The crypto assets economy: Reality, myth and opportunity*

The recent and rapid growth of the global crypto assets market has allowed it to attain substantial relative size – below only that of the leading tech giants. Having achieved such a dimension, crypto assets have logically attracted significant attention from regulators, who simultaneously seek to manage emergent risks, while exploring possibilities for these digital cash alternatives to support improvements in current payments systems.

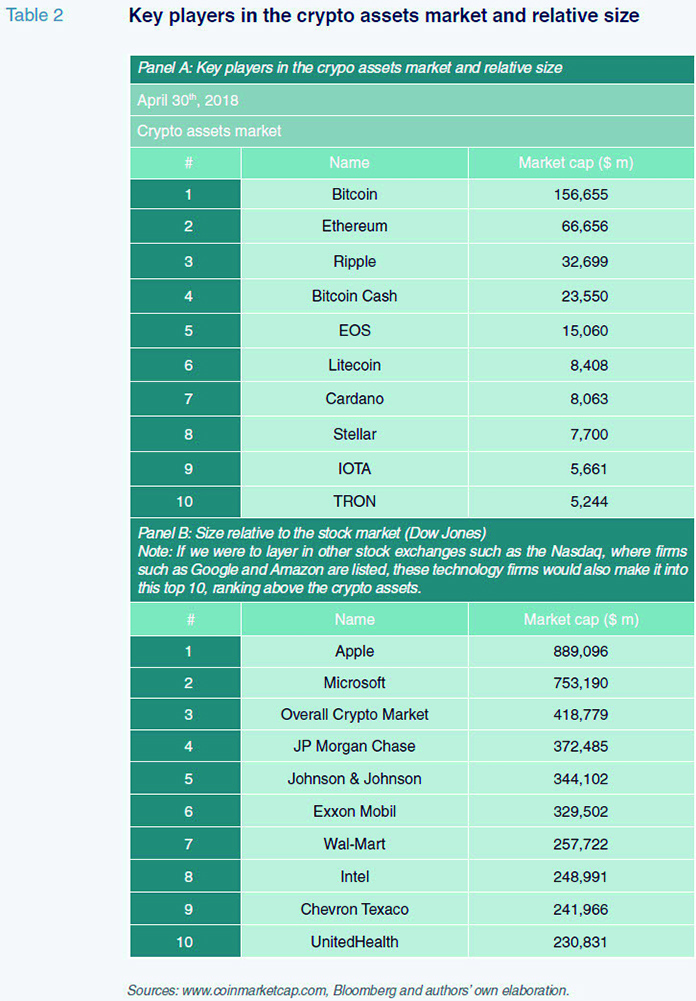

Abstract: The global market for crypto assets has boomed in recent years. There are 1,587 companies who participate in the crypto assets market. 888 correspond to crypto currencies and 699 to tokens. In total, they command an aggregate market value, or ‘market capitalisation’ of 418.78 billion dollars. By year-end 2017, a total of 2.38 billion dollars had been issued via 136 ICOs worldwide. However, these assets are traded on platforms whose market organisation and valuation systems warrant special consideration. This relative size and growth of the crypto asset market has sparked a debate over the extent to which these assets constitute a speculative bubble versus a genuine opportunity for an alternative payment and exchange system in multiple sectors. While there is evidence of a significant speculative component, there are also a breadth of opportunities to exploit the technological advantages that have arisen as a result of this phenomenon. One such possible opportunity lies in central bank digital currencies (CBDCs), which could facilitate improvements in current payment system costs and reduce tax fraud. For the case of Spain, data suggest that the country is not significantly positioned in this market in quantitative terms. Analysing the main exchange, that of Bitcoin, 24.32% of its traffic takes place in the US, 19.25% in Germany, 7.03% in China and 6.45% in France. Spain ranks in the 20th spot with 0.68% of total traffic. But Spain is nonetheless playing a prominent role in generating projects that are attracting considerable investment in the market for initial coin offerings (ICOs), having already developed 24 ICO projects to date.

