Spanish economic forecasts panel: March 2020*

Funcas Economic Trends and Statistics Department

GDP growth forecast for 2020 trimmed to 1.5% due to COVID-19

According to provisional figures, GDP growth accelerated slightly in the last quarter of 2019, with a rebound in exports offsetting a lower contribution from domestic demand. On the basis of this data, 2019 GDP growth would stand at 2%.

The indicators available for the first two months of the year are, in general, weak. However, none of them so far reflect the impact of the coronavirus: the IPI and confidence indicators point to a slowdown, with the exception of a recovery in the PMI and social security contributor numbers in February. The consumer spending and services indicators, particularly those related with tourism, similarly indicate a slowdown.

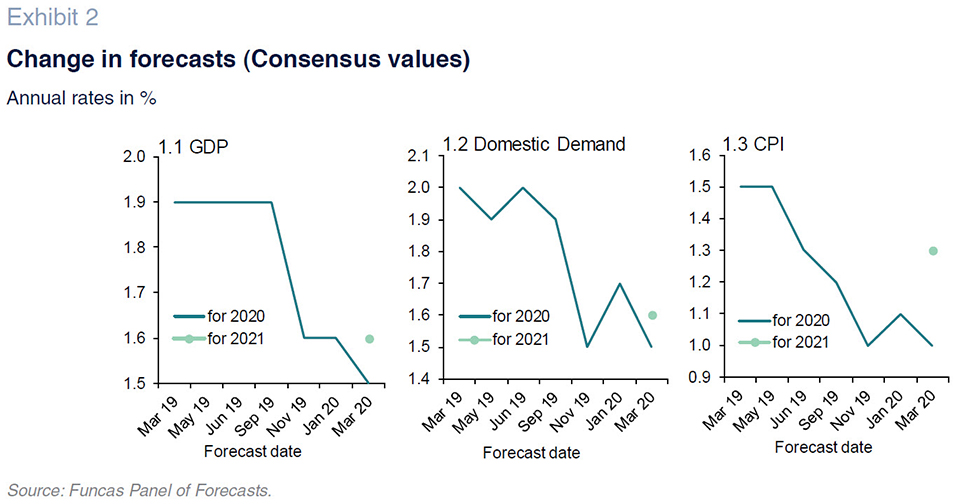

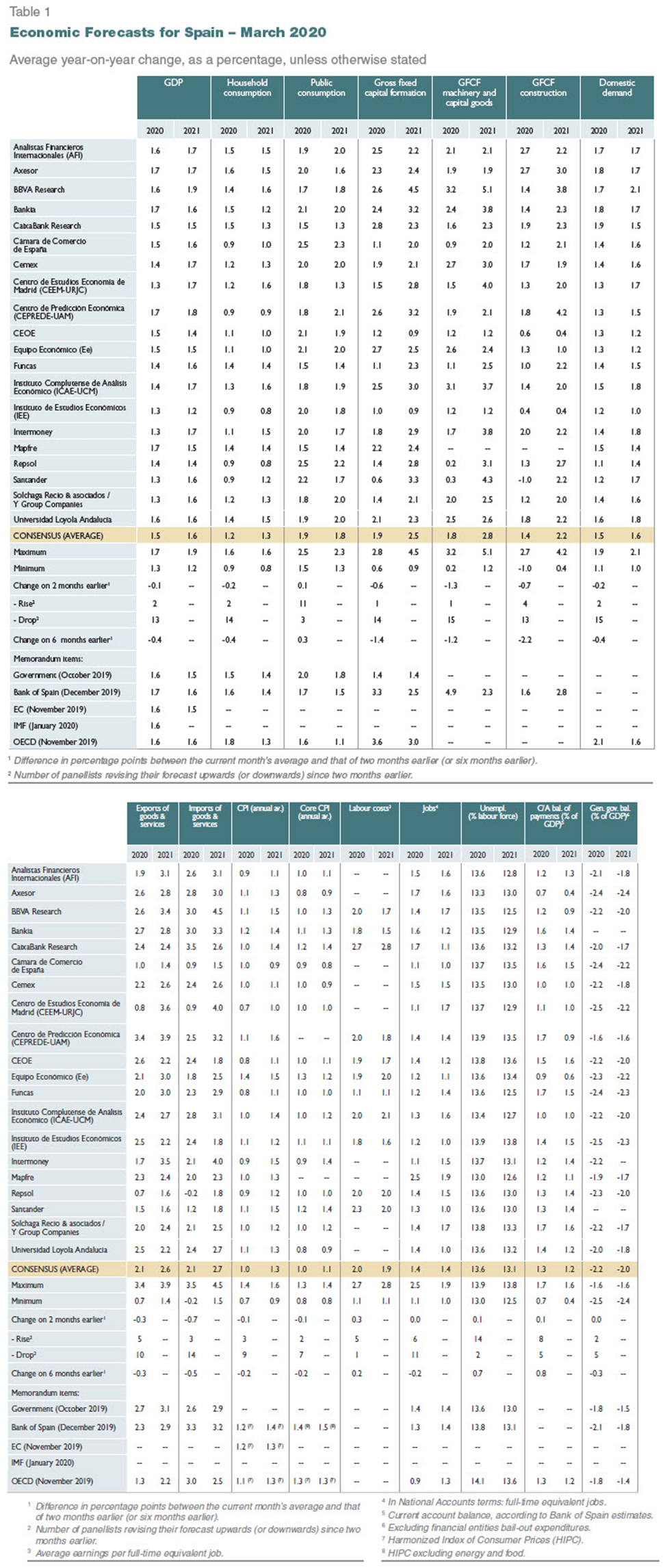

