The impact of the pandemic on Spain’s housing market

Although home purchases and prices have fallen as a result of COVID-19, it is unlikely that the market will experience a collapse. However, the recovery may be uneven across regions and types of property, with low interest rates and lower average prices relative to peer countries supporting the market in Spain’s urban areas.

Abstract: The health crisis is affecting the real estate sector, albeit moderately considering the scale of the economic shock. According to the most recent data available at the time of writing this article, home purchases are 33% below pre-COVID levels. Prices have also been affected, falling by close to 1.2% in August. Nevertheless, all signs suggest that unless the economy is once again locked down in response to the second wave of contagions, the market is not on the verge of collapse. Demand is being underpinned by current and anticipated low interest rates and the scarcity of attractive investment alternatives for buyers. Another factor pointing to a limited correction in prices in Spain is their relatively low level by comparison with other European countries and the rest of the world. In 2020 as a whole, average prices are expected to contract by between 5% and 8% (considerably less than the contraction anticipated for the overall economy - 13%), going on to stabilise in the first half of 2021 and start to recover thereafter. The trend is, however, likely to be uneven across regions and types of property.

Introduction

The Spanish economy has been one of the hardest hit by the pandemic due to its high exposure to those sectors most dependent on human contact and mobility, as well as shortcomings in the response to the crisis (Torres and Fernández, 2020). In the past, the real estate market has tended to overreact to economic developments, particularly when recessions have been preceded by bubbles, raising the issue of whether the same pattern will prevail in the aftermath of the current crisis.

The goal of this article is to outline the main trends in the housing market since the onset of the pandemic and draw some conclusions about the outlook for the months to come. The analysis builds from the comparative analysis completed at the end of 2019, which detected solid signs of resistance notwithstanding the clear symptoms of slowdown (refer to Ocaña Pérez de Tudela and Torres, 2019).

Transaction volumes are sharply down since the onset of the pandemic

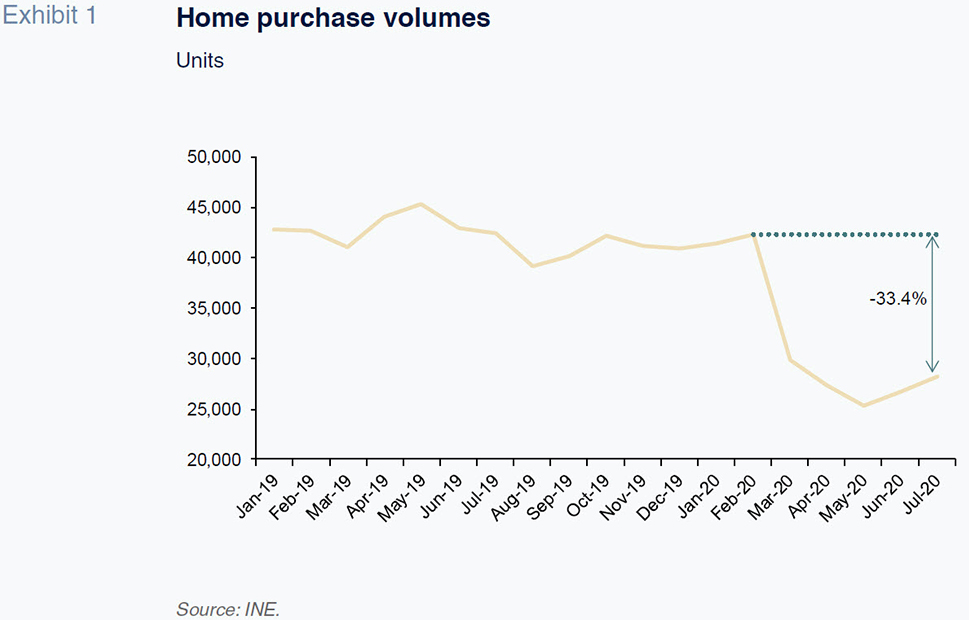

Transaction volumes have fallen sharply since the start of the COVID-19 crisis. House purchases sustained an abrupt contraction of around 40% between mid-March and May. In June and July, the market recovered, although only very slightly, such that July transaction volumes were still 33.4% below pre-crisis levels (Exhibit 1).