The crypto asset universe: Growth opportunity… but not without risk

Crypto assets are a sign of the times we are living in insofar as they combine technological innovation, opportunity and uncertainty. Broadly defined, these assets comprise the universe of crypto currencies and other kinds of goods and services that use cryptography and blockchain technology to function. From this definition, a plethora of connotations has proliferated that are not always sufficiently exclusive. For example, these assets exclude the currencies, applications and services that are simply virtual or digital but lack encryption as their system of generation and protection.

At any rate, it is necessarily an unfinished classification given the multiple branches opening up within the realm of the crypto universe. A new language is even emerging. As with so many other dimensions of the digitalisation phenomenon, the ideas contain a very high potential value that does not always tally with the real value of their practical manifestations.

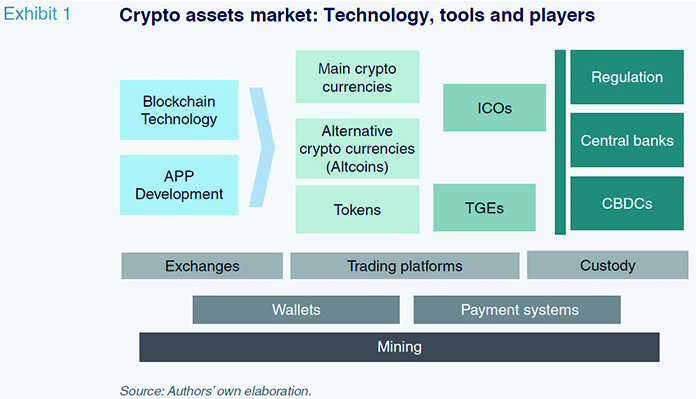

The purpose of this paper is to outline the economic fundamentals and recent development of crypto assets. Pinning down and understanding the taxonomy of this phenomenon is a challenge as it is an environment in a state of heightened flux. However, Exhibit 1 represents a reasonable attempt at a basic, yet illustrative, classification of the universe of crypto assets and at structuring their main foundations and development mechanisms.

Crypto assets bring together two worlds experiencing growth and offering still-untapped possibilities to generate financial and non-financial assets and services protected by cryptography that have already commanded a considerable presence in the market: blockchain technology and apps development. Blockchain is the most popular form of distributed ledger technology. It consists of keeping permanent track of transactional data that cannot be manipulated. The blockchains formed constitute a decentralised database that is administered by computers that belong to a peer-to-peer (P2P) network. On this network, each device keeps a copy of the system ledger to prevent any points of failure. All copies are updated and authenticated simultaneously in the network. Software applications make use of the ledger’s incorruptibility to create shared value systems. In their most common form, there are two main classes of crypto assets: crypto currencies and tokens. The cryptocurrency refers to the cryptographic representation of a currency or coin for exchange. It is used for the purpose of making or receiving payments on the blockchain. The token is a particular fungible and tradable asset/chip or a utility that is often found on an existing distributed ledger technology (DLT)

network. To define them simply, tokens are virtual units or chips that are exchanged over existing networks (mainly via blockchain). They are used to exchange goods and services of all kinds. A token may grant a right, be used to pay for a service, transfer data, join a club, attend a sporting event or indeed for any other item for distribution for which value needs to be assigned.

The notoriety of crypto currencies such as Bitcoin has made this currency manifestation the most widely known of the crypto assets to date. In parallel to Bitcoin and other currencies with a certain level of cache, such as Ethereum and Ripple, hundreds more alternative currencies have been developed that are generically known as ‘altcoins’. Nevertheless, it is conceivable that the token has become the major gateway for the potential for app development in this market. It is also the dimension where it is equally likely to find the most creative contributions for which the likelihood of true value or genuine development potential is most dubious.

At the bottom of Exhibit 1 is the architecture that is common to these assets and their development. The exchanges are markets of varying depth that function by means of algorithms that match buy and sell orders. They are in turn supported by brokers and trading/marketing platforms that offer interconnection between participants; the blockchain system permits transaction clearing and settlement at a speed that can vary but is sufficient to allow for the formation of prices that are observable by the participants. As in standard financial markets, the funds invested in crypto assets are subject to a custody regime in the main exchanges. This regime means that value can be accumulated with sufficient guarantees. Value is stored in wallets, systems or software applications designed to store crypto assets. There are custody wallets – in which the custodian holds the key for each crypto asset – and private wallets – in which the asset holder’s private key, essentially an access password, is stored.

