The economic outlook following the third wave of COVID-19

Restrictions on mobility and businesses, as well as the slow progress on the vaccination front, will delay the recovery of the Spanish economy. The result is a cut in growth projections for 2021 by one percentage point, to 5.7%. Looking further ahead, the strength of the expansion will depend heavily on business insolvency rates and the extent to which tourism will be able to rebound.

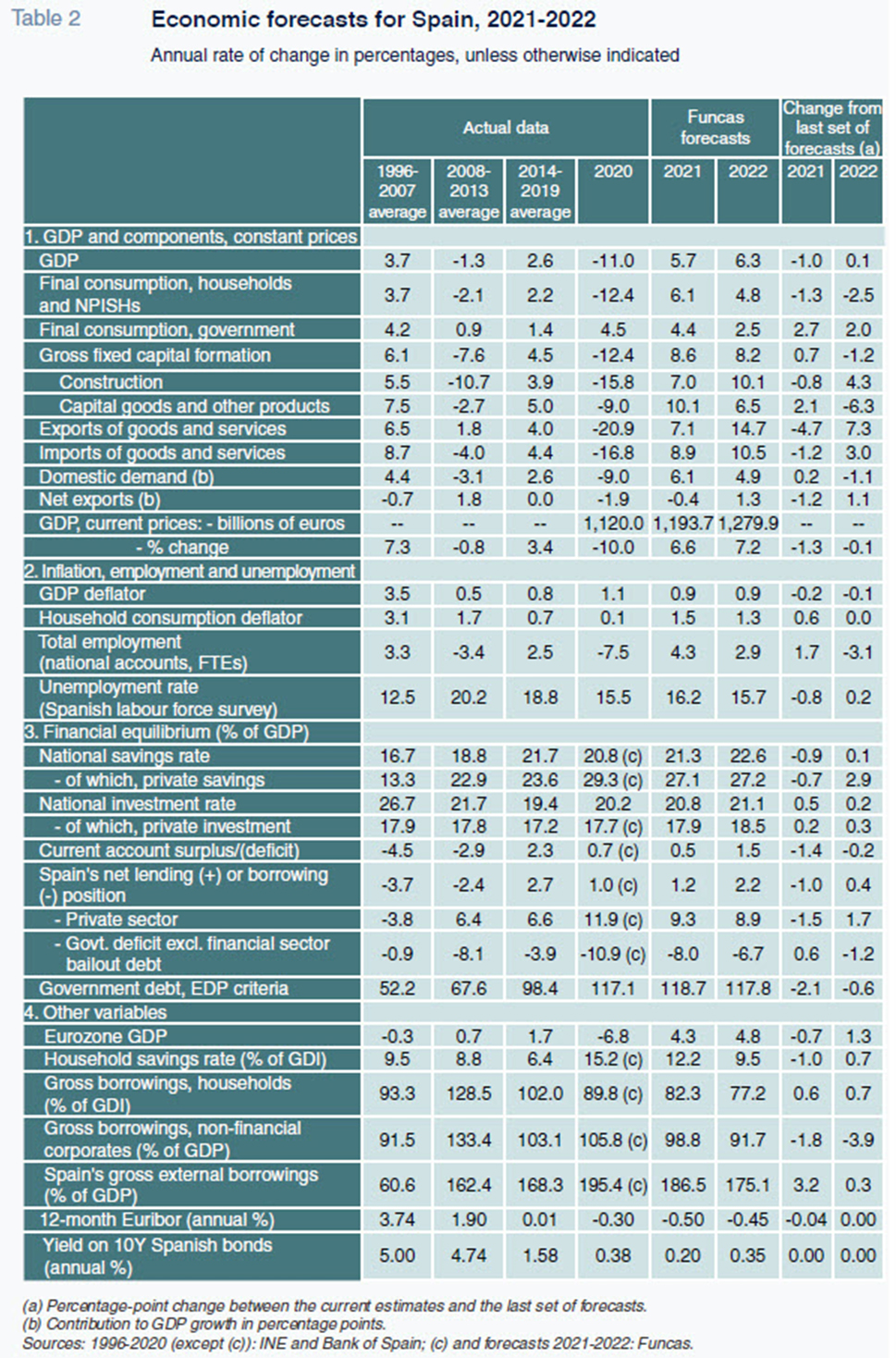

Abstract: Based on provisional figures, Spain’s GDP contracted by 11% in 2020, with 70% of the decline concentrated in sectors most dependent on human contact — retail, transport, hospitality and artistic and leisure activities. Available indicators suggest that the economy weakened again in early 2021, with a markedly uneven impact across sectors. In light of restrictions on mobility and businesses, as well as the slow progress on the vaccination front, growth forecasts have been cut to 5.7% in 2021, one point less than in previous projections. In 2022, growth should reach 6.3%, a 0.1 percentage point increase from the last set of forecasts. However, there are downside risks relating to insolvency rates and corporate debt levels. In addition, although the combination of investments and reforms is crucial for transformation purposes in the medium- and long-term, in the short-term, the recovery depends more on the plight of Spain’s tourism sector. Baseline assumptions see the tourism sector staging a gradual recovery from the second quarter on, such that tourism receipts this summer come close to last year’s levels (which were less than a quarter of pre-crisis levels). By 2022, tourism should have made up 75% of the ground lost due to the crisis.

Introduction

Spanish GDP suffered an unprecedented contraction of 11% in 2020 as a result of the pandemic, with the impact differing significantly across sectors. Following the sharp corrections sustained in the first two quarters, the economy recovered strongly in the third quarter, before progressing only modestly in the fourth quarter. As for the start of 2021, currently available data, particularly employment indicators, point to a fresh contraction. High infection rates in Spain and the rest of Europe, coupled with the slow vaccine rollout, have pushed back the possibility of a significant and sustained recovery until at least the early summer.