The consensus forecast for 2020 is for GDP growth of 1.5%, down 0.1 percentage points from the last Panel forecast. Of the 13 analysts who revised their forecasts downwards, 11 said they had done so on account of the impact they expect COVID-19 will have on the economy.

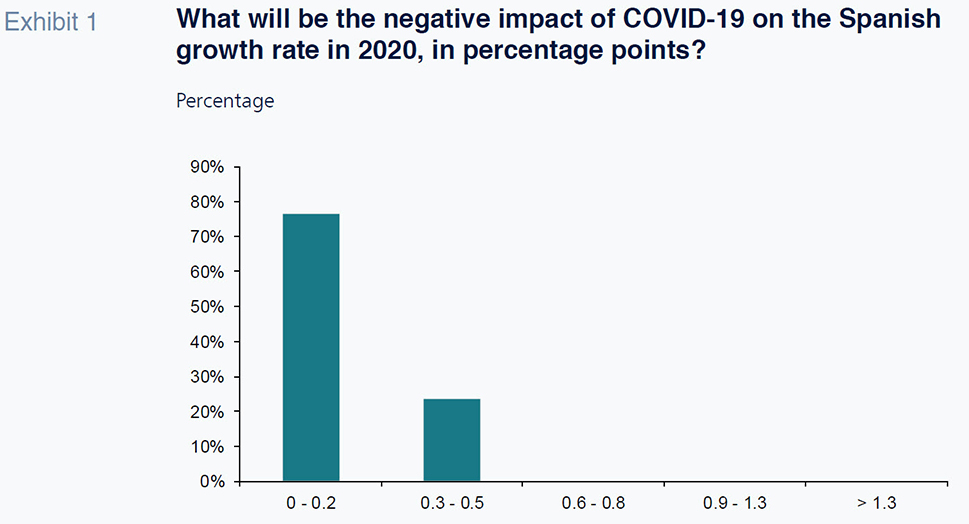

[1] Some panelists said they had not yet factored the outbreak into their forecasts, so that there is downside risk to this estimate vis-à-vis the upcoming May Panel. Seventy-seven percent of the panelists believe that the virus will erode annual GDP growth by 0.2 percentage points or less; the remaining 23% expect an impact of between 0.3 and 0.5 percentage points (Exhibit 1).

As for the quarterly breakdown, the consensus forecast is for growth of 0.3% in the first quarter, 0.2% in the second quarter and 0.4% in the last two quarters of the year. Note that two of the analysts think the Spanish economy will contract in the second quarter.

