The Spanish banking sector in 2020: Renewed risks

A lower for longer rates outlook, together with an increased regulatory burden and limited demand for credit, weighed heavily on Spanish banks’ profitability in 2019. For 2020, it remains to be seen whether recently announced stimulus measures by both the Spanish government and the ECB can help banks mitigate some of the adverse impact of emergent external shocks, in particular Covid-19.

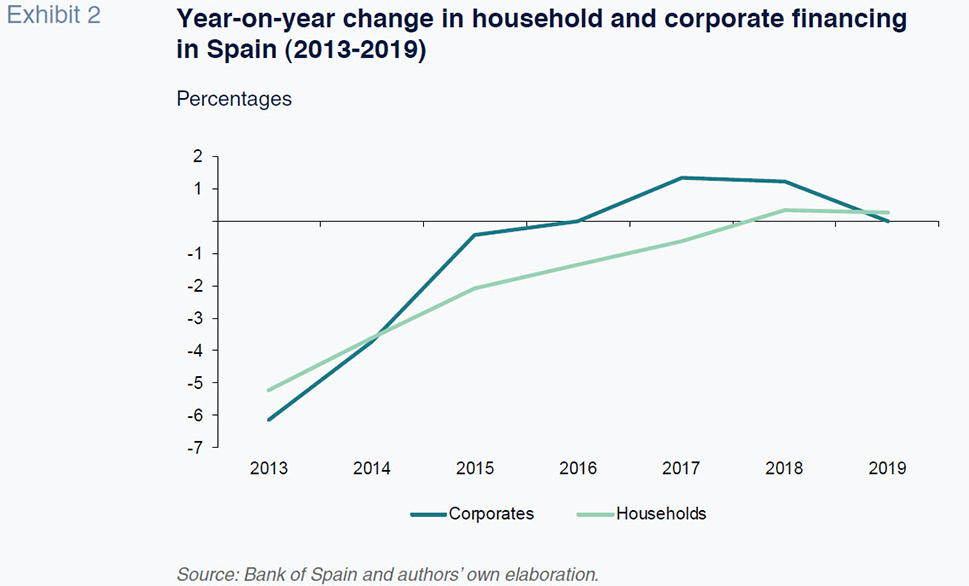

Abstract: 2019 was a challenging year for the Spanish banking sector, as was the case for most European banks. The downward revision to macroeconomic forecasts and the associated shift in monetary policy, prolonging the outlook for ultra-low rates, was largely responsible for the fact that Spain’s six largest banks saw their aggregate net profit decline by 18.4% to 13.59 billion euros in 2019. That correction, which was in line with the dip observed in the rest of the eurozone, in conjunction with cross-cutting geopolitical and structural shocks (trade and technology tensions, respectively) and ad hoc developments of an unforeseen magnitude (particularly the Covid-19 virus) are having a very adverse impact on the banking industry’s market value. The large-scale measures approved by the Spanish government, particularly those related to an ambitious financing and public-private guarantee scheme, together with the measures announced by the ECB –a 750 billion euro asset purchase programme for the eurozone– are intended to mitigate this impact. The difficulties facing banks are not confined to the impact interest rates are having on asset prices, but also the issues being encountered in driving business volumes. On the one hand, regulatory pressure is considerable and loan approval policies are particularly cautious. On the other hand, demand for credit remains limited. That explains why, despite the low level of interest rates and NPL ratios of well below 5%, year-on-year growth in private sector financing remains stagnant. Specifically, financing for households increased by just 0.26% year-on-year last year, while corporate lending inched just 0.01% higher, down significantly from growth of 1.26% in 2018. Spanish banks continue to face considerable difficulties in 2020. There are several potential drivers of bank profitability, such as improved efficiency/asset quality, as well as investor perceptions of undervaluation. However, it remains to be seen whether or not some of the recent, unforeseen shocks will prove transitory, potentially dissipating in the coming months.

Introduction

It is difficult to reach cruising altitude in a context where unforeseen challenges continue to materialize. That is what would appear to be the case of the banking sector. Every time sector stock prices and profits are expected to begin their recovery, the materialization of delays or impediments alter those expectations. The Spanish banks are no exception. Even in the face of this difficult environment, their profit generation has been relatively stable in recent years. Nevertheless, as with most of the sector in Europe and beyond, profitability remains the most pressing challenge. One of the biggest obstacles recently encountered by the sector was the shift in monetary policy direction in 2019. What in mid 2019 looked like an anticipated increase in interest rates, ended up as a prolongation of the prevailing expansionary measures and zero or negative rates policies

[1]. However, monetary obstacles were not the only stumbling blocks. The value ascribed by the market to Europe’s banking industry is suffering from geopolitical factors and a significant downturn in macroeconomic prospects related to Covid-19.

