Two episodes of collapse in Spanish exports: The health crisis vs. the financial crisis

Similar to the effects observed during the financial crisis, COVID-19 has significantly disrupted global export markets, with Spain’s total exports and number of exporting firms having fallen during the lockdown. Looking forward, any recovery in Spain’s export sector will depend on the duration of uncertainty and number of firms who survive the crisis.

Abstract: Export markets have been hit hard by COVID-19, which necessitated lockdown measures across numerous countries. In this context, it is useful to analyse the specific effects on Spain’s export industry and compare them to those experienced in the financial crisis, or Great Recession. From March through June 2020, total exports as well as the number of exporting firms fell. However, closer analysis shows that while the collapse in Spanish exports was widespread, it was primarily driven by a drop in the value of goods exported by Spain’s most active exporters. This group includes the nearly 27,000 firms that exported in any of the 12 months prior to both the lockdown and financial crisis. Notably, in both periods, the intensive margin explains more of the contraction in exports, though it is slightly less significant in explaining the lockdown contraction (91% during the lockdown

vs. 100% during the financial crisis). During the lockdown, product and destination mixes were hurt more and there has been a higher number of exiting firms than during the financial crisis. This suggests Spain will experience a tougher recovery this time relative to that observed in the wake of the previous crisis, if the current health crisis causes a prolonged period of uncertainty.

[1]

Introduction

Global economic activity contracted in 2020 mainly due to the uncertainty and the loss of confidence associated with the COVID-19 pandemic and the attendant measures, such as the mobility restrictions, introduced by various countries to mitigate its effects. In this paper, we analyse the trend in Spanish goods exports during the months of lockdown in Spain (March to June 2020) and compare it with the same months of 2009, when Spanish trade collapsed in the wake of the international financial crisis. One of the novelties of the present analysis lies with the comparison made for the group of exporting firms that sustained both international trade shocks.

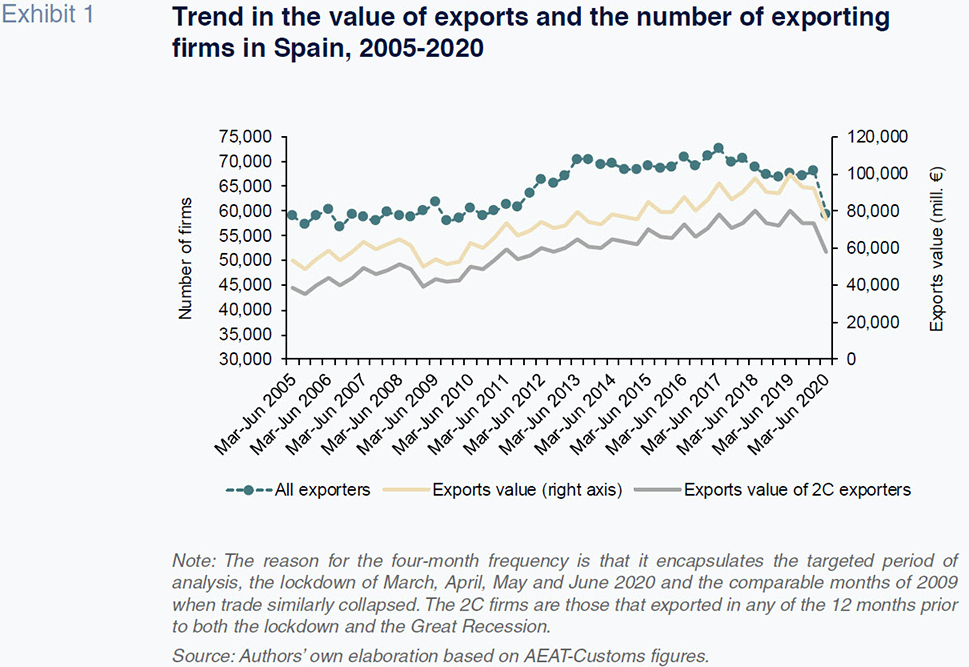

Exhibit 1 illustrates the sharp contraction in the value of total exports between March and June 2020 (down 28.1% year-on-year), following a period of sustained growth that lasted nearly a decade. During the lockdown, the number of exporting firms fell abruptly (by 12.7% compared to the same four months of 2019). The number of firms that exported during the lockdown was 59,452, a level not seen in a decade.