There are three main kinds of exchanges for crypto-assets in the marketplace. The first are the centralised exchanges, in which a wallet with ledger software acts as a single clearing house for transactions on that exchange. The second exchange model is that of the ‘integrated third party’ in which several wallets interact with a central ledger of record that functions as a common exchange for all. The third model is that which fosters the direct exchange of crypto assets among their holders, the P2P or decentralised exchanges or marketplaces.

The crypto assets and the exchanges are of fundamental use as payment systems. There are two main models of crypto assets as payment instruments. The first are the crypto currencies focused on enhancing the efficiency of a standard currency. These are encryption systems that attempt to render the payments between individuals or the clearance of payments in standard currencies in a given country more efficient. The second are the payment systems centred on the crypto currencies themselves. Here, the crypto currencies are also convertible into standard currencies but the goal is for them to develop as standalone currencies and to be used for their own payments without the need for conversion.

Crypto assets are developed by means of mining, which consists of the fundamental programming operations needed to generate, authenticate and distribute these assets over a blockchain network. As with any other network, they function via nodes and their generation and recording implies numerous hours of computing to combine the various blocks and the components or ‘hashes’ of each block. This requires hardware and programmers who may work individually in exchange for a fee or interest in the assets (self-mining) or as part of a cooperative structure devised to make the network deeper and faster (mining pool). In the latter instance, the profits are divided among the pool members. These are matters of not only great economic but also technical importance insofar as one of the issues the crypto assets can face are capacity restrictions that slow down their transactions or imply (in the case of Bitcoin, for example) a maximum number of units of the crypto asset.

The universe of crypto assets depicted in Exhibit 1 prompts two considerations:

- The first relates to the extent to which the creators of the crypto currencies and tokens find financing. And the scale involved. If in the world of finance as we know it firms raise capital by offering or selling shares, in the digital world this takes place by means of initial coin offerings (ICOs) or token-generating events (TGEs). As we will show later on in this paper, a significant volume of funds has been raised in this manner in a relatively short period of time.

- The second consideration has to do with the extent to which crypto currencies or tokens are conceived of and used as a payment instrument versus a speculative investment. This is a crucial debate and it is an enthralling one. If the definition is confined to that of a means of payment or exchange, the key is to determine whether an instrument that generally lacks the official backing of a central bank can become an alternative to the mainstream currencies. Can crypto assets create the stability, backing and counterparty guarantees that a central bank attempts to provide? By way of example, academic debates are ongoing about the extent to which the crypto currencies could interfere with monetary policy targets, such as control over inflation, or replace the central banks by generating seigniorage (the income obtained by being the official issuer of a currency). This question has become murkier in light of the fact that in the midst of this technical-philosophical debate, the draw of certain crypto assets – mainly crypto currencies – has turned them into speculative investments subject to considerable volatility and, on occasion, hard to value in the marketplace.

As often happens, private enterprise and innovation have run ahead of the official alternatives and regulations. However, the role of central banks is shaping up to be pivotal in the near future for several reasons. One of the most powerful is the fact that a substantial portion of the flows of crypto-currencies entering the market is being hacked or stolen. It is not that the underlying technology is being compromised but more a matter of identity theft or plain fraud. Ernst & Young estimates that by mid-2017, some 11% of the funds that had been issued by way of ICOs (equivalent to approximately 400 million dollars) had been hacked or robbed.

[1] There have also been cases of theft of some of the most popular crypto currencies, such as Bitcoin. These thefts are not the result of technological vulnerabilities attributable to the blockchain but rather the theft of keys from a certain wallet or exchange platform. It is also important to consider the risk intrinsic to the ultimate use of certain crypto currencies for illicit and fraudulent activities, the flip side of the liberty and anonymity (partial) forming part of the powerful philosophy underpinning the crypto assets.

