The potential impact on Spain

from recent protectionist measures

Recent US trade measures raise the risk of heightened protectionism. Spain’s increased integration into the global value chain leaves the country exposed to the potential impact from such measures in key sectors should their introduction bring about a slowdown in global trade.

Abstract: The recently announced tariffs by the US and China exemplify a paradigm shift in the era of globalisation. Although Spain has not engaged in the protectionist rhetoric, at least for the time being, it is relevant to analyse its role in global production chains and the potential channels for economic contagion. Spain’s integration in cross-border production processes is concentrated in the sectors of greatest importance for manufacturing exports, namely the automotive, agro-food, textile, machinery and chemicals industries. The impact of the mainstreaming of protectionist measures would come, mainly, via those sectors and could be meaningful in light of their importance in terms of job creation and investment.

Introduction

Globalisation has unquestionably been one of the driving forces behind global economic growth in recent decades, helping, among other things, to reduce the income gap between developed and developing economies. The elimination of international trade barriers gained traction from the 1950s following the signature in 1947 of the General Agreement on Tariffs and Trade (GATT), which would later become the World Trade Organisation (WTO). As a result, growth in global trade flows was twice that of GDP until 2008. The reduction of protectionist barriers also facilitated growth in cross-border ties between the various economies via the formation of global value chains, which also led to increased productive specialisation by these distinct economies.

Nevertheless, it remains necessary to make further progress on trade liberalisation, particularly in certain areas such as the agricultural sector, where the developed economies are highly protectionist. The manufacturing industries, meanwhile, are more liberalised, although those intensive in manpower continue to be protected by high barriers in many countries. Elsewhere, non-conventional protectionist measures (such as anti-dumping) have gained ground.

Despite the intense pace of liberalisation, the growth in global trade has slowed significantly in recent years. Since the economic-financial crisis of 2008-2009, annual growth in the volume of trade in goods and services has averaged 2%, well below the average of 6% observed during the two preceding decades. Among the factors that may be explaining this slowdown is the uptick in protectionist measures, coupled with a halt in trade liberalisation agreements, a slowdown in the formation of global value chains and low investment rates. This trend could accelerate if the steps towards greater trade restrictions being put in motion by the United States ultimately materialise. In recent months, the US has announced protectionist measures affecting different products of increasing relevance, prompting in-kind responses by the countries affected.

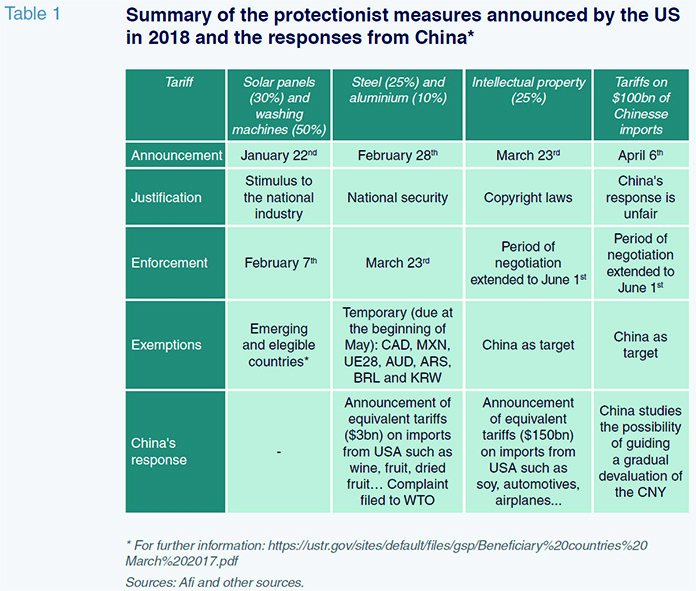

At the beginning of the year, the US announced the imposition of tariffs on solar panels and washing machines, with the goal of boosting national industry. It was a widespread measure, applicable to all countries, albeit of limited impact given the scant materiality of these products in US trade: they account for less than 1% of US imports.

One month later, the Trump administration announced fresh tariffs, this time on steel and aluminium imports. The announcement marked an important quantitative leap, insofar as these products represent around 2% of US imports. These measures initially implied a major impact for the exports from countries such as Canada, Brazil and the Eurozone, the US’s key suppliers of these commodities.

However, the ultimate impact was reduced as all countries have been (temporarily) exempted except for China, to which the new tariffs have been in effect since March 23rd. That same day, China announced tariffs on US imports (products such as wine, fresh fruit, etc.) for an import value equivalent to that represented by the steel and aluminium imported by the US from China: 3 billion dollars.