[2]

Exhibit 1 also depicts the trend in the value of exported goods by the 26,976 firms that exported in any of the 12 months prior to both the lockdown and the Great Recession. This subset of firms is referred to as “2C”, denoting the fact that they lived through the two crises. That subset represents on average close to 50% of exporting firms and 80% of the total value of goods exported. The 2C firms therefore boasted extensive experience as exporters before they were locked down. The year-on-year decline in the value of exports by this subset of experienced exporters was 32.1%, with the number of 2C exporters down 12.5%. Those figures demonstrate that the collapse in Spanish exports during the lockdown, albeit widespread, was primarily driven by a drop in the value of the goods exported by Spain’s most active exporters.

[3]

The rest of this paper is structured in three parts. We first measure the extent to which the intensive and extensive margins contributed to the overall drop in exports in both periods. We then repeat that analysis for the firms accounting for the top 1% in each period and for the companies that have suffered during both crises (the ‘2C’ firms). This is a new analytical approach and enables a comparison of the incidence of both shocks on the same subset of companies. Thirdly, we analyse the trends in aggregate exports at the product and destination levels in order to identify characteristics that set the 2020 shock apart from that of 2009.

Trend in exports and export margins

In this section, we calculate the growth margins for Spanish exports before and during the lockdown and financial crisis. We do so first for the entire universe of firms and then for just those active during both trade shocks. We do so using the methodology put forward by Bernard et al. (2009), which breaks down the growth in the value of exports during a given period into three components: (i) the net entrance of new exporters; (ii) diversification in incumbent exporters’ portfolio of products and destinations; and, (iii) variation in the value of existing export relationships. The first two represent the extensive margin, while the third factor represents the intensive margin.

