Spanish economic forecasts panel: September 2020*

Funcas Economic Trends and Statistics Department

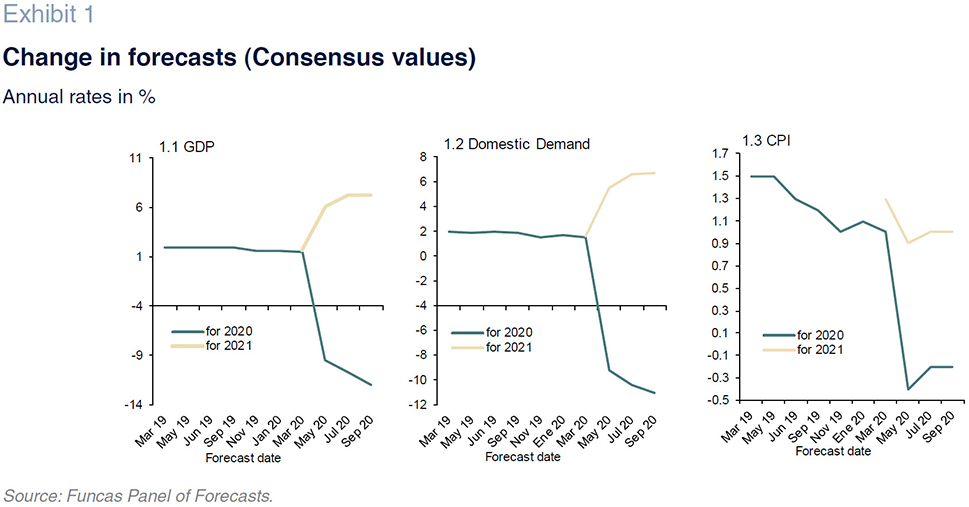

The economy is expected to contract by 12%, a cut of 1.2 percentage points vis-à-vis the July consensus

According to provisional data, GDP contracted by 18.5% in Spain during the second quarter, which is 1.5pp more than the July consensus. The sharp contraction was evident in the collapse of most indicators, which hit bottom in April. The indicators recovered during the subsequent months, picking up steam in July, a trend that may have stalled in August.