In the following days, a series of threats of additional tariffs ensued: the US at one point was threatening tariffs on 150 billion dollars of Chinese imports, focused on intellectual property goods, with China responding in kind.

At the time of writing, the negotiations between the various countries (China and the US and the US and the rest of the countries that are, temporarily, exempt) remain ongoing. The outcome of these negotiations will tell whether the threat to foreign trade dissipates, remains a point of contention between China and the US only, or extends to other countries.

Against this backdrop, it is relevant to assess the vulnerability of the Spanish economy by analysing its role in the global production chains in a world in which economies have become increasingly integrated in recent years.

Spanish exports are highly concentrated in strategic sectors

The Spanish economy’s goods trade deficit would appear to have stabilised at around 25 billion euros since the start of the economic recovery, although it is worth noting the sharp dependence on oil imports. In fact, the non-energy account is virtually balanced, in contrast to a deficit of over 60 billion euros in 2007. This correction was enabled by an extraordinary performance of the exports of goods (whose weight in the economy has increased by nearly six percentage points to 24% of GDP) compared with a more moderate growth in imports. As a result, the trade openness ratio (goods) has increased from 44% of GDP at the start of the crisis to almost 50% today. The significance of this increase lies with the fact that it has been driven essentially by the growth in trade.

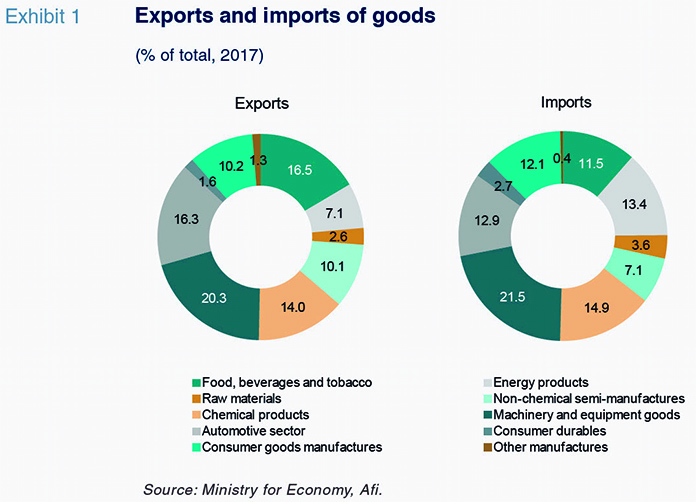

Within exports, in 2017, it is worth highlighting the sale of machinery and equipment goods (20% of the total), food, beverage and tobacco products (16.5%), the automotive sector (16.3%) and chemical products (14%). However, a more detailed breakdown reveals how concentrated goods exports really are. Around 40% are distributed between a few sub-sectors: the automotive sector (vehicles and parts), which accounts for 16% of the total, followed by fruits and vegetables, at 6%, similar to the weight commanded by textiles. Lastly it is worth singling out exports of equipment for industry and transportation (almost 11% on aggregate).

As for imports, energy products represented 13.4% of the total. The energy sector is followed by the automotive sub-sector (13% of the total), textiles (7%) and industrial equipment (5.6%).

This relative symmetry between exports and imports of goods is one indicator of the extent of the Spanish economy’s integration into the global value chains.

Elsewhere, the surplus in the trade of services has widened notably in recent years (from 3% of GDP in 2007 to nearly 5% in 2017). This increase is not only the result of a strong performance across tourism-related exports (around 50% of total) but also healthy momentum in non-tourism services. The burgeoning weight of non-tourism service exports represents one of the most significant changes in the Spanish economy since the economic crisis of 2008.

By class of activity, business services represent nearly one-third of all non-tourism service exports, led by technical services, related mostly to engineering activities but also trade-related (22%), professional and management consultancy services (9%) and R&D services (2%). Transportation, maintenance and repair services account for 29% of non-tourism service exports; telecommunications, computer and data services represent 17%; and financial, insurance and pension services account for 11%. Other sundry services, including construction-related services, account for the remaining 10%.

Another characteristic trait of Spanish trade is its significant exposure to certain markets. Over 65% of all exports go to economies within the European Union, the top destinations being France, Germany and Italy. The flip side of the coin is that the bulk of imports also come from this region. Outside the EU, Spain’s main trading partners are the US, China and Morocco.

Spain’s integration into global production chains is concentrated in manufacturing exports

Spain has not been apart from the growth in global value chains in recent decades. This is evident in the significant symmetry between the main exporting and importing sectors, as well as the significant percentages of intermediate goods in exports and imports, as noted above.