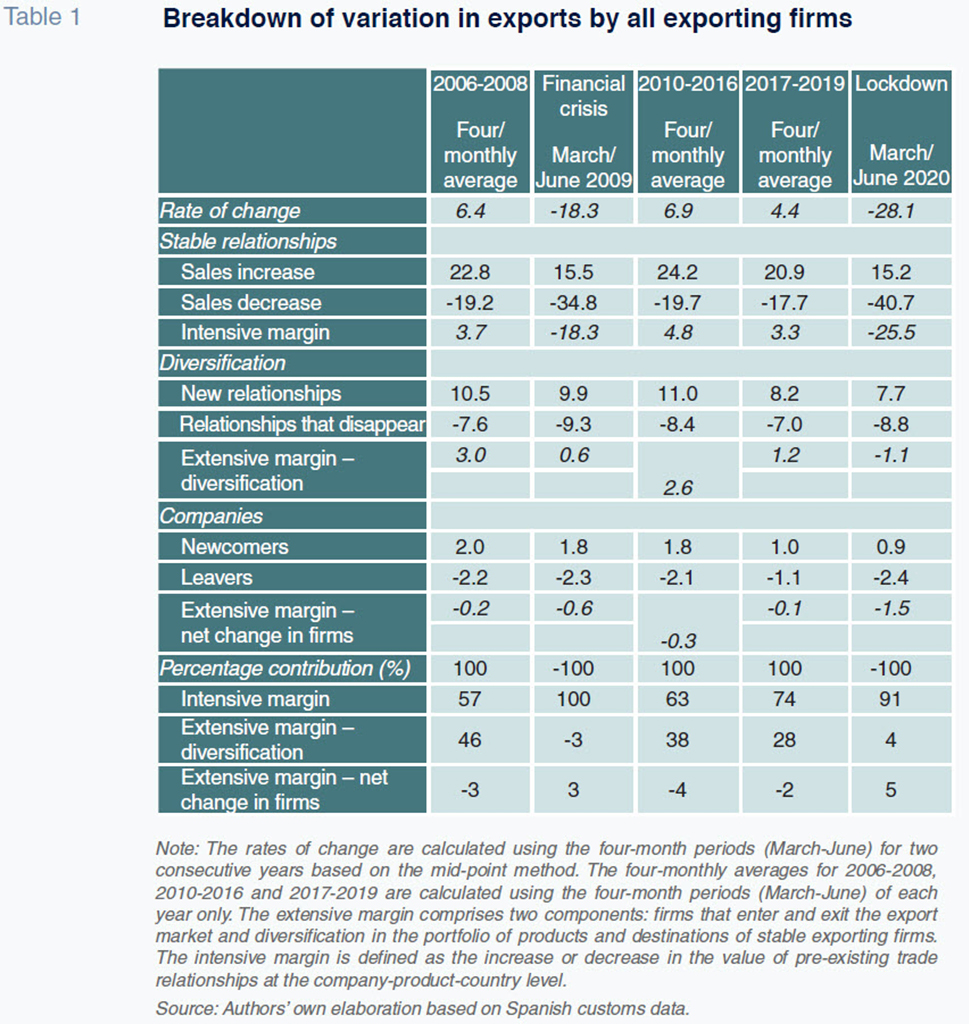

Table 1 presents the contribution made by each margin to the year-on-year change in four-monthly exports before and during the lockdown and the financial crisis. During the lockdown, exports fell by 28.1% y-o-y compared to average growth of 4.4% between 2017 and 2019 and of 6.9% between 2010 and 2016. Conversely, the contraction during the financial crisis was smaller, at 18.3%, compared to growth during the previous years of 6.4%. It is therefore evident that during the first four months of the pandemic, the impact on exports was greater than during the financial crisis of 2009.

In both periods, the intensive margin explains more of the contraction in exports. That said, it is slightly less significant in explaining the lockdown contraction (91% vs. 100%). The extensive margin explains 9% of the drop in exports during the lockdown: 4 percentage points due to reduced portfolio diversification and 5 percentage points due to the net decline in exporting firms. During the financial crisis, the extensive margin had zero impact on the decline in exports. Specifically, the 3-percentage-point drop attributable to the net outflow of companies was offset by a 3-percentage-point increase in the portfolio diversification of stable exporters.

Comparing the contribution by the six components, without offset, to the contraction in exports between periods reveals three clear differences that explain the bigger contraction observed during the lockdown: (1) established trade relationships whose export sales value fell did so to a greater degree (-40.7% during lockdown vs. -34.8% during financial crisis); (2) the value of exports in new product or destination pairs registered lower growth (7.7% vs. 9.9%); and, (3) the value of exports by newcomers registered lower growth (0.9% vs. 1.8%).