In the first quarter of 2020, economic instability and trade tensions have left a particular mark on emerging economies, including some in Latin America, where Spanish banks’ interests are especially significant. There also remains some uncertainty about how the financing and liquidity markets will function post Brexit, although the supervisory authorities have gotten ahead of the main concerns, announcing plans to fine-tune certain measures before the end of the transition period, currently scheduled for the end of this year. However, the biggest unexpected development affecting the banking sector and, in general, valuation and economic expectations in the first quarter, and presumably well into the second, has been the emergence of the coronavirus originated in Wuhan (China). Its spread beyond China and, specifically in Europe, triggered sharp share price corrections towards the end of February and above all in March, from which the banks were not immune. The ultimate impact of the pandemic remains uncertain. What is clear is that all sectors (with very few exceptions) will suffer a significant decline.

Leaving these risks aside, the start of 2020 was also marked by certain regulatory announcements. Specifically, the European Banking Authority (EBA) announced additional details regarding the upcoming round of stress tests scheduled for this year, the results of which were to be published on July 31

st.

[2] The methodology had been published in November 2019 but additional important details were announced on January 31

st, including the macroeconomic scenarios to be modelled. This will be the EBA’s fifth set of stress tests. As with the last two rounds, they will not be articulated around a ‘pass or fail’ threshold. The philosophy underlying that approach is for the results of the tests to serve as an input for the supervisor –the European Systemic Risk Board (ESRB)– as part of its Supervisory Review and Evaluation Process (SREP).

The baseline scenario contemplates cumulative growth in GDP in the eurozone of 3.9% between 2020 and 2022, with unemployment stable at 5.3% all three years. In keeping with the concerns regarding the prolongation of expansionary monetary policy measures, it is worth highlighting a new assumption modelled by the EBA, specifically the possibility in the adverse scenario that rates will remain at historically low levels, described as the ‘lower for longer’ narrative. In the adverse scenario, GDP is forecast to notch up a cumulative contraction of 4.3% between 2020 and 2022, making it the most severe scenario contemplated to date. The ‘lower for longer’ rates assumption increases the severity of the scenario due to the sudden change in expectations that any financial shock can produce in this context, given that, as the EBA itself states, investors may be ‘not fully pricing in’ risk within this environment. The adverse scenario also assumes that unemployment in the eurozone would increase by 3.5 percentage points by 2022, that the advanced economies’ stock indices would correct by 25% over that timeframe and that real estate prices would fall 16%.

The Spanish banks’ results

The last quarter of 2019 was a dampener for expectations for the European banking industry, with Spanish banks being no exception. The confirmation that monetary policy would remain extraordinarily expansionary was a negative development for banks whose funding costs in the current environment are very close to the rate earned by lending, impeding the banks’ basic function of taking short-term deposits and lending longer term. The decision to extend the quantitative easing measures was attributable to the persistence of low inflation and the downward revision to European growth prospects- particularly, in certain economies such as Italy’s, where the banking sector’s relative weakness is very pronounced by comparison with other eurozone countries.

The economic climate is largely responsible for the fact that the six largest Spanish banks reported an aggregate net profit of 13.59 billion euros in 2019, down 18.4% from 2018, as is shown in the first panel of Exhibit 1. It is important to note that when monetary policy took another twist, investors reacted by repricing the banking sector. That repricing affected all of Europe. Moreover, that has been the trend prevailing in recent years: the performance in the Euro Stoxx Banks index (second panel of Exhibit 1) is closely correlated to the Spanish banks’ earnings performance. As noted in earlier papers written by us for this publication, many in the analyst community have said repeatedly that a significant number of the Spanish banks are somewhat undervalued in the stock market but the monetary policy shifts and economic projections have been working against the expected recovery.

Covid-19 aside, the difficulties facing the banks are not confined to the impact interest rates are having on asset prices but also the issues being encountered in driving business volumes. On the one hand, because regulatory pressure is considerable and loan approval policies are particularly cautious. On the other hand, because demand for credit remains limited. That explains why the year-on-year growth in private sector financing remains stagnant, despite the low level of rates (Exhibit 2).

Although no longer contracting, as was the case between 2013 and 2017, growth was lower in 2019 than in 2018. Specifically, financing for households increased by just 0.26% year-on-year last year, while corporate lending inched just 0.01% higher, down significantly from growth of 1.26% in 2018.

Even though they are finding it hard to generate income, Spanish banks continue to improve their asset quality. Indeed, the drop in non-performance is one of the most noteworthy developments of late. Exhibit 3 illustrates, in the first panel, the volume of private sector credit outstanding and non-performing assets. Between 2013 and 2019, the balance of credit outstanding to other resident sectors declined by a cumulative 18.4%, but non-performing assets contracted by 71.7% over the same timeframe. In the second panel of Exhibit 3, we see that as of December 2019, the banks’ non-performance ratio stood at 4.78%, the lowest level since September 2009 and far below the highs of close to 14% in 2013.

