New coverage requirements and accounting rules: Impact on Spanish banks’ non-performing exposures

The overlap of recent EU guidelines on coverage levels for non-performing exposures (NPEs) with the implementation of new accounting standards is expected to put additional strains on banks’ profits. While pressures should be limited in Spain, both in Spain and in Europe, the regulatory changes have incentivized an unwinding of banks’ stocks of NPEs, which is expected to continue into 2018.

Abstract: The new coverage requirements for NPEs arising from proposals put forth both by the European Commission and the ECB, together with the entry into force this year of IFRS 9 accounting standards, is expected to put additional pressures on banks’ income statements at a time when profitability remains a key challenge. In this context, banks are given a clear-cut incentive to reduce their exposure to such assets. The Bank of Spain’s recent modifications to NPE classification will help reduce the impact of IFRS 9 on Spanish banks. At the same time, Spanish banks have already reduced their NPEs 46% since December 2013. The sale by Spanish banks of large portfolios of non-performing exposures in 2017 accounted for nearly half of all sales of non-performing assets in Europe last year. Taking into consideration Spanish banks’ strategic plans for further reducing their non-performing exposures and the portfolios already on sale, the market will once again be very active in 2018. However, concerns regarding the impact on the market of the influx of properties as a result of the large transactions closed last year could weigh on potential buyers’ expected returns.

IntroductionIt is clear that a high ratio of non-performing assets or exposures (NPEs) hurts banks’ profitability. Non-performing assets have to be written down for impairment, financed and managed with a view to recovering them. All of these factors weigh on banks’ income statements, particularly at times of ultra-low and/or negative interest rates such as at present. The concern expressed by Europe’s financial regulators and supervisors regarding the stock of non-performing exposures is not new. As part of the Supervisory Review and Evaluation Process (SREP), and on the basis of non-performing assets as at December 2015, the ECB established criteria for requiring many entities to present a strategic plan for managing their non-performing exposures

[1].

However, since mid- 2017, this concern has become far more palpable in the form of new regulations designed to put pressure on banks to reduce their NPEs quickly. The ultimate goal of these regulations is to create incentives conducive to the early management of non-performing loans (NPLs) and in the event of accumulation, their sale in secondary markets. Against this backdrop, the Action Plan to Tackle Non-Performing Loans in Europe announced by the European Commission in July 2017 raises a series of proposals for forcing the financial institutions to reduce the risk of running high stocks of impaired exposures in the future. Although the plan includes a plethora of proposals, three aspects stand out: (i) the proposal for a minimum common coverage level for newly- originated loans that become non-performing by means of an amendment to the CRR; (ii) the development of secondary markets for non-performing assets with the aim of enabling creditors to recover value even during episodes of stress; and, (iii) a technical blueprint for the creation of national asset management companies (AMCs) or so-called ‘bad banks’. In this paper we will focus on the impact of the amendment to the CRR Pillar I requirement and the ECB’s supervisory expectations (Pillar II) when assessing a bank’s level of prudential provisions for non-performing exposures in light of the new guidance published by the ECB.

The new regulations require higher coverage levels for non-performing exposures and introduce incentives for their efficient management or sale in the event of accumulation. It is important to note that these initiatives overlap with the implementation of the new IFRS 9

[2], which has generated concern regarding the potential crystallisation of an additional stock of non-performing assets that would weigh on European banks’ profits. Estimates have suggested an increase of 11% for the European banks in this respect. In Spain, the situation is a little less worrisome since Bank of Spain Circular 4/2016 had already brought Spanish regulations closer to the FINREP framework. As a result, using Bank of Spain nomenclature, the ‘substandard’ loan category has disappeared and the exposures that used to be classified as substandard or underperforming now qualify for ‘special monitoring’ within ‘normal’ or performing exposures. This new classification system is fairly close to what qualifies as stage 2 impairment under IFRS 9. Similarly, the Bank of Spain also updated its definitions of ‘doubtful’ and ‘normal’ exposures (Annex IX) to distinguish more clearly between ‘performing’ and ‘non-performing’, in line with the FINREP framework. These modifications, among others, help explain the reduced incidence of IFRS 9 on the Spanish banks’ stock of non-performing exposures, as detailed further below.

