Overlapping securities holdings across distinct financial sector actors: Spain versus the Eurozone

The interrelationship of the portfolios held by the various sub-sectors of the financial system has recently caught the attention of regulators tasked with overseeing potential sources of systemic risk. Close analysis of data shows not only a high degree of overlap in terms of investment strategy among these entities in both Spain and the Eurozone, but also an increase in the aggregate risk profile of the overall securities holdings of Spanish financial intermediaries.

Abstract: European regulators have begun to focus their attention on a new area of potential systemic risk in the region’s financial markets. Their concerns centre around the overlap of portfolios held by the four main types of financial sub sectors: banks, insurance corporations, investment funds and pension funds. European Central Bank data on the size and composition of these portfolios in both the Eurozone and Spain reveal a high degree of interconnectedness in the securities held by these four actors, indicating a significant source of potential systemic risk. Nevertheless, there were some notable differences in the composition of these portfolios in Spain versus the Eurozone as a whole. For example, Spanish banks are the major holders of securities in the country, whereas across the rest of the Eurozone, this asset is primarily held by investment funds. Moreover, in Spain, the heightened risk profile in financial markets originates largely from investment funds. These entities may not pose a risk to the solvency of the financial system as a whole, but through responses by investors, have the potential to trigger sudden market swings.

Introduction

In recent years, systemic risks across financial markets have increasingly been the focus of both regulators and financial supervisors. These risks originate within the various financial sub-sectors (banks, insurers, investment funds and pension funds) and can have implications for the broader financial system.

It is in this context that we see the creation of new supervisory institutions. These institutions are based on two prevailing models. The first consists of a sector-specific model currently used in Spain (i.e., separate bank, insurance and pensions and investment fund watchdogs). The second, known as the ‘twin peaks’ regime in the UK, splits the supervisory roles between a prudential supervisor and a conduct watchdog, each with responsibility over the full spectrum of banks, investment funds, insurers and pension funds.

With the publication of Royal Decree-Law 22/2018 on December 14th, Spain has become one of the most recent countries to establish an institution tasked with supervising systemic risk in financial markets. This law outlined macroprudential tools and included a period of public consultation on draft legislation for the creation of the so-called Financial Stability Council Macroprudential Authority.

The main purpose of this initiative is to oversee the systemic risk associated with various financial institutions, their interactions and pattern of conduct. Such institutions include banks, insurers, investment funds and pension funds. Because each institution collects and holds clients’ savings, the similar treatment of these funds could amplify the potential for systemic risk in the event of liquidity shocks in the main markets or assets in which those entities invest.

Overlapping investment strategies

It is against this backdrop that the European Central Bank’s (ECB) most recent Financial Stability Review highlighted the overlap of securities portfolios among the four categories of financial institutions: banks, insurance corporations, investment funds and pension funds. If those four main types of financial sector entities pursue primarily overlapping investment strategies, they are assuming the same type of market risk and thus amplifying systemic risk in the event of a sudden, sharp drop in those securities’ market prices.

The potential size of this source of systemic risk will depend on two factors. The first is the extent to which their investment strategies overlap. The second is the absolute size of the investment portfolios in the various subsectors.

