How the emerging markets slowdown will impact listed Spanish companies

Despite the favourable impact of recent international expansion by Spanish companies, the deteriorating outlook for emerging markets is raising concerns of possible negative implications on Spanish corporates´ earnings. While a supportive stance by the ECB and positive economic outlook in key developed markets should minimise these downside risks, IBEX 35 players with heightened exposure to Latam could still come under pressure.

Abstract: During the last five years, Spanish companies have greatly intensified their international expansion. This trend has had a very favourable impact on their earnings performance, in particular as a result of growing exposure to emerging markets, helping to counteract the effects of the crisis in Spain. This same exposure could, however, become a major vulnerability in 2016, due to the anaemic growth outlook for Latin America, which has been exacerbated by uncertainty in China. (Latin America´s share of Spanish corporate revenues is significant, representing 23% of the total, second only to the domestic market itself.) Overall, we believe continued ECB intervention in 2016, coupled with the positive growth dynamics for Spain, and other developed markets, should help to mitigate the uncertainty deriving from fresh concerns over the emerging markets economic outlook. The performance of the IBEX 35 should not be significantly affected by deteriorating conditions in emerging markets. However, due to the heterogeneity of geographic diversification among the IBEX 35 companies, precisely those with greater earnings exposure to Latam will likely see their share prices come under pressure, which could have a considerable impact on the performance of the index as a whole.

Introduction

International expansion by Spanish companies has intensified in recent years in an effort to offset weak domestic demand. This process is not new: the flow of direct foreign investment to other economies had become a significant factor at the turn of the century. What is new is the noteworthy growth in the number of companies based in Spain, which export overseas. According to the data published by the national statistics bureau, this figure had jumped by 50% from the start of the crisis in 2008 to over 150,000 by 2014.

The increased exposure to international markets, while very favourable in the last five years, is, however, currently the source of uncertainty due to the anticipated slowdown in some of the biggest emerging markets economies, notably China and Brazil. Below, we break down some of the regions in which Spanish companies have established a more extensive footprint and attempt to pinpoint the extent to which their share price performance could be adversely affected by forecasts for more sluggish emerging markets growth in the quarters to come.

The article is structured as follows: firstly, we analyse the Spanish economy’s international exposure, using foreign direct investment, export and M&A figures to support the analysis; and secondly, we look at the recent performance of the IBEX 35 with a view to approximating the potential outlook for the market in light of the listed companies’ geographic exposure.

Spain’s international exposure

To determine the countries to which Spain is exposed, we have analysed foreign direct investment and trade flows as well as the trend in M&A activity. Next, we outline the key results of this exercise.