Moreover, there is an element of overlap between the new accounting rules and the regulators’ desire to accelerate the reduction of banks’ stock of non-performing exposures. Some banks, particularly those of Italy and Greece with high NPE ratios, would appear to be pre-empting their coverage requirements, making the most of the advantageous 5-year transition period put in place by the EC for new provisions with an impact on capital. The Italian banks have recognised 10.7 billion euros of provisions for expected losses while those of the Greek and Cypriot banks are expected to reach 3.5 billion euros

[3]. These additional provisions incentivise the accelerated reduction of non-performing assets although it would appear that they have caused the ECB some concern on account of their deferred accounting treatment.

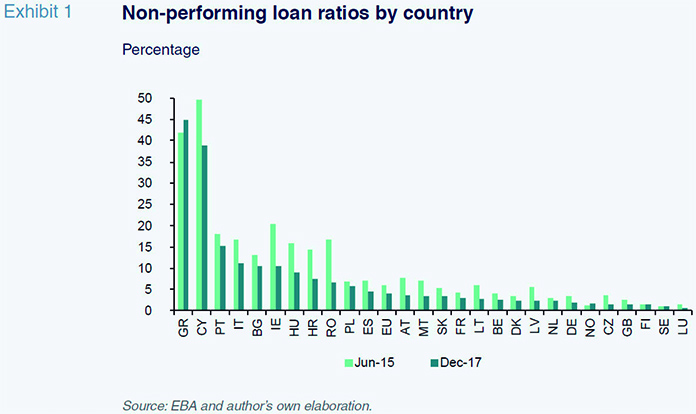

European banks: Non-performing assets and new regulationsThe financial crisis of 2008 left European banks saddled with a sizeable burden of non-performing assets which is making it hard for them to restore their margins to acceptable levels, in light of the cost of capital, in a context of historically low rates. Exhibit 1 depicts the trend in non-performing loans in the EU between June 2015 and December 2017. Greece and Cyprus stand out, with NPL ratios of over 35%. In Cyprus at least the stock of NPLs is declining, whereas in Greece it continues to climb. The Spanish financial sector is very close to the EU average, having reduced its average exposure by more than the EU as a whole.

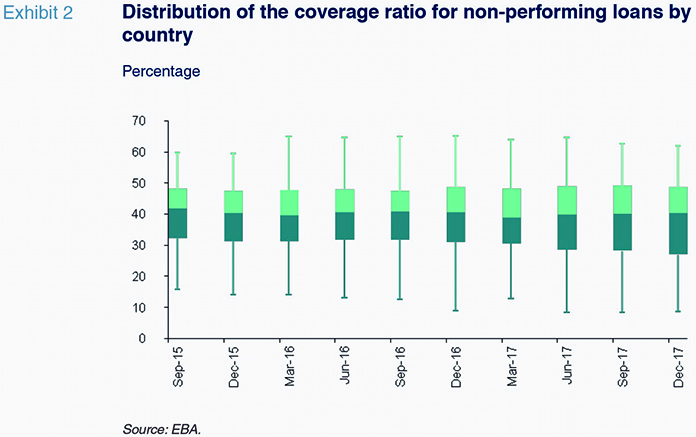

One of the main objectives of the new regulations on non-performing assets is to standardise the provisioning effort by establishing a minimum level of coverage of non-performing assets applicable to all entities. Exhibit 2 provides the interquartile range for coverage in the various EU member states. The upper quartile represents the value of the indicator that includes 95% of the sample while the lower quartile represents the indicator that includes 5%. The interquartile ranges (between 25% and the median and between the latter and 75%) are shown in dark blue and light blue, respectively. Exhibit 2 shows how the median coverage ratio has been steady at around 40% but the interquartile range between 25% and the median has been expanding considerably, while the level that captures 95% of the sample has been falling. The huge range between the 5% and 95% percentiles of the distribution is particularly eye-catching.