However, new home mortgages, having also fallen sharply at the onset of the crisis, have rebounded more vigorously, and were just 7% below pre-crisis levels by July. The difference in the trends for new mortgages and transactions is unusual, suggesting that it could be attributable to a lag in solicitor or property registration on account of the lockdown (transaction volumes track sales placed on record with the property registries). If that were the case, it would mean that the impact of the pandemic on demand for housing has thus far proved moderate, having overcome the interruption induced by the lockdown.

Supply has recovered since the end of the lockdown

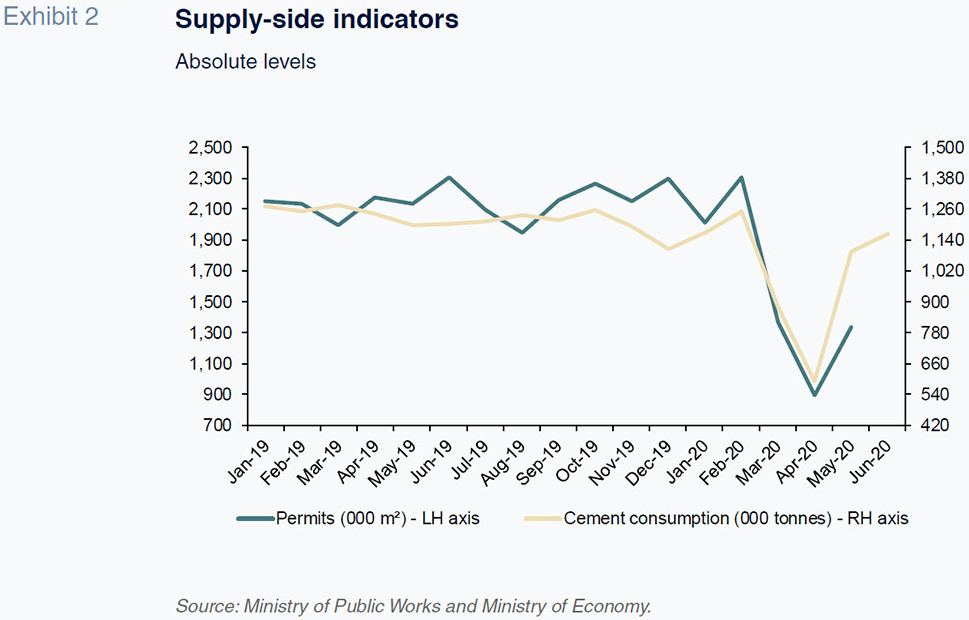

On the supply side, construction virtually shut down in March and April but has since rebounded sharply. Construction jobs have recovered quickly (faster than in any other sector), as has cement construction, which, having fallen by half in April, was virtually back at pre-pandemic levels by June (Exhibit 2). Another positive indicator can be found in the sales recorded by the major construction and developer firms, which in July were back at just 5% below pre-crisis levels. New works permits also fell sharply in March and April but in May (the last month for which this indicator is available), were already showing signs of recovery.

The overall snapshot suggests that the contraction sustained during the lockdown may be temporary, such that the permanent impact on the market should be moderate. Some kind of fallout is inevitable given the impact on GDP and unemployment. Furthermore, the level of uncertainty generated by the health crisis will continue to influence households’ investment decisions.