The forecasts remain shrouded by significant uncertainty. GDP growth is highly dependent on variables whose evolution is difficult to predict in the current climate. Tourism will be particularly key, even more so than receipts from the Next Generation EU funds, at least in the short-term.

Assuming that tourist activity in 2021 largely repeats last summer’s volumes, and that from that point it recovers to reach around 80% of pre-crisis levels by year-end 2022, we estimate that GDP would register growth of 5.7% this year and 6.3% next year.

Recent developments

According to the provisional figures reported by the National Statistics Office (INE), during the last quarter of 2020, GDP registered growth of 0.4%. Although this is better than anticipated, it is insufficient to achieve the momentum needed to make up for all the lost ground during the first half of the year. Moreover, that growth stemmed mainly from an uptick in public consumption. Private consumption recovered much less, while all components of investment as well as exports suffered setbacks.

Exports of goods and tourism services both weakened in the fourth quarter of 2020, with the marginal recovery observed in tourism during the third quarter evaporating later on. Specifically, volumes returned to levels witnessed during the time of lockdown as a result of the restrictions adopted in both Spain and across Europe to contain the second wave of the pandemic.

Altogether, based on provisional figures, GDP contracted by 11% in 2020. Only primary and public services sectors registered growth. Stripping them out, the contraction in Gross Value Added (GVA) in private non-farming sectors was 14%. Within that group, the impact of the crisis was very uneven. In the sectors most affected —retail, transport, hospitality and artistic and leisure activities— the GVA contraction was 24%, compared to 8.5% in the other sectors. This means that 70% of the GDP wiped out in 2020 came from those hard-hit sectors.