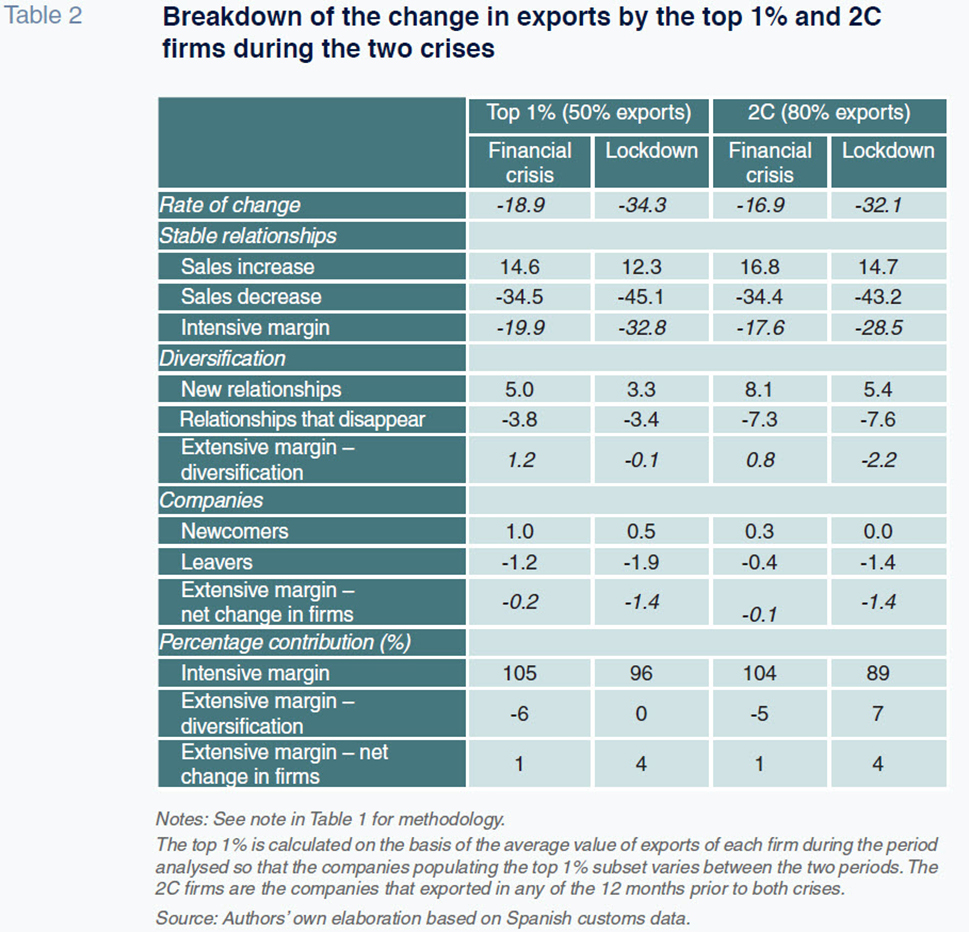

Given that the intensive margin is largely responsible for the drop in exports during both the lockdown and the financial crisis, we believe it is important to analyse the trend in exporting activity by the firms most responsible for that contraction. To that end, Table 2 presents the contribution by each of the margins to the year-on-year change in exports in the two crises for two subsets of companies: (i) the firms responsible for the top 1% of export volumes (50% of all exports according to Bricongne

et al.); and, (ii) the firms that have lived through both crises (the so-called 2C firms, which represent 80% of total exports).

The contraction in exports among the top 1% (-34.3%) and 2C firms (-32.1%) exceeded the aggregate fall in exports (-28.1%) during the lockdown. During the collapse in international trade in 2009, however, the differences were smaller: the overall decline was 18.3%, compared to contractions of 18.9% in exports among the top 1% and of 16.9% for the 2C firms. As we saw for the overall universe of exporters, the drop in exports is similarly attributable to the decrease in sales in stable trade relationships (intensive margin). That being said, in the lockdown, all components experienced net declines, whereas during the financial crisis, product and destination diversification had a net positive effect.