FDI, flows and stock

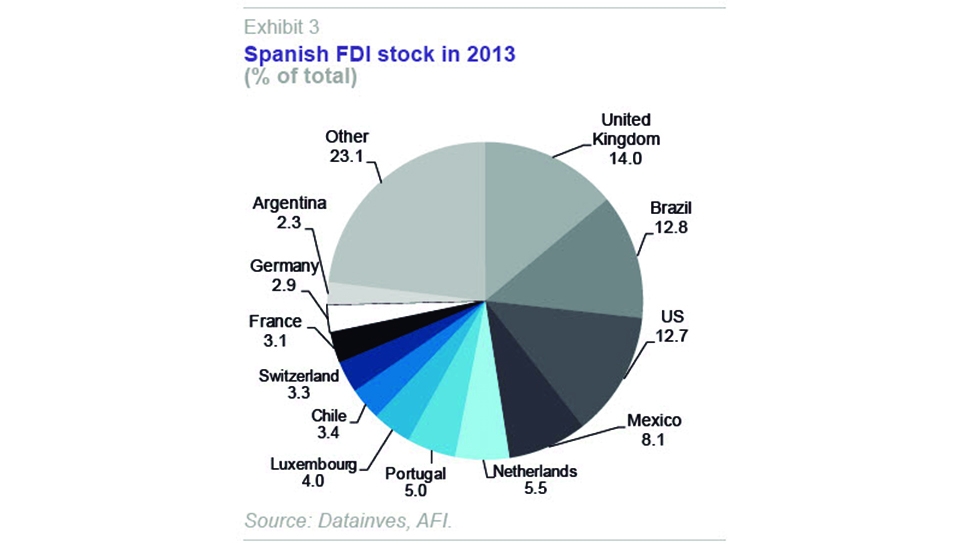

Stripping out the developed economies, Spain’s foreign exposure via direct investment is concentrated in Latin America, which accounts for over one-quarter of the total. Thirteen per cent of the stock of Spain’s foreign direct investment in 2013 (latest figures available) was concentrated in Brazil (surpassed only by the UK, at 14%).

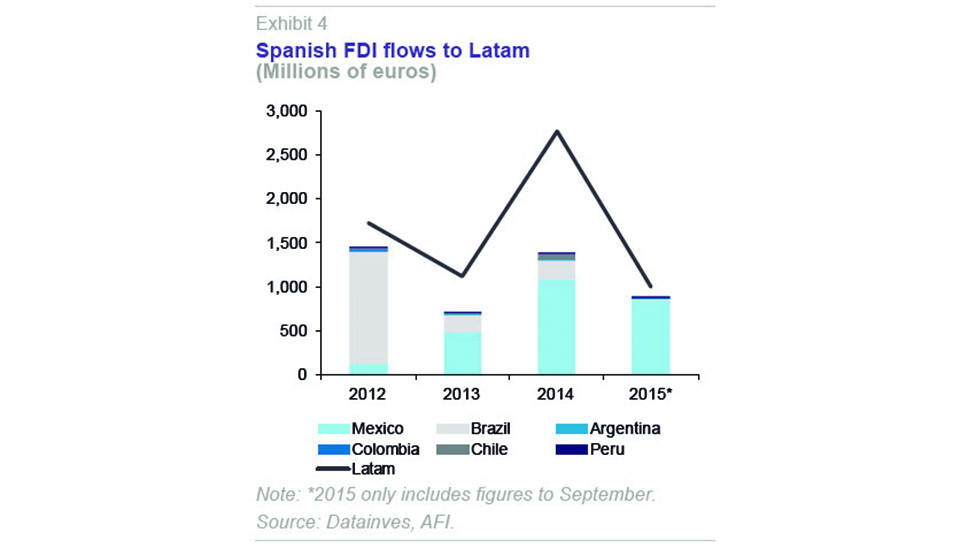

Further analysing the flows of FDI from Spain to Latin America, a change in destination is evident in recent years. Until 2012, Brazil was the Latam country receiving the greatest FDI inflows from Spain. However, from 2013, Spain began to earmark larger flows to Mexico and Brazil slipped considerably down the ranks in 2015.

