Spanish economic forecasts panel: March 2021*

Funcas Economic Trends and Statistics Department

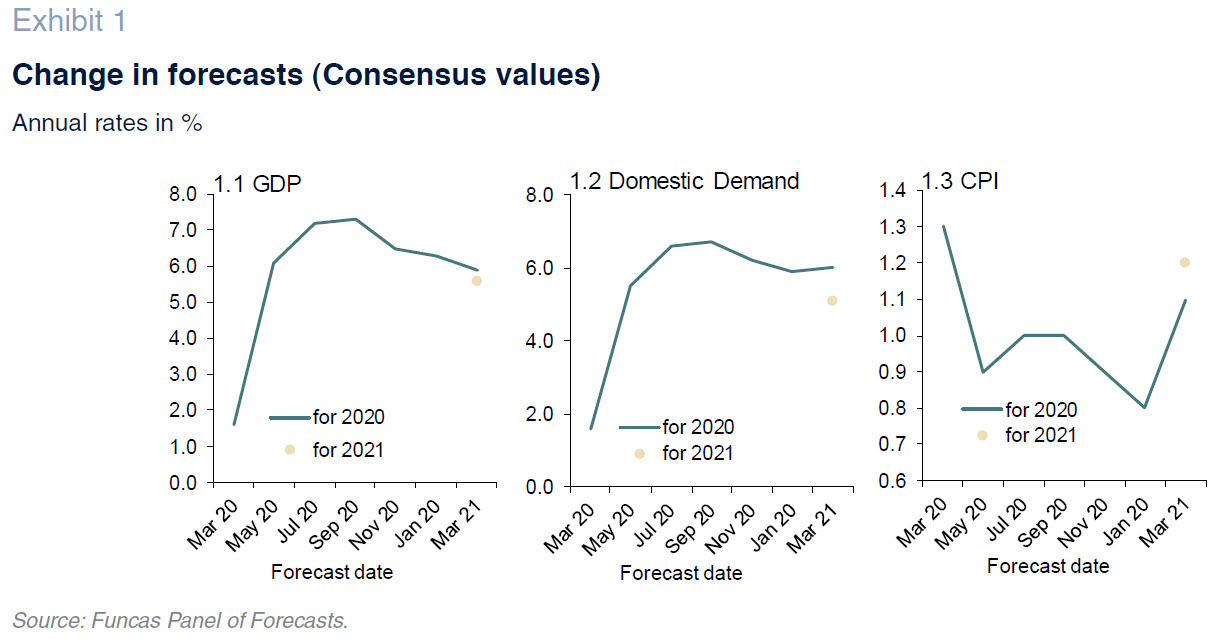

2021 GDP growth estimate trimmed by 0.4pp to 5.9%

During the last quarter of 2020, Spanish GDP registered growth of 0.4% according to the provisional figures, which was higher than the consensus forecast. That performance was shaped by positive domestic demand which more than offset the weakness in exports. In 2020 as a whole, the economy contracted by 11%.

The first-quarter indicators available to date are not encouraging: industrial output contracted in January; effective employment (social security contributors less those on furlough and self-employment benefits) fell sharply in January-February; and foreign tourist arrivals retreated once again, after a slight improvement in December.