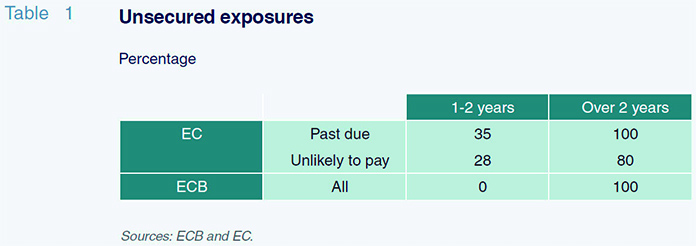

As noted in our introduction, the pressure to increase coverage ratios is coming from two fronts. On the one hand, the European Commission (EC) has proposed setting a new minimum coverage ratio (Pillar I); on the other hand, the ECB has established expectations concerning coverage for the SREP (Pillar II). The EC regulation is automatic and implies the imposition of a minimum coverage ratio by way of an amendment to the CRR, whereas the limits established by the ECB are framed by the supervisory dialogue the ECB engages in with the entities as part of the SREP. This means that not complying stringently with the coverage requirements deriving from the ECB’s guidelines may not have consequences if convincingly justified to the supervisor.

Much of the analysis regarding the differences between the EC and ECB requirements has focused on the noteworthy calendar difference for maximum coverage (100%) for secured exposures which is set at eight years of NPL vintage in the EC regulation, compared to seven years for ECB purposes. Nevertheless, there are multiple similarities between the two sets of requirements, as well as certain important differences. For example, in both instances the requirements relate to assets that turn non-performing after effectiveness of the new regulations (

i.e., new non-performing exposures); it is logical, however, to interpret the measures as setting a precedent for all non-performing exposures

[4]. In addition, bank exposures are classified in the same way in both regimes, distinguishing between secured exposures or secured balances of partially-secured exposures and unsecured exposures, or unsecured balances of partially-secured exposures. The requirements both vary depending on how long the assets have been non-performing. However, the EC requirements distinguish between past due and ‘unlikely-to-pay’ exposures. There are other important differences. As noted earlier, the EC proposal consists of a regulation and would therefore be binding, whereas the ECB guidance puts forward an expectation for discussion with the regulator. In addition, as the EC proposal is a minimum requirement set down in the CRR, it would apply to all the countries to which that Regulation applies, whereas the ECB guidance only applies to the member states under the Single Supervisory Mechanism (SSM). In general, the ECB imposes higher coverage ratios