Domestic demand is expected to contribute 1.5 percentage points (down 0.2pp from the January forecasts), while trade is expected to have a neutral impact (compared to -0.1pp in January). The downward revision to the forecast for growth in investment, particularly machinery and equipment, stands out. The forecast for household consumer spending has been trimmed by 0.2 percentage points, while the estimate for public spending has been raised by 0.1 percentage points.

The forecast for 2021 is 1.6%

This was the first survey asking panellist for 2021 forecasts. The panelists are looking for GDP growth of 1.6% in 2021, up 0.1 percentage points from 2020. They are expecting even growth of 0.4% each quarter (Table 2).

Growth is expected to accelerate slightly in 2021 on the back of a higher contribution by domestic demand, driven mainly by a rebound in investment, expected to ease in 2020. As in 2020, foreign trade is expected to have a neutral impact on growth.

Inflation expected to edge slightly higher in 2021

The year-on-year rate of inflation has decreased since the start of the year and is hovering at around 0.8%. Oil prices, meanwhile, having ended 2019 at around $70 per barrel, have started the year on a downward trajectory, trading at $54 per barrel by mid-February. That correction has been exacerbated in recent days with the expansion of COVID-19 and higher production in Saudi Arabia – oil is currently trading at around $36 per barrel.

Inflation is expected to continue to trend lower until the start of the second quarter. The current forecast is for an annual average rate of 1%. As for 2021, inflation is expected to pick up to 1.3%; however, it is worth highlighting the lack of consensus in this respect, with the forecasts ranging from a low of 0.9% to a high of 1.6%.

The year-on-year inflation rate forecasts for December 2020 and December 2021 are 1.2% and 1.3%, respectively (Table 3).

Moderate job growth

According to the most recent social security contributor numbers, the slowdown in job creation observed towards the end of 2019 continued in January; although the February figures were unexpectedly strong, a change in trend is not anticipated. Sector-wise, it is worth noting that the manufacturing sector has barely been creating jobs for the past several months.

In terms of full-time equivalent jobs, growth is estimated at 1.4% in 2020, unchanged with respect to the last Panel, and 2021. Those rates of growth would translate into the net creation of around 260,000 jobs each year.

Using the forecasts for growth in GDP, job creation and wage compensation yields implied forecasts for growth in productivity and unit labour costs (ULC): the former is expected to increase by 0.1% in 2020 and by 0.2% in 2021, while ULCs are forecast to increase by 1.9% in 2020 and a further 1.7% in 2021.

The average annual rate of unemployment is expected to continue to fall to 13.6% this year (0.1pp above the last set of forecasts) and to 13.1% in 2021.

External surplus expected to persist in 2020 and 2021

According to the provisional figures, the current account surplus amounted to 23.9 billion euros in 2019, up 2% year-on-year.

The consensus forecast is for a continued current account surplus throughout the projection period: 1.3% of GDP in 2020 (up 0.1pp from the last survey) and 1.2% in 2021.

The public deficit looks set to narrow, albeit missing the targets

In the first 11 months of the year, the deficit at all levels of government except for the local corporations amounted to 20.7 billion euros, up 18% year-on-year. The deterioration was concentrated at the regional governments, which went from recording a surplus to a deficit over that time horizon, more than offsetting the improvement in the Social Security Funds. At the central government level, the deficit was very similar in both periods.

The analysts are forecasting a reduction in the deficit in 2020 to 2.2% of GDP (unchanged from the last set of forecasts) and again in 2021 to 2%, which would be 0.4 and 0.5 percentage points above the government’s targets, respectively.

Substantial deterioration in the external climate

The global economy is reeling from the impact of the health crisis which has spread from China to every continent. In February, Chinese manufacturing PMI fell to its lowest level in the series, pointing to a severe contraction in the sector with important ramifications for the rest of the world. Global supply chains have suffered, triggering supply shortages in numerous sectors. In addition to that supply-side shock, which has been particularly harsh in the most affected economies, such as Italy, the spread of COVID-19 has sparked a loss of investor confidence, a stock market decline not seen since the days of Brexit and a sharp correction in oil and other commodity prices. The pandemic has also curtailed the freedom of movement and tourism.