Trade flows

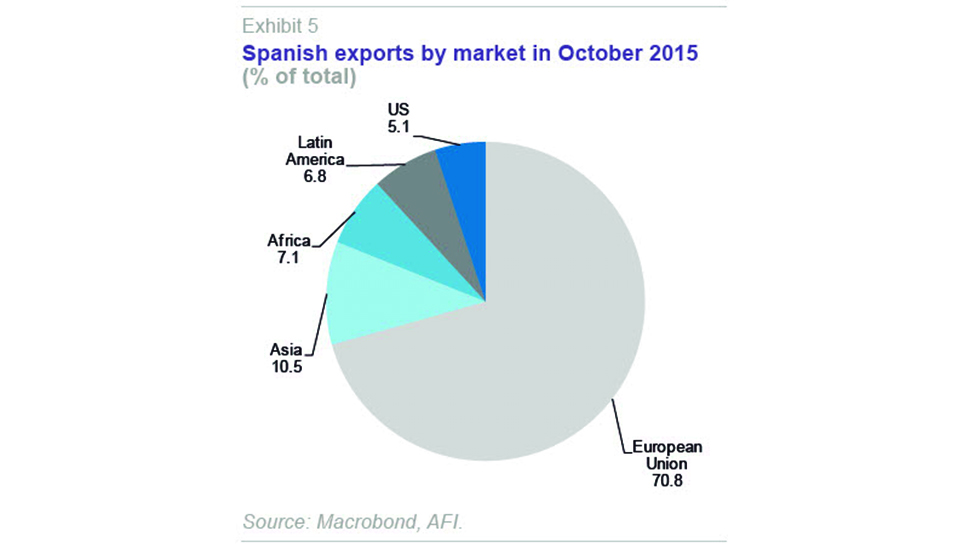

Spain’s biggest trade partner remains the European Union, the destination for 70% of its exports, a figure that has been trending upward since the end of 2009. Despite the fact that more Spanish exports go to France than to any other country, trade flows to Germany have been increasing at a relatively faster pace in recent months.

Another way to gauge Spain´s exposure to emerging markets is to analyse the countries to which Spain is more exposed via trade flows.

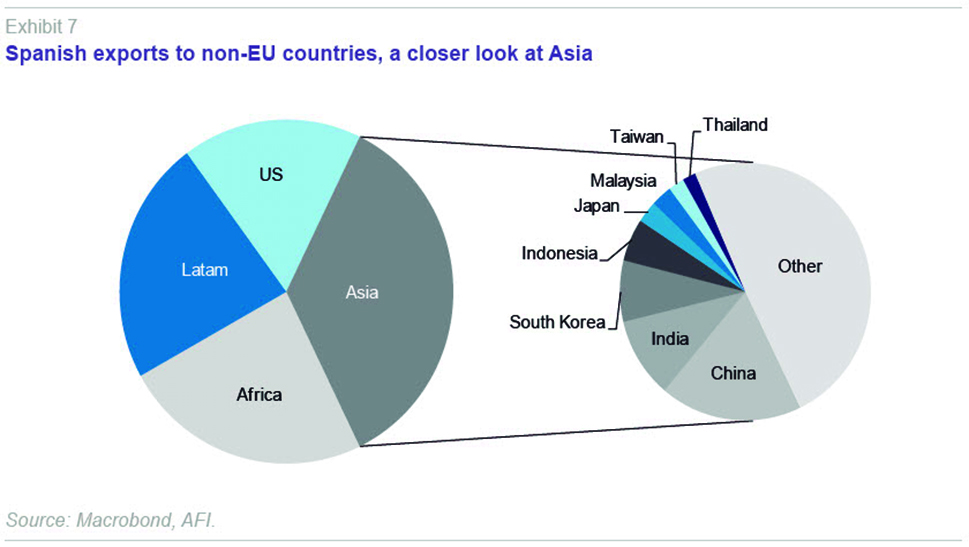

The emerging markets to which Spain exports the most are concentrated in Asia, followed by Africa (with Morocco and Algeria accounting for the biggest chunks of flows to this continent). Latin America ranks last, representing 7% of all Spanish exports.

