticipated hurdles relate to the relationship between the state and regional governments. This is due to the imbalance between the two levels of government in terms of financing their respective competencies. The second set of hurdles has to do with the relationship among the regional governments with respect to the methodology for dispersing the funds: whether or not to abandon the status quo; the scope of any levelling (partial or total); and the new key variables (and their corresponding weights) in the adjusted population calculations for the financing of essential public services. The third challenge concerns the need to restructure the regional governments’ debt while keeping in mind the limitation posed by the risks associated with moral hazard.

Given the complications associated with it, the review’s delay is the most conservative course of action that could have been taken. That said, it does imply risks that should not be ignored. The main risk is that kicking the can down the road means negotiations will ultimately be tackled at a time when the economy may be less buoyant. Weaker growth prospects and the challenge of re-structuring the Social Security deficit would leave less room for the transfer of funds. Additionally, the longer the negotiations are delayed, the likelier they will coincide with an even more critical economic situation. This would make it harder to predict the dynamic performance of a new system, thus hindering the regional governments’ decision-making ability.

It therefore seems likely that a consensus around the system’s reform will emerge in piecemeal. There are not only negotiation risks to consider but also the issue of incentives. The current system generates positive effects during periods of economic expansion, which are particularly pronounced in the regions with greater fiscal capacity. Furthermore, the relative position of the regions is likely to shift as certain regions age and struggle to attract new residents. The ideal consensus may well consist of tackling more ad-hoc modifications for which agreement is assured and, simultaneously, weighing up a specific response to legacy under-funding, while maintaining the structural traits of the current system.

Notes

Recall that approval of the current financing regime (2009) brought an increase in regional government funds of around 11 billion euros with the idea of financing that transfer with the increase in the general VAT rate (2010). However, the intensification of the economic crisis in the early years of the new system prevented that mechanism from translating into higher funding. Instead, it merely mitigated a reduction in funding that would have been more severe in the absence of this new system.

Moreover, certain regions stood to lose out from the -albeit gradual- rollback of the status quo. Not to mention the likely confrontations over the new key allocation variables -adjusted population (and its relative weight)- as a result of the conflicting interests of regions with greater fiscal capacity (and populations) relative to those that are gradually losing population and/or whose populations are ageing.

Last year of definitive settlements.

The funds subject to regional transfer are obtained from payments on account and the settlements made two years later (personal income tax, VAT, business tax) and funds (the so-called Sufficiency Fund and the Fundamental Public Service Guarantee Fund). To visualise the impact on each budget, one has to take the payments made on account in the year in question plus the settlement paid, i.e., that corresponding to two years earlier. Note that the ‘Definitive funding’ series contains taxes that are traditionally transferred but not subject to settlement, which are estimated in regulatory terms.

The growth in the Canary Islands is attributable above all to changes in the Competitiveness Fund calculation.

“The changes in the state tax rates in respect of the duty on manufacturing and VAT shall determine the revision of the provisional or definitive Global Sufficiency Fund in the amount of the increase or decrease in tax revenue estimated for each autonomous region or city. That revision shall be made by the Ministry of Finance ex officio, without the need for approval from the Mixed Committees.”

The regions that presented a negative Global Sufficiency Fund have benefitted from the overall reduced weight of this source of financing.

That information is broken down quantitatively in the regional governments’ finance department reports until 2016 (last RFS settlement).

Susana Borraz. A.F.I. - Analistas Financieros Internacionales