Trend in exports by sector and country

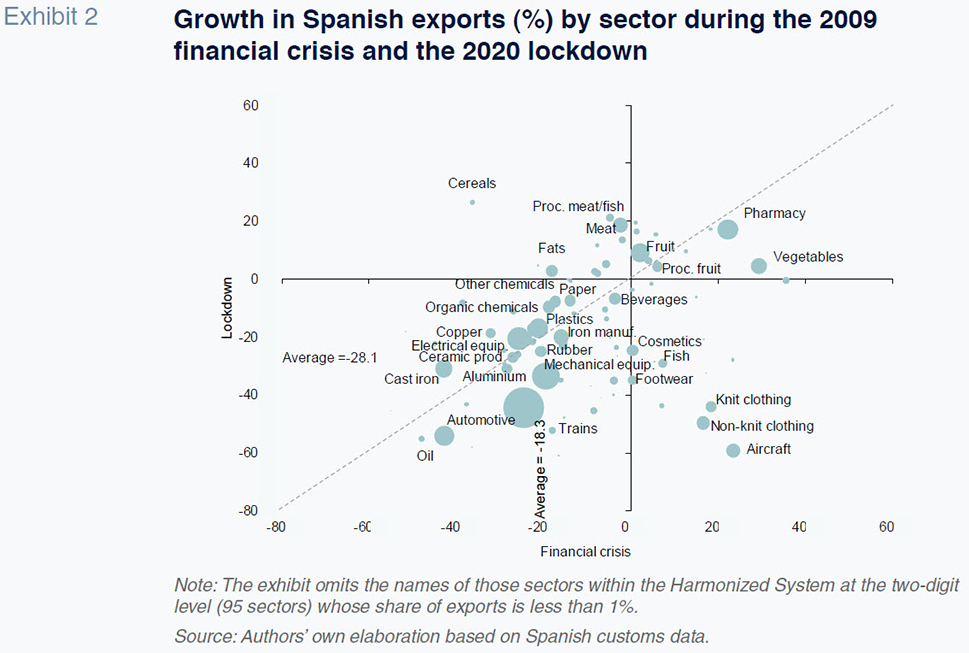

In this section, we analyse the different impact the 2020 lockdown has had by sector and country compared to the financial crisis of 2009. Exhibit 2 shows those sectors that sustained a similar performance during the lockdown (x-axis) and during the financial crisis (y-axis). The size of the bubbles represents the weight of the sector in Spanish trade. The lower left quadrant shows the sectors whose exports fell the hardest during both crises. As expected, the highest number of sectors falls within this quadrant, although most have sustained bigger contractions during the lockdown than during the financial crisis (points below the 45-degree dotted line). On account of their weight in Spanish exports, the automotive sector (whose exports fell by twice as much during the lockdown) and the fuels sector stand out, followed by electric and mechanical equipment.

There are some sectors whose exports contracted during the lockdown but grew during the financial crisis (lower right quadrant). For example, the textile and footwear sectors, indicating a drop in demand for consumer outdoor goods in 2020. That same line of reasoning explains the drop in exports of cosmetics and beauty products during the lockdown compared with the financial crisis.

There are also sectors whose exports grew during lockdown. The upper left quadrant shows the sectors whose exports contracted during the financial crisis but grew during the lockdown: cereals, fresh meat, and processed meat and fish products. Lastly, the upper right quadrant presents the counter-cyclical sectors, i.e., sectors whose exports rise when trade is generally contracting. That group again includes food products (fruit, processed fruit products, vegetables) and pharmaceutical products.

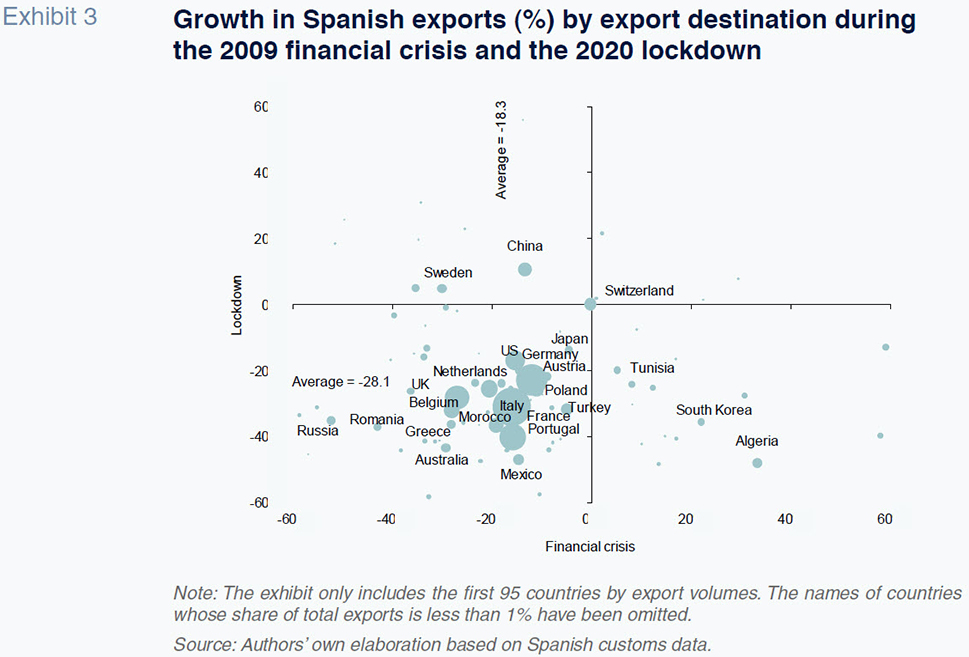

Exhibit 3 shows the change in Spanish exports during the lockdown and financial crisis by country. With the odd exception, Spain’s main export destination markets are concentrated in the lower left quadrant. The contraction in Spanish exports to its main trading partners (France, Germany, Portugal, Italy and Morocco) was greater during the lockdown than observed in the financial crisis. Except for Russia, Romania and the UK, exports to the rest of Spain’s trading partners have also fallen by more during the lockdown than during the financial crisis. In the lower right quadrant, there are two countries —South Korea and Algeria— to which exports registered strong growth during the financial crisis but a sharp contraction during the lockdown. Lastly, it is worth highlighting China and Sweden (upper left quadrant), destinations which increased their imports of Spanish goods during the lockdown but not during the financial crisis.