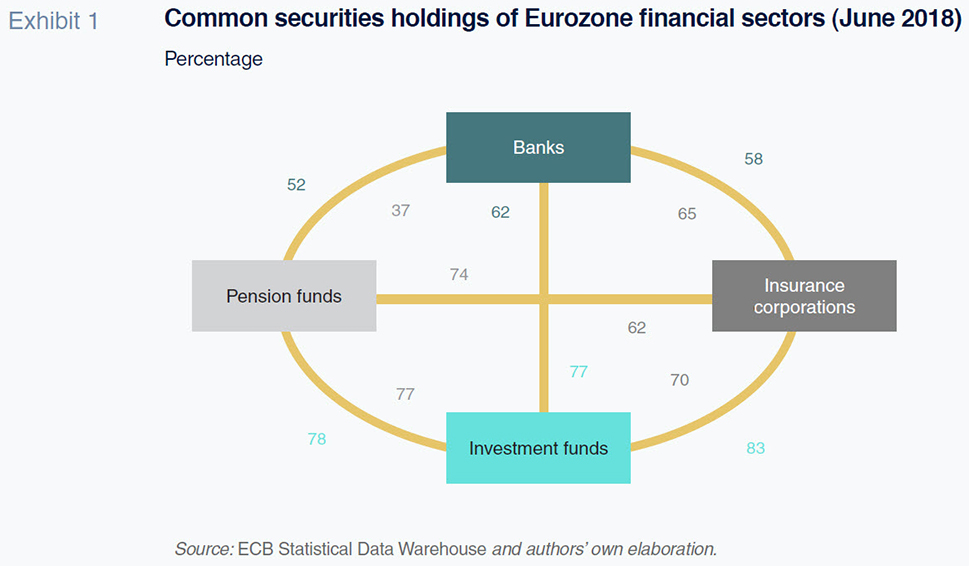

To assess the first effect, the ECB looked at the overlap in securities in the investment portfolios of the four categories of financial institutions. This analysis relied on data from June 2018, the results of which have been extracted from the report and are shown in Exhibit 1.

Each of the four entities is represented by a specific colour. Additionally, there are links joining each pair of sectors, which indicate the sum of the common holdings of the two Eurozone financial sectors. This is expressed as a percentage of total holdings of the sector and represented by the corresponding colour.

As an example, we will look at banks, which are depicted in dark blue. The exhibit tells us that of the total securities holdings of the banks, 58% corresponds with the holdings of the insurance corporations, 52% with pension funds, and 62% with investment funds.

Alternatively, if we analyse the securities held by the investment funds (depicted in ligher blue), we observe that of their total securities holdings, 77% overlap with those of the banks, 78% with those of the pension funds, and 83% with those of the insurers. The same logic can be followed for the insurance corporations and the pension funds.

Without getting into the details of which pairs of sectors present the highest levels of overlap, it is clear that the percentages of interconnectedness are very high in most of the pairings. This indicates a significant degree of overlap in the securities held by the various types of entities and, by extension, significant systemic risk, as they are exposed to market dynamics that are very similar in nature.

Securities holdings of banks, insurers and funds: Spain versus the Eurozone

Having observed the high level of overlap in securities holdings across the four categories of financial intermediaries, it is now necessary to round out the analysis with a quantitative estimate of the size of the portfolios. This exercise will provide insight into the possible systemic risk derived from these holdings.

To arrive at that estimate, we compare Spain with the Eurozone as a whole, using data taken from the Spanish economy’s financial accounts for the former and the ECB’s Statistical Data Warehouse for the latter.

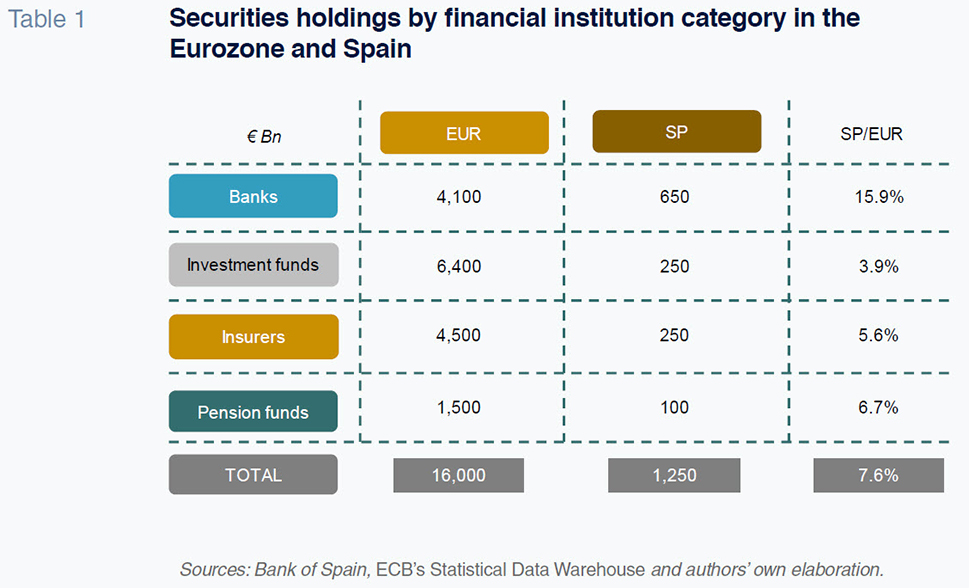

Table 1 sums up the estimated value of the securities holdings at year-end 2017 in each of the financial sectors for both Spain and the Eurozone. The figures are provided in billions of euros and the Spanish figures are also expressed as a percentage of the Eurozone total.