Elsewhere, another open-ended question is to what extent the crypto assets can advance privately in an economy whose financial safety net depends on central banks as the basis for the circulation of fiat currencies not to mention their role in underpinning the safety of certain savings and investments.

What neither the supervisors nor the central banks can or seem to want to deny is the significance of blockchain technology for payment systems and the possibilities it opens up. Against this backdrop, some public initiatives and public-private partnerships are cropping up in the area of central bank digital currency (CBDC) development, an instrument also depicted on Exhibit 1. The idea behind a CBDC is to combine payment security with authentication speed and lack of third-party intermediation offered by blockchain technology. The central bank would simply constitute the backer, the technology system and the overseer of a virtual currency that could replace cash, which would increase payment system efficiency while reducing the fraud and other collateral costs associated with payments using notes and coins.

This does not mean that regulators are unilaterally against crypto assets. To date, their position has been to urge extreme caution because they believe there are two aspects of how they work that are not suitable for retail investors. One is, precisely, the lack of control and regulations which means that when one of these initiatives is identified as a fraud it may be too late to warn users. The other is that the supervisors believe that the investment dimension of these assets (as opposed to their use as a payment mechanism) is not suited to retail investors on account of their high volatility and the difficulties in determining their market value.

On February 8

th, 2018, the European Securities Markets Authority (ESMA), the European Banking Authority (EBA) and the European Insurance and Occupational Pensions Authority (EIOPA) issued a joint statement

[2] warning consumers of the high risks of buying and/or holding so-called virtual currencies (VCs). These authorities stated that the “VCs currently available are a digital representation of value that is neither issued nor guaranteed by a central bank or public authority and do not have the legal status of currency or money. They are highly risky, generally not backed by any tangible assets and unregulated under EU law, and do not, therefore, offer any legal protection to consumers. The three ESAs are concerned by the fact that an increasing number of consumers buy VCs particularly with the expectation that the value of VCs will continue to grow but without being aware of the high risk of losing their money invested.”

In Spain, similarly on February 8

th, the securities market regulator, the CNMV, and the Bank of Spain issued a joint statement

[3] along similar lines, noting that “these cryptocurrencies are not backed by a central bank or any other public authority, and while they are occasionally presented as an alternative to legal tender, their characteristics differ greatly from the latter:

- Their acceptance as a means of payment for a debt or other obligations is not mandatory.

- Their circulation is very limited.

- Their value fluctuates widely, meaning that they cannot be considered a sound store of value or a stable unit of account.”

The Spanish supervisory bodies also warn in the same joint statement of the problems of “liquidity and extreme volatility” posed by these currencies as investments.