Current situation and prospects

Spanish banks continue to face considerable challenges in 2020. In recent years a lot of their efforts have gone into managing the legacy from the Great Recession. On the one hand, by addressing non-performance. On the other hand, from a more ideological standpoint, attempting to tackle the not always proportionately allocated blame for the crisis and the ramifications on their image. In parallel, it has become apparent, as has been embraced by the sector itself, that, as with most service providers, financial intermediation services are destined for digitalisation, underpinned by lighter cost structures.

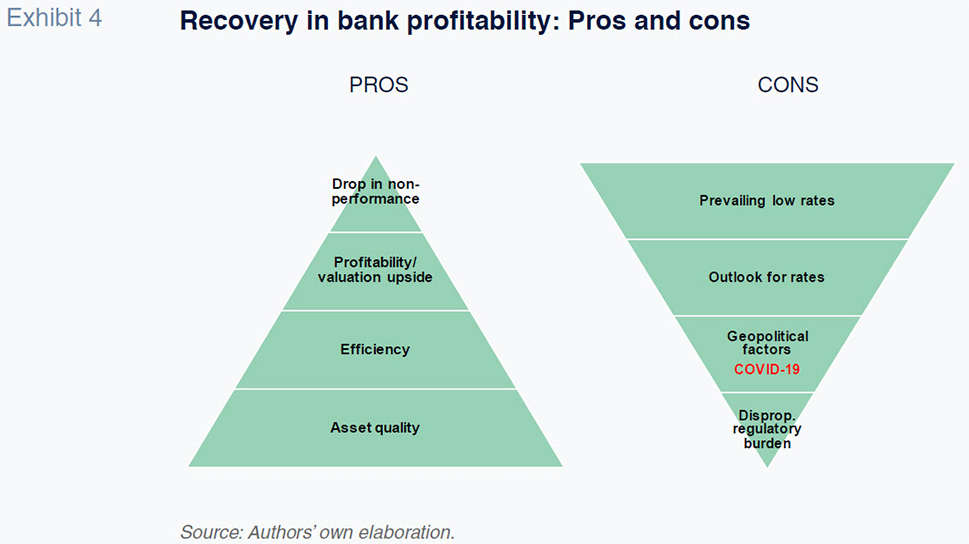

Exhibit 4 lists the pros and cons faced by the banks in terms of making up some of the ground lost profitability-wise. The stark reality of the current situation calls for an initial assessment of the cons. The expansion of the coronavirus, Covid-19, a phenomenon affecting most sectors, adds negative downward pressure for the banks in a year in which they were hoping to see their share prices start to recover. The hit taken by the banks’ market values has been very significant. At the time of writing this article, both the Spanish government and the ECB have announced very sizeable plans for tackling this crisis in which the banks will be required to play a leading role. Upcoming editions of this publication will cover the impact of Covid-19 on the financial sector’s activity and the impact of the mitigating policies put into place.

Taking a longer-term perspective, the banks have strengthened their position thanks to the asset quality effort and drop in non-performance in recent years. Also, the cost-to-income efficiency presented by the Spanish banks in the European context is a long-standing comparative advantage; and, as a corollary, underpins a positive long-term assessment by most investors. There are other factors in play, however, that have been pushing back materialisation of those favourable longer-term prospects. Nevertheless, monetary conditions, referred to above, are in a category of their own, due to the low absolute level of rates but also the expectation that they are not likely to change significantly for a protracted period of time. Elsewhere, the regulatory burden. There is general agreement –even across financial sector players– that the regulatory reforms undertaken in the wake of the crisis included many measures that were necessary to restoring financial stability and confidence in the longer-term. However, compliance is beginning to become a bureaucratic burden, sometimes overlapping, and not always reasonable. Specifically, a new financial transactions tax for banks does not seem to be an optimal solution. It is important to note that in addition to paying their corporate income tax like any company, the banks have to make sizeable contributions to the deposit guarantee scheme (1.1 billion euros in 2019). That regulatory framework is, moreover, generating a competitive disadvantage vis-à-vis other current and potential competitors from the worlds of FinTech and BigTech.

Notes

For an extensive review of the effects of negative interest rates on the banking sector and, in general, the European financial system, refer to the Funcas report, “Intermediation below zero: The effects of negative interest rates on banks’ performance and lending”, by Santiago Carbó Valverde, Pedro Cuadros Solas and Francisco Rodríguez Fernández:

https://www.funcas.es/docsInst/Ibz.pdf

Note that at the time of writing this article, the EBA had just announced its decision to delay the stress test exercise until 2021 to allow banks to focus on operational continuity.

Santiago Carbó Valverde. CUNEF, Bangor University and Funcas

Francisco Rodríguez Fernández. University of Granada and Funcas