The advent of these value chains has permitted the fragmentation of the process of producing a given good or service among different economies. The rise of these chains has been facilitated by the drop in transportation costs, technological changes and the liberalisation of global trade. In many instances, the formation of these chains has segmented the more value-added tasks involving more highly skilled jobs, which remain in the more advanced economies, while the more labour intensive and less value-adding steps have been offshored to developing economies. Against this backdrop, bilateral trade relations have lost relevance in terms of analysing trade flows between countries, while analysis of the cross-border integration of countries in global production processes has become more important.

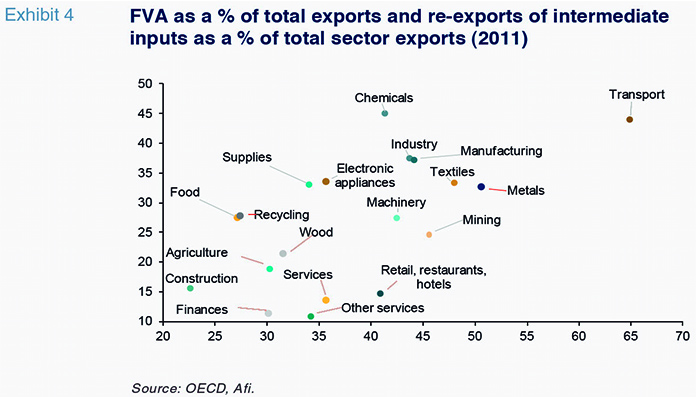

An analysis of the Spanish economy’s participation in the global value chains can help us better understand the correlations between exports and imports. One way of measuring this integration is by means of the foreign value added (FVA) content of the goods and services exported. The higher the percentage of FVA embedded into these goods, the higher a country’s integration into the global value chains. Another measure of trade in value added (TiVA) is the percentage of imported intermediate inputs used for exports (re-exports)

[1], the larger the volume of re-exports the more integration in the GVC.

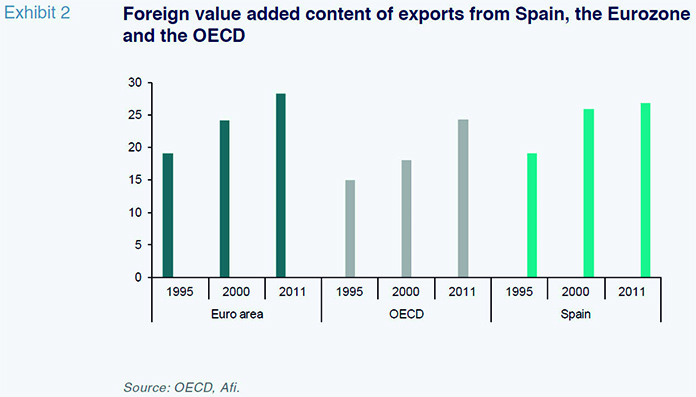

The Spanish economy’s participation in global value chains has increased substantially in recent years, in line with the rest of the Eurozone member states. According to the OECD

[2], the percentage of FVA embedded in exports increased by over five percentage points between 1995 and 2011 to 27% (Exhibit 2). In the case of the Eurozone, the trend is similar: from 19% in 1995 to 26% in 2011. In this same vein, re-exports of intermediate goods have been steadily increasing in recent decades (from 30% of all intermediate goods in 1995 to 41% in 2011).

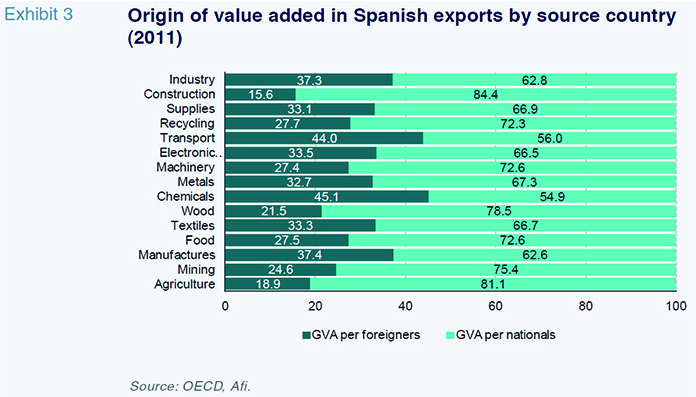

At the sector level, manufacturing goods exports are the most integrated in the global value chains, presenting a FVA of 37% and re-exports of 44%. Meanwhile, services tend to be far less tradable and those that are, are less fragmented. The FVA content in this sector stands at 14% (Exhibit 4).