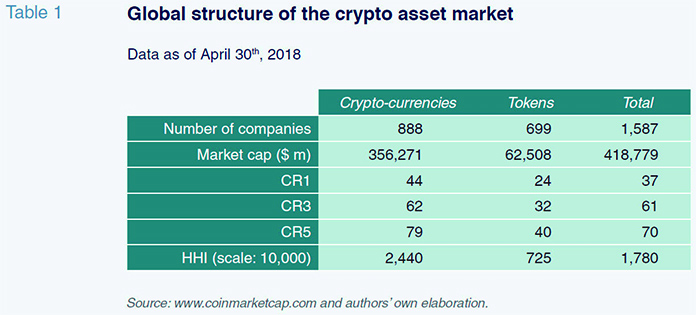

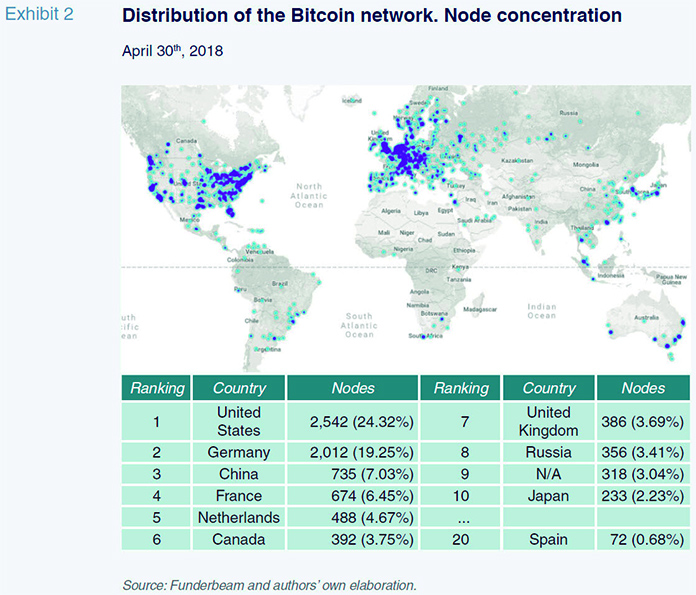

Global data and the situation in SpainThe crypto market has clearly been one of the fastest growing in the world in recent years, particularly since 2016. Table 1 provides certain structural indicators. Although comings and goings are frequent, as of April 30

th, 2018, there were 1,587 companies in this market – 888 correspond to crypto-currencies and 699 to tokens – and www.coinmarketcap.com attributes these firms a market value of 418.78 billion dollars (356.27 billion dollars accounted for by crypto currencies and 62.51 billion by tokens). Note that the very use of the term ‘market cap’ in respect of these assets highlights their de-facto classification as investments rather than payment mechanisms.

The market structure also provides insight into how it has developed. Looking at the crypto-currencies, the market share commanded by Bitcoin, the leading company (concentration ratio or CR1) is 44%; that of the three largest virtual currencies (CR3) is 62% and that of the top five (CR5) is 79%. The market shares are somewhat lower in the tokens segment, albeit still significant, as the top five tokens account for 40% of the segment’s market cap.

Concentration in the market as a whole – considering all participants – can be measured using the Hirschman-Herfindahl Index (HHI). The HHI is the sum of the squares of the market shares of all market participants. It can range between “1/number of participants” and 1. In practical terms, it is usually expressed on a scale of between 0 and 10,000. In the case of the market for crypto assets, the HHI is 1,780, and is substantially higher in the crypto currencies segment (2,440) than in tokens (725).

As shown in Table 2 (Panel A), among the main crypto currencies there are two particularly prominent exponents: Bitcoin and Ethereum. Ripple and Bitcoin Cash are also playing a significant and increasingly prominent role. The line that divides the main from the alternative (altcoin) currencies is hard to pin down and depends on the relative success of each initiative in snatching market share away from the rest. At this juncture, it is pertinent to point out certain aspects of how the crypto currency market is organised given that it uses the platform formula – software underpinned by an exchangeable unit of value. As in other current multi-sided platforms, there is a price that can be assigned to the value of one of the sides (in this case that of the software and idea) and another that depends on the success of the crypto currency among users. This price structure similarly applies to tokens. For the different sides of the platform to see their value increase, it is necessary to leverage the network effect. Specifically, growth in the acceptance and use of a crypto currency so that it can achieve scale and dilute costs. However, the crypto currency platforms present a unique quality: the software is generally open source (as was the case with Bitcoin which is the origin of nearly all the other crypto currencies); herein lies part of its success because the programmers can propose improvements and make it work more efficiently. However, open-source software gives rise to two types of forking: ‘soft forks’, meaning the upgrade of existing software without altering its compatibility; and ‘hard forks’, which have the effect of rendering the prior software platform obsolete or incompatible. As a result, innovation and competition can end up compromising scalability and convertibility among crypto currencies.

In Table 2 (Panel B), albeit a rough financial approximation, the aggregate value of the market for crypto assets (defined broadly as the dollar equivalent of all of these assets) would rank it as the third-largest company on the Dow Jones at 418.78 billion dollars, behind only Apple (889.1 billion dollars) and Microsoft (753.19 billion). The importance of these figures, despite the fact that we are comparing the market value of shares with the value of currencies, is that they paint a picture of the relative importance attained by crypto assets; indeed, they are probably the most relevant financial phenomenon of recent years.