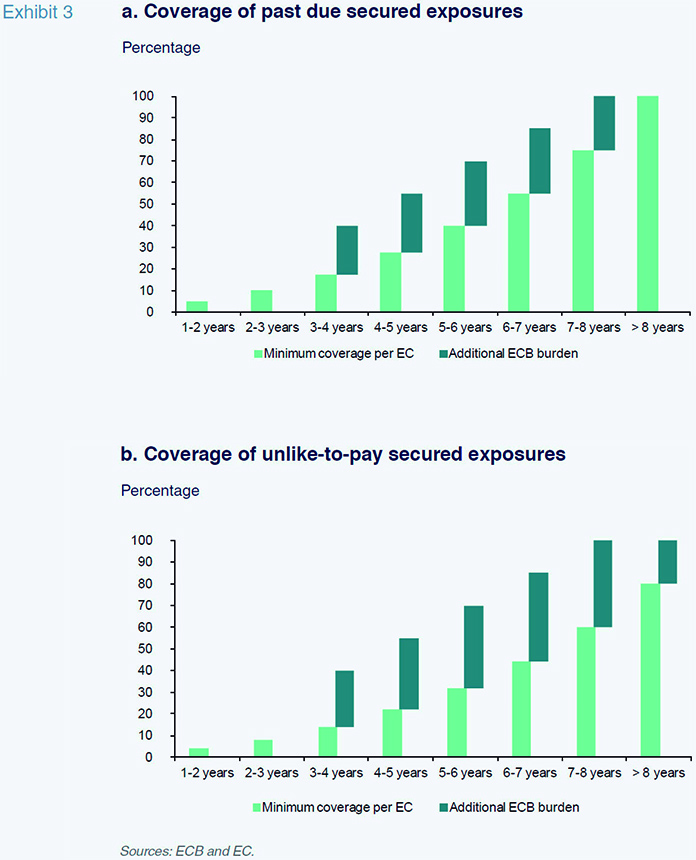

[5] relative to the EC requirements. For unsecured exposures, the ECB is looking for 100% coverage from year two after classification as non-performing. The EC proposal is to have banks provision 100% of past due exposures only from year two and a lower 80% of unlikely-to-pay exposures. Exhibits 3a and 3b provide the coverage ratios for secured exposures as a function of the length of time they have been non-performing and the likelihood of collection.

Exhibits 3a and 3b evidence the additional burden implied by the ECB guidance. In the case of the ECB requirements, both past due and unlikely-to-pay exposures require 100% coverage by year seven after classification as non-performing, whereas the EC proposal only requires 100% of secured exposures past due by more than eight years.

New regulations and non-performing assets in SpainThe most recent data concerning Spanish banks’ non-performing exposures show clear signs of improvement. The deposit-takers’ non-performing loans declined by 16.1% to 94.18 billion euros in 2017

[6]. The percentage of newly non-performing exposures (28.7%) increased in 2017 compared to the trend witnessed during the three prior years but recoveries were also proportionately higher (-31.2%). The reduction in non-performing assets due to write-offs was 13.7% of the opening NPE balance. The biggest contributor to the reduction in NPEs was the corporate segment (-20.7%), particularly companies in the construction and real estate sectors (-30.6%) which presented a non-performing ratio of as high as 37% in December 2013. Non-performing exposure to home mortgages fell by 4.4%, a somewhat narrower decline than the year before. However, in the household lending segment other than mortgages the rate of change in non-performing exposures was broadly the same, with these exposures even increasing at some banks (Bank of Spain, 2018).

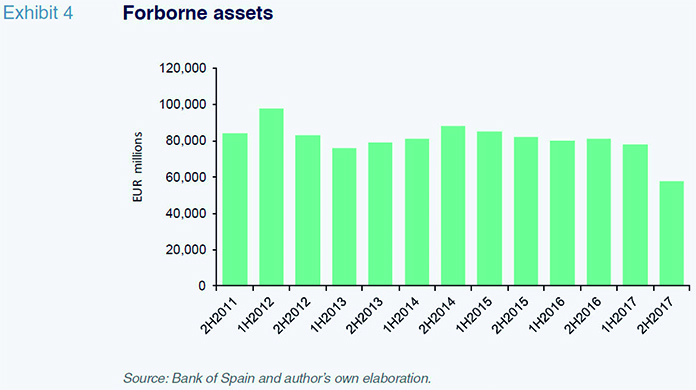

As for forborne assets, as illustrated in Exhibit 4, volumes have been very stable since the assets of the Group 1 and 2 entities (around 80 billion euros) were transferred to the national asset management company (SAREB). In the second half of 2017, as a result primarily of the write-down of Banco Popular’s forborne assets to their carrying amount at the time of its resolution, as well as other adjustments, total forborne assets were reduced significantly, to 58 billion euros. Thus, the non-performing exposures of the Spanish deposit-takers had declined from 192 billion euros at year-end 2016 to 152 billion a year later. This figure, despite its magnitude, contrasts sharply with the stock of almost 280 billion euros of non-performing exposures of December 2013. The cumulative decline in non-performing exposures since that date stands at 46%.

The market for non-performing assets in Spain

The effectiveness of IFRS 9 from January 1st, 2018, is expected to have a relatively small impact on the Spanish banks’ capital.The new impairment provisioning criteria are based on expected losses, in contrast to the outgoing IAS 39 framework, which was articulated around incurred losses. For ‘stage 2’ or ‘underperforming’ exposures (financial instruments that have experienced a significant increase in credit risk or probability of default since initial recognition but do not present objective evidence of impairment), impairment provisions must be calculated for the loans’ ‘lifetime’ expected credit losses. Spanish regulations already contemplated a similar scenario (these exposures, subject to a few nuances, were defined as ‘substandard’ until Bank of Spain Circular 4/2016 renamed this category as requiring ‘special monitoring’). As a result, the impact of these new impairment provisions for otherwise performing exposures is small in the case of the Spanish banks.