Conclusions

The momentum observed in Spanish exports since 2010 has been interrupted by the spread of COVID-19 and the lockdowns imposed on populations throughout Spain’s export destination markets between March and June 2020. The most recent data available show that the lockdown has had a greater adverse effect on Spanish exports than the collapse in trade in 2009. Granular analysis of the exports of goods by the companies that have lived through both crises corroborates that finding.

In both crises, the change in the value of stable trade relationships (i.e., the intensive margin) is responsible for most of the contraction. That tells us that the recovery will depend on the activity of a few large companies (the top 1% accounts for 50% of the value of Spanish exports and the firms that have experienced both crises account for 80%).

The extensive margin has played a bigger role in the drop in exports during the lockdown than during the financial crisis, due to both the net decline in exporting firms and the contraction in the number of export products and markets. Given that the extensive margin accounts for a high percentage of growth over the medium- and long-term (Lucio et al., 2011), this margin’s negative trend during the lockdown increases the risk of slower growth in exports over the long-term than was observed following the financial crisis.

As long as the pandemic persists, global growth will suffer, with adverse consequences for exports in all countries. Unfortunately, governments have adopted policies to fight the pandemic (e.g., restrictions on individual mobility, protectionism, etc.) that are not conducive to a recovery in global trade. In Spain, this trend is exacerbated by a smaller contribution by the extensive margin in recent years compared to that observed during the initial period of growth in exports.

Although it is difficult to predict in what condition Spain’s export sector will exit this crisis, a full recovery in exports is plausible so long as Spain maintains a sufficient number of exporting companies.

Notes

We would like to thank the Spanish Tax Agency’s Department of Customs and Duties for access to their export figures. We would also like to express our gratitude for the financing received from the Spanish Ministry of the Economy and Competitiveness (RTI2018-100899-B-I00, co-financed by FEDER), the Basque regional government’s Department of Education, Linguistic Policy and Culture (IT885-16), the Universities of Alcalá and Santander (2019/00003/016/001/007) and the regional government of Valencia (GVPrometeo 2018/102).

In March 2020, the number of exporters fell to 51,995, the lowest reading in the entire series. During the lockdown, companies were offered the possibility of postponing their intrastat reports, which may have weighed on the monthly statistics tracking the number of exporters.

The number of 2C firms changes quarterly as some do not export every quarter.

References

BERNARD, A. B., JENSEN, J. B., REDDING, S. J. and SCHOTTt, P. K. (2009). The margins of US trade. American Economic Review, 99(2), pp. 487-493. .

—. BRICONGNE, J., FONTAGNÉ, L., GAULIER, G., TAGLIONI, D. and VICARD, V. (2012). Firms and the global crisis: French exports in the turmoil. Journal of International Economics, 87, pp. 134-146..

—. DE LUCIO, J. and MÍNGUEZ, R. (2008). ¿Cuáles son las fuentes de crecimiento del comercio exterior? [What are the sources of growth in trade?]. ICE Economic Bulletin, 2946, pp. 23-31.

DE LUCIO, J., MÍNGUEZ, R., MINONDO, A. and REQUENA, F. (2011). The extensive and intensive margins of Spanish trade. International Review of Applied Economics, 25(5), pp. 615-631.

—. (2017). Los márgenes del crecimiento de las exportaciones españolas antes y después de la Gran Recesión [Growth in Spanish exports before and after the Great Recession]. Estudios de Economía Aplicada, 35(1), pp. 43-62.

—. (2018). Is Spain experiencing an export miracle? Spanish Economic and Financial Outlook, Vol. 7, No. 4, July 2018.

Juan de Lucio. University of Alcalá

Raúl Mínguez. Spanish Chamber of Commerce and Nebrija University

Asier Minondo. Deusto Business School

Francisco Requena. University of Valencia