The figures are relatively high regardless of the parameter used to compare them. In the Eurozone, the financial institutions hold securities portfolios with an aggregate value of around 16 trillion euros, which is 1.5 times the size of the Eurozone’s GDP and over 80% of the total capitalisation of member states’ existing bond and stock markets. The last percentage is provided merely to give an idea of scale and should not be interpreted as an example of these entities’ dominance in the European securities markets. Non-European investors also invest in the European securities markets and European financial institutions also invest in markets outside of Europe.

By financial institution category, the investment funds have the largest portfolios (6.4 trillion euros), followed by the banks and insurers, with portfolios of just over 4 trillion euros each.

In Spain, the aggregate securities portfolios of the various financial institutions’ balance sheets totalled 1.25 trillion euros, which is 7.6% of the Eurozone total, and somewhat less significant in terms of GDP (1.2 times GDP in Spain vs. 1.5 times in the Eurozone) and securities market penetration (70% in Spain vs. 80% in the Eurozone).

Analysis of this data shows a key point of divergence between Spain and the Eurozone. In Spain, the banks are the major securities holders, with an aggregate position (650 billion euros) that exceeds the other three categories combined, in contrast to the Eurozone, where the investment funds are the biggest holders of securities.

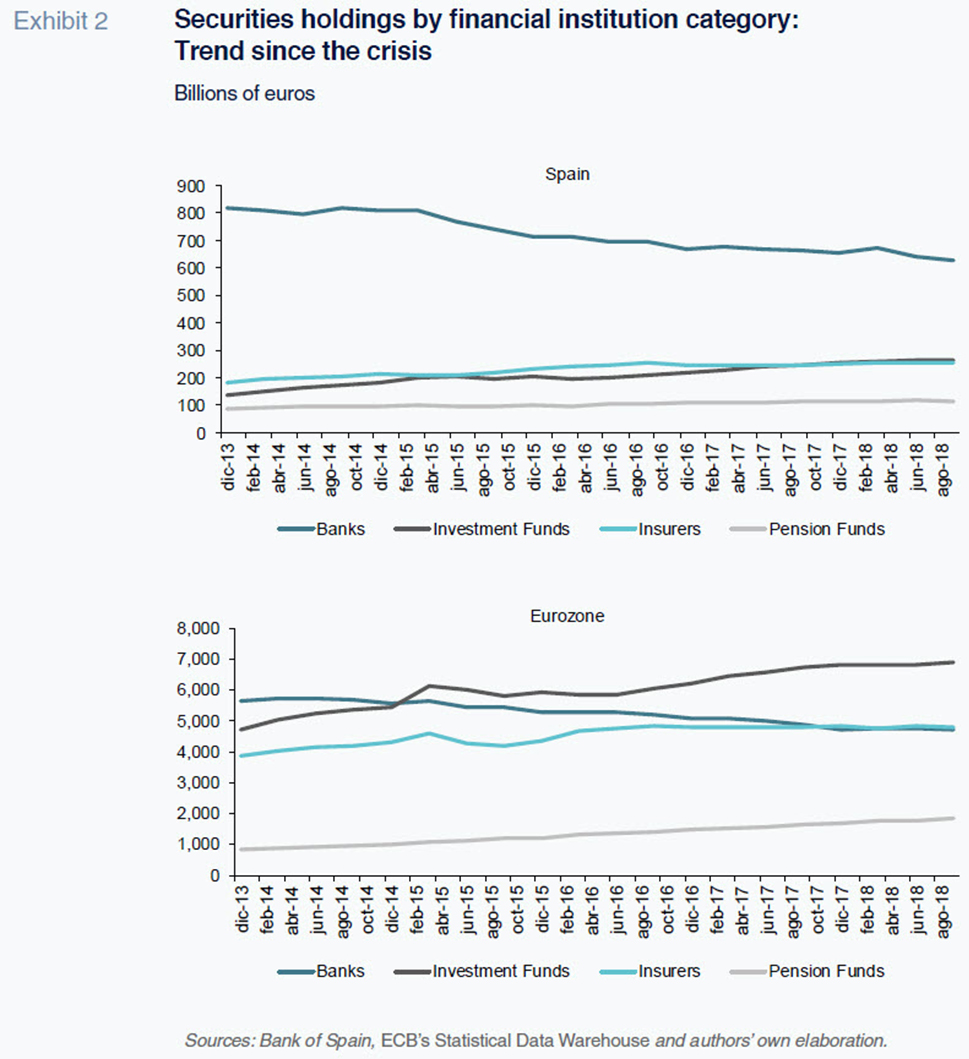

It should be noted that the role of the banks as investors in securities has declined considerably in recent years in both the Eurozone and Spain, with the latter seeing a more pronounced movement in this direction. This downward trend is largely attributable to the trend in fixed-income holdings, particularly sovereign bond portfolios. Between 2013 and the middle of 2018, the fixed-income assets on the banks’ balance sheets have contracted by 25% in the Eurozone and 40% (200 billion euros) in Spain. The country’s banking system played an essential role as a primary purchaser of Spanish government bonds at the height of the financial crisis when foreign investors largely fled the market.

Recently, the market for sovereign bonds has rebounded, which coupled with the impact of the ECB’s asset buyback programmes, has exerted strong downward pressure on both public and private bond yields, making this asset class less attractive to the banks. The fact that these trends have been magnified in Spain explains the relatively greater drop in fixed-income assets, and by extension, securities holdings among the Spanish banks.

That reduction in the banks’ securities holdings coincided with an expansion of the investment funds’ portfolios. In fact, investment funds in the Eurozone have now surpassed the banks as the biggest holders of securities. Although the Spanish banks continue to hold the primary position in the securities markets, the investment funds have narrowed the gap. This is driven by a shift of household savings to investment funds from banks, thereby increasing the value of the former’s assets under management.