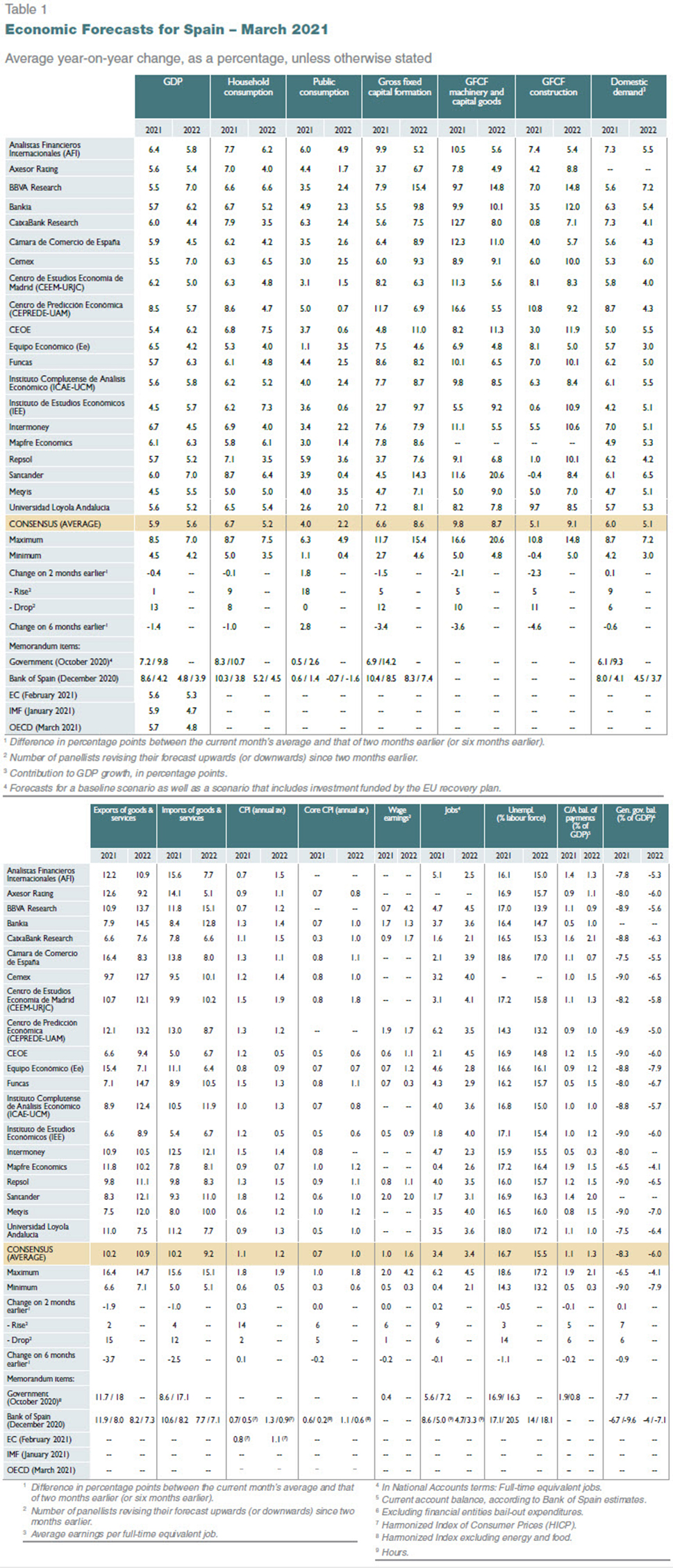

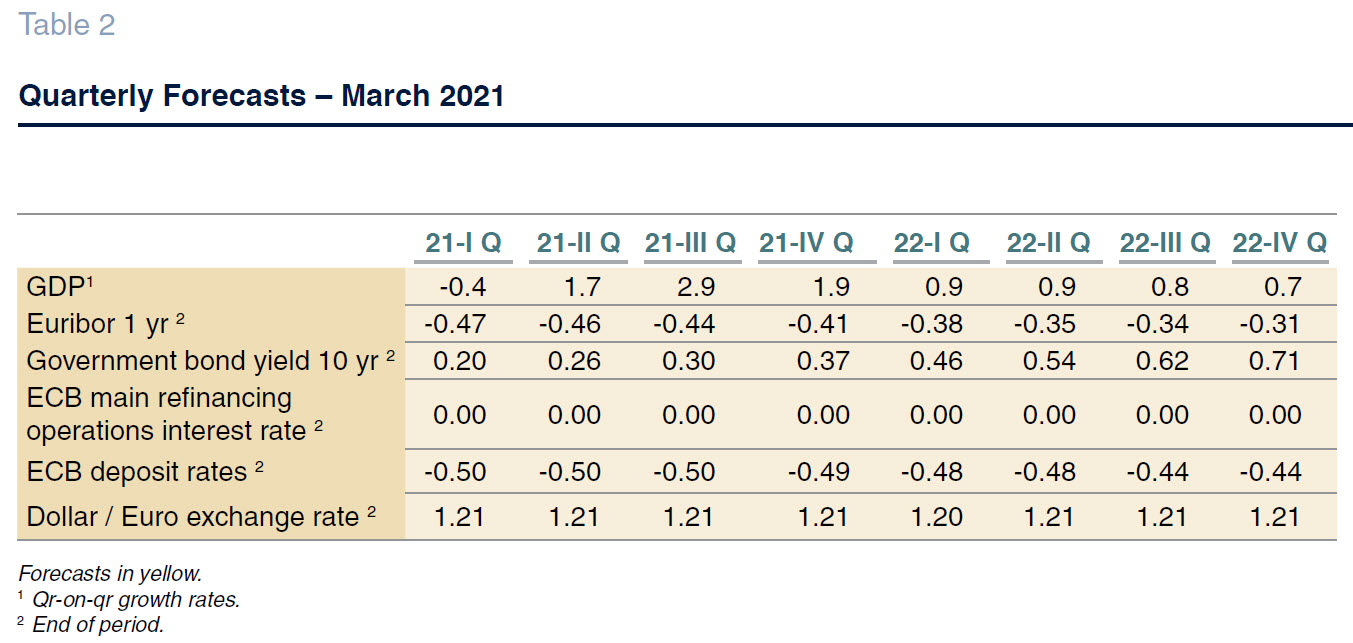

As a result of the recent downturn in expectations, the GDP forecast for 2021 has been trimmed by 0.4 percentage points to 5.9%. That figure is in line with the most recent estimates issued by the international organisations and the Bank of Spain but lower than the government’s projections (dated to last October). As for the quarterly profile, the consensus forecasts point to a GDP contraction of 0.4% in the first quarter, compared to estimated growth of 0.5% as per the last Panel survey. The forecasts for the following quarters have also been trimmed to 1.7% in 2Q21, 2.9% in 3Q21 and 1.9% in 4Q21 (Table 2). Note, however, that these figures could vary significantly depending on how the vaccination effort progresses.

Domestic demand is expected to contribute six percentage points (up 0.1 percentage points from the January consensus forecast), while trade is expected to detract from growth by 0.1 percentage points (down from +0.4 percentage points). It is worth highlighting the upward revision to the public spending forecast and the downward revision to all items of investment (Table 1).

The economy is expected to grow by 5.6% in 2022

This was the first survey to ask for estimates for 2022. The consensus forecast is for GDP growth of 5.6%, implying a 0.3 percentage point slowdown with respect to the 2021 forecast. However, half of the analysts think growth will pick up in 2022, with the other half forecasting a slowdown. That consensus estimate exceeds that of both international organisations and the Bank of Spain.

The contribution by domestic demand is estimated at 5.1 percentage points. Within that overall trend, public and private consumption, as well as investment in machinery and equipment, are expected to slow, while construction would accelerate (Table 1). Net exports, meanwhile, would make a 0.5 percentage point contribution, driven by the anticipated recovery in tourism.

Upward revision in inflation projections