It is worth highlighting the significant role played by the specialisation of the manufacturing industry in the economy’s integration into the global value chains. Thus, the FVA content of automotive sector exports is over 40%, while the re-export of imported intermediate inputs stands at 65%. This sector and the chemicals industry (FVA content: 45%) are the most integrated in the cross-border production chains. The chemicals industry also stands out for the speed of its integration into these processes (the FVA content embedded in the sector’s imports increased by nearly 10 percentage points between 2000 and 2011). Other strategic sectors such as the food and textile sectors also present an increasing amount of FVA contents in their exports.

In short, the snapshot of the flows of goods traded by Spain suggests that not only are its exports highly concentrated sector-wise (recall that almost 40% of all exports correspond to vehicles and vehicle parts, fruits and vegetables, textiles and equipment) but that these exports are in many instances part of cross-border production processes. In contrast, the surge in the export of services −tourism and non-tourism services − has taken place with less involvement in the global value chains.

Increased restrictions on trade flows could adversely impact growth

In the current environment, it is particularly important to analyse the possible implications for the Spanish economy of an increase in restrictions on international trade flows. Any measure that ultimately impacts final consumer goods or the inputs used in the global value chains in which Spain is more integrated could have an adverse impact on the country’s growth. The automotive industry, for example, generates nearly 10% of all industrial jobs (almost 250,000 jobs) and 10% of total value added; it also presents an investment ratio of close to 16%. In addition to the direct impact on activity, jobs and investment, there would be a knock-on effect as a result of the impact on the auxiliary sectors that depend to a large extent on the automotive industry.

In addition, the food industry (whose exports account for 16% of the total) generates nearly 19% of all industrial jobs and 15% of GVA, while its investment ratio is 21%. Lastly, the textile industry, another strategic sector, is responsible for 4% of industrial jobs and its investment ratio is 9%.

For now, the focus of the negotiations between the EU and the United States is on the automobile sector. The United States wants to improve the access its vehicles have to the EU common market. Currently, imports of American cars are subject to a tariff of 10% compared to 2.5% on European cars in the United States. It should also be remembered that the United States is the EU’s main trading partner with 17% of total exports, of which almost half are linked to the automotive and transport equipment sector.

However, it is important to remember that the greater the integration of Spanish firms into the global value chains, the harder it is to implement protectionist trade measures on account of the difficulty in finding substitutes for the intermediate inputs used in them, among other things.

Conclusions

Protectionism has reared its head on the international policy agenda. After decades of progress on the liberalisation of trade and elimination of trade barriers up until the financial crisis of 2008, there is a risk of heightened protectionism which is being spearheaded by the US.

The Spanish economy is exposed to any increase in restrictions on trade flows in the event they materialise.

A glance at the export and import figures fails to reveal the complexity underpinning those flows. Indeed, in many sectors, the value chain is fragmented at the global level, which means that Spanish companies depend to a significant extent on the import of intermediate inputs produced abroad and, vice versa, the foreign exporters also embed intermediate products made in Spain into their final products. This so-called integration of the global value chains has gained importance in recent decades. As a result, the interruption of those production chains would harm foreign enterprises, domestic enterprises and end consumers. That being said, the greater the integration into the global value chains, the harder it will be to implement protectionist trade measures.

In Spain, the integration in cross-border production processes is concentrated in the sectors of greatest importance for manufacturing exports, namely the automotive, agro-food, textile, machinery and chemicals industries. On aggregate, these sectors account for nearly 40% of goods exports and 40% of industrial job generation. In addition, some of these sectors present high investment ratios.

As a result, the impact on the Spanish economy of widespread application of protectionist measures would be transmitted via these channels and could be significant in the event that the measures adopted bring about a slowdown in world trade.

Notes

Re-exports of imports imply the export of an intermediate good that includes or transforms a previously imported intermediate input.

References

DE BACKER, K., and S. MIROUDOT (2013), Mapping Global Value chains, OECD Trade Policy Papers, No 159, OECD Publishing.

OECD (2016), Trade in value added (TiVA) statistics.

PRADES, E. and P. VILLANUEVA (2017), “España en las cadenas globales de valor”, Banco de España, Boletín Económico, 3/2017.

SOLAZ, M. (2016), Cadenas globales de valor y generación de valor añadido: El caso de la economía española, Instituto Valenciano de Investigaciones Económicas.

SPANISH MINISTRY OF THE ECONOMY, INDUSTRY AND COMPETITIVENESS (2017), The monthly trade report, December.

Nereida González and Diana Posada. A.F.I. - Analistas Financieros Internacionales, S.A.