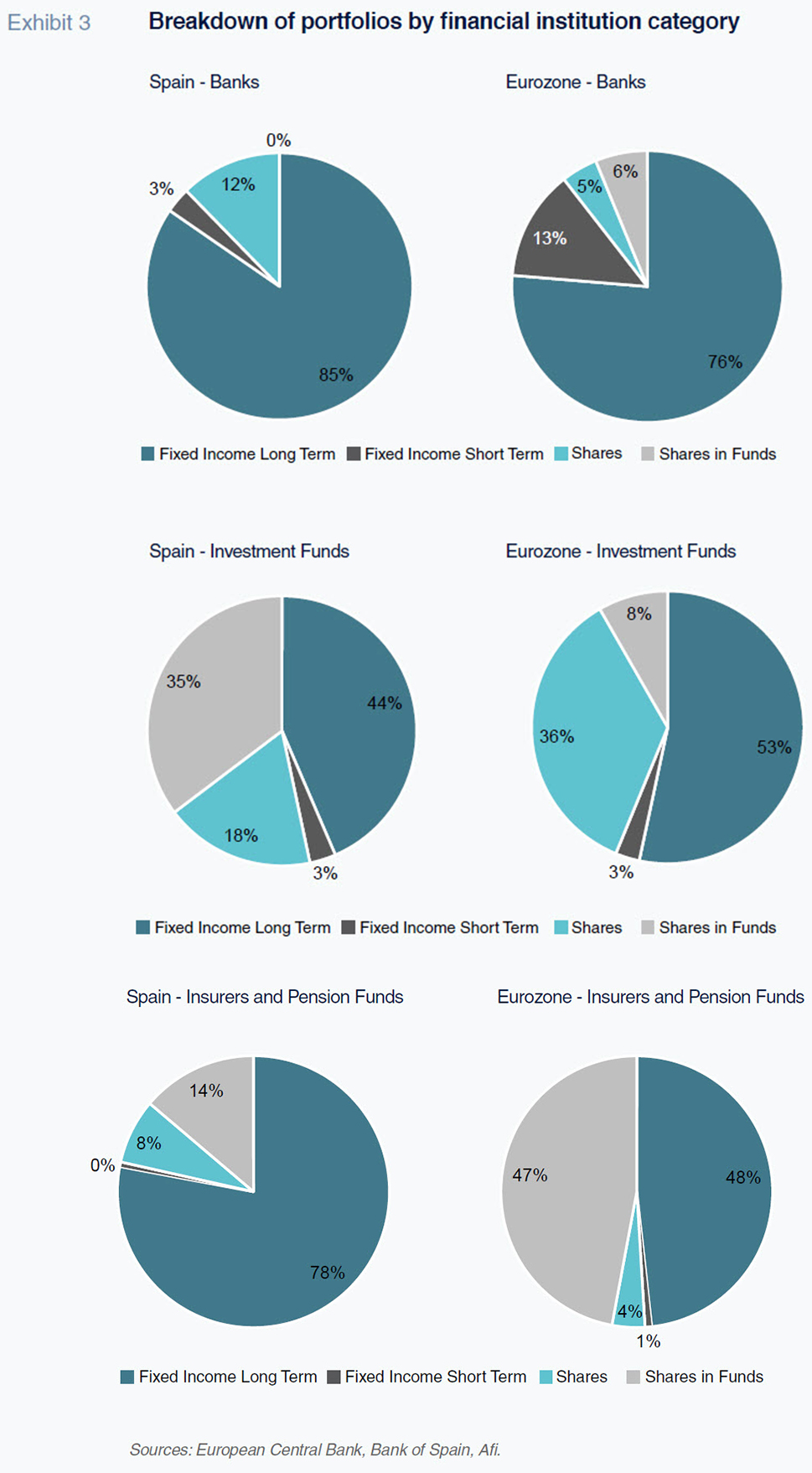

It is logical to suppose that the shift in the relative weights of the various financial intermediaries’ securities holdings will impact the overall allocation of invested assets. If this is indeed the case, they may follow different investment strategies. That is what we have attempted to show by comparing the aggregate composition of the various portfolios. This comparison distinguishes the major classes of assets included in these entities’ financial statements including short-term fixed-income securities, long-term fixed-income securities, equities, and investments in investment funds (both fixed-income and equity securities).

Although we have the relevant data for each of the four financial subsectors in Spain, we do not have a breakdown for the insurance corporations and pension funds for the Eurozone. These two entities are combined in the same category, which we have replicated for the Spanish analysis. Note that the aggregation of those two types of entities barely translates into a loss of information because the make-up of the insurers’ and pension funds’ portfolios is very similar.

That nuance aside, Exhibit 3 illustrates the composition of the holdings of the three categories of financial institutions in Spain and the Eurozone. This analysis reveals a clear difference in investment focus. The banks’ securities holdings are strongly biased towards fixed-income securities in both Spain (85%) and the Eurozone (76%) with Spanish banks holding somewhat longer-dated paper. The banks’ propensity to invest in fixed-income securities makes sense given that these portfolios are used to managing interest rate risk derived from banks’ various balance sheet headings. Equities do not play that same role and the risk profile of this asset class makes them less appropriate, particularly in the new capital framework (Basel III), which assigns very high capital requirement weightings to equity holdings.