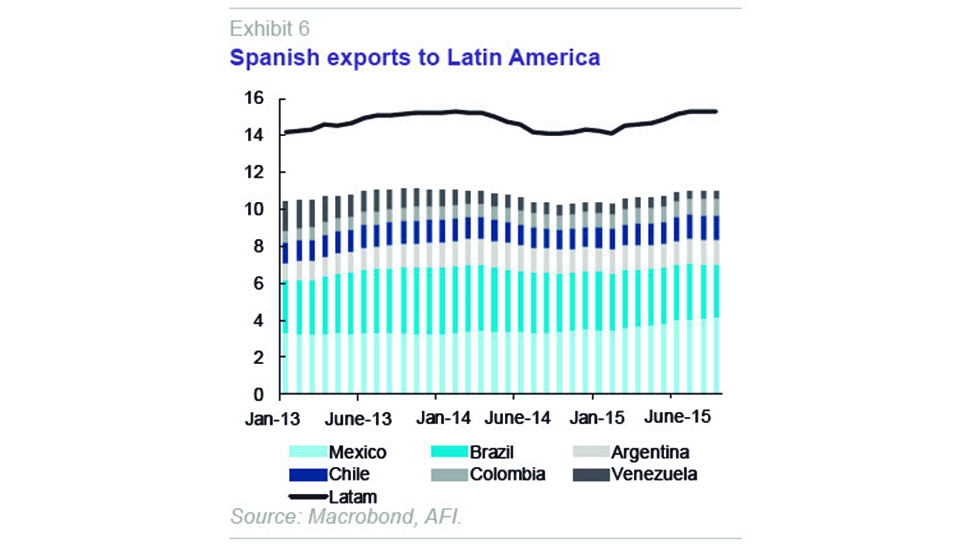

Trade flows to Latin America have remained stable in recent months despite the region’s economic difficulties, particularly those facing Brazil. The sharp drop in exports to Brazil has been offset by growth in exports to Mexico and other countries presenting more stable macroeconomic conditions.

The stability of Latin America’s share of Spanish exports contrasts with the steady growth in exports to Asian economies. Asia’s share of Spanish exports continues to rise and currently stands at 11% of the total (36% of exports to non-EU countries).

China is still Spain’s biggest Asian trade partner. Despite the slowdown in China, exports to this market continue to register stable growth. The shift in the Chinese economic model towards that of a consumer society has facilitated ongoing growth of Spanish exports to China in recent months.

In short, the trend is one of a downturn in exports from Spain to emerging markets and a shift towards developed economies, mainly in the eurozone. The fastest-growing export market is Germany.

Against this backdrop, Spain is more exposed to emerging markets, and especially to Latin America, via investment flows. Spanish companies are principally entrenched in Brazil and Mexico, a presence that implied, particularly in the case of the former market, a significant source of earnings instability in 2015.

M&A-led growth

The trend in cross-border M&A activity by Spanish companies completes the snapshot provided by the trade flows and FDI stock figures. The most important takeaways from this exercise are:

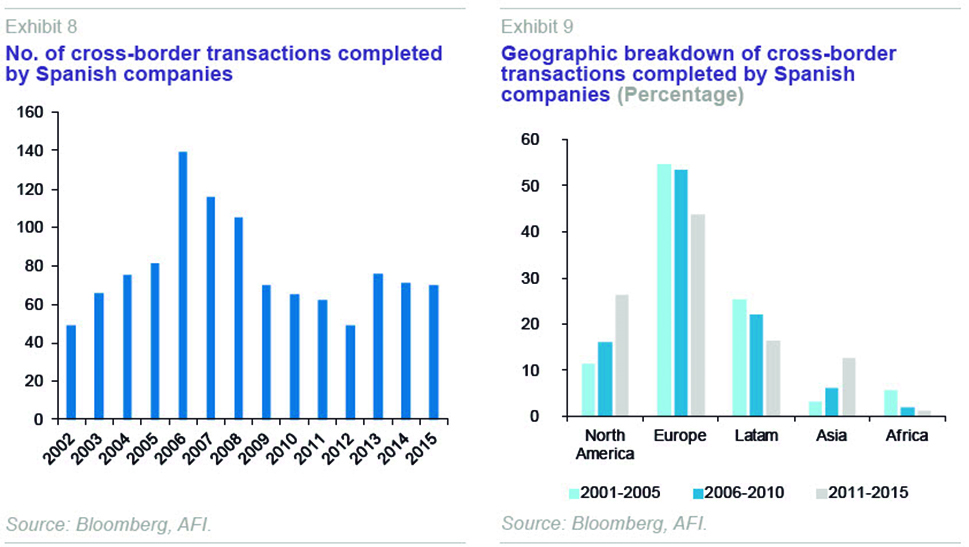

- The financial crisis has had the effect of significantly slowing international expansion via mergers and acquisitions. Since 2007, the number of transactions has fallen by almost half to just 70 in 2015 (data to November).