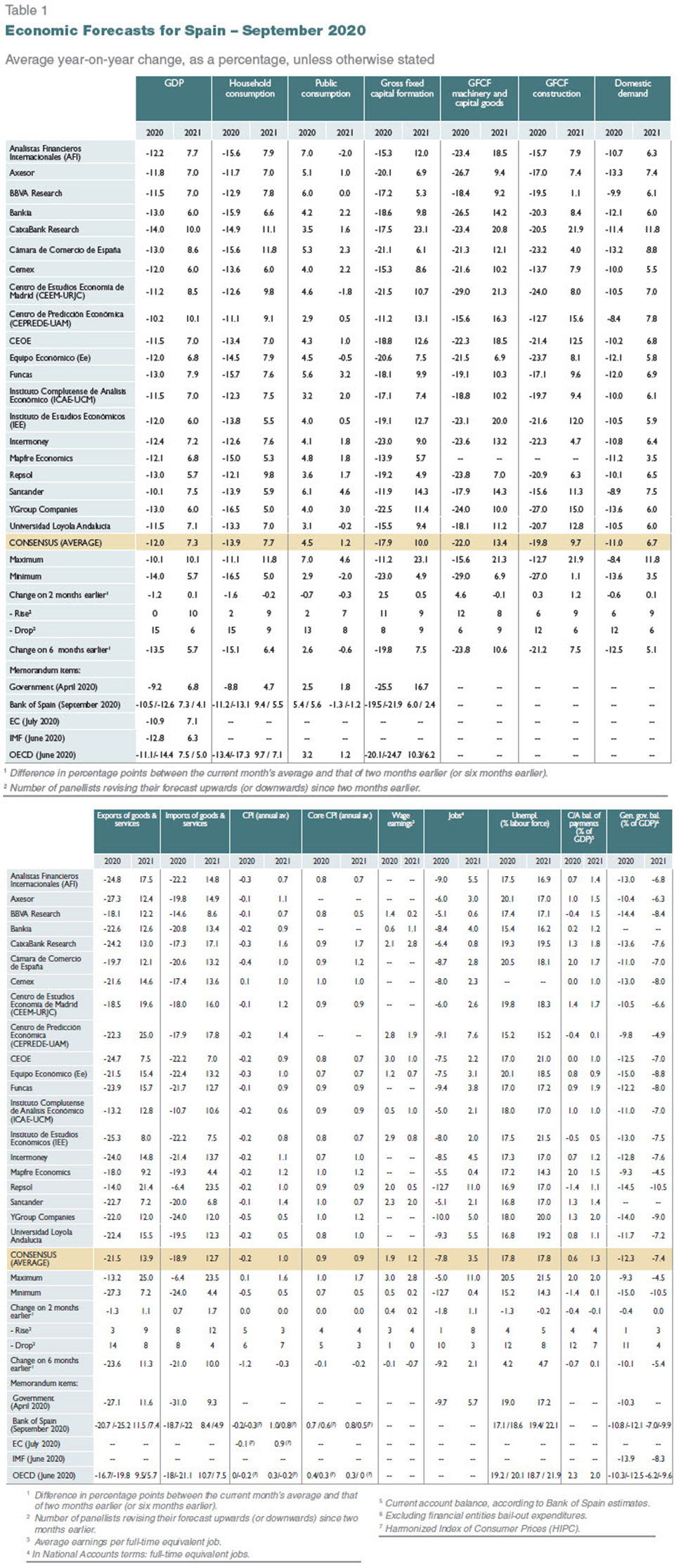

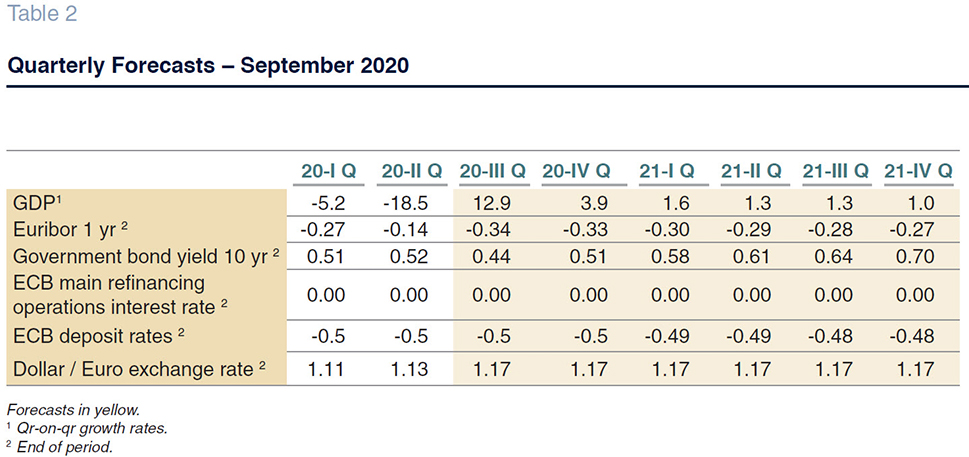

The consensus GDP forecast for 2020 is for a contraction of 12%, compared to 10.8% in our last report, with 15 of the panellists having become more pessimistic (Table 1). The quarterly pattern forecast is for growth of 12.9% and 3.9% in the third and fourth quarters, respectively (Table 2). Most of the analysts have based their estimates on the assumption that the rest of the year will continue to be marked by fresh outbreaks of the virus but without the reintroduction of a country-level lockdown (projections would be consistent with more local lockdowns).

Both domestic demand and foreign demand are expected to detract from GDP in 2020. The former is expected to erode GDP by 10.7 percentage points (vs. 10.1pp in the last set of forecasts) and the latter, by 1.3 percentage points (vs. 0.7pp). All components of private sector demand are expected to contract sharply, although the analysts’ estimates vary widely in this respect. Foreign demand is also expected to significantly decline. The outlook for exports has deteriorated since the last survey, whereas the forecasts for imports have improved slightly.

The GDP forecast for 2021 has been raised by 0.1pp to 7.3%

The consensus forecast for growth in 2021 stands at 7.3%, which is up 0.1 percentage points from the July report, with the following quarterly growth profile: 1.6%, 1.3%, 1.3% and 1% (Table 2). That growth would only partially mitigate the contraction sustained in 2020.

The recovery in 2021 is expected to be fuelled by a rebound in domestic demand, which is forecast to contribute 6.7 percentage points of GDP growth. That rebound is expected to be driven by an improvement in all of its components other than public expenditure, which is expected to slow. Foreign trade, meanwhile, would contribute 0.6 percentage points to growth, down 0.1 percentage point from the last set of forecasts.

CPI forecasts for 2020 and 2021 unchanged

In the months most affected by the pandemic (March, April and May), oil prices suffered an unprecedented contraction, which drove headline inflation into negative territory throughout the second quarter (compared to positive rates of close to 1% before the pandemic). Since then, despite a recovery in oil prices to around $40 - $45 per barrel, inflation has remained negative due to the drop in prices of other product groups.