Elsewhere, given that the data is exchanged via software, the geographic distribution of the transactions depends on the number of nodes. From an analytical perspective, this enables identification of where traffic is heaviest and, by extension, the pinpointing of the importance of each country or region in this market. This is all the more relevant considering that many of the crypto asset initiatives may be developed by programmers of a given nationality but have the financial backing of another territory and be developed technology-wise in yet another. The Funderbeam trading platform maps the location of these nodes in the most important market, that of Bitcoin (Exhibit 2). As of April 30

th, 2018, 24.32% of the nodes were located in the US, 19.25% in Germany, 7.03% in China and 6.45% in France. The UK, known as the originator of companies that trade in Bitcoins, accounts for just 3.69% of its nodes. Spain ranks 20

th with 0.68% of total nodes.

Pinpointing Spain’s ranking in this market is nevertheless complicated by the fact that some Spanish initiatives are being developed from London, Singapore and Gibraltar. The first crypto currency in Spain was SpainCoin in 2014; however, the most developed to date is PesetaCoin (PTC), which, as of the end of April, had a market cap of 6.4 million euros. A new Spanish initiative based in London called Bilur was set up last year. There is also a burgeoning generation of tokens, which, as we will see later on, are cropping up in a number of sectors: from betting platforms secured by blockchain systems to payment systems for restaurant chains.

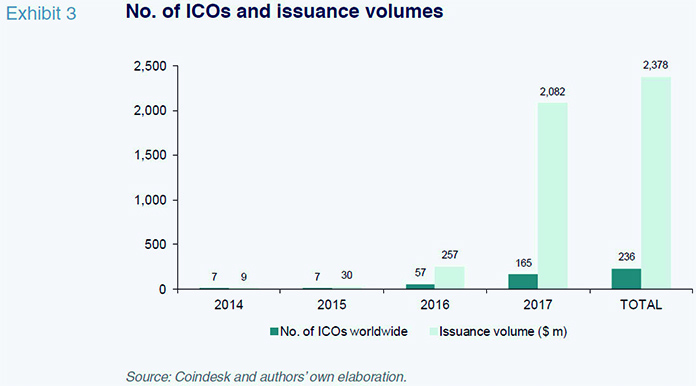

When investment in crypto assets reaches the point of institutionalisation, many firms opt to fund their projects by raising capital via public offerings. Against this backdrop, the market in initial coin offerings (ICOs) and initial-token events (ITGs) has experienced very considerable growth in recent years. Note that it is commonplace for both routes to be indistinctly labelled ICOs, as is reflected in the main statistics. For example, the numbers provided by Coindesk (Exhibit 3) show that by the end of 2017, ICO issuance had reached 2.38 billion dollars, most of which was issued in 2017 (2.08 billion dollars). The total number of ICOs was 236, 165 of which took place in 2017.

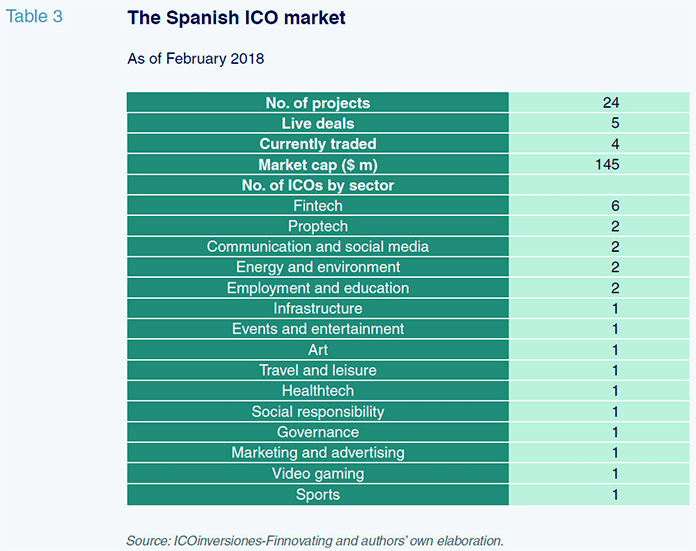

As indicated in Table 3, Spain is an active market for ICOs and is currently home to 24 projects, five of which are live (as of February 2018 according to Finnovating) with four already trading on some form of trading platform. The aggregate market cap of the ICOs in Spain is 145 million dollars. As for the breakdown by sector, as many as 15 different sectors can be identified for this type of investment, the most popular being the financial sector (Fintech; 6 projects), real estate (Proptech; 2), communication and the social media (2), energy and the environment (2) and employment and education (2).