- Secondly, the geographic footprint revealed by FDI and trade flow figures overlaps to an extent with the M&A strategies pursued by Spanish companies. Specifically:

- Spanish cross-border M&A activity is also concentrated in Europe.

- The concentration of the stock of foreign direct investment in Anglo-Saxon economies is also borne out by the fact that almost 25% of the transactions completed between 2002 and 2015 involved targets in the US and UK.

- Lastly, Asia also accounts for a growing share of M&A transactions, emulating the trend observed in trade flows to the region.

Implications for Spanish equities

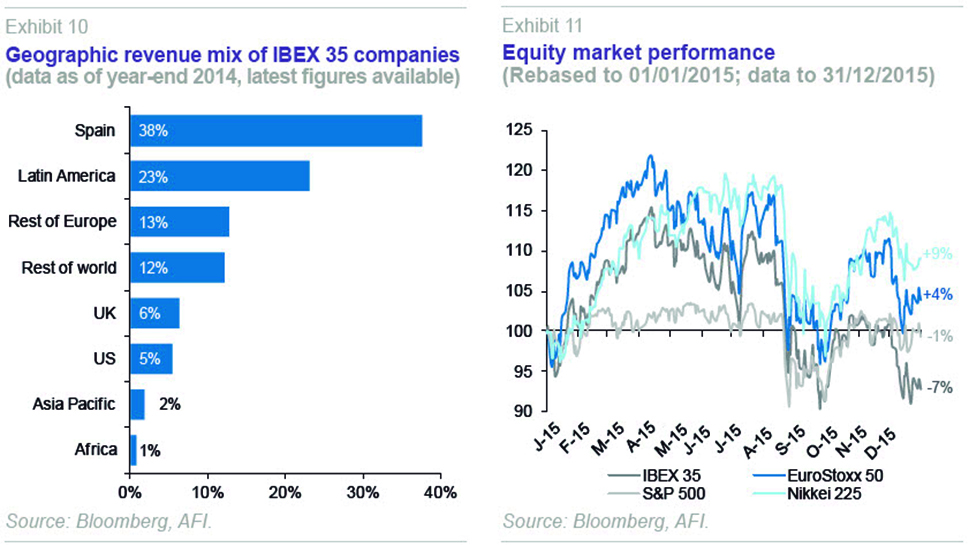

The IBEX 35 companies remain predominantly exposed to their domestic market. According to the most recent data available (year-end 2014), close to 40% of the blue chip index members’ sales revenue is still generated in Spain. The international expansion pursued in recent years has, for the most part, focused on neighbouring and developed economies in general, which represent approximately one-third of their revenue.

Nevertheless, the weight of the emerging markets in the IBEX companies’ accounts is very substantial, with Latin American notably representing 23% of revenue, second only to the domestic market.

The slowdown in China and ongoing correction in commodity prices are weighing on most emerging markets, particularly in Latin America and especially in Brazil. Thus, given the geographic exposure of IBEX 35 stocks, the emerging markets crisis may have a bigger impact on Spanish companies than on their European counterparts – even though the Spanish economy is staging a more vigorous recovery than the rest of the core euro economies.

Looking at the recent trend in the IBEX, the share prices of the companies comprising Spain’s benchmark index have underperformed other benchmark indices, such as the EuroStoxx 50 (eurozone), S&P 500 (US) and the Nikkei 225 (Japan). The geographic exposure of the IBEX 35 largely justifies its relative underperformance in 2015.