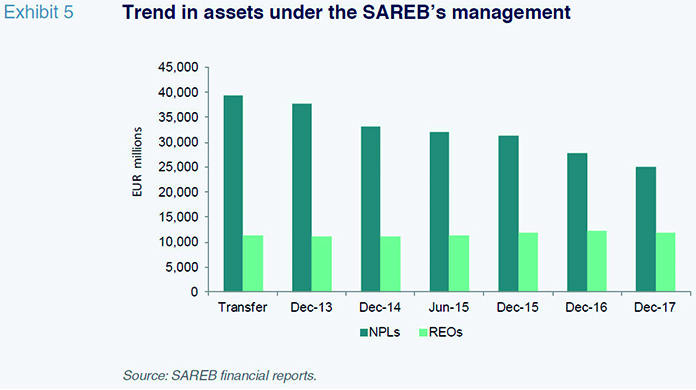

However, the impact of the changes concerning coverage requirements – or expectations – put forward by the EC and ECB could potentially be higher. In anticipation of the impact of the regulatory changes to minimum coverage levels contained in the EC proposal and ECB guidance, the Spanish deposit-takers accelerated the sale of non-performing assets in 2017. Before analysing the market for non-performing assets in Spain, it is important to introduce a very significant player. A noteworthy part of the supply of non-performing assets in Spain, already scoped out of the banking sector, are those managed by the national asset management company, the SAREB. Exhibit 5 shows the trend in the assets under its management. That trend is similar to that observed for the deposit-takers’ non-performing exposures: a sustained decline in non-performing loans and a steady stock of forborne assets.

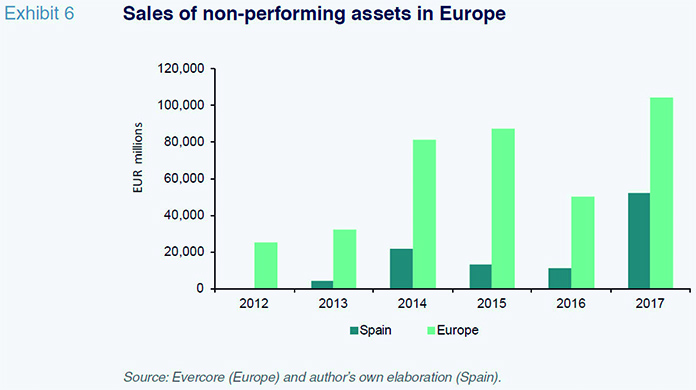

Exhibit 6 shows the trend in sales of non-performing exposures (non-performing loans and forborne assets) in Europe and in Spain. The activity in these markets coincides with the reduction by one-third in non-performing loans (from 1.12 trillion euros three years ago to 0.81 trillion at year-end 2017) of European banks reported by the EBA. The figures reveal intense activity in Spain in 2014, which trailed off in 2015 and 2016. During this period, the improvement in the economy, coupled with the recovery in real estate prices, may have slowed the rate of sales of non-performing assets by the Spanish banks in light of the possibility of recovering a growing portion of their non-performing loans and securing higher prices for forborne assets. In this situation, the price expectations of the investment funds that typically buy these assets diverged substantially from those of the banks. During this period, several plans for the sale of toxic assets (Mammut, Lince, Big Bang, etc.) were cancelled and funds that had been very active during the early years of activity in non-performing asset disposals such as Cerberus dropped off the scene. In 2017, when the banks were faced by clear signs of pressure from the regulators and supervisors to reduce their non-performing exposures, the Spanish market rebounded, accounting for roughly 50% of the European market for the sale of non-performing assets.