Crypto assets as an investment: Prices, volatility and valuation issues

Crypto currencies have to date enjoyed the greatest popularity among the crypto assets and their valuations have oscillated significantly in short periods of time. This volatility has drawn attention to three technical aspects: i) the possible existence of speculative bubbles; ii) the intrinsic long-term value of these currencies; and, iii) how to measure that value. As demonstrated by the case of bitcoin.

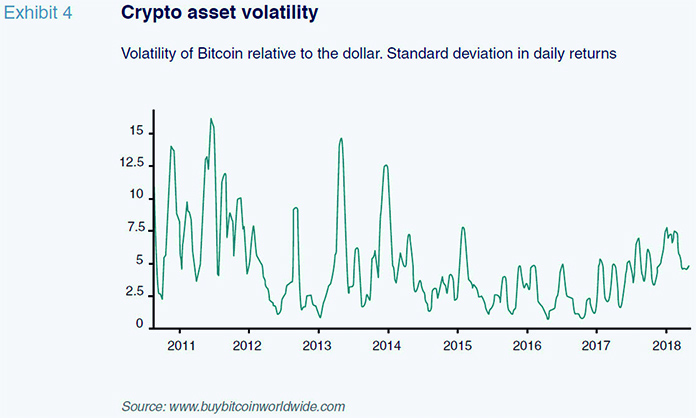

The main crypto currencies, particularly Bitcoin, have been characterised by volatility. Exhibit 4 depicts the volatility sustained by Bitcoin measured as the standard deviation in its daily returns relative to the dollar. In this sense, if Bitcoin is to be considered an alternative currency to the fiat money backed by central banks, it could be deemed comparable to gold, offering protection against inflationary movements and changes in the money supply. This theoretical approach has prompted some to label the crypto currencies ‘digital gold’. However, gold presents daily volatility of around 1%, whereas that of Bitcoin depicted in Exhibit 4 is several times higher.

As for the existence of speculative bubbles, Shiller (2014) suggests that such bubbles are shaped by fashions, sociological epidemics and biased or flawed reporting in the media. A first indication suggesting that Bitcoin is being used to speculate lies with the fact that 70% of this currency is not apparently being used but is instead being kept in ‘dormant’ accounts as an investment (Weber, 2015). The ups and downs in the value of this and other crypto currencies in the wake of warnings from the supervisors or the odd episode of fraud or theft have also raised red flags regarding their intrinsic value.

Although the speculative component would appear undeniable, it is far more complicated to establish the intrinsic value of these assets including all of their tangible and intangible components. If we use the standard methodology for valuing a currency or financial asset, the results commonly suggest that the market prices of the crypto currencies are driven excessively by their trading volumes and that they are considerably overvalued. Some even argue that the intrinsic value of currencies such as Bitcoin is zero

[4] and suggest that the price can certainly go to zero if trust vanishes.

[5]

The purpose of this paper is not to determine that value but rather to describe their economic fundamentals and contrast the various approaches to valuing them. Despite the pessimism regarding their intrinsic value touched upon above, it is nevertheless advisable to consider the possibility that these assets embody significant value for several reasons. The first is that many of the analysts who have augured a short life for assets such as Bitcoin have already seen them outlive their own expectations and, albeit with ups and downs, their valuations have continued to rise. More importantly, however, is the consideration that although part of their value may be being fuelled by an irrational bubble, another significant part may not be being properly measured. Recent studies suggest that standard financial analysis is not appropriate for measuring currencies such as Bitcoin. The reason is that the value of these encrypted currencies depends on aspects, such as the level of competition between the various networks, the speed with which each unit is produced and the complexity of the algorithms used for mining purposes. In short, the costs of production and network effects. These methods highlight the importance of production costs and the advantage conferred by blockchain technology in determining the fair value of crypto currencies (refer, for example Hayes, 2017).