The start of the year was marked by a considerable rally in oil prices, which, combined with other factors —some of which are transient—, has lifted inflation, leaving behind the negative year-on-year rates observed since April 2020. Inflation is expected to remain in positive territory over the coming months (Table 3).

The consensus forecast has been raised by 0.3 percentage points since the last survey, to an annual average rate of 1.1%. The forecast for 2022 is for inflation of 1.2%. In terms of core inflation, although the forecast for 2021 is unchanged at 0.7%, it has been increased slightly to 1% in 2022.

The year-on-year rates forecast for December 2021 and December 2022 are 1.5% and 1.3%, respectively.

Unemployment expected to rise to 16.7% in 2021

According to the social security contributor numbers, job destruction in January and February was not particularly noteworthy by comparison with prior years. However, the number of people on furlough or self-employed benefits has increased considerably, implying the loss of 370,000 effective jobs. The only time in the entire series in which effective employment decreased by that much was in the same period of 2009. It is worth noting, however, that the employment and unemployment figures are highly distorted by the fact that the people on furlough are included within the employment ranks.

The consensus forecast for employment, in terms of full-time equivalents, is for an increase of 3.4% in both 2021 —up 0.2 percentage points from the last survey— and 2022. The forecasts for growth in GDP, job creation and wage compensation yield implied forecasts for productivity and unit labour costs (ULC). Productivity is expected to gain 2.5% this year, down 0.6 percentage points from the last survey, and 2.2% in 2022. ULCs, meanwhile, are forecast to contract by 1.5% in 2021 and by 0.6% in 2022, having risen sharply in 2020. Again, the trend in these variables should be interpreted with caution due to the impact of the furloughs.