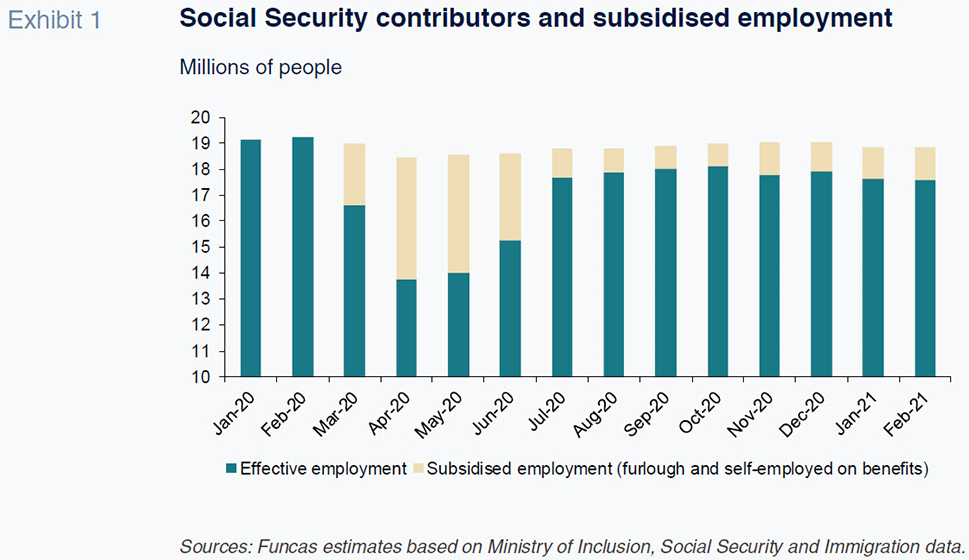

The indicators released so far this year suggest that GDP has contracted again in early 2021. In January, both the manufacturing and the services PMIs fell for several reasons: tighter restrictions in response to rising infection rates; historic snowfall in January; and, in the case of the manufacturing sector, interruptions in the flow of supplies from Asian factories as a result of insufficient maritime shipping capacity, which increased transport costs. In addition, rail and air passenger traffic as well as tourist arrivals have contracted again following lacklustre growth in December. The trend in Social Security contributors in January has held up fairly well in year-on-year terms, but effective employment, measured as contributors less employees on furlough and self-employed professionals on benefits, registered the second-ever biggest drop in the month of January. In February the PMIs recovered, but jobs fell again, calling into question the possibility of an economic recovery in the short-term (Exhibit 1).

Forecasts for 2021 and 2022

All signs suggest that Spain’s economic recovery will be on hold until at least the summer. The prolongation of restrictions on businesses and mobility, coupled with the slow progress on the vaccination front, is weighing on both private consumption and tourism. Weak internal demand is being exacerbated by contractions in some of Spain’s main export markets, especially in Europe, where the indicators are similarly headed south, particularly in Germany and France

[1].

Things should turn around during the second half of the year, however, as the vaccination effort leads to falling infection rates and the easing of restrictions. This should facilitate a recovery in private spending and international mobility. Elsewhere, public investment is set to increase in the second half of the year, to the extent that the European Commission endorses Spain’s recovery plan projects. The external environment should also improve, particularly in the US, boosted by the American Rescue Act, a fiscal stimulus package equivalent to around 9% of US GDP (the second most expansionary in the country’s history).

Given the weak start to the year and the downturn in expectations for the main European trading partners, we have cut our growth forecast for 2021 by one percentage point to 5.7%

[2]. This weaker forecast is driven mainly by lower estimated growth in private consumption as a result of households’ reluctance to spend in the face of a prolonged health crisis. We continue to expect a partial recovery in investment, framed by the stimulus anticipated from the European funds. We have revised our forecasts for public consumption upwards (shaped by the acceleration in public spending observed during the final stretch of 2020 and the knock-on effect this year). Internal demand is expected to contribute 6.1 percentage points to growth, with foreign trade eroding it by 0.4 percentage points (down from our last estimate for a positive contribution of 0.8 percentage points), due to the later than initially forecast recovery in tourism (Table 2).

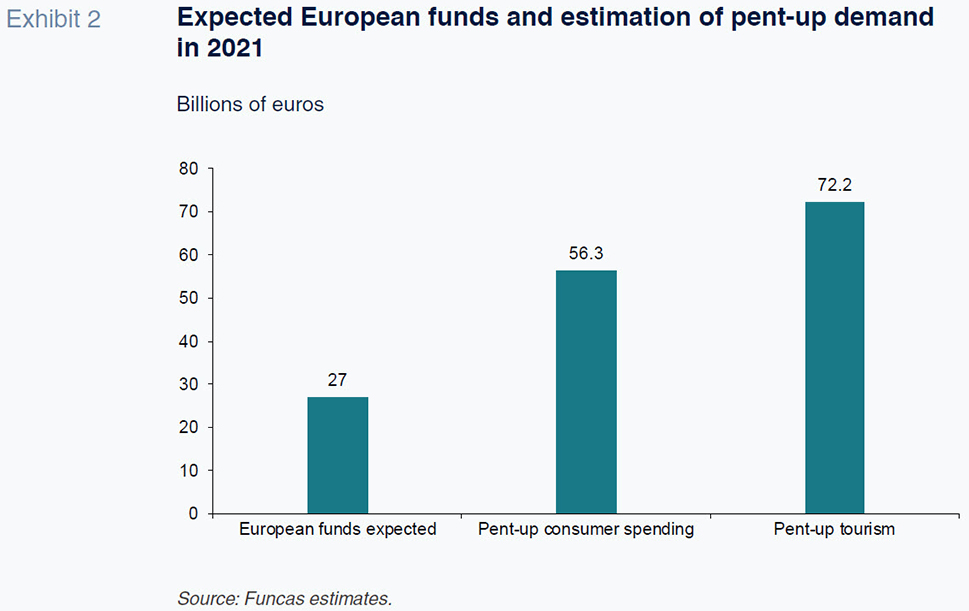

The fiscal stimulus expected during the second half of 2021 should carry over to next year. Indeed, for 2022, we are estimating growth of 6.3%, up 0.1 percentage points from our last set of forecasts. The key recovery drivers will be operating at full throttle. Private consumption should register strong growth thanks to the release of some of the surplus savings built up during the crisis. Meanwhile, tourism should normalise steadily, and the fiscal stimulus measures funded by the European recovery funds will be even greater than this year, once the operating procedures are up and running (Exhibit 2). In all, both internal demand and foreign trade are expected to make a clear-cut positive contribution (4.9 percentage points and 1.3 percentage points, respectively).