In its most recent published outlook, the OECD cut its forecast for global growth in 2020 by 0.5 percentage points; forecasts for the eurozone were cut by 0.3 percentage points, which would leave growth in the region at a scant 0.8%. Those forecasts assume that the pandemic will be brought under control in the coming months. If the crisis were to endure beyond the summer, global economic growth would be eroded by 1.5 percentage points and the eurozone would go into recession.

Against that backdrop, the panelists have become more pessimistic in their outlook for the external environment, in both the EU and more broadly at the international level. Compared to the January panel, the number of negative assessments of the current economic situation in Europe and globally has increased. The analysts have similarly become more pessimistic about the outlook for the coming months. In contrast to the last Panel, more than half of the analysts now believe the international context will either remain unchanged or deteriorate rather than improve.

Monetary policy set to remain expansionary

Monetary policy is expected to remain markedly expansionary. The outlook for the ECB’s benchmark rates and its public and private asset purchase programmes (the PSPP and CSPP programmes) has not changed since January. In addition, in her recent statements, ECB President Christine Lagarde has expressed concerns regarding the risks implied by the coronavirus crisis for growth and financial stability, opening the door to new liquidity measures which may be announced shortly, in additional to the large stimulus package announced on March 18th.

Given the prospect of further monetary easing, 12-month EURIBOR has traded lower, by about 0.1 percentage points since January, to -0.35%. The yield on the 10-year bond remains at low levels, although the spread over the equivalent German sovereign bond (the country risk premium) has widened as a result of growing investor appetite for safe-haven assets in light of the prevailing uncertainty.

The analysts unanimously agree on the expansionary nature of monetary policy. In addition, one in four panelists expect the ECB to introduce new stimulus measures imminently, such as cutting the rate on the deposit facility to -0.6%. The yield on the 10-year bond is barely expected to move in the next few months and is forecast at 0.4% at the end of 2020, down 0.1 percentage points from the last set of forecasts. 12-month EURIBOR is expected to remain in markedly negative territory for the entire forecast horizon, at similar readings to those forecast in January. The majority of analysts believe that the prevailing accommodative monetary policy is what the Spanish economy needs right now (similar stance to that expressed in January).

Euro appreciation against the dollar

The euro has appreciated against the dollar since the last Panel, in the wake of pronounced monetary easing by the Federal Reserve, in contrast to the status-quo-stance taken by the ECB (pending decisions to be taken at the next meeting of its Governing Council). The analysts believe that the current exchange rate could prevail until the end of 2020, going on to appreciate slightly in 2021.

Greater diversity of opinion about fiscal policy

There are signs of a shift in the analysts’ assessment of fiscal policy. While a solid majority of the panelists still view it as expansionary, their opinion about the direction fiscal policy should take is changing: the number of analysts who believe it should be expansionary is increasing as the number calling for tighter policy is diminishing.

The Spanish Economic Forecasts Panel is a survey run by Funcas which consults the 20 research departments listed in Table 1. The survey, which dates back to 1999, is published bi-monthly in the months of January, March, May, July, September and November. The responses to the survey are used to produce a “consensus” forecast, which is calculated as the arithmetic mean of the 20 individual contributions. The forecasts of the Spanish Government, the Bank of Spain, and the main international organisations are also included for comparison, but do not form part of the consensus forecast.

Notes

The cut-off date for the panelist forecasts captured within this panel may not reflect the full impact of the extension of COVID-19. The expansion of the virus globally, and in particular within Europe, since the last set of panel forecasts was recorded has led to the declaration of a state of emergency within the US and several EU countries. This may lead to further deterioration of growth expectations for a prolonged period of time, even heightening the risk of recession in some of these regions. It is too early to estimate the exact magnitude of the negative impact from COVID-19 and related events - at this stage we do not know the length that such emergency measures will remain in place, nor whether or not COVID-19 will be transient or a longer-term shock. However, we think it is important to point out the emergence of these new significant downside risks and their potential implications.