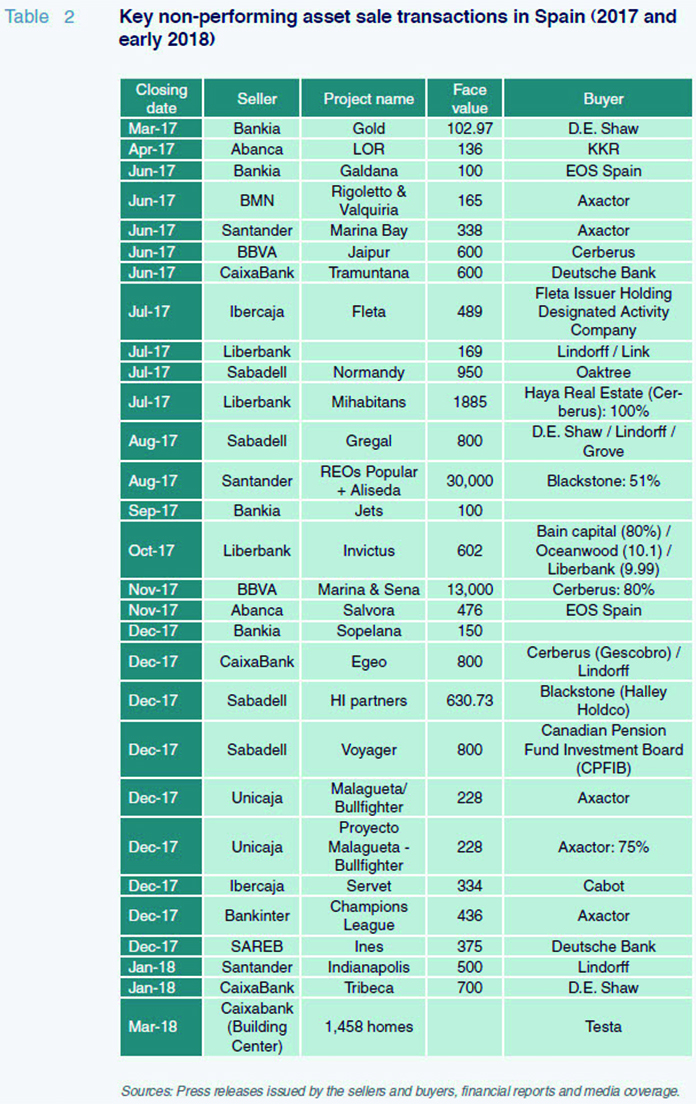

Table 2 itemises the most significant transactions. Unquestionably, the market was marked by the announced purchase by Cerberus of 80% of BBVA’s non-performing exposures and the acquisition by Blackstone of 51% of Aliseda and some of Popular’s non-performing exposures in the latter part of the year.

In light of the portfolios that are currently up for sale and the plans of many Spanish banks for reducing non-performing assets, it is likely that the market will remain very active in 2018. Sabadell is planning to reduce its non-performing exposures by 2 billion euros by 2020 although depending on investor appetite and the agreements with the deposit guarantee scheme, this figure could be raised significantly in 2018. Bankia’s 2018-2020 business plan calls for the sale of 2.9 billion euros of non-performing exposures per year. Ibercaja is planning to cut its non-performing exposures by 50% through to 2020, equivalent to around 600 million euros per year. Liberbank, meanwhile, is targeting an annual reduction of 900 million euros until 2020. In 2018, Santander is targeting a 6 billion euro reduction and the SAREB is aiming for 3 billion euros.