Prices are suffering but so far not by much

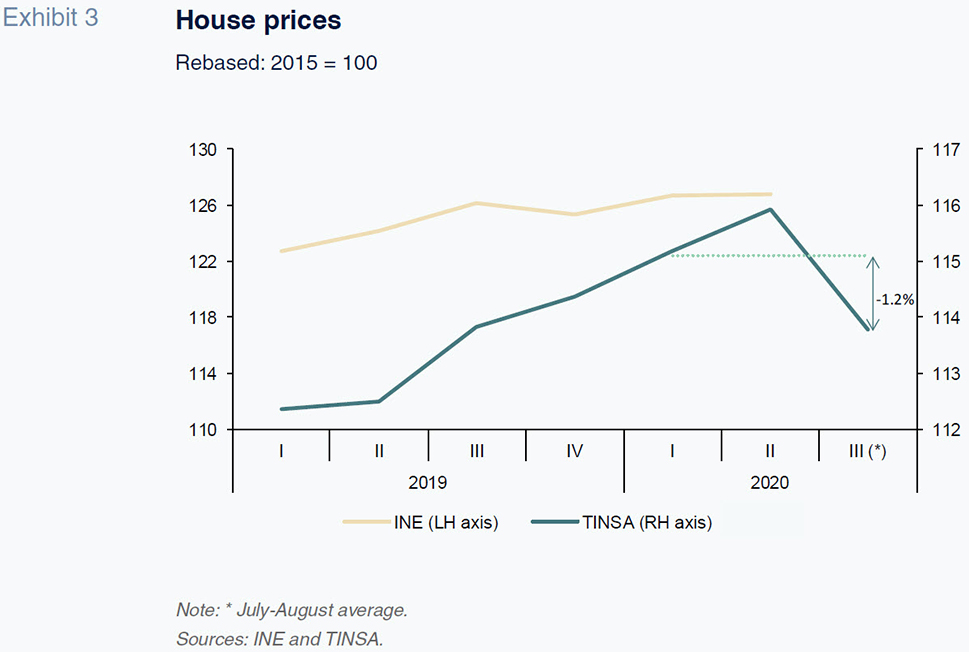

Prices actually increased in the second quarter according to appraiser TINSA and the national statistics office INE, despite the contraction in transaction volumes. Conversely, the Ministry of Public Works’ numbers point to a second-quarter price drop (Exhibit 3). TINSA’s numbers show prices correcting in July and August, however. The recovery in transaction volumes since June suggests that the price correction may well prove limited in scale and duration.

A number of factors leads us to believe that, unlike what we have seen in previous economic crises, the impact of this recession on house prices is going to be limited, by which we mean of a smaller scale than the contraction in GDP. The first factor is the cautious attitude of sellers who, anticipating a recession of limited duration, are likely to postpone the sale of their houses rather than sell at lower prices. Secondly, the fact that interest rates are low and are expected to remain so in the medium-term acts as a support for prices. Thirdly, abundant liquidity and the lack of attractive investment alternatives for buyers are also stimulating demand. Another factor pointing to a limited correction in prices is their relatively low level by comparison with other countries in Europe and the rest of the world (Ocaña Pérez de Tudela and Torres, 2019). Lastly, the Spanish market is trending in line with what we are seeing in other European markets, where prices are similarly displaying a degree of resilience in a context of sharply falling transaction volumes (refer to Knight Frank, 2020).

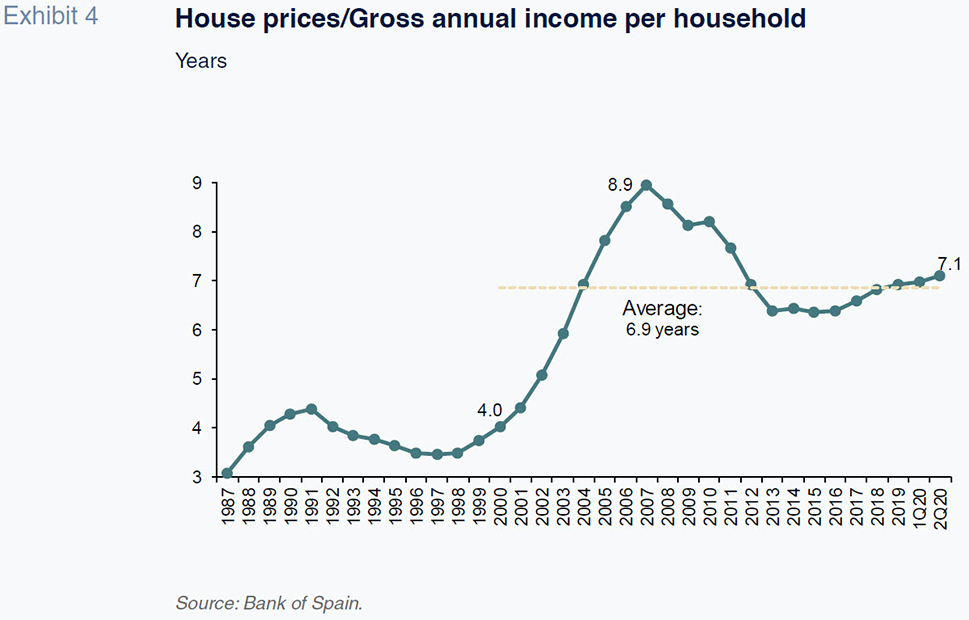

That being said, the house affordability indicators point to an easing in demand on account of the decline in household gross disposable income (GDI). Specifically, the upward trend in house prices in relation to GDI underway since 2017 accelerated during the second quarter of the year. At present, price-to-GDI stands at around 5% to 8% above the long-run average (Exhibit 4).