The average annual rate of unemployment is expected to increase to 16.7% in 2021 (down 0.5 percentage points from the last set of forecasts) and to fall back to 15.5% in 2022.

Rebound in external surplus

In 2020, according to provisional figures, the current account surplus amounted to 8 billion euros, down 70% year-on-year. That significant contraction was the result of the collapse in tourism receipts.

The consensus forecast is for a surplus equivalent to 1.1% of GDP in 2021 (down 0.1 percentage points from January), widening to 1.3% in 2022.

Consensus public deficit forecasts: 8.3% of GDP in 2021 and 6% in 2022

In the first 11 months of the year, the deficit at all levels of government except for the local corporations stood at 87.6 billion euros, compared to 19.6 billion euros at the same juncture of 2019. The deterioration is the result of a 22.2 billion euros drop in revenue coupled with growth of 45.8 billion euros in spending, of which around 35 billion euros is related to the pandemic. Public debt, meanwhile, increased by 122.4 billion euros to 117.1% of GDP in 2020.

The analysts are expecting the overall deficit to come down over the next two years. The forecast for 2021 is for a deficit of 8.3% of GDP (which is 0.6 percentage points higher than government predictions), declining to 6% in 2022.

External environment expected to improve in the coming months

According to the confidence indicators available to February, business sentiment has improved markedly, with the IHS Markit overall business confidence reading at its highest level in three years. The optimism is clearly biased towards the US, where the vaccination effort is making fast progress, restrictions are gradually being lifted and President Biden has announced a massive new fiscal stimulus package. In China, too, businesses are revising their investment and hiring plans upwards. In Europe, despite a weak start to the year, the recovery is also on the horizon, albeit less clearcut. Higher shipping and raw material costs are, however, a common concern.

The OECD has revised its global growth forecast upwards, to 5.6% in 2021 (up 1.4 percentage points from December) and to 4% in 2022 (up 0.3 percentage points). China and the US are expected to lead that recovery, without driving a sharp uptick in inflation that would oblige the central banks to roll back their monetary stimulus measures. The eurozone is expected to register growth of close to 4% throughout the projection horizon.

In sum, although the external environment remains unfavourable on the whole, as is reflected in the analysts’ assessments, the outlook should begin to brighten as the vaccination campaign moves forward. Thus, a wide majority of analysts expect a turnaround within the next six months, both within the EU and beyond. That appraisal is more upbeat than in January.

Tension in bond markets

Since the January survey, debt markets have been under considerable strain, pricing in the prospect of ‘reflation’ and a possible change in monetary policy regimes. The central banks, starting with the Federal Reserve and followed by the ECB, have reiterated their commitment to leaving the monetary stimuli in place for as long as necessary. Their reaction has contained pressure on interest rates, at least for the time being. Nevertheless, the yields on benchmark sovereign bonds have increased from their January lows and the spread between the yields on either side of the Atlantic has widened. The yield on the 10-year Spanish bond, which had traded in negative territory of late, widened to almost 0.5% towards the end of February, though falling back since then to close to 0.25%. The 12-month EURIBOR has etched out a similar pattern, climbing from under -0.51% in January to -0.48% at the time of writing this Panel.

Against that backdrop, the analysts believe that the upward movement in interest rates will be somewhat more pronounced than previously estimated. However, they expect rates to remain at low levels in absolute terms (Table 2).

Slight euro depreciation

In light of the growing interest rate spread, the euro has depreciated slightly against the dollar to trade at around 1.20 ($0.04 down from January levels). The analysts believe the exchange rate will remain close to current levels throughout 2021.

Macroeconomic policy should remain expansionary

The analysts unanimously consider that monetary and fiscal policies are expansionary and virtually all of them believe they should remain so for the coming months (Table 4). No major change in the ECB’s benchmark rates are expected over the projection horizon.

*

The Spanish Economic Forecasts Panel is a survey run by Funcas which consults the 20 research departments listed in Table 1. The survey, which dates back to 1999, is published bi-monthly in the months of January, March, May, July, September and November. The responses to the survey are used to produce a “consensus” forecast, which is calculated as the arithmetic mean of the 20 individual contributions. The forecasts of the Spanish Government, the Bank of Spain, and the main international organisations are also included for comparison, but do not form part of the consensus forecast.