The analysts’ estimates for average inflation are unchanged from July at -0.2% and 1% in 2020 and 2021, respectively. Core inflation estimates are similarly unchanged at 0.9% in both years. The year-on-year rates forecast for December 2020 and December 2021 stand at -0.2% and 1.1%, respectively (Table 3).

Insufficient recovery in the labour market

Over 40% of all jobs lost between March and April have been recovered since May. In addition, more than 2.5 million furloughed workers are back at work. The number of people covered by the furlough scheme has decreased from a peak of nearly 3.4 million at the end of April to just over 800,000 at the end of August. The consensus forecast for employment, in terms of full-time equivalents, is for a contraction of 7.8% in 2020 and a recovery of 3.5% in 2021.

That would put average annual unemployment at 17.8% this year and next, which is 1.3 and 0.2 percentage points better than forecast in July.

Consensus forecast for external surplus cut by 0.4pp

To June, Spain presented a current account surplus of 319 million euros, down 8.27 billion euros from the same period of 2019. That hefty reduction is attributable to the 64% decline in the balance of trade in goods and services, driven mainly by the collapse in tourism receipts, which more than offset the improvement in the income deficit.

The consensus forecast is for a surplus of 0.6% of GDP in 2020, down 0.4 percentage points from the last set of forecasts, rising to 1.3% in 2021, down 0.1 percentage points.

The public deficit for 2020 is higher than estimated (2021 estimate unchanged)

The fiscal deficit, excluding local authorities, amounted to 68.41 billion euros in the first half of 2020, compared to 25.73 billion euros in the same period of 2018. That downturn is the result of a 15.34 billion euro drop in revenue coupled with growth of 27.34 billion euros in spending, of which around 20.8 billion euros is related to COVID-19 expenditure.

The analysts are currently estimating a public deficit in Spain of 12.3% of GDP in 2020, which is 0.4 percentage points wider than they were forecasting in July. The deficit forecast for 2021 is unchanged at 7.4%.

External environment is expected to turn less negative in the coming months

The main global sentiment indicators (PMI, OECD leading indicators, business sentiment) have improved in recent months, suggesting a somewhat better second half than initially anticipated. That has prompted the OECD to revise its forecast for global GDP in 2020 upwards. It is currently estimating a contraction of 4.5%, compared to of 6% in May. The recovery in China, the US and, to a lesser degree, the eurozone, is now expected to be stronger than initially thought. However, the OECD has reiterated its belief that the recovery will be incomplete and uneven in an environment characterised by unusually high uncertainty.

Although most of the panellists continue to describe the external environment as unfavourable, they are forecasting an improvement in momentum in the coming months, both within the EU and beyond.

Both EURIBOR and Spain’s 10Y bond yield have trended lower since July

In light of the extraordinarily complex situation, central banks have rolled out exceptional liquidity and state financing measures. The ECB has increased the size of its pandemic emergency purchase programme (PEPP) to 1.35 trillion euros. Meanwhile, the Spanish government has launched a new state-backed loan guarantee scheme (upping the original 100 billion euros approved during the state of emergency by 40 billion euros).

As a result of those measures, 12-month EURIBOR has fallen considerably since June, by nearly 0.3 percentage points, to almost -0.4%. The yield on Spain’s 10-year government bonds has also narrowed, to 0.3% (0.2 percentage points less than in the last survey), which is close to its record low. The spread over the German government bond (country risk premium) has narrowed to under 80 basis points.

The analysts unanimously agree that monetary policy is expansionary and should remain so for the coming months. Although interest rates are still expected to move higher during the projection horizon, they are forecast to remain at relatively moderate levels, facilitating the funding of the measures taken by governments in response to the pandemic.

Euro appreciation against the dollar

The euro has appreciated considerably since the July report, to close to €/$1.18. The Federal Reserve’s decision to ease monetary policy further, even relaxing its inflation target, has contributed to that trend. The analysts believe that the euro will hold on to current levels against the dollar for the rest of the projection horizon.

Fiscal policy needs to prop up the economy

The analysts remain unanimous that fiscal policy is expansionary. Moreover, all but one (all but two in the July survey) believe that is the direction fiscal policy should take for the months to come. None of the analysts is calling for fiscal policy tightening at present.

*

The Spanish Economic Forecasts Panel is a survey run by Funcas which consults the 20 research departments listed in Table 1. The survey, which dates back to 1999, is published bi-monthly in the months of January, March, May, July, September and November. The responses to the survey are used to produce a “consensus” forecast, which is calculated as the arithmetic mean of the 20 individual contributions. The forecasts of the Spanish Government, the Bank of Spain, and the main international organisations are also included for comparison, but do not form part of the consensus forecast.