The recovery should facilitate the re-incorporation of furloughed workers, which means that the impact on job creation will be limited. The unemployment rate is estimated at 15.7% at the end of the projection horizon, compared to 14.1% before the crisis.

The external surplus is expected to narrow in 2021, shaped largely by the rally in oil prices, but should increase in 2022 thanks to the recovery in tourism. The public deficit, however, will remain high at 8% of GDP in 2021 and 6.7% in 2022. These forecasts imply growth in public debt of around 190 billion euros over the two-year period. The ratio of debt to GDP should remain at around 118% thanks to the growth in nominal GDP.

We are expecting the rate of inflation to tick up to 1.5% on average this year, driven by higher oil prices and price recovery in some of the sectors that suffered sharp price contraction last year on account of the crisis, such as hotels, air travel and tourist packages. In 2022, inflation should fall back slightly. However, there is a risk of higher inflation if demand comes back stronger than supply in the sectors that are suffering greater destruction of their productive capacity, such as tourism and hospitality.

Main risks

The materialisation of these forecasts depends on side stepping the downside risks associated with management of the pandemic, effectiveness of economic policy and the passage of reforms. More pressing, however, is the speed of vaccination rollout and its effectiveness.

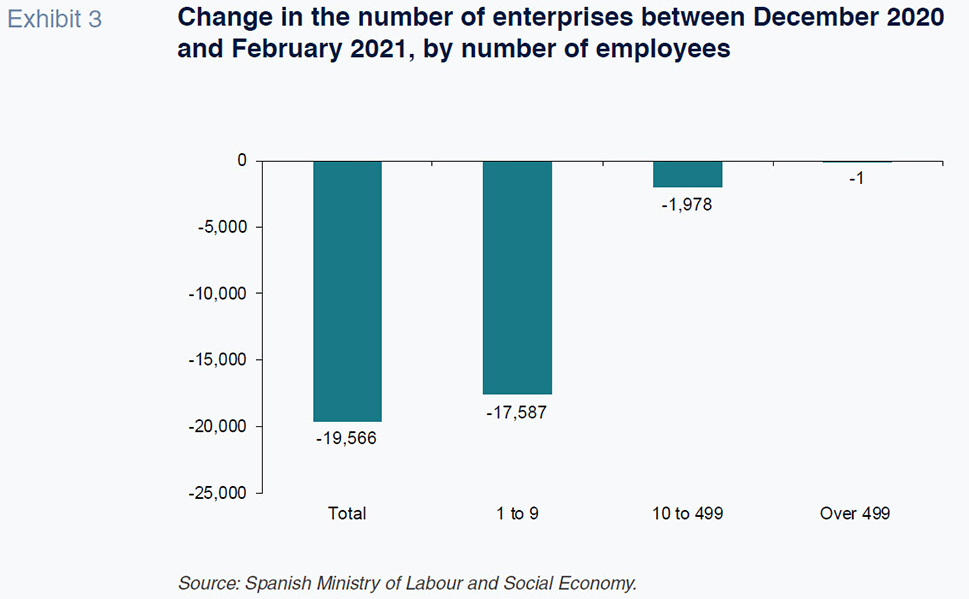

The intensity of the recovery will be proportionate to the effectiveness of the support measures extended to viable businesses at risk of insolvency. The crisis is not only destroying swaths of the productive fabric in the sectors hit hardest but is also increasing business indebtedness and reducing the capital base. In the first two months of 2021 alone, nearly 20,000 businesses disappeared, putting an end to the green shoots observed during the last part of 2020 (Exhibit 3). Importantly, smaller companies are more exposed to the risk of insolvency.

Policy effectiveness could weigh on the pace of economic recovery once normality resumes. The challenge is to design a support plan that is effective and targeted exclusively at viable companies with the aim of safeguarding as much of the productive fabric as possible but without fuelling zombie companies. The propping up of non-viable companies, in addition to implying the ineffective allocation of public funds, would impede the recovery of those enterprises that are viable. Indeed, banks would keep dubious loans on their balance sheets, which would undermine the credit flowing to promising projects and therefore weigh on potential output, as has happened in Italy and particularly in Japan

[3]. The government has just adopted a plan to support businesses, including both direct transfers to the hardest-hit sectors (worth 7 billion euros, to be implemented by regional governments) and financial measures to prevent insolvency (for a total of 4 billion euros). The plan comes late in comparison with other European countries, and its impact will depend crucially on two factors: its swift implementation by the regions; and the extent to which it effectively targets viable businesses.