The role of the central banks and CBDCs: Backing, clearance, seigniorage and efficiency

Ultimately, it is hard to refute the value of using distributed ledger technology, such as blockchain to accelerate the virtualisation of money. The question is to what extent this challenge can be taken up by central banks and to what measure the privately-developed crypto currencies could be displaced by central bank digital currencies (CBDCs).

The origin of this dichotomy between crypto currencies and CBDCs lies with the use of the digital currencies as an alternative to fiat money. Specifically, to the extent that the crypto currencies may present a degree of inelasticity with respect to the money supply and, thus, not be so dependent on inflation, as is the case of gold. However, their volatility suggests that price stability is not the advantage conferred by crypto-currencies. Where the bulk of the value most probably lies is in the associated technology (the blockchain) and the scope for making payments in the absence of third-party authentication, relying instead on the secure authentication offered by the blockchain itself.

The idea underpinning a CBDC is to use blockchain technology to generate a digital version of cash that can be readily exchanged peer-to-peer (P2P) at a constant face value. It is important to distinguish this initiative from others which, with the blessing of the monetary authorities, have been launched by private banks as wallets to foster the substitution of cash with electronic payment mechanisms, such as the J Coin in Japan. These are unofficial alternatives that do not imply convergence towards a common official digital system.

The potential benefits of CBDCs may be significant to the extent they facilitate progress towards a cashless society, substantially lowering the cost of payment and exchange systems and reducing fraud in parallel. However, they also pose major challenges, such as changes in the money supply and articulation of central bank policy; another issue is the right pace at which to replace physical funds with digital money so as not to disrupt the system.

Final considerations: The future for crypto assets

It is not easy to predict the fate of the crypto assets. So far, the figures are incredibly eye-catching: the crypto currencies are already moving virtual money equivalent to close to half a billion dollars. It is also noteworthy that over 2.3 billion dollars has been raised around the world in the form of initial coin offerings (ICOs).

The analysis undertaken in this paper suggests that Spain is not significantly positioned in this market in quantitative terms but is playing a prominent role in generating projects that are attracting considerable investment in the market for ICOs.

The paper highlights the prevailing debate concerning the volatility being displayed by the crypto assets and the suitability of the conventional valuation models for determining the intrinsic value of these assets. The suggestion is that standard price analysis should be complemented by other methods that specifically factor in the cost of producing crypto assets and the value of the underlying technology. On this point it is also worth examining to what extent the forks in the software underpinning these assets may be compromising their scalability and economies of scale expected to result from growth in user numbers.

Lastly, it is looking increasingly as if central banks and supervisors will play a vital role in the development of crypto assets. On the one hand, they may seek to exercise their oversight and control duties over these assets and warn users in the event of suspected fraud or an environment not deemed suitable for retail investors. On the other hand, and just as important, if not more so, we cannot rule out the possibility that they could develop their own digital currencies (CBDCs) and establish a digital alternative to cash that could drive a reduction in payment system costs and tax fraud. At any rate, these are uncharted waters and not a journey to be embarked on lightly on account of the technical ramifications and huge significance for financial stability.

Notes

References

HAYES, A. S. (2017), “Cryptocurrency value formation: An empirical study leading to a cost of production model for valuing bitcoin,” Telematics and Informatics, 34: 1308–1321.

SHILLER, R. J. (2014), “Speculative asset prices,” American Economic Review, 104: 1486-1517.

WEBER, B. (2016), “Bitcoin and the legitimacy crisis of money,” Cambridge Journal of Economics, 40: 17–41.

Santiago Carbó Valverde. CUNEF and the Funcas Observatory of Financial Digitalisation

Francisco Rodríguez Fernández. Granada University and the Funcas Observatory of Financial Digitalisation