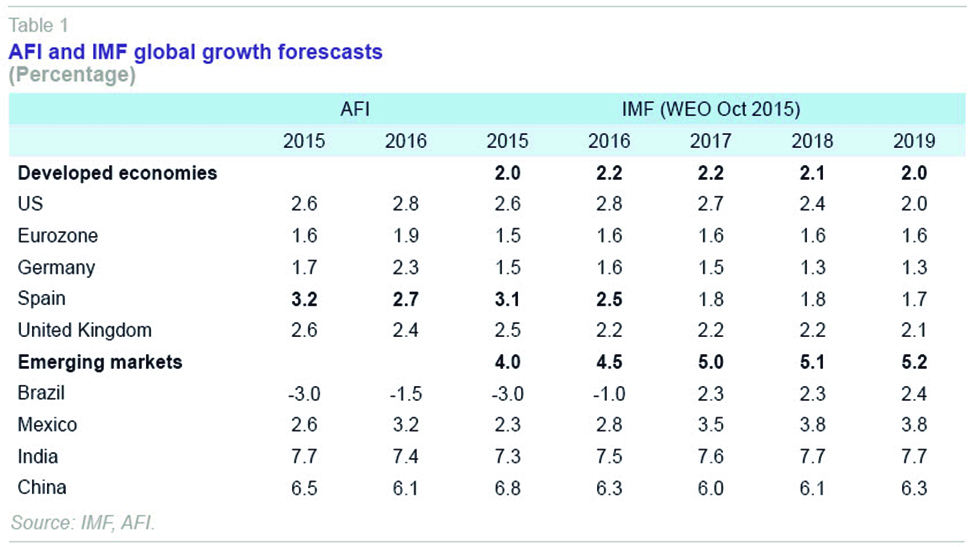

Going forward, the anticipated stabilisation of growth in China at annual rates of GDP of around 6.0%-6.5% should drive a shift in the recent commodities dynamics and brighter prospects for the emerging economies.

The outlook for China extends to the emerging markets as a whole, as revealed by our growth forecasts, in line with those of the IMF. According to the IMF, the emerging markets as a whole will register growth of 4.0% in 2015 and of 4.5% in 2016, further accelerating then stabilising around 5.0% in 2017-2019.

It is important to note, however, that the region to which the IBEX 35 is most exposed, Latin America, is expected to be hit hard by the negative outlook for Brazil and the economic weakness anticipated in Mexico and Chile. This may spell continued volatility in corporate earnings in companies most exposed to these economies.

Overall, however, we believe that continued ECB intervention in the financial markets in 2016, coupled with the positive growth dynamics forecast for Spain, the US, the UK and Germany, should help to mitigate the uncertainty deriving from concerns over the emerging markets economic outlook for the first time in five years. On the basis of this observation, the broad conclusion is that the performance of the IBEX 35 should not be significantly affected by the conditions in emerging markets. However, to the extent that the geographic footprint of the companies comprising the benchmark index is not homogeneous, it is important to stress that those with greater earnings exposure to Latam will continue to see their share prices come under pressure, a factor which could have a considerable impact on the performance of the index as a whole.

Conclusions

The international expansion pursued by Spain’s companies has been a decisive factor in counteracting economic weakness throughout the recent crisis in Spain. This international expansion has been characterised by an increasingly entrenched presence by Spanish corporates in Latin America and burgeoning trade flows with Asia, cushioning (albeit to a limited extent) the traditional dependence of Spanish trade on the European economy.

In the immediate future, this international footprint may introduce a source of earnings volatility for Spanish companies as a result of the uncertain outlook for key emerging markets economies, such as China and Brazil. The underperformance of the IBEX 35 in 2015 is undoubtedly largely explained by idiosyncratic geographical exposure relative to that of comparable benchmark indices.

The uncertainty deriving from the economic climate in emerging markets should not, however, overshadow Spanish companies’ predominant presence in markets, such as the US, the UK or Germany, for which the outlook for the coming quarters is positive. This, coupled with the prospect of continued growth in Spain in the order of 3%, should mitigate the weakness stemming from emerging markets.

Going forward, it is important to stress that the geographic footprints of the IBEX 35 companies vary and the share prices of those most exposed to Latam will, in all likelihood, come under significant pressure in 2016, weighing on the performance of the index as a whole.

Nereida González, Pablo Guijarro and Diego Mendoza. A.F.I. - Analistas Financieros Internacionales, S.A.