Lastly, as with all recoveries, market expectations play a crucial role. This depends on the ability to articulate a reform agenda, and adapt measures to both the prevailing situation and the digital, green and social transformation objectives. The very management of the European funds also requires structural reforms

[4].

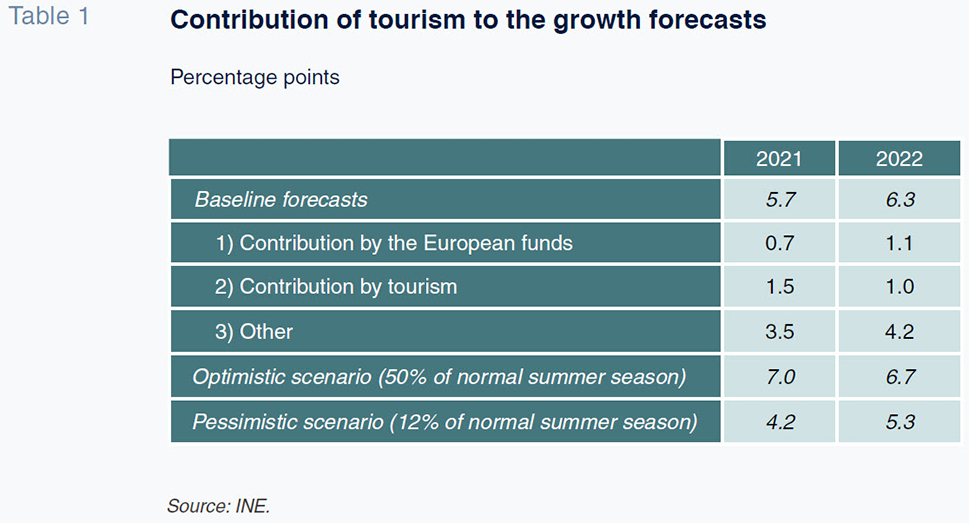

In light of these challenges, it is important to keep a close eye on tourism. The sector has entered its second year of crisis with many companies on the verge of bankruptcy. The forecasts are based on the assumption that the sector will stage a gradual recovery after the second quarter, such that tourism receipts this summer come close to last year’s levels (which were less than a quarter of pre-crisis levels). We are estimating growing momentum throughout the rest of the projection period, with tourism reaching 80% of pre-crisis level at the end of 2022. This means making up 75% of the ground lost due to the crisis by the end of 2022 (Exhibit 4).

If normalisation were to come faster, and the sector reached 50% of pre-crisis levels over the summer and 95% by year-end 2022, estimated GDP growth would rise to 7% in 2021 and 6.7% in 2022 (1.3 and 0.4 percentage points more than estimated in the baseline scenario).

The pessimistic scenario in which tourists remain too cautious to travel would push back the tourism recovery to 2022. As a result, estimated GDP growth would fall to 4.2% in 2021 and 5.3% in 2022 (respectively 1.5 and 1 percentage points less than estimated in the baseline scenario). Additionally, in the pessimistic scenario, the risk of company insolvencies would be very high, requiring sector restructuring.

Lastly, it is important to note that although the combination of investments and reforms is crucial for transformation purposes in the medium- to long-term, in the short term the recovery depends more on the plight of Spain’s tourism sector (Table 1).

Notes

Refer to European Commission (2021). Winter 2021 Forecasts, February 2021. https://ec.europa.eu/info/sites/info/files/economy-finance/ip144_en_1.pdf

Refer to Funcas (2021). Previsiones macroeconómicas para España 2021-2022, 19 February 2021. https://www.funcas.es/textointegro/previsiones-para-la-economia-espanola-2021-2022/

Refer to Gandrud, C. and M. Hallerberg (2017). How not to create zombie banks: lessons for Italy from Japan. Bruegel Policy Contribution, Issue No. 6

For an estimate of the impact of the reforms and European funds on the Spanish economic recovery, refer to Torres, R. and Fernández, M. J. (2021). Rising COVID-19 cases dampen economic forecasts, SEFO, Volume 9, No. 5 (September 2020).

Raymond Torres and María Jesús Fernández. Economic Perspectives and International Economy Division, Funcas