The tendency to invest in fixed income is also evident among both the insurance companies and pension funds, albeit less pronounced compared to the banks (78% in Spain and 48% in the Eurozone). Conversely, investment funds’ portfolios are generally balanced between fixed income and equity securities, either directly or through investments in other investment funds.

Given these differences in investment patterns, it becomes clear that the aggregate risk profile of the overall securities holdings of the Spanish financial intermediaries has increased. That heightened risk profile is primarily attributable to the investment funds, unincorporated vehicles whose market risk is assumed by their investors. This means that the systemic risk associated with these positions does not impact the solvency of the system as a whole but has the potential to affect the responses by fund investors to sudden market swings.

This is another area on which the ECB has focused in its most recent Financial Stability Review. Specifically, it concludes that the sensitivity of investment fund subscription and redemption flows to market movements is currently quite low (correlation of around 0.2), but that the trend is likely pro-cyclical, in which case it could amplify sudden market movements.

References

BERGES, A., PELAYO., A. and ROJAS, F. (2018). Spain’s bank-sovereign nexus (II): Perspectives from the banking sector. Spanish and International Economic & Financial Outlook, 7(5), pp. 29-38. Funcas.

ECB (2018). Financial Stability Review, November.

Ángel Berges and Fernando Rojas. A.F.I. - Analistas Financieros Internacionales