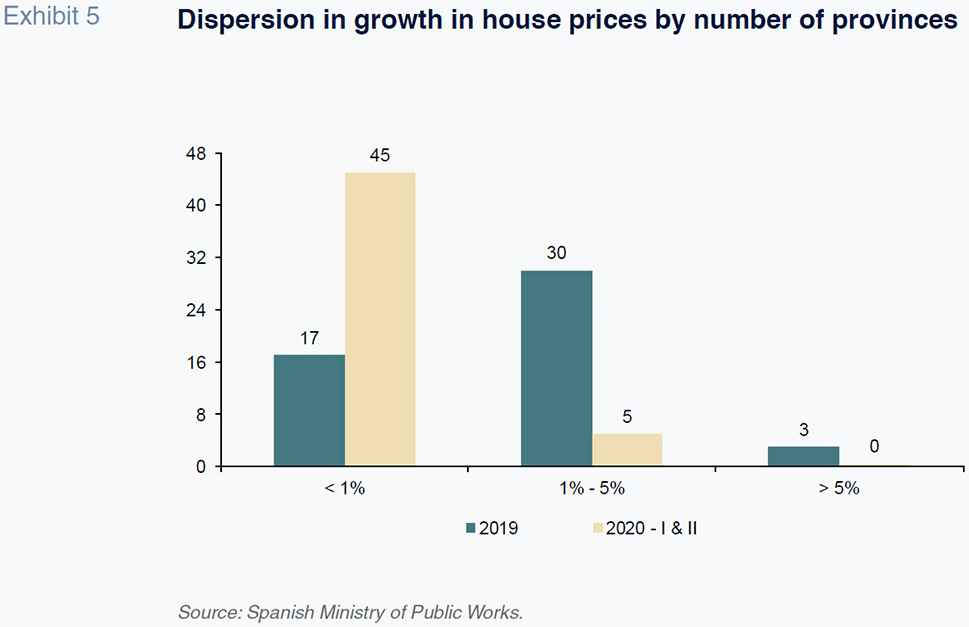

The moderate impact, by comparison with the historical trend, on prices is nevertheless compatible with differing outlooks by housing location and type. Quality housing in urban centers is expected to remain attractive relative to housing in areas in which unemployment will be hit harder or where foreign investment is scarcer. Also, while the housing market for individual buyers appears to be relatively resilient, corporate real estate is likely to suffer significantly (refer to Natixis, 2020). That trend may well prove persistent insofar as demand for office space falls as a result of home-working arrangements.

Conclusions

In short, the outlook for the housing sector in 2020 has deteriorated significantly since our last analysis. In light of the trends we are observing, average house prices are expected to contract by between 5% and 8% in 2020. A correction of that magnitude would fix the over-valuation detected in our last market assessment.

However, assuming that health policy manages to contain the second wave of COVID-19 infections, thereby avoiding another lockdown scenario, there are no reasons to expect the market to collapse. In contrast, the safe-haven nature of the housing market, low prevailing interest rates and the attractive relative positioning of the Spanish market should facilitate price stabilisation during the second half of 2021, and gradual recovery thereafter.

References

KNIGHT FRANK. (2020). Global House Price Index. Retrievable from:

www.knightfrank.com/researchNATIXIS. (2020). Covid-19: what impact on European real estate valuations. Retrievable from:

www.natixis.com/natixis/jcms/lpaz5_83078/en/covid-19-what-impact-on-european-real-estate-valuationsOCAÑA P. DE TUDELA, C. and TORRES, R. (2019). The Spanish housing market: Current situation and short-term outlook.

Spanish Economic and Financial Outlook, Volume 8 | No. 6, November 2019.

TORRES, R. and FERNÁNDEZ, M. J. (2020). Rising case numbers undermine economic forecasts.

Spanish Economic and Financial Outlook, Volume 9 | No. 5, September 2020.

Carlos Ocaña Pérez de Tudela. General Director, Funcas

Raymond Torres. Economic Perspectives and International Economy Division, Funcas