How buyers view these assetsThe supply of NPLs and REOs, looking solely at the Spanish banks and the SAREB

[7], stood at 190 billion euros at year-end 2017 (119bn of NPLs and 71bn of REOs). There is a good deal of interest in Spanish banks’ assets. Nevertheless, the investment funds, the usual buyers of these assets, are somewhat concerned about two issues. Firstly, the growth in house prices in Spain and the rapid rise in rental prices have considerably impaired accessibility. Some funds are worried that the affordable housing thresholds (ownership and rent) have been reached in Spain. Certainly, growing competition in the mortgage segment, marked by a price war and with some entities offering to leverage 100% of appraisal values, reminiscent of the credit bubble, may ease their concerns over house prices somewhat but not over rental prices. Secondly, and more importantly, there is concern regarding the impact the unwinding of the large portfolios sold by the banks at the end of 2017 could have on house prices. This concern is justified by the significant percentage of all residential property sales represented by sales by banks and the SAREB in recent years: 22.8%. The unwinding in the market of the enormous stocks of housing acquired by the funds at the end of 2017 could have a significant impact on prices and undermine returns on these transactions. In this climate, and despite the banks’ eagerness to reduce their REOs, it may become increasingly harder to arrive at a price that matches buyers’ and sellers’ expectations. The improvement in economic forecasts could, in contrast, boost sales of NPLs.

Conclusions

Entry into effect of IFRS 9 and, more significantly, the new coverage requirements for non-performing exposures, are set to give the banks a clear-cut incentive to reduce their exposure to these assets. In Spain, non-performing exposures have been reduced by 46% since December 2013. The sale by Spanish banks of large portfolios of NPLs and REOs in 2017, which accounted for nearly half of all sales of non-performing assets in Europe last year, and the write-down of Banco Popular’s non-performing assets for impairment in the wake of its sale to Santander, has played a significant role in this reduction. In theory, judging by the Spanish banks’ strategic plans for reducing their non-performing exposures and the portfolios already on sale, the market will once again be very active in 2018. However, concerns regarding the impact on the market of the influx of properties as a result of the large transactions closed last year could weight on potential buyers’ expected returns.

Notes

On March 8th, 2018, the EBA launched a public consultation on guidelines on the management of non-performing exposures and forborne exposures with the aim of achieving a sustainable reduction. One aspect of this initiative worth highlighting is the requirement that entities with high levels of non-performing exposures (NPL ratios of over 5%) establish a strategy for reducing them and a governance structure and operational set-up for facilitating the process.

IFRS 9 took effect in January 2018, replacing the IAS 39 framework, even though some entities began to calculate their impairment provisions under the new standard from the second half of 2017.

According to Autonomous Research estimates.

The similarity is subject to nuances, for example in terms of the cut-off date for newly-non-performing loans: March 14th in the case of the EC and April 1st for the ECB. Moreover, the ECB deems any exposures newly classified as non-performing (regardless of when originated) as subject to the new requirements, whereas the EC requirements only apply to exposures originated after the date of adoption of the proposal.

The maximum coverage ratio is 185% for secured exposures past due by less than 90 days between three and four years after classification as non-performing.

Exposures had fallen again to 92.47 billion by February 2018.

At present, some of the funds themselves are also sellers given where they are at in their own investment cycles.

References

BANK OF SPAIN (2016), Circular 4/2016.

BAUDINO, P.; ORLANDI, J., and R. ZAMIL (2018), The identification and measurement of non-performing assets: a cross country comparison, Bank for International Settlements, FSI Insights No 7.

EBA (2016), Report on the dynamics and drivers of non performing exposures in the EU banking sector.

— (2017), Guidance to banks on NPLs.

— (2018), Consultation paper: Guidelines on management of non-performing and forborne exposures.

— (2018), Addendum to the ECB guidance to banks on NPL.

EUROPEAN COMMISSION (2018), Proposal for a regulation on amending the CRR as regards minimum loss coverage for NPEs.

— (2018), Second progress report on the reduction of non-performing loans in Europe, COM (2018) 133.

José García Montalvo. Professor of Economics at Universitat Pompeu Fabra, ICREA-Academia Fellow and Research Professor (Barcelona GSE and IVIE)

BLAKE, D.; SARNO, L., and G. ZINNA (2014), The market for lemmings: is the investment behaviour of pension funds stabilizing or destabilizing?, Bank of England mimeo.

DE GRAUWE, P., and Y. JI (2012). “Mispricing of sovereign risk and macroeconomic stability in the Eurozone,” JCMS: Journal of Common Market Studies, 50(6): 866-880.